What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

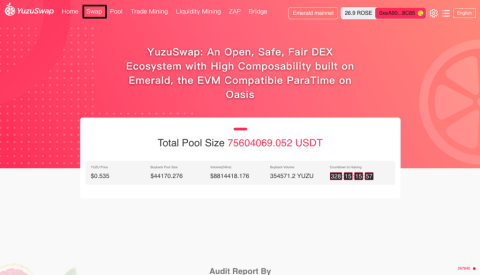

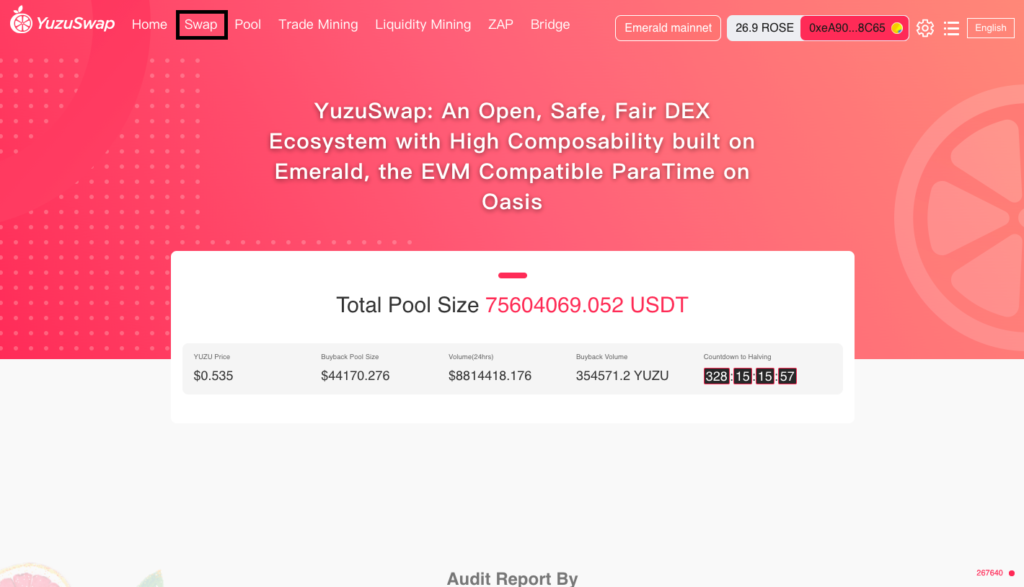

YuzuSwap is a decentralized exchange on Oasis Emerald ParaTime that includes incentives such as liquidity and trade mining. YuzuSwap follows an automated, peer-to-peer, unattended market maker model and aims to provide a secure, fast, and low-cost tool for token discovery and swapping in the Oasis ecosystem. The YuzuSwap platform itself is completely open to Yuzu DAO developers and members.

The exchange was created with the ability to connect any project on the Oasis chain. Furthermore, the project is also highly synthetic, allowing it to be highly flexible, to react quickly to changes and innovations, and to adapt to new technology.

Start a fair project

All tokens are mined block by block from origin, including developer, institutional and investor tokens. In addition, the number of tokens mined in each block will be halved every year.

Trade once, mine forever

YuzuSwap's trade mining mechanism is designed based on TPST (trading pool share token). When users trade in incentivized trading pairs, they will receive a balance in TPST, similar to LPT (liquidity provider token) as proof of their trade. They will receive trade mining tokens in each block according to TPST's market share. If the user does not claim the trade mining reward, the TPST balance will always be there and mine in each block until the user chooses to receive the trade mining reward, after which the TPST balance will reset to zero.

Repurchase

Of the 0.3% transaction fee, 80% will go to the buyback smart contract. This contract will trigger an action to buy YUZU tokens if its price falls below the 72 hour average. So, the more transaction fees accumulate, the better the YUZU token price.

Knife Vault

The remaining 20% of transaction fees will be transferred to the DAO vault. The use of the DAO vault will be voted on by YUZU token holders. Possible uses include encouraging developers to build tools for YuzuSwap, investing in other projects on Oasis, purchasing insurance for YuzuSwap, and so on.

Infinitely expandable

YuzuSwap can be integrated into any project on Oasis. Example: Users can collateralize their LPT (liquidity provider token) on the upcoming lending protocol on Oasis and get their liquidity back. In addition, they can also borrow LPT from the lending protocol to mine YUZU tokens without worrying about Impermanent Loss. The DAO Vault can choose to insure groups on YuzuSwap, so even if an unexpected incident occurs, those groups will be covered.

Promising new projects on Oasis can apply for IDO/IFO on YuzuSwap and this will be a great way to raise funds for projects from the community. Users with YUZU tokens will vote for which projects can work on the IDO/IFO launchpad, whether to allocate new tokens to the mining pool and what percentage of the mining pool will be allocated to the new tokens…

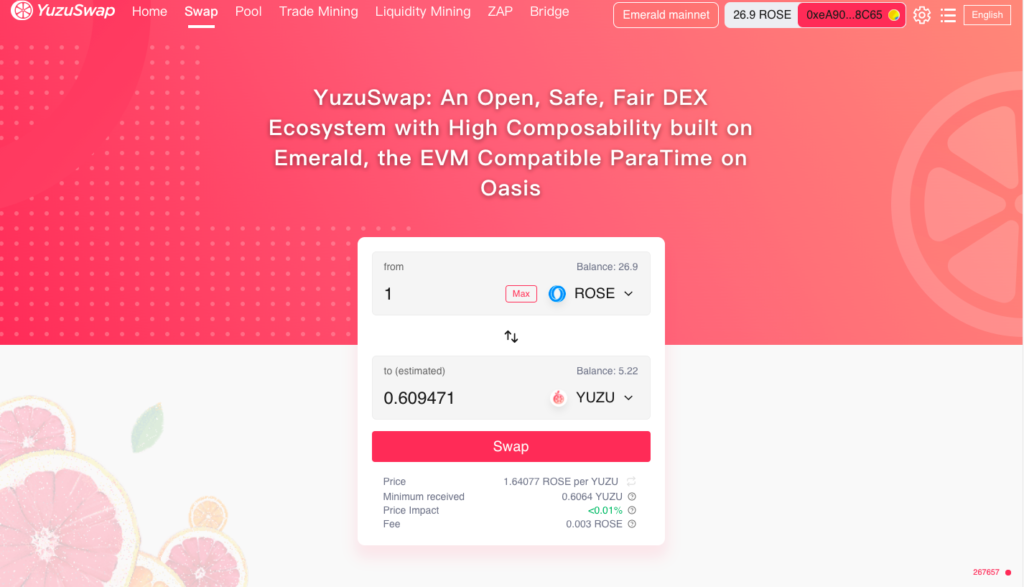

Swap

Transactions on YuzuSwap are extremely easy and convenient. Currently the project is working on beta version, so there will be new features updated when the main version is released.

To be able to trade on YuzuSwap, users need to connect a wallet and select “Swap” .

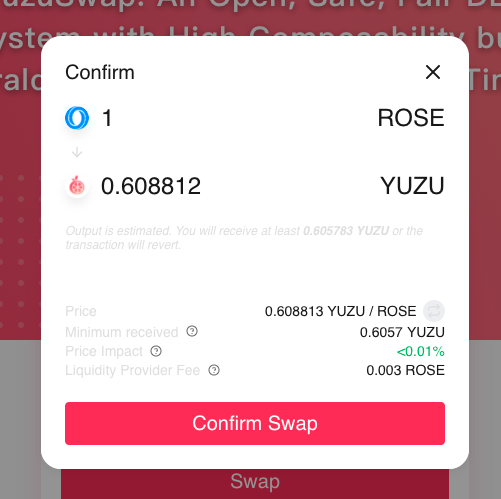

Select the token pairs you want to trade. Enter the transaction amount and click “Swap” .

Make sure everything is correct and click “Confirm Swap” .

Pools and liquidity

A liquidity provider (also known as a market maker) is someone who provides their crypto assets to a platform to help decentralize trading. In return, they are rewarded with fees generated from transactions on that platform, which can be considered a form of passive income. User-supplied crypto assets are deposited into a liquidity pool.

In addition, it is very important to watch out for the risks associated with this function, especially impermanent loss: “Impermanent loss occurs when a user provides liquidity to the liquidity pool and the asset price after signing. deposit is changed from before deposit. In this case, the loss means that the USD value at the time of withdrawal will be less than at the time of deposit.”

Here's how to provide liquidity to the pool:

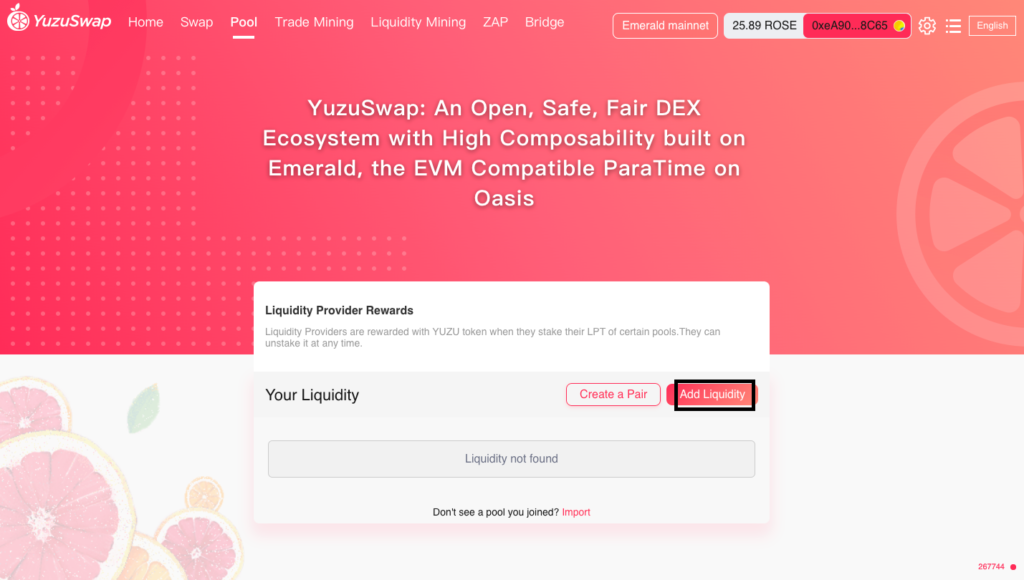

Select the Pool and click “Add Liquidity” .

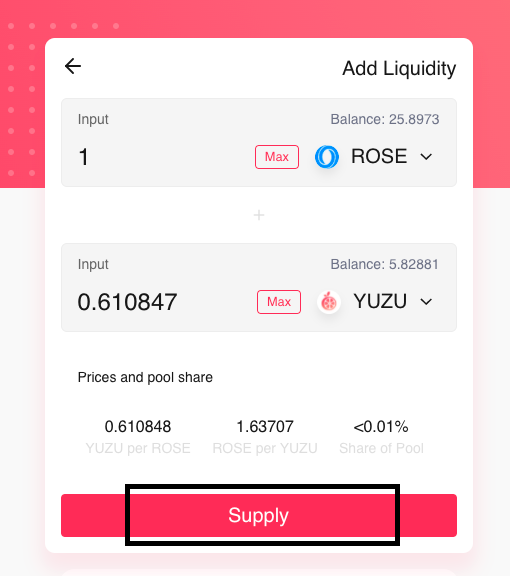

Select the token pairs you want to add to the pool (in this case, ROSE/YUZU). Enter the amount and first click on “Approve Yuzu” .

Then select “Supply” .

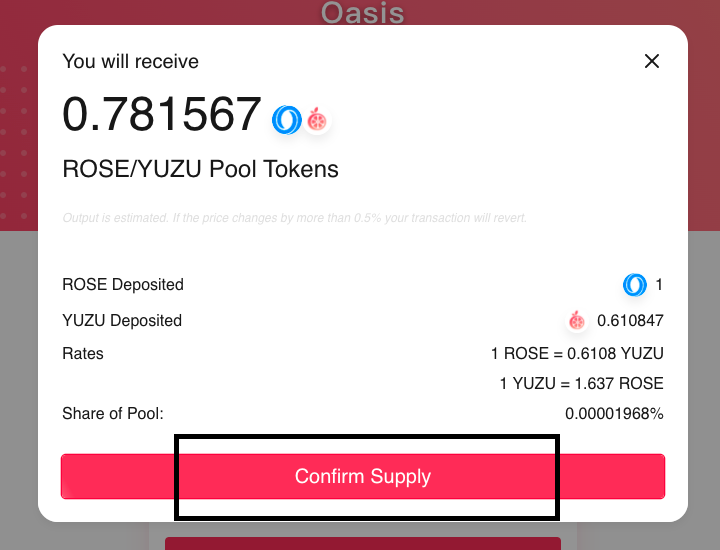

Make sure everything is correct then click “Confirm Supply” .

Trade Mining

As stated above, YuzuSwap's trade mining mechanism is designed based on TPST. When users trade in incentivized trading pairs, they will receive a balance in TPST, similar to LPT as their proof of trade. They will receive trade mining tokens in each block according to TPST's market share. If the user does not claim the reward, the TPST balance will always be there and mine in each block until the user chooses to receive the commercial mining reward, after which the TPST balance will reset to zero.

Currently, there are quite a few pairs for users to participate in trade mining, users have more choices. In addition, trading in trade mining helps users to earn more YUZU tokens.

Liquidity Mining

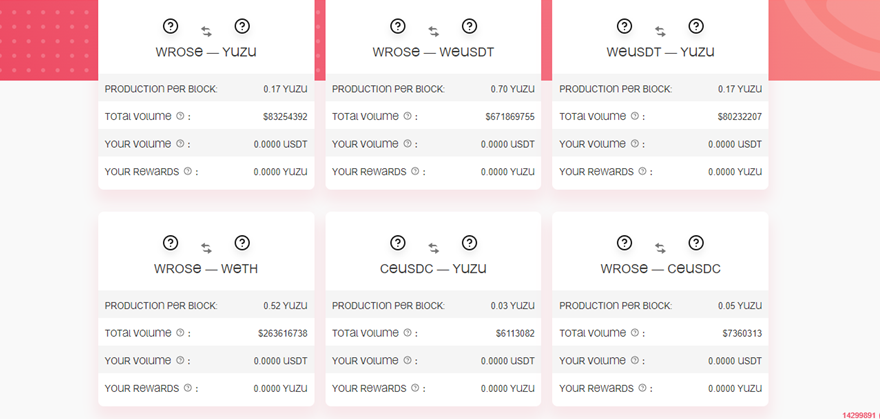

In the liquidity mining tab, you can staking the LPT generated by providing liquidity to several pools inside YuzuSwap.

First, it is necessary to choose a pool to be able to mine for liquidity.

Select “Stake LP” , then confirm and the liquidity mining is done. The operations in YuzuSwap are very simple and user-friendly.

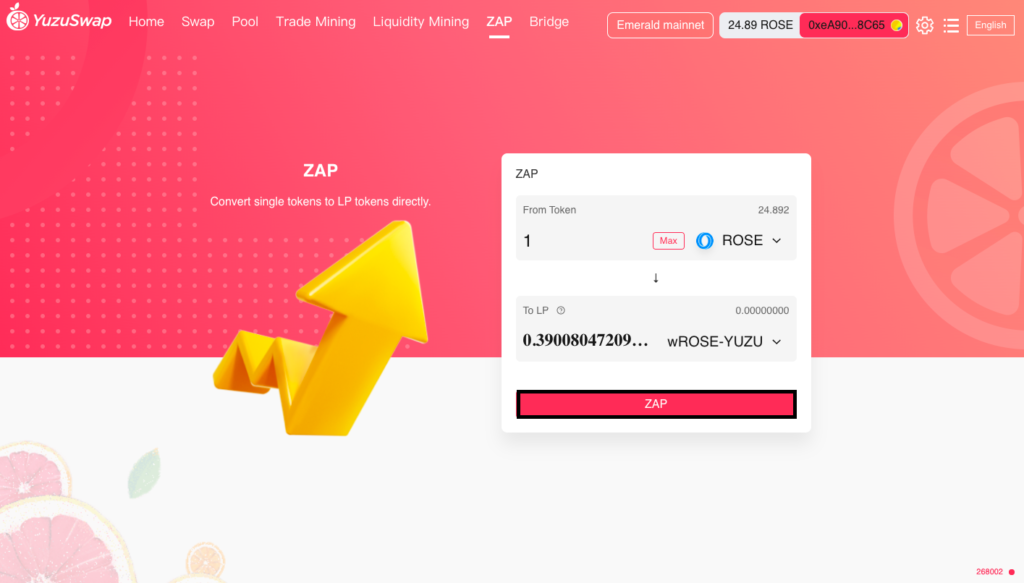

ZAP

In ZAP, users can earn LPT tokens just by swapping one of them, instead of adding 2 tokens to the liquidity pool, with ZAP they will be able to do it with just one. Select the token you want to exchange for LPT, the LPT pair and finally, enter the amount and click “ZAP” .

Bridge

Currently, YuzuSwap can interact with other blockchain platforms such as Avalanche, BSC, Terra, Ethereum, Polygon, Solana, Celo... through Wormhold and cBridge bridges.

Development team

The project's development team includes some members from the Oasis Network and a few other members who are still unknown. In it, Ruben Amar is a BD at Oasis Protocol Foundation and a community management team leader at YuzuSwap.

Investors

YuzuSwap raised $2 million in seed round, led by Mirana Ventures with participation from many other institutional investors such as FBG Capital, NGC, Oasis Protocol Foundation, Simply VC, Signum and QCP Capital.

In addition, the project is currently working with partners such as De Spread, Peckshield, Assembly Research, PSP and Celer Network.

The YUZU token is the utility token of YuzuSwap.

YuzuSwap token details:

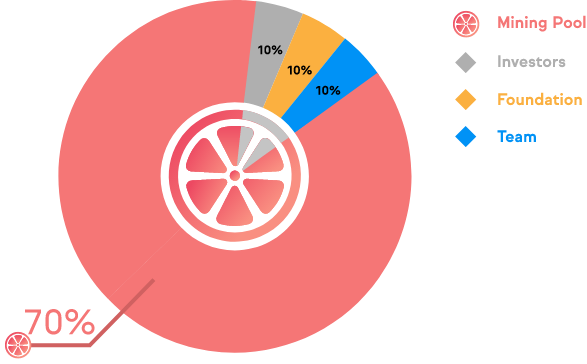

YUZU token allocation:

Currently, the YUZU token has not been released to the community.

YuzuSwap DEX allows users to participate in liquidity pools, swap, trade and earn rewards with high APY. In addition, thanks to the Wormhole bridge, it will connect to nearly 1 billion USD TVL via Avalanche, BSC, Terra, Ethereum, Polygon and Solana. This will make it easier for capital to flow to YuzuSwap.

YuzuSwap takes advantage of Emerald's low fees and massive 1k TPS throughput – ParaTime is EVM-compatible. YuzuSwap's goal is to be an Oasis-based DeFi application , built to be composable and open, with safety and fairness at its core.

Potential uses for the DAO admin repository could include purchasing insurance to further protect YuzuSwap users, incentivizing developers to build more tools for YuzuSwap.

YuzuSwap is a fair, fast and scalable DEX, built on Oasis. YuzuSwap allows users to earn rewards just from trading using a system called Trade Mining. Every transaction that a user makes entitles them to receive Trade Pool Share tokens.

To continuously update new information about the YuzuSwap project, investors can visit the project's social networking page:

Website | Twitter | Medium | Telegram | Instagram | Project information

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.