What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

sUSD is the native stablecoin of the Synthetix platform whose value is pegged to the US dollar at a ratio of 1:1. To mint sUSD, users must collateralize SNX into the smart contract of the Synthetix platform. sUSD is the main currency of Synthetix, used on the platform to trade and exchange with other synthetic assets.

Synthetix establishes a stable sUSD with a value of 1 USD. Therefore, users can take advantage of this feature to earn income from arbitrage of sUSD.

Example: If the market price of sUSD drops to $0.98, a user can buy 100 sUSD for $98 and exchange that amount of sUSD for a corresponding amount of sBTC worth $100 or any synthetic asset any other on Synthetix.

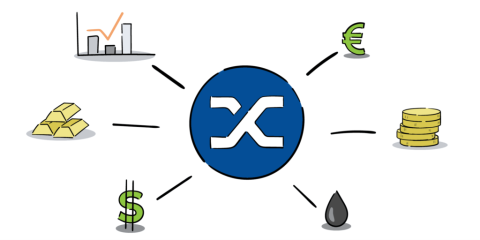

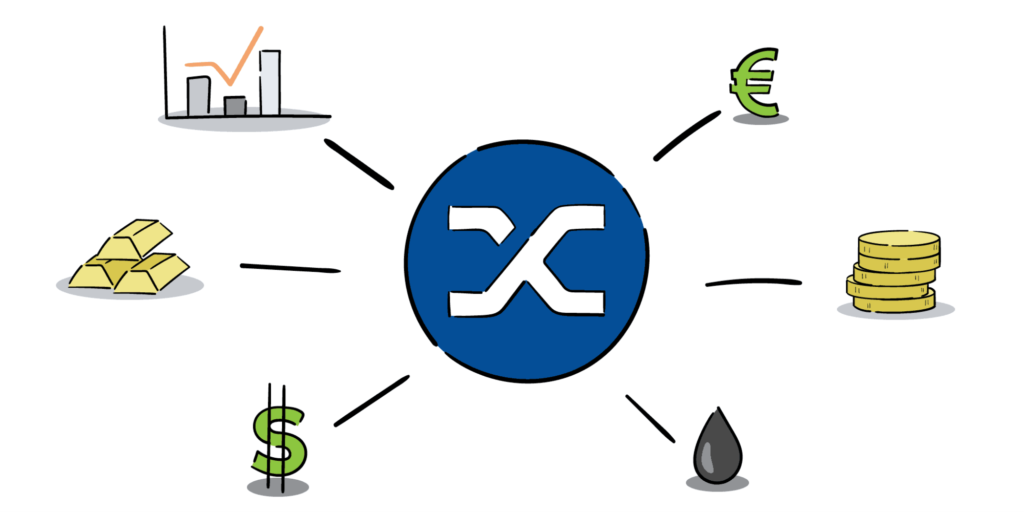

Synthetix is a decentralized derivatives platform built on Ethereum . Synthetix's synthetic asset (called Synth) is created by collateralizing SNX tokens. Users can trade Synths, including cryptocurrencies, indices, real-world assets like gold, etc. on Kwenta , Synthetix's decentralized exchange (DEX).

Synths use decentralized oracles, protocols that provide real-time price data based on smart contracts, to track the prices of the assets they represent. Synths are issued on Ethereum so you can use them on other DeFi platforms like Curve, Uniswap… to trade, provide liquidity and make profits.

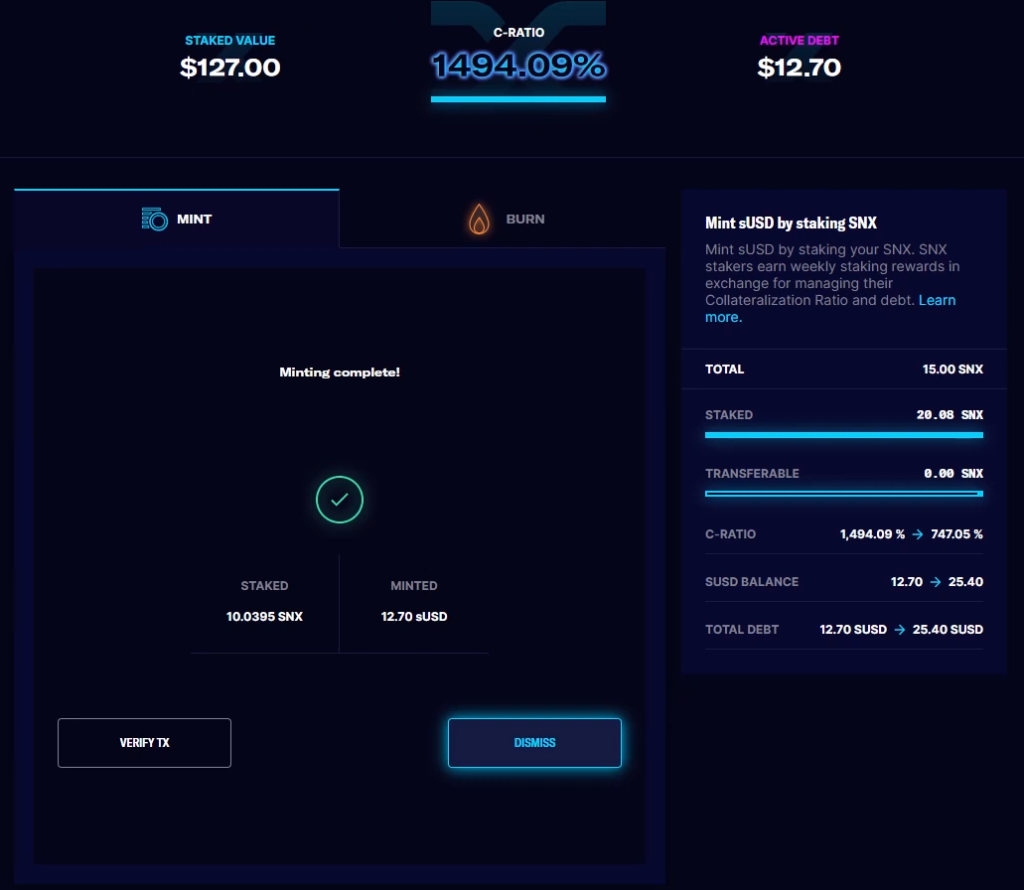

To ensure Synths have enough assets to absorb major price adjustments from the market, Synthetix encourages users to maintain their collateral ratio (C-Ratio) at an optimal level (currently at 750%). If the C-Ratio falls below 750%, the user will not be able to receive interest until it is restored to 750%. To adjust this ratio, the user can mint more Synth if the ratio is above 750% or burn Synth if the ratio is below 750%.

Users minting Synth will also receive a debt, which is the amount of Synth they need to burn to unlock their collateralized SNX. When users mint sUSD, they will also receive the same debt. The debt of sUSD will also be included in all debt on Synthetix for Synth miners. This total debt is expressed in sUSD and increases or decreases depending on the supply of Synths and their exchange rates. If the total debt on the system increases, your debt will also increase proportionally and vice versa.

Example: If you mint 1000 sUSD and the total sUSD value of all the Synths in circulation is currently US$1 million, your debt ratio is 0.1%. However, if the total sUSD value of all Synths suddenly doubles to US$2 million due to an increase in the price in Synths such as sBTC or sETH, you will need to return 2000 sUSD to unlock them all. My staked SNX. This amount that users minting sUSD must pay will be interest for users who own Synth when they withdraw from the system.

Investors must own SNX tokens to use features on Synthetix's platform. SNX can be purchased directly on many major crypto exchanges like Binance, HitBTC, OKX, Coinbase, Uniswap… Users will mint sUSD by staking their SNX.

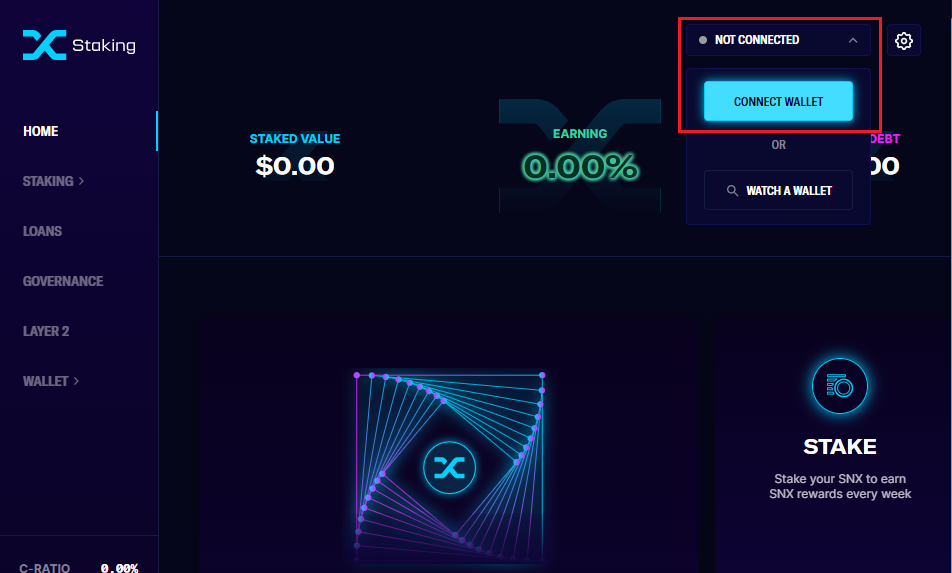

Step 1 : You access and connect your wallet at https://staking.synthetix.io/ .

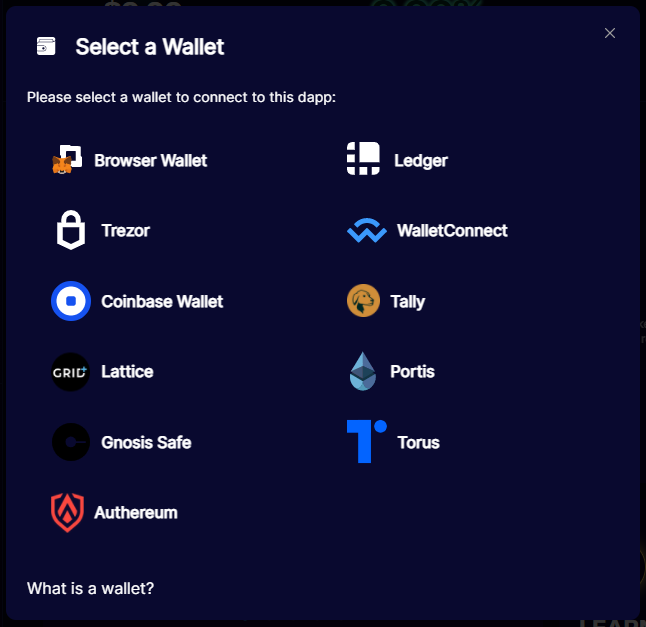

Synthetix supports many different wallets such as MetaMask, Ledger, Trezor, etc.

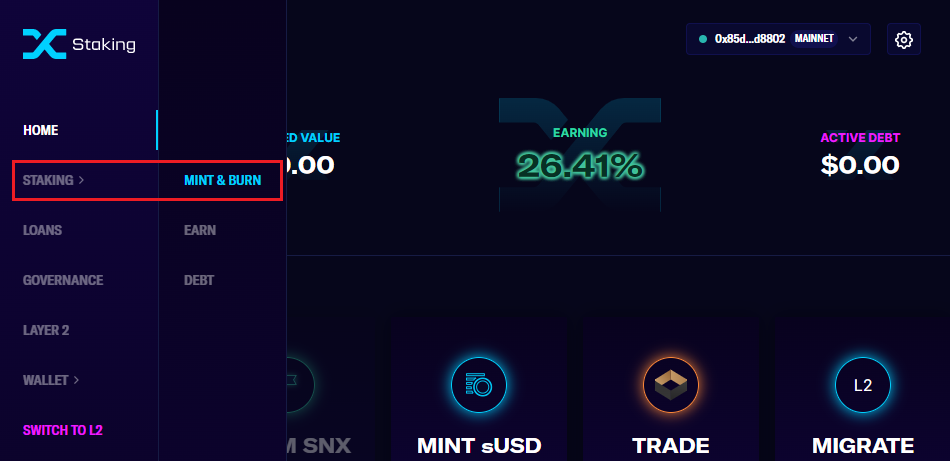

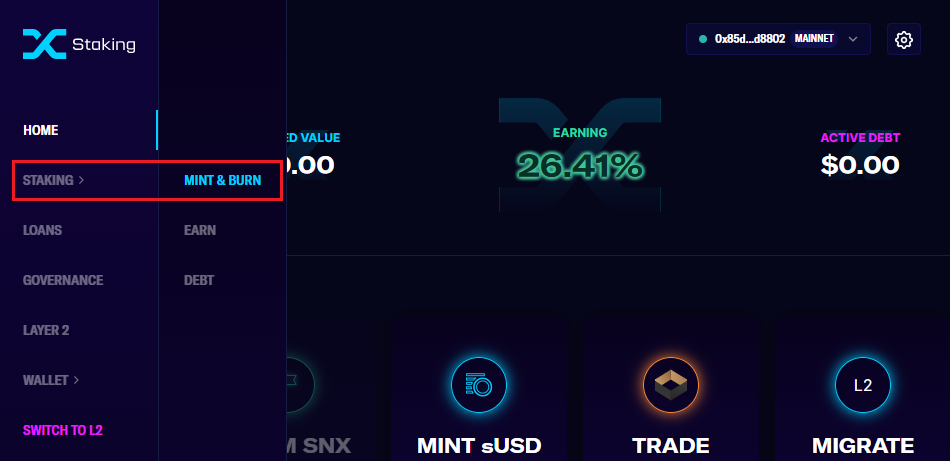

Step 2 : You access the "STAKING" section and select "MINT & BURN".

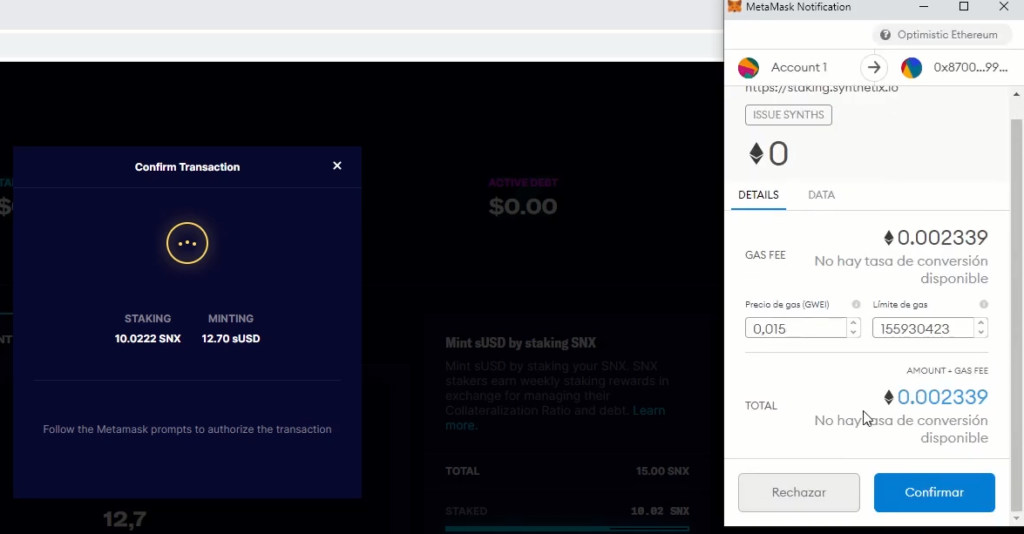

Step 3 : In the "MINT" section, enter the amount of sUSD you want to mint and press "MINT sUSD". Synthetix supports 2 main sUSD minting modes including:

Step 4 : You confirm the transaction on the wallet to complete the sUSD minting process.

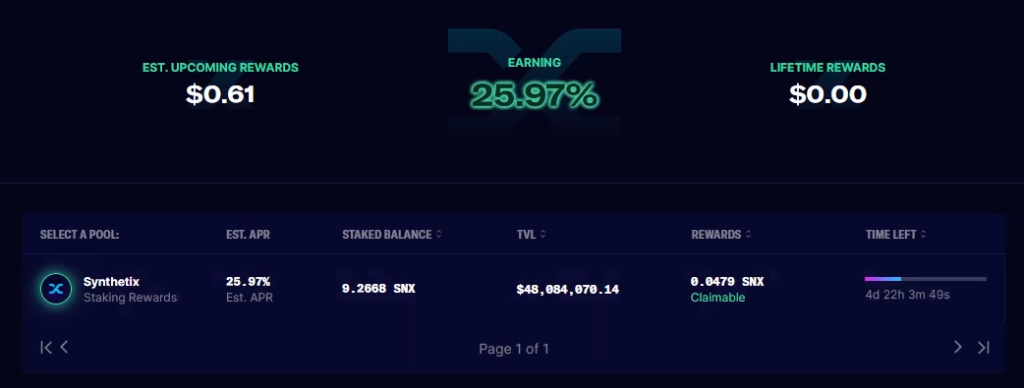

When staking SNX, users will receive weekly rewards if C-Ratio is greater than 600% including stake interest calculated in SNX and fees from all Synth transactions denominated in sUSD.

Step 1 : You access and connect your wallet at https://staking.synthetix.io/ .

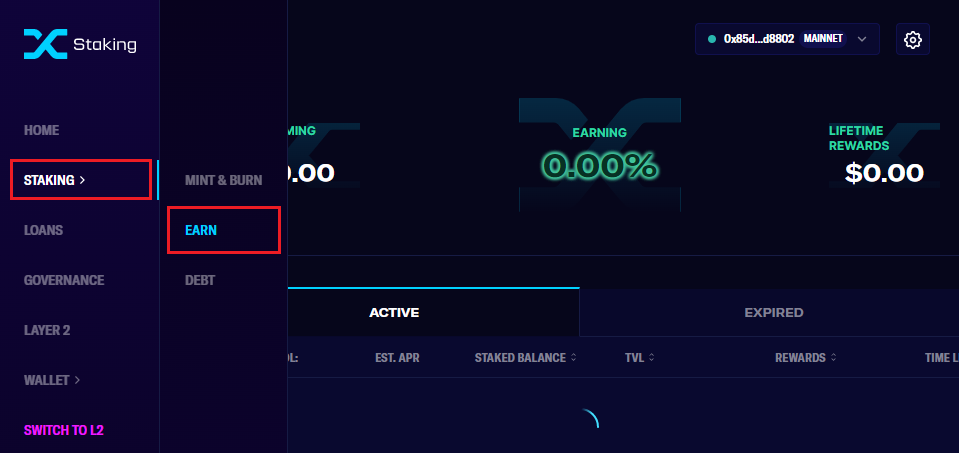

Step 2 : You access the "STAKING" section and select "EARN".

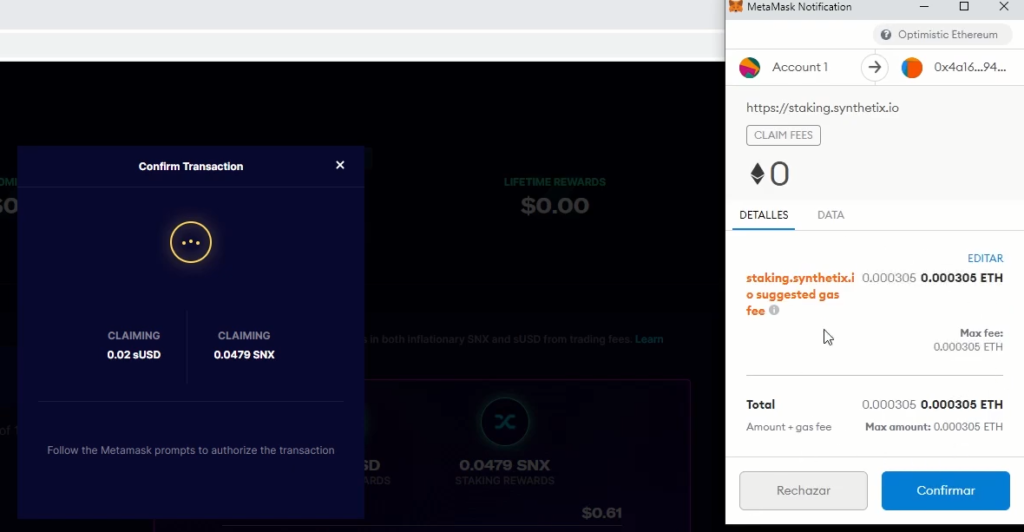

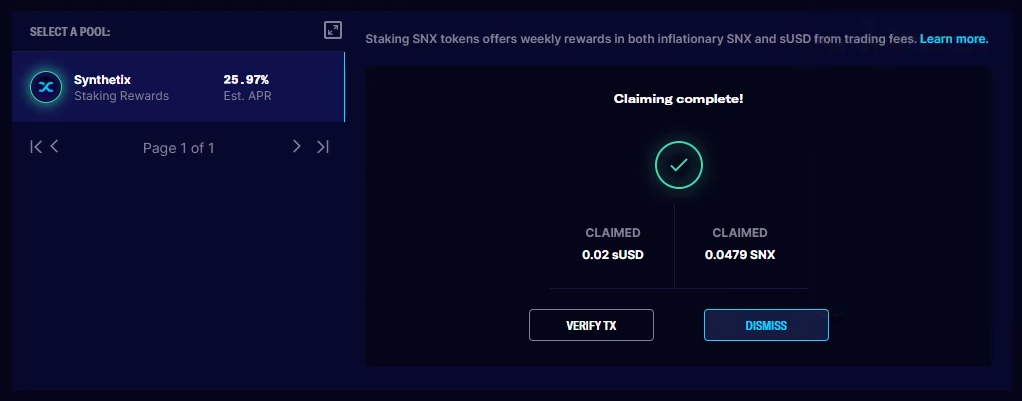

Step 3 : You continue to select “Syntheix” and click “CLAIM REWARDS” to receive the reward.

Step 4 : You confirm the transaction on the wallet to complete the reward process.

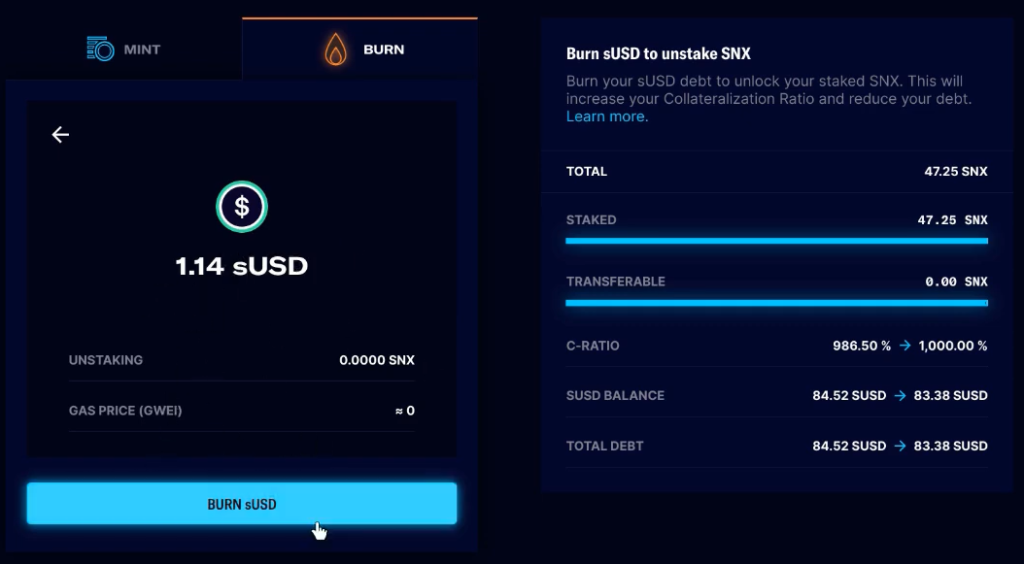

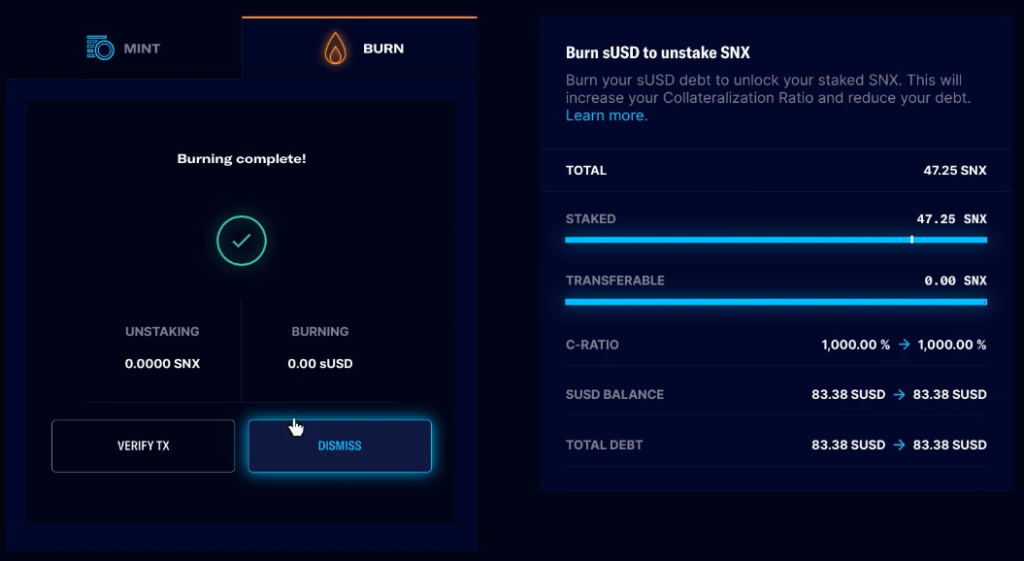

To get back the staked SNX, the user will have to burn the minted sUSD plus a small amount of sUSD to pay the interest (debt). The unstake period will be 7 days.

Step 1 : You access and connect your wallet at https://staking.synthetix.io/ .

Step 2 : You access the "STAKING" section and select "MINT & BURN".

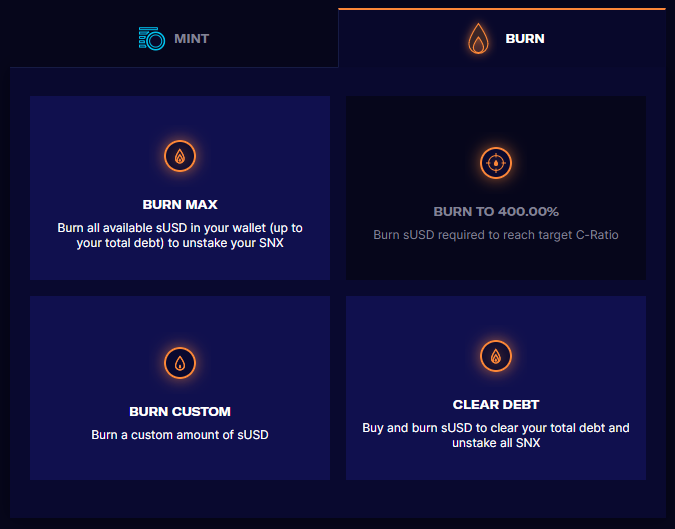

Step 3 : In the “BURN” section, enter the amount of sUSD you want to burn and press “MINT sUSD”. Synthetix supports 2 main sUSD minting modes including:

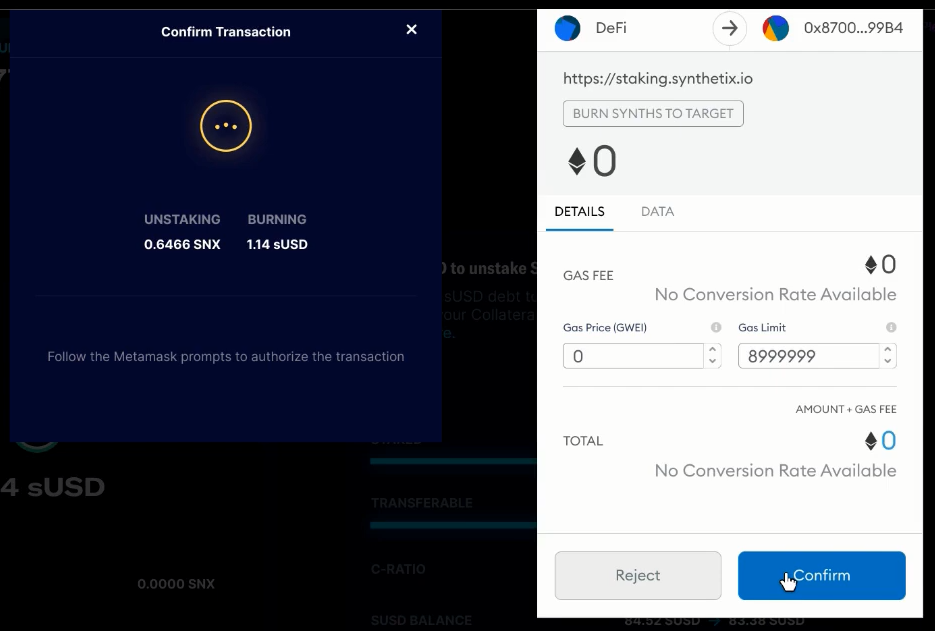

Step 4 : You confirm the transaction on the wallet to complete the sUSD minting process.

Currently, investors can trade sUSD on a number of exchanges such as Kwenta, Uniswap, Binance...

sUSD was created with the aim of being the currency for the DeFi ecosystem. Therefore, investors trade sUSD on Kwenta and Uniswap to optimize profits.

Above is the basic information about sUSD and Synthetix platform. Hopefully with these useful information and instructions for minting sUSD from SNX, you will have a new investment option with this stablecoin.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.