What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

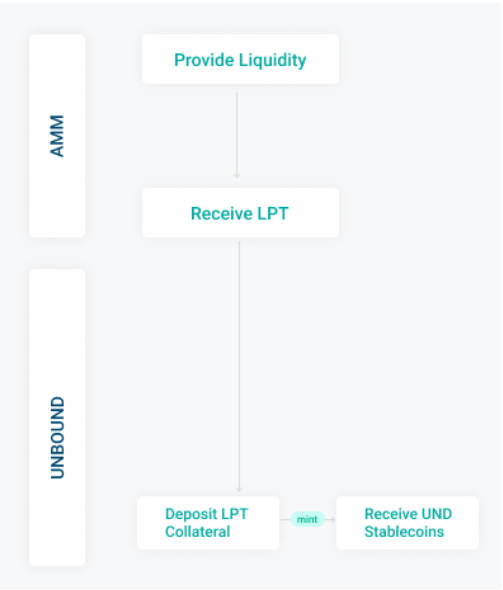

Unbound Finance is a decentralized cross-chain liquidity protocol that is building a Derivatives Layer for Automated Market Makers (AMMs).

The project aims to create products that can be combined with DeFi ecosystems, including AMM projects on Ethereum, Binance Smart Chain , Polygon, Avalanche, Fantom, Arbitrum , Solana, HECO, KCC , Polkadot and Harmony.

To that end, Unbound Finance offers a suite of products to unlock liquidity from multiple AMMs on different blockchains, including LP token-collateralized synthetic assets, liquidity pools, and more. The new account will be sourced from multiple AMMs, financial instruments that make it possible for investors to receive compound interest and other benefits.

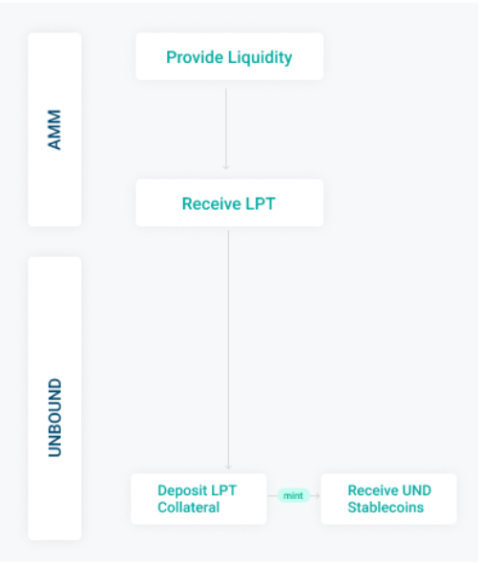

Liquidity providers will gain additional income by leveraging their LP tokens to mint UND, a decentralized stablecoin that integrates cross-chain technology to easily switch between different chains.

Liquidity Unlock

Building as an aggregation layer on top of existing AMMs, Unbound Finance aims to unlock liquidity trapped on DEXs in DeFi. It also allows liquidity to be transferred from one chain to another more easily.

To do this, Unbound Finance allows the use of LP tokens as collateral, providing the opportunity to leverage this token for other investment activities. From there, investors can effectively use the capital that DeFi projects provide and will earn more profits.

A Lending Protocol with Independent Stablecoin

In addition, Unbound's decentralized, cross-chain stablecoin UND plays an important role in driving interoperability and profitability across different blockchains.

Unbound Finance is also a liquidity-backed lending protocol that drives the overall capital efficiency of the DeFi ecosystem. The project allows users to leverage idle LP tokens to borrow stablecoins. They can then use the borrowed money to reinvest on decentralized financial applications.

The collateral is guaranteed not to be liquidated

Unbound Finance solves the collateral liquidation problem that most DeFi lending platforms are facing, by using LP tokens that are much more stable than a certain cryptocurrency as an asset. Mortgage.

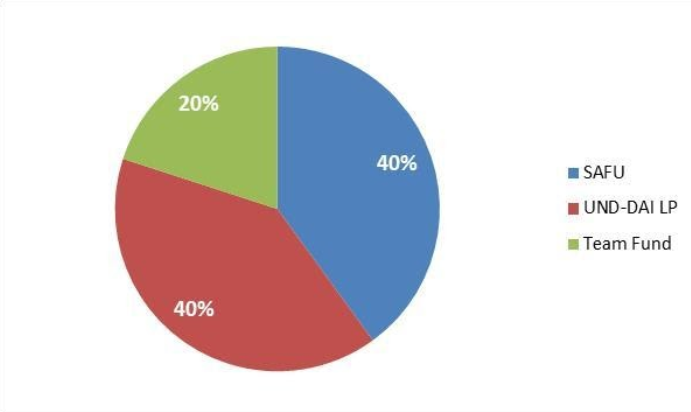

In addition, Unbound Finance will transfer a part of the fee collected from investors into SAFU Fund to maintain the safety of users' assets. This reserve is then used to protect users' assets in the event of a sharp drop in the cryptocurrency market volatility.

Lending products

Unbound Finance is a decentralized lending platform that issues interest-free crypto loans to users based on LP tokens as collateral. Loans are offered as synthetic assets starting with Unbound Finance's stablecoin UND.

Additionally, Unbound Finance can unlock liquidity in different DEXs across multiple blockchains. Thereby, Unbound Finance has some characteristics as follows:

In addition, Unbound Finance does not have a liquidation tool like other Lending projects. As we all know, the biggest risk for investors when borrowing assets on Lending protocols, is that their assets may be liquidated when market volatility plummets.

Crypto assets commonly used for collateral such as ETH, BTC or any large cap coins will be liquidated when they have an adjustment of 40%. But, when using LP tokens, their assets are liquidated when the correction is 75-80% in cases of strong market volatility.

Instead of using a liquidation mechanism, Unbound Finance built the SAFU Fund to keep users' collateral safe in the event of a bad crypto market.

SAFU Fund

In the event of a particularly severe drop in collateral value, the SAFU fund will cover part or all of the loss without liquidating the user's collateral.

Products increase profits for users

Investors can increase profits by using borrowed funds to trade on DEX exchanges, provide liquidity for UND Pools or participate in staking activities.

Notably, the money that investors deposit into liquidity groups can be withdrawn at any time, including profits from this investment. Initially, the return that investors receive can be up to 60% in 1 year. The current rate of return is subject to change and is voted on by the user community.

Unbound Finance development team

Tarun Jaswani: He is the founder and CEO of Unbound Finance. Tarun is also a developer, technologist and entrepreneur. He has 21 years of experience in digital advertising, VR and blockchain. He started building Unbound Finance in March 2020.

Pratik Oswal: You are currently the CMO of Unbound Fiance. Pratik is ranked by Mensa in the top 4% of the population with a high IQ in the world. He is also the author of 7 books on mathematics which are currently used by more than 100,000 students in more than 300 schools across India. He has also advised over 50 blockchain projects and written over 200 articles on various blockchain projects.

Investors of Unbound Finance

The project has raised US$8 million in a pre-public round from major investment funds in the cryptocurrency market such as Pantera Capital, Arrington XRP Capital, Hashed, CMS, LD Capital, Zee Prime, Ledger Prime, KuCoin , Gate.io…

In addition, Unbound Finance also has a few more individual investors such as Founders of Enjin, Gnosis, Kyber Network, Swissborg, Polkastarter, Fantom, Harmony, WikiHow, Zilliqa, TomoChain, Polygon, Matrix Partners...

Partner of Unbound Finance

Current Unbound Finance partners are Avalanche, Chainlink , Uniswap, Ethereum, Binance Smart Chain, PancakeSwap and Polygon.

Competitors

Unbound Finance is a new name in the lending market. The project is also a blockchain startup designed to increase capital efficiency by providing liquidity backed mortgage loans to users. Competitors to Unbound Finance include Maker DAO, Compound , Synthetix and Nexo.

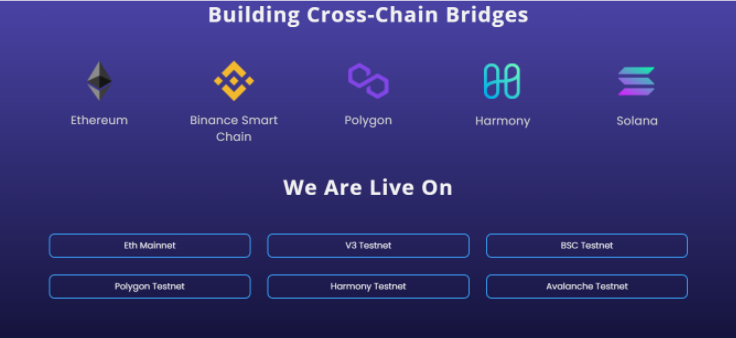

Unbound Finance will develop according to the following roadmap:

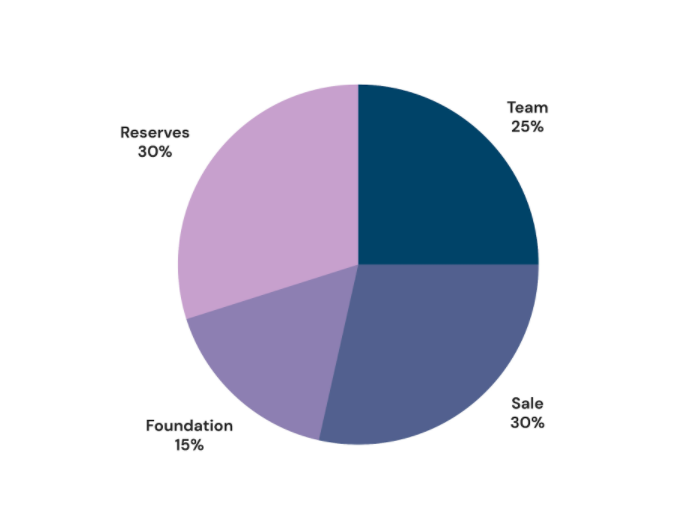

The ecosystem of Unbound Finance will have 2 main types of tokens: UND will be the stablecoin and UNB will be the governance token.

UND is a stablecoin whose value is pegged to USD and collateralized by LP tokens. Also, the value of UND upon minting will be based on the value of the deposited LP tokens.

The amount of UND generated at the time of collateralizing the LP token is the amount that the user has to pay back to get their original LP token. The minted UND will then be burned when deposited into smart contracts, before returning the original collateral to the user.

In addition, arbitrage traders in the AMM group will ensure that the USD rate is maintained.

Also, what makes UND different is not liquidating large-cap crypto pairs (ETH/DAI, USDT/USDC...). Specifically, open smart contracts will lock LP tokens as collateral whenever the minted UND is returned to Unbound Finance. This means that when a user mints UND, there will be no debt position, where:

UNB is used in the governance of Unbound Finance. UNB token holders will be able to vote on changes to policies or suggest ideas to better serve the community and help the Unbound Finance platform grow.

Mining fees are broken down as follows:

Note : Fees distributed to Team Fund will not be fixed. As the system becomes more autonomous, the allocation may increase or decrease.

Currently UNB token is not listed on any cryptocurrency exchange. Upcoming Unbound Finance will open sale of UNB tokens on Huobi Primelist on December 14, 2021 and sell in the form of IDO on Polkastarter on December 13, 2021.

Unbound Finance is targeting an area of high demand in DeFi that is Lending, and also provides a solution to limit the risk of asset liquidation for investors.

There are currently more than $8 billion in LP tokens in user wallets, with no other platform effectively utilizing this amount. In the future, that number will increase as the cryptocurrency market in general and DeFi in particular develop.

Therefore, Unbound Finance is highly appreciated when it can help many investors around the world take advantage and reinvest from their idle LP tokens.

Some official information channels of the project that investors can follow are:

Website | Twitter | Medium | Telegram | Github

Above is the information about the Unbound project and the UNB token. With the development of the DeFi market, measures to maximize capital efficiency and make cash flow continuously circulate will be more and more widely applied. Unbound Finance is a puzzle piece that helps solve problems related to idle LP tokens in user wallets.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.