What is Themis?

Themis is a peer-to-peer lending protocol integrated with multi-chain technology that allows users to borrow and lend with both tokens and LP tokens. Notably, the project uses Chainlink as a source of real-time price data.

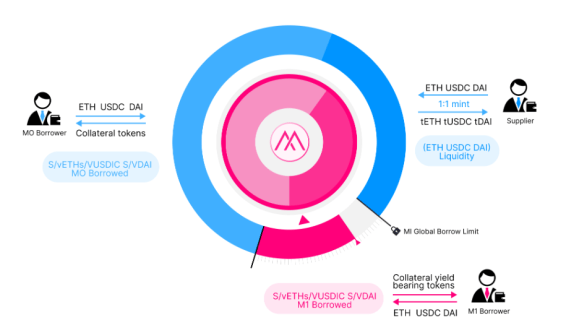

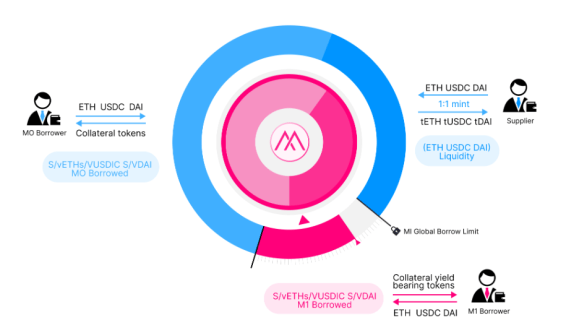

User object on Themis

Lender (Lender): They will deposit assets (token) into Themis platform and mint 1 amount of tToken in a 1:1 ratio representing the amount of user assets in the platform. This tToken will increase over time and users can convert tToken to the original balance at any time. After the conversion, the entire amount of tToken is burned.

Borrower (Borrower): They will provide collateral (token or LP token) to borrow a corresponding amount of assets. After that, the project will mint 1 amount of sToken or vToken at a ratio of 1:1 representing the debt that users have to pay to the platform. Similarly, the number of these s/vTokens also increases over time, after the borrower pays off the debt and interest, they will get back the original collateral. Then the entire amount of s/vToken will also be burned.

Types of properties on Themis

Assets on Themis include two types as follows:

- M0: Represents a high amount of liquid collateral.

- M1: Representing collateral are LP tokens.

Lenders can award the property to one of two groups. Providing liquidity with M1 will give you a higher APY profit.

If the borrower's loan exceeds 80% of the collateral value, the property will be liquidated. Themis can be divided into two situations as follows:

- For M0 assets: Liquidators repay part or all of the debt, in return they receive a liquidation bonus. They can choose to receive the corresponding amount of tToken, instead of the underlying asset.

- For M1 property: In this case there will be no liquidation bonus, the liquidator must repay the entire debt to receive collateral at a discounted price.

Themis difference

Themis' difference lies in the E-mode feature, which helps users maximize capital efficiency when the value of collateral and borrowed assets are correlated. E-mode only supports lending to users assets of the same type (e.g. stablecoins ). However, this feature will not restrict the use of other assets as collateral.

Development team

Currently, Themis project does not disclose information about the development team. TraderH4 team will update this information after the project is announced.

Investors

On November 9, 2021, Themis successfully raised 2 million USD from investors: NFX, Dao Maker, LD Capital…

Tokenomics

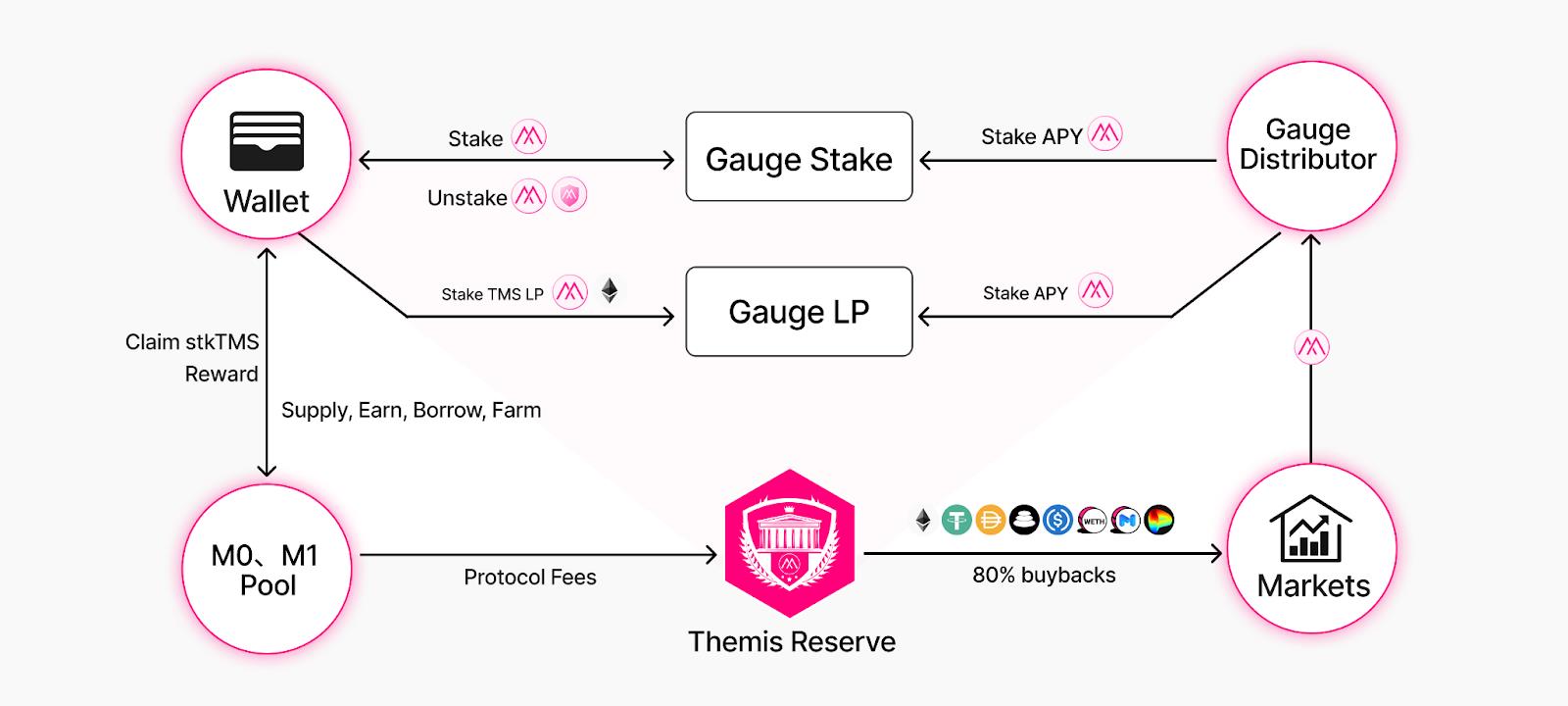

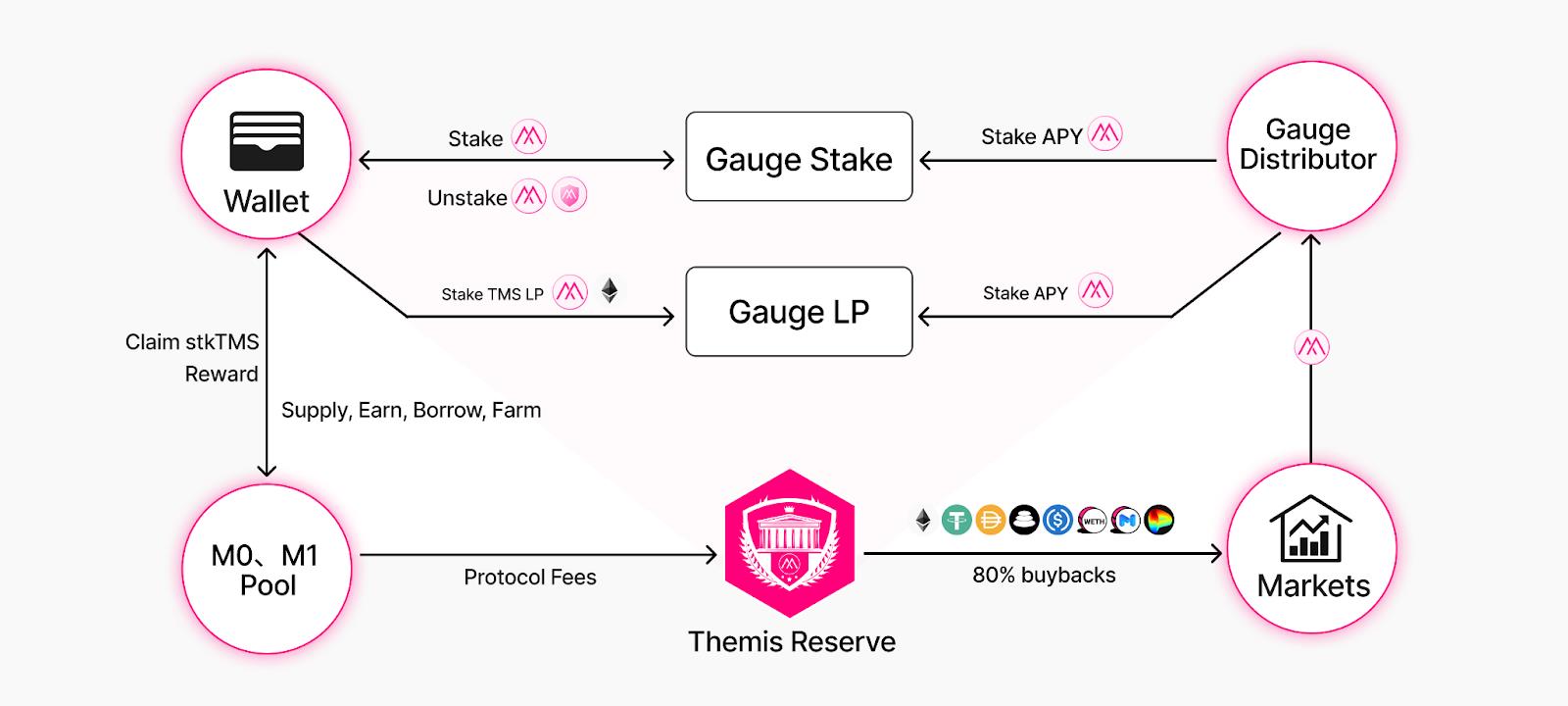

TMS is the governance token of Themis Protocol. TMS holders can create a new governance proposal, which can be voted on by TMS holders and stkTMS – staked TMS token.

TMS is designed to capture a portion of the revenue of the Themis protocol. The project will distribute protocol fees using 80% of the protocol revenue to purchase TMS and put it into the staking TMS reward pool.

The stkTMS token is also used as an incentive to limit borrowing supply and demand. The protocol for distributing stkTMS tokens to suppliers, borrowers, is proportional to the number of tTokens and s/vTokens.

TMS collects protocol fees generated from Themis, about 5%-25% of interest returned from borrowers will be used as protocol revenue and purchased TMS deposited into the staking rewards pool.

summary

Above is some basic information about Themis multi-chain lending protocol and TMS token. Currently, information about the project is still quite sketchy because this is a fairly new project. If you are interested in this project, you can follow more social networking sites below:

Website | Twitter | Medium | Discord