Sei Network and Ecosystem Overview

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Rocket Pool is a decentralized Ethereum staking network built to be compatible with the Beacon Chain.

The purpose of Rocket Pool is:

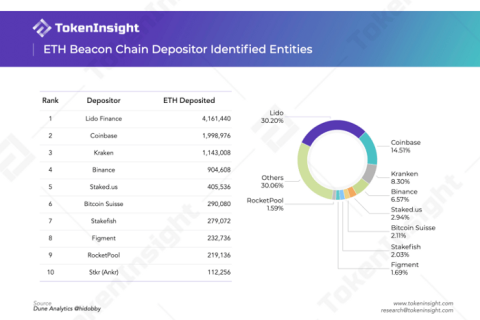

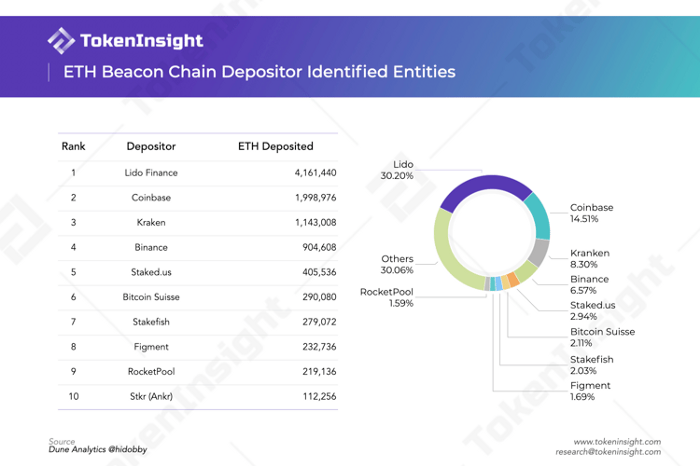

Rocket Pool, with a TVL of $500 million, ranks second in liquid staking protocols just behind Lido Finance . Rocket Pool accounts for only a small fraction of the ETH liquid staking market share. There is less than $220,000 worth of ETH deposited into Rocket Pool compared to over $4 million deposited in Lido Finance. However, Rocket Pool distributes this ETH to over 1,400 node operators, while Lido Finance distributes over 4 million ETH to just 24 node operators. Maybe Rocket Pool is a hidden hero working hard towards more decentralized Ethereum validating power.

The recent Tornado Cash sanctions have spurred heated discussion about censorship risks on Ethereum. After Ethereum transitioned to the Proof of Stake blockchain, staking providers like Binance Stake and Coinbase Stake control a large amount of staked ETH. These validators are responsible for validating new transactions and creating new blocks for Ethereum, and they are susceptible to pressure to censor certain transactions to comply with their respective regulatory requirements.

On the other hand, more than 30% of the staked ETH is transferred through Lido Finance, the largest liquid staking protocol. Users deposit ETH into Lido's staking pool and this deposited ETH will then be allocated to 24 whitelisted node operators. These node operators are selected by Lido and are all major players in the professional node industry such as P2P Validators, Stake.Fish and Chorus One. Lido Finance covers over 90% of the liquidity staking fields and allocates all deposited ETH to only a handful of professional node operators selected by the DAO protocol. This, of course, raises concerns that Lido's success brings about a centralization of validating power and possibly even influence over Ethereum.

The vision of Ethereum is to have a decentralized and diverse composition of validator nodes located around the world. However, the current situation is that most of the staked ETH is either staked via centralized exchanges or passed through Lido to some professional node operators.

Just like Lido Finance with a liquid staking token of stETH, Rocket Pool provides liquid providers with a liquid staking token of rETH. rETH does not accumulate revenue through incremental issuance like stETH does. Once Ethereum is successfully merged and staked ETH is available for redemption, users can return rETH to the protocol, and then exchange ETH and corresponding ETH rewards. Thus the value of rETH increases over time. rETH is currently trading on the secondary market for around 1,023 ETH.

rETH has only a small share of Ethereum's liquid staking market, with just 106,000 in circulation. stETH has over 4 million copies in circulation. Due to its small market share size, rETH has limited liquidity on exchanges and very few DeFi use cases.

The real value of Rocket Pool lies in the service that allows the validator to work independently (solo). In contrast to Lido Finance allocating $4 million in ETH to only 24 selected node operators, Rocket Pool distributes all sent ETH to individual validators around the world.

To be able to run an Ethereum node requires 32 ETH, equivalent to 48,000 USD. That's not a small financial requirement for most people. Rocket Pool reduces this barrier to 16 ETH and allows participants to run a node, which is how Ethereum is intended to be used. Solo Validator contributes 16 ETH, which will be added to 16 ETH from the staking pool (which staking people deposit into Rocket Pool in exchange for rETH) to meet the 32 ETH requirement to become a validator node.

This is completely permissionless, there is no 3rd party involved when it comes to being a node operator for Rocket Pool, while Lido allocates only to professional node operators. Rocket Pool also develops smart node software to make setting up an Ethereum node simpler.

Rocket Pool's native token is RPL. The protocol has a tokenomic design to achieve two purposes:

Lido Finance allocates staked ETH to professional node operators. While this strategy creates a centralized authentication problem, professional node operators have first-class hardware and technical expertise. There is nothing to worry about in terms of their performance.

On the other hand, solo validators are beneficial for decentralized validation, but may not have the same performance quality as professional node operators. If the validator is offline and misses the recommendation to validate or block, he or she will be penalized by cutting the amount of ETH staked.

To ensure the performance of the solo validator and protect those who have staked ETH, solo validators are required to stake at least 1.6 ETH worth of RPL tokens as additional insurance against slashing incidents. Since RPL is required to be locked as insurance, when more solo validators join Rocket Pool, more RPL is needed to act as insurance. This will reduce the circulating supply of the RPL. 34.55% of the RPL supply is currently being booked for this purpose.

It is important to note that since the RPL needs to be staked to become a solo validator based on the value of ETH (the RPL is worth 1.6 ETH), it means that if the ETH price increases and the RPL price does not change then the becoming a node operator will require more RPL, the RPL circulating in the market will decrease faster.

The benefits of being a Solo Validator for Rocket Pool come from two main sources, network verification rewards and RPL rewards. Solo Validator earns 100% staked ETH reward for half of ETH offered, 15% commission on other half of ETH provided by Rocket Pool, and RPL reward. 70% of the total RPL supply will be allocated to reward Solo Validator. According to the protocol's estimate, the estimated staking reward and commission is 4.81% APR, slightly higher than Ethereum's staking return of 4.2%. The APR of the RPL reward is about 12.16%.

Two forces are affecting the circulating supply of RPL:

The problem with Rocket Pool is how to scale. Since Solo Validator needs to provide 16 ETH and a certain amount of RPL as insurance, this is still an important financial requirement. In addition, to be able to run a node of Ethereum, requires a good computer with good performance, such as CPU greater than 2.8 GHz, RAM 16 GB, memory greater than 100 GB and connection Stable internet, suitable speed. These are insurmountable hard barriers that limit the number of potential independent validators.

Rocket Pool's liquid staking token rETH offering is directly linked to the number of Solo Validators. Even with demand from the staking side, there may not be enough Solo Validator to absorb Rocket Pool's increase in staking demand. This limits the potential for rETH, without the larger scale, it is difficult for other DeFi protocols to accept rETH, limiting the application scenario for rETH in DeFi.

Rocket Pool has many good points, it is a protocol to help Ethereum achieve its vision of decentralization and permissionless. The protocol is doing something good for the Ethereum ecosystem. However, scaling issues will certainly limit the protocol's growth. The founding team acknowledges this limitation and is working to fix it. If the problem can be solved, the potential for Rocket Pool is bright.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

In the Move-to-Earn trend, besides StepN's famous name, Digital Fitness is also a project that is quite appreciated by users.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

Etherity Chain, where you can access authenticated NFTs while making a difference in society. Let's explore more about this NFT platform with TraderH4 in the article below.

Ethereum Name Service (ENS) is a simplified solution for Ethereum addresses, managed by the non-profit organization True Names LTD in Singapore.

Decentralized Society, also known as DeSo, is the first decentralized social media-based blockchain.

Optimism is a potential Layer 2 project. In 2022, it launched OP, the project's own token. To better understand OP's activities and potential, we will analyze the tokenomics of this project.

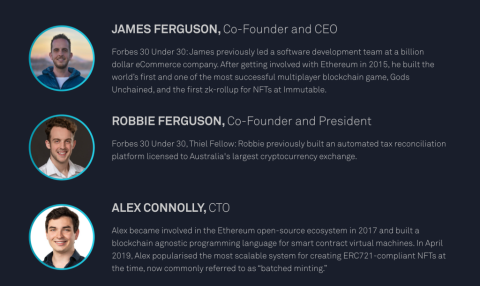

Immutable X is a project that provides an extensible solution to improve the processing speed of NFT buying and selling, minting NFT and building NFT projects on Ethereum.

Gyroscope Protocol is an Ethereum-based Stablecoin protocol that uses existing Stablecoin assets to create a stablecoin P-GYD, pegged to USD.

Taiko is the next generation Layer 2 platform developed for Ethereum. In this article, we will learn together the salient features of the Taiko project.

Instadapp, an asset management solution provider in the DeFi space, raised US$2.4 million from investors in October 2019.

Many experts think that Zk Rollups projects will explode in 2023 and zkSync will be one of them. Let's look back at TraderH4 to 2022 to see what the project has prepared for the next boom.

Following part 1, we will continue to review the developments of the zkSync ecosystem in 2022.

What is Project Cronos? Learn more about the Cronos Token (CRO) as well as predict the future of this project through TraderH4's article.

Cosmos is a decentralized network of independent parallel Blockchains. Each Blockchain is powered by BFT consensus algorithms similar to Tendermint.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.