What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

UXD Protocol is a decentralized financial protocol built on Solana, responsible for creating UXD – a decentralized algorithmic stablecoin . Stablecoin UXD is backed by cryptocurrency with Delta neutral position strategy.

Explanation of words : Delta neutral is a strategy that helps investors trade assets without being affected by volatility in the market.

This stablecoin will be integrated with leading derivatives exchanges on Solana helping to keep the position of volatile crypto assets. Mango Markets is the first derivatives exchange powered by UXD Protocol.

With a specially designed structure, stablecoin UXD can solve the problems of stability, capital efficiency and decentralization. Not stopping there, this stablecoin helps investors make a profit when the Funding rate of the perpetual futures position is positive.

Stable

The value of UXD has always been stable as it is pegged to the USD and is fully supported by the strategy of holding a Delta neutral position. Therefore, users can always exchange 1 UXD for 1 USD.

On the other hand, if the value of the UXD deviates from the USD rate for any reason, then traders will be able to make a risk-free profit and bring the UXD price back to the anchored price.

Decentralized

UXD is a non-custodial (non-custodial) stablecoin and does not hold investors' deposited crypto assets. They can use or redeem the UXD without having to go through a 3rd party.

Although the development team will control the initial design choices of UXD Protocol, holders of UXP (the governance token of UXD Protocol) will have the right to future design proposals.

This will ensure that the UXD is decentralized in the long run and never depends on any individual organization.

Effective use of capital

Unlike many other stablecoins that require users to collateralize crypto assets worth more than $1, in order to mint a $1 stablecoin. UXD allows users to exchange at par value with crypto assets, i.e. 1 UXD can be exchanged for 1 USD of crypto assets.

This helps users save time monitoring the fluctuations of mortgage funds to prevent the risk of asset liquidation.

Original profit

Once the UXD is minted, the UXD protocol establishes a derivatives trading position on the DEX exchanges. Thus, the question arises "who will pay the Funding rate?". There will be 2 cases as follows:

If the money in the insurance fund does not have enough money to pay the Funding rate, the project will bring UXP (the governance token of UXD Protocol) to auction to create a source of money for the fund.

UXD uses a new value stabilization mechanism that is completely different from existing stablecoins in the crypto space. UXD uses perpetual futures contracts to create an on-chain neutral position by stabilizing value in USD terms. UXD stablecoins are issued in proportion to the position value created and backed by the position itself.

That is, the UXD Protocol will hold an asset (such as SOL or BTC) and simultaneously open a short position on that same asset through a perpetual futures contract. If holding a buy position and a corresponding short position on the same asset, the collateral value to mint UXD will remain the same.

To do that, UXD Protocol has adopted a strategy of keeping a Delta neutral position, meaning that the stablecoin will be stable in the value of USD despite the constantly fluctuating price of crypto assets.

UXD is an algorithmic stablecoin that uses a strategy of keeping a Delta neutral position on Solana. This is seen as a new innovation to stablecoins, as well as a unique innovation enabled by Solana's extensible structure and existing DEX infrastructure.

UXD's value stabilization mechanism is highly appreciated with many advantages over competitors in the stablecoin segment. The advantages of UXD are scalability, capital efficiency and decentralization.

On the other hand, UXD is the first decentralized algorithmic stablecoin built on Solana – the first smart contract platform to directly compete with Ethereum. Although, Solana already has centralized stablecoins, Ethereum-based stablecoins can be transferred to Solana via the Wormhole bridge. However, this ecosystem still does not have a decentralized stablecoin and UXD is the missing piece of the system.

By becoming a decentralized stablecoin on Solana, UXD can benefit a lot from the development of this ecosystem.

Platform risk

UXD is built on Solana – a new and growing platform that is technically still in beta. Solana's September network outage is proof that the network still poses a relatively large degree of risk to users and projects within it, such as the UXD Protocol.

Smart contract and protocol risks

UXD Protocol is currently in the process of being finalized. All new protocols and unfinished contracts carry some potential risks. Vulnerabilities in the contracts of UXD Protocol or Mango Markets (and other integrated DEXs) are an issue that should always be considered.

Market risk

Although, UXD uses a new value stabilization mechanism, there are some rare risks in the cryptocurrency market that result in UXD positions losing value. In that case, the value of the UXD token will also deviate from the USD rate, even though UXD is a stablecoin.

Development team

UXD Protocol is a decentralized stablecoin protocol built on Solana, founded in 2020 as Soteria. After a period of operation, Soteria was changed to UXD Protocol. Currently, information about the development team has not been announced. TraderH4 team will update after getting information from this project.

Investors

UXD Protocol has raised US$3 million in a seed round led by Multicoin Capital with participation from Alameda Research, DeFiance Capital, CMS Holdings, Solana Foundation, Mercurial Finance. In addition, the list of investors also includes individuals such as Anatoly Yakovenko, Raj Gokal...

First half of 2022

Second half of 2022

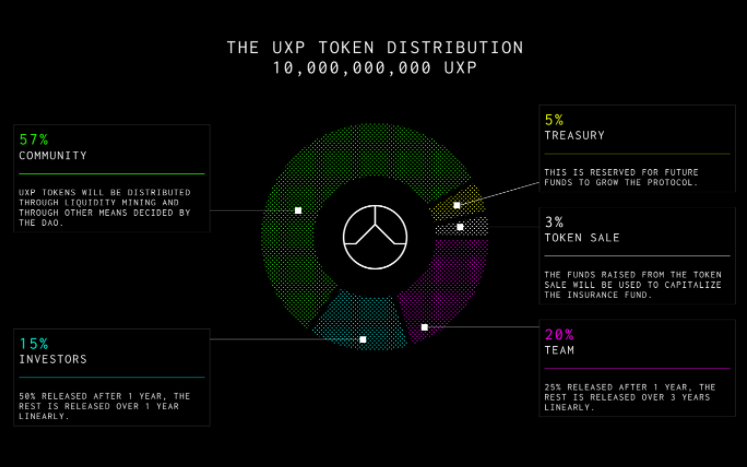

UXD is a stablecoin of the UXD Protocol whose value is pegged to 1 USD. Besides, UXD Protocol also has another token called UXP, which acts as an administrative token, controlling the UXD DAO.

Details about the governance token of UXD Protocol:

Currently, investors can buy UXP tokens on Solana's decentralized exchanges such as Serum DEX, Raydium.

Creating a stablecoin with all the elements such as stable value pegged to USD, decentralization and efficient use of capital, is considered a huge challenge. Before that, dozens of stablecoins have appeared, but have also failed.

UXD Protocol was created to solve the outstanding problems in the space of cryptocurrencies in general and the stablecoin array in particular. The project aspires to become a stablecoin that crypto users trust to perform transactions (such as buying NFTs, paying employees, etc.), using it as a store of value…

In the long term, UXD's goal is to become the asset of choice for a decentralized bank, a payment application. Because UXD Protocol believes its stablecoin meets the requirements to be an essential part of the decentralized financial ecosystem. In addition, UXD Protocol believes that UXD can serve more areas than just DeFi and replace USDC, USDT.

Above is information about the UXD Protocol project and the UXP and UXD token duo. The UXD Protocol project provides a decentralized stablecoin that fully meets criteria such as trustworthiness, stability, and scalability. If investors are interested in the UXD Protocol project, they can refer to the following information channels:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.