Stablecoin Tanımı: Stablecoin Nedir? Stablecoinler nasıl çalışır? (2022)

Stabilcoin nedir? Stablecoin'in piyasadaki rolü nedir? Kaç çeşit Stablecoin vardır? Stablecoin'ler hakkında buradan bilgi edinin!

DeFi Legos serisine hoş geldiniz - size farklı pazar segmentlerinde derinlemesine analiz ve araştırma sağlayan bir dizi anlayışlı makale. Bugünkü konu Stablecoin.

Şu anda USDT, USDC, DAI, ESD gibi çeşitli Stabilcoin'ler var ama bunların mekanizmaları tamamen farklı. Bu yüzden bu yazımda Stablecoin sektörünü detaylı bir şekilde analiz edip size şu konularda detaylı bilgiler vereceğim:

Pek çok özel anlayış olacağından, kendiniz için bazı yararlı noktaları not etmeniz önerilir. Ayrıca her bölüm bir diğerine sırayla bağlıdır, bu yüzden hiçbir bölümü atlamayın. Şimdi başlayalım.

Feragatname: Bu makalenin amacı, finansal tavsiye değil , esas olarak yapıcı bilgi ve kişisel bakış açıları sağlamaktır . Kripto piyasasına yatırım yapmak oldukça risklidir, bu nedenle yatırım yapmadan önce Kendi Araştırmanızı Yapın.

Stabilcoin Tanımı

Stablecoin kelimesi “Stabil” ve “Coin” ile birleştirilmiştir:

Genel olarak konuşursak, bir kripto para birimine dönüştürülen Altın veya gümüş, bir Stabilcoin olarak kabul edilebilir; Fiat para birimleri de aynı şekilde Stablecoin olarak kabul edilebilir.

Bununla birlikte, bu makale yalnızca kriptoda en sık kullanılan Stablecoin'lere, yani değerleri 1 $'a sabitlenmiş Stablecoin'lere odaklanacaktır.

Stablecoin'in DeFi'deki rolü

Şu anda, kripto para piyasası 2.200 milyar dolardan fazla değere sahip, bu da piyasadaki dolaşımdaki nakit akışının son derece büyük olduğunu ve kripto varlıkların alım satımı, depolanması veya yatırımı için yüksek bir talep olduğunu gösteriyor.

Bununla birlikte, her Fiat para birimi kripto borsaları tarafından desteklenmez. Stablecoin mevcut değilse, kullanıcılar önce ülkelerinin Fiat para birimini USD'ye çevirmelidir (çünkü USD dünya çapında bir ödeme para birimi olarak kabul edilir), ardından yüksek maliyetli, yüksek spreadli bir aracı (banka gibi) aracılığıyla değişime devam etmelidir. , karmaşık prosedürler,... herhangi bir kripto para birimi jetonunu almadan önce.

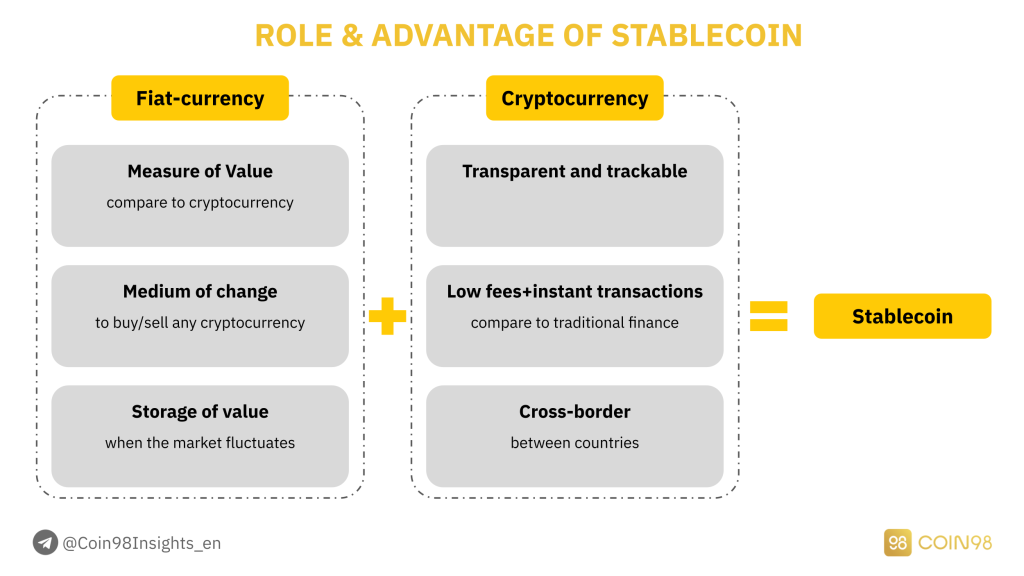

Stablecoin bu sorunu çözmek için icat edildi. Stablecoin'in güçlü yönleri 2 faktörün birleşimi olarak görülebilir:

Stablecoin'in rolü ve avantajı.

Kripto pazarında, Stablecoin'in rolü:

Stablecoin'in, Fiat-para biriminin değeri ile kripto para biriminin blockchain ağındaki rahatlığının mükemmel birleşimi olduğuna inanılıyor . Stablecoin, kullanıcıların en hızlı şekilde yatırım yapmasına, en fazla sayıda kripto varlığına erişmesine ve özellikle gereksiz aracılık sürecini ortadan kaldırmasına yardımcı olacak.

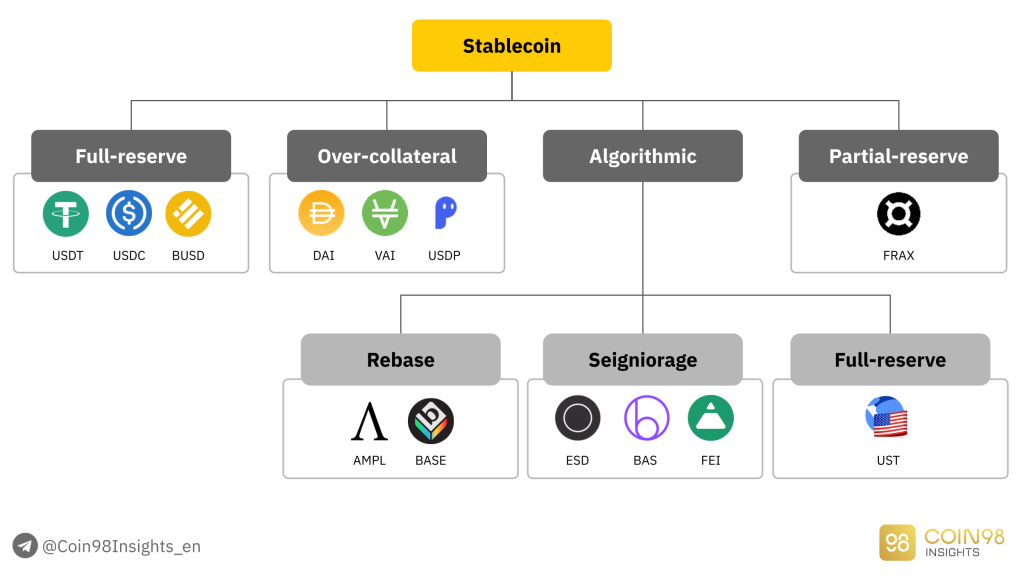

Farklı Stabilcoin türleri

USDT, USDC ve DAI en popüler üç Stablecoin'dir. Bununla birlikte, Stablecoin dünyası, sermayeleri optimize etme konusunda farklı yeteneklere sahip 4 ana türe ayrılabilecek olandan çok daha büyüktür.

4 ana Stabilcoin türü.

Bu bölümde, her birinin mekanizmasını, güçlü ve zayıf yönlerini analiz edeceğim.

Tam rezerv Stablecoin'ler (Merkezi Stablecoin'ler)

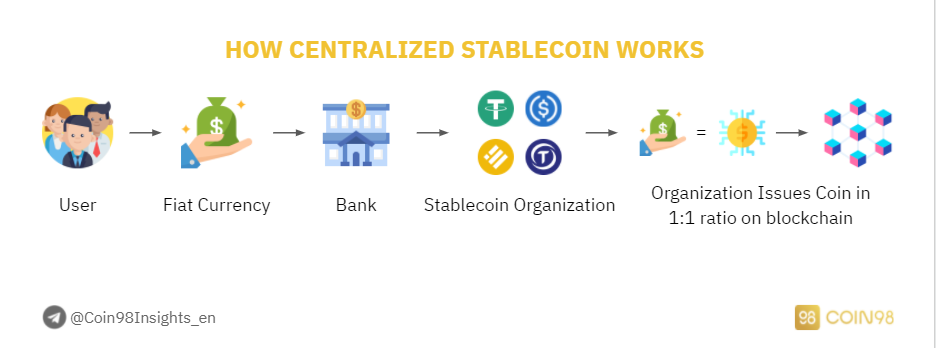

Merkezileştirilmiş Stabilcoin nasıl çalışır?

Tam rezerv Stablecoin'ler, gerçek hayatta bir Fiat para birimi tarafından desteklenen Stablecoin'lerdir . En iyi bilinen durumlar USDT, USDC ve BUSD'nin USD tarafından desteklenmesidir; bu, blok zincirinde basılan her 1 USDT için gerçek hayatta 1 USD ayrıldığı anlamına gelir.

Tam rezervli bir Stablecoin'in özellikleri:

Tam rezerv Stabilcoinler veya Merkezi Stabilcoinler, Toplam Arz ve Dolaşımdaki Arz açısından bir kuruluş tarafından yönetilir. Daha spesifik olarak, USDT Tether tarafından kontrol edilir , USDC Circle tarafından kontrol edilir ve BUSD Binance ve Paxos tarafından kontrol edilir.

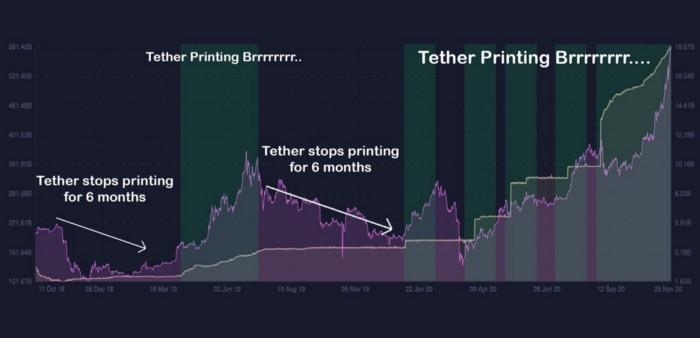

Haberleri düzenli olarak takip ederseniz, Centralized Stablecoinlerin Tether USDT başta olmak üzere yasal konularda düzenli olarak FUD'larla karşı karşıya kaldığını fark edeceksiniz. 2016'dan beri Tether'in Bitfinex ile piyasayı manipüle ettiğinden şüpheleniliyor.

En büyük FUD, Tether'in bankadaki ayrılmış fondan daha fazla sabit para basıyor olmasıdır. Bu durumda, Tether'in piyasayı manipüle etme şansı tamamen mümkündür. Bununla birlikte, USDT 2016'dan bugüne hayatta kaldı ve etkin üretkenliği sürdürdü.

Tether FUD'ları.

Aşırı Teminatlı Stabilcoinler (Merkezi Olmayan Stablecoinler)

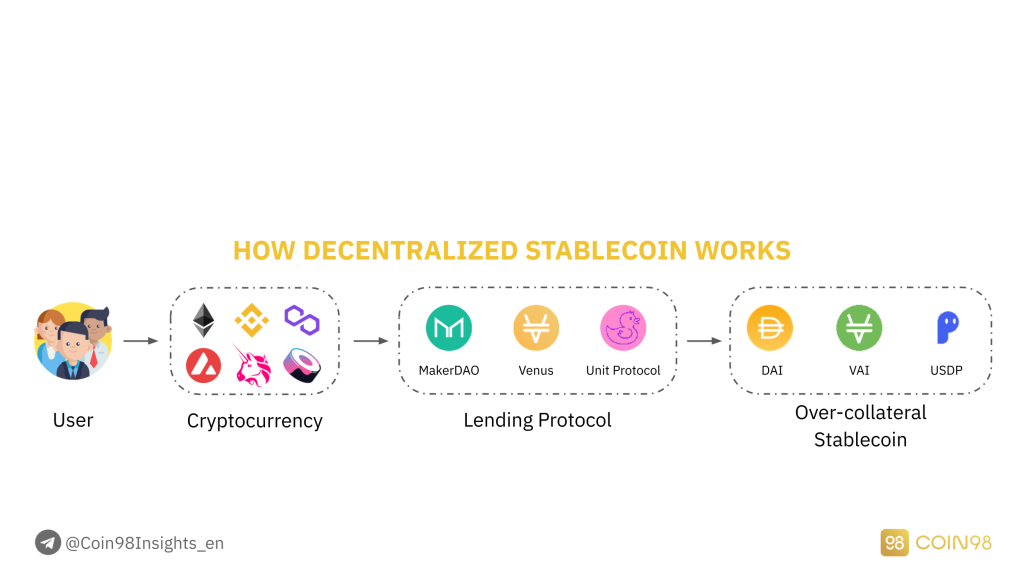

Fazla teminatlı Stablecoin, teminatın değeri basılan Stablecoin'lerin değerinden yüksek olduğunda oluşturulan en popüler ikinci Stablecoin türüdür. En belirgin Over-collateral Stablecoin, bir borç verme protokolü olan MakerDAO tarafından üretilen bir stablecoin olan DAI'dir.

Aşırı Teminatlı Stabilcoin'in özellikleri:

DAI'yi piyasaya sürmek için, kullanıcıların diğer kripto para birimlerini, toplam değerlerinin basılan DAI sayısının en az %150'si kadar olacak şekilde teminatlandırması gerekir. Varlıkların fiyatı izin verilen eşiğin altına düşerse, basılan DAI'nin değerini sağlamak için bu varlıklar tasfiye edilecektir.

Bu, DAI'nin fiyatını sabit tuttu ve 1 USD'ye sabitledi. Bununla birlikte, bu yaklaşım, mekanizması sermaye açısından verimli olmadığı için DAI jetonlarının ölçeklenebilirliğini sınırlar (DAI'nin basılması her zaman daha büyük miktarda teminat değeri gerektirir).

Merkezi Olmayan Stablecoin nasıl çalışır?

Önde gelen bazı Aşırı Teminatlı Stabilcoinler: MakerDAO (MKR & DAI), Venus (XVS & VAI), Party Parrot (PRT & PAI),...

Ve 12 Mart 2020'de olan da tam olarak buydu. Bir Flash Dump gerçekleştiğinde, Ethereum ağının tıkandığından bahsetmeye gerek yok, ETH fiyatı 2 gün içinde yarıya indi. Ne yazık ki, bu muazzam varlık tasfiyeleriyle sonuçlandı.

Sermaye verimliliği açısından, Fazla Teminatlı Stablecoin'ler fonları kullanamaz çünkü basılmasına izin verilen Stablecoin'lerin sayısı teminat değerinin yalnızca %75'ini, hatta kullanıcılar belirtildiği gibi bir Flash Dump'tan kaçınmak istiyorsa %50'sini oluşturur.

Aslında, çoğu borç verme protokolü, DAI gibi Aşırı Teminat mekanizması yerine USDT veya USDC gibi diğer Durağan Paraları ödünç almak için teminat yatırmaya izin verir. MakerDAO'nun Aşırı Teminatlı Stabilcoin segmentine hakim olmasının ana nedeni budur.

Rezervsiz Stabil Paralar (Algoritmik Stabil Paralar)

Rezervsiz Stablecoin'ler veya Algoritmik Stablecoin'ler, herhangi bir yedek rezerv olmaksızın basılan Stablecoin'lerdir . Protokoller, fiyatını 1 dolarda tutmak için Stablecoin'in Dolaşımdaki Arzını sürekli olarak ayarlamak için algoritmalar kullanır.

Algoritmik bir Stabilcoin'in özellikleri:

Algoritmik Stabilcoinler 2 ana tip içerir: Rebase Model ve Seigniorage Model.

1. Modeli Yeniden Temellendir

Rebase Modelini izleyen Stablecoin'ler, tokenin Dolaşım Arzını değiştirmek ve fiyatı etkilemek için algoritmalar uygulayan yalnızca 1 token kullanır. Bu modeli kullanan en belirgin proje AmpleForth'tur (AMPL).

Her 24 saatte bir AMPL arzı, AMPL fiyatına bağlı olarak değişecektir:

Rebase işlemi, bir kullanıcının sahip olduğu jeton sayısını doğrudan etkiler. Sonuç olarak, AMPL fiyatını tekrar sabitlenmesi için arz-talep dengesi korunur.

Rebase Modelini takip eden bazı önde gelen Algoritmik Stabilcoinler: AmpleForth (AMPL), BASE Protokolü (BASE), Yam Finance (YAM),...

2. Senyoraj Modeli

Seigniorage Modelini izleyen Stablecoin'ler, jeton fiyatını çalıştırma ve sürdürme sürecinde 2-3 yan jeton kullanır. Genel olarak, bir token bir Stablecoin'dir ve diğeri ise Stablecoin'in arzını/talebini artırmak/azaltmak ve onu sabitlenmiş değerde tutmak için Burn-Mint, Stake-Earn gibi bazı mekanizmaları uygulayan bir token'dır.

Senyoraj Modelini izleyen bazı önde gelen Algoritmik Stabil paralar:

Güç: Sermaye veya teminat gerekmez.

Zayıflık: Teorik olarak, Algoritmik Stabilcoin, Tam rezerv Stabilcoin ve Aşırı Teminatlı Stabilcoin sınırlamalarını çözebilir. Gerçekte, Algorithmic Stablecoin, aşırı yüksek satış baskısı nedeniyle fiyatı 1 dolarda sürdürülemediğinden en verimsiz ve verimsiz türdür.

Algoritmik Stabilcoin projeleri, token fiyatını sürdürmede onları desteklemek için güçlü ve sağlam bir topluluğa sahip olduklarını normalde en başından kabul ettikleri için durum böyledir. Teşvik Programının proje için çok sayıda destekçi çekebileceği inancına güveniyorlar.

Aslında Teşvik Programı (Tarım), kullanıcıları projeyi uzun vadede takip etmeye teşvik edecek kadar ikna edici değil. Kullanıcılar yalnızca yüksek APR ile çiftçiliğe odaklanır ve ardından kazanılan ödülleri satar ⇒ satış baskısı yaratır > talep satın alır ⇒ fiyatı sabitleyemez.

Ayrıca Algoritmik Stabilcoinler piyasada yaygın olarak uygulanmamaktadır. Şu anda en işlevsel iki Algoritmik Stabilcoin projesi olan Fei Protokolü ve Terra USD dışında, bu sektörde başka hiçbir proje öne çıkmıyor.

Kısmi rezerv Stablecoin'ler (Kısmi rezerv Stablecoin'ler)

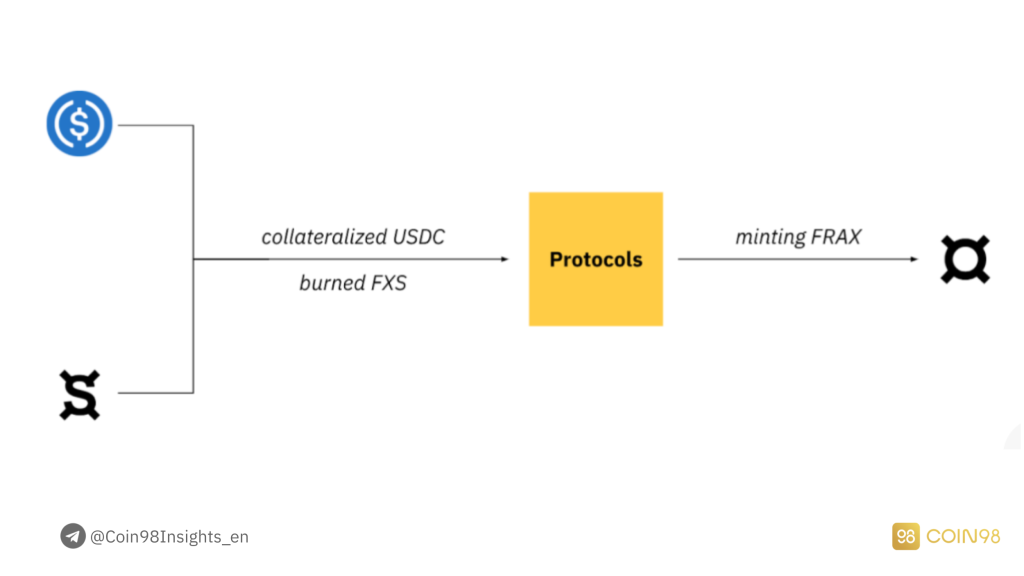

Kısmi rezerv Stablecoin'ler veya Fraksiyonel rezerv Stablecoin'ler, Tam rezerv Stablecoin'lerin ve Algoritmik Stablecoin'lerin birleşimidir . İlk ve en istisnai örnek Frax Finance'tir.

Kısmi rezerv Stablecoin'in özellikleri:

1 FRAX (kısmi rezerv Stablecoin) basmak için, kullanıcıların 1 FRAX fiyatını sübvanse etmek için bazı Stablecoin'lere (şu anda USDT ve USDC) sahip olmaları gerekir. Oran, teminat oranı %50 ile %100 arasında değişen Frax Finance'e göre ayarlanabilir.

FRAX modeli.

Önde gelen bazı Kısmi rezerv Stabilcoinler: Frax Finance (FXS & FRAX),...

Güç: Ortalama sermaye verimliliği, Tam rezervli Stablecoin (teminat gerekli) ve rezervsiz Stablecoin (algoritma tabanlı) kombinasyonu.

Zayıf yön: Frax Finance şu anda bu yaklaşımı uygulayan tek projedir ve bu, pek çok geliştiricinin bu segmentle ilgilenmediğini göstermektedir. Gerçek zamanlı veriler ayrıca FRAX'ın Piyasa Değerinin gerçekten küçük olduğunu ve FXS'nin DeFi veya CeFi'de çok fazla uygulaması olmadığını gösteriyor.

Başarılı bir Stablecoin'in özellikleri

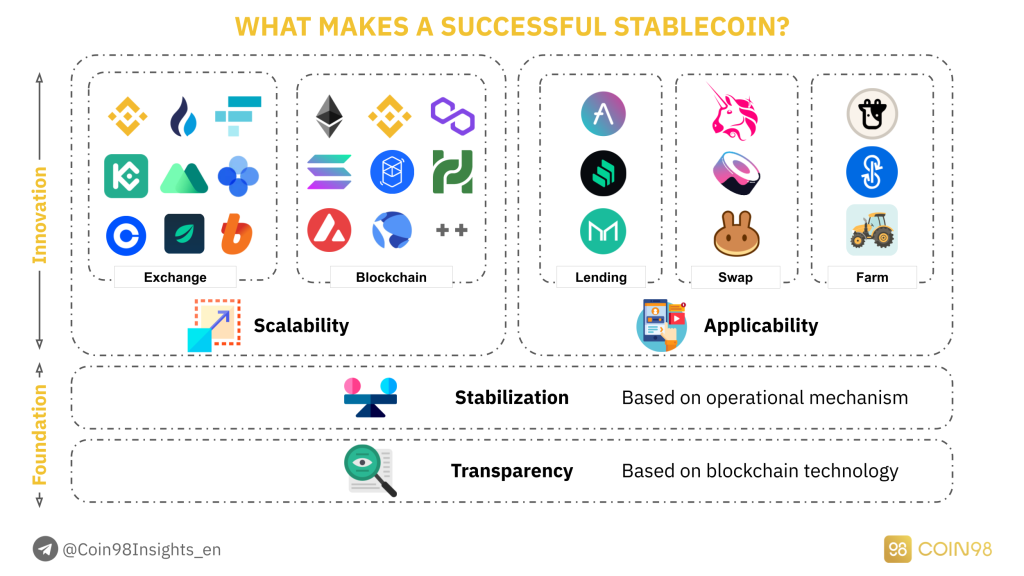

Her bir Stablecoin türünün güçlü ve zayıf yönlerini inceledikten sonra, şimdi başarılı ve etkili bir Stablecoin yaratan faktörleri inceleyeceğiz. Sonrasında kripto piyasasındaki çalışma ve genişleme sürecini görselleştirebileceksiniz.

Bir Stablecoin'in piyasada verimli çalışabilmesi için, aşağıdakiler dahil olmak üzere 4 faktörden oluşan eksiksiz bir yığına sahip olmaları gerekir:

Başarılı bir Stablecoin yapan 4 unsur.

şeffaflık

Transparency can be regarded as the basic foundation of a valuable Stablecoin. Who are the backers of that Stablecoin? If a Stablecoin is backed by enormous and reputable backers, it will be a trustworthy one for both retail users and whales to use for trading and storing. For instance:

The transparency of a Stablecoin can be evaluated through the users’ access to tracking tools, or in other words, whether users can track the token’s Total Supply and transactions on the blockchain. However, in the case of Centralized Stablecoins like USDT or USDC, their transparencies are still questionable as it is not certain if the amount of USD locked inside the Vault of Tether or Circle is relative to the minted Stablecoins.

Stabilization

The next element to consider is Stabilization, which is also an indispensable feature of a Stablecoin. Back to the original purpose, Stablecoin was created as a tool to avoid all the volatility in the crypto market.

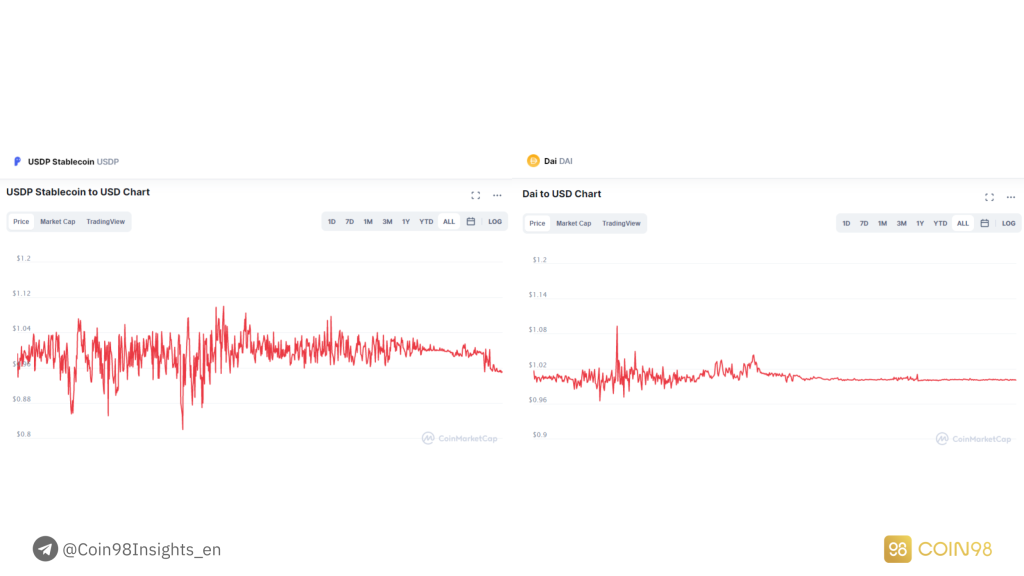

Therefore, if a Stablecoin cannot sustain its peg steadily, that Stablecoin cannot be used as a storing asset. In the illustration below, the two Stablecoins DAI (MakerDAO) and USDP (Unit Protocol) will be compared.

While the DAI price was able to remain stable around $1, the value of USDP usually dropped to $0.95, losing 5% compared to 1 DAI.

Compare USDP with DAI.

If Transparency and Stabilization are the requirements for a Stablecoin to work productively, then Applicability and Scalability are the two factors that help a Stablecoin expand extensively in the market.

Extra analysis: The paradox of Stabilization

Most Stablecoins peg their prices to USD, a Fiat-currency being backed by the whole United States economy. As a result, they are considered more stable than other highly inflationary currencies and highly volatile assets on the stock or cryptocurrency market.

But are Stablecoins really “Stable” if they are USD-pegged?

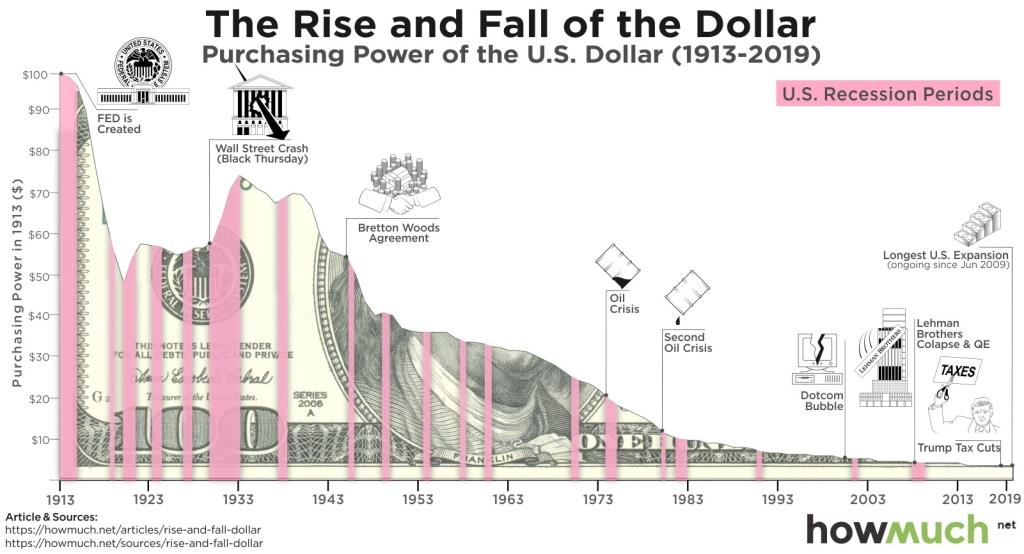

According to the statistics provided by HowMuch, from 1913 to 2019, the intrinsic value of the Dollar currency has been reduced by 90%.

Which means that, if in 1913 $100 could buy 10 kg of rice, in 2019 100$ could only buy less than 1 kg of rice. This happened due to the US abandoning the Gold and Oil standards, allowing FED to freely print money without any physical assets backing its value. This event created huge inflation in USD.

So was the recent price surge of Bitcoin a result of the pump scheme or of the declining USD value?

USD value reduces over time

Scalability

Scalability can be considered the Network Effect of a Stablecoin. When a Stablecoin expands its operating range, a corresponding amount of influence also increases.

On CeFi platforms, especially Centralized Exchanges, USDT is a gigantic force as it is used as the primary trading asset on some biggest exchanges at the moment, such as Binance, Huobi, FTX, OKEx, KuCoin,...

On DeFi platforms, USDC is having the greatest impact because it is the most common asset when it comes to creating Liquidity Pools. Even though USDC was released 3 three years after USDT, it has quickly issued its stablecoins on multiple developing DeFi ecosystems like Ethereum, BSC, Polygon, Fantom, Solana,...

Besides USDT and USDC, BUSD is another rapidly growing Stablecoin thanks to Binance as it is not only used as a trading asset on Binance Exchange, but also implemented in DeFi protocols on Binance Smart Chain.

Applicability

Given that a Stablecoin is widely expanded, at the same time exerting a considerable influence on the crypto market. The next step for it is to improve the Applicability.

For example:

Applicability needs to be developed alongside Scalability after Transparency and Stabilization are solidly built.

Most prominent Stablecoins in the market

We have gone through some basic attributes that make a successful Stablecoin. However, the Stablecoin segment is extremely competitive with a high domination ratio.

Top 10 Stablecoins in the market account for 96% of the Stablecoin Market Cap. Why are the highest-ranked Stablecoins so dominant? In this part, we will seek the answers by analyzing the Case Studies of 5 Stablecoins with the largest Market Cap, including:

Top 15 Stablecoins at the moment. Updated: 7 October, 2021.

Tether - USDT

Tether (USDT) is acknowledged as the earliest Stablecoin in the crypto market. Up to this moment, Tether is the Stablecoin with the largest Market Cap, and having the greatest influence on the market.

Tether has the advantage of implementing an early advent, hence being able to build an incredibly strong Network Effect. Especially, all of the biggest exchanges like Binance, FTX, Huobi are using USDT as the main trading pair for other Altcoins.

Some exchanges have tried to be independent of USDT by issuing their own Stablecoins: BUSD from Binance, HUSD from Huobi. Nonetheless, USDT remains to be the most widespread among every CeFi exchange.

Not to mention on OTC markets, USDT is currently the main gateway for worldwide users to swap from Fiat-currencies to cryptocurrencies. In spite of the fact that OTC markets are still allowing the exchange of other cryptocurrencies like BTC, ETH,... USDT is still dominating the market with high liquidity, low slippage and the ability to be directly traded to other Altcoins across different exchanges.

USD Coin - USDC

Although USDC was founded after USDT, it possesses the advantage of being more friendly to the law system by receiving support from enormous backers, especially Coinbase. Moreover, big exchanges like Binance, KuCoin, and Huobi also use USDC.

Nevertheless, the reason behind USDC’s success is the approach to the DeFi Market. Instead of issuing a large number of Stablecoins on the Tron network like USDT, USDC quickly issued its Stablecoins on other developing DeFi ecosystems, namely Ethereum, BSC, Polygon, Solana, and Fantom.

By seizing the chance faster, Circle did not have to wait for long to take over the DeFi market and attract more users to utilize USDC in the DeFi space.

Binance USD - BUSD

Binance USD is the product made by the cooperation between Binance and Paxos (the managing company of PAX Stablecoin, recently changed its ticker to USDP). Despite the fact that BUSD was released after USDC, USDT and DAI, BUSD has the fastest growth.

Thanks to Binance, BUSD has been broadly applied in Binance Exchange since the beginning of 2020 by being paired with myriads of other tokens, at the same time providing free transaction cost to the paired assets.

When Binance Smart Chain exploded as a phenomenon in March 2021, Binance increased the issuing rate of BUSD on Binance Smart Chain and made it a pairing asset for liquidity pools just like USDT and USDC, which resulted in the tremendous growth of BUSD recently.

Though BUSD is applied in both DeFi and CeFi, its Scalability outside the Binance ecosystem is strictly limited. This situation is pretty understandable because no competitor wants Binance to dominate the market.

Dai - DAI

DAI is an Over-collateral Stablecoin created by the lending protocol MakerDAO. At the moment, MakerDAO is the top 4 lending project in crypto with over $12.7B TVL (Total Value Locked). The Market Cap of DAI is around $6.5B, showing that the Collateral ratio is currently around 49%.

Not only does MakerDAO allow common assets to be used as collateral, but it also supports the collateralizing of LP tokens from Uniswap, helping MakerDAO attract many more users through its diversity.

The advantage of MakerDAO was being founded really early, forming a substantial Network Effect. In terms of coverage across different DeFi ecosystems, DAI is even more popular than BUSD, and only behind USDT and USDC.

Terra USD - UST

Terra USD is a very special Stablecoin as it is the combination of a Full-reserve Stablecoin and an Algorithmic Stablecoin. To maintain the peg price at around 1 USD, Terra USD is backed by LUNA (Full-reserve) and has its price adjusted by an algorithmic mechanism (transfer the price volatility to LUNA).

The success of UST comes from 2 factors:

The first is an effective work model. This was proved through the market collapse on May 19, 2021, which made LUNA price fall from $16 to $4.

If the same thing happened to ETH, MakerDAO and DAI would definitely be considerably affected as ETH was the biggest collateral asset, therefore activating a Domino chain of constant liquidations. However, after that event, UST still stood steadily thanks to the anti-price manipulation mechanism, and then quickly returned to its peg.

The second is the support from the Terra ecosystem (#3 DeFi ecosystem in terms of TVL). UST seems to be the one and only Stablecoin of the ecosystem. As a result, all protocols inside Terra try to capture the value for UST. The most prominent protocol among them is Anchor, a lending platform that allows UST saving with up to 20% APR.

Data analysis of Stablecoin

I hope that with the analysis above, you have visualized the work model of Stablecoins in the market. How can they succeed, and how can they take over the market? In this part, I will dive deeper into the influence of Stablecoins on the crypto market through data analysis.

The Market Cap of Stablecoins

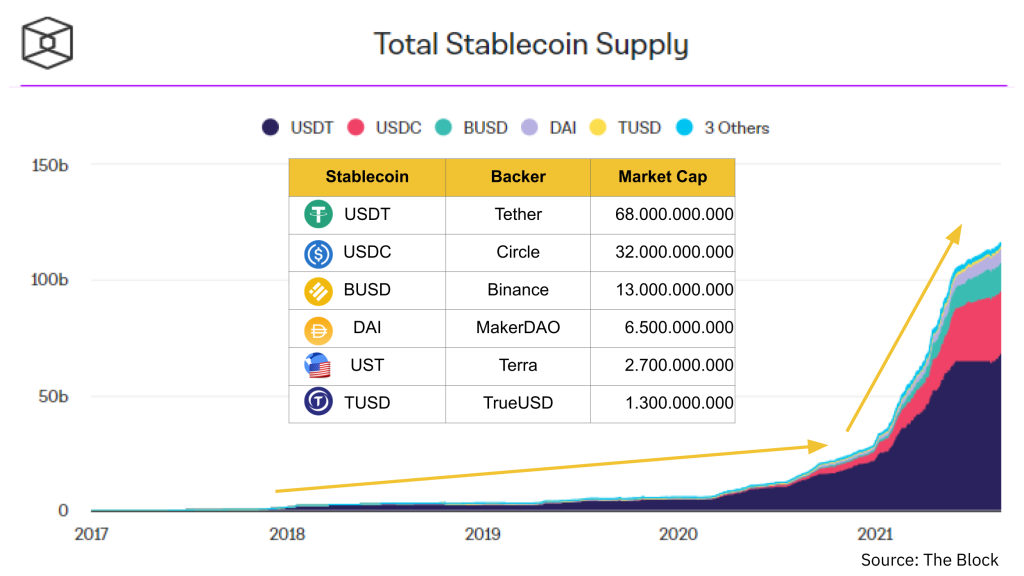

Stablecoins' Market Cap over time.

Market Cap ranking: USDT (#1), USDC (#2), BUSD (#3), DAI (#4), UST (#5), TUSD (#6).

According to the data above, the Market Cap of USDT is overwhelming at $68B, two times higher than that of USDC, even though no other Stablecoins in the market can surpass USDC.

The chart above also shows the two main periods of the crypto market:

Accumulating period (2018 - mid 2020)

In this period, Stablecoins grew slowly but steadily. This matched the market condition at that time when most crypto participants were retail investors, and the DeFi market didn’t receive much attention.

Furthermore, the Market Cap of the whole crypto market was really small, so every action from Tether brought about a huge influence. Every time Tether announced to “issue” more Stablecoins, the price of BTC pumped along.

Booming period (mid 2020 - now)

Forward to the second period, the market received more attention from whale investors and hedge funds, attracting a massive cash flow into the crypto market. The DeFi market gradually became more complete and appealing to the builders and investors.

Since September 2020 to now, the DeFi TVL has increased from $1B to more than $191B. The tremendous growth of DeFi has created a high demand for Stablecoin.

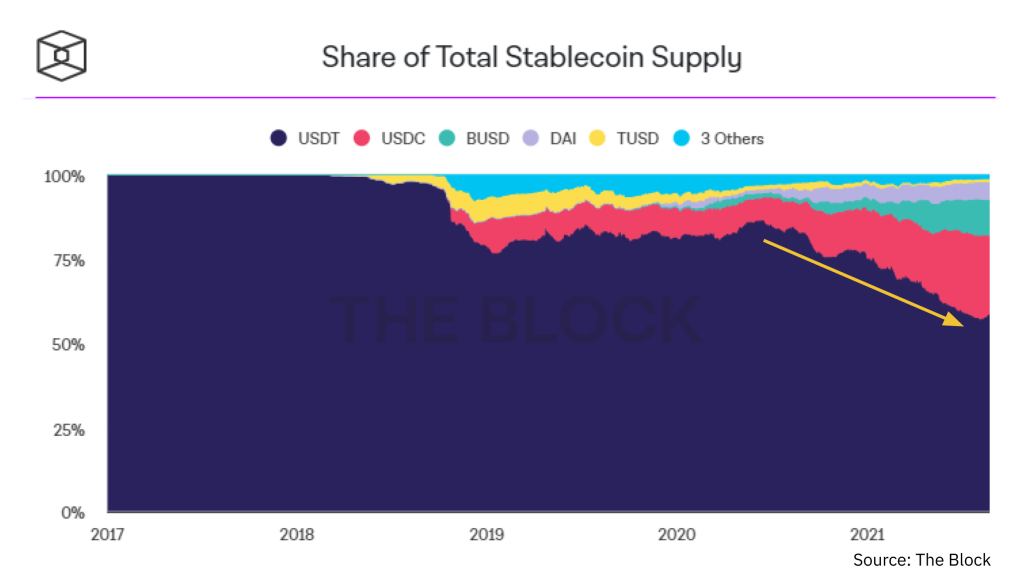

The Market Cap of USDT compared to other Stablecoins.

Although Tether's Market Cap is still overwhelming compared to other Stablecoins, USDC is also worth noting. If you take a close look at mid 2020, you will notice that the Market Cap of USDC rose incredibly fast, and it was at the same time when DeFi started its tremendous growth. That is the reason why when it comes to the DeFi market, I usually prioritize tracking USDC activities over others.

⇒ USDT and USDC are the two key Stablecoins in the market, so we should follow their activities closely because Stablecoins can be regarded as the cash flow supporting the market growth.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi

In the second period, the short-term price pumps of Bitcoin have been separated from Tether’s announcements on issuing Stablecoins. Nonetheless, Stablecoins will still be exerting an enormous influence on the market in the long term, as Stablecoins are the gateway for users to get access to the market and the inside assets.

More specific details can be illustrated in the pictures below. The growth of the market has brought along the demand for Stablecoins, and when Stablecoins were minted to satisfy the market’s demand, DeFi was the most rapidly growing sector.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi.

But if you take a look at the time around May 2021, when the growth of Stablecoins slowed down, the crypto market in general and the DeFi market in particular collapsed shortly after (on May 19, 2021).

However, the Market Cap of the Stablecoin sector did not decline but actually slightly increased, showing that Tether and Circle (2 big companies in the field) did not burn Stablecoins out of the market. This indicates that the number of investors going into the market was still higher than the number of investors going out.

Consequently, in late July 2021, the crypto market witnessed a strong recovery thanks to the afore-minted Stablecoins in the market.

⇒ In the long term, the growth of Stablecoins is the key to speculate the growth of the whole crypto market. If you are following the DeFi market, don’t miss out on any moves from USDC as it is currently the fastest growing Stablecoin in DeFi.

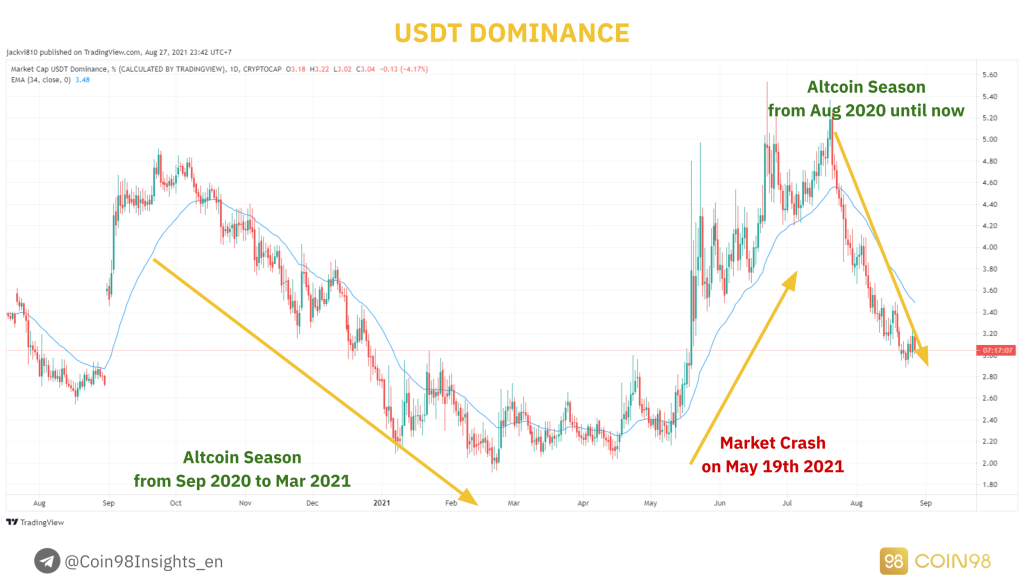

Stablecoin Dominance

Stablecoin Dominance is the measure of Stablecoin’s Market Cap relative to the Market Cap of the rest of the coins. Here is an example of the USDT Dominance index (USDT.D) from Tradingview.

Although there are still a variety of Stablecoins in the market, the Market Cap of USDT takes up more than 50% of the market, and it has been acknowledged as the representative index of the whole Stablecoin segment, so we will analyze the movement of USDT.D.

How USDT Dominance is related to the market condition.

⇒ We can rely on the USDT.D index to define the market trend, therefore understanding the right time to invest, and the right time to take profit.

Stablecoins in DeFi ecosystems

As analyzed above, Stablecoins play an important role in being the gateway for the cash flow from the Fiat-currency market to the cryptocurrency market.

If you are aware of how the cash flow in the crypto market transfers between different layers, then Stablecoins play the same role of allowing investors to transfer their funds from the crypto market (macro) to blockchain ecosystems (micro).

In this part, I will analyze 3 Case Studies of 3 blockchain ecosystems. Namely Terra, Solana and Avalanche, so you can understand the role of Stablecoins in the growth of DeFi ecosystems.

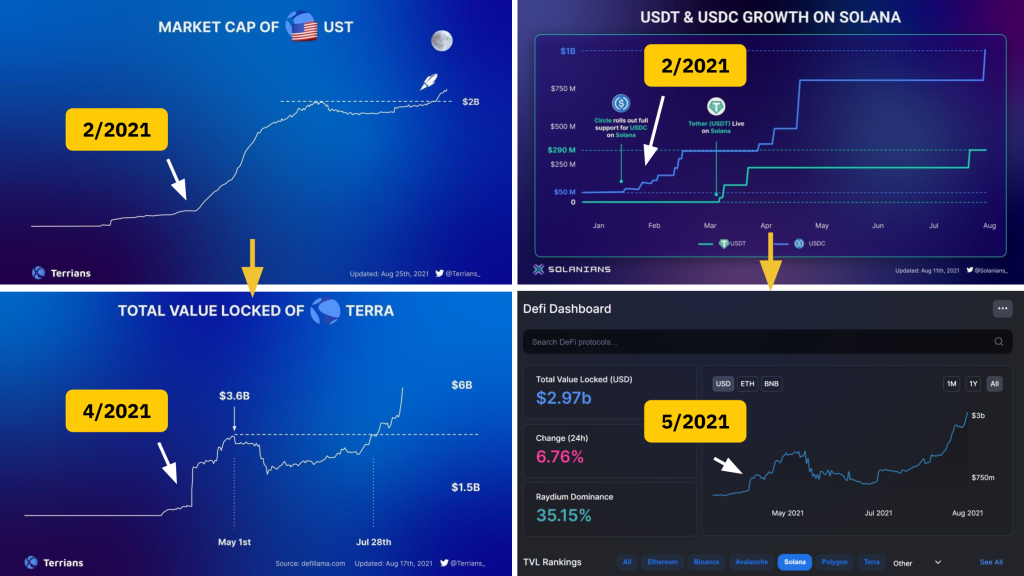

The Market Cap and TVL of Terra (left) and Solana (right).

Case Study 1: How did Terra USD foreshadow the growth of the Terra ecosystem?

Recently, we have witnessed the substantial growth of the Terra ecosystem with its TVL surpassing $6B, becoming the third largest ecosystem in the market behind Ethereum and Binance Smart Chain in terms of TVL.

The increase in TVL has produced a positive effect on the LUNA price, increasing the price of LUNA 700% since the market crash in May 2021. The question is, how could the TVL in Terra increase so rapidly?

The main catalyst is the Market Cap growth of Terra UST - the one and only Stablecoin in Terra. If you notice the chart above more carefully, you can see that when the DeFi TVL in the ecosystem rose, the UST Market Cap had seen an explosive growth 2 months before that, exceeding TrueUSD (TUSD) and Paxos (PAX) - two prominent Stablecoins in the market.

Case Study 2: USDC & Solana - the cooperation that grew Solana tremendously

Since February 2021, when the crypto market was not yet active, Circle and Solana Foundation had already started to issue more USDC into the Solana ecosystem to develop DeFi. Afterwards, in May 2021, the DeFi sector on Solana began to attract more users and reached $1.5B TVL.

During that period, the price of SOL (Solana native token) rose from $10 (February 2021) to $50 (May 2021). Even though a market crash happened shortly after, the number of Stablecoins on Solana continued to rise. In fact, the pace of issuing Stablecoins on Solana at that time was even faster than when the market was extremely active.

And the result is crystal clear: Since July 2021 to now, the cash flow into the Solana ecosystem has not stopped, helping the DeFi TVL to reach $3B. Every token in the Solana ecosystem has been growing tremendously (SOL, SRM, RAY, MNGO, SBR, ORCA,...) especially SOL has recovered from $25 to $170 at the time of this writing.

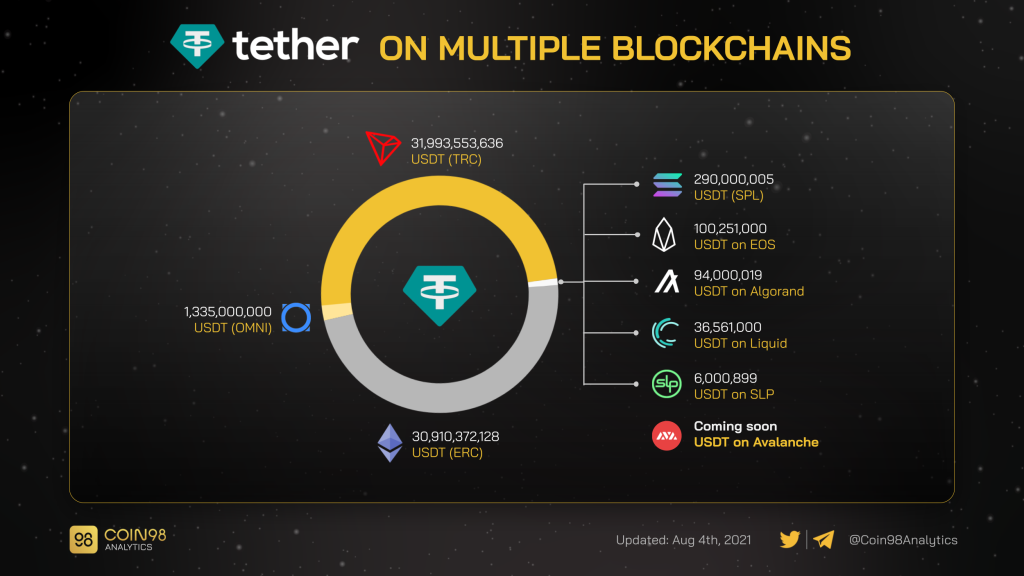

Case Study 3: Avalanche got in the sight of Tether

Tether has been deployed on multiple chains. Although the Market Cap of Tether on Tron and Ethereum accounts for the most, Tether has not issued any additional USDT on Tron, Omni, EOS, Algorand,... since earlier this year. Instead, Tether has now focused on Ethereum, Solana and Avalanche.

This resulted from the fact that they were the three immensely developed DeFi ecosystems. To compete with USDC, Tether quickly supported USDT on Avalanche to help the growth of the Avalanche ecosystem, therefore assisting tokens on Avalanche (AVAX, PNG, SNOB, XAVA) in recovering after the market collapse.

Aside from the Market Cap and Dominance index, the pace of growth is also an imperative index to track. For instance, even though the number of USDT on Solana is still incredibly small, at the same time, it is increasing at the most rapid pace compared to other ecosystems. Will that case happen again, but this time with Avalanche?

The number of USDT on different blockchains.

In conclusion, the investment opportunities do not come from Stablecoins, but from the movement of the market and of different blockchain ecosystems. Stablecoins help you to navigate that movement.

Note:

However, this case is only applicable to ecosystems with small TVL like Solana, Polygon, Terra, Avalanche, Fantom,... because when the ecosystem’s TVL is still insubstantial, the influence of issuing Stablecoins will be more immense, hence creating a motivation for the ecosystem to thrive.

To comprehensively developed ecosystems such as Ethereum and Binance Smart Chain, issuing Stablecoins does not matter that much as the number of Stablecoins being issued is too insignificant compared to the DeFi TVL of that ecosystem.

To speculate the cash flow efficiently, you have to:

Some useful tools to track Stablecoin indexes:

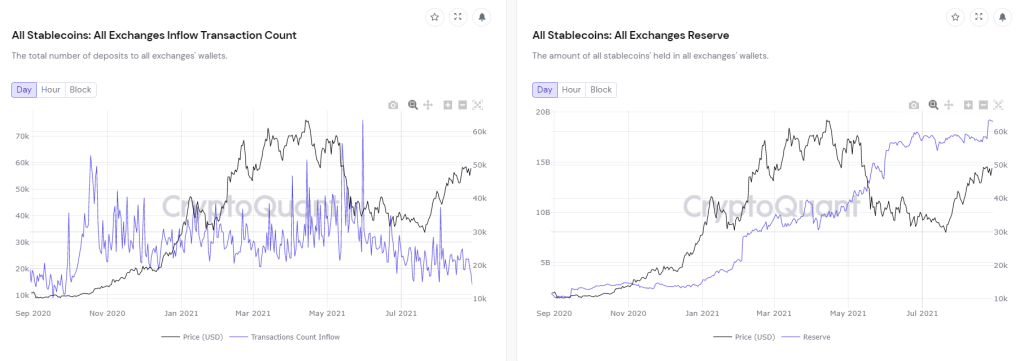

Stablecoin reserve on exchanges

Stablecoin reserve on exchanges.

Similar to the index of BTC Inflow & Outflow, the Stablecoin Exchanges Inflow & Outflow index allows investors to track the buy demand of the market. There are 2 circumstances:

In the long term, this index is correct to some extent. Before Bitcoin reached ATH (All-time high) in March 2021, the Stablecoin Reserve index had increased dramatically in November 2020 (5 months before). Before Bitcoin recovered in August 2021, the Stablecoin Inflow index had also risen significantly in June 2021.

However, the crypto market moves really quickly but this index does not show responsive signs in the short term (about 1 month). That is why this index should only be regarded as an additional tool to gather more information rather than a primary one, compared to the aforementioned methods.

How have Stablecoins evolved?

After going through some prominent Stablecoins, how they work and how they influence the crypto market, we will now look at the evolution of Stablecoins, hence defining the period we are at and predicting future Stablecoin movements.

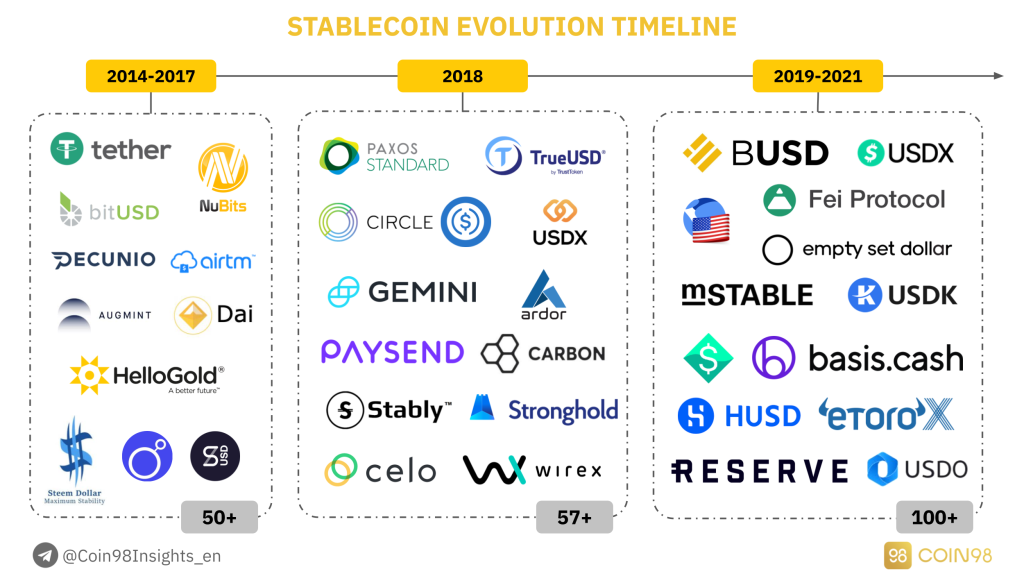

The evolution of Stablecoin.

First period (2014 - 2017): Pioneers in the Stablecoin sector

At an early stage of the first period, Stablecoins had the sole purpose of tokenizing all popular Fiat Currencies across the globe. Stablecoins were used mainly to resolve the problem of transactions’ cost and speed of the traditional financial system.

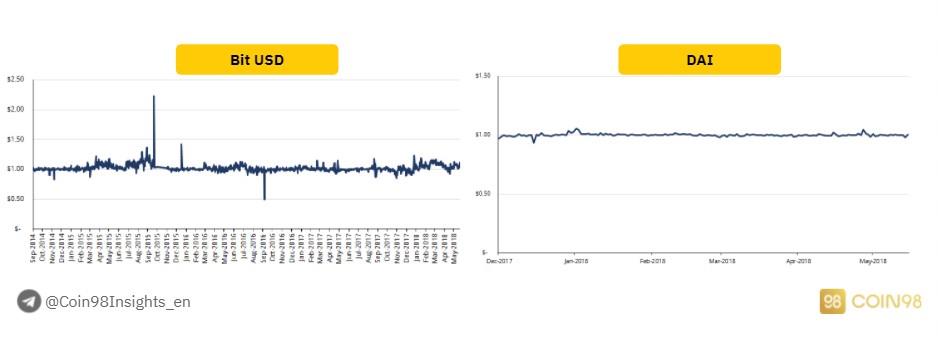

The most prominent of all was Bitshares, a platform founded by Charles Hoskinson (Ethereum's Co-founder and Cardano’s Founder). Bitshares tokenized a wide range of currencies, including CNY (BitCNY), Euro (BitEUR), USD (BitUSD), Gold (BitGOLD),...

Nevertheless, in order to create Fiat-backed cryptocurrencies, users had to collateralize BitShares with a larger amount. As BitShares were highly volatile, the value of Stablecoins such as BitUSD, BitEUR,... was not stable. Not to mention that with low liquidity, BitShares could be easily manipulated by speculators.

Compare Bit USD with DAI.

Fast forward to the end of the first period which is about 2017. The crypto market started to be recognized, and other Stablecoins like DAI and USDT started to appear. DAI was created and sustained up to this moment due to the incredibly high demand for lending & borrowing in the market. The stability of DAI was also better.

Meanwhile, USDT was backed by a gigantic force - Bitfinex. Bitfinex used to be the largest exchange in 2017, until Binance attracted more retail investors to its platform though most whales still stayed in Bitfinex. The substantial influence of Bitfinex at that time was the main catalyst that kept USDT stable around its peg and stood still till now.

Second period (2018): The boom of Stablecoins

The first period was the prerequisite for the second period, which was the most booming period of Stablecoins. The market witnessed the advent of various Stablecoin platforms as this was also the time when the crypto market became “Mainstream” in 2017, after Bitcoin reached an ATH of $20,000.

The demand to invest in Bitcoin as well as the demand for Stablecoins increased. To compete with USDT being backed by Bitfinex, a variety of exchanges issued their own Stablecoins (Gemini issued GUSD), whereas payment platforms also did the same thing (Paysend).

Stablecoins became a “trend” for whales to increase their influences on the crypto market that was already small. If you take a closer look at the illustration above, you can see that in 2018, more than 57 Stablecoin platforms appeared, ranging from Full-reserve Stablecoins to Over-collateral Stablecoins and Algorithmic Stablecoins.

This was also the time when Stablecoins that later became dominant made their debuts, namely Circle (USDC), Paxos (PAX), TrueUSD (TUSD),... they are the three major competitors of Tether (USDT).

Third period (2019-2021): Selection and elimination

From my perspective, the Stablecoin sector is currently in this period. After the booming phase in 2018-2019, myriads of Stablecoin projects appeared, at the same time a large number of projects showed their weaknesses.

Which is the main reason why in the third period, the market will begin the selection and elimination process, especially the recession of Algorithmic Stablecoin projects as they are not working efficiently (cannot maintain the peg price).

You can visualize the situation more clearly through the picture below along with the market’s real-time data. Over 200 Stablecoin projects have been developed, but the number of active and productive projects is only around 10 (USDT, USDC, BUSD,...). More and more Stablecoin projects are gradually fading into oblivion.

The number of active Stablecoins, in development, and closed.

Fourth period (2021+): Expand

The most important keyword to define the third and the fourth period is the Network Effect. As mentioned earlier, the Stablecoin segment is exceptionally competitive.

Among over 200 projects, only nearly 10 of them have an influence on the market. This forces Stablecoin platforms to constantly develop and expand so as to account for as much of the market as possible, including both DeFi and CeFi.

Except for USDT dominating the market for so long, USDC is a noteworthy Stablecoin in the fourth period. Officially launched in 2018 (3 years after Tether), USDC quickly deployed its Stablecoin on 10+ blockchains and focused mainly on the DeFi market, which was growing tremendously at that time. This approach made USDC more well-known than USDT in the DeFi market.

At the moment, BUSD is still following the Network Effect improvement scheme. Binance has been listing more BUSD trading pairs, issuing more BUSD to be used in the Binance Smart Chain ecosystem, with a vision of replacing USDT and USDC.

In the future, UST will definitely increase its Network Effect by accessing the Binance Smart Chain ecosystem and the Solana ecosystem - the two ecosystems possessing the largest cash flow behind Ethereum.

Anticipate the future of Stablecoin

Stablecoin weaknesses

We have gone through the approach and evolution of Stablecoins. So how can they be improved in the future to get rid of the current weaknesses? The answer to this question can be found in this part.

If you notice, Stablecoins are having 2 major issues without a solution which are Transparency and Applicability:

How Tether printing USDT affected the market.

Developing Stablecoins

Major companies are trying to create a Stablecoin that can solve both of the above problems, which can look like:

Some potential Stablecoins in development.

4 Stablecoins that are currently developing to satisfy the above requirements are:

1. Telegram TON

Pavel Durov - the founder of Telegram has been trying to issue a Stablecoin with high stability and high liquidity. However, he gave up the project after being pressured by SEC on the legal aspect.

2. Libra

During the past time, Facebook has been trying to create Libra and make it a global currency. Libra will be backed 50% by USD, 18% by EUR, 14% by JPY, 11% by GBP and 7% by SGD. However, it didn’t take long for Libra to fail as the Congress of the United States realized the threat of a private company competing with a public bank.

However, their ambition seems to remain enormous because after the failure of Libra, Facebook created Diem - Libra 2.0. At the moment, they have been able to cooperate with a variety of partners in the finance department in order to start expanding and integrating with social media applications like Facebook, Whatsapp,...

3. LPM Coin

JP Morgan - one of the biggest banks in the world, plans on creating JPM Coin, a Stablecoin that can replace the obsolete payment system Swift. Nonetheless, they have not made any further announcement. If JP Morgan successfully introduces their product, other major banks like HSBC, Citibank, Wells Fargo will also participate in the play.

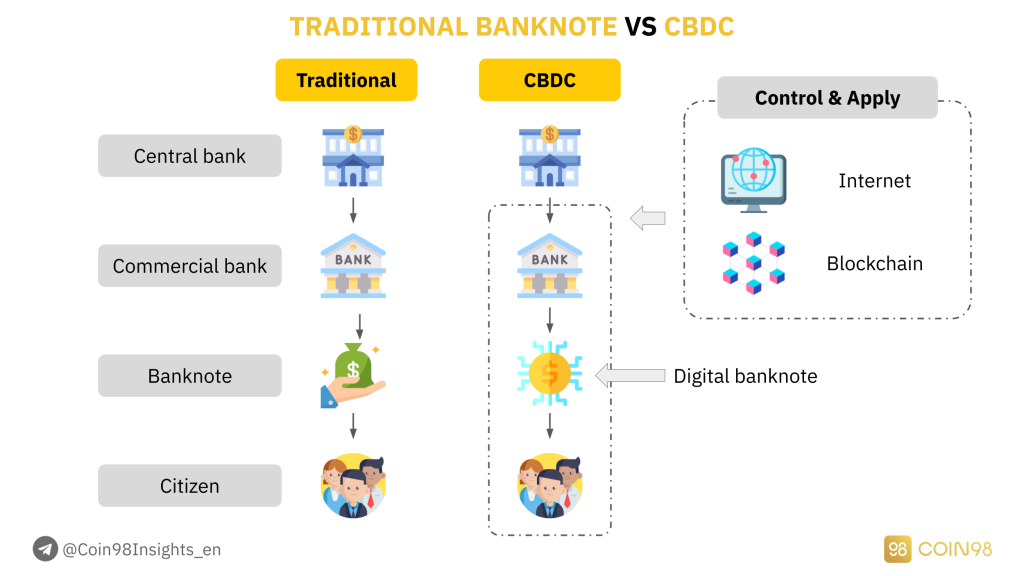

4. CBDC

The last Stablecoin, at the same time the most realistic one is CBDC. CBDC is short for Central Bank Digital Currency. Currently, many Western banks and China banks have been experimenting with the CBDC model and tried to apply it to their work models.

The difference between Traditional Banknote and CBDC.

Although there are still some limitations such that it is not yet possible to be applied worldwide, CBDC can be considered a Stablecoin comprehending all the benefits that the blockchain technology brings, namely transparency, tracing ability to prevent money laundering, low transaction cost, high speed.

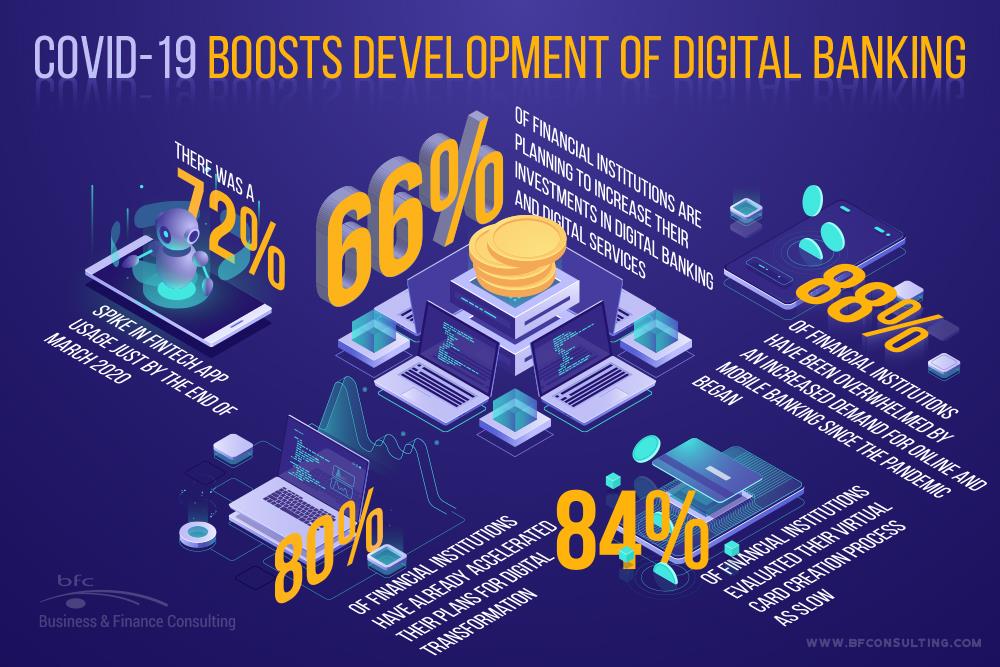

There is no doubt that CBDC will be applied in the future by not only commercial banks but also public banks. Moreover, the Covid 19 event taking place all around the world has shown how important CBDC can be to the global economy in the future.

When everyone has difficulties in commuting and using cash, CBDC becomes an optimal solution for the financial market to operate smoothly.

Covid-19 motivates the growth of Digital Banking.

Investment opportunities with Stablecoins

In terms of investment opportunities with Stablecoins, I can distribute into 2 types:

Now let’s go through each type of investment.

Discover investment opportunities through Stablecoin indexes

Yukarıda da bahsettiğimiz gibi Stablecoin yatırım yapılacak sektör değil. Stablecoin'den kazanç sağlamanın en iyi yolu hareketini gözlemlemek ve nakit akışına göre karar vermektir.

Bir ekosistemde ne zaman Stablecoin verilirse, nakit akışı hemen o ekosisteme girme eğilimi gösterir:

Bu nedenle, herhangi bir piyasa trendini kaçırmamak için, onları “kalkıştan” önce gözlemlemeli ve izlemelisiniz. Kendi içgörülerinizi bulmanıza yardımcı olabilecek bazı yararlı sorular:

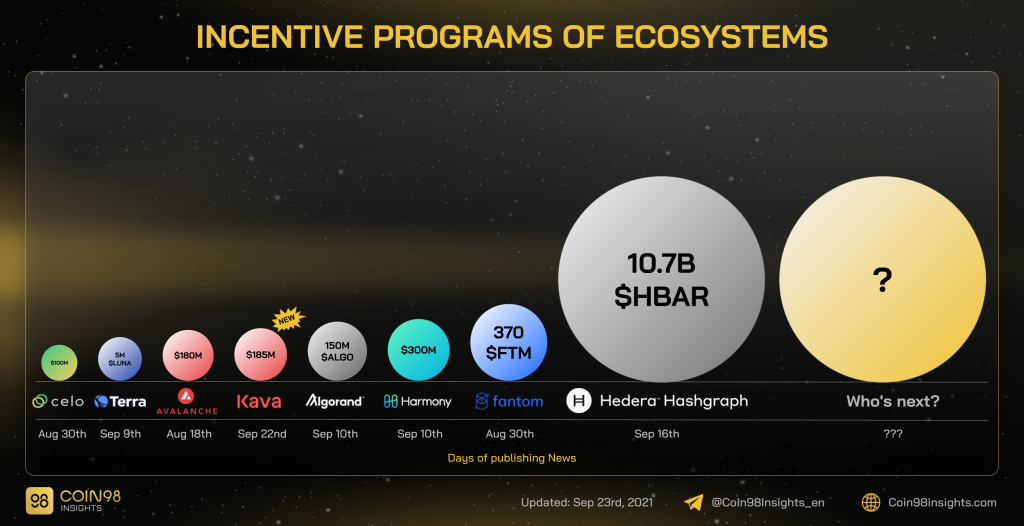

Son zamanlarda, birden fazla ekosistem, aşağıdakiler de dahil olmak üzere DeFi teşvik programlarını duyurdu:

Farklı blok zincirlerinde teşvik programları.

Bu ekosistemlerdeki Stablecoin hareketini takip etmeye ve yeni bir Stablecoin ihraç edip etmediklerini veya bunu yapmak için herhangi bir üçüncü tarafla işbirliği yapıp yapmadıklarını görmek önemlidir.

Stablecoin kullanarak doğrudan yatırım yapmak

Bununla birlikte, büyük miktarda sermayeniz varsa ve bu piyasada sıfır riskle kazanmak istiyorsanız, Stablecoin kullanmak hala bir yol olabilir.

Getiri Altcoin kullanmak kadar yüksek olmasa da Stablecoin kullanmak piyasa koşullarından bağımsız olarak esnek olmanızı sağlar. İşte bazı tavsiye edilen yöntemler:

1. Borç verme (%4 - 8 Nisan)

Tasarruf almak için Stablecoin'leri CEX'lere veya borç verme platformlarına yatırabilirsiniz. Lending'i kullanmanın avantajı, basit etkileşimleri, şeffaf faizi ve isteğe bağlı para yatırma süresidir.

Stablecoin'leri tasarruf etmek için kullanabileceğiniz bazı platformlar şunlardır:

CEX : Binance, Huobi, Gate, MXC, OKEx,...

Merkezi Kredi: NEXO, BlockFi,...

Merkezi Olmayan Kredi:

Bununla birlikte, Borç Verme protokollerini kullanmanın dezavantajı, faiz oranının %4-8/yıl arasında değişen oldukça düşük olmasıdır. Daha yüksek verim almak istiyorsanız, Çiftçiliğe bir göz atın.

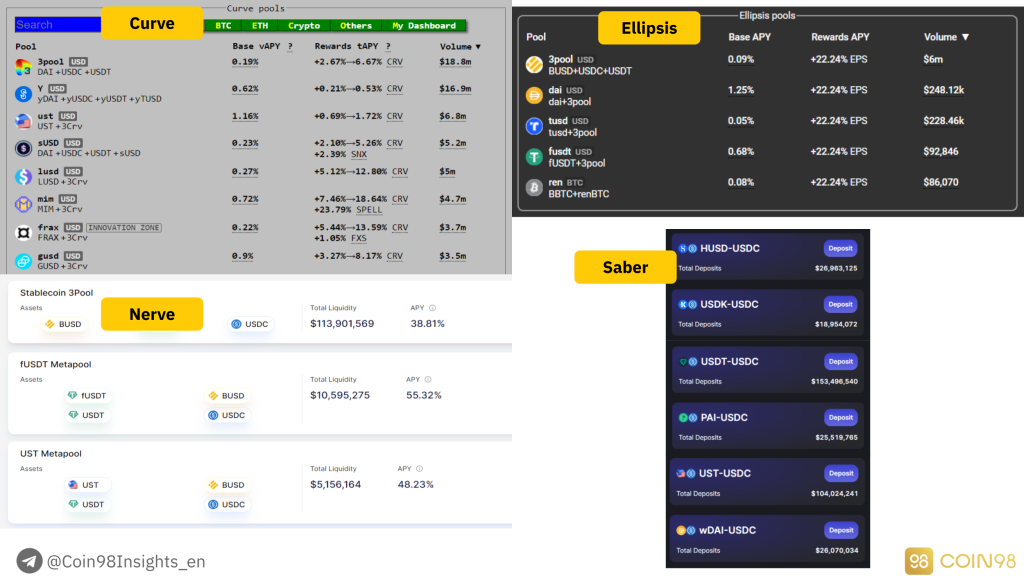

2. Çiftçilik (%20 - 40 Nisan)

Çiftçilik, merkezi olmayan borsaların platform ücretlerini ve platformun yerel belirtecini alması için likidite sağlama yaklaşımıdır. Bu yolu takip etmek için DeFi'de likidite sağlamak gibi bazı temel eylemleri bilmeniz gerekir.

Çiftçiliğin avantajı, gerçekten yüksek bir faiz oranı olan, yılda %20-40'a varan daha yüksek verimdir. Vietnam'da USD yatırırsanız faiz bile almazsınız. Oysa VND yatırırsanız, %7 faiz oranı elde edersiniz, ancak yıllık enflasyon oranı USD'den bile yüksektir.

DeFi, getiri elde etmek için çok sayıda fırsat sunan bir ağ geçididir ve piyasaya gerçekten yatırım yapmadan önce tamamen Stablecoin'leri kâr etmek için kullanabilirsiniz. Çiftçilik için kullanabileceğiniz bazı Stablecoin AMM platformları şunlardır:

Çiftçilik Stabilcoinler.

Bununla birlikte, merkezi olmayan protokollerde Farming yapmak, özellikle protokolün saldırıya uğraması durumunda bazı özel risklere sahiptir, bu yüzden Stablecoin'inizi daha küçük parçalara dağıtmalı ve bunları prestijli ve yüksek TVL platformlarında kullanmalısınız.

Çözüm

Stablecoins ile yatırım fırsatları bulmak için kullanabileceğiniz bazı bilgiler:

Umarım bu sektör hakkında daha değerli bilgiler edinmenize ve Stablecoin'leri kullanarak nasıl kar elde edebileceğinize yardımcı olmuştur.

Bu konu hakkında daha fazla bilgi edinmek istiyorsanız, lütfen aşağıya bir yorum bırakmaktan çekinmeyin ve daha fazla tartışma için Coin98 Topluluğuna katılın!

Stabilcoin nedir? Stablecoin'in piyasadaki rolü nedir? Kaç çeşit Stablecoin vardır? Stablecoin'ler hakkında buradan bilgi edinin!

Terra'nın etki mekanizmasını analiz etmek, UST ve LUNA arasındaki farkı ve Terra'nın LUNA için nasıl değer elde ettiğini anlamanıza yardımcı olacaktır.

Temel Protokolün temel anlayışını güncelleyin, böylece size o projenin Simgesi hakkında en sezgisel görüşleri sağlayın.

Orca, Solana tabanlı bir AMM DEX

Mina ve Polygon, ölçeklenebilirliği, gelişmiş doğrulamayı ve gizliliği artıran ürünler geliştirmek için birlikte çalışacak.

Herhangi bir AMM için en temel model olan Uniswap V2'nin çalışma modelini analiz edin ve değerlendirin.

Remitano borsası, VND'de kripto para alım ve satımına izin veren ilk borsadır. Remitano'ya kaydolma ve Bitcoin satın alma ve satma talimatları burada ayrıntılı olarak!

Makale, Tenderize test ağını kullanmak için size en eksiksiz ve ayrıntılı talimatları sağlayacaktır.

Makale, Solana'daki bu yeni projenin tüm işlevselliğini deneyimlemek için Mango Markets'ı kullanmanın en eksiksiz ve ayrıntılı kılavuzunu sağlayacaktır.

UNLOCKED Serisinin bu ilk bölümünde, Güvenlik Ayarları'nı kullanarak cüzdanınıza ekstra bir güvenlik katmanı ekleyeceğiz.

Çiftçilik, kullanıcıların DeFi'de kolayca kripto kazanmaları için iyi bir şans. Ancak kriptoyu toplamanın ve DeFi'ye güvenli bir şekilde katılmanın doğru yolu nedir?

Makale, yazar @jdorman81'in Defi'deki değerleme konusu hakkındaki görüşünü ve çevirmenin bazı kişisel görüşlerini tercüme etmektedir.

Saddle Finance, ticarete izin veren ve tBTC, WBTC, sBTC ve renBTC için likidite sağlayan bir AMM'dir. Sele Döşeme Kullanım Kılavuzu.