What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Port Finance is an unsupervised money market protocol, built on Solana , a blockchain with good scalability, low transaction fees. The project has provided a full suite of lending products including: Variable interest loans, fixed interest loans and interest rate swaps.

Port Finance is aiming to be a liquidity gateway for the Solana ecosystem through a simpler user interface that requires less collateral along with an adjustable liquidation threshold based on volatility and creditial.

The project wishes to take advantage of the advantages of Solana blockchain such as fast processing speed, low latency, etc. to provide innovative lending and interest rate derivative products that are difficult for the Ethereum ecosystem to deploy . :

By providing users with many interest rate choices depending on their borrowing needs as above, the development team hopes to attract more liquidity to Port Finance so that users can borrow more and lower interest rates. .

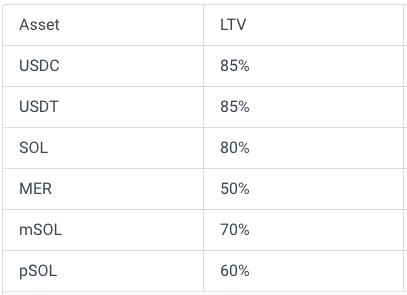

The loan ratio (LTV) is the ratio of the maximum amount borrowed to the value of the collateral. Most of the collateral that Port Finance accepts is in the form of stablecoins: USDC, USDT, SOL…

Figure: LTV ratio as prescribed by Port Finance in December 2021 (Source: Port Finance)

Variable rate lending protocol

Variable-rate lending products have interest rates based on supply and demand, cross-mortgage, and instant lending.

This protocol has a similar implementation to Compound Finance on Ethereum with three core features:

With the transaction processing speed of Solana blockchain, lending and liquidation on Port Finance has many advantages over current products on Ethereum. As more liquidators enter the market, users on Port Finance can borrow more with the same level of collateral than on other platforms.

Protocol Parameter comparison table between other protocols with Port Finance. (Source: Port Finance )

Fixed rate lending protocol

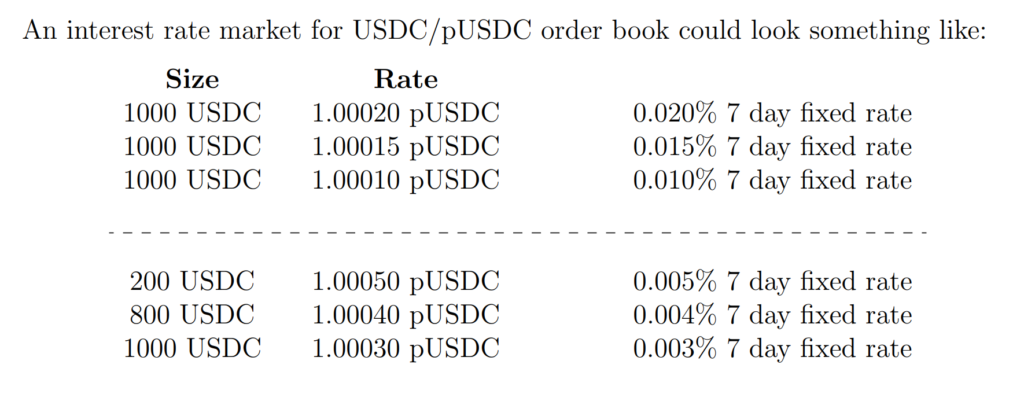

Port Finance aims to build a fixed-rate market by using the Serum order book to provide: Fixed-term and fixed-rate loan products with sensitive, accurate interest rate detection sharper.

The project provides the market with loans with a fixed term of 7 days. After that, users can extend the loan or convert to 14-day, 21-day loans...

The platform will also introduce pToken, a derivative token with a corresponding 1:1 conversion rate (this rate is subject to change to calculate interest) for the underlying loan. In addition, there will be a market for pToken and basic tokens on the platform such as: USDC/pUSDC, SOL/pSOL, ETH/pETH…

Example: Interest rate for USDC/pUSDC on order book:

Having a separate pToken eliminates the need for lenders and borrowers to record amounts for the same loan term, and provides transferability or composability of loan ownership.

Borrowers are required to deposit crypto assets and generate corresponding pTokens that they want to borrow at a ratio of loan/collateralized value. Lenders will use their cryptocurrency in exchange for these pTokens. At the end of the loan term, they can exchange their pToken for the base token (similar to loan repayment).

Each borrower will have an account representing the amount they have borrowed. If the loan period expires and the borrower has not repaid their loan, a liquidator (third party) can come and liquidate the loan by repaying the borrower's funds then seizing the account. collateral at a discount to the loan amount.

Interest Rate Swap (Interest Rate Swap Protocol)

Finally, Port Finance aims to implement an interest rate swap market between fixed and floating interest rates.

Fixed-rate lenders want the highest possible interest rate to maximize returns, while floating-rate lenders want the lowest fixed-rate in order to make a profit when the exchange rate is low. Variable interest rates increase more than fixed interest rates.

This relationship is similar to that of buyers and sellers in a central limit order book (CLOB). Where the buyer is the floating rate lender (who wants the lowest fixed rate) and the seller is the fixed rate lender (who wants the highest fixed rate).

Port Finance can create such a market using the Serum matching engine.

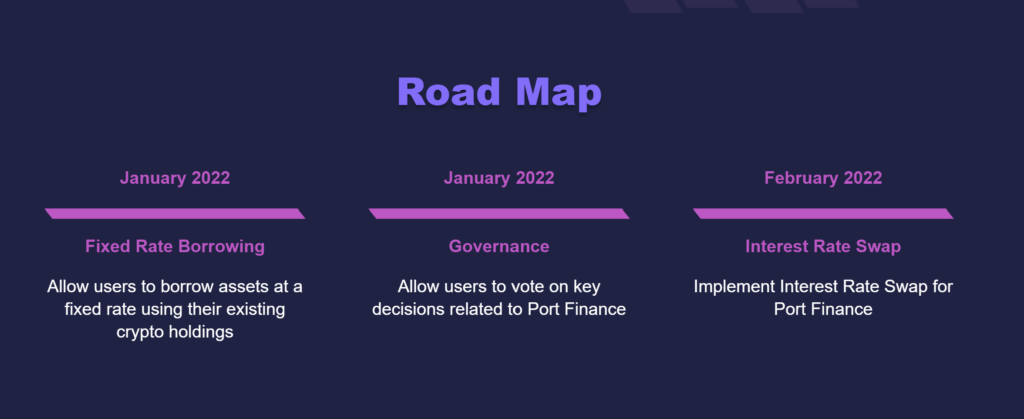

Port Finance is focusing on perfecting the Fixed Rate Lending product.

December 2021: The project has provided an intuitive user interface for users to lend and borrow at a fixed interest rate. In addition, the development team also works with several external market makers to provide liquidity on the order book.

January 2022: Offers more fixed-rate lending assets, while allowing users to borrow assets at a fixed rate using their existing cryptocurrencies.

February 2022: Deploy Interest Rate Swap.

Development team

The key members of Port Finance are a group of engineers who have worked with Google, Facebook, Microsoft and those who have contributed open source code to Serum and Solana.

Investors

The project has raised US$5.3 million in Series A round, led by well-known investment organization Alameda Research with the participation of other investment organizations such as Spartan Group, Brevan Howard, A41, Jump Capital, Solana Foundation, GSR and Defi Alliance.

PORT is the native token of the Port Finance ecosystem.

Port Finance token details:

Token Allocation:

The PORT token allows users to participate in governance and share the protocol fees obtained from all the products of the ecosystem.

PORT token holders can participate in the governance of the project such as: Adjustment of loan-to-collateral ratios, liquidation thresholds... and other changes related to protocols.

Once the staking program has been established, users can staking PORT to get a share of the revenue from the platform's service fees such as: Protocol borrowing fee, quick loan fee.

Currently the PORT token has been launched on most of the major exchanges in the market.

Port Finance is a lending protocol that aims to provide innovative lending services with attractive loan terms such as: Lending more with less collateral, flexible interest calculation mechanism, transaction Easy-to-use interface… This has given the project a competitive edge over Ethereum-based lending protocols.

The appearance of Port Finance also contributes significantly to the development of the DeFi decentralized financial market in the Solana ecosystem. Leading investment funds in the market such as Alameda Research, Spartan Group… also recently invested millions of dollars in the project.

Currently, the Port Finance project does not have much information to be able to make a detailed assessment of the potential. Investors need to do more research to get a more objective assessment if they intend to participate in the project.

Port Finance is a liquidity protocol that provides innovative lending protocols, simple user interface, accepts multiple types of collateral benefiting all parties involved. Investors who are interested in this project can find more information about the project on TraderH4 or official communication channels such as:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.