What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Rikkei Finance is a DeFi Metaverse protocol using Cross-chain technology. Thanks to this technology, investors can interact with any blockchain when using Rikkei Finance products.

Besides, Rikkei Finance also accepts crypto assets that work on any blockchain and their value shows in real time. In addition to Cross-chain support, the project also provides other core features such as NFT lending and asset liquidation insurance.

Cross chain support

The majority of lending protocols available in the crypto market only support single-chain transactions, or use intermediate bridges to interact with other blockchain crypto assets. Rikkei Finance offers unlimited cross-chain transactions using Wrapped tokens. This allows users to lend or borrow directly the crypto assets of any blockchain.

Effective interest rate model

Current interest rate models do not optimize loan interest rates during periods of low demand, as well as lending profits during high borrowing needs.

Rikkei Finance offers a more flexible and efficient interest rate model that allows users to borrow at low interest rates when demand is low. At the same time, the project will increase liquidity and provide incentives to encourage more investors to lend assets in times of high demand.

Various types of collateral

Most lending platforms currently only support stablecoins and tokens of blockchain projects as collateral. While Rikkei Finance allows users to freely decide which asset class to use as collateral based on the platform's asset rating system. It is noteworthy that in addition to stablecoins and tokens of blockchain projects, users can take NFT assets as collateral when borrowing or providing loans to other users.

Liquidation insurance

Insurance in the blockchain ecosystem is largely limited to smart contract coverage. A user can be liquidated at any time without any kind of insurance available to prevent it. Rikkei Finance provides loan asset insurance, users do not need to worry about collateral being liquidated when the cryptocurrency market fluctuates.

RiFi Liquidity Vault

Stablecoin Vault: Here, users can stake stablecoins such as USDC, USDT, BUSD... to receive high interest rates and an attractive reward of RIFI tokens.

RiFi Vault: Users can stake their RIFI tokens to receive attractive rewards.

RiFi Liquidity Ranking System

The liquidity rating system was developed to ensure the transparency of the asset selection process and the sustainability of the system in Rikkei Finance. Investors' assets will be evaluated and ranked based on Rikkei Finance's own standards. After analyzing these types of assets, the system will put them in the vote before being officially added to the Vault.

RiFi Lending Protocol

Rikkei Finance provides a safe and secure lending system. Thereby, investors can feel secure when bringing their assets as collateral to borrow or lend on this platform.

RiFi United

RiFi United is a football management simulator, researched and developed by the Rikkei Finance team with a unique Play-to-Earn model. This product is a stepping stone to develop Rikkei Finance's future NFT lending feature.

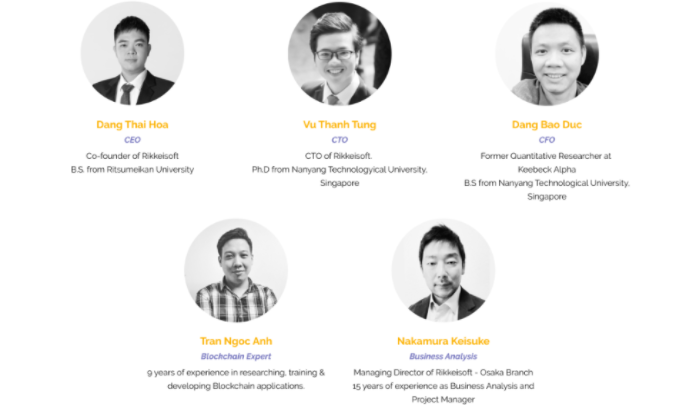

Rikkei Finance Development Team

Dang Thai Hoa : He is the co-founder and CEO of Rikkei Finance. Before that, he also founded Rikkeisoft - a leading IT outsourcing unit in Vietnam.

Vu Thanh Tung : He is also the co-founder and CTO of Rikkei Finance. Vu Thanh Tung used to be the CTO of Rikkeisoft and holds a PhD from Nanyang Technological University in Singapore.

Dang Bao Duc : Currently, he is the financial director of Rikkei Finance. Dang Bao Duc used to be a quantitative researcher at Keebeck Alpha.

Tran Ngoc Anh : He has 9 years of experience in blockchain application research, training and development.

Nakamura Keisuke : He takes on the role of business analyst of Rikkei Finance. In addition, he is the managing director of RikkeiSoft in Osaka and has more than 15 years of experience in business analysis and project management.

Advisor of Rikkei Finance

Luu The Loi – Technical Advisor : He is the co-founder and CEO of Kyber Network.

Ta Son Tung – Business Advisor : Currently, he is the chairman of Rikkeisoft's member council.

John Ng Pangilinan – Advisor : He is the managing director of Signum Capital – an investment fund managed by MAS based in Singapore. He also serves as a consultant in Kyber Network, Ren Protocol, Sentinel Protocol, Sparrow Exchange, Oasis Labs…

Investor of Rikkei Finance

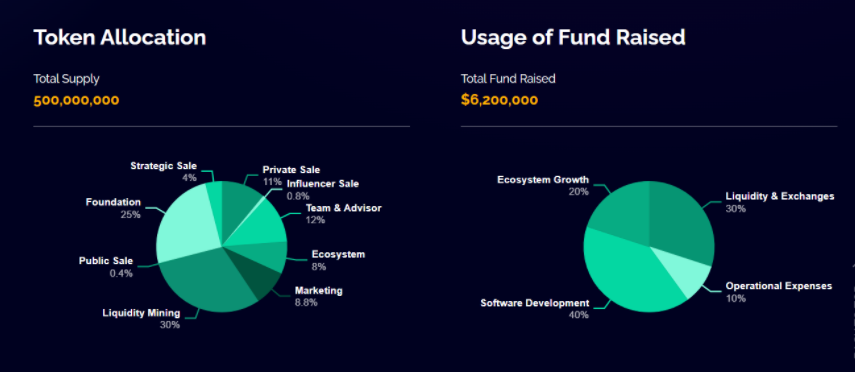

The project has raised US$5.6 million to build the first open lending platform with cross-chain support and NFT collateral. With the participation of large investment institutions such as Signum Capital, HyperChain Capital, Kyber Network, PNYX, X21 Digital, LD Capital, TomoChain, Kernel Ventures, Kyros Ventures, YBB Foundation Limited, Ark Stream Capital, Inclusion Capital, Basics Capital and K300 Capital.

Rikkei Finance's Partner

The current partners of Rikkei Finance are Oraichain, HeroVerse, Kaby Arena, DEC Ventures, Crypto Premier League.

December 2021

January 2022

March 2022

May 2022

July 2022

September 2022

November 2022

December 2022

RIFI is the official native token of Rikkei Finance, it has some functions as follows:

Currently, RIFI tokens will be sold on Huobi Primelist on December 7, 2021. During this time, the RIFI token is not currently listed on any other exchange. TraderH4 team will update as soon as there is an announcement from the project.

Rikkei Finance is a DeFi application with the main product of Lending & Borrowing. The project integrates Cross-chain features that allow investors to interact, borrow or lend on any blockchain. The initial blockchain platforms that Rikkei Finance supports are Binance Smart Chain , Ethereum , and Polkadot . What makes Rikkei Finance special is its NFT property lending and mortgage feature. Thereby, it can be seen that the project has opened up more options for users to maximize profits.

Some official information channels of the project that investors can follow are:

Website | Twitter | Medium | Telegram

Thus, TraderH4 has just brought to you all the information of the Rikkei Finance project and the RIFI token. With the application of Cross-chain technologies, many opportunities to profit from this cryptocurrency market have opened up. In addition, the loan interest rate model improved by Rikkei Finance has brought countless benefits to investors. At the same time, the project also ensures the borrower's collateral is safe with loan property insurance.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.