What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Saddle Finance was founded in 2020 and belongs to the Ethereum blockchain. This is an automatic staking tool for exchanges on the DeFi market (aka AMM). Saddle is designed to optimize transactions between pegged crypto assets, with the goal of achieving the lowest possible slippage rate.

Saddle makes transactions cheaper, more efficient and faster. Besides, Saddle also offers protocols to help minimize slippage for swaps, or high-profit liquidity pools.

The Saddle team's goal is to build Saddle Finance as a lego piece for the DeFi ecosystem, meaning it can be grafted onto any blockchain, on any DeFi protocol.

Saddle is built on the following characteristics:

Project Saddle was built by experts who know the DeFi market with years of experience in programming at Web2 companies like Uber, Amazon and Square.

As pioneers, the Saddle Finance development team understands very well the importance of an active, diverse community to the success of a project. Besides, they are very knowledgeable about Web2, so they believe that Web3 will be a more advanced platform (Web2, Web3 is the 2nd and 3rd generation of the Internet).

Saddle Finance project development team includes:

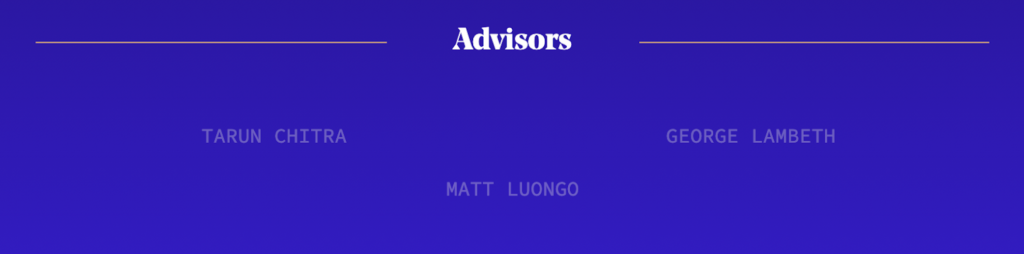

On 11/11/2021, Saddle Finance announced a successful fundraising with $7.5 million raised in the fundraising round. Leading the round were Polychain and Electric Capital Fund, followed by participation from eGirl Capital, Nascent and several others. Up to now, the total capital that Saddle has collected is 11.8 million USD.

In addition, the project also receives mentoring from veteran individuals in the field of Crypto such as Tarun Chitra, George Lambeth and Matt Luongo.

Currently, the products that have been launched on Saddle Finance only support 2 networks, Ethereum and Arbitrum, with 2 features: swapping and liquidity pools. However, each feature has its own characteristics as follows:

Swapping

In addition to features like other swapping services, Saddle offers remarkable advanced customizations such as:

Liquidity pool

In addition to BTC and ETH liquidity pools, Saddle also has pools that focus on other price stabilizers. Besides, they also divide the items out quite specific.

Currently, in addition to making money through liquidity pools like other AMM systems, users can participate in Saddle Finance's b4b (Bounties 4 Bandits) program. b4b is an extended version of programs like hackathons available to all members of the Saddle community. Everyone can participate and be rewarded for their contributions to Saddle's ecosystem.

Besides, Saddle's team is also building the first Dapp projects with smart contracts. Not only that, Saddle Finance is a growing project every day, they need all the resources and support of the user community. Therefore, it makes sense to cooperate with the community at this time.

And of course, user contributions will be rewarded with SDL tokens. The total prize value is currently up to SDL 7.5 million.

How to join Saddle Finance's b4b program:

The Saddle Finance platform's SDL token is a DAO (governance token) token for the main protocol or for the system's projects. The SDL token was launched in November 2021 and is a non-transferable token with a lock-in period of 3 to 12 months (for the purpose of gratitude and reward to members of the Saddle community, as well as to limit the opportunistic investors). The SDL coin has the address code 0xf1dc500fde233a4055e25e5bbf516372bc4f6871.

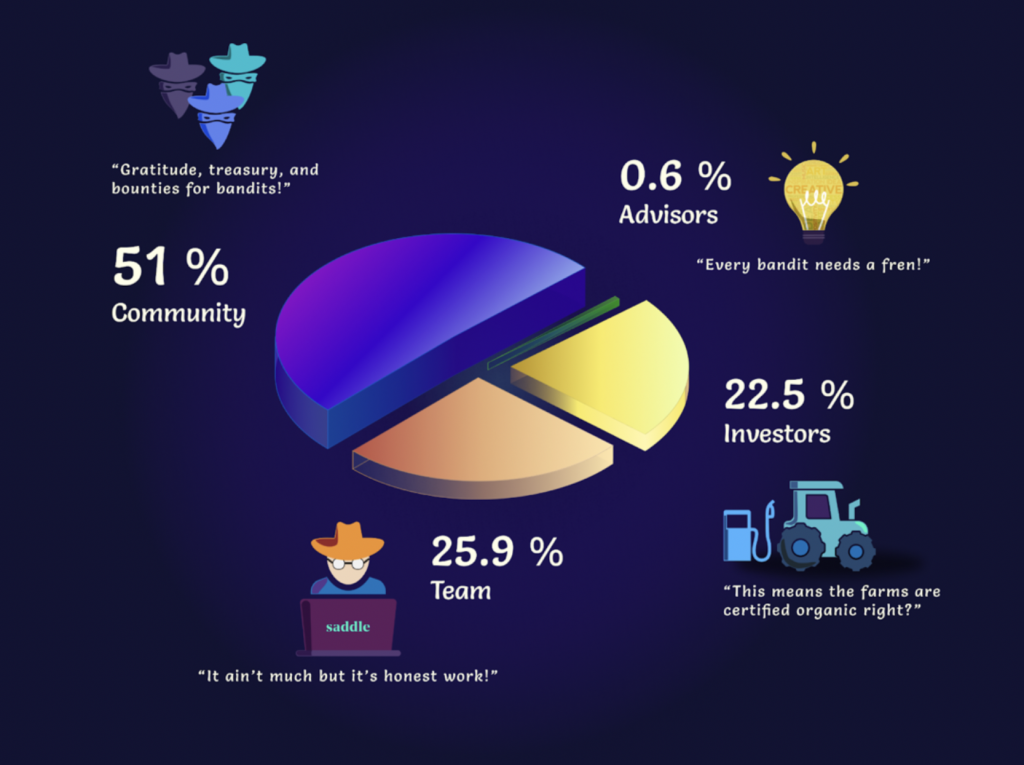

The total reserve of SDL is 1 billion tokens, with 51% of the reserve to be allocated to the user community, of which 15% has been distributed to those who invested in the project in the early stages ( about 2 to 3 years). In addition, 30% of total SDL reserves will be gradually invested in the management budget within 3 years. The user community will then decide how to allocate these coins to community contributors, staking activities, and other programs.

| STT | Segment | % Token Amount | Token Amount | Installment Policy |

| first | Staking users and providers: | 15% | 150,000,000 SDL | 2 years |

| Old liquidity pools | 10.5% | 105,000,000 SDL | 2 years | |

| veCRV . coin holder | 3% | 30,000,000 SDL | 2 years | |

| Any wallet address that has swapped over 100 USD using Saddle tokens | 0.5% | SDL 5,000,000 | 2 years | |

| Multi-signature wallet users | 0.5% | SDL 5,000,000 | 2 years | |

| Initial Loaders | 0.5% | SDL 5,000,000 | 2 years | |

| 2 | Staking | 5% | 50,000,000 SDL | Do not have |

| 3 | Community Program (b4b) | first% | 10,000,000 SDL | Do not have |

| 4 | Management budget | 30% | 200,000,000 SDL | 3 years |

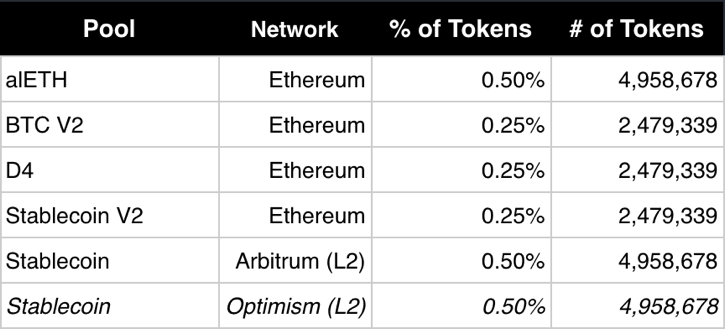

Besides, SDL tokens can also be mined through Saddle's liquidity pools on both Ethereum and Arbitrum networks, or through the b4b program. Liquidity pools open mining function from November 18, 2021 at 7 am (Vietnam time).

SDL token holders will have administrative rights. They can vote on proposals on the system to develop the project. In the early stages, proposals will be posted on Snapshot and the community on it will make decisions. In parallel, the channel for discussing proposals is Discord.

Saddle intends with proposals for the coming months, the system will move all operations back to the governance system on the blockchain. The project will use Compound's Bravo governance protocol to then introduce new features to the SDL token.

There is currently no information on exchanges that can buy and sell SDL.

With a macro vision of making transactions on the DeFi market have the lowest slippage rate, Saddle Finance has now made an impressive start with the user community and investors. At this early stage, although it only has basic features, but with the mindset and orientation of the community, Saddle Finance promises to bring about certain successes.

Besides the bold idea of creating an AMM system that supports optimizing transactions between crypto assets of fixed value with the goal of achieving the lowest possible slippage rate, the Saddle Finance project also was built by a team of longtime experts in many fields. All of the above points are great potentials, promising Saddle Finance will be a successful project in the future.

See more specific information about the project through the following media channels:

Website | Project Information | Twitter | Discord | Telegram | LinkedIn | Medium | GitHub | DefiPulse

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.