What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Instadapp is an All-in-one asset management platform specially designed for both users and developers to exploit the full potential of DeFi, especially lending services. It uses DeFi Smart Layer (DSL), where Instadapp acts as middleware to link different DeFi protocols into one platform.

This means that users can directly interact with Layer 2 DeFi protocols such as Uniswap, Compound , AAVE… through the Instadapp platform. It also allows users to leverage their crypto assets.

There are many DeFi services that you can use on the Instadapp platform as follows:

DeFi Smart Layer (DSL) is a financial framework that makes it easy for all users and developers to access the DeFi space. The DSL contains three main components, including:

Instead of connecting wallets to the platform directly, Instadapp uses DeFi Smart Accounts connected to non-custodial wallets for portfolio management. It optimizes steps to interact with other available protocols.

Users can use the account extension to easily integrate functions such as Flash Loan, Power Extension, Layer 2 Extension, etc.

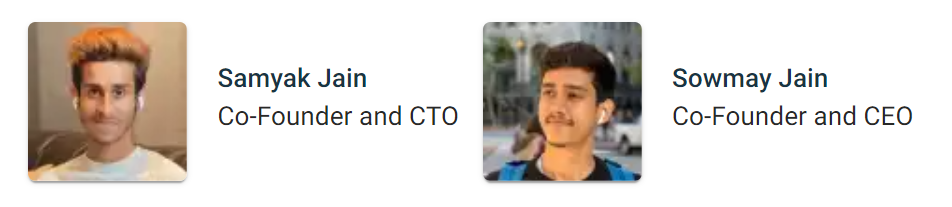

Instadapp was founded by two Indian developers Samyak Jain and Sowmay Jain in their 20s after they participated in a hackathon organized by ETHIndia.

In October 2019, Instadapp raised $2.4 million in Seed Round led by Partera Capital along with amazing investors including Naval Ravikant, Coinbase Ventures, Balji Srinivasan, IDEO Colabs and Kyber's Loi Luu Network.

Chainlink is an Instadapp partner as a provider of real-time price data.

INST is the governance token of Instadapp, the owner of this token has the right to participate in governance. As of June 2021, INST tokens have been active on the Ethereum mainnet with a total supply of 100,000,000 and distributed to the following entities:

Instadapp issues INST as its native token, which has the following functions:

Rewards : Users can earn token rewards for providing liquidity on the platform.

Transaction Fees : INST tokens are used to pay for platform services.

Governance : Instadapp states that on-chain voting governance will be passed on to community members as soon as the ability to upgrade the platform works as intended. On-chain voting will allow token holders to propose upgrades and protocol changes.

Currently, Instadapp is on its way to becoming the leading loan aggregator in the crypto space. To achieve that ambition, the Instadapp team is constantly optimizing the protocol. There are some highlights that you need to keep in mind before investing as follows:

Instadapp is focusing on both users and developers. They built a user-friendly interface to interact with other DeFi protocols and an SDK to guide users step-by-step to set up the extension for the platform.

The protocols on Instadapp are limited to Ethereum and those projects are currently facing high gas fees and TPS challenges. So how does Instadapp overcome these challenges to grow? To find the answer, we need to observe a little more time.

The Instadapp team does not reveal the Roadmap to develop the project, they seem to develop everything and then make it public. Therefore, many people will not know what features will be updated by Instadapp in the future and cannot set expectations on the project without knowing this information.

This can become a barrier for investors if they want to buy INST tokens to hold for a long time. It is still too early to answer the question, is Instadapp a good project or not? Therefore, readers need to research carefully before making a decision to invest in the Instadapp project.

If you are interested in the Instadapp project, readers can follow more social networking platforms such as:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

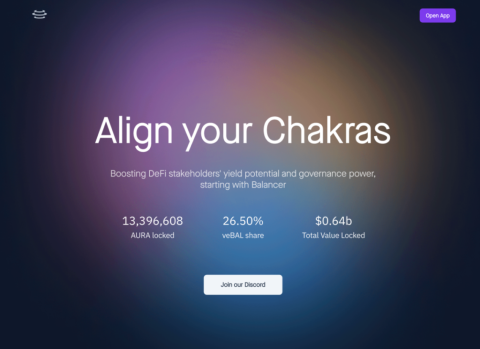

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

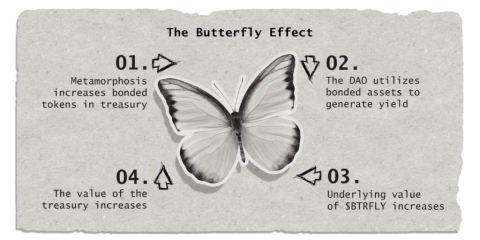

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

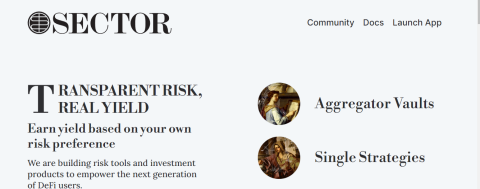

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

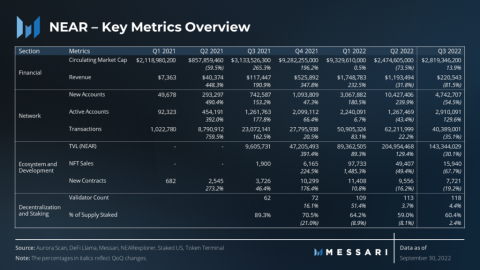

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

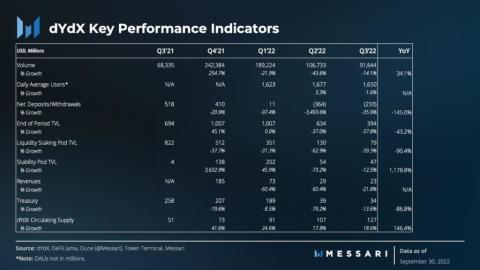

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

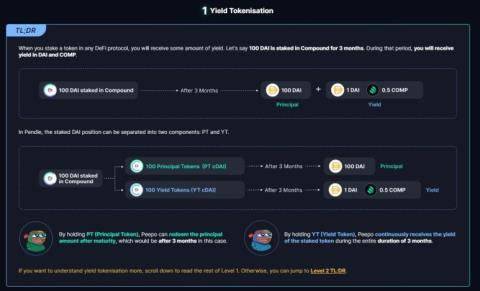

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

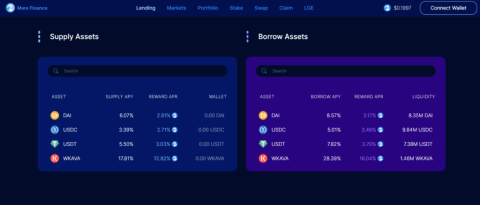

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.