穩定幣定義:什麼是穩定幣?穩定幣如何運作?(2022)

什麼是穩定幣?穩定幣在市場中的作用是什麼?有多少種穩定幣?在這裡了解穩定幣!

歡迎來到 DeFi 樂高系列——一系列富有洞察力的文章,為您提供對不同細分市場的深入分析和研究。今天的主題是穩定幣。

目前,有USDT、USDC、DAI、ESD等各種穩定幣,但它們的機制是完全不同的。這就是為什麼在本文中,我將徹底分析穩定幣領域並為您提供一些有關以下方面的詳細信息:

由於會有很多專業的見解,建議您自己記下一些有用的觀點。此外,每個部分都按順序鏈接到另一個部分,所以不要跳過任何部分。現在讓我們開始吧。

免責聲明:本文的目的主要是提供建設性信息和個人觀點,而不是財務建議。投資加密市場具有很高的風險,因此在投資前請自行研究。

穩定幣定義

穩定幣一詞由“穩定”和“硬幣”組合而成:

一般來說,黃金或白銀被標記為加密貨幣可以被視為穩定幣;法定貨幣也可以以同樣的方式被視為穩定幣。

但是,本文將僅關注加密貨幣中最常用的穩定幣——其價值與 1 美元掛鉤的穩定幣。

穩定幣在 DeFi 中的作用

目前,加密貨幣市場價值超過 $2,200B,表明市場的流通現金流量非常巨大,對加密資產的交易、存儲或投資需求很高。

然而,並非所有法定貨幣都受到加密貨幣交易所的支持。如果穩定幣不存在,用戶首先需要將本國法幣兌換成美元(因為美元在全球範圍內都被接受為支付貨幣),然後通過高成本、高點差的中介(如銀行)繼續兌換,複雜的程序,......在獲取任何加密貨幣令牌之前。

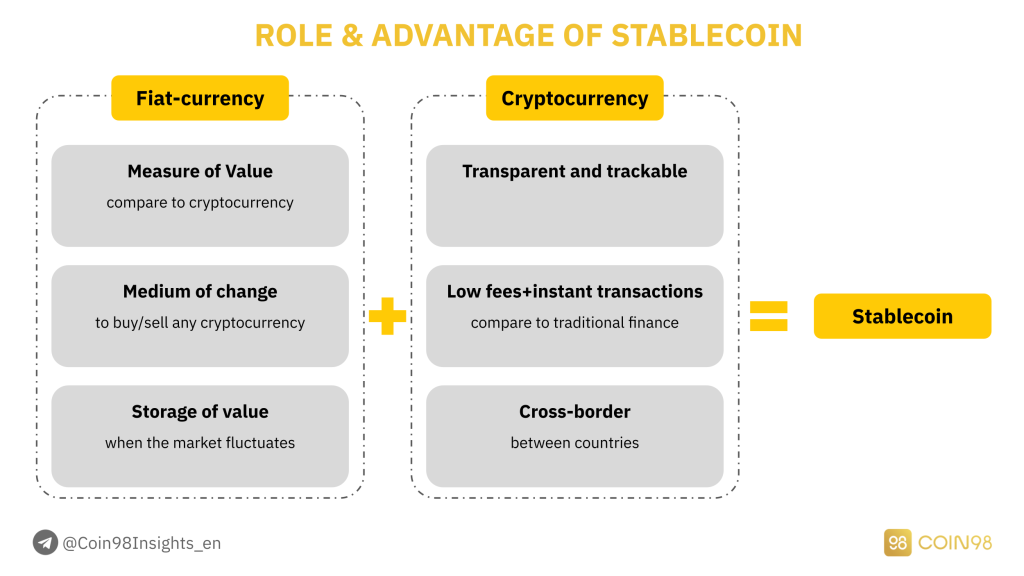

發明穩定幣就是為了解決這個問題。穩定幣的優勢可以看作是兩個因素的組合:

穩定幣的作用和優勢。

在加密市場中,穩定幣的作用是:

相信穩定幣是法幣的價值和加密貨幣在區塊鍊網絡上的便利性的完美結合。穩定幣將幫助用戶以最快的方式投資,獲取最多的加密資產,尤其是消除不必要的中介過程。

不同類型的穩定幣

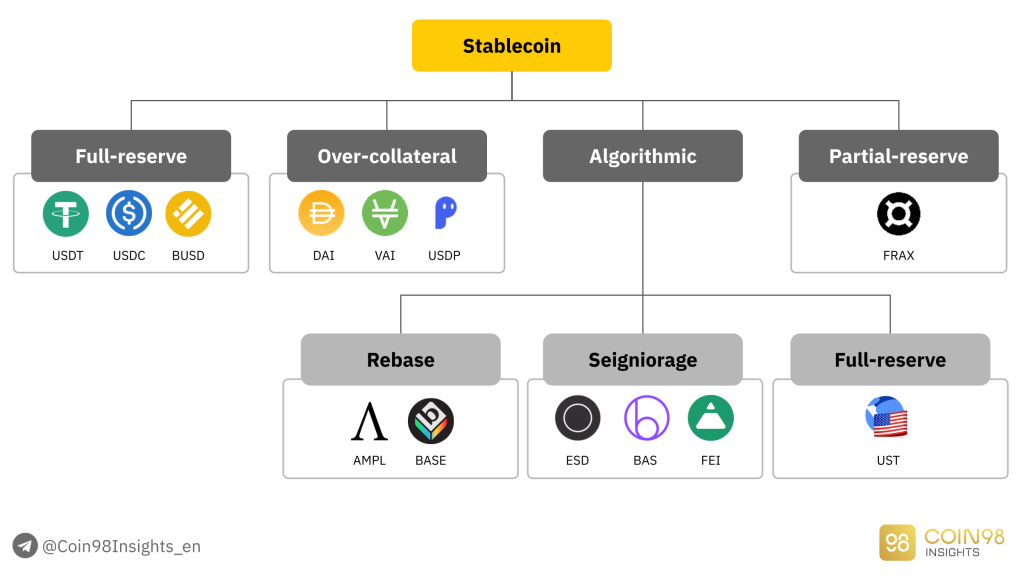

USDT、USDC 和 DAI 是最受歡迎的三種穩定幣。然而,穩定幣的世界遠不止於此,它可以分為 4 種主要類型,具有不同的資本優化能力。

4 種主要類型的穩定幣。

在這一部分中,我將分析它們各自的機制、優缺點。

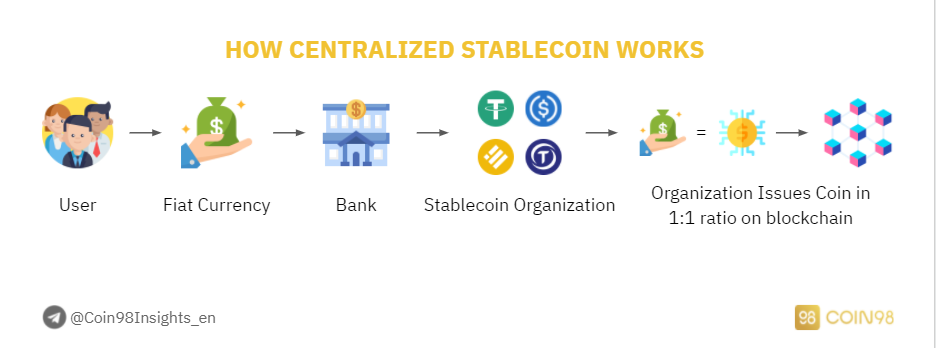

全額儲備穩定幣(中心化穩定幣)

中心化穩定幣如何運作。

全準備金穩定幣是現實生活中由法定貨幣支持的穩定幣。最著名的案例是USDT、USDC和BUSD以美元為後盾,這意味著在區塊鏈上每鑄造1個USDT,現實生活中就會保留1個USD。

全額儲備穩定幣的屬性:

全額儲備穩定幣或中心化穩定幣由一個組織根據其總供應量和流通供應量進行管理。更具體地說, USDT 由Tether控制,USDC 由 Circle 控制,BUSD 由Binance和 Paxos 控制。

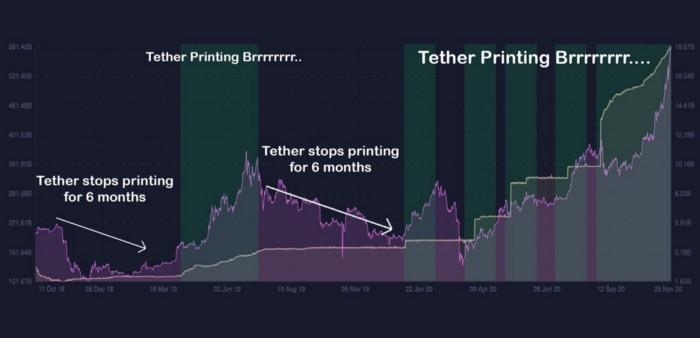

如果您定期關注新聞,您會注意到中心化穩定幣定期面臨有關法律問題的 FUD,尤其是 Tether USDT。從 2016 年開始,Tether 就被懷疑與 Bitfinex 操縱市場。

最大的 FUD 是 Tether 鑄造的穩定幣比銀行中的儲備金還多。如果是這樣的話,Tether 操縱市場的機會是完全有可能的。儘管如此,USDT 從 2016 年到現在都倖存下來,並保持了有效的生產力。

繫繩 FUD。

超額抵押穩定幣(去中心化穩定幣)

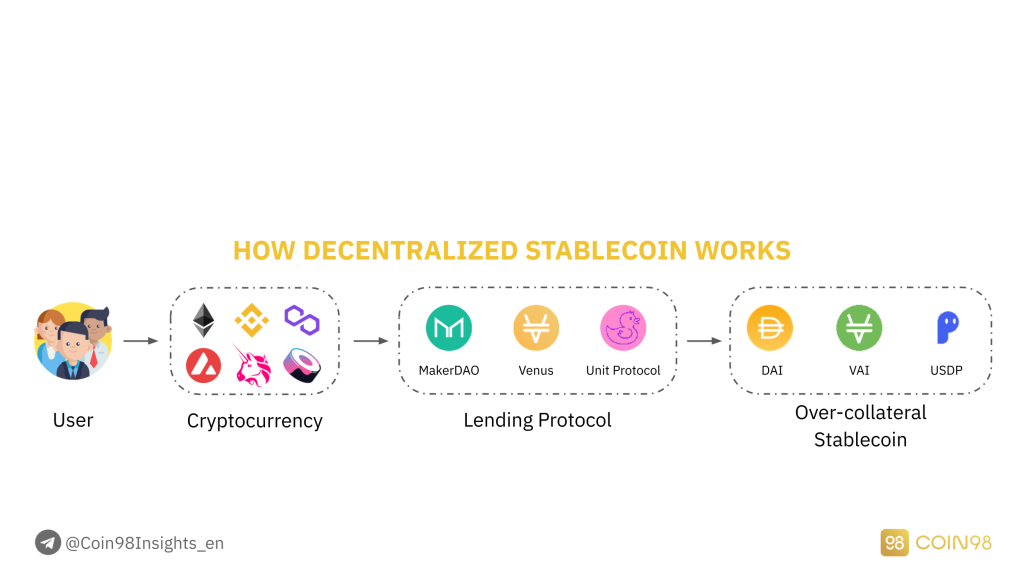

超額抵押穩定幣是第二種最受歡迎的穩定幣類型,當抵押品的價值高於鑄造的穩定幣的價值時創建。最突出的超額抵押穩定幣是 DAI——一種由借貸協議 MakerDAO 生成的穩定幣。

超額抵押穩定幣的屬性:

要將 DAI 鑄造到市場上,用戶需要抵押其他加密貨幣,使其總價值至少是鑄造 DAI 數量的 150%。如果資產的價格低於允許的閾值,這些資產將被清算以確保鑄造 DAI 的價值。

這使 DAI 的價格保持穩定並與 1 美元掛鉤。儘管如此,這種方法限制了 DAI 代幣的可擴展性,因為它的機制不具有資本效率(鑄造 DAI 總是需要大量的抵押價值)。

去中心化穩定幣如何運作。

一些著名的超額抵押穩定幣:MakerDAO (MKR & DAI)、Venus (XVS & VAI)、Party Parrot (PRT & PAI)、...

而這正是 2020 年 3 月 12 日發生的事情。當 Flash Dump 發生時,ETH 價格在 2 天內減半,更不用說以太坊網絡擁堵了。不幸的是,這導致了巨額資產清算。

在資金效率方面,超額抵押穩定幣無法利用資金,因為允許鑄造的穩定幣數量僅佔抵押品價值的 75%,如果用戶想避免如前所述的 Flash Dump,甚至可以達到 50%。

事實上,大多數借貸協議都允許存入抵押品以藉入其他穩定幣,如 USDT 或 USDC,而不是像 DAI 這樣的超額抵押機制。這就是 MakerDAO 在超額抵押穩定幣領域佔據主導地位的主要原因。

非儲備穩定幣(算法穩定幣)

非儲備穩定幣或算法穩定幣是在沒有任何儲備儲備的情況下鑄造的穩定幣。 協議使用算法不斷調整穩定幣的流通供應量,以將其價格保持在 1 美元。

算法穩定幣的屬性:

算法穩定幣包括 2 種主要類型:變基模型和鑄幣稅模型。

1. 變基模型

遵循 Rebase 模型的穩定幣僅使用 1 個代幣,它應用算法來修改代幣的流通供應並影響價格。使用此模型的最突出的項目是 AmpleForth (AMPL)。

每 24 小時,AMPL 供應量將根據 AMPL 價格變化:

Rebase 過程直接影響用戶擁有的令牌數量。結果,維持了供需平衡,使 AMPL 價格回到了掛鉤。

遵循 Rebase 模型的一些著名算法穩定幣: AmpleForth (AMPL)、BASE 協議 (BASE)、Yam Finance (YAM)、...

2.鑄幣稅模式

遵循鑄幣稅模型的穩定幣在運營和維持代幣價格的過程中使用 2-3 個邊代幣。通常,一種代幣是穩定幣,另一種是應用一些機制的代幣,例如 Burn-Mint、Stake-Earn 等,以增加/減少穩定幣的供需並使其保持錨定價值。

一些遵循鑄幣稅模型的著名算法穩定幣:

實力:不需要資本或抵押品。

弱點:理論上,算法穩定幣可以解決全額儲備穩定幣和超額抵押穩定幣的局限性。實際上,算法穩定幣是效率最低、效率最低的類型,因為由於極高的拋售壓力,其價格無法維持在 1 美元。

之所以如此,是因為算法穩定幣項目通常從一開始就理所當然地認為他們擁有強大而穩固的社區來支持他們維持代幣的價格。他們相信激勵計劃可以為該項目吸引大量支持者。

事實上,激勵計劃(農業)並沒有足夠的說服力來鼓勵用戶長期關注該項目。用戶只專注於高 APR 的耕種,然後出售獲得的獎勵⇒ 製造賣壓 > 購買需求 ⇒ 無法錨定價格。

此外,算法穩定幣在市場上的應用並不廣泛。除了飛協議和 Terra USD 這兩個目前功能最強大的算法穩定幣項目外,該領域沒有其他項目脫穎而出。

部分準備金穩定幣(Fractional-reserve Stablecoins)

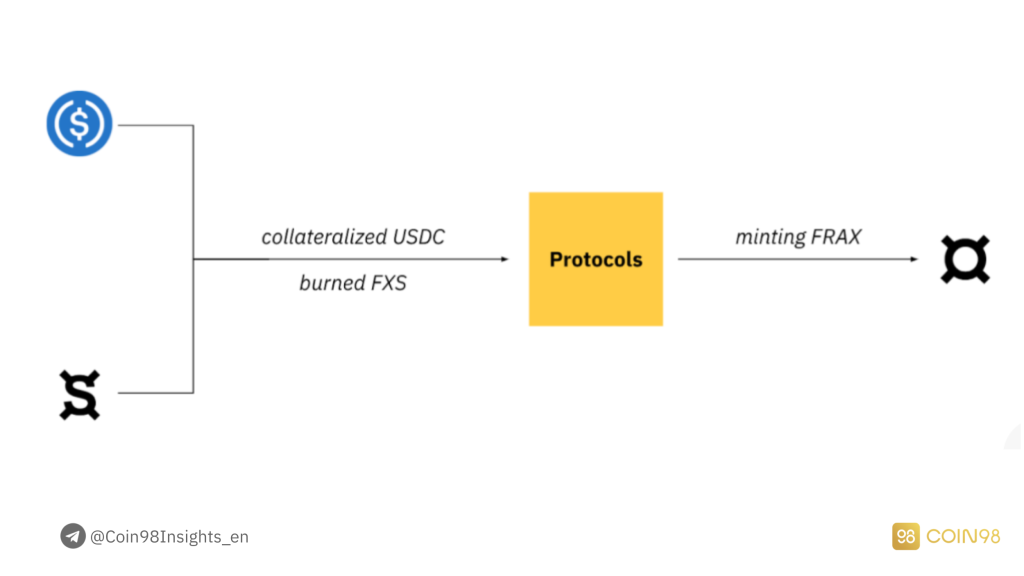

部分準備金穩定幣或部分準備金穩定幣是全額準備金穩定幣和算法穩定幣的組合。第一個也是最特殊的例子是 Frax Finance。

部分儲備穩定幣的屬性:

要鑄造 1 FRAX(一種部分儲備的穩定幣),用戶需要擁有一些穩定幣(目前為 USDT 和 USDC)來補貼 1 FRAX 的價格。該比率可根據Frax Finance進行調整,抵押率範圍為50%至100%。

FRAX 模型。

一些著名的部分準備金穩定幣:Frax Finance (FXS & FRAX),...

優勢:平均資本效率,全準備金穩定幣(需要抵押品)和非準備金穩定幣(基於算法)的組合。

弱點: Frax Finance 是目前唯一採用這種方法的項目,表明沒有多少開發商對該領域感興趣。實時數據也表明FRAX的市值確實很小,而FXS在DeFi或CeFi中的應用並不多。

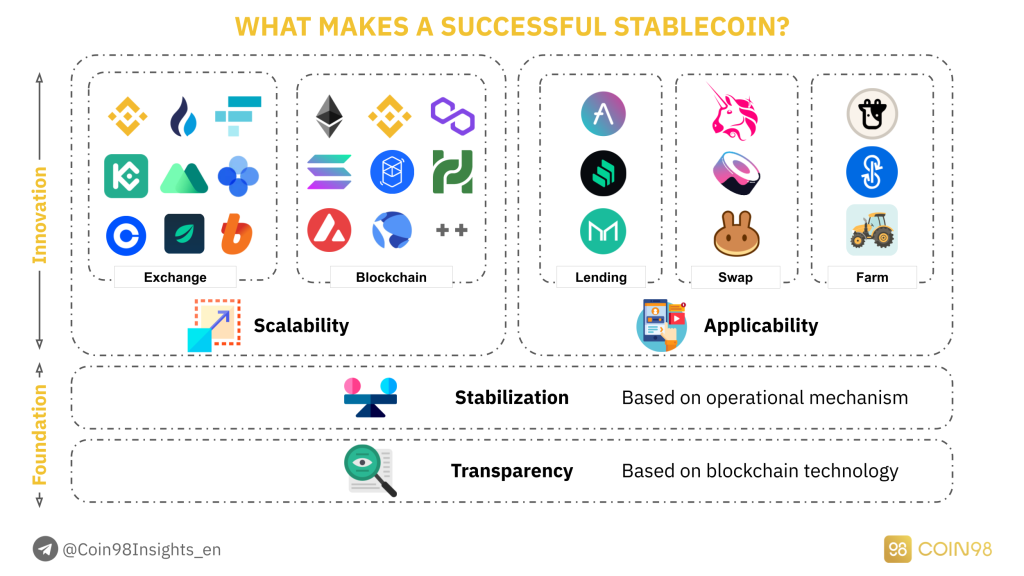

成功穩定幣的屬性

在了解了每種穩定幣類型的優缺點之後,我們現在將研究創建成功且有效的穩定幣的因素。之後,您將能夠可視化加密市場的工作和擴展過程。

為了使穩定幣在市場上有效運作,他們需要具備完整的 4 個因素,包括:

成功穩定幣的 4 個要素。

透明度

透明度可視為有價值穩定幣的基礎。誰是穩定幣的支持者?如果穩定幣得到龐大且信譽良好的支持者的支持,那麼它將是零售用戶和鯨魚用於交易和存儲的值得信賴的穩定幣。例如:

The transparency of a Stablecoin can be evaluated through the users’ access to tracking tools, or in other words, whether users can track the token’s Total Supply and transactions on the blockchain. However, in the case of Centralized Stablecoins like USDT or USDC, their transparencies are still questionable as it is not certain if the amount of USD locked inside the Vault of Tether or Circle is relative to the minted Stablecoins.

Stabilization

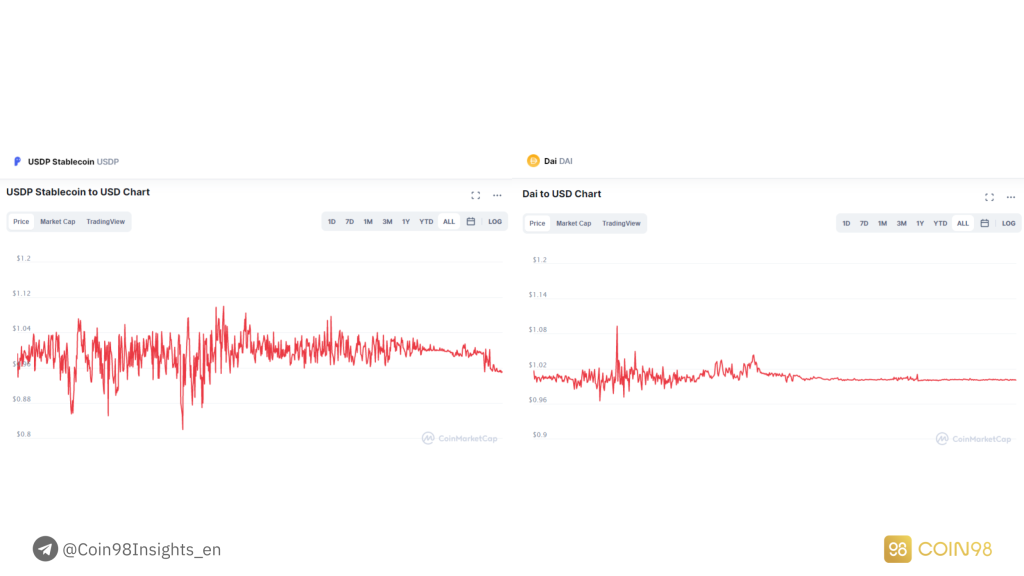

The next element to consider is Stabilization, which is also an indispensable feature of a Stablecoin. Back to the original purpose, Stablecoin was created as a tool to avoid all the volatility in the crypto market.

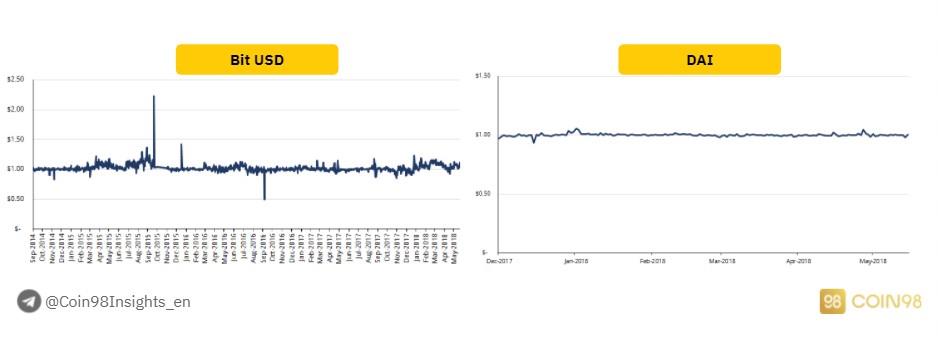

Therefore, if a Stablecoin cannot sustain its peg steadily, that Stablecoin cannot be used as a storing asset. In the illustration below, the two Stablecoins DAI (MakerDAO) and USDP (Unit Protocol) will be compared.

While the DAI price was able to remain stable around $1, the value of USDP usually dropped to $0.95, losing 5% compared to 1 DAI.

Compare USDP with DAI.

If Transparency and Stabilization are the requirements for a Stablecoin to work productively, then Applicability and Scalability are the two factors that help a Stablecoin expand extensively in the market.

Extra analysis: The paradox of Stabilization

Most Stablecoins peg their prices to USD, a Fiat-currency being backed by the whole United States economy. As a result, they are considered more stable than other highly inflationary currencies and highly volatile assets on the stock or cryptocurrency market.

But are Stablecoins really “Stable” if they are USD-pegged?

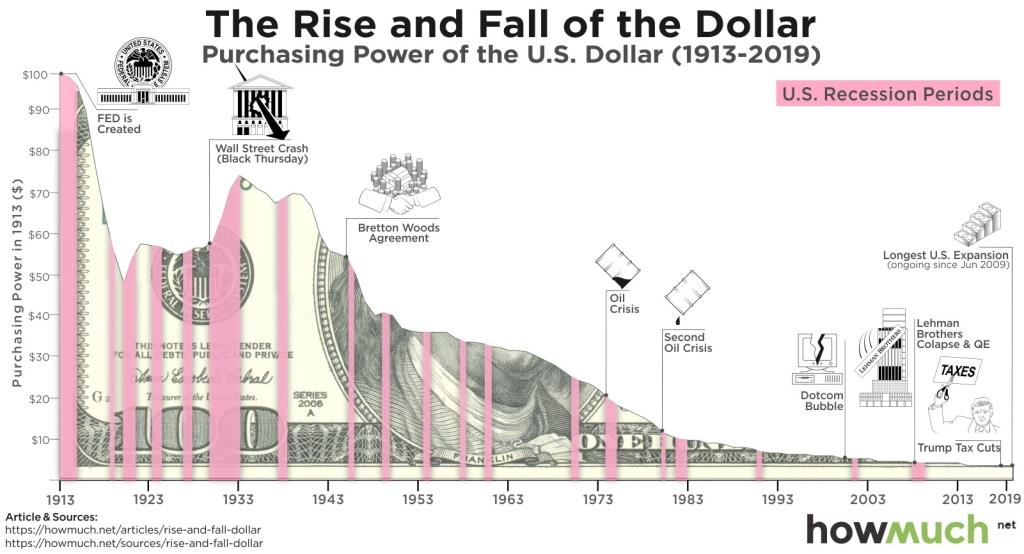

According to the statistics provided by HowMuch, from 1913 to 2019, the intrinsic value of the Dollar currency has been reduced by 90%.

Which means that, if in 1913 $100 could buy 10 kg of rice, in 2019 100$ could only buy less than 1 kg of rice. This happened due to the US abandoning the Gold and Oil standards, allowing FED to freely print money without any physical assets backing its value. This event created huge inflation in USD.

So was the recent price surge of Bitcoin a result of the pump scheme or of the declining USD value?

USD value reduces over time

Scalability

Scalability can be considered the Network Effect of a Stablecoin. When a Stablecoin expands its operating range, a corresponding amount of influence also increases.

On CeFi platforms, especially Centralized Exchanges, USDT is a gigantic force as it is used as the primary trading asset on some biggest exchanges at the moment, such as Binance, Huobi, FTX, OKEx, KuCoin,...

On DeFi platforms, USDC is having the greatest impact because it is the most common asset when it comes to creating Liquidity Pools. Even though USDC was released 3 three years after USDT, it has quickly issued its stablecoins on multiple developing DeFi ecosystems like Ethereum, BSC, Polygon, Fantom, Solana,...

Besides USDT and USDC, BUSD is another rapidly growing Stablecoin thanks to Binance as it is not only used as a trading asset on Binance Exchange, but also implemented in DeFi protocols on Binance Smart Chain.

Applicability

Given that a Stablecoin is widely expanded, at the same time exerting a considerable influence on the crypto market. The next step for it is to improve the Applicability.

For example:

Applicability needs to be developed alongside Scalability after Transparency and Stabilization are solidly built.

Most prominent Stablecoins in the market

We have gone through some basic attributes that make a successful Stablecoin. However, the Stablecoin segment is extremely competitive with a high domination ratio.

Top 10 Stablecoins in the market account for 96% of the Stablecoin Market Cap. Why are the highest-ranked Stablecoins so dominant? In this part, we will seek the answers by analyzing the Case Studies of 5 Stablecoins with the largest Market Cap, including:

Top 15 Stablecoins at the moment. Updated: 7 October, 2021.

Tether - USDT

Tether (USDT) is acknowledged as the earliest Stablecoin in the crypto market. Up to this moment, Tether is the Stablecoin with the largest Market Cap, and having the greatest influence on the market.

Tether has the advantage of implementing an early advent, hence being able to build an incredibly strong Network Effect. Especially, all of the biggest exchanges like Binance, FTX, Huobi are using USDT as the main trading pair for other Altcoins.

Some exchanges have tried to be independent of USDT by issuing their own Stablecoins: BUSD from Binance, HUSD from Huobi. Nonetheless, USDT remains to be the most widespread among every CeFi exchange.

Not to mention on OTC markets, USDT is currently the main gateway for worldwide users to swap from Fiat-currencies to cryptocurrencies. In spite of the fact that OTC markets are still allowing the exchange of other cryptocurrencies like BTC, ETH,... USDT is still dominating the market with high liquidity, low slippage and the ability to be directly traded to other Altcoins across different exchanges.

USD Coin - USDC

Although USDC was founded after USDT, it possesses the advantage of being more friendly to the law system by receiving support from enormous backers, especially Coinbase. Moreover, big exchanges like Binance, KuCoin, and Huobi also use USDC.

Nevertheless, the reason behind USDC’s success is the approach to the DeFi Market. Instead of issuing a large number of Stablecoins on the Tron network like USDT, USDC quickly issued its Stablecoins on other developing DeFi ecosystems, namely Ethereum, BSC, Polygon, Solana, and Fantom.

By seizing the chance faster, Circle did not have to wait for long to take over the DeFi market and attract more users to utilize USDC in the DeFi space.

Binance USD - BUSD

Binance USD is the product made by the cooperation between Binance and Paxos (the managing company of PAX Stablecoin, recently changed its ticker to USDP). Despite the fact that BUSD was released after USDC, USDT and DAI, BUSD has the fastest growth.

Thanks to Binance, BUSD has been broadly applied in Binance Exchange since the beginning of 2020 by being paired with myriads of other tokens, at the same time providing free transaction cost to the paired assets.

When Binance Smart Chain exploded as a phenomenon in March 2021, Binance increased the issuing rate of BUSD on Binance Smart Chain and made it a pairing asset for liquidity pools just like USDT and USDC, which resulted in the tremendous growth of BUSD recently.

Though BUSD is applied in both DeFi and CeFi, its Scalability outside the Binance ecosystem is strictly limited. This situation is pretty understandable because no competitor wants Binance to dominate the market.

Dai - DAI

DAI is an Over-collateral Stablecoin created by the lending protocol MakerDAO. At the moment, MakerDAO is the top 4 lending project in crypto with over $12.7B TVL (Total Value Locked). The Market Cap of DAI is around $6.5B, showing that the Collateral ratio is currently around 49%.

Not only does MakerDAO allow common assets to be used as collateral, but it also supports the collateralizing of LP tokens from Uniswap, helping MakerDAO attract many more users through its diversity.

The advantage of MakerDAO was being founded really early, forming a substantial Network Effect. In terms of coverage across different DeFi ecosystems, DAI is even more popular than BUSD, and only behind USDT and USDC.

Terra USD - UST

Terra USD is a very special Stablecoin as it is the combination of a Full-reserve Stablecoin and an Algorithmic Stablecoin. To maintain the peg price at around 1 USD, Terra USD is backed by LUNA (Full-reserve) and has its price adjusted by an algorithmic mechanism (transfer the price volatility to LUNA).

The success of UST comes from 2 factors:

The first is an effective work model. This was proved through the market collapse on May 19, 2021, which made LUNA price fall from $16 to $4.

If the same thing happened to ETH, MakerDAO and DAI would definitely be considerably affected as ETH was the biggest collateral asset, therefore activating a Domino chain of constant liquidations. However, after that event, UST still stood steadily thanks to the anti-price manipulation mechanism, and then quickly returned to its peg.

The second is the support from the Terra ecosystem (#3 DeFi ecosystem in terms of TVL). UST seems to be the one and only Stablecoin of the ecosystem. As a result, all protocols inside Terra try to capture the value for UST. The most prominent protocol among them is Anchor, a lending platform that allows UST saving with up to 20% APR.

Data analysis of Stablecoin

I hope that with the analysis above, you have visualized the work model of Stablecoins in the market. How can they succeed, and how can they take over the market? In this part, I will dive deeper into the influence of Stablecoins on the crypto market through data analysis.

The Market Cap of Stablecoins

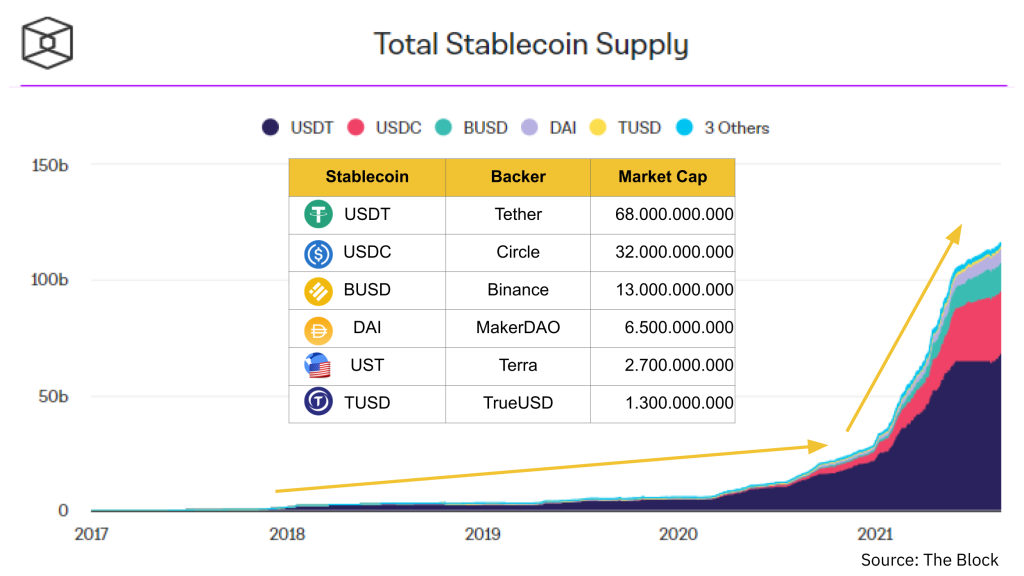

Stablecoins' Market Cap over time.

Market Cap ranking: USDT (#1), USDC (#2), BUSD (#3), DAI (#4), UST (#5), TUSD (#6).

According to the data above, the Market Cap of USDT is overwhelming at $68B, two times higher than that of USDC, even though no other Stablecoins in the market can surpass USDC.

The chart above also shows the two main periods of the crypto market:

Accumulating period (2018 - mid 2020)

In this period, Stablecoins grew slowly but steadily. This matched the market condition at that time when most crypto participants were retail investors, and the DeFi market didn’t receive much attention.

Furthermore, the Market Cap of the whole crypto market was really small, so every action from Tether brought about a huge influence. Every time Tether announced to “issue” more Stablecoins, the price of BTC pumped along.

Booming period (mid 2020 - now)

Forward to the second period, the market received more attention from whale investors and hedge funds, attracting a massive cash flow into the crypto market. The DeFi market gradually became more complete and appealing to the builders and investors.

Since September 2020 to now, the DeFi TVL has increased from $1B to more than $191B. The tremendous growth of DeFi has created a high demand for Stablecoin.

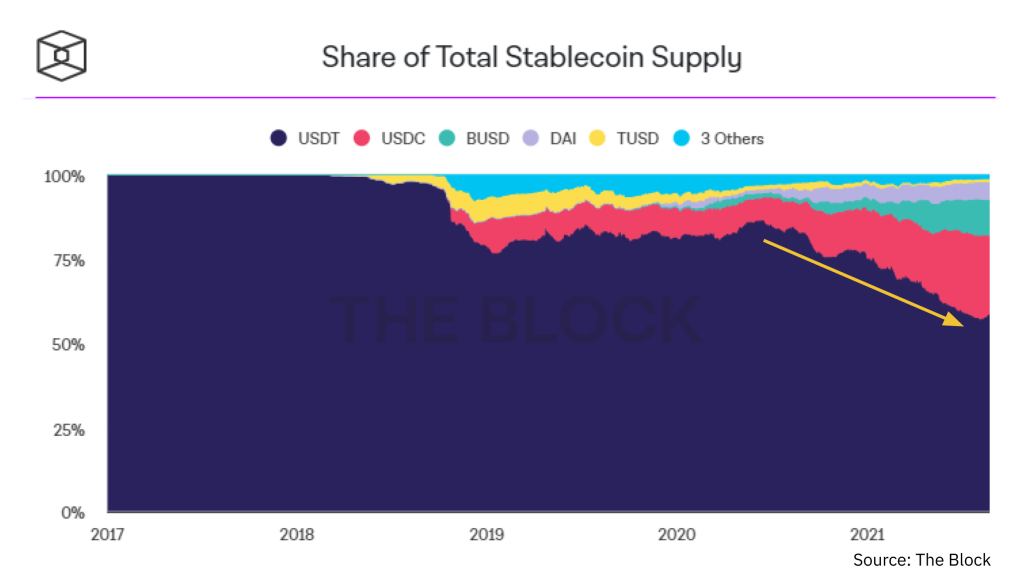

The Market Cap of USDT compared to other Stablecoins.

Although Tether's Market Cap is still overwhelming compared to other Stablecoins, USDC is also worth noting. If you take a close look at mid 2020, you will notice that the Market Cap of USDC rose incredibly fast, and it was at the same time when DeFi started its tremendous growth. That is the reason why when it comes to the DeFi market, I usually prioritize tracking USDC activities over others.

⇒ USDT and USDC are the two key Stablecoins in the market, so we should follow their activities closely because Stablecoins can be regarded as the cash flow supporting the market growth.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi

In the second period, the short-term price pumps of Bitcoin have been separated from Tether’s announcements on issuing Stablecoins. Nonetheless, Stablecoins will still be exerting an enormous influence on the market in the long term, as Stablecoins are the gateway for users to get access to the market and the inside assets.

More specific details can be illustrated in the pictures below. The growth of the market has brought along the demand for Stablecoins, and when Stablecoins were minted to satisfy the market’s demand, DeFi was the most rapidly growing sector.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi.

But if you take a look at the time around May 2021, when the growth of Stablecoins slowed down, the crypto market in general and the DeFi market in particular collapsed shortly after (on May 19, 2021).

However, the Market Cap of the Stablecoin sector did not decline but actually slightly increased, showing that Tether and Circle (2 big companies in the field) did not burn Stablecoins out of the market. This indicates that the number of investors going into the market was still higher than the number of investors going out.

Consequently, in late July 2021, the crypto market witnessed a strong recovery thanks to the afore-minted Stablecoins in the market.

⇒ In the long term, the growth of Stablecoins is the key to speculate the growth of the whole crypto market. If you are following the DeFi market, don’t miss out on any moves from USDC as it is currently the fastest growing Stablecoin in DeFi.

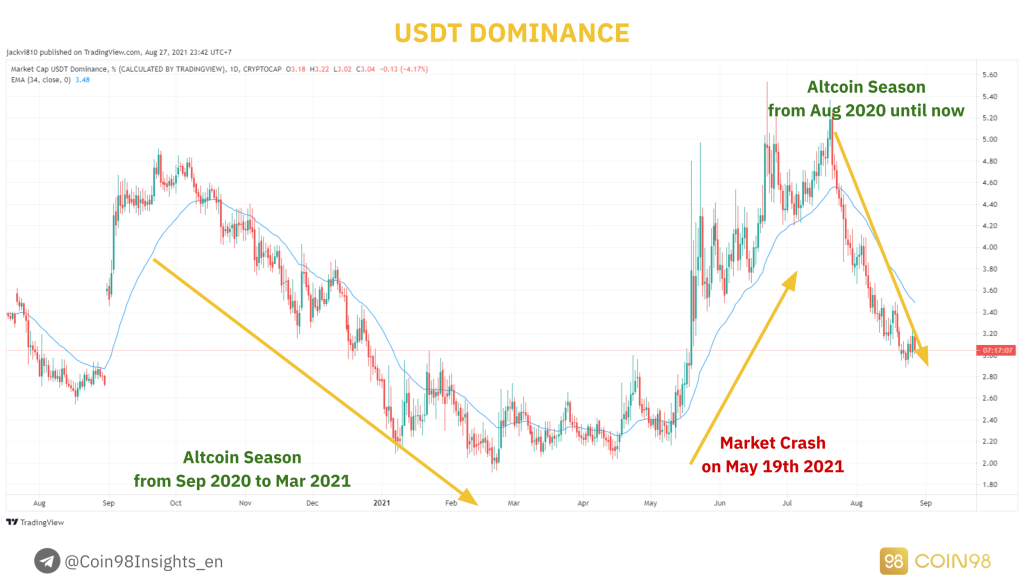

Stablecoin Dominance

Stablecoin Dominance is the measure of Stablecoin’s Market Cap relative to the Market Cap of the rest of the coins. Here is an example of the USDT Dominance index (USDT.D) from Tradingview.

Although there are still a variety of Stablecoins in the market, the Market Cap of USDT takes up more than 50% of the market, and it has been acknowledged as the representative index of the whole Stablecoin segment, so we will analyze the movement of USDT.D.

How USDT Dominance is related to the market condition.

⇒ We can rely on the USDT.D index to define the market trend, therefore understanding the right time to invest, and the right time to take profit.

Stablecoins in DeFi ecosystems

As analyzed above, Stablecoins play an important role in being the gateway for the cash flow from the Fiat-currency market to the cryptocurrency market.

If you are aware of how the cash flow in the crypto market transfers between different layers, then Stablecoins play the same role of allowing investors to transfer their funds from the crypto market (macro) to blockchain ecosystems (micro).

In this part, I will analyze 3 Case Studies of 3 blockchain ecosystems. Namely Terra, Solana and Avalanche, so you can understand the role of Stablecoins in the growth of DeFi ecosystems.

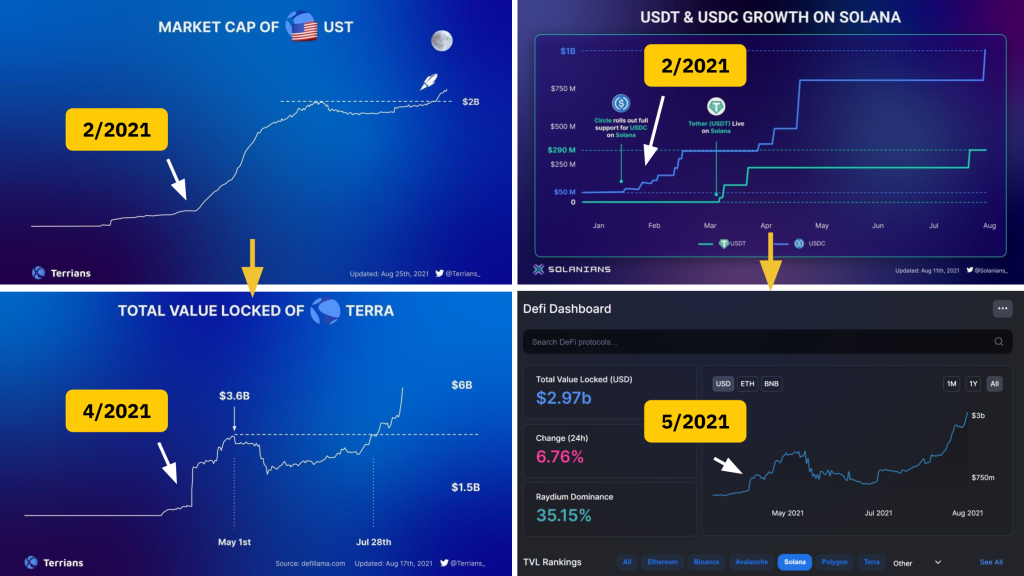

The Market Cap and TVL of Terra (left) and Solana (right).

Case Study 1: How did Terra USD foreshadow the growth of the Terra ecosystem?

Recently, we have witnessed the substantial growth of the Terra ecosystem with its TVL surpassing $6B, becoming the third largest ecosystem in the market behind Ethereum and Binance Smart Chain in terms of TVL.

The increase in TVL has produced a positive effect on the LUNA price, increasing the price of LUNA 700% since the market crash in May 2021. The question is, how could the TVL in Terra increase so rapidly?

The main catalyst is the Market Cap growth of Terra UST - the one and only Stablecoin in Terra. If you notice the chart above more carefully, you can see that when the DeFi TVL in the ecosystem rose, the UST Market Cap had seen an explosive growth 2 months before that, exceeding TrueUSD (TUSD) and Paxos (PAX) - two prominent Stablecoins in the market.

Case Study 2: USDC & Solana - the cooperation that grew Solana tremendously

Since February 2021, when the crypto market was not yet active, Circle and Solana Foundation had already started to issue more USDC into the Solana ecosystem to develop DeFi. Afterwards, in May 2021, the DeFi sector on Solana began to attract more users and reached $1.5B TVL.

During that period, the price of SOL (Solana native token) rose from $10 (February 2021) to $50 (May 2021). Even though a market crash happened shortly after, the number of Stablecoins on Solana continued to rise. In fact, the pace of issuing Stablecoins on Solana at that time was even faster than when the market was extremely active.

And the result is crystal clear: Since July 2021 to now, the cash flow into the Solana ecosystem has not stopped, helping the DeFi TVL to reach $3B. Every token in the Solana ecosystem has been growing tremendously (SOL, SRM, RAY, MNGO, SBR, ORCA,...) especially SOL has recovered from $25 to $170 at the time of this writing.

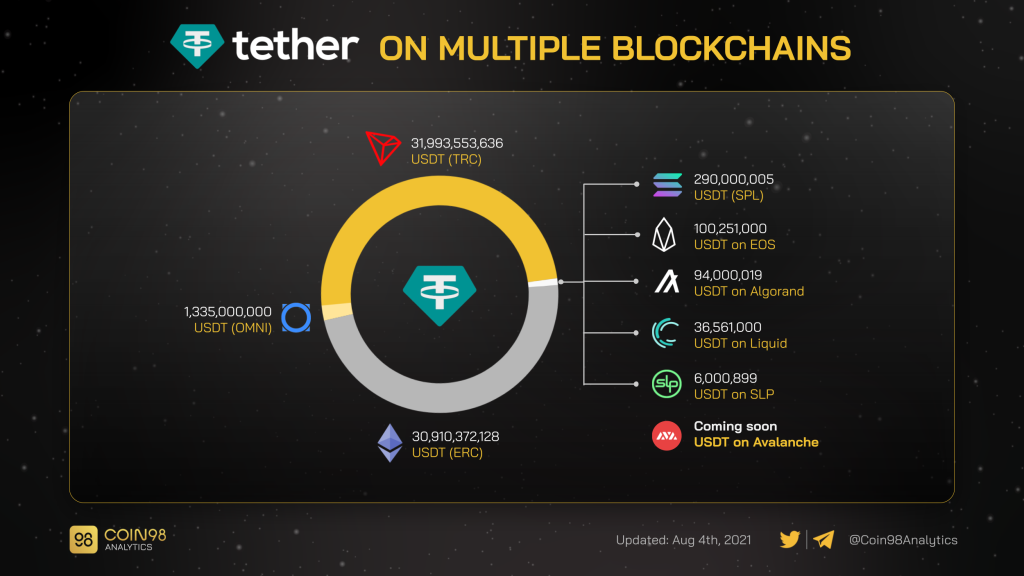

Case Study 3: Avalanche got in the sight of Tether

Tether has been deployed on multiple chains. Although the Market Cap of Tether on Tron and Ethereum accounts for the most, Tether has not issued any additional USDT on Tron, Omni, EOS, Algorand,... since earlier this year. Instead, Tether has now focused on Ethereum, Solana and Avalanche.

This resulted from the fact that they were the three immensely developed DeFi ecosystems. To compete with USDC, Tether quickly supported USDT on Avalanche to help the growth of the Avalanche ecosystem, therefore assisting tokens on Avalanche (AVAX, PNG, SNOB, XAVA) in recovering after the market collapse.

Aside from the Market Cap and Dominance index, the pace of growth is also an imperative index to track. For instance, even though the number of USDT on Solana is still incredibly small, at the same time, it is increasing at the most rapid pace compared to other ecosystems. Will that case happen again, but this time with Avalanche?

The number of USDT on different blockchains.

In conclusion, the investment opportunities do not come from Stablecoins, but from the movement of the market and of different blockchain ecosystems. Stablecoins help you to navigate that movement.

Note:

However, this case is only applicable to ecosystems with small TVL like Solana, Polygon, Terra, Avalanche, Fantom,... because when the ecosystem’s TVL is still insubstantial, the influence of issuing Stablecoins will be more immense, hence creating a motivation for the ecosystem to thrive.

To comprehensively developed ecosystems such as Ethereum and Binance Smart Chain, issuing Stablecoins does not matter that much as the number of Stablecoins being issued is too insignificant compared to the DeFi TVL of that ecosystem.

To speculate the cash flow efficiently, you have to:

Some useful tools to track Stablecoin indexes:

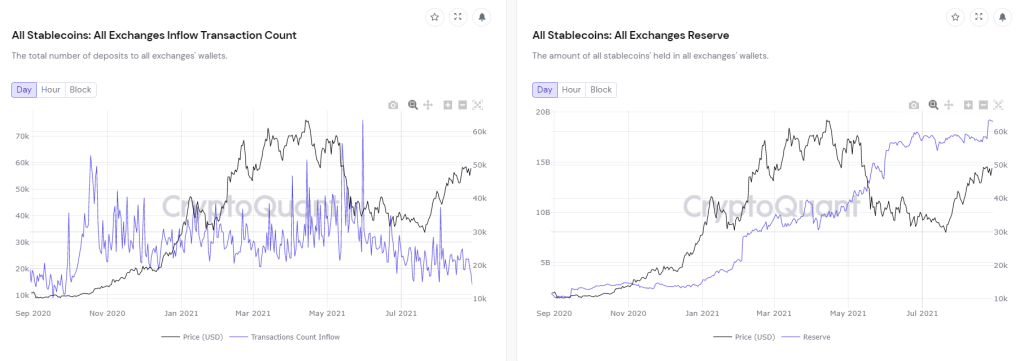

Stablecoin reserve on exchanges

Stablecoin reserve on exchanges.

Similar to the index of BTC Inflow & Outflow, the Stablecoin Exchanges Inflow & Outflow index allows investors to track the buy demand of the market. There are 2 circumstances:

In the long term, this index is correct to some extent. Before Bitcoin reached ATH (All-time high) in March 2021, the Stablecoin Reserve index had increased dramatically in November 2020 (5 months before). Before Bitcoin recovered in August 2021, the Stablecoin Inflow index had also risen significantly in June 2021.

However, the crypto market moves really quickly but this index does not show responsive signs in the short term (about 1 month). That is why this index should only be regarded as an additional tool to gather more information rather than a primary one, compared to the aforementioned methods.

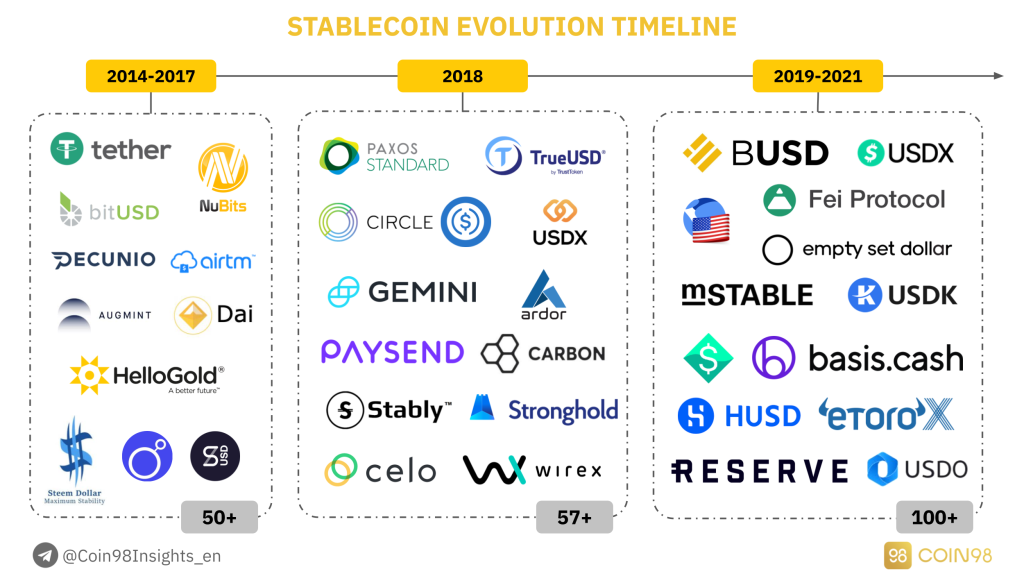

How have Stablecoins evolved?

After going through some prominent Stablecoins, how they work and how they influence the crypto market, we will now look at the evolution of Stablecoins, hence defining the period we are at and predicting future Stablecoin movements.

The evolution of Stablecoin.

First period (2014 - 2017): Pioneers in the Stablecoin sector

At an early stage of the first period, Stablecoins had the sole purpose of tokenizing all popular Fiat Currencies across the globe. Stablecoins were used mainly to resolve the problem of transactions’ cost and speed of the traditional financial system.

The most prominent of all was Bitshares, a platform founded by Charles Hoskinson (Ethereum's Co-founder and Cardano’s Founder). Bitshares tokenized a wide range of currencies, including CNY (BitCNY), Euro (BitEUR), USD (BitUSD), Gold (BitGOLD),...

Nevertheless, in order to create Fiat-backed cryptocurrencies, users had to collateralize BitShares with a larger amount. As BitShares were highly volatile, the value of Stablecoins such as BitUSD, BitEUR,... was not stable. Not to mention that with low liquidity, BitShares could be easily manipulated by speculators.

Compare Bit USD with DAI.

Fast forward to the end of the first period which is about 2017. The crypto market started to be recognized, and other Stablecoins like DAI and USDT started to appear. DAI was created and sustained up to this moment due to the incredibly high demand for lending & borrowing in the market. The stability of DAI was also better.

Meanwhile, USDT was backed by a gigantic force - Bitfinex. Bitfinex used to be the largest exchange in 2017, until Binance attracted more retail investors to its platform though most whales still stayed in Bitfinex. The substantial influence of Bitfinex at that time was the main catalyst that kept USDT stable around its peg and stood still till now.

Second period (2018): The boom of Stablecoins

The first period was the prerequisite for the second period, which was the most booming period of Stablecoins. The market witnessed the advent of various Stablecoin platforms as this was also the time when the crypto market became “Mainstream” in 2017, after Bitcoin reached an ATH of $20,000.

The demand to invest in Bitcoin as well as the demand for Stablecoins increased. To compete with USDT being backed by Bitfinex, a variety of exchanges issued their own Stablecoins (Gemini issued GUSD), whereas payment platforms also did the same thing (Paysend).

Stablecoins became a “trend” for whales to increase their influences on the crypto market that was already small. If you take a closer look at the illustration above, you can see that in 2018, more than 57 Stablecoin platforms appeared, ranging from Full-reserve Stablecoins to Over-collateral Stablecoins and Algorithmic Stablecoins.

This was also the time when Stablecoins that later became dominant made their debuts, namely Circle (USDC), Paxos (PAX), TrueUSD (TUSD),... they are the three major competitors of Tether (USDT).

Third period (2019-2021): Selection and elimination

From my perspective, the Stablecoin sector is currently in this period. After the booming phase in 2018-2019, myriads of Stablecoin projects appeared, at the same time a large number of projects showed their weaknesses.

Which is the main reason why in the third period, the market will begin the selection and elimination process, especially the recession of Algorithmic Stablecoin projects as they are not working efficiently (cannot maintain the peg price).

You can visualize the situation more clearly through the picture below along with the market’s real-time data. Over 200 Stablecoin projects have been developed, but the number of active and productive projects is only around 10 (USDT, USDC, BUSD,...). More and more Stablecoin projects are gradually fading into oblivion.

The number of active Stablecoins, in development, and closed.

Fourth period (2021+): Expand

The most important keyword to define the third and the fourth period is the Network Effect. As mentioned earlier, the Stablecoin segment is exceptionally competitive.

Among over 200 projects, only nearly 10 of them have an influence on the market. This forces Stablecoin platforms to constantly develop and expand so as to account for as much of the market as possible, including both DeFi and CeFi.

除了USDT長期主導市場之外,USDC是第四期值得關注的穩定幣。USDC 於 2018 年正式推出(Tether 後 3 年),迅速將其穩定幣部署在 10 多個區塊鏈上,並主要專注於當時發展迅猛的 DeFi 市場。這種做法讓 USDC 在 DeFi 市場上比 USDT 更為知名。

目前,BUSD 仍在遵循網絡效應改進方案。幣安已經上線更多BUSD交易對,發行更多BUSD用於幣安智能鏈生態,願景是取代USDT和USDC。

未來,UST 肯定會通過接入幣安智能鏈生態系統和 Solana 生態系統來增加其網絡效應——這兩個生態系統擁有僅次於以太坊的最大現金流。

預測穩定幣的未來

Stablecoin weaknesses

We have gone through the approach and evolution of Stablecoins. So how can they be improved in the future to get rid of the current weaknesses? The answer to this question can be found in this part.

If you notice, Stablecoins are having 2 major issues without a solution which are Transparency and Applicability:

How Tether printing USDT affected the market.

Developing Stablecoins

Major companies are trying to create a Stablecoin that can solve both of the above problems, which can look like:

Some potential Stablecoins in development.

目前正在開發以滿足上述要求的 4 種穩定幣是:

1. 電報噸

帕維爾·杜羅夫(Pavel Durov)——Telegram 的創始人一直試圖發行一種具有高穩定性和高流動性的穩定幣。然而,在受到 SEC 在法律方面的壓力後,他放棄了該項目。

2. 天秤座

在過去的一段時間裡,Facebook 一直在嘗試創建 Libra 並使其成為全球貨幣。Libra 將獲得 50% 的美元、18% 的歐元、14% 的日元、11% 的英鎊和 7% 的新元支持。然而,隨著美國國會意識到私人公司與公共銀行競爭的威脅,Libra 很快就失敗了。

However, their ambition seems to remain enormous because after the failure of Libra, Facebook created Diem - Libra 2.0. At the moment, they have been able to cooperate with a variety of partners in the finance department in order to start expanding and integrating with social media applications like Facebook, Whatsapp,...

3. LPM Coin

JP Morgan - one of the biggest banks in the world, plans on creating JPM Coin, a Stablecoin that can replace the obsolete payment system Swift. Nonetheless, they have not made any further announcement. If JP Morgan successfully introduces their product, other major banks like HSBC, Citibank, Wells Fargo will also participate in the play.

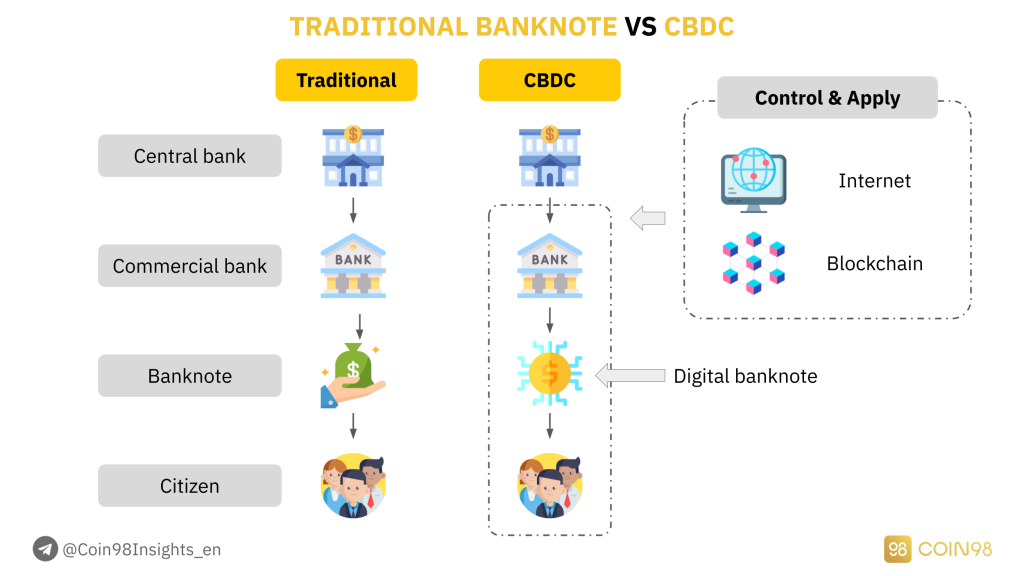

4. CBDC

The last Stablecoin, at the same time the most realistic one is CBDC. CBDC is short for Central Bank Digital Currency. Currently, many Western banks and China banks have been experimenting with the CBDC model and tried to apply it to their work models.

The difference between Traditional Banknote and CBDC.

Although there are still some limitations such that it is not yet possible to be applied worldwide, CBDC can be considered a Stablecoin comprehending all the benefits that the blockchain technology brings, namely transparency, tracing ability to prevent money laundering, low transaction cost, high speed.

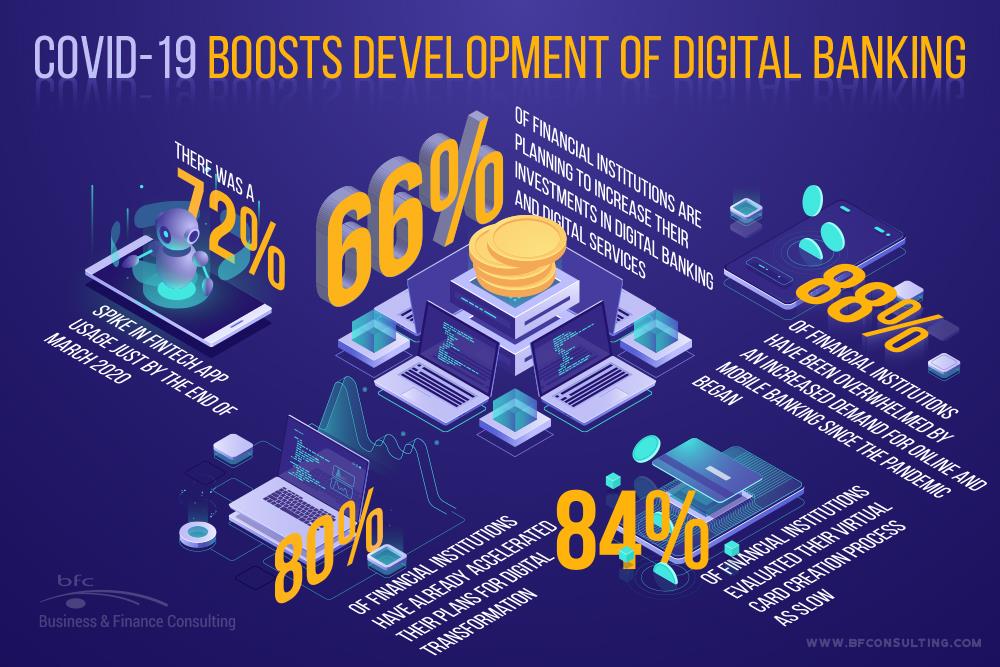

There is no doubt that CBDC will be applied in the future by not only commercial banks but also public banks. Moreover, the Covid 19 event taking place all around the world has shown how important CBDC can be to the global economy in the future.

When everyone has difficulties in commuting and using cash, CBDC becomes an optimal solution for the financial market to operate smoothly.

Covid-19 motivates the growth of Digital Banking.

Investment opportunities with Stablecoins

In terms of investment opportunities with Stablecoins, I can distribute into 2 types:

Now let’s go through each type of investment.

Discover investment opportunities through Stablecoin indexes

如上所述,穩定幣不是投資領域。從穩定幣中獲利的最佳方法是觀察其走勢並根據現金流量做出決策。

任何時候穩定幣在生態系統中發行,現金流都會立即進入該生態系統:

因此,為了不錯過任何市場趨勢,您必須在它們“起飛”之前對其進行觀察和跟踪。以下是一些有用的問題,可以幫助您找到自己的見解:

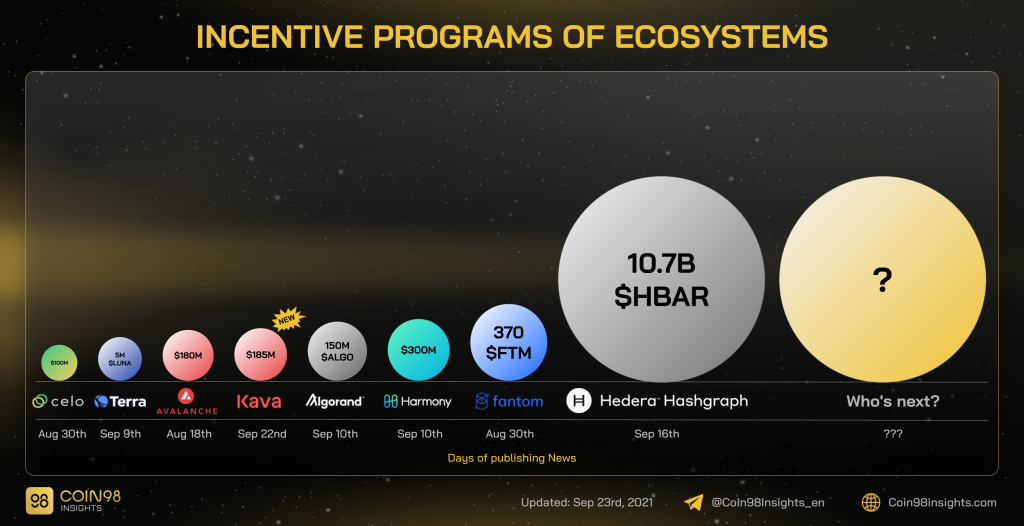

Most recently, multiple ecosystems have announced their DeFi incentive programs, including:

Incentive programs in different blockchains.

It is worth following the Stablecoin movement in these ecosystems and see if they are issuing any new Stablecoin or cooperating with any 3rd-party to do so.

Directly investing using Stablecoins

Nevertheless, if you own a large amount of capital and want to earn with zero risk in this market, using Stablecoins can still be the way to go.

Although the Yield is not as high as using Altcoins, using Stablecoins allows you to be flexible regardless of the market condition. Here are some advisable methods:

1. Lending (4 - 8% APR)

You can deposit Stablecoins on CEXs or lending platforms to receive savings. The advantage of using Lending is its simple interactions, transparent interest, and optional deposit period.

Here are some platforms that you can use Stablecoins to earn savings:

CEX: Binance, Huobi, Gate, MXC, OKEx,...

Centralized Lending: NEXO, BlockFi,...

Decentralized Lending:

However, the disadvantage of using Lending protocols is that the interest rate is pretty low, ranging from 4-8%/year. If you want to receive higher yields, take a look at Farming.

2. Farming (20 - 40% APR)

Farming is the approach to provide liquidity for decentralized exchanges to receive platform fees and the native token of the platform. To follow this way, you have to know some basic actions in DeFi, like providing liquidity.

The advantage of Farming is a higher yield with up to 20-40% per year, which is a really high interest rate. In Viet Nam, if you deposit USD, you won’t even receive interest. Whereas if you deposit VND, you will earn a 7% interest rate but the annual inflation rate is even higher than USD.

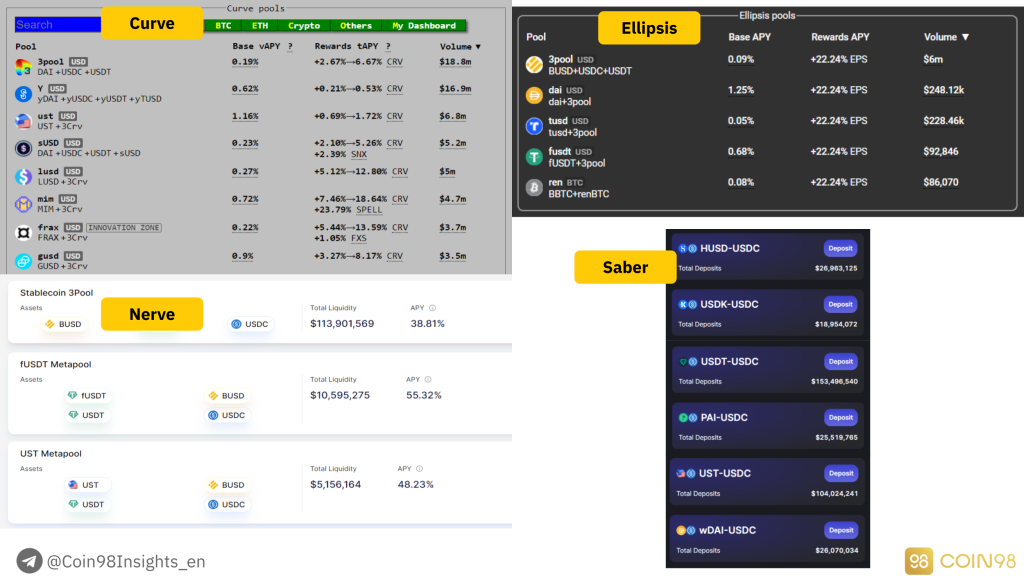

DeFi is really a gateway bringing a vast amount of opportunities to earn yields, and you can totally use Stablecoins to make a profit before actually investing in the market. Here are some Stablecoin AMM platforms that you can use for Farming:

Farming Stablecoins.

However, Farming on decentralized protocols has some particular risks, especially in the case of the protocol being hacked, which is why you should distribute your Stablecoin into smaller parts and use them on prestigious and high TVL platforms.

Conclusion

Here are some insights that you can use to find investment opportunities with Stablecoins:

我希望它可以幫助您獲得對該領域更有價值的見解,以及如何通過使用穩定幣獲利。

如果您想進一步了解該主題,請隨時在下方發表評論並加入Coin98 社區進行進一步討論!

Mina 和 Polygon 將共同開發提高可擴展性、增強驗證和隱私的產品。

分析和評估 Uniswap V2 的運營模式,這是任何 AMM 的最基本模型。

Remitano 交易所是第一個允許以越南盾買賣加密貨幣的交易所。在這裡註冊 Remitano 並詳細買賣比特幣的說明!

本文將為您提供使用 Tenderize 測試網的最完整、最詳細的說明。

本文將為您提供最完整、最詳細的使用 Mango Markets 的指南,以在 Solana 上體驗這個新項目的全部功能。

在解鎖系列的第一集中,我們將使用安全設置為您的錢包添加額外的安全層。

農業是用戶在 DeFi 中輕鬆賺取加密貨幣的好機會。但是,什麼是種植加密貨幣並安全加入 DeFi 的正確方法呢?

文章翻譯了作者@jdorman81對Defi中估值問題的看法,以及譯者的一些個人觀點。

Saddle Finance 是一種 AMM,它允許交易並為 tBTC、WBTC、sBTC 和 renBTC 提供流動性。馬鞍地板用戶手冊。

為什麼你現在應該開始關注比特幣(BTC)?當比特幣(BTC)超過 5 億越南盾 / BTC 的峰值時要準備什麼?