What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Astroport is a next-generation AMM for Terra, built to improve pricing and trading efficiency. Better pricing and performance will help Astroport attract more liquidity, further improving pricing and efficiency in a self-reinforcing loop. This is important because efficient transactions are at the core of driving adoption and integration with other protocols.

Built on top of the Cosmos SDK, Terra applications such as Astroport can be integrated with Wormhole v2 or other interoperability protocols, thereby extending Astroport's reach to other blockchains. Users on other chains can access Astroport's liquidity without needing a wallet developed on Terra or even realizing they are using Terra.

Witnessing the development of projects and applications on Terra is like looking at 6 years of Ethereum development compressed into a span of just a few months. The platform AMM will assist Terra in transitioning from the beta of Terra 1.0 to promoting mass adoption of Terra 2.0.

Astroport allows users to select different types of pools in a single AMM system . Anyone can join and trade tokens without permission. There is no group leader or official to stop them.

Astroport brings cutting-edge innovations in the field of decentralized exchanges:

Astroport supports two types of liquidity pools:

It is backward compatible with Terraswap message formats and features as well as next generation user interface.

The trading floor on Astroport is always open. Anyone can set up a trade booth by providing liquidity in a pool. After that, anyone else can trade with those tokens at any time.

LP offers the ability to earn fees. At launch, they can also provide liquidity to earn ASTRO. Since all of Astroport's liquidity is in smart contracts, it's programmable.

Other Terra-based dapps can integrate Astroport's liquidity directly into their platforms. That means traders across the entire Terra ecosystem always have access to your liquidity.

Astro pools

The AMM system may use a different algorithm to determine the token price based on the ratio of the two tokens in the pools. As DEXs matured, many new AMM algorithms emerged, each with its own equalizer.

Astroport allows the following pool types to support Astroport for a wide range of token markets:

Constant Product pools

The constant product family pioneered by Bancor and Uniswap, has gained popularity on decentralized exchanges due to their simplicity and flexibility. They are easy to create, easy to encourage, and require minimal active management. No matter how simple, constant product groups have proven that they can be priced competitively with centralized exchanges.

The unchanged product group still has disadvantages. LPs bear price risk in the form of impermanent losses. Therefore, the LP must receive enough fees or other incentives for liquidity operations to be profitable. In addition, most of the liquidity in the constant product groups is not used to support trades under normal conditions. This capital inefficiency results in relatively high slippage (i.e. the difference between the expected and strike prices) relative to other pool types.

However, these pools are a good choice for high volatility pairs (e.g. mBTC-UST), as they facilitate trading at all possible price levels, even in volatile markets. big, sudden. They are also well suited for primary markets, where traders are more likely to speculate and act on outside information despite high slippage.

Stableswap Invariant pools

We have seen above how increasing liquidity into a constant product AMM can help reduce slippage. There are however some situations where the amount of liquidity required to provide a reasonable and low slippage for traders is not feasible. For example, it is the case of token pairs whose exchange rates rarely deviate from 1:1.

USD-pegged stablecoins are a prime example. When exchanging one stablecoin for another, traders expect an exchange rate close to 1:1 because these tokens are designed to represent the same value (1 USD). It is extremely common to exchange one stablecoin for another, so reducing slippage on these types of transactions is a valuable part of the market infrastructure. Other examples of these types of “stable pairs” include different wrapped, synthetic, or staked versions of the same underlying asset (e.g. bLUNA-LUNA).

Stableswap AMM was first introduced by Curve Finance. By modifying the underlying swap formula, the fixed swap AMM "amplifies" liquidity around the 1:1 exchange rate, resulting in a significant reduction in slippage. As a result, swap AMMs are more efficient than their constant product pool, as most of this amplified liquidity is used to facilitate transactions.

Astro Generator

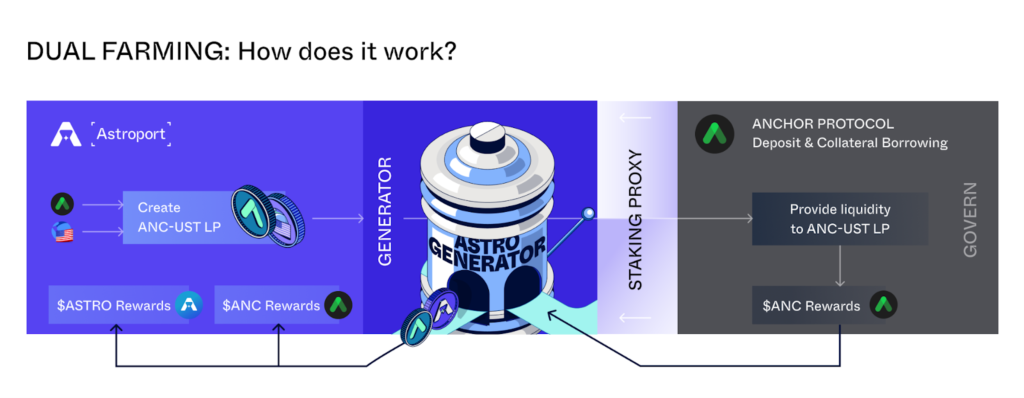

One of the problems faced by liquidity providers (LPs) is deciding which platforms to provide liquidity to, as rewards can vary in quantity or value. Astroport solves this problem with special, proxy-based smart contracts that allow for “dual farming” of the ASTRO token and governance token from another community looking to incentivize LP.

These authorization contracts are connected to the Astro Generator contract, allowing liquidity providers to claim dual governance token rewards (both ASTRO tokens and tokens from other communities, e.g. ANC and MIR). ).

Integration with Astroport Generator will bring more liquidity to Terra projects, and LP will have a better user experience with fewer steps and transactions.

Dual Liquidity Mining

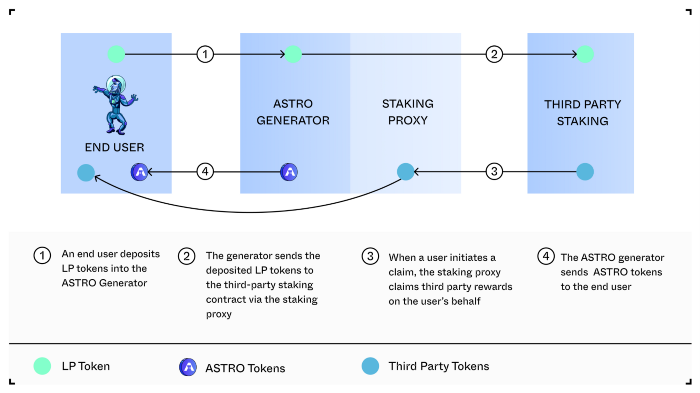

Instead of directly depositing Astroport LP tokens in third-party staking contracts, LPs can deposit their tokens into one of the Astro Generators. Using authorization contracts, Astro Generator forwards LP tokens into relevant third-party staking contracts. As a result, the LP will accumulate two sets of rewards (both ASTRO and third-party protocol tokens).

When an LP wants to claim the accumulated dual rewards from a particular generator, (1) the ASTRO generator transfers their appropriate amount of ASTRO and (2) the authorization contract requests a third party token reward and sends these rewards go to LP's wallet.

This dual distribution model has several advantages. First, this architecture minimizes development and operational requirements for third-party protocols that want to integrate with Astroport. Second, LPs that continue to stake only on third-party protocol staking contracts will continue to receive those issued tokens.

Astroport DAO (Astral Assembly)

Astral Assembly will run Astroport. It's Astroport's version of the DAO (decentralized autonomous organization) . Astral Assembly's goal is to operate, maintain, develop and grow Astroport as a user-managed DeFi community. xASTRO and vxASTRO holders will have the right to propose and issue binding votes on smart contract parameter changes, smart contract upgrades, and fund disbursements.

This information is being updated.

Development team

Astroport has been developed through a consortium of builders, including Delphi Labs, We3, Attic Labs and Terraform Labs (Astroport Venture).

Investors

Astroport's investors also include Delphi Labs and Terraform Labs, but not much is known about the project's investors.

Partner

Astroport is currently partnering with many other Dapps, protocols, and blockchain platforms to integrate tokens into its DEX. Specifically, XDeFi Wallet, Rango Exchange, Apollo DAO, Nexus Protocol…

ASTRO sits at the heart of the Astroport ecosystem, helping to coordinate and align the incentives of all stakeholders.

Astroport token details:

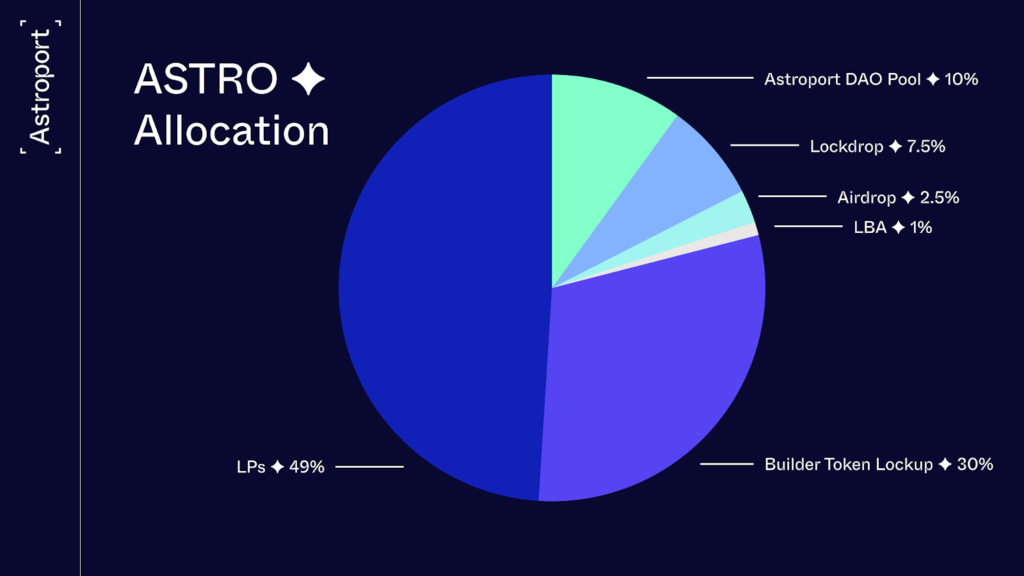

Token Allocation:

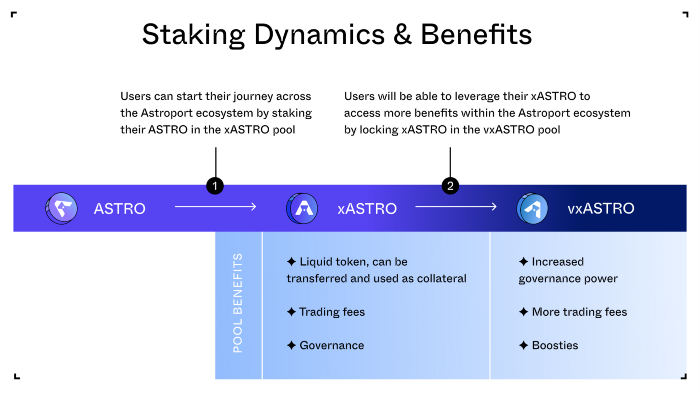

ASTRO staking and locking

ASTRO owners will be able to use ASTRO in two ways to assume administrative responsibilities for Astroport:

xASTRO

vxASTRO

Otherwise, vxASTRO will not be encrypted. Instead, vxASTRO can be thought of as points that allow users to leverage their xASTRO to access additional benefits within the Astroport ecosystem, namely:

ASTRO is now community launched and can be traded on Terraswap, MEXC Exchange and Astroport.

Just as Uniswap has become a mainstay of the Ethereum ecosystem, so will the top Terra DEX Astroport.

Optimized for flexibility and adaptability, Astroport is capable of attracting significant volumes of transactions. That means the platform's launch could also have implications for many other upcoming Terra 2.0 projects. It will do it by:

In addition, as stated above, thanks to development on Cosmos SDK, it is possible to integrate Astroport with Wormhole v2 or other interoperability protocols to extend the reach of this platform to other blockchains.

In general, Astroport has a fairly reasonable and rhythmic operating mechanism. If the Terra ecosystem continues to grow, and money continues to flow into the system, the project may grow more and more in the near future.

To update the latest information about the Astroport project, follow the project's communication channels:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.