What is Chainlink (LINK)? Things to know about Chainlink and LINK

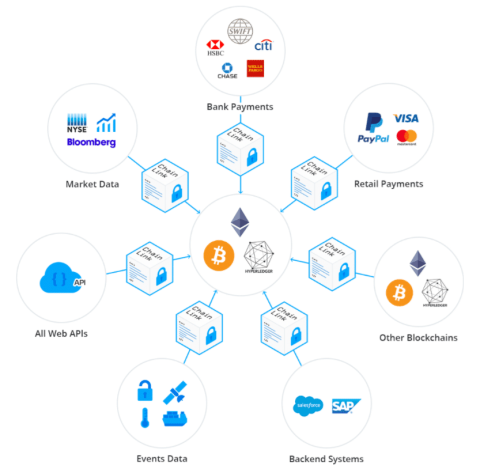

ChainLink is a decentralized Oracle network founded in 2017 by Smart Contract company Chainlink Ltd., based in Cayman Islands.

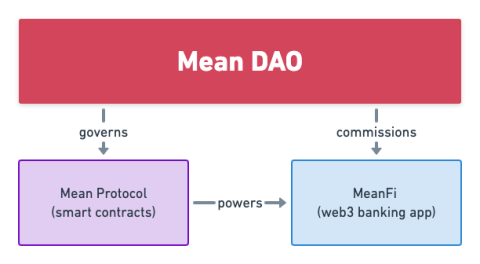

MeanFi is a Web 3.0 banking application, managed by the user without being dependent on 3rd party intermediaries. MeanFi is funded by Mean DAO and built on top of Mean Protocol.

Mean DAO is a decentralized autonomous organization (DAO). Mean DAO's goal is to build the necessary decentralized products and blockchain infrastructure that act as financial tools for people and businesses around the world.

Mean Protocol is a set of rules and smart contracts that help developers build banking applications and processes based on blockchain technology. This protocol facilitates transaction coordination using a number of programs and sub-graphs such as Hybrid Liquidity Aggregator, DDCA and direct money transfer schemes. .

Transparency

Fast transaction processing speed and cost savings

By building Mean Protocol on the Solana blockchain platform , developers and users can transact and perform investment, business, and other daily tasks with almost zero cost.

Minimalist design, friendly and easy to use app

MeanFi is designed and works like a regular bank with accounts, transactions and exchange rates, deposits and withdrawals, all powered by Mean Protocol on Solana.

A common liquid market

Mean Protocol allows developers to access more than $1.9 billion in aggregate liquidity through the Universal Liquidity Program. This helps users exploit aggregated liquidity from many AMMs such as Raydium , Orca ... and Serum 's CLOB to optimize routing, fees, slippage...

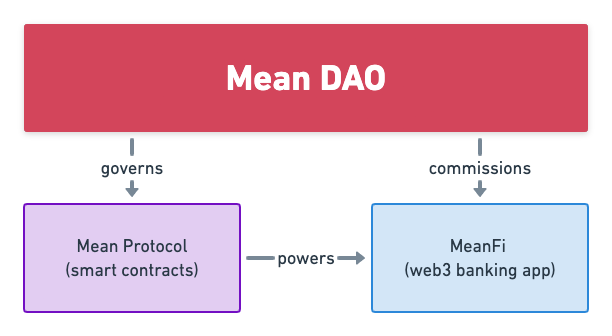

Implement decentralized DCA (price averaging) strategy

MeanFi provides users with the ability to DCA in a decentralized way, not controlled, monitored and managed by any intermediary. It helps you stay in control of your cash flow and leverages Mean Protocol DDCA contracts to schedule and plan DCA over various timelines.

MeanFi . app

With the MeanFi application, users can access the tools and services they normally use at traditional banks such as depositing, withdrawing, transferring... MeanFi is a decentralized application so anyone can can access and use these tools and services for free at almost zero cost.

Some outstanding tools and services of MeanFi can be mentioned as:

Mean Protocol

Mean Protocol supports various sub-graphs making it easy for developers to build their decentralized applications with low cost of use without requiring identity authentication.

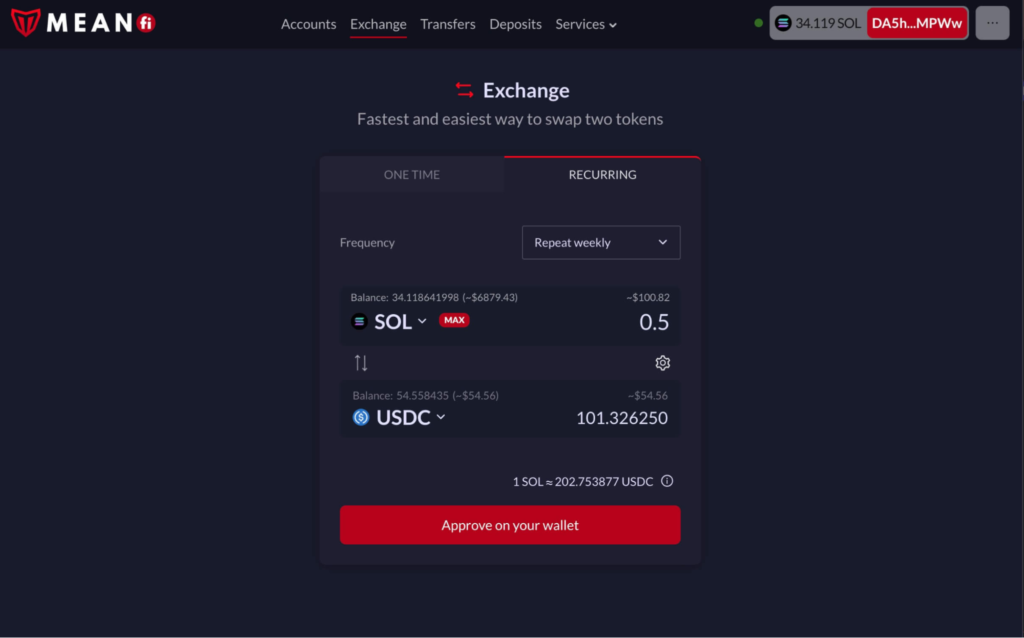

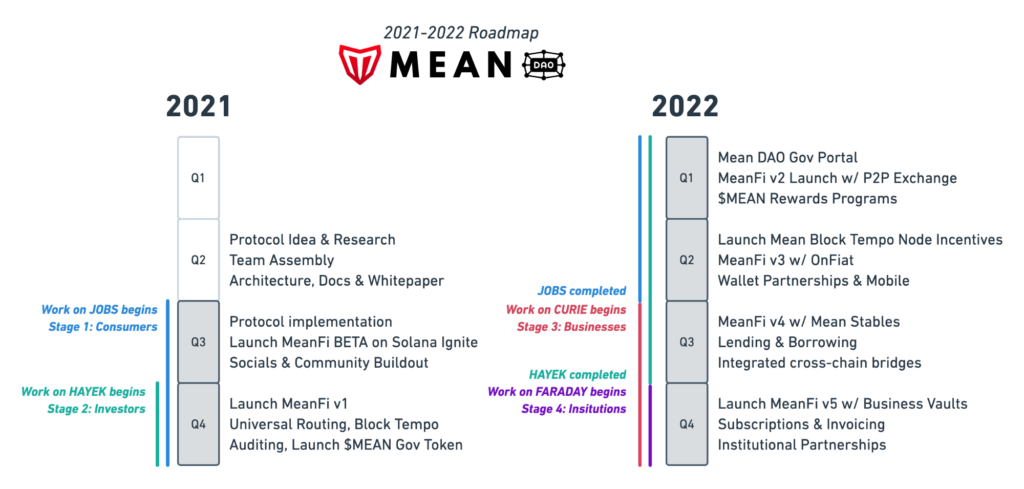

The development roadmap of the project is divided into 5 main phases:

Although each phase has its own specific focus and goals, they are all planned to run in parallel and launch sequentially. For the remainder of 2021 and all of 2022, the project will focus on completing phases 1 and 2.

Development team

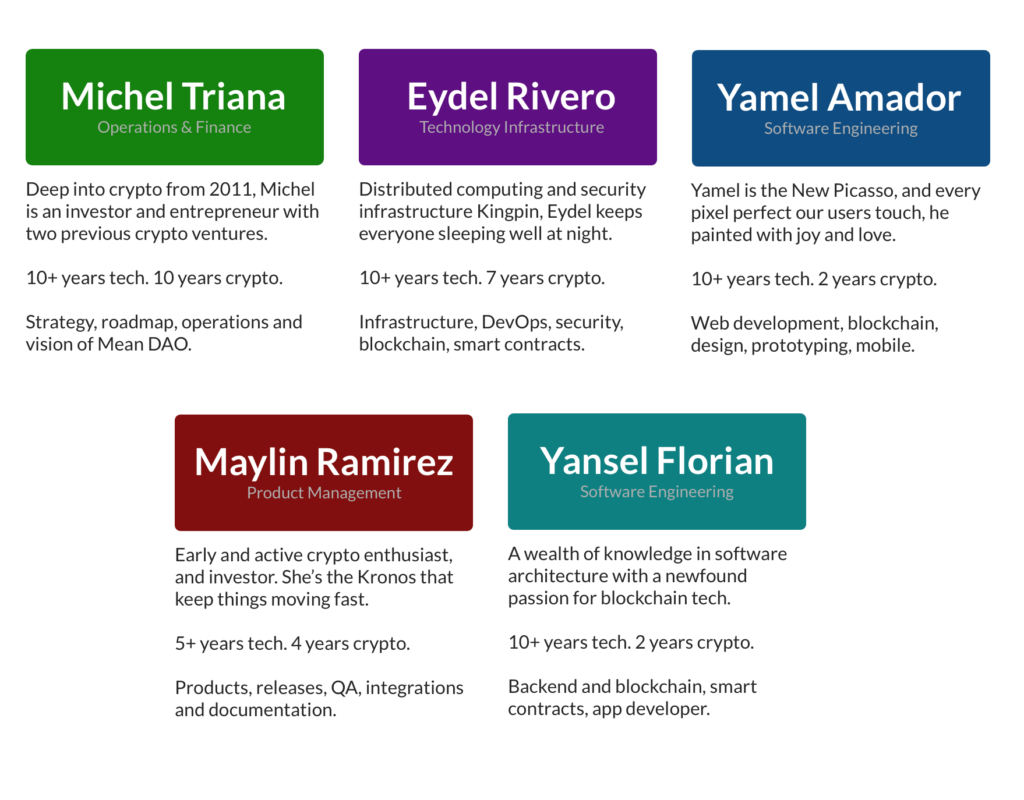

Michel T. – CEO : Michel has over 10 years of experience in both technology and crypto. He is also an investor and businessman with two investment funds. Currently, Michel is the one providing the strategies, development roadmap, activities and leadership for Mean DAO.

Eydel R. – Chief Technology Officer : Eydel is an expert in computer science, data security, and distributed networking. Eydel was also Michel's classmate from high school to college. At MeanFi, Eydel is responsible for issues related to infrastructure, DevOps, security, blockchain engineering, and smart contract architecture.

Yamel A. – Information Technology and Software Engineering : Yamel has more than 15 years of experience in the technology field and has provided many applications on mobile, web, embedded systems to startups. and businesses. He is currently the leader of MeanFi's website and mobile application development team.

Maylin R. – Information Technology and Product Management : Maylin has more than 5 years of experience in the technology and crypto industry, currently working as product, releases and documentation manager for MeanFi.

Yansel F. – Information Technology and Software Engineering . With over 10 years of experience in software development and over 2 years in coding. Yansel is in charge of developing backed, blockchain, smart contracts and applications for the project.

Investors

Mean DAO has raised $3.5 million in investment capital from many large investment funds and institutions such as Three Arrows Capital, SoftBank's SB Opportunity Fund and DeFiance Capital.

Other investors include Skyvision Capital, Solar Eco Fund, Sesterce Capital, Big Brain Holdings, Gerstenbrot Capital, a41 Ventures, Solanium Ventures, MEXC, PrimeBlock Ventures, Gate. io, LPI, Akshay from Solana Labs, Tanmay from SuperteamDAO and Norbert from Synthetify.

Partner

Some prominent partners of MeanFi include Jupiter, Synthetify, Grape Protocol, Solflare.

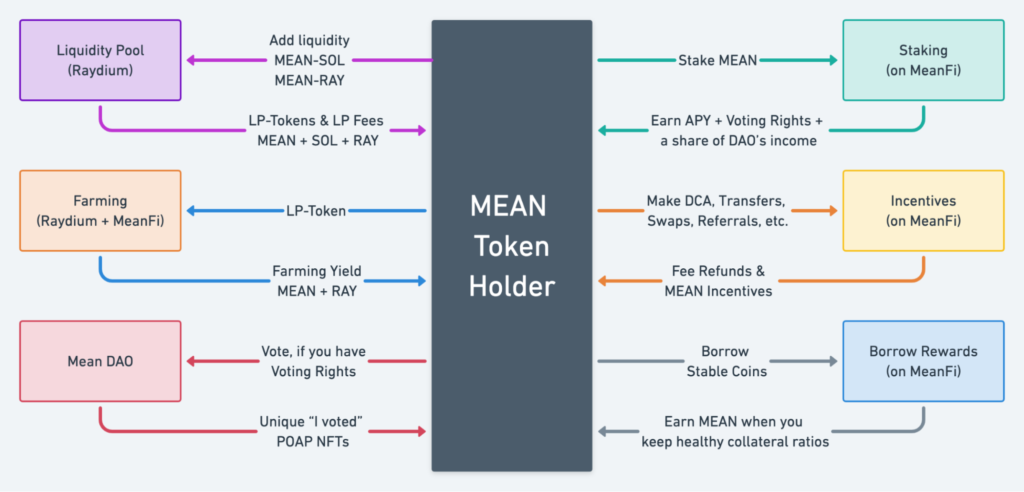

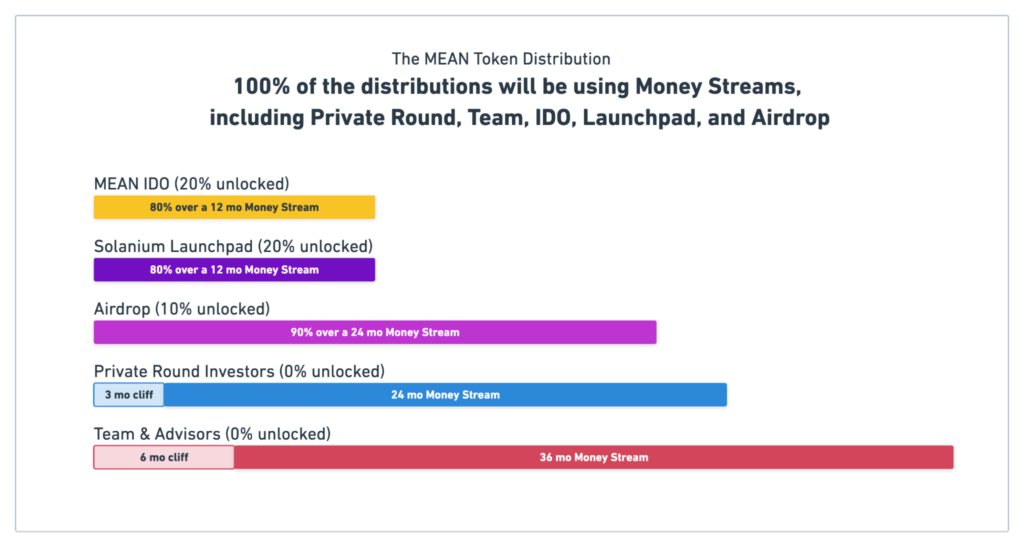

MEAN is the governance token of the MeanDAO ecosystem.

The MEAN token used in the MeanDAO ecosystem has the following basic functions:

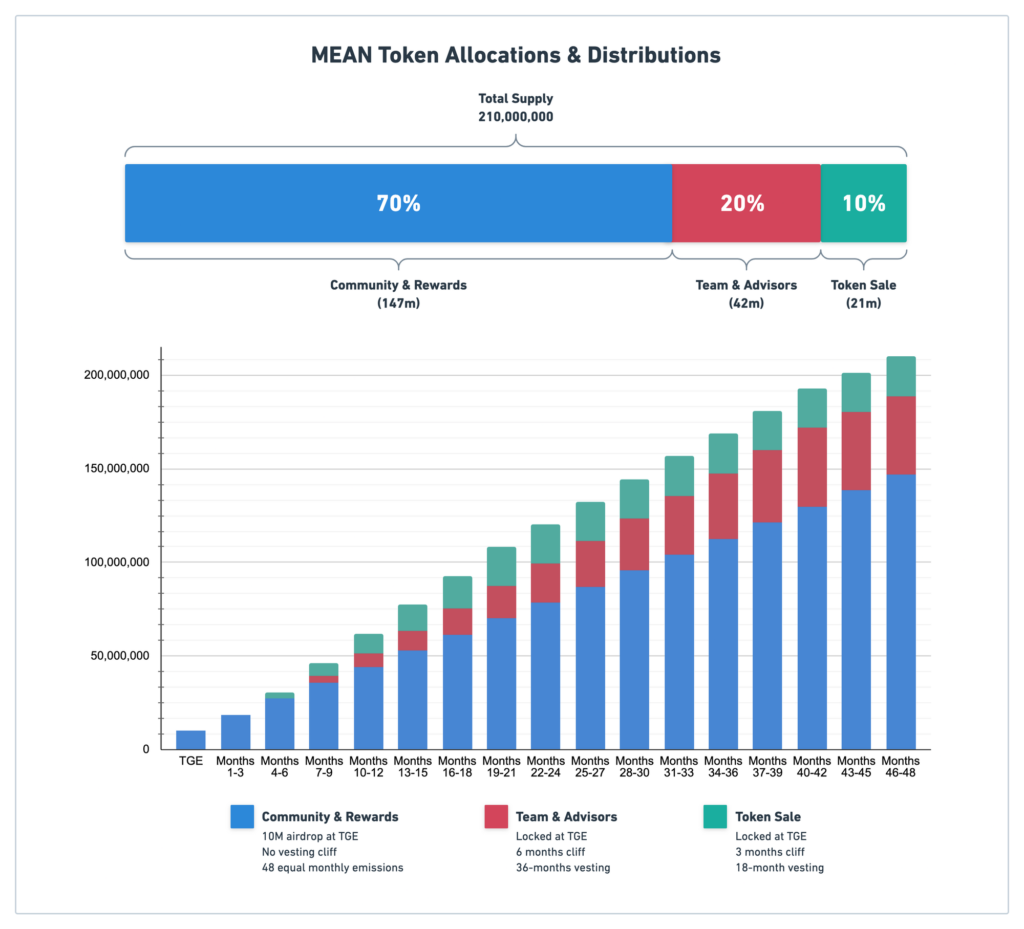

Currently, MEAN token has not been listed on any exchange. Recently, MEAN was launched on Solanium platform with IDO event on December 18, 2021 and from December 22, 2021 to December 24, 2021 at MeanFi app. After the IDO event ends, you can directly buy MEAN tokens with US dollars or euros on MeanFi or through cryptocurrency exchanges like Gate, Raydium, Serum, Orca...

Decentralized finance (DeFi) has seen a breakout growth from $900 million in July 2020 to a whopping $250 billion in total key assets (TVL) as of December 2020. 2021. But to make DeFi the new economic standard, it needs to be used and recognized by more users.

Mean DAO is building and developing MeanFi decentralized application and Mean Protocol on Solana network to help bring DeFi closer to people, businesses, companies and organizations. With MeanFi, a decentralized bank, users can access the tools and services they normally use at traditional banks such as depositing, withdrawing, transferring, saving... As for Mean Protocol , developers can easily build decentralized financial applications with powerful toolset and optimal cost.

The project is also built and managed by a professional development team with many years of experience in both technology, business and cryptocurrency. In addition, the project also receives the support and advice of large investment funds in the cryptocurrency market such as Three Arrows and DeFiance, as well as in the traditional financial sector, SoftBank.

The MeanFi project is a good project with the idea of building a decentralized banking application based on blockchain technology. However, the crypto market is currently not accepted by many countries and there are no specific regulatory laws. This will directly affect MeanFi's ability to grow and expand in the future. Therefore, you need to do thorough research before making a decision to invest in the MeanFi project.

summary

Above is all the basic information about the MeanFi project and the MEAN token. Mean DAO with the construction and development of the decentralized bank MeanFi and MeanProtocol will bring the cryptocurrency market and DeFi into daily banking activities. In addition to basic banking tools and services, MeanFi also offers users many features only available in the cryptocurrency market such as staking, farming, thereby making DeFi and crypto accessible to everyone. , businesses, companies and organizations.

ChainLink is a decentralized Oracle network founded in 2017 by Smart Contract company Chainlink Ltd., based in Cayman Islands.

Aurora is a solution for developers to migrate their applications from Ethereum to Near to take advantage of the platform.

Recent Metaverse projects are receiving great attention from investors in the crypto market. Radio Caca is one of the most prominent projects at the forefront of this trend.

Justin Sun - CEO of Tron Blockchain once said: “If Ethereum is iPhone, TRON is Android. So what is Tron?

BSCSstation is a platform that provides DeFi services and utilities on BSC. TraderH4 will guide you on how to join IDO on BSCSstation.

NuCypher is a protocol that provides a layer of security for decentralized applications built on open source blockchains.

RunNode is a project that provides RPC nodes with the most optimal scalability and cost on the Solana blockchain.

Artemis Vision revolutionizes the NFT space with a social media platform that connects artists, creators, and fans.

This article will give you all the updates you need to know about Monero, as well as predictions about its potential in 2022.

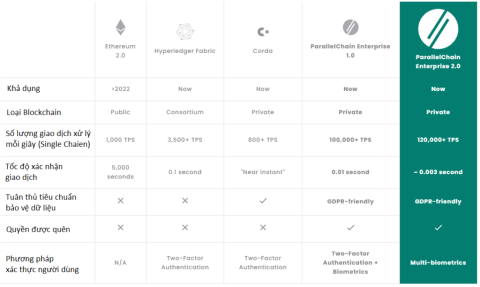

ParallelChain is a cross-platform blockchain suitable for many users from general to organizations, companies, and businesses.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.