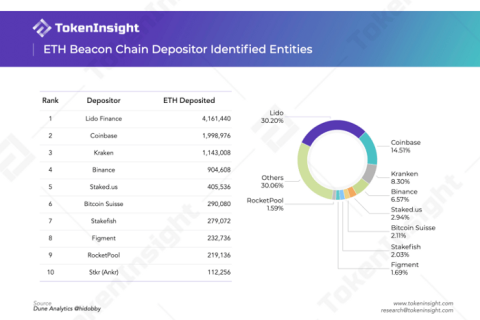

Did you know that a third of the ETH staking on the Ethereum Beacon chain comes from a single protocol? The protocol is Lido Finance , and although there have been concerns about its massive stake, the crypto project has more to offer than can be seen.

History of Lido Finance

Lido Finance was founded in October 2020 by Konstantin Lomashuk, Vasiliy Shapovalov and Jordan Fish.

Konstantin holds a PhD in finance and has worked in the crypto space since 2015, most notably as the founder of P2P Validator, a company that runs validator nodes on multiple blockchains. Proof-of-Stake is different.

Konstantin bought his first Bitcoin in 2014, participated in the Ethereum ICO later that year, and apparently never sold his ETH BTC nor any other cryptocurrency he has purchased since. .

As a result, his wealth has grown from 10,000x to 50,000x in his crypto portfolio and he says his secret is to focus on projects that the founders have in mind. look forward.

Vasiliy Shapovalov has a bachelor's degree in mathematics and spent nearly a decade as a software engineer before turning to crypto in 2019.

In 2020, Vasiliy became the CTO of P2P Validator and one of his first assignments was to build a third-party staking solution for the upcoming Ethereum Beacon chain. This third-party staking solution eventually became Lido Finance and Vasiliy continues to act as the person responsible for the technical aspects of the project.

Although the name Jordan Fish may sound unfamiliar, if you are passionate about crypto and active on Twitter, you may already be following him. That's because Jordan is Cobie, formerly Crypto Cobie, a popular crypto podcaster and writer with nearly 700,000 followers on Twitter and growing.

Jordan has been involved in crypto since 2012, and in a recent four-hour interview, he explained that he invested $500 in Bitcoin from the start.

Jordan has a bachelor's degree in computer science and coding is a side part of his career. He spent most of his time working in marketing, specifically for Monzo bank, one of the first online banks in the UK.

Interestingly, Jordan served as the CEO of P2P Validator and he claims that he is the head of quotes for Lido Finance with Konstantin and Vasiliy being the “quotation brains” of the operation.

Even so, Jordan was the author of the Medium post announcing Lido Finance in October 2020. And it seems his role was to attract attention and investors to the project when it first started. head.

Jordan leaves Lido Finance in early 2021, presumably just to focus on the appropriately titled crypto podcast, which starts in February 2021 and he co-hosts with Brian Krosgaard aka Ledger once again highly recommended.

According to crunchbase and the privacy policy on Lido Finance's website, the protocol itself was built by a Cayman Islands-registered software company called Defi Limited. Although Lido Finance has since become a decentralized autonomous organization with no entity behind it.

Lido Finance Explained

Lido Finance is a liquid staking protocol that allows you to staking Proof-of-Stake cryptocurrencies without having to lock them, meaning you can trade freely while staking.

A brief explanation of how this works is that when you staking your cryptocurrency through Lido Finance, the protocol gives you a tradable token that acts as a kind of receipt for the cryptocurrency you have purchased. stake. So, in the case of Ethereum when you staking ETH on the Beacon chain through Lido Finance, the protocol gives you a token called ETH staking or stETH, which reflects the price of ETH and can be freely traded.

stETH maintains its price peg in three ways the first is through arbitrage, where arbitrage traders buy stETH when it falls below the ETH price because it can be exchanged for actual ETH in the future. .

The second way that stETH maintains its peg is through liquidity mining, where the Lido DAO provides additional rewards to anyone providing liquidity for trading pairs between ETH and stETH.

A third way for stETH to maintain its peg is through underlying demand for stETH as stETH earns staking rewards in real time. This is the ideal collateral for borrowing protocols like AAVE and Maker DAO. However, the fact that stETH earns staking rewards in real time means that its value changes and this makes it incompatible with some DeFi protocols specifically decentralized exchanges like Uniswap.

This is why there is a second stETH token called wrapped stETH or wstETH, which essentially allows your stETH to continue to increase in value while maintaining a fixed price for DEX trading.

Besides the Ethereum Beacon chain, Lido Finance currently supports Solana, Kusama, and Polygon. It is also in the process of adding support for Polkadot.

As mentioned in the introduction, Lido Finance is staking about a third of all ETH on the Ethereum Beacon chain, an amount worth over eight billion US dollars. This is for a few reasons.

First becoming a validator on the Ethereum Beacon chain requires 32 ETH, which most people can't afford and technically cannot authorize.

Second, being a validator on the Ethereum Beacon chain requires technical knowledge as well as 24/7 monitoring as validators risk losing some of their ETH, if they go offline or fail to upgrade. timely.

The third becoming a validator on Ethereum's Beacon chain requires the aforementioned ETH key until Ethereum completes its transition from PoW to PoS . Even withdrawals of staked ETH may not be allowed immediately and in a recent interview, Ethereum enthusiast Anthony Sasano revealed that validators can be stuck waiting for a while. six months.

It should come as no surprise that so much ETH is staking in a liquid way and why the need for liquidity staking is so much higher for Ethereum than for other PoS cryptocurrencies. If you're wondering why people flock to Lido Finance for liquidity staking instead of centralized exchanges, it's all about convenience and security.

For those just starting out staking liquidity on Lido Finance does not require KYC and the protocol is therefore accessible to anyone with an internet connection, save for a few exceptions, learn more about that later.

When you stake ETH through Lido Finance, a set of audited smart contracts automatically distributes this ETH to a pool of 22 validators on the Ethereum Beacon chain that have been tested by the Lido DAO. It is important to note that the Lido community is actively introducing new Beacon chain validators. This is why Lido Finance having a third of ETH staking is not necessarily cause for concern.

As a reward for sharing their staking infrastructure, these Beacon chain validators earn 5% of the staking rewards from all ETH being delegated to them by Lido Finance. Another 5% of the staking rewards will go to the Lido DAO Treasury, which can be used to fund a new Lido Finance implementation or even protocol insurance if the Lido Finance affiliate validator gets cut. remaining.

90% goes to stETH holders, hence why the staking reward for ETH on Lido Finance is 4% compared to the 4.4% you would get if you staking directly to the Beacon chain.

LDO ICO & Tokenomics

Lido Finance was officially launched after the establishment of the Ethereum Beacon chain in December 2020, and in January of the following year, the LDO token was officially launched. LDO is an ERC-20 token on the Ethereum blockchain with a maximum supply of 1 billion, all of which are minted at the supply.

LDO's use cases are currently limited to voting in the Lido DAO. According to the blog post announcing the LDO token, about 36% of its supply goes to the Lido DAO treasury, about 22% goes to investors, 6.5% goes to early validators and holders signatures know more about them then, 20% go to the original developers of Lido Finance and 15% go to the founders and future employees.

According to an article about the LDO token on the Lido Finance website, citing initial contributors to Lido has a one-year term, followed by a one-year vesting period. The one-year lockup ends in December 2021. Logically, this means that the LDO tokens will end vesting in December of this year, saving those on the Lido DAO treasury because of their elimination schedule. determined by community vote.

In terms of investors, Lido Finance has had three rounds of funding so far. According to Messari, the first round of funding was in December 2020 and it raised two million US dollars from various crypto venture funds , individual investors as well as the founders. AAVE and Synthetix.

The second round of funding for Lido Finance took place in March of this year and it raised US$70 million, all from Andreessen Horowitz cryptocurrency.

The third funding round for Lido Finance took place earlier this month and it has raised around US$73 million from various crypto venture funds, US$50 million of which came from Paradigm. This third round of funding involved crypto funds purchasing LDO tokens directly from the Lido DAO treasury in exchange for approximately 21,000 ETH, a purchase proposal that was approved by the Lido community through governance. .

As per the proposal, all LDO tokens sold to the fund during the third funding round come with a one-year lockup, followed by the same one-year vesting period as the original distribution albeit with a later schedule. It is not clear whether Andreessen Horowitz will acquire any LDOs as part of the investment or if it is related to the bidding schedule.

A quick trip to Etherscan reveals that LDO distribution is currently fairly centralized in the largest wallets although most of these are smart contracts, presumably vesting contracts for recent investors. by Lido Finance.

The worrying thing is that there are only about 15,000 people holding LDOs on Ethereum although imagine that there are many others holding their LDOs on centralized exchanges. The distribution of stETH and wstETH is also concentrated in the largest wallets although most of them are smart contracts related to the DeFi protocol .

The great thing is that there are over 75,000 people owning Ethereum and this number seems to be growing. This is that despite the lack of support for stETH on centralized exchanges, it is probably a consequence of this fact. On top of that, both stETH and wstETH have done a pretty good job of maintaining their pegs even though stETH seems to be trading slightly below ETH price and wstETH is trading slightly higher than ETH price.

Price Analysis

As can be seen the price of LDO is quite dismal not only that, but trading volume is limited and LDO even seems to have had some speculative pumping and selling.

The first speculative injection took place last spring and it happened because Lido Finance announced that they would be adding support for Solana. The rest of the crypto market was also rallying at the time.

The second speculative pump took place last summer and it happened because Lido Finance released a referral program offering to share part of the ETH stake of anyone you refer to the protocol.

Lido Finance also added support for Terra's Anchor Protocol in partnership with Ledger hardware wallet to be able to perform liquidity staking using cold wallets and officially added support for the Solana blockchain.

The third speculative pump took place last winter and was likely due to news that the Maker DAO opened the door to using stETH as collateral to mint the decentralized stablecoin DAI.

LDO's most recent speculative pumping was due to the announcement that AAVE would also be open to using stETH as collateral.

Lido Finance also adds support for Polygon sidechains and of course there's a lot of hype surrounding that $70 million fundraising.

Assuming the average price is one US dollar, which is being generous, there has been selling pressure up to $300 million since the LDO token started trading. On the demand side, the only real driver of demand seems to be speculation and that has dried up with the advent of the bear market.

Lido Finance Roadmap

As always, LDO's long-term potential depends on Lido Finance's upcoming milestones and there doesn't seem to be a shortage of them.

The first is the Lido Finance roadmap, detailed in a blog post last July. As the title suggests, Lido Finance's long-term goal is to make liquidity staking completely trustless, meaning there is no centralized organization involved in depositing, staking or withdrawing cryptocurrency on the exchange. awake.

Lido Finance is also obsessed with making sure Ethereum remains as decentralized as possible, and that means opening the door to as many Beacon chain validators as possible, while also making its protocol more appealing. compared to other liquid staking alternatives found on centralized exchanges .

There are only two factors that do not make Lido Finance completely trustworthy and unique, is that all withdrawals from the validator are controlled by a multi-signer wallet with 11 signers, six of whom must sign each withdrawal transaction. Obviously that's not very reliable and also impractical in the long run.

The second element is the process of introducing new validators to Lido Finance, which you will call back is audited by the Lido DAO. While this ensures that Lido Finance validators are legit, it also serves as a point of trust and at the same time prevents further decentralization.

In a follow-up blog post from April this year, Lido Finance detailed the characteristics of a good validator suite and suggested two specific solutions on how additional validators could be integrated. The first solution is decentralized validation technology or DVT where validators can work together to sign a single block. This allows new validators to be included as part of an existing validator pool, making the protocol adaptable to manipulation or errors from new validators.

The second solution is a node operator score, or NOS, which will generate a reputation for each validator based on a range of metrics potentially including LDO stakes, which can be cut.

Snapshot for the Lido DAO revealed that only three proposals are active, the first of which appears to be just a test question. The second proposes to reduce the referral fee for staking Ethereum and the third proposes to increase the cost of making the proposal. Both proposals are currently being approved, so let's expect to see those implemented soon.

Lido Finance concerns

It would be remiss not to mention potential concerns about Lido Finance. The first is potential bugs in the protocol, and that's mainly because critical bugs in the Lido Finance code have been detected twice.

The first bug was discovered last October and it put more than 20,000 ETH at risk. Fortunately, the bug was discovered and fixed before an attack occurred.

The second bug was discovered in March of this year and it is related to many front-ends of the Lido Finance protocol, the bug was again discovered and fixed before any attacks occurred.

This leads us to believe that it is possible that more bugs will continue to be discovered and that is because adjustments to the protocol will take place as Ethereum's transition to PoS continues. This is something that has been mentioned by the Lido Finance development team and no matter how competent they are or how many audits they perform, there are always mistakes.