What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Trader Joe is a decentralized cryptocurrency exchange DEX ( Decentralized Exchange ) operating under the Automated Market Maker (AMM) mechanism, built on the Avalanche blockchain .

AMM projects on Avalanche (AVAX) are mostly new, most of them are modeled after other platforms on Ethereum , Binance Smart Chain such as Pangolin and Zero Exchange are modeled after Uniswap , Olive and Lydia Finance modeled after Pancakeswap .

Although Trader Joe is a relatively recent platform, it has an advantage over existing AMM projects by integrating leveraged trading and lending features. Since its launch, the platform has attracted more than $4 billion in funding and received backing from many major investors.

The project consists of the following two main components working in conjunction with each other:

This combination has contributed to boosting liquidity and attracting more cash flow into the project.

Banker Joe provides investors with the ability to lend or borrow a number of crypto assets, and can deploy flexible DeFi investment strategies on the Avalanche network with low costs, fast processing fast.

Trader Joe is one of the first projects to plan to execute limit orders, to overcome the weakness of DEXs in price slippage. If successful, it will have a significant additional advantage in the decentralized financial market.

In addition, Trader Joe also develops many other DeFi features such as: Yield Farming, Staking, Zap, Lending with the aim of becoming an aggregator platform that brings the best user experience. ZAP is a function that allows users to exchange tokens for LP tokens directly, without swap.

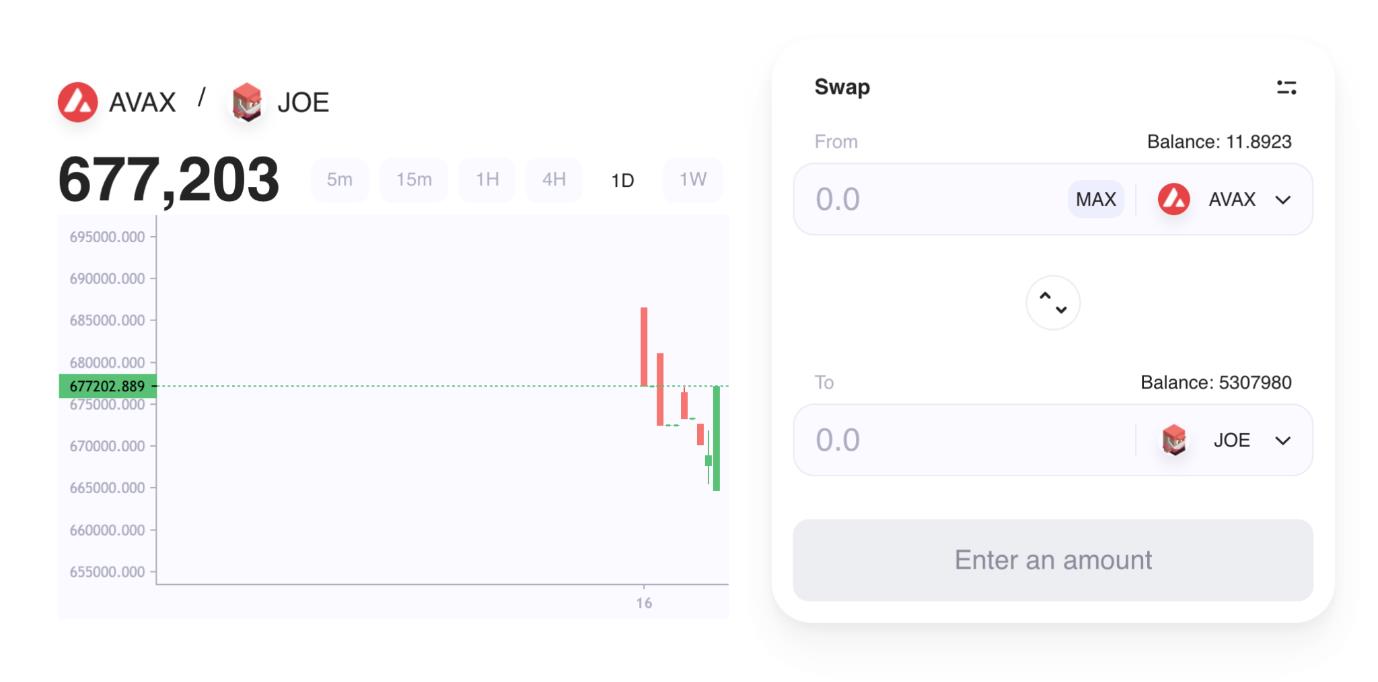

Trading

Trader Joe is an AMM DEX exchange that allows users to swap tokens. Its user interface is quite simple, just choose two tokens and swap.

Users will pay a 0.3% transaction fee when swapping tokens. Of which 0.25% is paid to the liquidity providers and the remaining 0.05% will be put into the xJOE pool.

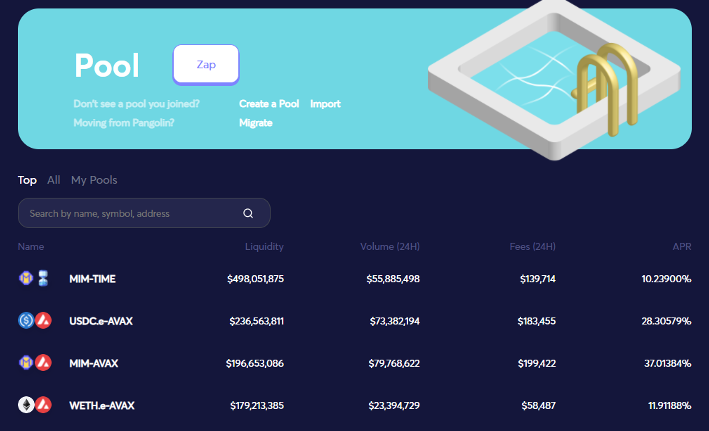

Liquidity pool (LP)

The liquidity of this exchange comes from liquidity providers. They will deposit a pair of tokens into the LP (also known as adding liquidity) to receive the LP token, which represents the contribution in the pool.

Liquidity pool is a pool of two tokens, for example, Token AVAX and JOE. LP allows users to swap automatically between two tokens in the pool, liquidity providers will earn 0.25% swap fee of the token pair they deposit into the pool.

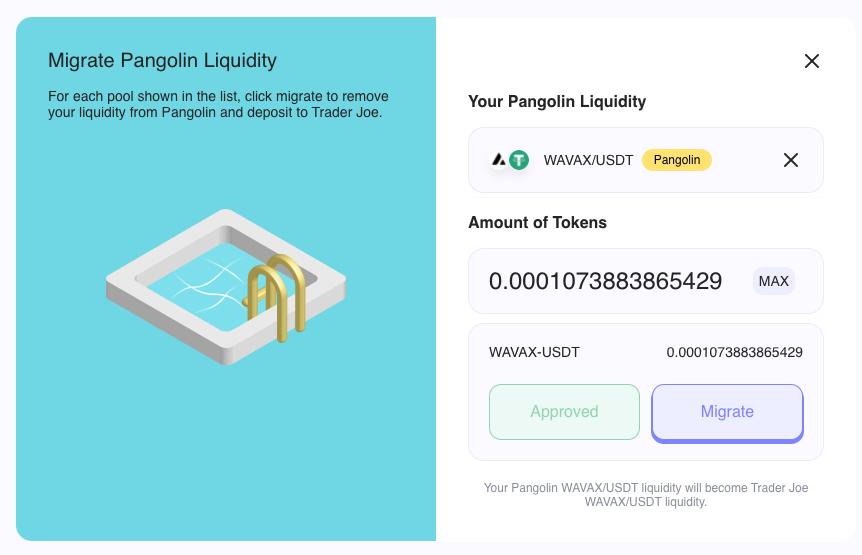

Trader Joe also allows users to transfer liquidity from LP on Pangolin to Trader Joe.

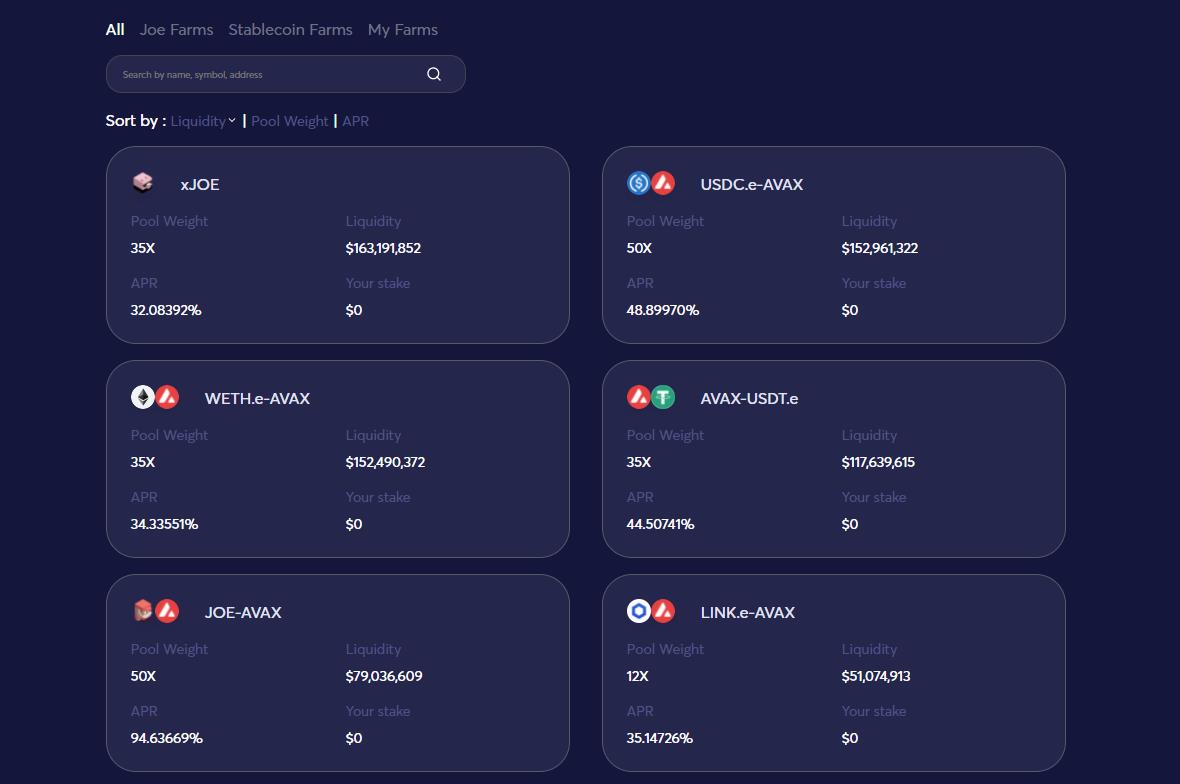

Yield farming

Users can deposit their LP tokens into the farm to earn rewards in JOE tokens while still receiving transaction fees from Liquidity Pools.

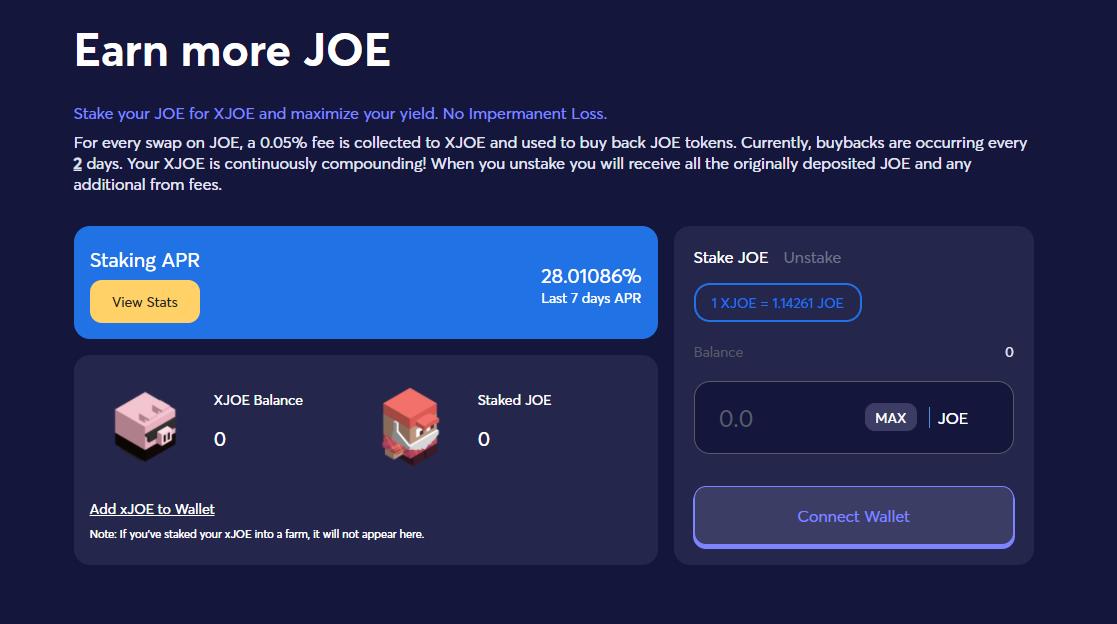

Staking

Trader Joe's Auto-compounders function will help users increase LP tokens by automatically selling JOE tokens they receive during yield farming. Although this function can increase user LP tokens, it also misses the opportunity to own JOE tokens if this token increases in price.

Instead, they can stake their JOE tokens in xJOE to maximize profits when JOE tokens increase in price.

xJOE is the main staking mechanism on the Trader Joe ecosystem. When staking, it means the user is exchanging JOE tokens to xJOE.

For every token swap made on Trader Joe's DEX exchange, 0.05% of the transaction fee is transferred to the xJOE pool. This fee is used to redeem JOE tokens (currently, redemption happens every 2 days).

Therefore, when a user unstakes or in other words converts xJOE to JOE, they will get back the amount of JOE tokens they originally staked plus some additional JOE tokens from using the extra purchase transaction fee.

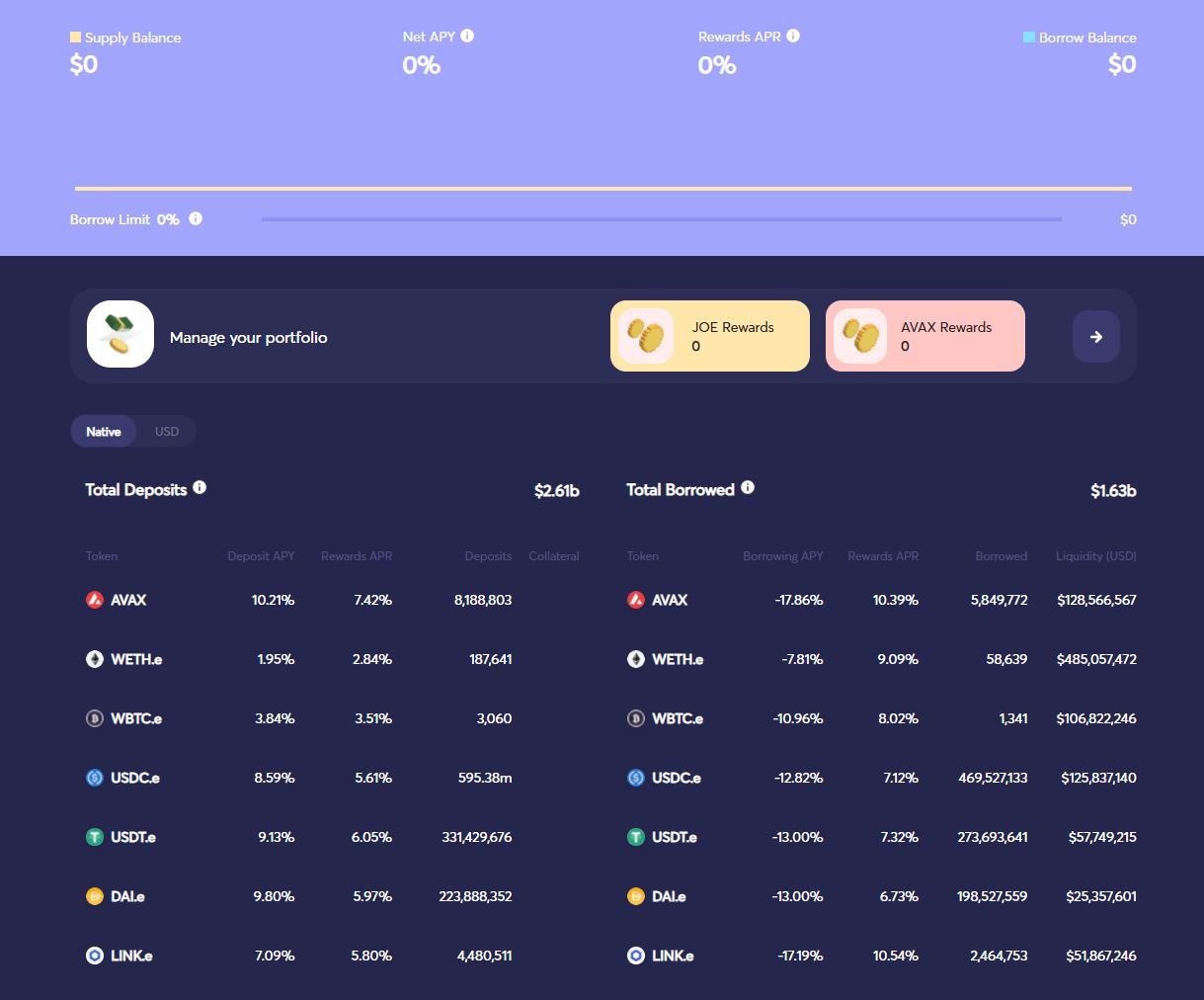

Lending

Trader Joe is a one-stop decentralized exchange on Avalanche. Banker Joe is Trader Joe's lending protocol based on Compound protocol. The Trader Joe project has combined the two above into one trading platform to provide trading leverage.

Users can lend or borrow cryptocurrency for Trader Joe's Whitelist assets such as AVAX, WETH, USDT, DAI... and make profit through Yield Farming or using leveraged trading.

For lending transactions : Investors deposit money into one of the Lending Markets, each Lending Market has a full listing of information such as: Total liquidity, APY. The system will give them a receipt. Example: When a user provides a loan using AVAX, they receive jAVAXreceipt. The lender will then receive both AVAX principal and interest when returning jAVAXreceipt to Banker Joe.

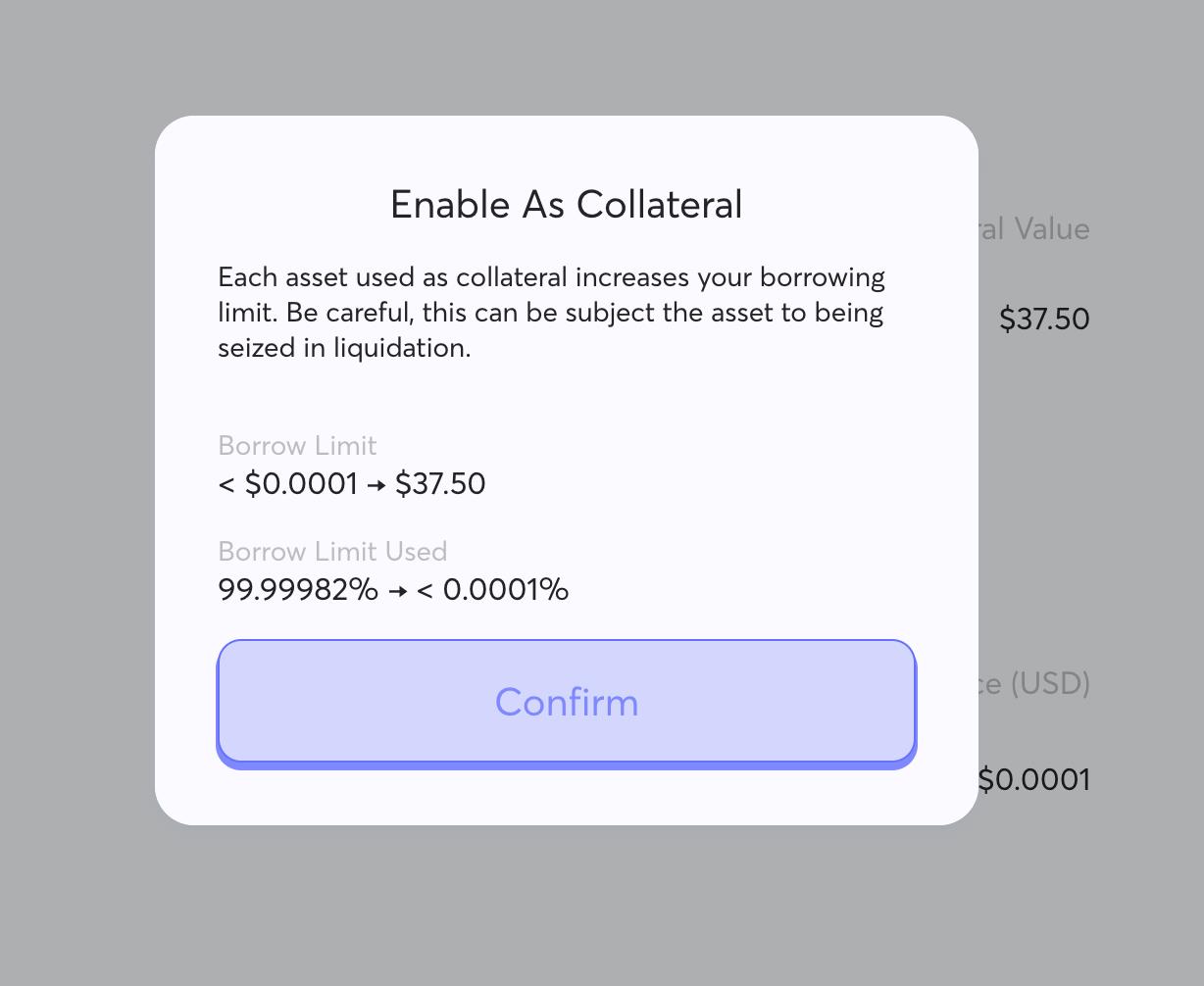

For Borrowing Transactions : Using their tokens as collateral, the borrower can use leveraged trading by borrowing another token on Bank Joe. After repaying the loans, users can withdraw the collateralized tokens.

However, besides the benefits mentioned above, users also have a few risks to be aware of:

Trader Joe takes a phased approach to growth.

Trader Joe has a flexible, non-fixed roadmap, the 2022 roadmap is still undecided. The team still wants to focus on market opportunities from time to time, rather than offering a long-term roadmap. The DeFi market innovates very quickly so the project needs to remain agile and responsive to ensure long-term success.

Development team

Trader Joe has a highly technical team from all over the world, many of whom are members of the Avalanche community.

Cryptofish (Co-Founder) : Cryptofish is a full-stack, smart contract engineer. He is an original contributor to several Avalanche projects such as Snowball, Sherpa Cash. Most recently, he has worked at Google and a CEX specializing in derivatives. He holds a Master's degree in computer science from a top US university.

0xMurloc (Co-Founder) : 0xMurloc graduated with a bachelor's degree in electrical engineering from a top US university. He is a full-stack developer, but his specialty is product management. He is primarily in charge of products and programs at Trader Joe. 0xMurloc has extensive experience at a number of startups and was most recently a senior product lead at Grab.

Blue (Marketing Lead) : Blue is the Marketing and Community lead at Trader Joe. He has over 10 years of experience working in finance at a leading wealth management firm based in London.

MountainFarmer (Farm Scientist) : MountainFarmer has many years of experience as an analyst in investment banking and venture capital funds. He holds a degree in Mechanical Engineering and Finance.

R00001ndom (Graphic Artist) : R0001ndom is a civil engineer, he has a special passion for coding, art.

Louis MeMyself (Software Engineer) : Louis is a Computer Science student at a French university. He is mainly in charge of bots and everything related to HAT.

Intro_0000 (Software Engineer) : Intro_0000 has a bachelor's degree in Electrical Engineering. He has many years of experience in machine learning and robotics.

Investors

The project has raised US$ 5 million from a strategic investment round, led by large investment organizations such as: Defiance Capital, GBV and Mechanism Capital. In addition, the project also attracts the participation of large investment organizations in the market such as: Not3Lau Capital, Three Arrows Capital, Coin98 Ventures, Delphi Digital, Avalanche Foundation, Stani Kulechov, Avalaunch and Yield Yak.

Partner

Chainlink: Bank Joe is using the price feed from Chainlink to determine loan limits and liquidation mechanisms for assets, helping borrowers obtain loans at fair market rates.

Rome Terminal & Trader Joe: Users can use Rome Terminal to interact directly with Trader Joe through the Rome Terminal interface, accessing advanced charting and analysis sections.

JOE is the native token of the Trader Joe project. The function of the JOE token is:

Trader Joe's Token Details:

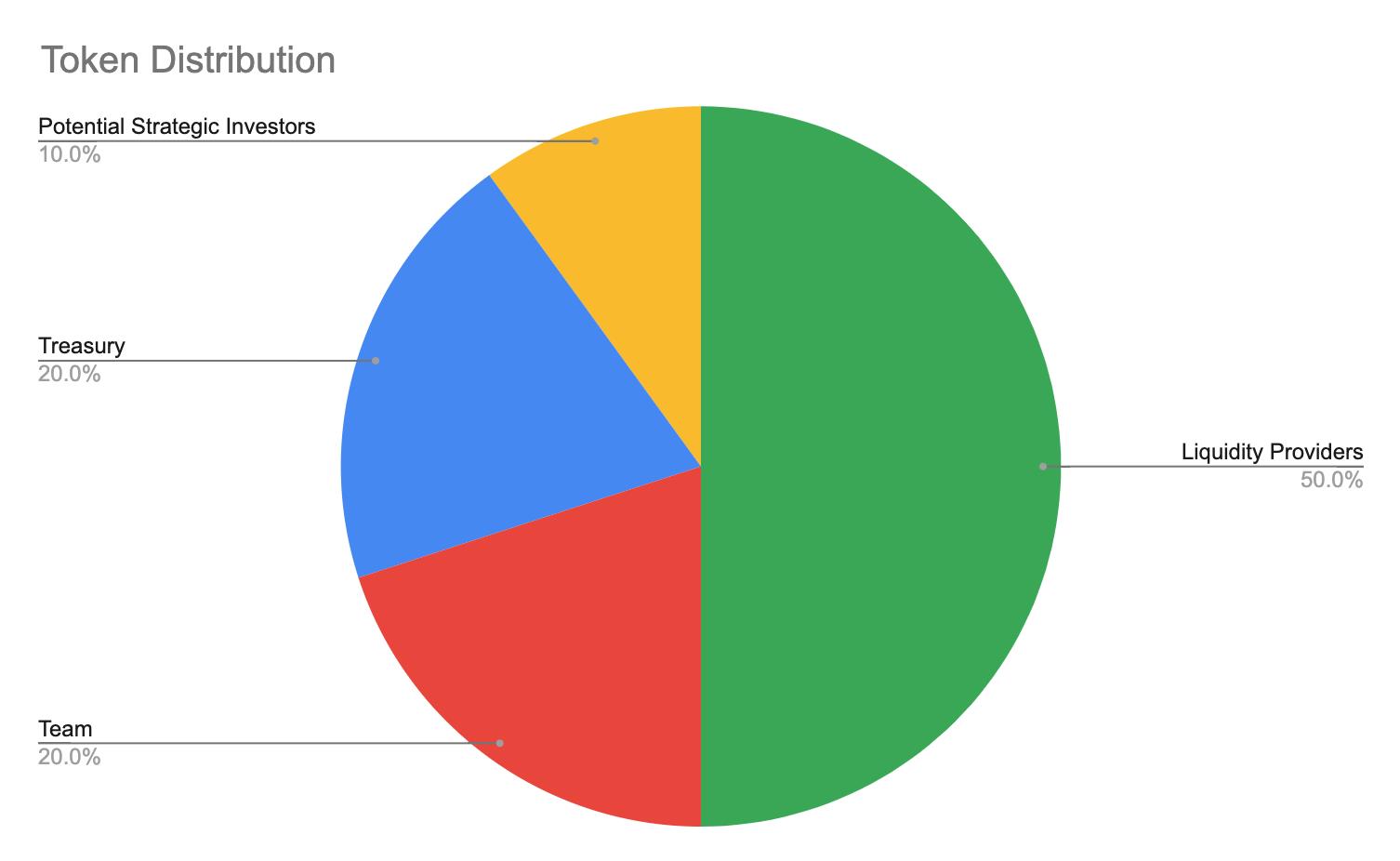

Token Allocation:

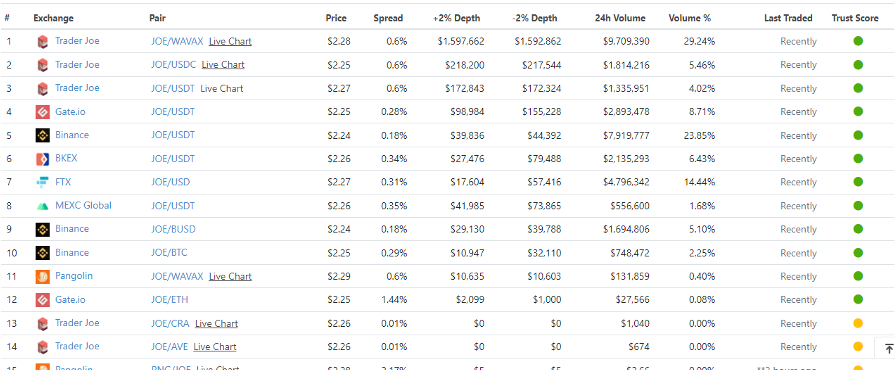

Currently, JOE token has been listed on major exchanges such as: Binance, Gate.io, BKEX, FTX...

Trader Joe can aggregate many utilities for users on the same trading platform along with Lending & Leverage mechanism, Limit order will definitely make the project stand out in the market.

The project's development team is not only experienced in the blockchain field but also financial investment experts, thereby providing a better user experience.

Trader Joe is the leading DEX in the Avalanche ecosystem. It has huge potential for growth as it aims to overcome problems that Ethereum Defi has not been able to solve such as: gas fees and transaction speed.

Therefore, if Avalanche can develop and become a popular platform like Ethereum, Polkadot ... in the market, many investors can expect the success of Trader Joe like Uniswap (UNI) or Sushiswap ( SUSHI) in the Ethereum ecosystem.

summary

Trader Joe is currently a prominent AMM DEX project on the Avalanche blockchain. The role of AMM DEX projects is extremely important because it is the tool to attract money flows into the ecosystem, promoting the development of the whole platform. With the current efforts of the Trader Joe development team, it can be expected that the project will go even further.

Investors can update more information about the project on TraderH4 or on the following official media channels:

Website | Twitter | Telegram | Discord | Medium

From January 20-24, 2022, TraderH4 organizes a mini game "Reading newspapers to find lucky money" with prizes up to 100 USDT. Join now to receive gifts from the team. Refer to the contest information in this article .

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.