What is Liquity (LQTY)?

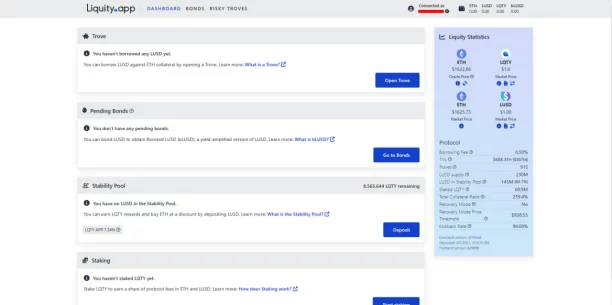

Liquity (LQTY) is an interest-free lending protocol. Liquity facilitates users to borrow stablecoin LUSD with a minimum collateral ratio of 110%. Users only need to lock Ethereum (ETH) and pay a one-time loan fee to be able to borrow LUSD of Liquity.

Highlights of Liquity (LQTY)

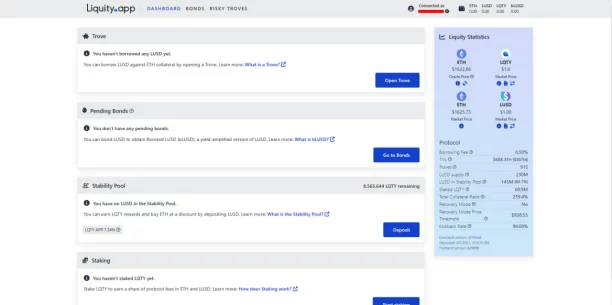

Liquity uses collateralized debt positions (CDPs) called “Troves”. Each Troves debt position is required to have a minimum collateral ratio of only 110%, while in similar platforms like Maker, the minimum collateral is up to 150%, looking at this aspect, Liquity is effective. The return on capital is much higher than Maker and similar platforms.

Liquidation is necessary to ensure that the protocol can cover the outstanding debt before the collateral ratio of some assets falls below 100%. Liquity supports instant liquidation by combining dual token mechanism (LQTY and LUSD) and Stability Pool. Thanks to this feature, users and protocols can be more secure during strong market dumps.

Liquity's development strategy is focused on making the platform stable, as well as allowing other parties to host the Liquity GUI, in return, they will receive certain benefits depending on the quantity. liquidity that their GUI attracts.

Project development team

Liquity's founder Robert Lauko and Rick Pardoe's Co-Founder are both well-known entrepreneurs and investors in the cryptocurrency market. In particular, Robert Lauko used to be a researcher at DFINITY - one of the projects being valued at hundreds of billions of dollars.

Investors

During the Seed round, Liquity raised $2.4 million from investors, led by Polychain Capital. In the Serie B round, the project raised 6 million USD from investors, led by Pantera Capital. The other rounds are not disclosed.

Detailed information about the LQTY . token

Some basic information

- Ticker: LQTY

- Blockchain: Ethereum

- Token Standard: ERC20

- Contract: 0x6dea81c81…2ed88c54d

- Token type: Utility

- Total Supply: 100,000,000 LQTY

- Circulating Supply: 3,676,781 LQTY

LQTY . Token Allocation

- Investors: 33.9%

- Rewards: 32%

- Team and advisors: 23.7%

- Liquity AG endowment: 6.1%

- Community reserve: 2%

- LP Rewards: 1.3%

- Service providers: 1%

Token Release Schedule

32,000,000 LQTY will be allocated to the LQTY reward pool. Users can earn these tokens by depositing the Stability Pool. In addition, the protocol will also reward LQTY tokens for Host GUI and Stability Providers.

1,333,333 LQTY will be allocated to the LUSD pool LP and will be distributed according to the protocol within 6 weeks.

2,000,000 LQTY will be allocated as a community reserve, this pool of tokens is used to fund hackathons, events, and community building efforts.

23,664,633 LQTY will be distributed to current Liquity employees and advisors, these tokens will be locked for 1 year and amortized after that.

33,902,679 LQTY will be for initial investors of Liquity and lock for 1 year.

6,063,988 LQTY allocated to Liquity AG and locked for 1 year.

1,035,367 LQTY allocated to service providers that supported Liquity prior to launch and these tokens will be locked for 1 year.

Utilities to use LQTY

Rewards: Users can staking LQTY to earn fees from issuing and redeeming loans. Besides, LQTY is used as a reward to incentivize liquidity, platform users and GUI host.

Conclude

Above are details about the Liquity project and the LQTY token. This project has received the attention of investors when it was listed in the Innovation Zone by Binance. If you are interested in this project, you can follow more social networking sites such as:

Website | Twitter | Discord