What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Bridgesplit is a project designed as a financial infrastructure for cross-chain cryptocurrencies. Bridgesplit provides users with the ability to aggregate and liquidate cryptocurrencies for the next phases of the Web 3.0 platform .

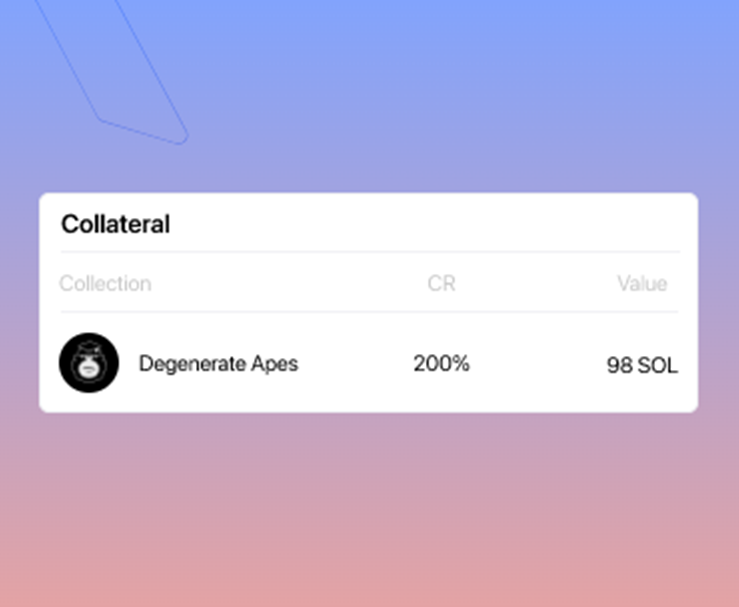

At the same time, the Bridgesplit project also provides a protocol to help solve the problem for NFT whales (whales holding more than 10 million USD) that are not yet able to trade in the NFT market ; for collectors who want to collect blue-chips for sale at the 1Sol protocol; and for collections looking to expand their utility to the NFT market.

Currently, Bridgesplit is the first decentralized financial repository for NFT. The protocol of this platform is designed with 4 main functions and will develop many more additional functions in the future.

Specifically, the current 4 main functions include:

The Bridgesplit project has some outstanding features as follows:

Provide a decentralized financial platform for NFT

This feature sets Bridgesplit apart and solves many of the outstanding problems of the NFT ecosystem:

Providing end-to-end financial infrastructure for NFT

This infrastructure includes 3 features:

Regarding Bridgesplit products, the design team provided the corresponding product system to meet the features of this platform. Specifically:

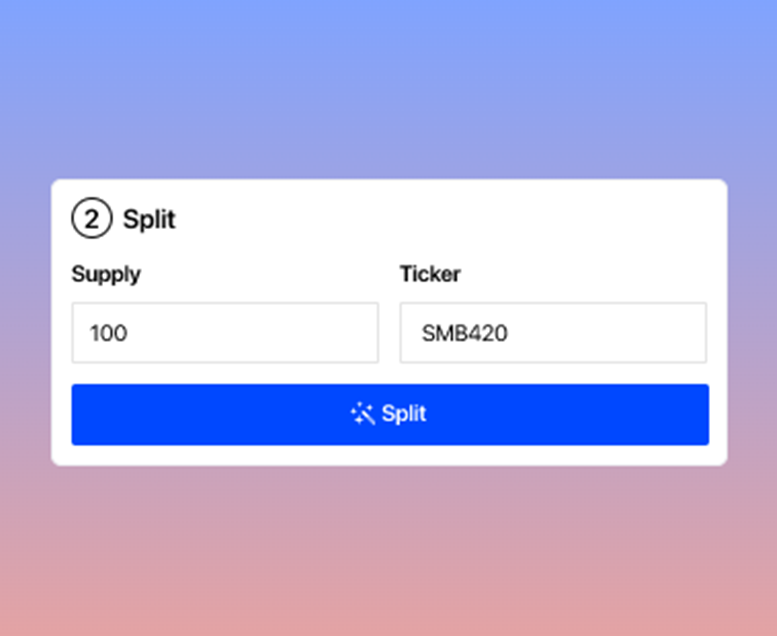

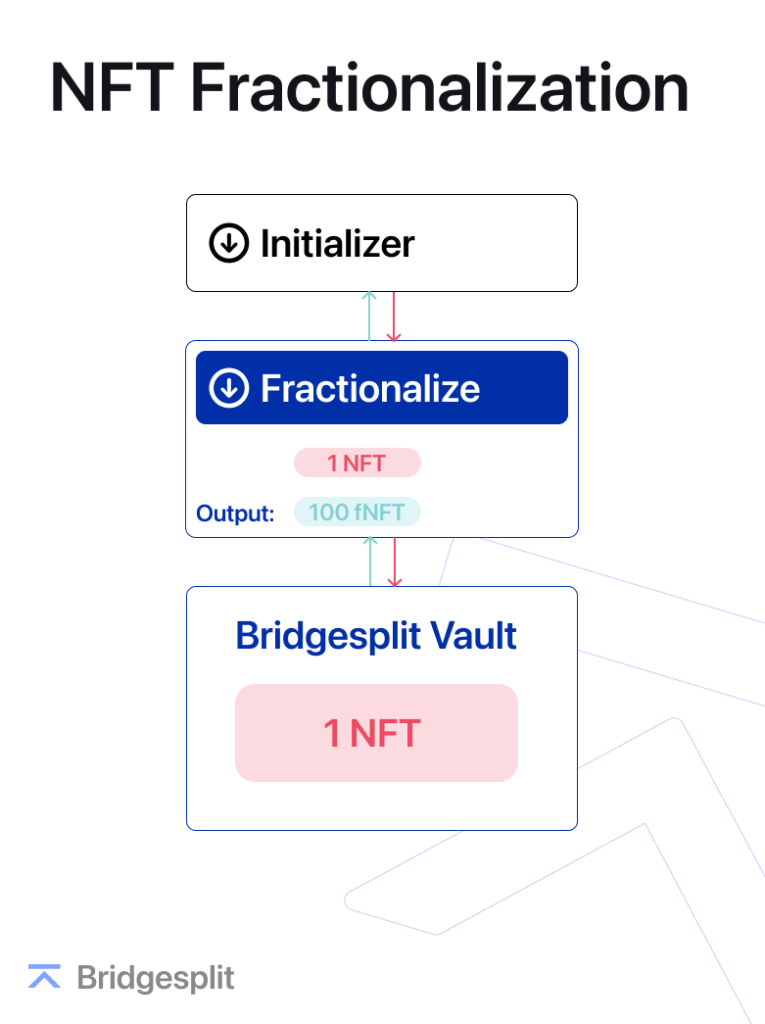

NFT fragmentation

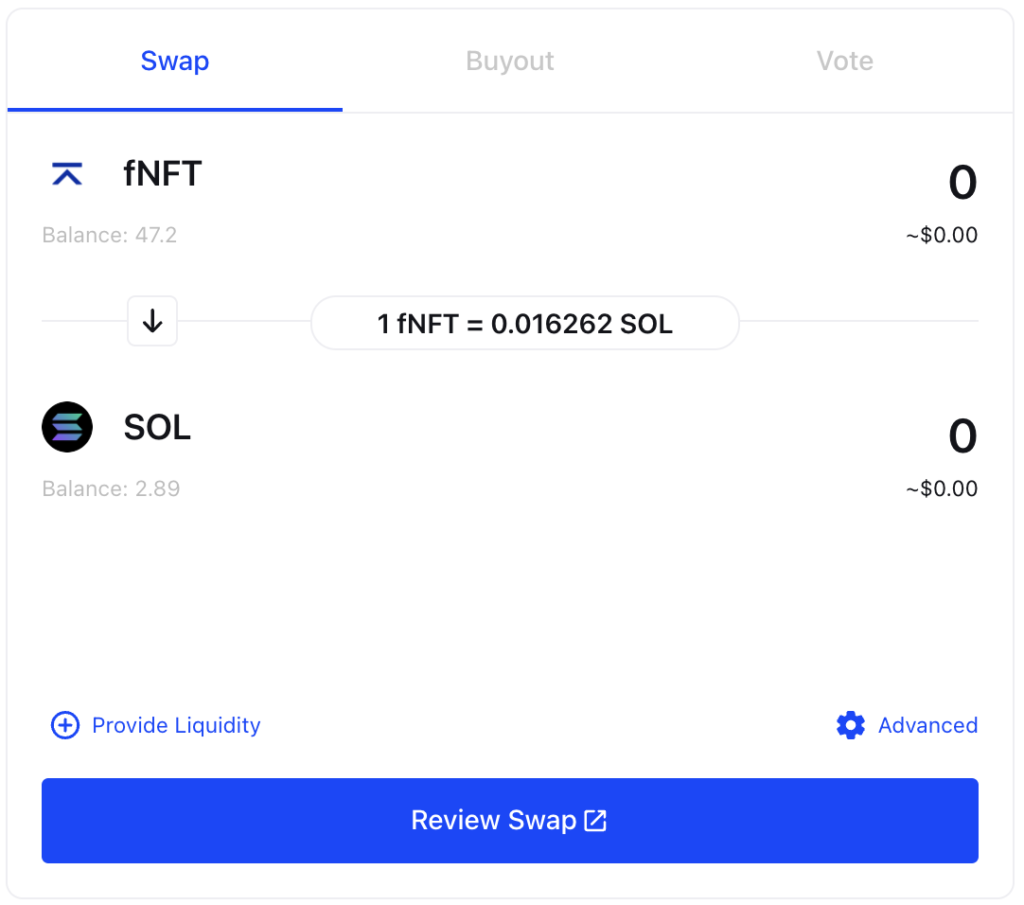

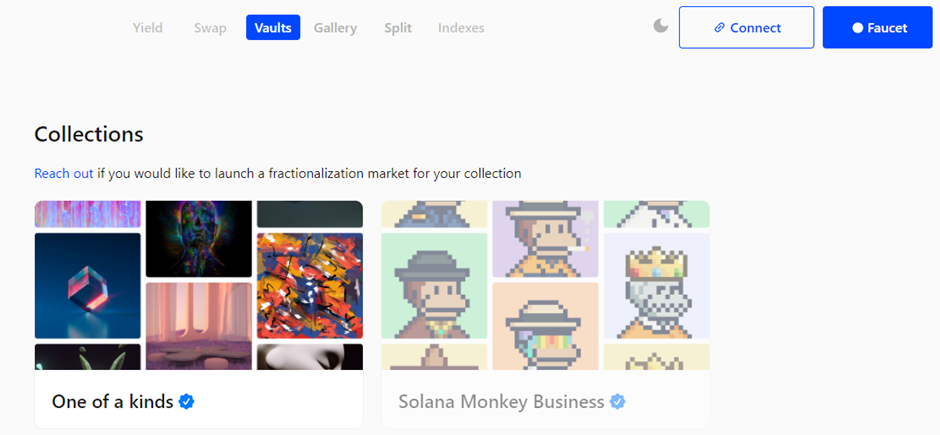

When NFT fragmentation is performed, a smart contract containing new cryptocurrencies, displayed representing NFT transactions, will appear. These segmented transactions are unique to each NFT.

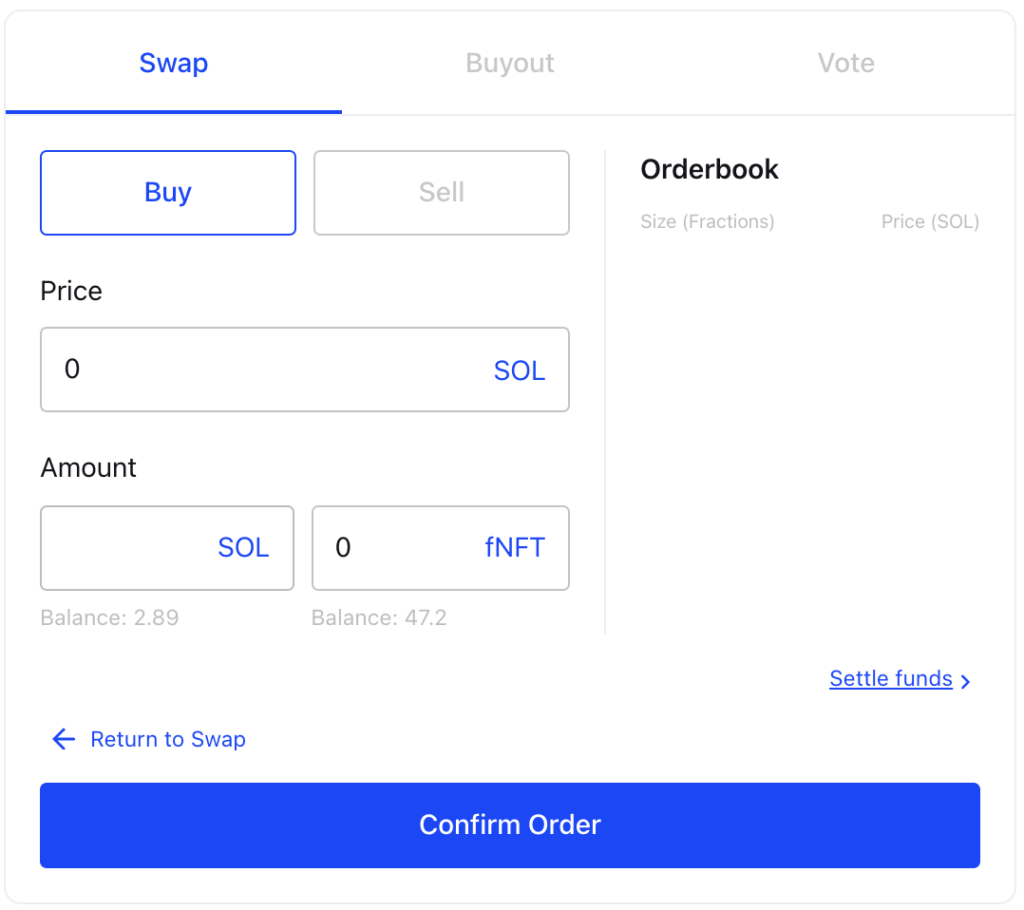

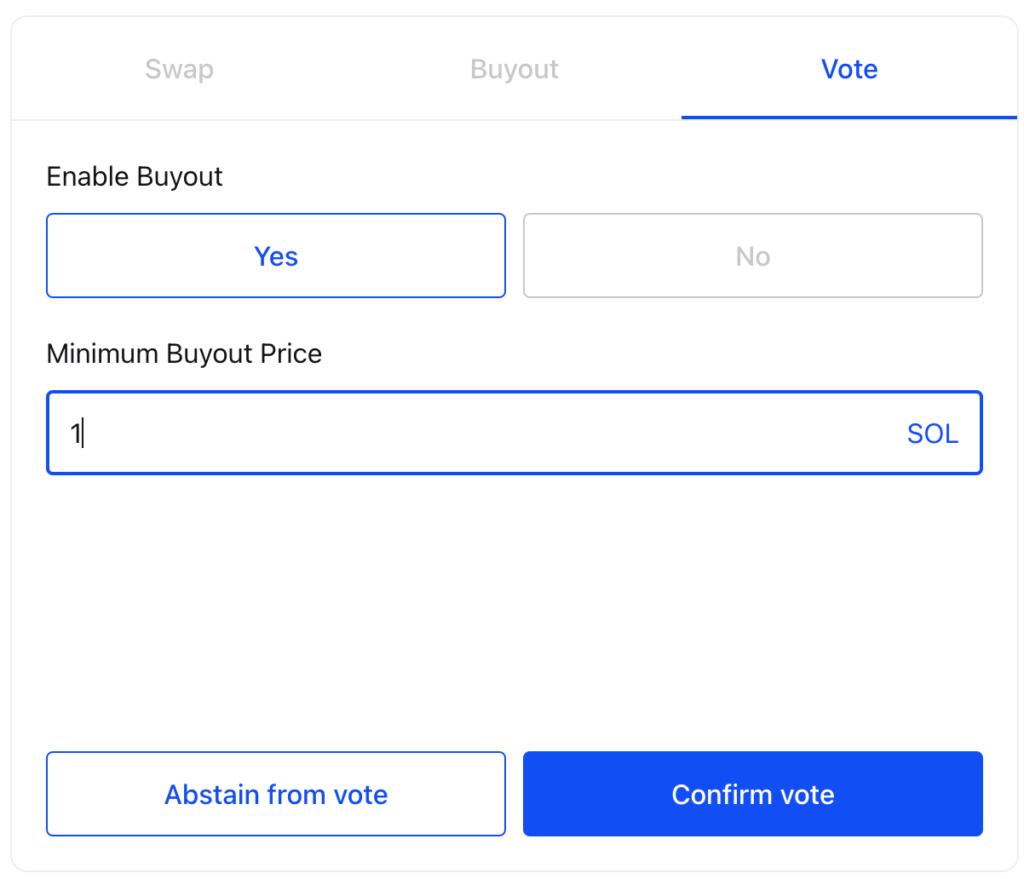

Transactions involving NFT fragmentation are NFT asset exchange. After forking their NFT, the owner can create a marketplace for the sale of the forked NFT portions. To implement this feature, the project needs the support of the Raydium AMM protocol on Serum. Owners of NFT shards can also provide liquidity to the AMM and recoup revenue from transaction fees or book order fees. For collectors, they can purchase NFT shards from these marketplaces and it will be displayed directly on the vault page, as long as the NFT shard has not been purchased by anyone.

Specifically, these transactions include:

NFT Group

The NFT team product is currently in the process of being finalized and will be available soon.

NFT Lending

The NFT loan product is currently in the process of being finalized and will be available soon.

Updating

This information is being updated.

Investors

In the seed round, the Bridgesplit project raised $4.25 million and the investors leading this round are CoinFund and JumpCapital. In addition, Bridgesplit has also received investments from many other large institutional investors in the market such as: Coinbase Ventures, Solana Ventures, Not Boring Capital (Packy McCormick), Sfermion, Liquid2 (Joe Montana), a41 Ventures and Rucker Park Capital.

Partner

Regarding partners, Bridgesplit will cooperate with PlaygroundsDAO after successfully launching the MonkeDAO mascot segment. PlaygroundsDAO will join Bridgesplit as the Alpha launch partner in the second phase of the project.

This information is being updated.

Compared to the blockchain market in general, the Bridgesplit project is relatively new and is currently in the early stages of idea development. However, the initiative to bring a decentralized financial infrastructure to NFT is quite unique and outstanding. At the same time, the project can solve many outstanding problems in the NFT ecosystem and will bring more sources of liquidity to this ecosystem. From there, it helps NFT to be easily exchanged on the market.

With the orientation of providing the market with the aforementioned financial products and working on Solana and many other blockchains, Bridgesplit brings many differences and practical uses to market participants. current blockchain market.

As the first NFT financial platform to leverage Solana, at the same time allowing NFT to be combined with DeFi and providing extensive features such as NFT segmentation, mortgage lending, etc., the Bridgesplit project is considered extremely important. important and necessary for those who own NFT and participate in crypto-asset trading activities.

Interested readers and want to learn more information about the project can watch the channels below:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.