Revealing the truth behind the collapse of Celsius Network

In this article, the TraderH4 team will dive into the Celsius ecosystem and decipher the main cause of the Celsius project's demise.

Notional.Finance is a protocol built on Ethereum that allows borrowing/lending crypto-assets with a fixed interest rate (fixed interest rate) for a fixed period of time through a tool called a tool called Notional.Finance. fCash .

As their name suggests, fixed interest rates are set by the lender and accepted by the borrower for the term of the loan. For borrowers, this can be a boon if interest rates rise — they pocket the savings at a lower interest rate.

But this can backfire in times of high interest rates. If a borrower fixes a high interest rate on a mortgage or loan and then the base rate falls, they may end up paying more than they would if they could lower the rate. for its loans respectively.

That's why lenders also offer adjustable-rate loans and mortgages. Now, this is great for borrowers who have high interest rates and then benefit when they drop. But if they do the opposite – borrow at low interest rates – interest rates can go up and make loans more expensive to repay.

fCash Token

fCash tokens are the building blocks of the Notional system. fCash is a transferable token and represents a positive or negative cash flow claim at a specific time in the future.

2 important features of fCash:

fCash tokens are always created in pairs of assets (assets) and liabilities (liability) . Total assets and liabilities are always zero in Notional's system.

fCash allows users to move capital over time. Let's say you want to borrow $10,000 worth of DAI from Notional. After calculating interest, you agree to pay 10,500 DAI at a future date, typically 3 weeks to a year for stablecoins and up to six months for ETH and WBTC. The borrower will then receive a cryptographic form of that debt obligation, expressed as -10,500 fCash, charged for that future payment and redeemable for 10,500 DAI on the maturity date.

This is why there is an “f” prefix before Cash, where the difference in value between DAI and fDAI is the accrued interest. In other words, when borrowers deposit their collateral, they will generate fCash tokens, which the lender will receive in the form of fCash.

In return, these fCash tokens can be exchanged for other cryptocurrencies, such as ETH, WBTC , USDC or DAI. At the end, the borrower gets the property they want, remembering to pay it off by the due date. If they default on the loan, borrowers risk liquidating their excess collateral. Of course, due to their stable nature, stablecoins have a lower overcollateralization at 120%, while WBTC and ETH have overcollateralization at 150%. In addition to repaying the loan, borrowers can extend their future maturity date, known as an extension of their contract.

Liquidity Pool (LP)

Notional makes it possible for fCash to trade in liquidity pools built under the AMM mechanism. A liquidity pool will hold fCash along with one of its currencies (e.g. DAI and fDAI). Each liquidity pool will provide an expiration time. For example, a DAI/fDAI pool with an expiration date of October 20, 2021, the pool will hold fDAI until October 20, 2021.

Maturity (time to maturity)

Liquidity pools will exist for a certain period of time depending on the governance parameter settings . For example, the quarterly liquidity pool will mature every 3 months.

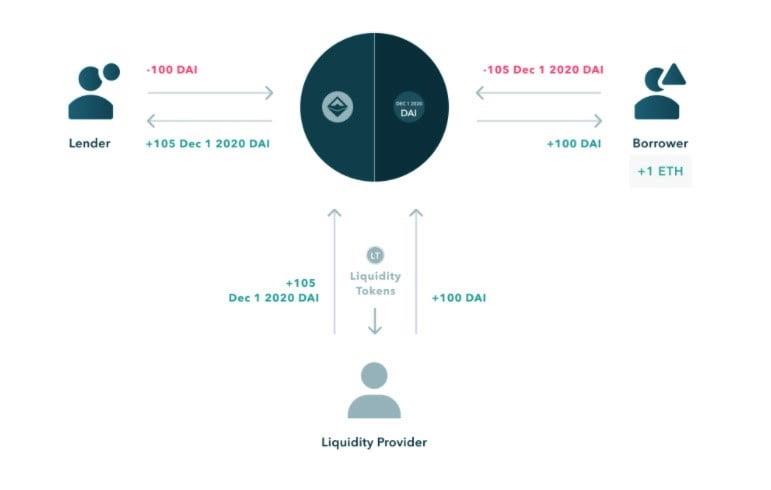

There will be 3 main types of users involved, including:

Source: Notional Finance

The above 3 users will participate in Notional Finance by:

Lending (Lending)

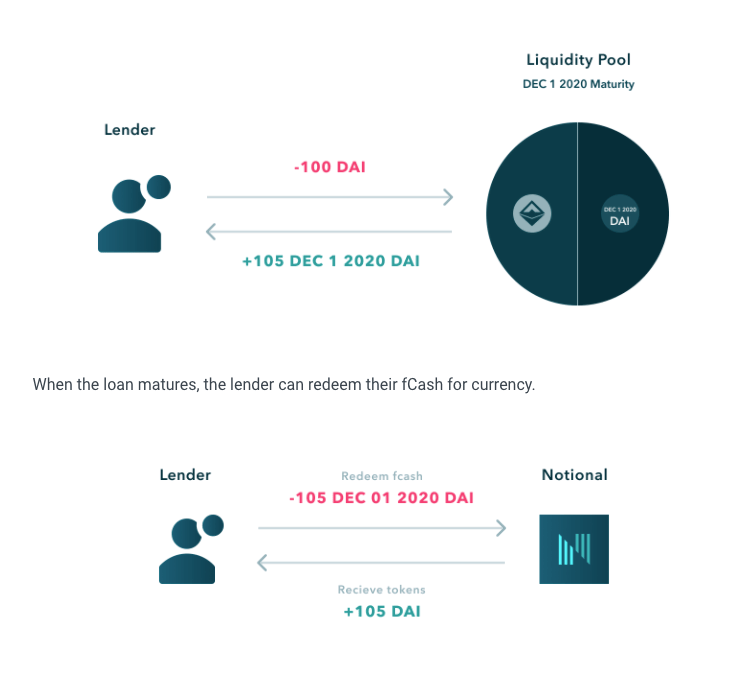

Users who want to lend their assets at a fixed rate can buy fCash.

For example: Person A has 100 DAI, wants to lend for 3 months, then A will bring 100 DAI to the DAI/fDAI pool with a term of 3 months and exchange for an amount of fDAI. Assuming a fixed rate of 5% for 3 months, A will be exchanged by the pool for 105 fDAI for 3 months. After 3 months, A exchanged this 105 fDAI (in positive form) to receive 105 DAI.

Borrowing

To borrow on Notional, users first need to mortgage a certain amount of assets into the Notional system.

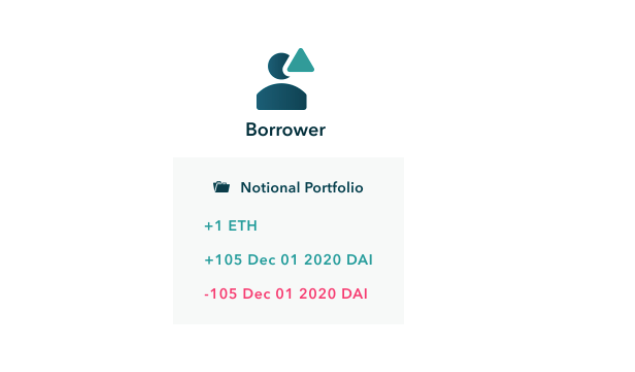

For example: An has 1 ETH and does not need to use it, wants to borrow DAI to invest in another token but still holds ETH. An mortgages this 1 ETH to Notional and mints a term fCash pair of positive and negative numbers. The example authors here are 105 fDAI and -105 fDAI.

Next, to borrow DAI, An just needs to bring +105 fDAI to the fDAI/DAI pool in exchange for DAI, say 100 DAI. At that time, An's portfolio at Notional will be -105 fDAI. If you pay attention to the meaning of negative balance, you will understand that An defaults to a debt repayment obligation at maturity. At maturity, An must bring 105 DAI to pay Notional, otherwise the collateral will be used to repay the debt (which is the initial 1 ETH).

Providing Liquidity

Liquidity providers on Notional will contribute an amount of money and fCash to the liquidity pools and get a part of the fee back when the borrower/lender makes a currency/fCash transaction at the pool.

Liquidity supply mechanism

Hung has an amount of money of 100 DAI that he wants to bring to provide liquidity. Hung will enter Notional mint 1 with another pair of -105 fDAI and +105 fDAI with a certain maturity.

After that, Hung will add 100 DAI and +105 fDAI liquidity to the DAI/fDAI pool, receiving Liquidity Token (LT). At that time, Hung's portfolio consisted of LT and -105 fDAI with term.

Liquidity Token at Notional is completely similar to the LP Token that you get when providing liquidity on Uniswap or other platforms. It will meaningfully represent the capital that you have provided to the pool.

Notional's nTokens and cTokens

Another way to provide liquidity is through nTokens. When lenders provide liquidity to the liquidity pool, they will receive nTokens as an ERC-20 asset . They represent encrypted maturities for deposited cryptocurrencies, redeemable for “a share of Notional’s total liquidity in a given currency across all active maturities.”

Example: If LP offers DAI stablecoin to the liquidity pool, they will receive nDAI. Same goes for nETH and nUSDC.

The nTokens themselves can be used as collateral for borrowing. Furthermore, LPs earn a passive income with their nTokens just by holding them, based on transaction fees (when people borrow their assets), based on fCash interest rates, and on receiving incentives. by NOTE.

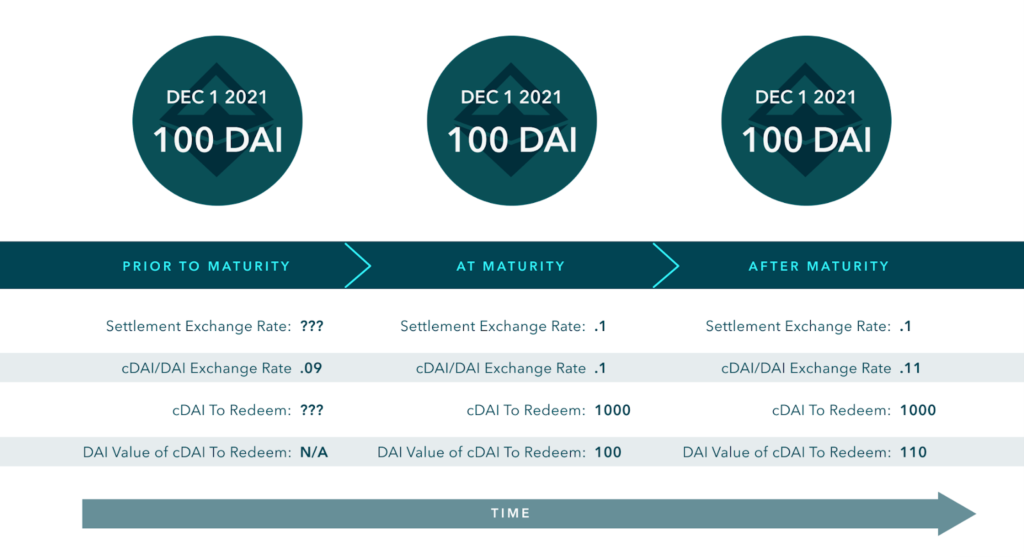

Derived from the Compound protocol, the built-in cTokens is notable as a yielding asset. As such, they increase profitability for liquidity providers in a similar way to nTokens. In Notional V1, only fCash is used as a settlement asset.

Source: Notional Finance

This changed in V2, where a cToken, such as cUSDC or cDAI, represents settlement at maturity. This split allows Notional to increase their LP returns when they deposit cTokens into the liquidity pool instead of the base currency.

Likewise, cToken allows fixed-rate loans to accrue variable cToken rates as soon as they mature.

Revenue drivers

The calculation of PnL of liquidity providers will be based on the formula:

PnL = assets at the time of calculation – initial assets

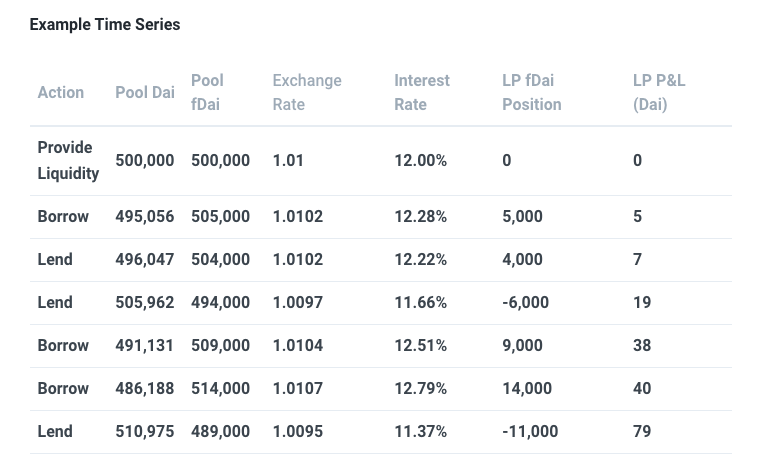

You can refer to the demo revenue calculation here:

Thus, the profit of providing liquidity on Notional will come from 2 main sources :

As for transaction fees, you can simply understand that the more borrowing and lending activities take place at the Pool => the more DAI/fDAI transactions => the more fees collected.

Regarding the holding position, you can review the table above to see its impact on the PnL of the liquidity providers.

The only difference between Notional AMM and AMMs like Uniswap is that the pool on Notional has a much lower rate of price volatility than the Pool pairs on Uniswap => minimizing the occurrence of Impermanent Loss (Impermanent Loss).

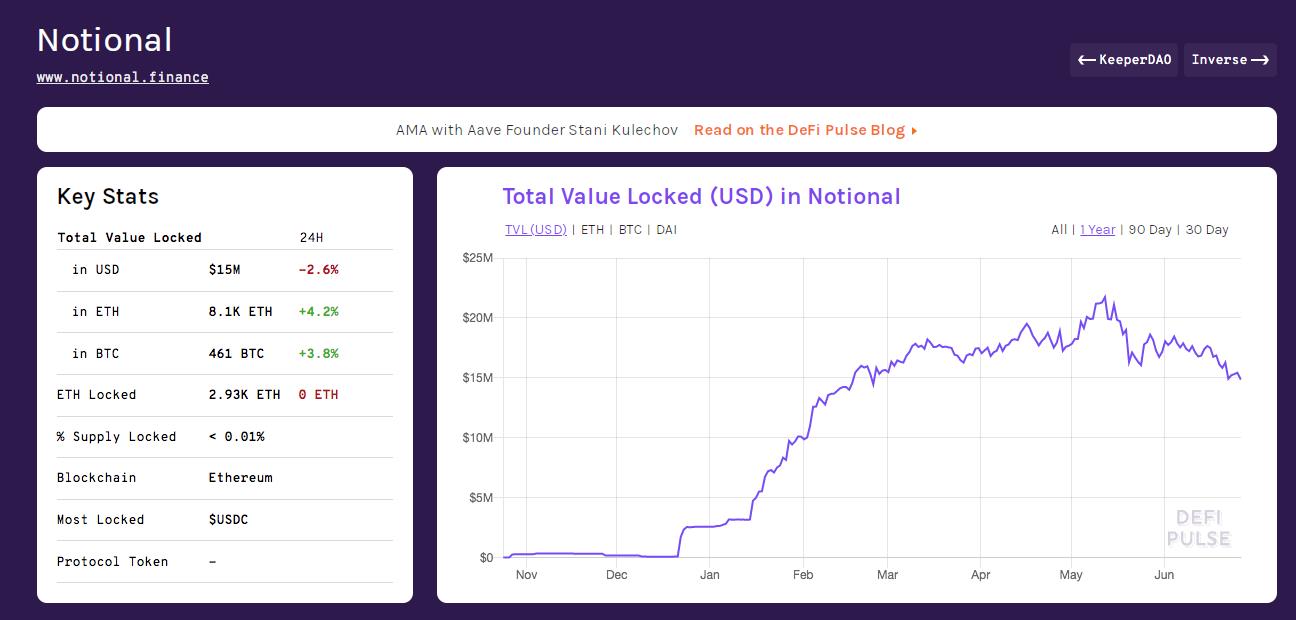

Notional Fiance has experienced an impressive period of development with the sudden growth of Total Value Locked (TVL). You can track the parameters in the image below:

Source: DefiPulse

From November 2020 to now, Notional's TVL has grown from about $ 100,000 to more than $ 15 million, equivalent to a growth rate of about 150 times . This is a very terrible number in just 7 months.

Currently, fixed interest rates on Notional range from more than 5% to around 7% depending on the term. According to the author, this is an impressive fixed interest rate to attract users to borrow money because in fact, if you use the loan effectively, it is entirely possible for you to earn more profit than the interest paid. exam.

When borrowing activity increases sharply => transactions in the pool increase => the benefits of both lenders and liquidity providers increase => creating growth for the platform.

Based on the above analysis, you can see that the Notional Finance mechanism works very interestingly with the combination mechanism between Liquidity Pool, Maturity and fCash. This mechanism contributes to maintaining fixed interest rates and smooth operation of the protocol, while ensuring the interests of borrowers/lenders, while still generating revenue for the project and payment providers. account.

This is extremely meaningful in the context that many organizations and individuals are still very afraid of the fast and strong volatility of the cryptocurrency market. The author believes that Notional Finance will continue to grow, not only as a fixed-rate lending platform, but also as a bridge between the crypto lending/borrowing market and real life.

Fixed interest rates are one of the key issues in DeFi. Notional Finance has come up with their solution and product.

Teddy Woodward and Jeff Wu formed Notional Finance in November 2019 at a hackathon in San Francisco. In January 2020, they launched the project on Ethereum. As of April 2021, they have raised US$11.3 million across three funding rounds, primarily powered by Pantera Capital, Polychain, and Coinbase Ventures.

So, you can try to experience the platform for a chance to get retroactive if available.

Main Partner of Notional Finance

In addition, because it is a newly developed niche, you can also find out more solutions and other projects by yourself to seize the best investment opportunities.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.