What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Stader is a smart contract platform , founded in April 2021 on the Terra network. Stader was created to help delegators conveniently explore staking solutions and gain access to the best returns based on their risk tolerance.

Stader started with Terra because the ecosystem is focused on creating opportunities for mainstream users to participate in blockchain, as well as having a growing community of developers. Terra is also a mature DeFi ecosystem that can be leveraged to build strategies with staking rewards. The development team believes that Terra will be one of the largest cryptocurrency ecosystems.

In addition, Stader has deeply identified the problems that the 3 main stakeholders of the PoS network (delegator, validator and network) face:

In 3 to 5 years, the crypto world will have 100 blockchains spanning Layer-1, NFT, games, Web 3.0, and Layer-2 networks. PoS and Staking will be the underlying layer powering these blockchains. Trillions of dollars of the staking economy will be built on staking systems.

As staking solutions explode in diversity and complexity, there will be a huge gap in the market, i.e. a platform that helps users or institutions discover and identify the best staking opportunities. , tailored to their needs and risk tolerance. The gap will be bridged by an unattended, smart contract-based platform, and Stader aspires to be an aggregate layer solution across multiple blockchain networks.

With interoperability with individual contracts, an explosion of applications built on top of Stader contracts can be predicted in the near future.

At its core, Stader was created to address the challenges of the staking ecosystem by designing a modular infrastructure that allows project development teams and third parties to build Seamless staking products, while rapidly accelerating innovation.

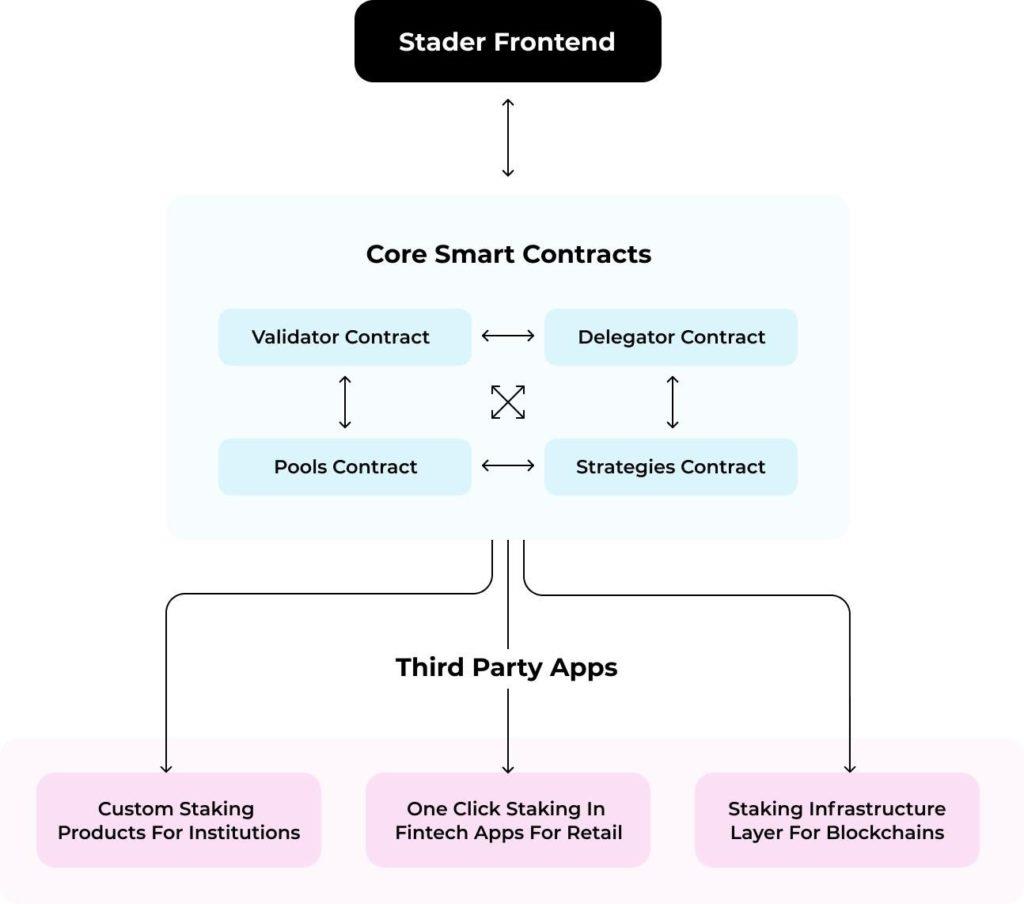

At the beginning, the project built smart contracts for staking on Terra. Stader smart contracts to be launched in the next few weeks, have the following capabilities:

With a multitude of staking possibilities, Stader is building a modular platform that allows anyone to use Stader's existing components to build their own staking solutions.

As staking grows over the next few years, the project's architecture will allow for flexible development and the incorporation of new features every day. Scalability is at the core of Stader's technical design, with a system of highly interoperable smart contracts. In the future, incorporating a strategy or a new tank will only require minor changes in some specific stand-alone contracts.

Stader separates the base capital and rewards by different contracts. This is to ensure that the underlying is always isolated from interactions with other protocols.

Here are a few core smart contracts that make up the current Stader infrastructure:

The modular design of Stader smart contracts opens the door for third parties to interact with any of the project's smart contracts and build additional staking applications. Here are some examples of what this capability can do:

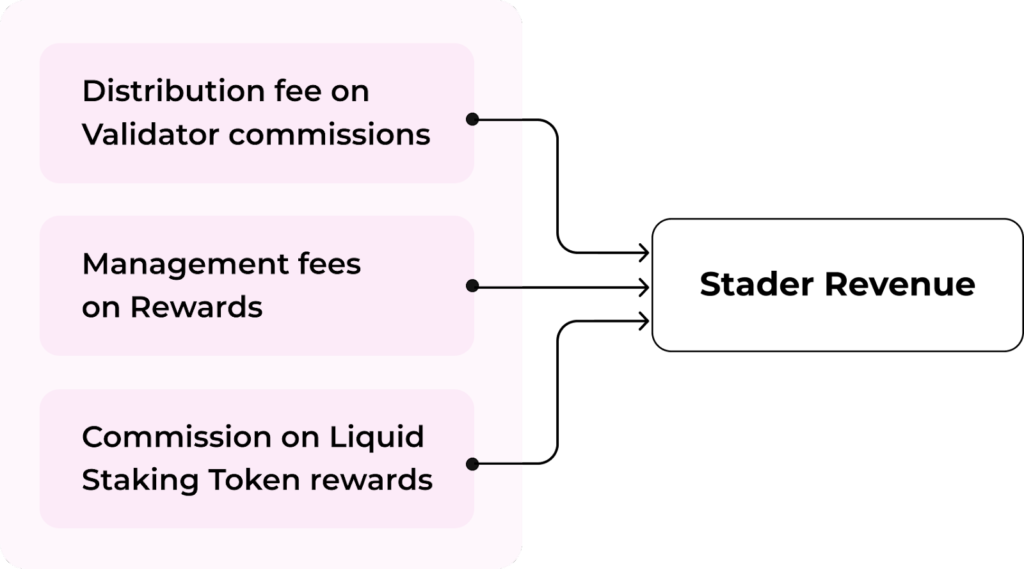

From short to medium term, Stader will make profit in 3 ways:

Staders started their journey by creating staking products on Terra. Stader for the goal of 5 to 6 PoS blockchains by mid-2022, including Near, Polkadot, Ethereum, Polygon… At the same time, integrate third-party liquidity tokens and build strategies to maximize yield mining (yield) automatically.

In the long term, Stader Labs plans to build APIs to provide end-to-end staking solutions for mainstream Fintech exchanges and applications, exploiting unmet financial needs with quality staking products. high for retail crypto investors.

When the project successfully captures market share on Terra and Solana, Stader will focus on releasing other systems (NEAR, EVM chains...) by:

Stader version 1.0

Stader's V1 contracts are currently undergoing extensive testing upon completion of the audit. The project plans to launch the first version (V1) on the official Terra network in mid-November. Details of the V1 launch event will be updated soon.

Here are some of the key features of Stader's V1:

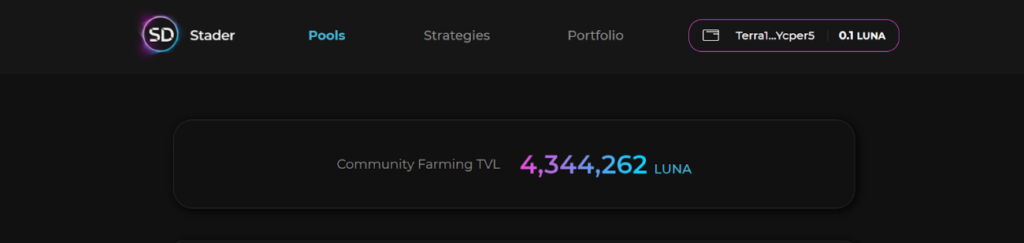

Stader V1 will be launched with a community farming event. The project will dedicate a portion of the total supply of SD tokens to this event. More details on the community farming event will be shared on the project's media channels soon.

Stader version 2.0

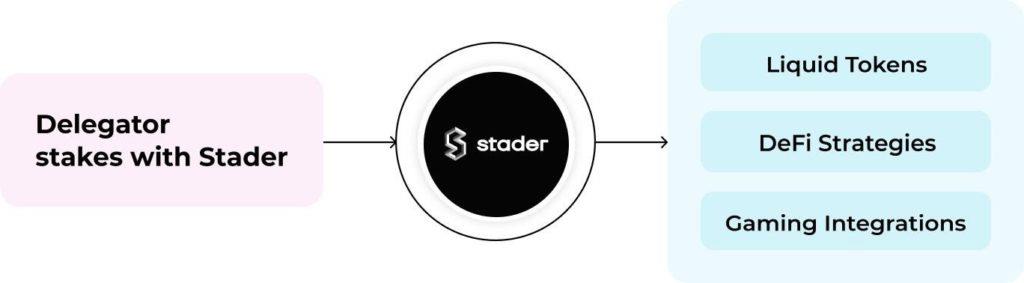

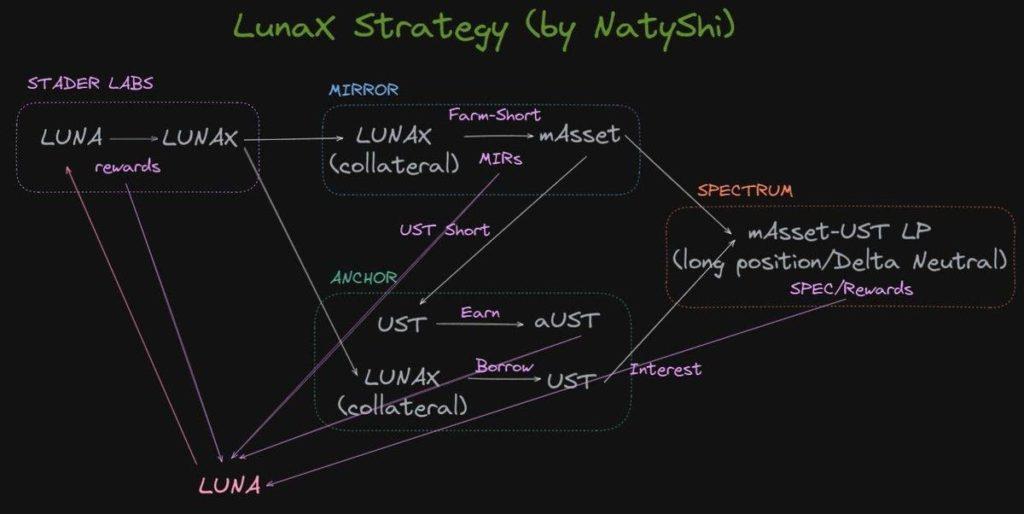

Stader's V2 will open up even more possibilities for staked assets. The development team plans to launch a liquid token for staking LUNAs. At the same time, adding more integration possibilities across ecosystems into staking and airdrop rewards strategies. V2 launch time will be shared soon. V1 participants will also have access to most of V2's features.

Some key features of Stader V2:

Liquidity tokens

The highly liquid token allows instant unlocking of staked LUNA along with:

DeFi Strategy

DeFi Strategy integrates with a DeFi protocol and a launchpad on Terra to amplify APY.

Integrated gaming

Integrate with at least one reward-driven gaming protocol.

Stader's founding team are people who have been active in the crypto world for many years. They have deep experience in staking and building mining optimized platforms. The team realizes how difficult and laborious it is to choose a mining pool, and they see the same thing happening in staking. The project development team wants to make staking easier, along with introducing some staking innovations.

As they embarked on their journey to build cross-chains based on fragmented blocks, Stader Labs understood that the most important thing was to first demonstrate the success of the platform. Thus, they began their journey with Terra and Solana.

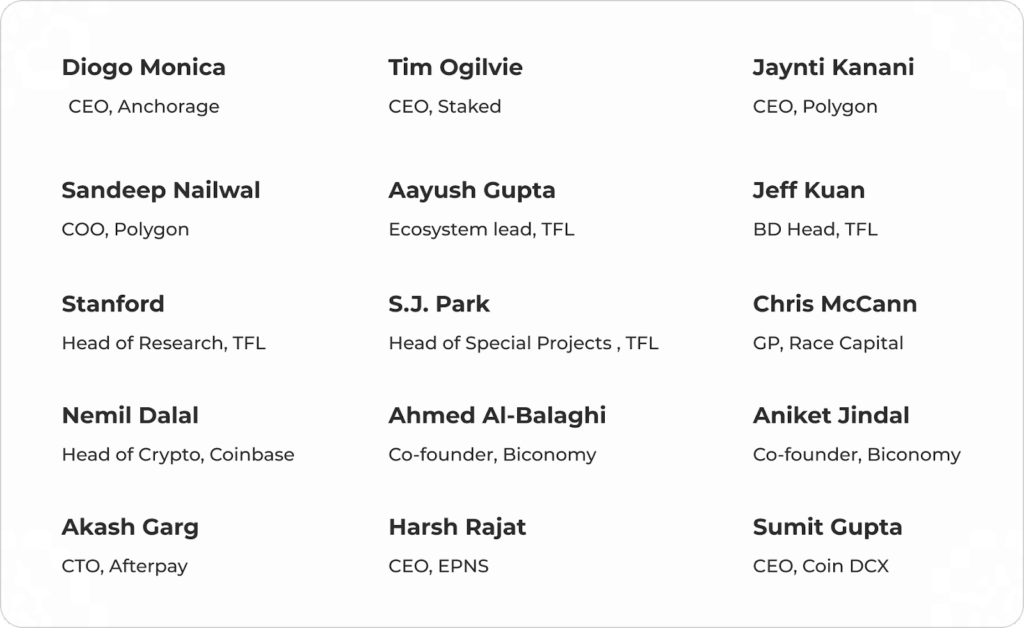

Stader Labs has raised a total of $4 million in funding in one round. This is a seed round announced on October 7, 2021, led by Panterra Capital. The project is funded by 16 investors. Terra and True Ventures are the most recent investors. Also present were Coinbase Ventures, True Ventures, Jump Capital, and Ledgerprime, and angel investors including Jaynti Kanani (CEO, Polygon), Sandeep Nailwal (COO, Polygon), Nemil Dalal (Head of Department), Crypto developer, Coinbase), Sumit Gupta (CEO, CoinDCX), Ahmed Al Balaghi (CEO, Biconomy), Aniket Jindal (COO, Biconomy) and Harsh Rajat (CEO, EPNS).

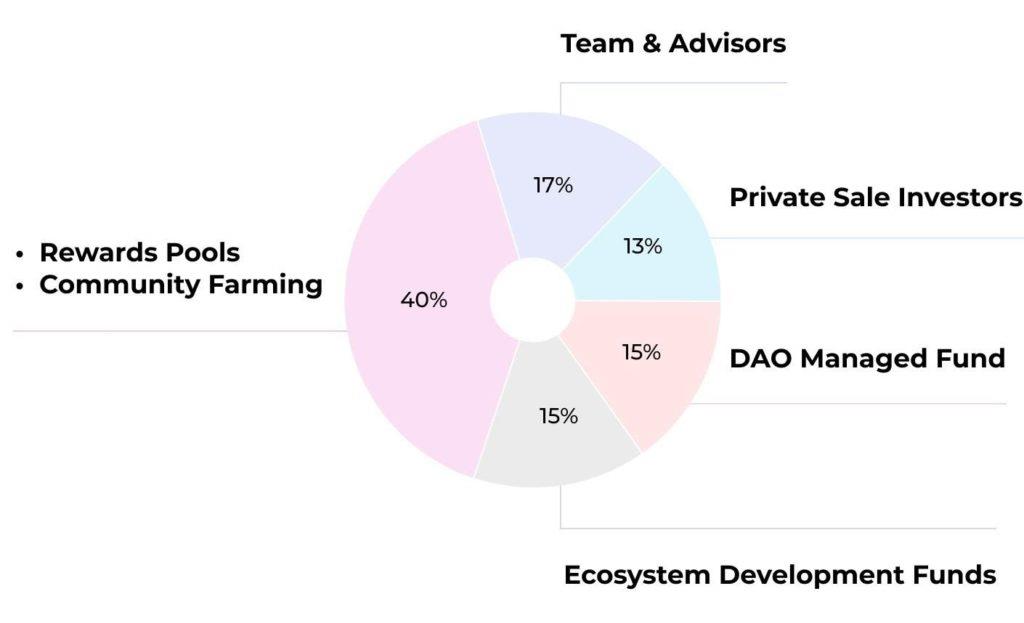

SD token is the project's own token. The total Stader token supply will be capped at 150 million SD tokens. The project development team has carefully designed the protocol's tokenomics to encourage the long-term sustainability of the Stader platform.

The Stader SD token distribution was planned to incentivize the community to own the majority of the network, while retaining a suitable portion to incentivize third parties to build on the Stader platform.

The core benefits of SD tokens include:

Incentive trust and insurance

Rewards and discounts

Administration

The SD token is the governance token. Governing shareholders can propose and vote on policies related to the selection of effective pools, selection of validator nodes, changes in implementation methods, etc.

Leverage Stader . infrastructure

Protocol developers holding SD tokens can access Stader's infrastructure and smart contracts.

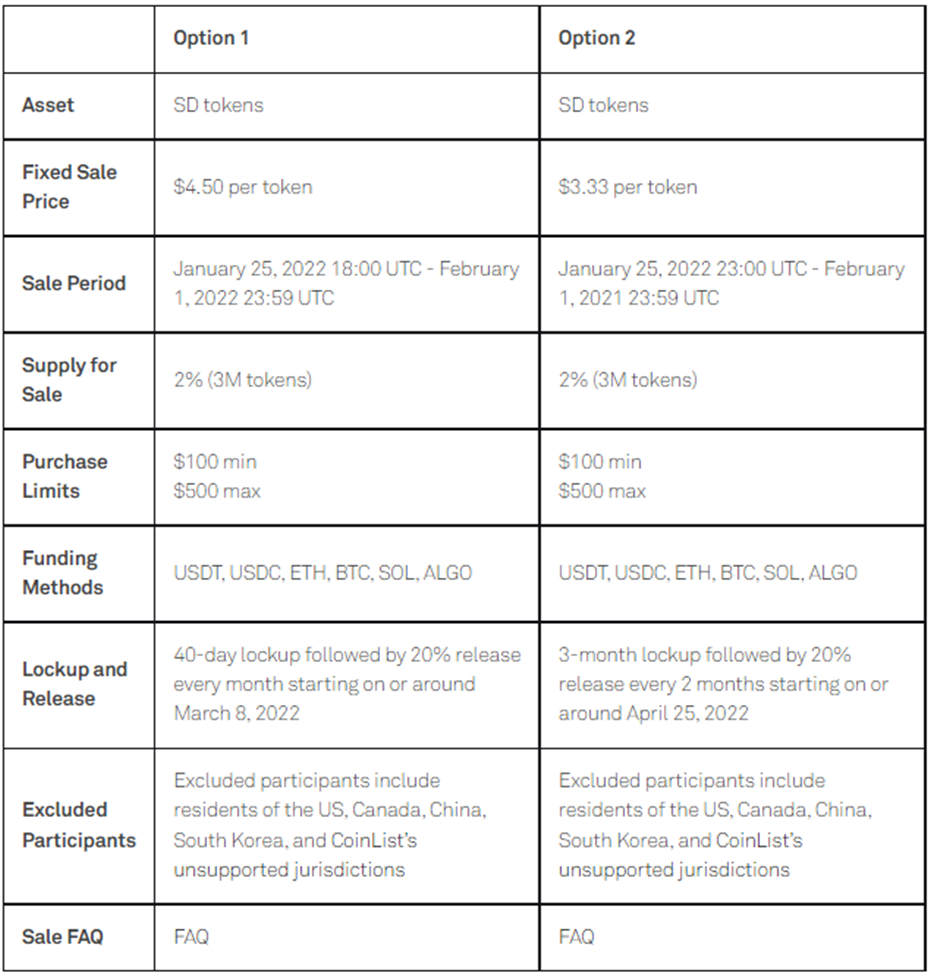

Currently, SD token has opened trading registration on CoinList . The deadline for registration is at 06:59 on January 24, 2022. The open sale program has 2 options as follows:

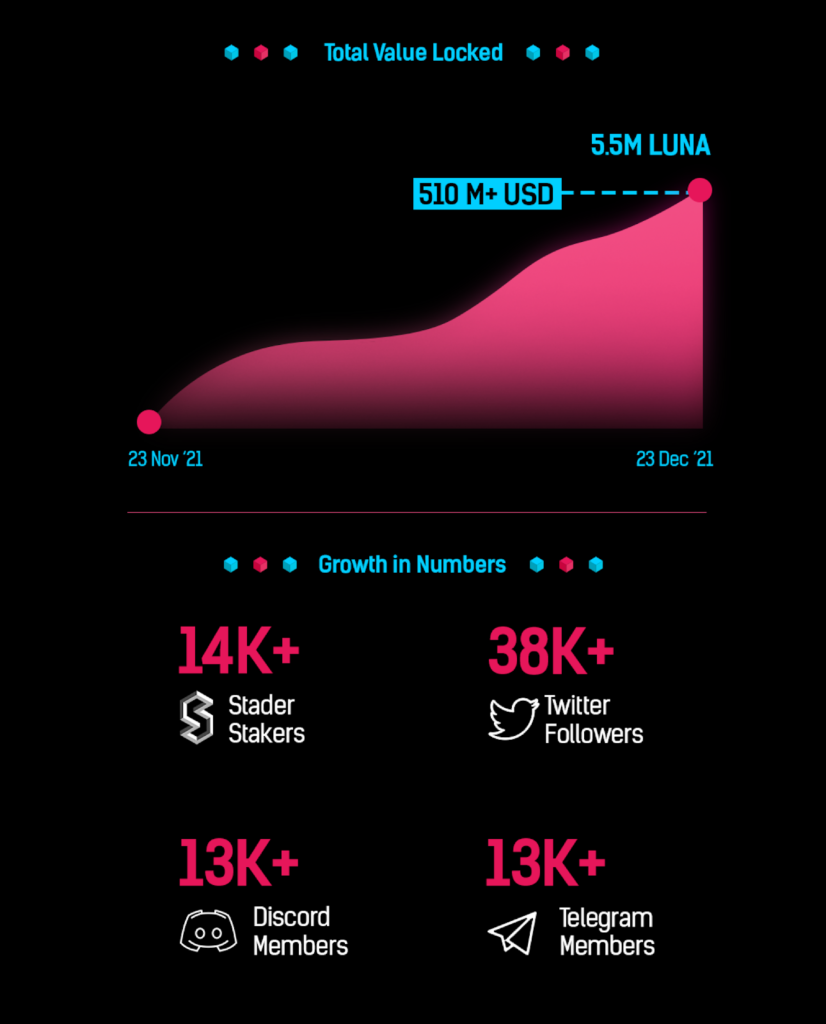

A few highlights of the project so far:

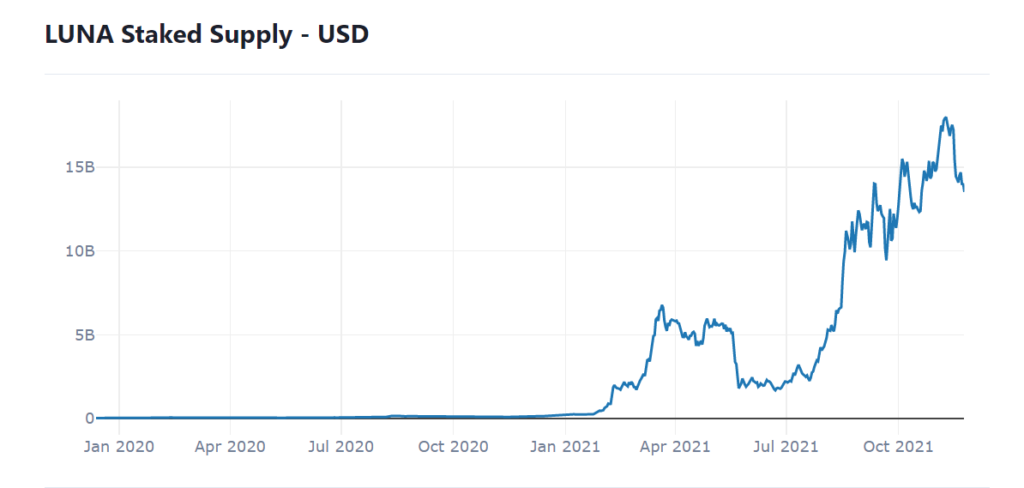

Stader Labs is built on Terra, where staking activities take place in full swing. From the chart above, investors can see that the overall supply of LUNA stock is trending up. This is possible because Terra creates many incentives for investors to stake LUNA or other tokens: Stake to vote, earn money with attractive savings rate, stake to participate in lockdrop events, stake to receive airdrops…

Therefore, Stader Labs can also benefit from this behavior of Terra users. By emphasizing outstanding features when staking on Stader, the platform can attract investors to stake into Stader Labs pools. Besides, by providing some superior features to Terra Station, Stader Labs can also attract users from Terra Station to its platform.

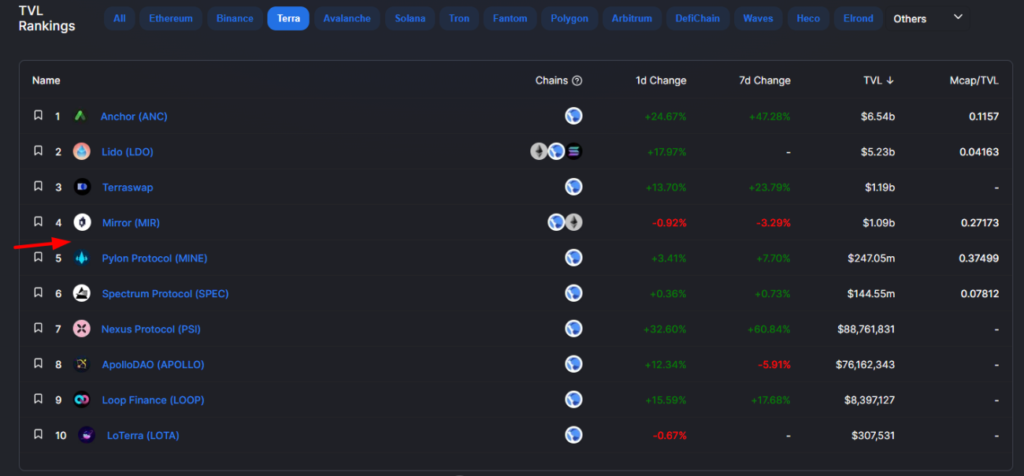

Stader Labs' current TVL has reached about 300 million, which means that if you follow it on DefiLlama, it will be in 5th place, just behind the key players in Terra (Anchor, Lido, Terraswap and Mirror). Besides having a significant TVL, Stader Labs is also invested by top investors: Pantera, Coinbase Ventures… so it can be seen as a legitimate and promising project on Terra.

Stader Labs is on a mission to deliver sustainable staking returns from digital assets to over 1 billion users. Stader was developed with the aim of becoming a staking distribution layer, and at the same time, building protocols and products that enhance security, decentralization, liquidity, governance for some of the major DPoS blockchain networks such as: Ethereum, Terra, Polygon and Solana.

To better understand the project as well as keep up to date with the latest information, please visit Stader's communication channels:

Website | Project Information | Twitter | Telegram | Medium | Discord

From January 20-24, 2022, TraderH4 organizes a mini game "Reading newspapers to find lucky money" with prizes up to 100 USDT. Join now to receive gifts from the team. Refer to the contest information in this article .

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.