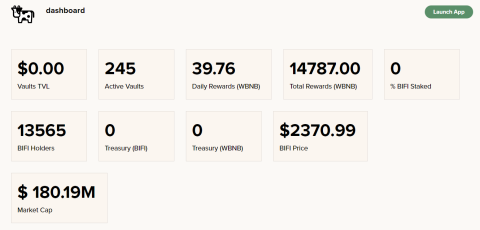

Beefy Finance becomes the highlight of Yield Farming on the Binance Smart Chain network

Beefy Finance and the BIFI token have seen over 70,000% growth in less than 7 months.

So what is the WOO Network Project that is so interested? Please join TraderH4 to find out in this article!

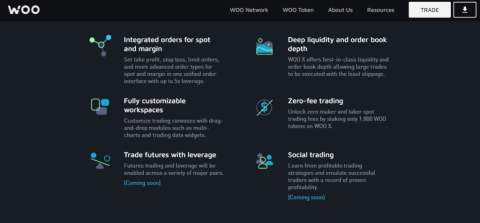

WOO Network is a liquidity network connecting traders, exchanges, institutions and DeFi platforms with democratic access to liquidity strategies, trade execution and best profit generation at low cost. lower or zero.

WOO Network was founded by Kronos Research, a multi-strategy trading firm specializing in market making, arbitrage, CTA and high frequency trading (HFT), averaging around $5 – $10 billion in volume. daily trading on global cryptocurrency exchanges.

Currently, a diverse set of products and services that communicate with retail, institutional, CeFi and DeFi, has been built:

As of 2021, WOO Network begins to provide liquidity on Binance Smart Chain (BSC) through decentralized WOOFi products. They used WOO Network's custom market feeds and advanced hedging strategies to provide centralized market depth and spreads without needing too much on-chain capital.

WOO Network liquidity currently supports several decentralized protocols, including DYDX, Matcha, ParaSwap, 1inch, and DODO. WOO Network leverages capital-saving solutions to gain an edge over passive liquidity providers.

WOO Network's institutional partnerships have continued to grow. Three major partnerships have been added, including major global exchange Kucoin, Nash offering the first WOO/EUR trading pair, and Fantom EVM-compatible ecosystem. More than 40 clients now trade on WOOtrade, the WOO Network's institutional liquidity service.

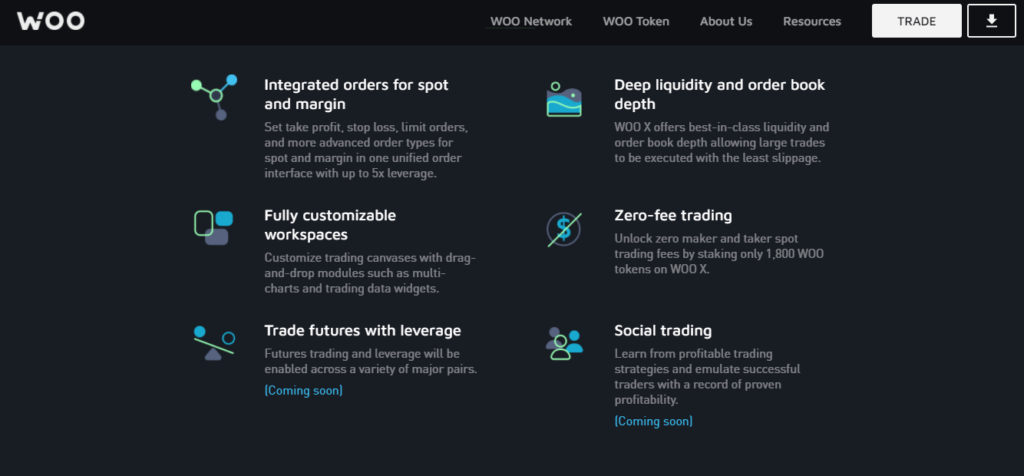

In addition, WOO Network has integrated complete, unified transaction elements in a single platform, including:

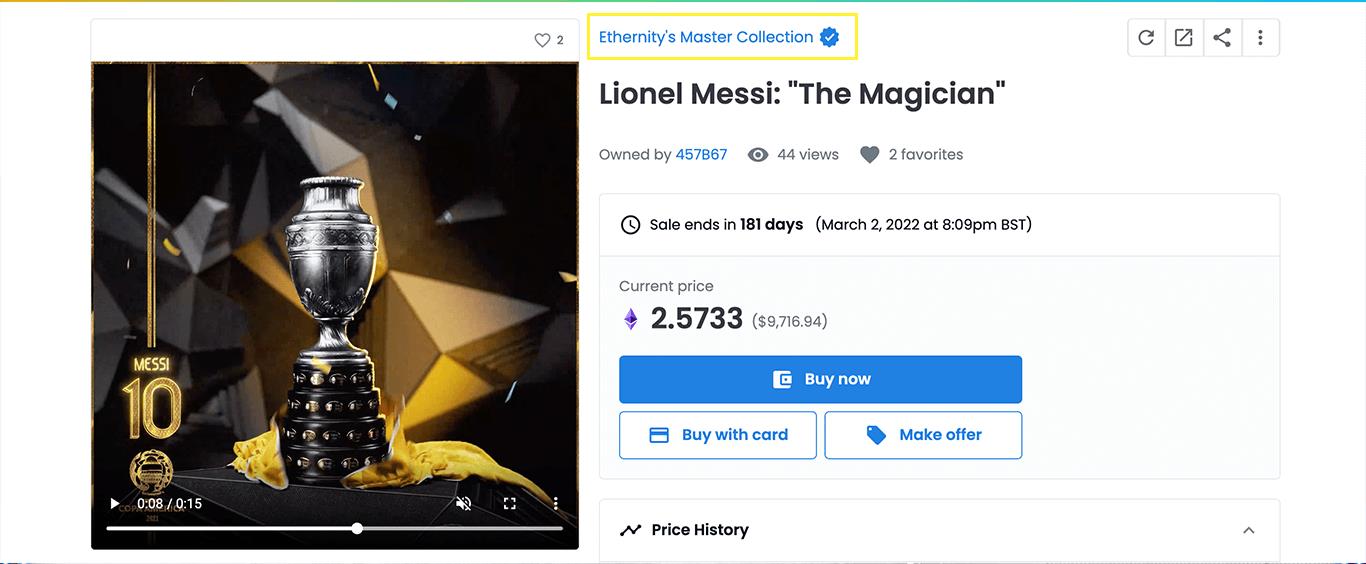

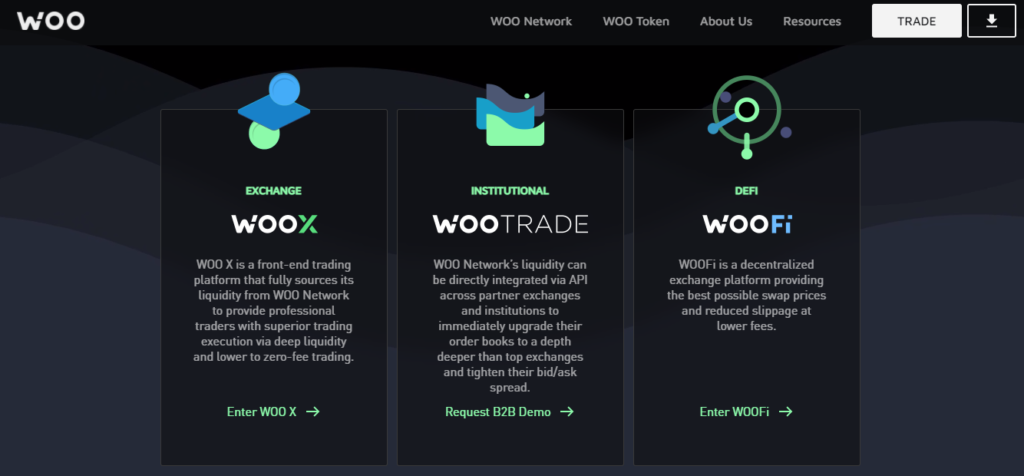

WOO X (CEFI)

WOO X is a fully-liquid front-end trading platform from WOO Network to provide professional traders with superior trade execution through deep liquidity and free trades from lower to 0.

Zero Fee Trading: Traders not using the API can reduce their creator and receiver fees to zero once they reach level 2 with 1,800 WOO tokens staked on WOO X.

– Deep Liquidity: One of the biggest differences on WOO X is the high liquidity on trading pairs. This deep liquidity allows large orders to be executed without severe slippage. Along with no-fee trading, the cost savings through slippage and low fees are ideal for any professional trader who regularly trades large amounts. This allows users to experience democratized liquidity that would otherwise be accessible only through over-the-counter trading.

Currently WOO X is supporting 2 main trading types, Spot Trading and Margin Trading.

WOOtrade (CEFI)

Offers highly liquid crypto exchanges, wallets and CeFi platforms with built-in order books.

WOOFi (DEFI)

WOO Network has created an on-chain product to enhance transaction execution and capital efficiency in DeFi. WOOFi – an open source DeFi protocol to benefit:

Swap

WOOFi Swap is a decentralized exchange that uses a brand new on-chain market creation algorithm called Synthetic Proactive Market Making (sPMM). The sPMM algorithm is designed for professional market makers to provide on-chain liquidity in a way that better simulates price, spreads and order book depth on centralized exchanges.

According to recent tests, WOOFi's sPMM liquidity pool can achieve over 500% capital efficiency (i.e. volume-to-liquidity ratio), which is higher than all other DEXs in the market and it gives allow the lowest swap fee (ie 0.025%) in the gap. At launch, Kronos Research will be the first market maker for WOOFi, while also relying on WOOtrade as a centralized source of liquidity.

When users enter the number of tokens they want to sell, WOOFi compares the performance with other popular DEXs on the same chain, including details such as the number of tokens to be received, transaction fees, and rates.

Stake

Users can stake their WOO tokens to profit from the fees paid by WOOFi Swap users. Users receive xWOO as LP tokens in exchange for staking WOO in the WOOFi staking contract.

While holding xWOO tokens, users can automatically accrue their profits from WOOFi swaps paid to xWOO holders. When a user makes a trade on the WOOFi swap, a fee of 0.025% is charged, from 0.02% used to reward xWOO holders and the remaining 0.005% collected to incentivize future volumes through programs such as discounts, referrals and trade exploits.

The accumulated swap fee (excluding the portion obtained for future promotions) will be used to purchase WOO on WOOFi. The newly acquired WOO is then prorated among all xWOO holders in the pool, meaning their xWOO is now worth more than WOO. Due to the way rewards are created, the price of xWOO will increase with the value of WOO, and the value of an xWOO will always be greater than the value of a WOO.

WOO Knife

WOO Network is starting its journey towards decentralization by establishing a DAO to manage the treasury and drive growth across the DeFi ecosystem – WOO DAO will evolve in several stages throughout the journey of progressive decentralization mine. The DeFi components of WOO Network, such as WOOFi and strategic partnerships, will gradually be controlled by the WOO DAO and WOO token holders.

The roles of the WOO DAO include:

Detailed Project Roadmap: Updating.

Development team

WOO Network is the combined effort of quant traders, engineers, technologists and entrepreneurs from leading crypto and traditional financial institutions with extensive experience and expertise in development of innovative financial and trading solutions.

WOOtrade was founded by Kronos Research in 2019, a multi-strategy trading firm specializing in market making, arbitrage, CTA and high frequency trading (HFT), average trading volume 5 – $10 billion daily on global crypto exchanges.

The leadership team includes Kronos Research co-founders Jack and Mark, who transformed the team of 2 in 2018 into a global quantitative trading powerhouse with over 100 employees in 12 cities .

Investors

WOO Network closed a $30 million Series A funding round in November that included investments from Avalanche, BitTorrent, Crypto.com Capital, and Three Arrows Capital. Binance Labs has announced a $12 million strategic investment in WOO Network. In addition, there are a number of other investment funds.

Partner

WOO Network's services provide partners with significant improvements in their transaction execution, while WOO Network benefits from higher network volumes by capturing order flows.

Current partners of WOO Network include:

WOO is the native token of the WOO Network ecosystem. WOO Network token details include:

WOO tokens are allocated as shown below:

Staking

Yield

Borrow and lend with WOO

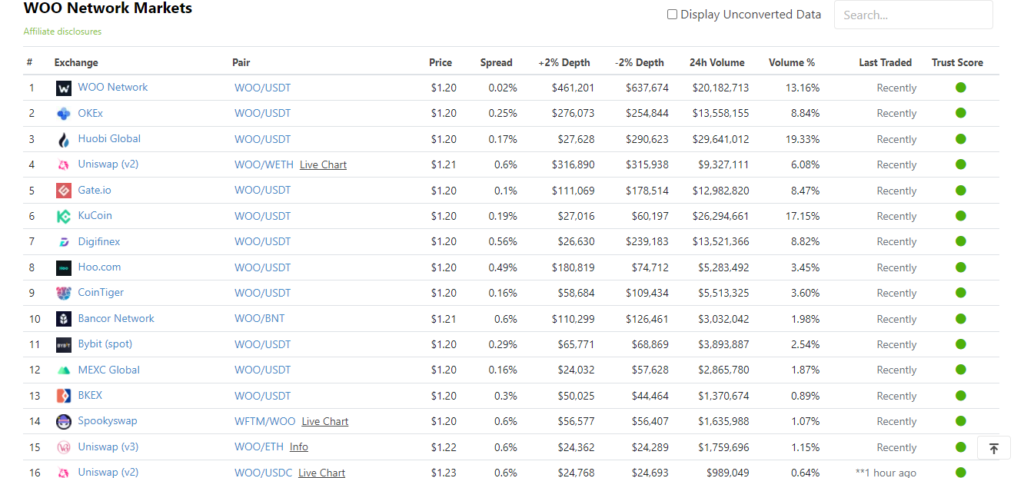

Currently, the WOO token is available on most of the major exchanges in the market.

Since its inception, the ultimate goal of WOO Network has always been a decentralized ecosystem managed by its community members. An ecosystem with a multitude of engaged stakeholders presents many advantages over a single centralized entity, especially in the crypto space where the decentralization ethos grows stronger day by day. .

In a nutshell, WOO Network is a deep liquidity network connecting traders, exchanges, institutions, and DeFi platforms . WOO Network for democratized access to best-in-class liquidity and lower or zero-cost trade execution. The WOO token is used in the network's CeFi and DeFi products for staking and fee discounting. Along with the detailed strengths that Coiinvn analyzed above, we believe that WOO Network will have breakthroughs worth waiting for in the near future.

Please refer to the project information channels here:

Website | Twitter | Discord | Telegram | Facebook | Medium | Docs

Beefy Finance and the BIFI token have seen over 70,000% growth in less than 7 months.

The TreasureDAO ecosystem has also received attention from the market and its activity volume has also increased in a short period of time.

In the framework of this article, let's take a look at the development of BNB Chain with the TraderH4 team - a smart contract platform powered by Binance.

What is Binance Coin? BNB is an exchange coin that plays an important role in the ecosystem of Binance Smart Chain.

On February 22, 2023, Binance announced that Synapse Protocol would be listed on their platform. Let's learn about this project with TraderH4 in the article below.

In this article, we will learn the basics of a new project invested by Binance Labs called Polyhedra Network.

Continuing from part one, in part two we will continue to learn about the ecosystem of BNB Chain and its development plans in the future.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.