What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

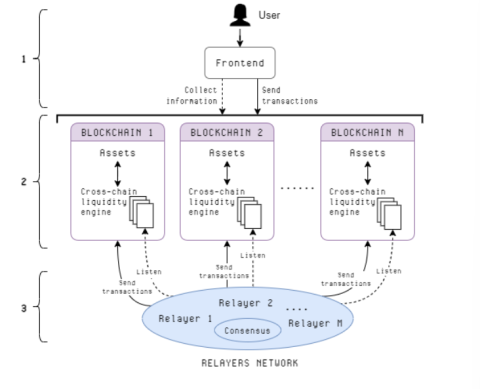

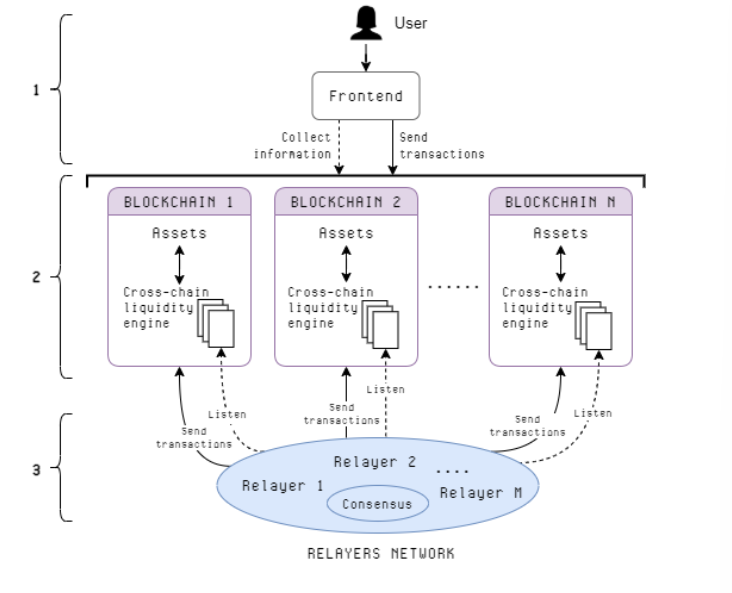

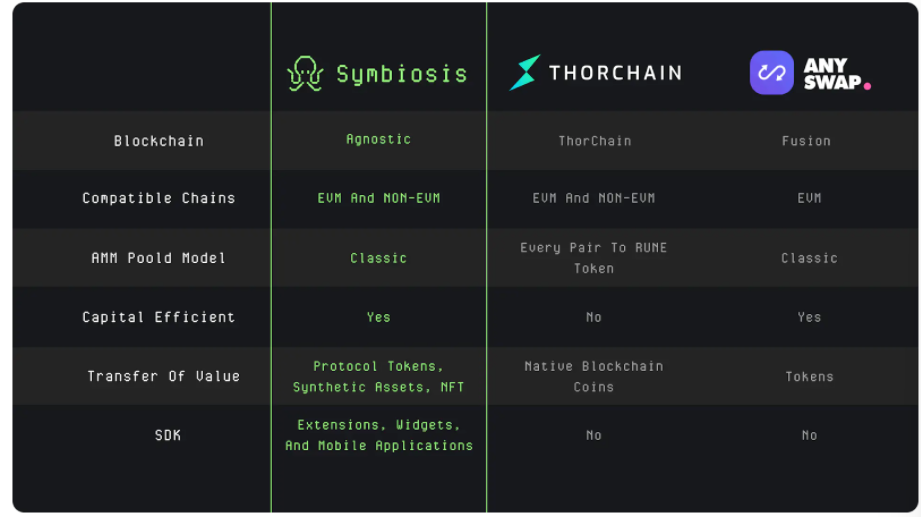

Symbiosis Finance is a decentralized multi-chain liquidity protocol that provides a user-friendly interface. In a simpler way, Symbiosis Finance provides a source of liquidity that is aggregated from many different chains including EVM-compatible and EVM-incompatible blockchains.

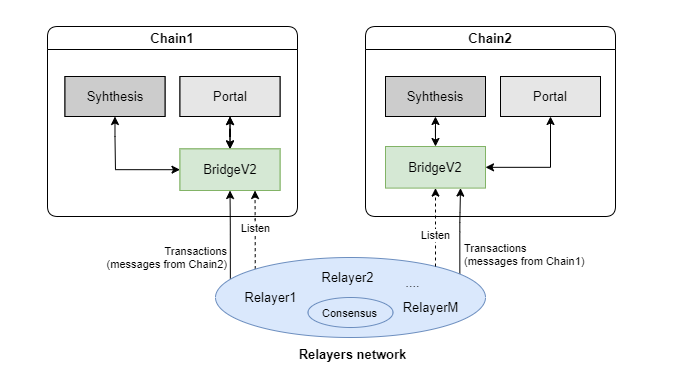

In addition, Symbiosis Finance operates cross-chain liquidity pools that focus on off-chain routing, allowing liquidity to be exploited on AMMs of blockchains that the project supports. The project is also a permissionless P2P network, based on Relayer Networks and incentive mechanisms built into the platform.

In addition to providing liquidity, Symbiosis Finance also provides asset swap features similar to DEX exchanges. The project also allows users to swap assets between all other blockchains more easily. Up to now, the project supports 4 blockchains including Ethereum , Polygon , Avalanche and BNB Chain.

Symbiosis Finance was created to solve the problem of fragmented liquidity on different blockchain networks and poor user experience when interacting with DeFi and Web 3.0 applications.

The platform also simplifies the process of finding a suitable cross-chain bridge for asset swaps on various blockchains. Symbiosis Finance provides a user-friendly interface, they just need to perform simple actions like “click” to instantly swap tokens, regardless of which blockchain network the user is using.

Symbiosis Finance has some other highlights as follows:

Symbiosis Finance uses both types of wrapped tokens:

The purpose of Symbiosis Finance is to perform a cross-chain swap with 2 cases:

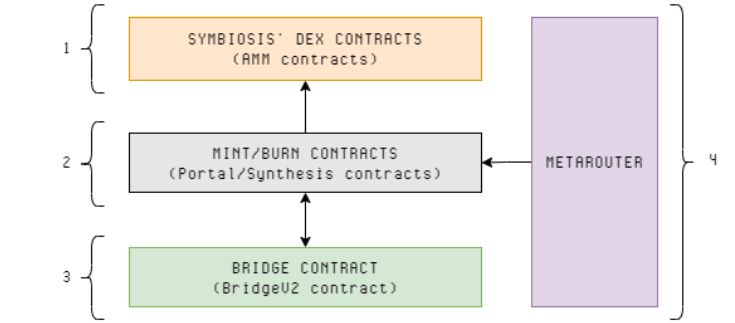

Cross-chain Liquidity Engine : This engine is a collection of smart contracts used to perform asset swaps between chains. These smart contracts will be deployed and regulated by Symbiosis Finance administrators.

Symbiosis DEX contract : This contract is used to exchange sToken and stablecoin. The swap feature of Symbiosis is designed according to the AMM model with 4 use cases as follows:

Mint/burn contract : This contract will be used to mint and burn sTokens.

Bridge contract : This contract is an authorization between the Relayer Network and the Portal/Synthesis contracts.

Metarouter : This is a smart contract that manages the trading orders transmitted to different contracts. It will act on behalf of users in the process of exchanging assets between different blockchains.

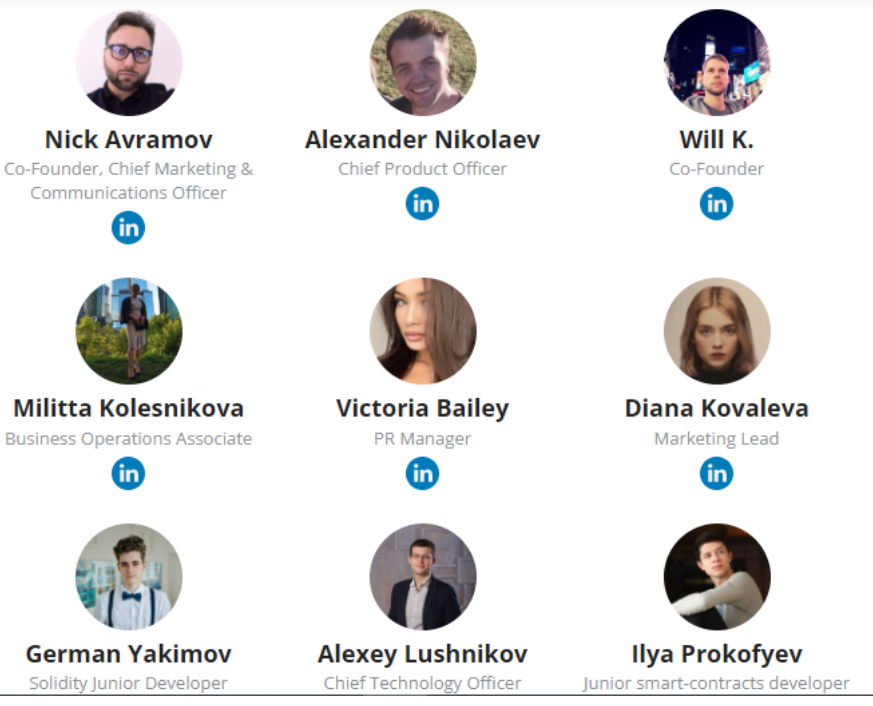

Development team

The development team of Symbiosis Finance consists of members as shown below.

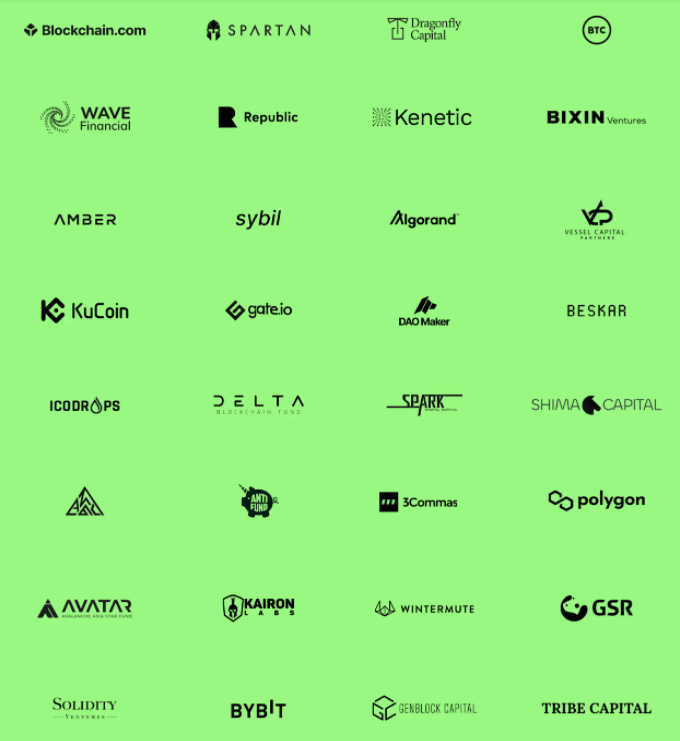

Investors

The project raised US$2 million in seed round with the participation of investment funds such as DAO Maker, Gate.io, Blockchain.com Ventures, Wave Financial Group, Injective Protocol, KuCoin, Primitive Ventures, Kairon Labs.

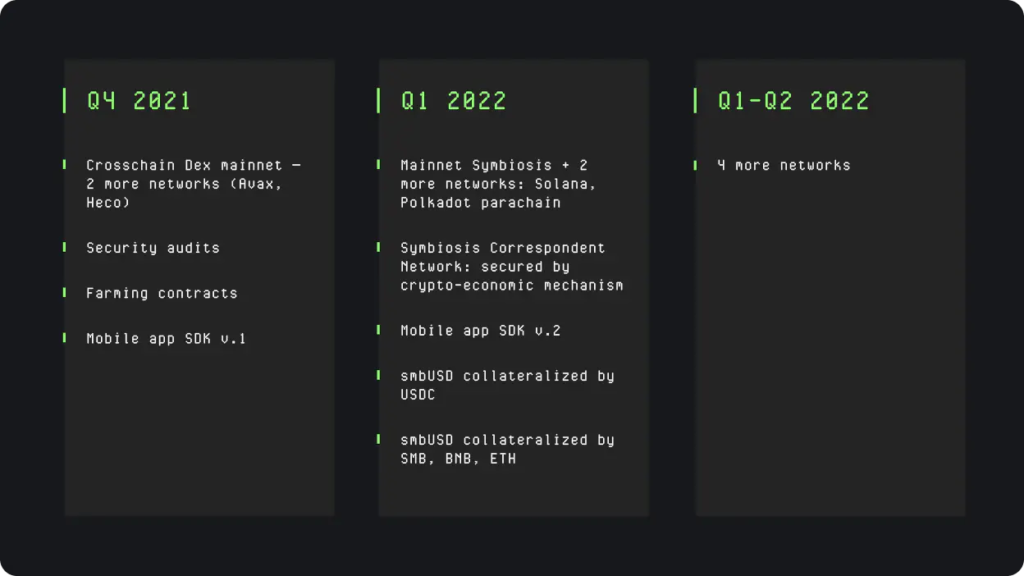

1st quarter of 2022

1st and 2nd quarter of 2022

SIS is the governance token of the Symbiosis Finance project with some outstanding information as follows:

With some functions as follows:

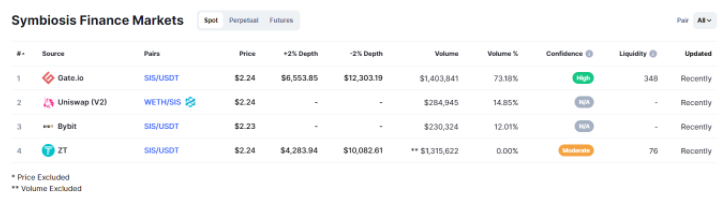

Currently SIS token is listed on exchanges such as Bybit, Uniswap (V2) Gate.io, ZT.

Symbiosis Finance is designed based on AMM models similar to Uniswap and Curve. In fact, these models have been proven by Uniswap and Curve to how effective they are.

Unlike the AMMs mentioned above, Symbiosis Finance provides a multi-chain liquidity source, helping to ensure smooth cross-chain transactions and more cost-effectiveness. Besides, it also helps to minimize the risk of slippage for low-liquid token swaps.

Symbiosis Finance is a protocol built on Ethereum. Therefore, it is considered as a solution to the limitations of transaction fees on this network. With the provision of multi-chain liquidity, users can now directly swap tokens on the Ethereum network with tokens of other networks in an easier and more cost-effective way. Some official information channels of the project that investors can follow are:

Website | Twitter | Telegram | Discord

Above is information about the Symbiosis Finance project and the SIS token. The project was created to meet the need to connect between blockchains so that investors can easily access more ecosystems. This will open up more profitable opportunities for investors. With the above information, hopefully readers can take it as a basis for self-assessment and making investment decisions for themselves.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.