What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

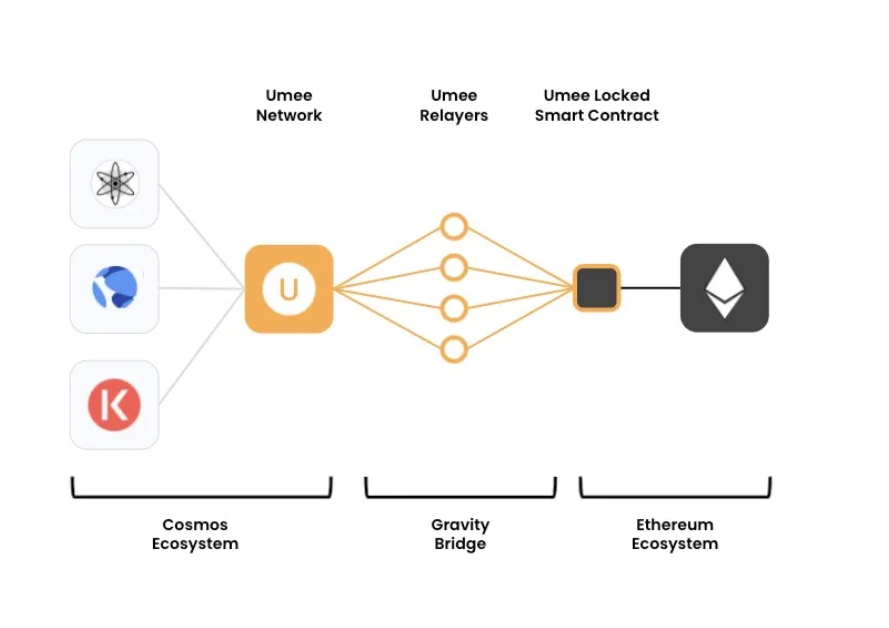

Umee is a decentralized financial protocol and a Cross-chain DeFi Hub that helps connect blockchains with each other. The project is owned and managed by the investor community. Umee allows users to collateralize their assets on any blockchain and then borrow on another blockchain.

With Umee, users can earn interest on lending or using assets as collateral, and borrow assets from another blockchain that can be reinvested on other decentralized financial applications.

In addition, Umee makes interoperability between other blockchains instant by using the Tendermint Proof of Stake consensus mechanism. Currently, Umee is supporting interoperability between two popular blockchain platforms, Ethereum and Cosmos.

Umee's goal is to create a multi- blockchain powered platform that is completely decentralized and governed by the community. Thereby, investors can directly perform loan transactions between many different blockchains on this platform.

The advantages of Umee include:

Umee's connection between Ethereum and Cosmos allows users to:

Up to now, Umee-compatible networks include: Cosmos, Ethereum, Solana , Polygon , Terra, Avalanche ...

Overview of technologies in Umee's infrastructure include:

In addition to buying and holding UMEE coins for profit, users can become validators (Validators) for the Tendermind BFT consensus protocol and receive bonuses for each participating in transaction validation.

Through the implementation of Bridge solutions, Umee will create a pool of funds for Cross Chain assets. Staking and delegation are areas that Umee is particularly interested in. After assets are sent from other blockchains via Umee bridge, the Cross Chain Capital Facility tool will support these assets to participate in DeFi. In addition to the governance token, Umee has two other tokens, uToken and meToken.

uToken

uToken is an ERC20 token representing a collateral position from the Cosmos side on Ethereum. When users want to participate in lending, they must send their assets via Umee Bridge (asset bridge) to be sent to Cross Chain Capital Facility. After the deposit is confirmed successfully, the lender will receive a collateral token (uToken). The uToken represents the loaned asset as well as the interest received.

meToken

When participating in staking assets through Umee, users will receive meToken. Users have the option of withdrawing their rewards when staking or accumulating so that their staking rewards are liquidated for another asset.

Umee Unlinking Process

To perform a reward withdrawal, the user must go through an unlinking process based on the staking attribute of the original token. The user then redeems the meToken for the original principal amount. After the unlinking period of 14 to 21 days, meToken holders can exchange for the equivalent uToken or can withdraw the amount of ATOM after staking is stopped.

Development team

Umee was built by a team of blockchain infrastructure engineers, software architects, researchers, and decentralized finance strategists. Some of the members included in the Umee development team are:

Brent Xu : Founder and CEO of Umee. He used to be the head of the strategy team at Tendermint. In addition, Brent Xu is a former system architect at ConsenSys.

Brandon Comer : He is the director of product development at Umee, Brandon Comer used to be the head of product development at Amazon.

Facundo Medica : He is an engineer and takes on a software development role at Umee.

Drew Tomich : I am an operations specialist at Umee.

Investor of Umee project

On June 15, 2021, Umee successfully raised US$6.3 million in a Seed Round, with the participation of major investment funds such as Alameda Research, Argonautic Ventures, CMS Holdings, Coinbase Ventures, ConsenSys , IDEO CoLab, Polychain Capital and Tendermint.

UMEE is the official token of Umee. UMEE meets the two standards of the Cosmos and Ethereum networks. UMEE is used to pay for transaction costs and reward Validators in the Tendermint BFT consensus protocol for performing transactions on the network. In addition, UMEE owners have the right to participate in the governance process and make suggestions to help the Umee project grow.

On December 2, 2021, Umee will open the sale of UMEE tokens on CoinList. Investors can register from now until 6:59 p.m. (AM) on November 29, 2021. With 2 options as follows:

Option 1

Option 2

The decentralized finance (DeFi) market is growing rapidly, with many new projects being launched. However, protocols or projects have not been able to fully meet the needs of users to be able to interact with other blockchains on the same platform.

Thanks to the use of IBC, Layer 2 scaling solutions, Sidechain architecture, Tendermint consensus mechanism, Umee hopes to bring optimal interoperability with other blockchains and transaction execution time. translation becomes faster. Therefore, once Umee successfully fulfills its wish, this project may receive a lot of attention from investors around the world.

Here are some frequently asked questions about Umee. Hope readers with the same questions can find their own answers.

What is special about Umee project?

The Umee platform involves collateralized assets from the PoS blockchain. That is, Umee uses those staked assets as collateral to borrow on another blockchain. Therefore, users can interact with many networks and not be dependent on any object.

What will users get when they deposit assets?

Lenders must deposit assets into Cross-chain Capital Facility, which will then receive uToken ERC20 Compliant. This uToken is transferred to both Cosmos and the Ethereum Blockchain via Two-way-Peg.

Above is all information about Umee project and UMEE token. Umee takes advantage of many advanced technologies and solutions to develop its projects, one of which is Cross-chain. With this technology, Umee can directly interact between different ecosystems to enhance the user experience. With the above information, hopefully readers have been able to assess the potential of this project and make investment decisions for themselves.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.