What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Cross-border remittances are a potential area, directly benefiting from the strong connection between DeFi and CeFi. This is an area that the community is looking forward to. And Velo is a project on the Stellar platform that has made its mark in this area. So what is the Velo project? Is the VELO token a wise investment choice? Let's find out more details with TraderH4 in the article below!

The Velo protocol is a decentralized platform that brings sweeping changes to the digital credit issuance space and enables borderless asset transfers. The Velo protocol enables trusted partners – individuals and institutions – to issue and manage digital credits, easily, transparently and efficiently. To do this, Velo combines with Stellar, along with Evrynet's smart contract capabilities to provide formula-based transaction processing, custom asset zoning, collateralization, and calculations. other enhancements.

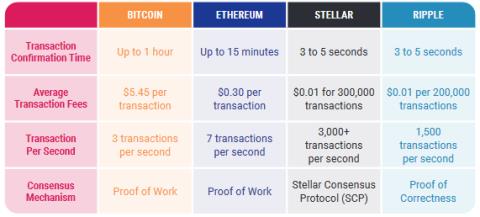

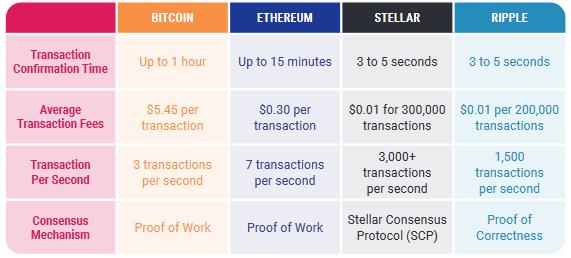

Stellar – the blockchain with extremely fast transaction speed, is the outstanding point that makes the transaction verification process on Velo much faster and more efficient than other competitors. Stellar has a transaction confirmation time of 3 to 5 seconds, an average transaction cost of US$0.01, and a transaction speed of over 3,000 transactions per second (tps). Stellar's transaction speed completely beats today's leading protocols such as Bitcoin, Ethereum, XRP.

In the financial infrastructure market, especially in Southeast Asia, there is a dilemma that remittances are often fragmented. This means that there are many intermediary links in the money transfer, leading to high transaction fees.

So how did Velo solve this difficult problem? Velo uses a blockchain technology platform to issue digital credit accounts. These accounts will be flexibly adjusted to individual/business needs. Velo uses the native token VELO as collateral, representing the value of digital and fiat money in the network.

At the same time, this token also helps to ensure liquidity in the Velo network. By building a network of partners around the globe, Velo circumvents physical limitations in locations without banks or reputable transaction addresses or restricted regions, helping millions of people to make transfers. money easy, safe, fast and low cost.

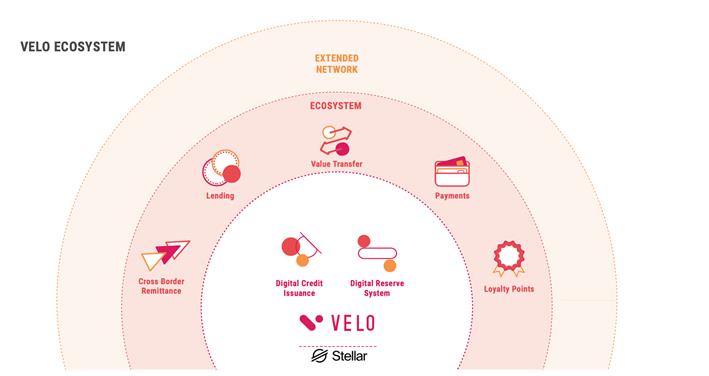

Velo's ecosystem consists of 3 main components: cross-border remittance, Velo FCX and Velo token.

Below is information about the project development team, advisory board and strategic partners of Velo Protocol.

Velo Protocol is developed by Velo Labs, headed by Chatchaval Jiaravanon (President), Tridbodi Arunanondcha (Vice President), Suvicha Sudchai (Product Manager) and IIya Zusman (CEO of Digital Finance).

The chairman of Velo is billionaire Chatchaval Jiaravanon. He is a member of the richest family in Thailand and is also the owner of the long-standing Fortune magazine. Besides, he is also the CEO of the investment group True Corporation PCL. In addition, he has held executive positions at many other companies such as Telecom Holding, WP Energy PCL, SVI PCL, Finansia Syrus Securities PCL, Ticon Industrial Connection PCL and AEON Thana Sinsap PCL

A team of experienced and well-known consultants in fields such as:

Not only has the backing of Velo Labs, a team of experienced advisors, but Velo's strategic partners are also big men.

CP Group

CP Group, also known as Charoen Pokphand Group, is one of the richest families in Thailand and ranks 21st among the richest families in the world, according to Bloomberg. Currently, this group is active in many fields including food production, animal feed, agriculture, retail and telecommunications. For easy visualization, CP's revenue is 16 times and the number of employees is 10 times that of Vingroup Vietnam.

Lightnet

Lightnet Pte. Ltd. is a Fintech company headquartered in Singapore. Lightnet supports user disbursements, SME trade finance, with the aim of empowering bank debtors and SME trade finance with a comprehensive international remittance ecosystem.

Lightnet Corporation uses Velo as its Blockchain protocol and positions itself as the next generation clearing and settlement network across the Asia Pacific region by leveraging blockchain and connecting existing financial systems. yes with its network of cash dealers and wallets. Lightnet's focus is on money transfer services in Southeast Asia, with an estimated $150 billion in annual revenue.

SCB – Siam Commercial Bank

SCB was established by Royal Charter on January 30, 1907 as the first Thai bank. SCB is in the top of the largest commercial banks in Thailand. King Vajiralongkorn is the largest shareholder, owning 23.35% of SCB shares. SCB is also a long-standing bank operating in Thailand, Cambodia and Myanmar. With over 110 years of experience in the industry, SCB is the leading financial services bank in Thailand with deep expertise.

The VELO token is the token of the Velo ecosystem. This token is used as collateral to lock the smart contract for the transfer of currencies and digital currencies. The purpose of VELO is to ensure digital credit liquidity. If the demand for digital credit increases, and the volume of transfers increases with more business partners and users, so does the value of this token.

As reported by TokenInsight, Velo has come up with a relatively detailed and transparent token issuance mechanism and plan. Token issuance will be completed in 2 years. Meanwhile, the remaining amount of tokens is used a lot for project development, community building, strategic partner rewards and reserves for 5 years. Tokens used as a reserve will be locked forever. Such a token mechanism will help the project develop in a sustainable way.

Currently, according to updated information on CoinMarketCap, from 2020 to now, Velo has only released 1.23 billion VELO out of the project's total supply of 30 billion tokens.

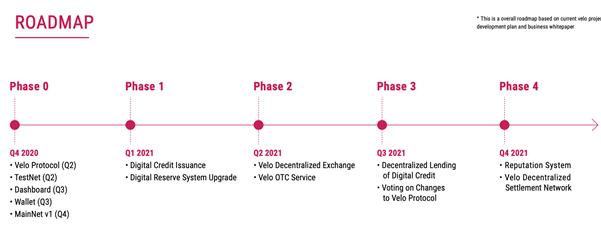

Up to now, the project has completed most of the steps in the development roadmap (4 phases/total 5 phases). Below are the stages presented by Velo in the roadmap.

Phrase 0: Completed in Q4 of 2020.

Phrase 1: Completed by the end of Q1, 2021.

Phrase 2: Completed by the end of Q3, 2021.

Phrase 3: Completed by the end of Q1, 2022.

Phrase 4: Expected to be completed before Q3, 2022.

As such, we have shared details of the Velo project. Hopefully through the article readers know what Velo is and get important information about this project. Velo is a project backed by Thailand's leading billionaire, a team of advisors and well-known strategic partners in the industry. However, the market is downtrend and Velo also has to compete fiercely with many of today's top DeFi protocols. Therefore, readers need to carefully study the project and choose the right investment time.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.