What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

TerraUSD (UST) is the decentralized and algorithmic stablecoin of the Terra blockchain. UST is a scalable and highly profitable stablecoin for investors with a value that remains stable at a 1:1 ratio to the US dollar.

TerraUSD (UST) is a Stablecoin built on the Terra blockchain. The UST token has no technical support. Instead, the UST will facilitate the burning of LUNA tokens.

The UST value fluctuates because it is driven by supply and demand for the asset and the price of US dollars. When the value of UST exceeds one US dollar, LUNA holders can sell tokens under the UST. Besides, due to the increased supply of UST, the price of LUNA also increased. As supply decreases, UST tokens can be converted to Terra (LUNA). This action increases the price of UST. Therefore, when a certain amount of LUNA is burned, it creates a scarcity and increases their value.

Terra's price chart on 11/05/2022

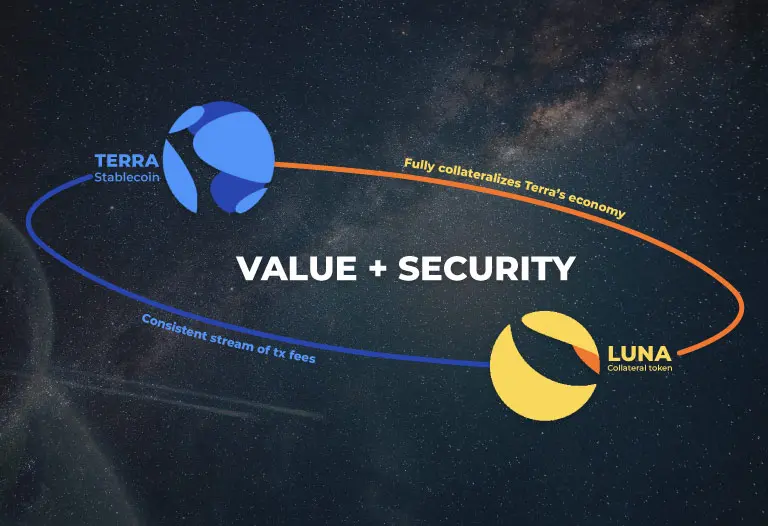

TerraUSD (UST) is based on US dollars and is guaranteed by Terra (LUNA). LUNA is a reserve of assets that ensures the stability and security of the UST through the seigniorage process (income received from the issuance of coins).

Miners also play an important role in the security of the Terra ecosystem. Miners participate in Proof-of-Stake (PoS), providing stability by addressing short-term demand fluctuations for Terra. After all, the need for stable mining is one of the main requirements that should be guaranteed. Therefore, TerraUSD strives to provide a stable reward in all market conditions. In this way, TerraUSD can compensate those who are maintaining and building the network.

As an algorithmic stablecoin, to avoid the effects of cryptocurrency market volatility, Terra maintains the value of UST by ensuring that its supply and demand are always in balance. Terra used the LUNA coin as a price stabilization method for the algorithm that created the UST coin. To generate 1 UST, the user needs to burn an amount of LUNA worth 1 USD and vice versa. Simply put, users will burn LUNA to cast UST and burn UST to cast LUNA. Thanks to this mechanism, it helps to ensure that the value of the UST will always be stable against the US dollar. This is also the factor that makes UST different from other stablecoins.

UST is an algorithmic stablecoin, which is stabilized through its LUNA burning mechanism and money market. With this unique mechanism, the value of UST will always be stable around the US$1 level regardless of whether the demand for this coin increases or decreases. This makes it possible for DeFi projects using UST as a means of payment to scale without fear of UST price volatility affecting their applications, products and services.

In addition to TerraUSD (UST), Terra also issues many other stablecoins including TerraCNY, TerraJPY, TerraGBP, TerraKRW, TerraEUR and TerraSDR for use in many different markets. The stablecoins in the Terra ecosystem all share a common liquidity pool, making it possible for users to exchange between these stablecoins relatively simply and quickly with an extremely low cost.

UST can be used to generate passive income through Anchor Protocol. With Anchor Protocol, users can use loan and savings features with interest rates up to 20%/year. Anchor Protocol uses smart contracts to create a money market between lenders and borrowers to maintain the above interest rates. To put it simply, Anchor Protocol is an online platform that helps connect borrowers with lenders. The project will take most of the interest from borrowers to pay depositors.

If the amount collected from the borrower is not enough to maintain the 20% interest rate for the depositor, Anchor Protocol will use the money in its reserve fund to make up the shortfall. Conversely, if the amount collected from the borrower is higher and there is still a balance after interest payment, that amount will be transferred back to the Anchor Protocol fund.

Other stablecoins such as DAI, USDC… through Terra's Orion Money project can also be converted into UST and deposited into Anchor Protocol to receive interest.

With Terra Bridge, users can use UST to participate, experience many decentralized applications and services on different blockchain platforms such as Ethereum , BNB Chain, Solana, Harmony , Osmosis ...

Currently, you can trade UST on many major cryptocurrency exchanges that list this token such as Binance, FTX, OKX, KuCoin, Uniswap, Terraswap …

There are several types of wallets that support TerraUSD (UST) storage, such as Terra Station Wallet, Ledger, MathWallet, MetaMask, etc.

Terra is developed by South Korea-based Terraform Labs, founded in 2018 by Do Kwon and Daniel Shin. Terra launched the first TerraUSD (UST) coin on Bittrex Global in September 2020.

Terra's development team has more than 70 members. Among them are many mathematicians, scientists and financial experts from many large technology companies and institutions such as Apple, Microsoft or the Federal Reserve Bank of New York. Some of the main members stand out such as:

Daniel Shin (left), Do Kwon (right)

In the past time, the Terra ecosystem has made great progress. As of March 2022, Terra's Тotal value locked (TVL) has reached US$23.3 billion, second only to Ethereum. LUNA coin has a market cap of 33.77 billion USD and is about to create a new ATH after growing more than 146 times since January 2021. Besides, the capitalization of UST also increased from 180 million USD at the beginning. in 2021 to more than 13.5 billion US dollars as at present.

Some of the reasons why the Terra ecosystem in general and the UST coin in particular have grown so strongly can be mentioned as:

Hopefully with the above information, readers have a better view of the TerraUSD (UST) coin and the Terra ecosystem. UST is the first stablecoin that provides the ability to generate passive income with high interest rates up to 20%/year and the ability to move and exchange between different platforms while maintaining stability and reliability. high expansion. Thereby giving users many new and unique experiences, which previous stablecoin projects have not been able to do. This deserves to be an investment option not to be missed by any investor, especially those who have faith in the future development of the Terra ecosystem.

See also: Information about Tether USDT is what ?

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.