What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

TrueUSD is a stablecoin issued on the Ethereum platform and supports a 1:1 peg to the US dollar. TUSD is designed and issued by TrustToken with the goal of being a simple, transparent and reliable stablecoin. Currently, in addition to Ethereum, users can also use TUSD on many other blockchain platforms such as BNB Chain, Avalanche , Harmony , Polygon , Tron...

TrustToken is a platform providing technologies and services to help tokenize real assets such as gold, silver, oil, US dollar, movies, music, etc. TUSD is the first stablecoin and token launched on the platform. TrustToken platform in Q3 2018. By December 2019, TUSD became the first stablecoin to offer real-time verification to users.

The TrueUSD project's development team is a member of TrustToken, including many prominent names from Stanford University, Google, UC Berkeley and Palantir Technologies. TrustToken is headquartered in San Francisco Bay and was founded in September 2017.

The TrustToken team has partnered with two law firms, WilmerHale and White & Case, to develop a regulatory framework for its collateralized cryptocurrencies. The project also owns a network of many partners, businesses and banks behind supporting its platform.

Some prominent members of TrustToken can be mentioned as:

In order to maintain the stability of the assets encrypted by TrustToken, the reserve assets will be sent to the escrow accounts of third-party companies, partners, banks instead of TrustToken's funds.

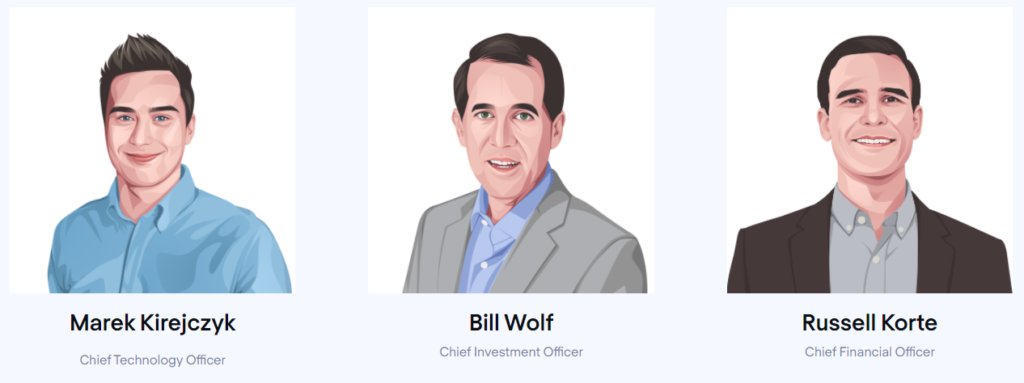

After completing identity verification (KYC) and anti-money laundering (AML), users who want to mint TUSD can send their USD and Ethereum wallet addresses to TrustToken's partner banks and companies. When these companies and banks receive enough funds and requests from customers, they will use specialized APIs to interact with the TrustToken smart contract. TrustToken will issue TUSD at a 1:1 ratio with the deposited assets and send them to the wallet address provided by the user previously.

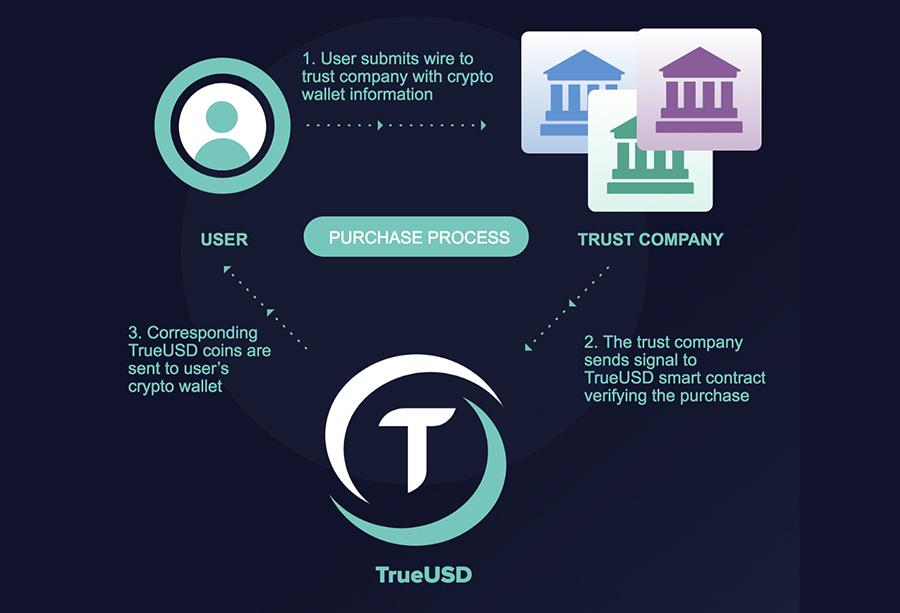

On the contrary, whenever the user wants to change back from TUSD to USD. The user will send the TUSD back to the TrustToken wallet address, the wallet address that transferred the TUSD to the previous user's wallet. Through this wallet address, TrustToken will notify the company, the partner bank to transfer USD back to the user's account. The equivalent amount of TUSD will be burned immediately once the process is complete.

The parties involved will sign an agreement on the disclosure and audit of the mortgages on a daily and monthly basis. In this way, TrustToken will ensure the transparency and safety of users' assets as well as always keep a 1:1 ratio between the amount of fiat money in the escrow account and the amount of TUSD circulating in the market.

Up to now, there have been many exchanges that allow users to buy and sell TUSD on their platforms. Some major exchanges that list TUSD include Binance, OKX, Coinsbit, BitMart, etc.

TUSD is an ERC-20 standard issuance token. Some popular cryptocurrency wallets currently used to store ERC-20 standard coins/tokens include MyEtherWallet, Trezor, Ledger, MetaMask...

If you are a trader, you can also store TUSD directly on the wallets of the exchanges you regularly trade with.

TrueUSD was released in 2018 to compete with two popular stablecoins at that time, Tether (USDT) and USD Coin (USDC). For both USDT and USDC, US dollar reserves are controlled and managed by two parent companies, Tether Limited and Circle, respectively. In contrast, the US dollar collateral for TrueUSD is stored and managed in a number of escrow accounts of companies and banks partnering with TrustToken. This means that none of the TrustToken members can use these deposited US dollars. Each TUSD token on the market is always collateralized with a corresponding amount of USD. In addition, users who want to mint and exchange TUSD have to go through a strict identity verification and anti-money laundering process that makes TUSD arguably the safest stablecoin available on the cryptocurrency market.

As of March 2022, only nearly 1.5 billion TUSD has been issued, which is quite modest compared to USDT and USDC. Moreover, as the crypto market grows, the number of new stablecoins born also increases with many attractive incentives for users such as Binance USD (BUSD) or TerraUSD (UST).

If you are an investor who wants to store, use TUSD to trade and make profits in the crypto market, this is not the perfect time as TUSD has quite a few trading pairs on exchanges as well. less supported by today's popular DeFi applications.

However, if you are a regular user, you can completely choose TUSD for transactions, cross-border money transfers, shopping... as TrustToken's network has covered more than 100 different countries with many companies. company, the service accepts TUSD as a means of payment.

Above is all the basic information about TrueUSD (TUSD) that TraderH4 has compiled. Hopefully, through this article, readers will have more useful information and knowledge and have a great choice for their investment portfolio.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.