What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

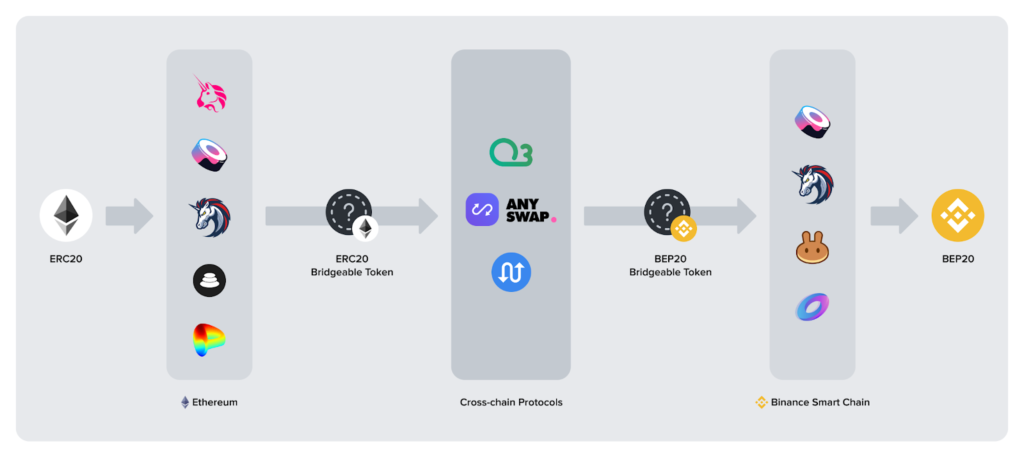

XY Finance is a cross-chain swap aggregation protocol designed specifically for DeFi and Metaverse. The purpose of the project is to facilitate users to transfer assets (including: Token, NFT ...) back and forth between blockchains in a more seamless and secure way.

In addition, XY Finance provides an intuitive and user-friendly interface that makes it easy for them to perform swaps with a simple click.

XY Finance is driving the growth of interoperability through its own cross-chain bridge. At the same time, the platform also provides a solution that helps the DeFi and Metaverse platforms to be more closely connected.

The most outstanding feature of XY Finance is its ecosystem that brings together all 3 major markets such as DeFi, GameFi and NFT. In which, XY token is an important component of XY DAO and XY Finance protocol. Those who contribute and help this ecosystem grow will have the opportunity to receive XY tokens.

Another highlight lies in XY Finance's cross-chain technology. With this technology, the project will facilitate users to transfer assets (including: Token, NFT ...) back and forth between blockchains more seamlessly.

In addition, XY Finance also provides many utilities to help the platform stand out from its competitors such as:

X Swap & Y Pool (DeFi)

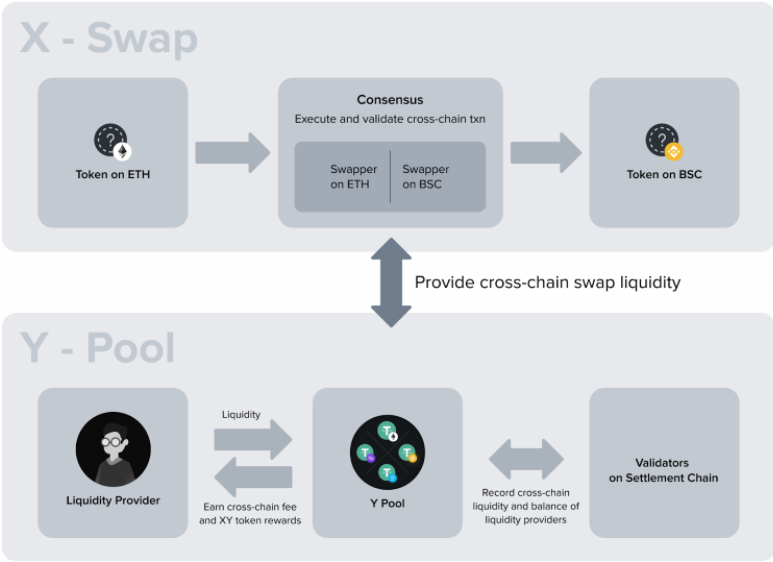

XY Finance introduces X Swap and Y Pool to optimize the fastest and most convenient cross-chain swap performance.

X Swap

X Swap provides a convenient interface for users to easily transfer tokens between other blockchains. This utility is specially designed for those who are less knowledgeable about blockchain technology . Therefore, to perform swaps on X Swap, users only need to use a simple operation that is to click.

X Swap consists of 2 main components:

Swapper : This is a smart contract deployed on different blockchains. It handles swaps and acts as a cross-chain liquidity wallet.

Consensus : This is the element that helps transactions take place smoothly on many different chains. Consensus will come from multiple nodes of stakeholders to ensure seamless cross-chain swaps and the security of X Swap.

As such, these two components will work in harmony as follows: When a user initiates a transaction with Swapper with a quote, Swapper automatically finds the best routing path to swap the user's token to a cross-chain bridge token . After Consensus confirms that transaction, the Swapper on the destination chain receives another transaction from Consensus and then uses the liquidity in his wallet to exchange the desired token.

Y Pool

Y Pool will assume the role of maintaining an abundant source of cross-chain liquidity for X Swap. Users can provide liquidity to Y Pool to earn rewards from trading fees and liquidity mining.

Unlike normal liquidity pools, Y Pool manages multiple liquidity sources in many different blockchains simultaneously. That is, a stablecoin on Y Pool can manage the liquidity of stablecoins on Ethereum, Binance Smart Chain, Polygon and provide liquidity for X Swap.

Y Pool manages many liquidity sources in chains thanks to Settlement Contract. This contract is deployed on a decentralized payment chain to record the liquidity of other chains and the balance of each liquidity provider. The settlement contract will continuously update data every time a liquidity provider deposits, withdraws assets or X Swap using cross-chain liquidity.

Besides, after the liquidity provider deposits assets in Y Pool, they will start accumulating their liquidity mining rewards. This reward will be derived from transaction fees on X Swap and the supply of XY tokens. In it, XY token rewards are distributed by XY Finance to incentivize more participants to contribute liquidity to the XY protocol.

Overall, with these two products, XY Finance can create a completely decentralized cross-chain bridge protocol. Anyone can transfer their assets to other chains, as well as use capital as liquidity to profit on XY Finance without being tied to anything. Notably, liquidity providers can earn interest in Y Pool without incurring the risk of temporary loss.

GalaXY Kats (GameFi)

GalaXY Kats is a collection of 10,000 unique NFT works and a Play-to-earn title built on blockchain technology. In this game players can explore the lore of the universe and help GalaXY Kats revive humanity by overcoming challenges and completing quests. Moreover, GalaXY Kats has many DeFi facilities on X Swap & Y Pool.

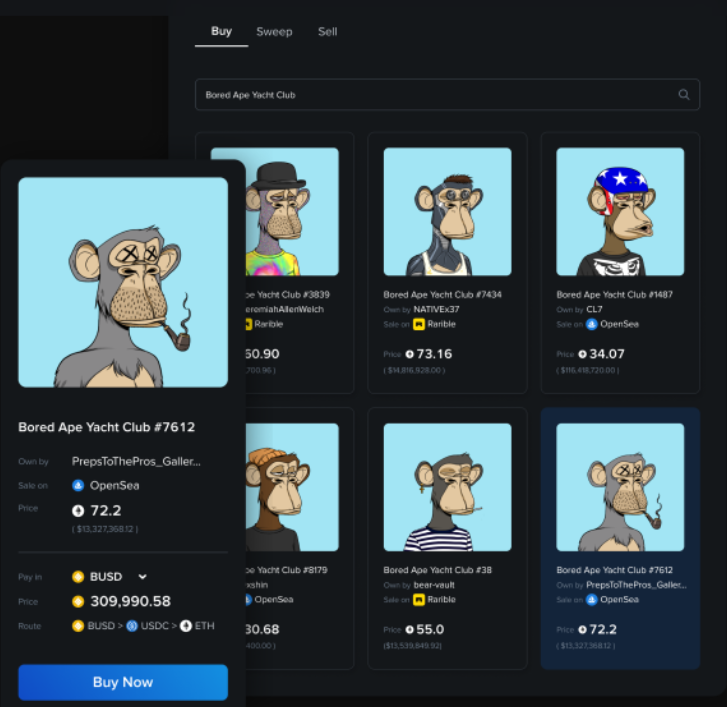

NFT Satellite (NFT)

NFT Satellite is an NFT Marketplace created to meet the needs of NFT trading at the moment. XY Finance introduces NFT liquidity aggregator with a simple and easy to use interface. From there, users can buy and sell NFTs between many different chains on a single platform..

Development team

XY Finance has not revealed the identity details of the development team, TraderH4 will update as soon as there is official information from the project.

Investors

XY Finance has raised US$12 million from Circle Internet Financial, Infinity Ventures Crypto, Mechanism Capital, Morningstar Ventures, YGG (Yield Guild Games) and Animoca Brands. Some other names such as MEXC Global, TRON Foundation, gCC (gumi Cryptos Capital), Lemniscap, Evernew Capital... These investment funds are also partners of XY Finance.

In addition, some angel investors of XY Finance can be mentioned as Tom Schmidt, Ben Chan, Brian Lu, Mr. Block, Yenwen Feng, MachiBigBrother, Leo Cheng and Chaval Richie Jiaravanon.

1st quarter of 2022

Second quarter of 2022

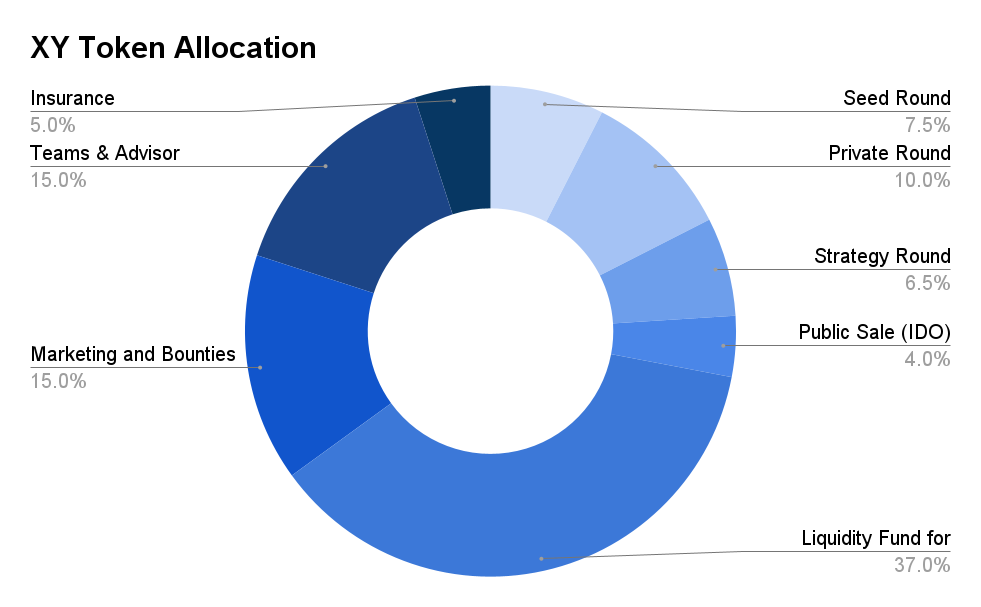

XY is a utility and governance token of the XY Finance ecosystem, some basic information to know about this token is:

Seed Round: 7.5%, these tokens will be locked for 10 months and then distributed within 3 years.

Private Round: 10%, this token will be locked for 6 months and then distributed within 2 years.

Strategy Round: 6.5%, these tokens will be locked for 4 months and then allocated within 1.5 years.

Public Sale (IDO): 4%

Liquidity Fund for Mining & GameFi Reward: 37%, this token will be distributed linearly over 3 years.

Marketing & Bounties: 15%, this token will be distributed within 3 years.

Teams & Advisor: 15%, these tokens will be locked for 10 months and then distributed within 3 years.

Insurance: 5%, this token will be locked and unlocked with XY DAO's consensus.

veXY

XY Finance is managed and upgraded by veXY token holders. The contract of the veXY token allows the community to propose, vote, and implement changes through their governance. Proposals could be modifying system parameters, initiating a new Y Pool, or adding entirely new functions to the protocol.

Users can lock their XY tokens into the veXY contract to receive veXY tokens. The minimum XY token lockup period is 1 week and the maximum is 104 weeks. The longer the XY token lock time, the higher the rewards users will receive.

Vote

As the XY Finance protocol grows, more strategies will be integrated and the community will make more recommendations. As veXY holders, users will have the right to vote on future protocol changes, including changes to transaction fee multipliers, use of XY DAO's treasury reserves, changes protocol structure…

Treasury & SAFU

A portion of the costs collected from users' token swaps will be deposited into XY DAO's treasury. This money will be used as an insurance fund to protect users against unnecessary risks, also known as SAFU - Secure Asset Fund for Users.

When there is more profit generated from the strategies, SAFU funds will be appreciated. From there, XY DAO can decide how to use the funds to develop a faster and more secure protocol.

Staking Incentives : XY token holders who can staking this token on the protocol will receive rewards commensurate with their contribution.

Liquidity Mining : XY token holders can stake their assets in Y Pool to get xyToken (ex: xyUSDT). In addition to receiving a portion of transaction fees, liquidity providers can receive additional XY tokens through the liquidity mining program.

Governance : XY token holders have the right to participate and vote in the platform's governance process. Through administration, users can influence and modify key features and parameters of XY Finance. This will allow XY token holders to influence the direction of the protocol.

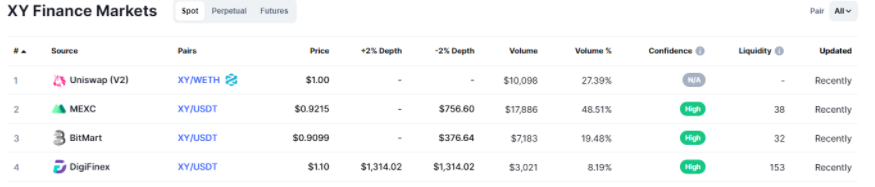

Currently XY is sold on exchanges like DigiFinex, MEXC, BitMart and Uniswap (V2).

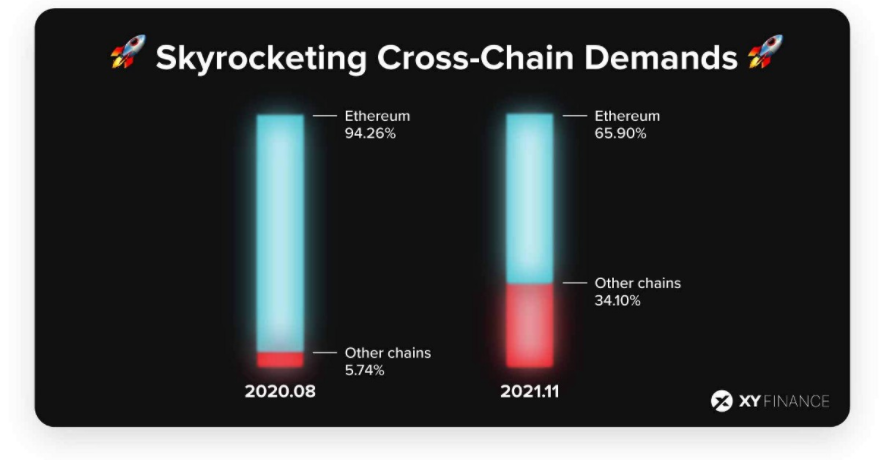

Based on data from DefiLlama, the total TVL on Ethereum accounts for 94.26% of the total TVL on all existing chains (August 2, 2020). However, on November 22, 2021, TVL on Ethereum plummeted 28.36% to 65.90%. Thereby, we see more and more investors joining other networks. This drives the need for cross-chain swaps between many different blockchains.

In fact, the DeFi market is still being held back by problems such as network congestion due to too many unprocessed transactions, gas fees, and excessive price slippage.

On the other hand, GameFi players and NFT collectors can currently only store, trade, and use NFT on the root chain. That is, they cannot transfer NFTs to other chains looking for profit-making opportunities. All of the above mentioned have created an extremely unpleasant user experience.

Understanding the problems that users are facing, XY Finance has created a platform to help solve the above problems. XY Finance facilitates users to transfer assets (including NFTs) across different chains seamlessly and securely. This saves users time and money while conducting exchanges in an uncomplicated environment.

With X Swap and Y Pool, XY Finance establishes a comprehensive cross-chain swap mechanism. From there, the project supports users to optimize profits through token swaps in many different chains. Not stopping there, XY Finance is developing new features with the creativity of the development team and the participation of the XY DAO community.

Above is information about XY Finance project and XY token. Overall, this is a project that integrates many utilities to help users interact more easily in all three potential markets such as DeFi, NFT, and GameFi. If investors are interested in XY Finance, they can follow the project's official information pages such as:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.