La tendance Algorithmic Stablecoin 2021 est-elle?

Cet article présentera quelques projets Fork du grand projet Algorithmic Stablecoin. Est-ce une tendance en 2021 ?

Bienvenue dans la série DeFi Legos - une série d'articles perspicaces qui vous fournit une analyse et une recherche approfondies sur différents segments de marché. Le sujet d'aujourd'hui est Stablecoin.

Actuellement, il existe différents Stablecoins tels que l'USDT, l'USDC, le DAI, l'ESD,... mais leurs mécanismes sont totalement différents. C'est pourquoi dans cet article, je vais analyser en profondeur le secteur du Stablecoin et vous donner quelques informations détaillées sur :

Comme il y aura beaucoup d'informations spécialisées, il est conseillé de prendre note de quelques points utiles pour vous-même. De plus, chaque partie est liée à une autre dans l'ordre, alors ne sautez aucune partie. Commençons maintenant.

Avis de non-responsabilité : le but de cet article est principalement de fournir des informations constructives et des points de vue personnels, et non des conseils financiers . Investir sur le marché de la cryptographie est très risqué, alors faites vos propres recherches avant d'investir.

Définition de Stablecoin

Le mot Stablecoin est combiné par « Stable » et « Coin » :

De manière générale, l'or ou l'argent étant tokenisé dans une crypto- monnaie peut être considéré comme un Stablecoin ; Les monnaies Fiat peuvent également être considérées comme des Stablecoins de la même manière.

Cependant, cet article se concentrera uniquement sur les Stablecoins les plus fréquemment utilisés en crypto - les Stablecoins dont la valeur est indexée sur 1 $.

Le rôle de Stablecoin dans DeFi

À l'heure actuelle, le marché de la crypto-monnaie vaut plus de 2 200 milliards de dollars, ce qui indique que les flux de trésorerie en circulation sur le marché sont extrêmement énormes et qu'il existe une forte demande de négociation, de stockage ou d'investissement dans des actifs cryptographiques.

Néanmoins, toutes les devises Fiat ne sont pas prises en charge par les échanges cryptographiques. Si Stablecoin n'existe pas, les utilisateurs doivent d'abord échanger la devise Fiat de leur pays contre l'USD (puisque l'USD est accepté dans le monde entier comme monnaie de paiement), puis continuer à échanger via un intermédiaire (comme une banque) avec un coût élevé, une forte propagation , procédures compliquées,... avant d'acquérir un jeton de crypto-monnaie.

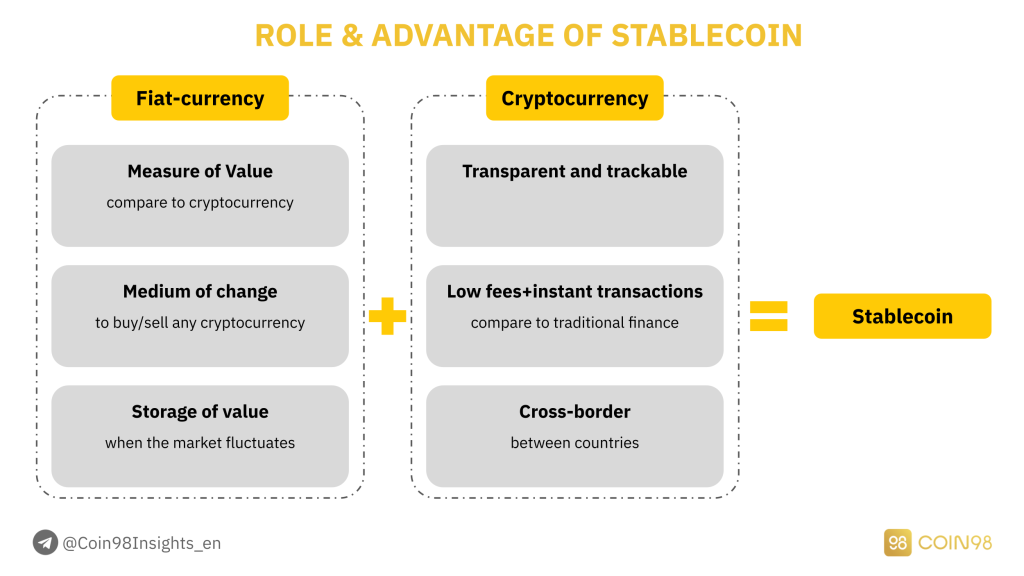

Stablecoin a été inventé pour résoudre ce problème. Les points forts de Stablecoin peuvent être considérés comme une combinaison de 2 facteurs :

Le rôle et l'avantage de Stablecoin.

Sur le marché de la crypto, Stablecoin a pour rôle de :

On pense que Stablecoin est la combinaison parfaite de la valeur de la monnaie Fiat et de la commodité de la crypto-monnaie sur le réseau blockchain. Stablecoin aidera les utilisateurs à investir de la manière la plus rapide, à accéder au plus grand nombre d'actifs cryptographiques et surtout à éliminer le processus intermédiaire inutile.

Différents types de Stablecoins

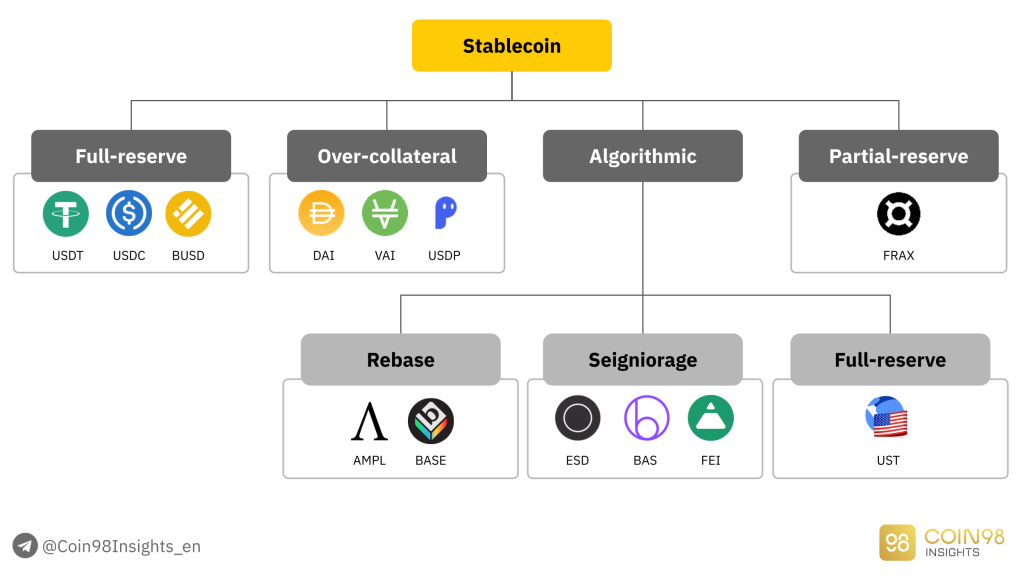

USDT, USDC et DAI sont les trois Stablecoins les plus populaires. Cependant, le monde de Stablecoin est beaucoup plus énorme que cela, qui peut être divisé en 4 types principaux avec différentes capacités d'optimisation des capitaux.

4 principaux types de Stablecoin.

Dans cette partie, je vais analyser le mécanisme, les forces et les faiblesses de chacun d'eux.

Stablecoins à réserve complète (Stablecoins centralisés)

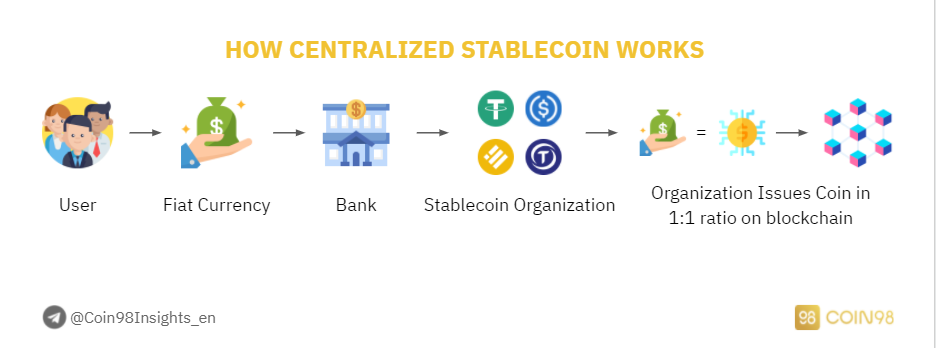

Comment fonctionne le Stablecoin centralisé.

Les Stablecoins à réserve complète sont les Stablecoins qui sont soutenus par une monnaie Fiat dans la vraie vie . Les cas les plus connus sont l'USDT, l'USDC et le BUSD soutenus par l'USD, ce qui signifie que pour chaque 1 USDT frappé sur la blockchain, 1 USD est réservé dans la vraie vie.

Les attributs d'un Stablecoin à réserve complète :

Les Stablecoins à réserve complète, ou Stablecoins centralisés, sont régis par une organisation en termes d'approvisionnement total et d'approvisionnement en circulation. Plus précisément, l'USDT est contrôlé par Tether , l'USDC est contrôlé par Circle et le BUSD est contrôlé par Binance et Paxos.

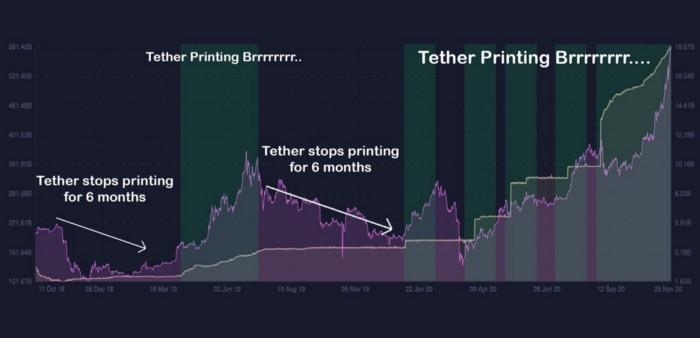

Si vous prêtez régulièrement attention aux actualités, vous remarquerez que les Stablecoins centralisés ont régulièrement été confrontés à des FUD concernant des problèmes juridiques, en particulier Tether USDT. Depuis 2016, Tether est soupçonné de manipuler le marché avec Bitfinex.

Le plus gros FUD est que Tether a frappé plus de pièces stables que le fonds réservé de la banque. Si tel est le cas, la possibilité que Tether manipule le marché est tout à fait possible. Néanmoins, l'USDT a survécu de 2016 à aujourd'hui et a maintenu une productivité effective.

Tether FUD.

Stablecoins surcollatéral (Stablecoins décentralisés)

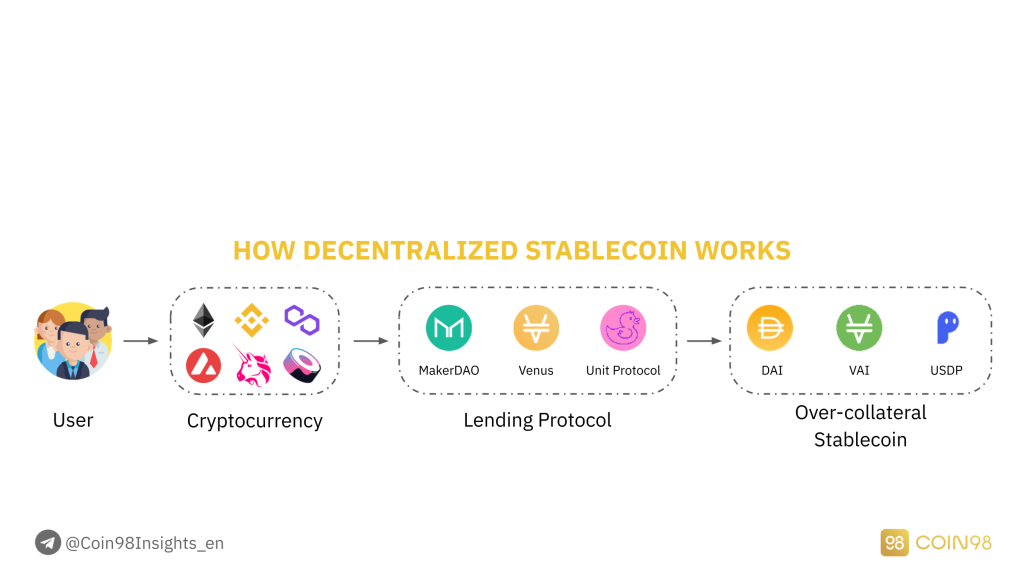

Le Stablecoin surgarantie est le deuxième type de Stablecoin le plus populaire, qui est créé lorsque la valeur de la garantie est supérieure à la valeur des Stablecoins frappés. Le Stablecoin Over-collateral le plus important est DAI - un stablecoin généré par MakerDAO, un protocole de prêt.

Les attributs d'un Stablecoin surcollatéral :

Pour frapper DAI sur le marché, les utilisateurs doivent garantir d'autres crypto-monnaies afin que leur valeur totale soit au moins 150% supérieure au nombre de DAI frappés. Si le prix des actifs tombe en dessous du seuil autorisé, ces actifs seront liquidés pour garantir la valeur du DAI frappé.

Cela a maintenu le prix de DAI stable et indexé à 1 USD. Néanmoins, cette approche limite l'évolutivité des jetons DAI car son mécanisme n'est pas efficace en termes de capital (la frappe de DAI nécessite toujours une plus grande valeur de garantie).

Comment fonctionne Stablecoin décentralisé.

Quelques stablecoins surcollatéral importants : MakerDAO (MKR & DAI), Venus (XVS & VAI), Party Parrot (PRT & PAI),...

Et c'est exactement ce qui s'est passé le 12 mars 2020. Lorsqu'un Flash Dump a eu lieu, le prix de l'ETH a été divisé par deux en 2 jours, sans parler de la congestion du réseau Ethereum. Malheureusement, cela a entraîné d'énormes liquidations d'actifs.

En termes d'efficacité du capital, les Stablecoins surcollatéral ne peuvent pas utiliser de fonds puisque le nombre de Stablecoins autorisés à être frappés ne représente que 75% de la valeur de la garantie, voire 50% si les utilisateurs veulent éviter un Flash Dump comme mentionné.

En fait, la plupart des protocoles de prêt permettent de déposer des garanties pour emprunter d'autres Stablecoins comme l'USDT ou l'USDC, au lieu du mécanisme de surgarantie comme DAI. C'est la principale raison pour laquelle MakerDAO domine le segment Over-collateral Stablecoin.

Stablecoins sans réserve (Stablecoins algorithmiques)

Les Stablecoins sans réserve, ou Stablecoins algorithmiques, sont des Stablecoins frappés sans réserve garantie . Les protocoles utilisent des algorithmes pour ajuster en permanence l'offre en circulation du Stablecoin afin de maintenir son prix à 1 $.

Les attributs d'un Stablecoin Algorithmique :

Les Stablecoins algorithmiques comprennent 2 types principaux : le modèle de rebase et le modèle de seigneuriage.

1. Rebaser le modèle

Les Stablecoins suivant le modèle Rebase n'utilisent qu'un seul jeton, qui applique des algorithmes pour modifier l'offre en circulation du jeton et influencer le prix. Le projet le plus important utilisant ce modèle est AmpleForth (AMPL).

Toutes les 24 heures, l'offre AMPL sera modifiée en fonction du prix AMPL :

Le processus de rebase affecte directement le nombre de jetons dont dispose un utilisateur. En conséquence, l'équilibre offre-demande est maintenu pour ramener le prix de l'AMPL à son ancrage.

Quelques stablecoins algorithmiques de premier plan suivant le modèle Rebase : AmpleForth (AMPL), BASE Protocol (BASE), Yam Finance (YAM),...

2. Modèle de seigneuriage

Les Stablecoins suivant le modèle de seigneuriage utilisent 2-3 jetons secondaires dans le processus d'exploitation et de maintien du prix du jeton. Généralement, un jeton est un Stablecoin, et l'autre est un jeton appliquant certains mécanismes tels que Burn-Mint, Stake-Earn,... afin d'augmenter/diminuer l'offre/la demande du Stablecoin et de le maintenir à une valeur indexée.

Quelques stablecoins algorithmiques de premier plan suivant le modèle de seigneuriage :

Force : Aucun capital ou garantie n'est nécessaire.

Faiblesse : Théoriquement, Algorithmic Stablecoin peut résoudre les limitations de Full-reserve Stablecoin et Over-collateral Stablecoin. En réalité, Algorithmic Stablecoin est le type le plus inefficace et improductif car son prix ne peut pas être maintenu à 1 $ en raison de la pression de vente extrêmement élevée.

C'est le cas puisque les projets Algorithmic Stablecoin tiennent normalement pour acquis dès le début qu'ils ont une communauté forte et solide pour les soutenir dans le maintien du prix du jeton. Ils s'appuient sur la conviction que le programme d'incitation peut attirer un grand nombre de partisans du projet.

En effet, le Programme Incitatif (Farming) n'est pas suffisamment convaincant pour inciter les utilisateurs à suivre le projet sur le long terme. Les utilisateurs se concentrent uniquement sur l'agriculture avec un APR élevé, puis vendent les récompenses gagnées ⇒ créent une pression de vente > demande d'achat ⇒ ne parviennent pas à fixer le prix.

De plus, les Stablecoins algorithmiques ne sont pas largement appliqués sur le marché. À l'exception de Fei Protocol et Terra USD - les deux projets Algorithmic Stablecoin les plus fonctionnels à l'heure actuelle, aucun autre projet dans ce secteur ne se démarque.

Stablecoins à réserve partielle (Stablecoins à réserve fractionnaire)

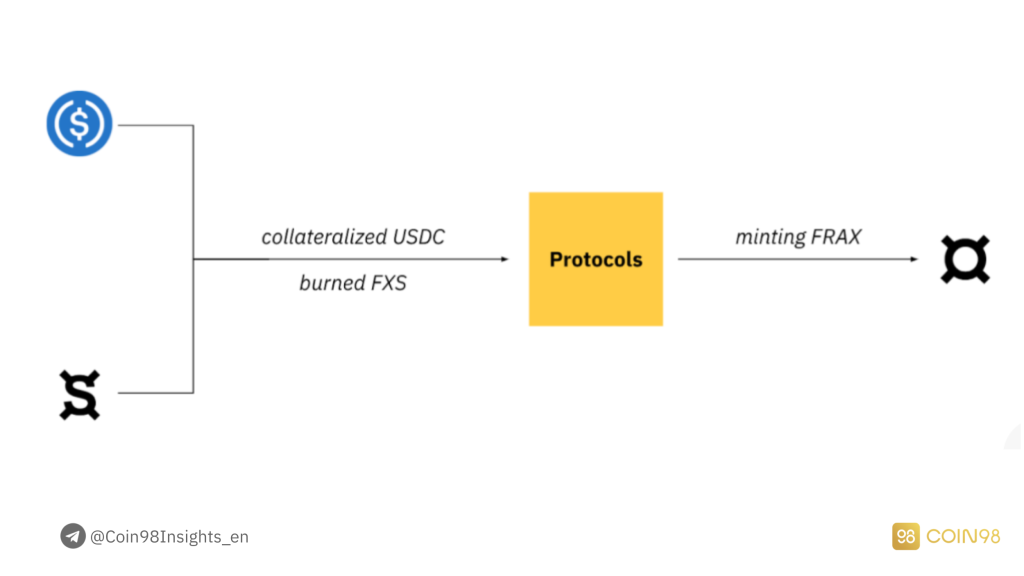

Les Stablecoins à réserve partielle, ou Stablecoins à réserve fractionnaire, sont la combinaison de Stablecoins à réserve complète et de Stablecoins algorithmiques . Le premier et le plus exceptionnel exemple est Frax Finance.

Les attributs d'un Stablecoin à réserve partielle :

Pour frapper 1 FRAX (un Stablecoin à réserve partielle), les utilisateurs doivent posséder des Stablecoins (actuellement USDT et USDC) pour subventionner le prix de 1 FRAX. Le ratio peut être ajusté selon Frax Finance, le taux de garantie allant de 50% à 100%.

Modèle FRAX.

Quelques Stablecoins à réserve partielle de premier plan : Frax Finance (FXS & FRAX),...

Force : Efficacité moyenne du capital, la combinaison de Stablecoin à réserve complète (nécessité d'une garantie) et de Stablecoin sans réserve (basé sur un algorithme).

Point faible : Frax Finance est actuellement le seul projet appliquant cette approche, ce qui montre que peu de développeurs s'intéressent à ce segment. Les données en temps réel indiquent également que la capitalisation boursière de FRAX est vraiment petite, et FXS n'a pas beaucoup d'applications dans DeFi ou CeFi.

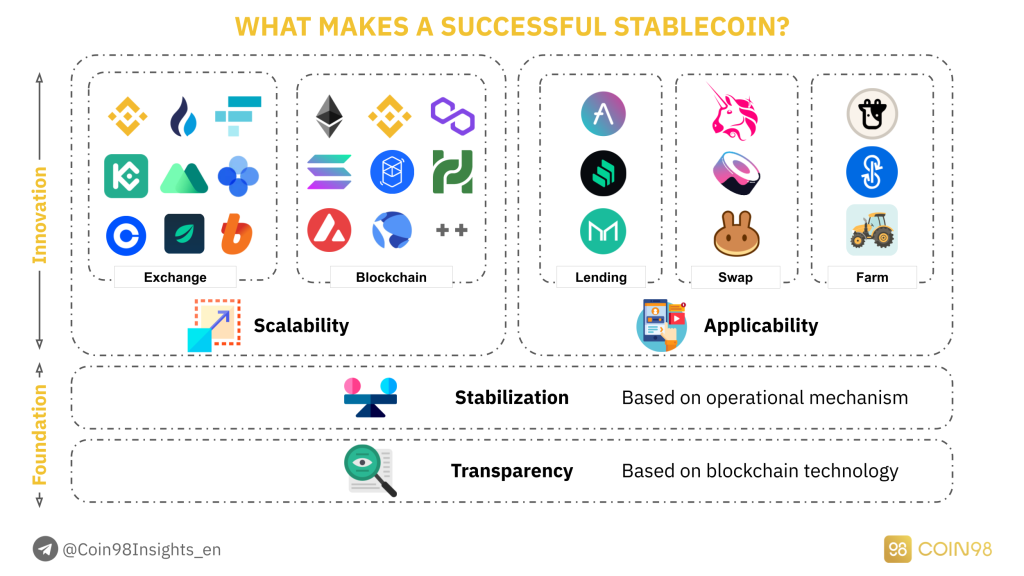

Les attributs d'un Stablecoin réussi

Après avoir passé en revue les forces et les faiblesses de chaque type de Stablecoin, nous allons maintenant examiner les facteurs qui créent un Stablecoin réussi et efficace. Ensuite, vous pourrez visualiser le processus de travail et d'expansion sur le marché de la cryptographie.

Pour qu'un Stablecoin fonctionne efficacement sur le marché, il doit disposer de la pile complète de 4 facteurs, notamment :

4 éléments qui font un Stablecoin réussi.

Transparence

La transparence peut être considérée comme le fondement de base d'un Stablecoin précieux. Qui sont les bailleurs de fonds de ce Stablecoin ? Si un Stablecoin est soutenu par des bailleurs de fonds énormes et réputés, il sera digne de confiance pour les utilisateurs de détail et les baleines à utiliser pour le commerce et le stockage. Par exemple:

La transparence d'un Stablecoin peut être évaluée par l'accès des utilisateurs aux outils de suivi, ou en d'autres termes, si les utilisateurs peuvent suivre l'offre totale du jeton et les transactions sur la blockchain. Cependant, dans le cas des Stablecoins centralisés comme l'USDT ou l'USDC, leurs transparences sont encore discutables car il n'est pas certain que le montant d'USD enfermé dans le Vault of Tether ou Circle soit relatif aux Stablecoins frappés.

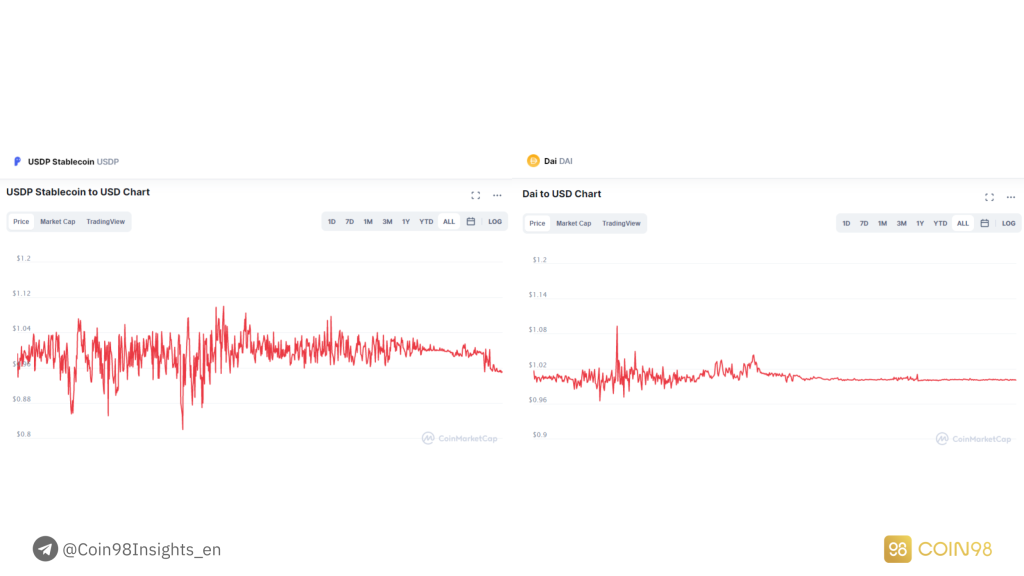

Stabilisation

Le prochain élément à considérer est la stabilisation, qui est également une caractéristique indispensable d'un Stablecoin . De retour à l'objectif initial, Stablecoin a été créé comme un outil pour éviter toute la volatilité du marché de la cryptographie.

Par conséquent, si un Stablecoin ne peut pas maintenir son ancrage de manière constante, ce Stablecoin ne peut pas être utilisé comme actif de stockage. Dans l'illustration ci-dessous, les deux Stablecoins DAI (MakerDAO) et USDP (Unit Protocol) seront comparés.

Alors que le prix du DAI a pu rester stable autour de 1 $, la valeur de l'USDP a généralement chuté à 0,95 $, perdant 5 % par rapport à 1 DAI.

Comparez USDP avec DAI.

Si la transparence et la stabilisation sont les conditions requises pour qu'un Stablecoin fonctionne de manière productive, alors l'applicabilité et l'évolutivité sont les deux facteurs qui aident un Stablecoin à se développer largement sur le marché.

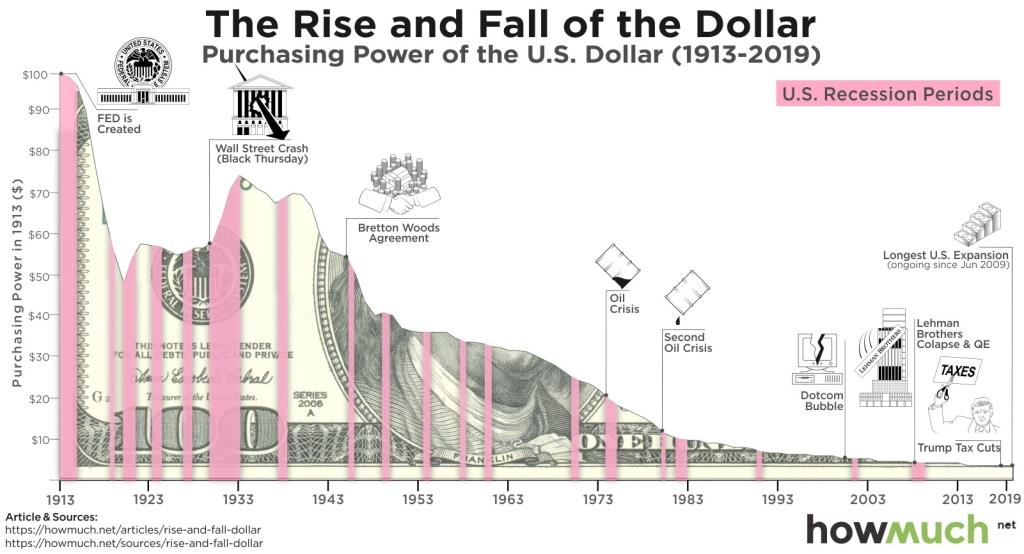

Analyse supplémentaire : le paradoxe de la stabilisation

La plupart des Stablecoins fixent leurs prix à l'USD, une monnaie Fiat soutenue par l'ensemble de l'économie des États-Unis. En conséquence, ils sont considérés comme plus stables que d'autres devises fortement inflationnistes et des actifs très volatils sur le marché des actions ou des crypto-monnaies.

Mais les Stablecoins sont-ils vraiment « stables » s'ils sont indexés sur l'USD ?

Selon les statistiques fournies par HowMuch, de 1913 à 2019, la valeur intrinsèque de la monnaie dollar a été réduite de 90 %.

Ce qui signifie que si en 1913 100 $ pouvaient acheter 10 kg de riz, en 2019 100 $ ne pouvaient acheter que moins de 1 kg de riz. Cela s'est produit parce que les États-Unis ont abandonné les normes de l'or et du pétrole, permettant à la FED d'imprimer librement de l'argent sans aucun actif physique soutenant sa valeur. Cet événement a créé une énorme inflation en USD.

La récente flambée des prix du Bitcoin était-elle donc le résultat du système de pompage ou de la baisse de la valeur du dollar ?

USD value reduces over time

Scalability

Scalability can be considered the Network Effect of a Stablecoin. When a Stablecoin expands its operating range, a corresponding amount of influence also increases.

On CeFi platforms, especially Centralized Exchanges, USDT is a gigantic force as it is used as the primary trading asset on some biggest exchanges at the moment, such as Binance, Huobi, FTX, OKEx, KuCoin,...

On DeFi platforms, USDC is having the greatest impact because it is the most common asset when it comes to creating Liquidity Pools. Even though USDC was released 3 three years after USDT, it has quickly issued its stablecoins on multiple developing DeFi ecosystems like Ethereum, BSC, Polygon, Fantom, Solana,...

Besides USDT and USDC, BUSD is another rapidly growing Stablecoin thanks to Binance as it is not only used as a trading asset on Binance Exchange, but also implemented in DeFi protocols on Binance Smart Chain.

Applicability

Given that a Stablecoin is widely expanded, at the same time exerting a considerable influence on the crypto market. The next step for it is to improve the Applicability.

For example:

Applicability needs to be developed alongside Scalability after Transparency and Stabilization are solidly built.

Most prominent Stablecoins in the market

We have gone through some basic attributes that make a successful Stablecoin. However, the Stablecoin segment is extremely competitive with a high domination ratio.

Top 10 Stablecoins in the market account for 96% of the Stablecoin Market Cap. Why are the highest-ranked Stablecoins so dominant? In this part, we will seek the answers by analyzing the Case Studies of 5 Stablecoins with the largest Market Cap, including:

Top 15 Stablecoins at the moment. Updated: 7 October, 2021.

Tether - USDT

Tether (USDT) is acknowledged as the earliest Stablecoin in the crypto market. Up to this moment, Tether is the Stablecoin with the largest Market Cap, and having the greatest influence on the market.

Tether has the advantage of implementing an early advent, hence being able to build an incredibly strong Network Effect. Especially, all of the biggest exchanges like Binance, FTX, Huobi are using USDT as the main trading pair for other Altcoins.

Some exchanges have tried to be independent of USDT by issuing their own Stablecoins: BUSD from Binance, HUSD from Huobi. Nonetheless, USDT remains to be the most widespread among every CeFi exchange.

Not to mention on OTC markets, USDT is currently the main gateway for worldwide users to swap from Fiat-currencies to cryptocurrencies. In spite of the fact that OTC markets are still allowing the exchange of other cryptocurrencies like BTC, ETH,... USDT is still dominating the market with high liquidity, low slippage and the ability to be directly traded to other Altcoins across different exchanges.

USD Coin - USDC

Although USDC was founded after USDT, it possesses the advantage of being more friendly to the law system by receiving support from enormous backers, especially Coinbase. Moreover, big exchanges like Binance, KuCoin, and Huobi also use USDC.

Nevertheless, the reason behind USDC’s success is the approach to the DeFi Market. Instead of issuing a large number of Stablecoins on the Tron network like USDT, USDC quickly issued its Stablecoins on other developing DeFi ecosystems, namely Ethereum, BSC, Polygon, Solana, and Fantom.

By seizing the chance faster, Circle did not have to wait for long to take over the DeFi market and attract more users to utilize USDC in the DeFi space.

Binance USD - BUSD

Binance USD is the product made by the cooperation between Binance and Paxos (the managing company of PAX Stablecoin, recently changed its ticker to USDP). Despite the fact that BUSD was released after USDC, USDT and DAI, BUSD has the fastest growth.

Thanks to Binance, BUSD has been broadly applied in Binance Exchange since the beginning of 2020 by being paired with myriads of other tokens, at the same time providing free transaction cost to the paired assets.

When Binance Smart Chain exploded as a phenomenon in March 2021, Binance increased the issuing rate of BUSD on Binance Smart Chain and made it a pairing asset for liquidity pools just like USDT and USDC, which resulted in the tremendous growth of BUSD recently.

Though BUSD is applied in both DeFi and CeFi, its Scalability outside the Binance ecosystem is strictly limited. This situation is pretty understandable because no competitor wants Binance to dominate the market.

Dai - DAI

DAI is an Over-collateral Stablecoin created by the lending protocol MakerDAO. At the moment, MakerDAO is the top 4 lending project in crypto with over $12.7B TVL (Total Value Locked). The Market Cap of DAI is around $6.5B, showing that the Collateral ratio is currently around 49%.

Not only does MakerDAO allow common assets to be used as collateral, but it also supports the collateralizing of LP tokens from Uniswap, helping MakerDAO attract many more users through its diversity.

The advantage of MakerDAO was being founded really early, forming a substantial Network Effect. In terms of coverage across different DeFi ecosystems, DAI is even more popular than BUSD, and only behind USDT and USDC.

Terra USD - UST

Terra USD is a very special Stablecoin as it is the combination of a Full-reserve Stablecoin and an Algorithmic Stablecoin. To maintain the peg price at around 1 USD, Terra USD is backed by LUNA (Full-reserve) and has its price adjusted by an algorithmic mechanism (transfer the price volatility to LUNA).

The success of UST comes from 2 factors:

The first is an effective work model. This was proved through the market collapse on May 19, 2021, which made LUNA price fall from $16 to $4.

If the same thing happened to ETH, MakerDAO and DAI would definitely be considerably affected as ETH was the biggest collateral asset, therefore activating a Domino chain of constant liquidations. However, after that event, UST still stood steadily thanks to the anti-price manipulation mechanism, and then quickly returned to its peg.

The second is the support from the Terra ecosystem (#3 DeFi ecosystem in terms of TVL). UST seems to be the one and only Stablecoin of the ecosystem. As a result, all protocols inside Terra try to capture the value for UST. The most prominent protocol among them is Anchor, a lending platform that allows UST saving with up to 20% APR.

Data analysis of Stablecoin

I hope that with the analysis above, you have visualized the work model of Stablecoins in the market. How can they succeed, and how can they take over the market? In this part, I will dive deeper into the influence of Stablecoins on the crypto market through data analysis.

The Market Cap of Stablecoins

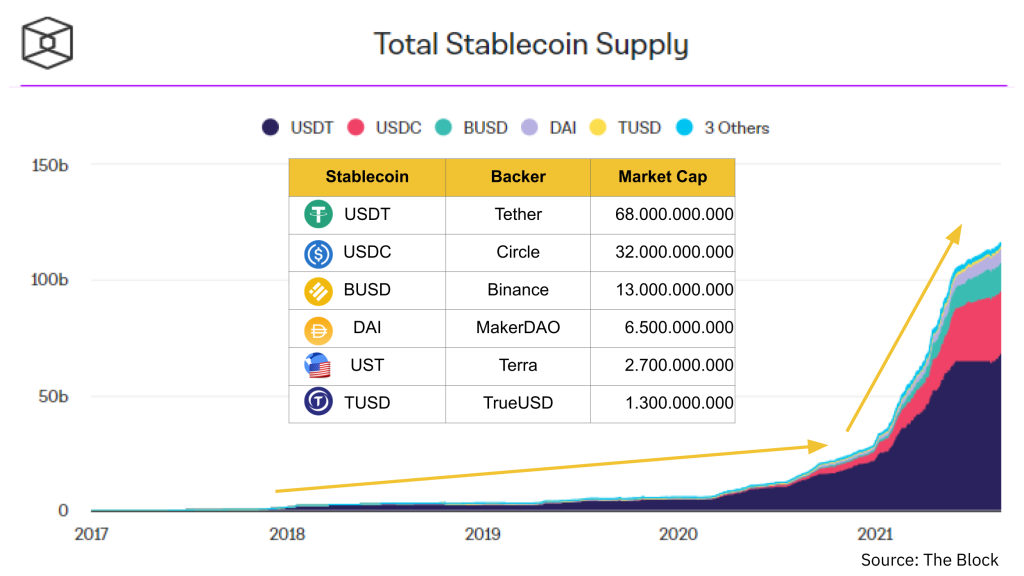

Stablecoins' Market Cap over time.

Market Cap ranking: USDT (#1), USDC (#2), BUSD (#3), DAI (#4), UST (#5), TUSD (#6).

According to the data above, the Market Cap of USDT is overwhelming at $68B, two times higher than that of USDC, even though no other Stablecoins in the market can surpass USDC.

The chart above also shows the two main periods of the crypto market:

Accumulating period (2018 - mid 2020)

In this period, Stablecoins grew slowly but steadily. This matched the market condition at that time when most crypto participants were retail investors, and the DeFi market didn’t receive much attention.

Furthermore, the Market Cap of the whole crypto market was really small, so every action from Tether brought about a huge influence. Every time Tether announced to “issue” more Stablecoins, the price of BTC pumped along.

Booming period (mid 2020 - now)

Forward to the second period, the market received more attention from whale investors and hedge funds, attracting a massive cash flow into the crypto market. The DeFi market gradually became more complete and appealing to the builders and investors.

Since September 2020 to now, the DeFi TVL has increased from $1B to more than $191B. The tremendous growth of DeFi has created a high demand for Stablecoin.

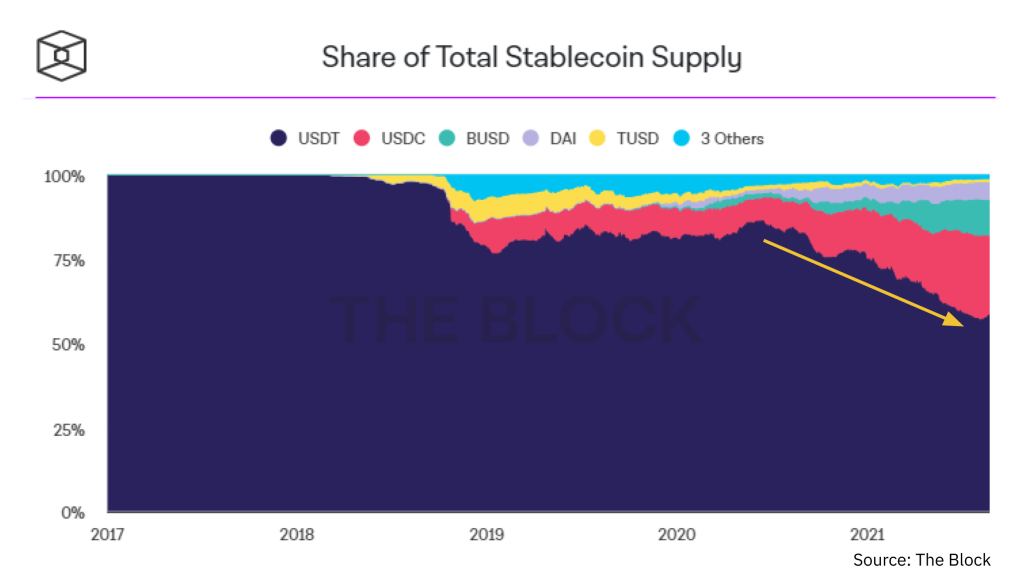

The Market Cap of USDT compared to other Stablecoins.

Although Tether's Market Cap is still overwhelming compared to other Stablecoins, USDC is also worth noting. If you take a close look at mid 2020, you will notice that the Market Cap of USDC rose incredibly fast, and it was at the same time when DeFi started its tremendous growth. That is the reason why when it comes to the DeFi market, I usually prioritize tracking USDC activities over others.

⇒ USDT and USDC are the two key Stablecoins in the market, so we should follow their activities closely because Stablecoins can be regarded as the cash flow supporting the market growth.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi

In the second period, the short-term price pumps of Bitcoin have been separated from Tether’s announcements on issuing Stablecoins. Nonetheless, Stablecoins will still be exerting an enormous influence on the market in the long term, as Stablecoins are the gateway for users to get access to the market and the inside assets.

More specific details can be illustrated in the pictures below. The growth of the market has brought along the demand for Stablecoins, and when Stablecoins were minted to satisfy the market’s demand, DeFi was the most rapidly growing sector.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi.

But if you take a look at the time around May 2021, when the growth of Stablecoins slowed down, the crypto market in general and the DeFi market in particular collapsed shortly after (on May 19, 2021).

However, the Market Cap of the Stablecoin sector did not decline but actually slightly increased, showing that Tether and Circle (2 big companies in the field) did not burn Stablecoins out of the market. This indicates that the number of investors going into the market was still higher than the number of investors going out.

Consequently, in late July 2021, the crypto market witnessed a strong recovery thanks to the afore-minted Stablecoins in the market.

⇒ In the long term, the growth of Stablecoins is the key to speculate the growth of the whole crypto market. If you are following the DeFi market, don’t miss out on any moves from USDC as it is currently the fastest growing Stablecoin in DeFi.

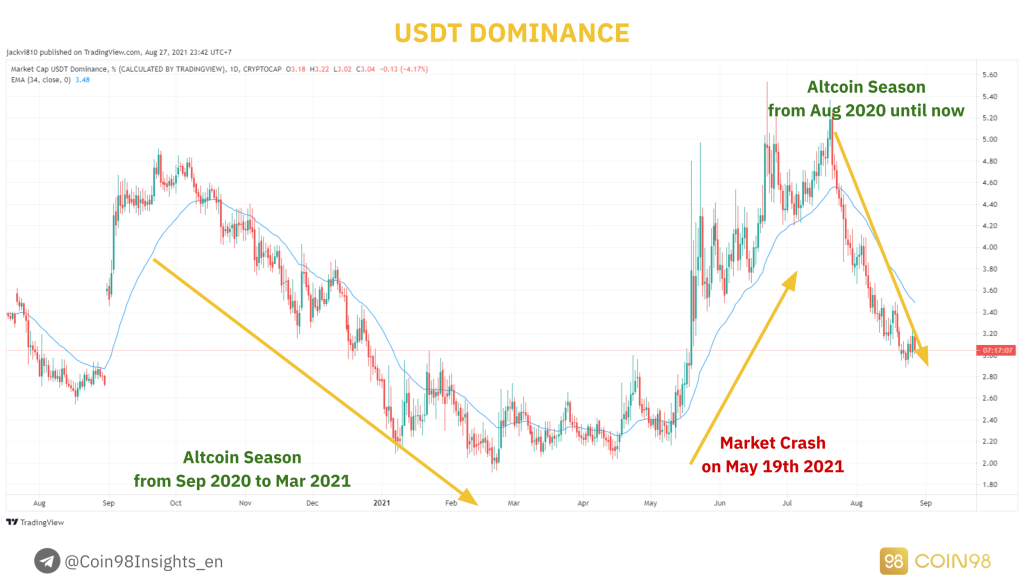

Stablecoin Dominance

Stablecoin Dominance is the measure of Stablecoin’s Market Cap relative to the Market Cap of the rest of the coins. Here is an example of the USDT Dominance index (USDT.D) from Tradingview.

Although there are still a variety of Stablecoins in the market, the Market Cap of USDT takes up more than 50% of the market, and it has been acknowledged as the representative index of the whole Stablecoin segment, so we will analyze the movement of USDT.D.

How USDT Dominance is related to the market condition.

⇒ We can rely on the USDT.D index to define the market trend, therefore understanding the right time to invest, and the right time to take profit.

Stablecoins in DeFi ecosystems

As analyzed above, Stablecoins play an important role in being the gateway for the cash flow from the Fiat-currency market to the cryptocurrency market.

If you are aware of how the cash flow in the crypto market transfers between different layers, then Stablecoins play the same role of allowing investors to transfer their funds from the crypto market (macro) to blockchain ecosystems (micro).

In this part, I will analyze 3 Case Studies of 3 blockchain ecosystems. Namely Terra, Solana and Avalanche, so you can understand the role of Stablecoins in the growth of DeFi ecosystems.

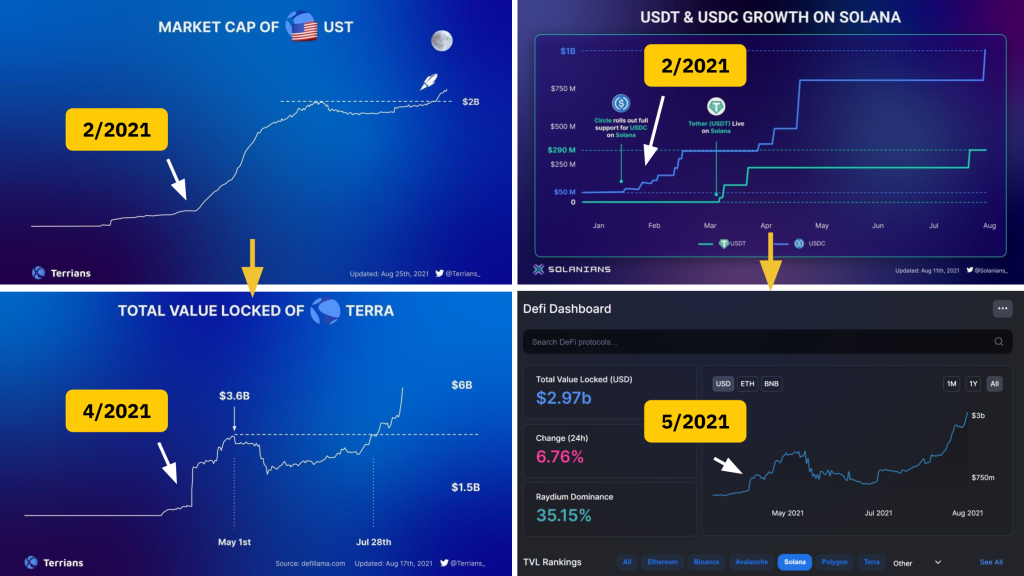

The Market Cap and TVL of Terra (left) and Solana (right).

Case Study 1: How did Terra USD foreshadow the growth of the Terra ecosystem?

Recently, we have witnessed the substantial growth of the Terra ecosystem with its TVL surpassing $6B, becoming the third largest ecosystem in the market behind Ethereum and Binance Smart Chain in terms of TVL.

The increase in TVL has produced a positive effect on the LUNA price, increasing the price of LUNA 700% since the market crash in May 2021. The question is, how could the TVL in Terra increase so rapidly?

The main catalyst is the Market Cap growth of Terra UST - the one and only Stablecoin in Terra. If you notice the chart above more carefully, you can see that when the DeFi TVL in the ecosystem rose, the UST Market Cap had seen an explosive growth 2 months before that, exceeding TrueUSD (TUSD) and Paxos (PAX) - two prominent Stablecoins in the market.

Case Study 2: USDC & Solana - the cooperation that grew Solana tremendously

Since February 2021, when the crypto market was not yet active, Circle and Solana Foundation had already started to issue more USDC into the Solana ecosystem to develop DeFi. Afterwards, in May 2021, the DeFi sector on Solana began to attract more users and reached $1.5B TVL.

During that period, the price of SOL (Solana native token) rose from $10 (February 2021) to $50 (May 2021). Even though a market crash happened shortly after, the number of Stablecoins on Solana continued to rise. In fact, the pace of issuing Stablecoins on Solana at that time was even faster than when the market was extremely active.

And the result is crystal clear: Since July 2021 to now, the cash flow into the Solana ecosystem has not stopped, helping the DeFi TVL to reach $3B. Every token in the Solana ecosystem has been growing tremendously (SOL, SRM, RAY, MNGO, SBR, ORCA,...) especially SOL has recovered from $25 to $170 at the time of this writing.

Case Study 3: Avalanche got in the sight of Tether

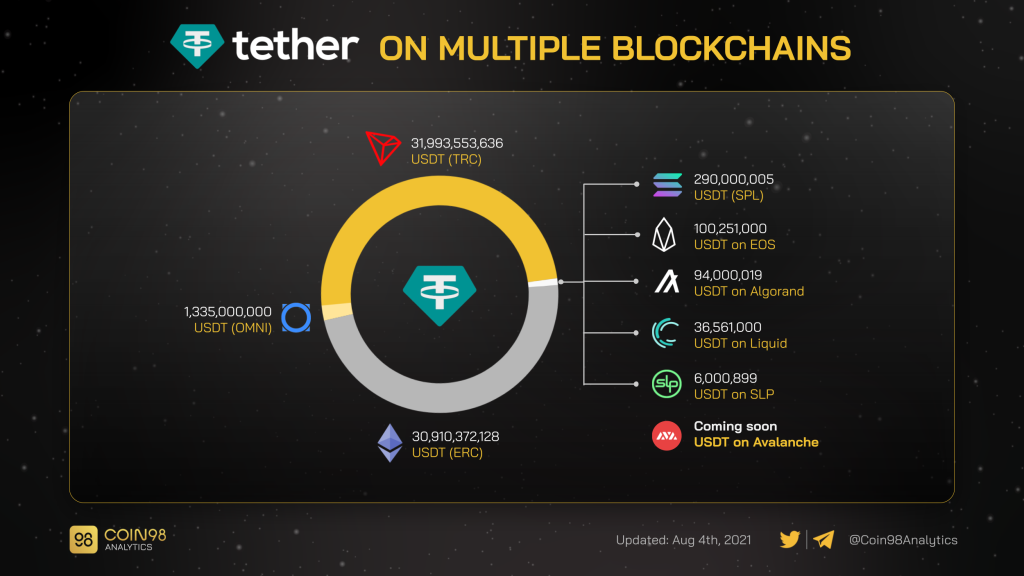

Tether has been deployed on multiple chains. Although the Market Cap of Tether on Tron and Ethereum accounts for the most, Tether has not issued any additional USDT on Tron, Omni, EOS, Algorand,... since earlier this year. Instead, Tether has now focused on Ethereum, Solana and Avalanche.

This resulted from the fact that they were the three immensely developed DeFi ecosystems. To compete with USDC, Tether quickly supported USDT on Avalanche to help the growth of the Avalanche ecosystem, therefore assisting tokens on Avalanche (AVAX, PNG, SNOB, XAVA) in recovering after the market collapse.

Aside from the Market Cap and Dominance index, the pace of growth is also an imperative index to track. For instance, even though the number of USDT on Solana is still incredibly small, at the same time, it is increasing at the most rapid pace compared to other ecosystems. Will that case happen again, but this time with Avalanche?

The number of USDT on different blockchains.

In conclusion, the investment opportunities do not come from Stablecoins, but from the movement of the market and of different blockchain ecosystems. Stablecoins help you to navigate that movement.

Note:

However, this case is only applicable to ecosystems with small TVL like Solana, Polygon, Terra, Avalanche, Fantom,... because when the ecosystem’s TVL is still insubstantial, the influence of issuing Stablecoins will be more immense, hence creating a motivation for the ecosystem to thrive.

To comprehensively developed ecosystems such as Ethereum and Binance Smart Chain, issuing Stablecoins does not matter that much as the number of Stablecoins being issued is too insignificant compared to the DeFi TVL of that ecosystem.

To speculate the cash flow efficiently, you have to:

Some useful tools to track Stablecoin indexes:

Stablecoin reserve on exchanges

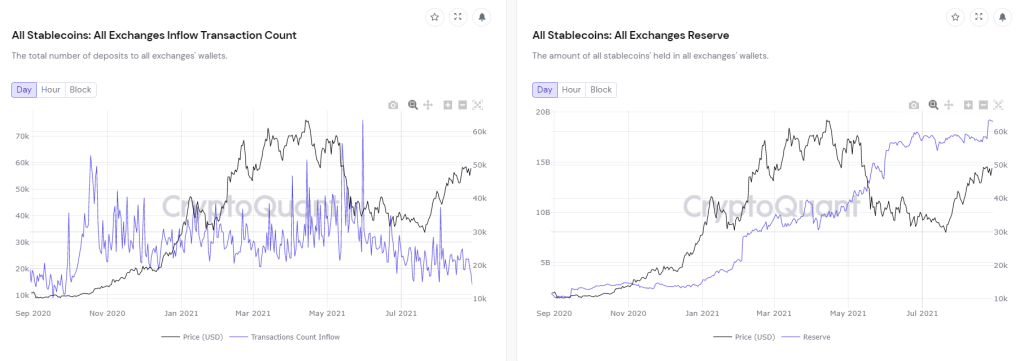

Stablecoin reserve on exchanges.

Similar to the index of BTC Inflow & Outflow, the Stablecoin Exchanges Inflow & Outflow index allows investors to track the buy demand of the market. There are 2 circumstances:

In the long term, this index is correct to some extent. Before Bitcoin reached ATH (All-time high) in March 2021, the Stablecoin Reserve index had increased dramatically in November 2020 (5 months before). Before Bitcoin recovered in August 2021, the Stablecoin Inflow index had also risen significantly in June 2021.

However, the crypto market moves really quickly but this index does not show responsive signs in the short term (about 1 month). That is why this index should only be regarded as an additional tool to gather more information rather than a primary one, compared to the aforementioned methods.

How have Stablecoins evolved?

After going through some prominent Stablecoins, how they work and how they influence the crypto market, we will now look at the evolution of Stablecoins, hence defining the period we are at and predicting future Stablecoin movements.

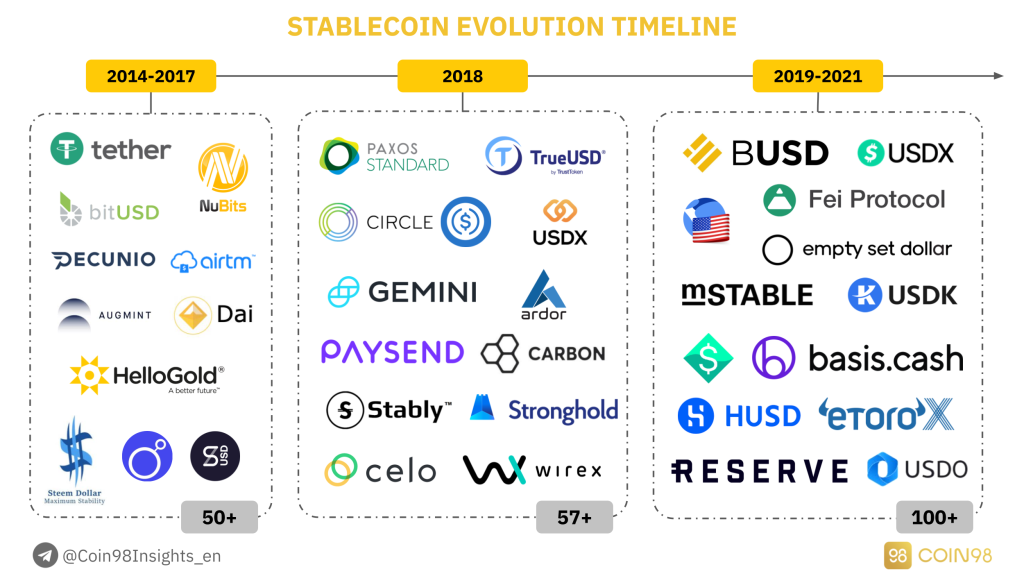

The evolution of Stablecoin.

First period (2014 - 2017): Pioneers in the Stablecoin sector

At an early stage of the first period, Stablecoins had the sole purpose of tokenizing all popular Fiat Currencies across the globe. Stablecoins were used mainly to resolve the problem of transactions’ cost and speed of the traditional financial system.

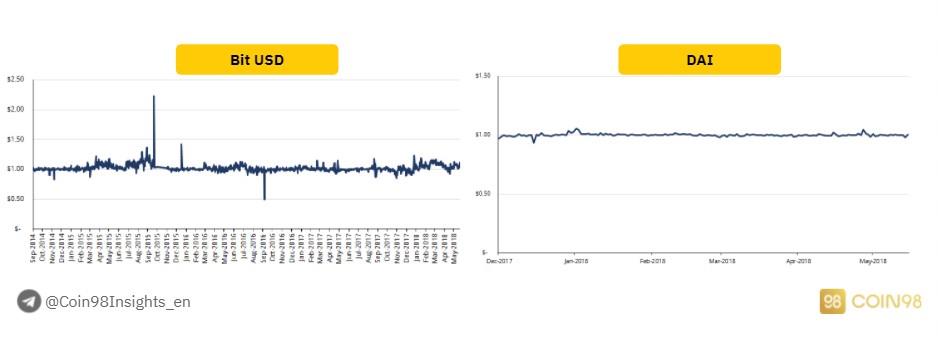

The most prominent of all was Bitshares, a platform founded by Charles Hoskinson (Ethereum's Co-founder and Cardano’s Founder). Bitshares tokenized a wide range of currencies, including CNY (BitCNY), Euro (BitEUR), USD (BitUSD), Gold (BitGOLD),...

Nevertheless, in order to create Fiat-backed cryptocurrencies, users had to collateralize BitShares with a larger amount. As BitShares were highly volatile, the value of Stablecoins such as BitUSD, BitEUR,... was not stable. Not to mention that with low liquidity, BitShares could be easily manipulated by speculators.

Compare Bit USD with DAI.

Fast forward to the end of the first period which is about 2017. The crypto market started to be recognized, and other Stablecoins like DAI and USDT started to appear. DAI was created and sustained up to this moment due to the incredibly high demand for lending & borrowing in the market. The stability of DAI was also better.

Meanwhile, USDT was backed by a gigantic force - Bitfinex. Bitfinex used to be the largest exchange in 2017, until Binance attracted more retail investors to its platform though most whales still stayed in Bitfinex. The substantial influence of Bitfinex at that time was the main catalyst that kept USDT stable around its peg and stood still till now.

Second period (2018): The boom of Stablecoins

The first period was the prerequisite for the second period, which was the most booming period of Stablecoins. The market witnessed the advent of various Stablecoin platforms as this was also the time when the crypto market became “Mainstream” in 2017, after Bitcoin reached an ATH of $20,000.

The demand to invest in Bitcoin as well as the demand for Stablecoins increased. To compete with USDT being backed by Bitfinex, a variety of exchanges issued their own Stablecoins (Gemini issued GUSD), whereas payment platforms also did the same thing (Paysend).

Stablecoins became a “trend” for whales to increase their influences on the crypto market that was already small. If you take a closer look at the illustration above, you can see that in 2018, more than 57 Stablecoin platforms appeared, ranging from Full-reserve Stablecoins to Over-collateral Stablecoins and Algorithmic Stablecoins.

This was also the time when Stablecoins that later became dominant made their debuts, namely Circle (USDC), Paxos (PAX), TrueUSD (TUSD),... they are the three major competitors of Tether (USDT).

Third period (2019-2021): Selection and elimination

From my perspective, the Stablecoin sector is currently in this period. After the booming phase in 2018-2019, myriads of Stablecoin projects appeared, at the same time a large number of projects showed their weaknesses.

Which is the main reason why in the third period, the market will begin the selection and elimination process, especially the recession of Algorithmic Stablecoin projects as they are not working efficiently (cannot maintain the peg price).

You can visualize the situation more clearly through the picture below along with the market’s real-time data. Over 200 Stablecoin projects have been developed, but the number of active and productive projects is only around 10 (USDT, USDC, BUSD,...). More and more Stablecoin projects are gradually fading into oblivion.

The number of active Stablecoins, in development, and closed.

Fourth period (2021+): Expand

The most important keyword to define the third and the fourth period is the Network Effect. As mentioned earlier, the Stablecoin segment is exceptionally competitive.

Among over 200 projects, only nearly 10 of them have an influence on the market. This forces Stablecoin platforms to constantly develop and expand so as to account for as much of the market as possible, including both DeFi and CeFi.

Except for USDT dominating the market for so long, USDC is a noteworthy Stablecoin in the fourth period. Officially launched in 2018 (3 years after Tether), USDC quickly deployed its Stablecoin on 10+ blockchains and focused mainly on the DeFi market, which was growing tremendously at that time. This approach made USDC more well-known than USDT in the DeFi market.

At the moment, BUSD is still following the Network Effect improvement scheme. Binance has been listing more BUSD trading pairs, issuing more BUSD to be used in the Binance Smart Chain ecosystem, with a vision of replacing USDT and USDC.

In the future, UST will definitely increase its Network Effect by accessing the Binance Smart Chain ecosystem and the Solana ecosystem - the two ecosystems possessing the largest cash flow behind Ethereum.

Anticipate the future of Stablecoin

Stablecoin weaknesses

We have gone through the approach and evolution of Stablecoins. So how can they be improved in the future to get rid of the current weaknesses? The answer to this question can be found in this part.

If you notice, Stablecoins are having 2 major issues without a solution which are Transparency and Applicability:

How Tether printing USDT affected the market.

Developing Stablecoins

Major companies are trying to create a Stablecoin that can solve both of the above problems, which can look like:

Some potential Stablecoins in development.

4 Stablecoins that are currently developing to satisfy the above requirements are:

1. Telegram TON

Pavel Durov - the founder of Telegram has been trying to issue a Stablecoin with high stability and high liquidity. However, he gave up the project after being pressured by SEC on the legal aspect.

2. Libra

During the past time, Facebook has been trying to create Libra and make it a global currency. Libra will be backed 50% by USD, 18% by EUR, 14% by JPY, 11% by GBP and 7% by SGD. However, it didn’t take long for Libra to fail as the Congress of the United States realized the threat of a private company competing with a public bank.

However, their ambition seems to remain enormous because after the failure of Libra, Facebook created Diem - Libra 2.0. At the moment, they have been able to cooperate with a variety of partners in the finance department in order to start expanding and integrating with social media applications like Facebook, Whatsapp,...

3. LPM Coin

JP Morgan - one of the biggest banks in the world, plans on creating JPM Coin, a Stablecoin that can replace the obsolete payment system Swift. Nonetheless, they have not made any further announcement. If JP Morgan successfully introduces their product, other major banks like HSBC, Citibank, Wells Fargo will also participate in the play.

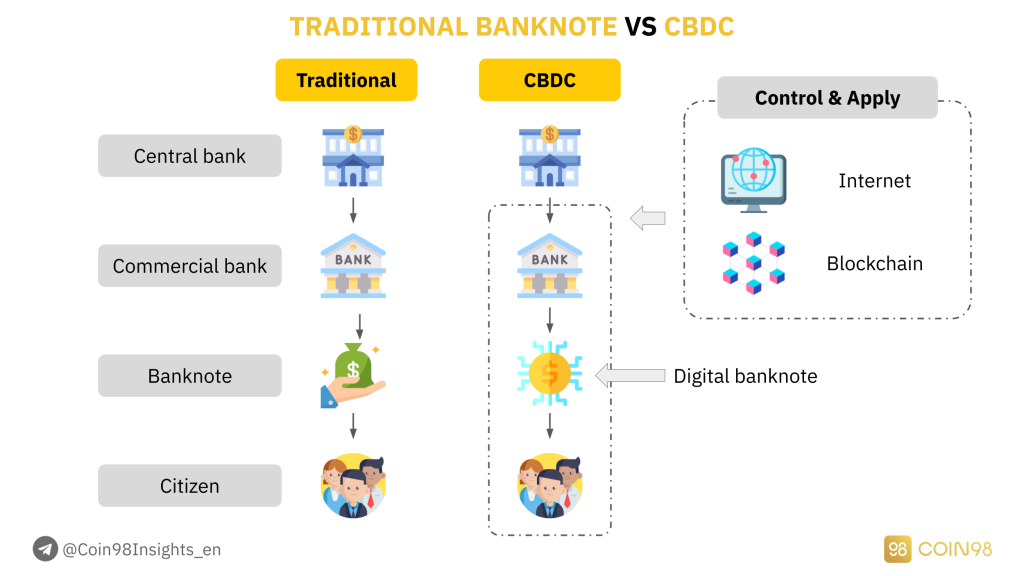

4. CBDC

The last Stablecoin, at the same time the most realistic one is CBDC. CBDC is short for Central Bank Digital Currency. Currently, many Western banks and China banks have been experimenting with the CBDC model and tried to apply it to their work models.

The difference between Traditional Banknote and CBDC.

Although there are still some limitations such that it is not yet possible to be applied worldwide, CBDC can be considered a Stablecoin comprehending all the benefits that the blockchain technology brings, namely transparency, tracing ability to prevent money laundering, low transaction cost, high speed.

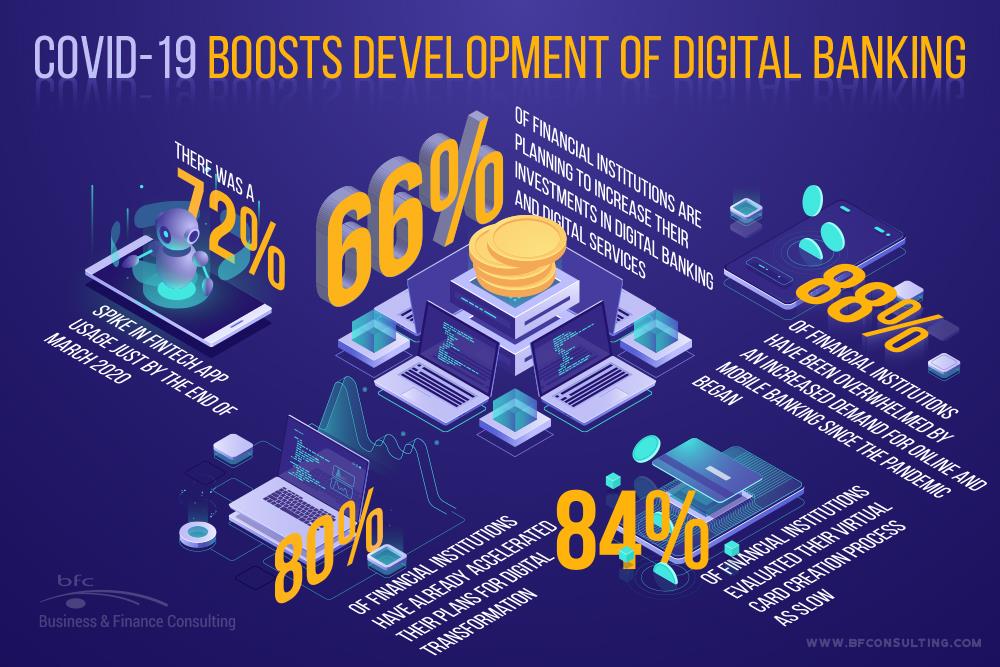

There is no doubt that CBDC will be applied in the future by not only commercial banks but also public banks. Moreover, the Covid 19 event taking place all around the world has shown how important CBDC can be to the global economy in the future.

When everyone has difficulties in commuting and using cash, CBDC becomes an optimal solution for the financial market to operate smoothly.

Covid-19 motivates the growth of Digital Banking.

Investment opportunities with Stablecoins

In terms of investment opportunities with Stablecoins, I can distribute into 2 types:

Now let’s go through each type of investment.

Discover investment opportunities through Stablecoin indexes

As mentioned above, Stablecoin is not the sector to invest in. The best way to make a profit from Stablecoin is to observe its movement and make decisions based on the cash flow.

Anytime Stablecoins are issued in an ecosystem, the cash flow immediately has the tendency to get into that ecosystem:

So in order to not miss any market trend, you have to observe and track them before they “take off”. Here are some useful questions that can help you find your own insights:

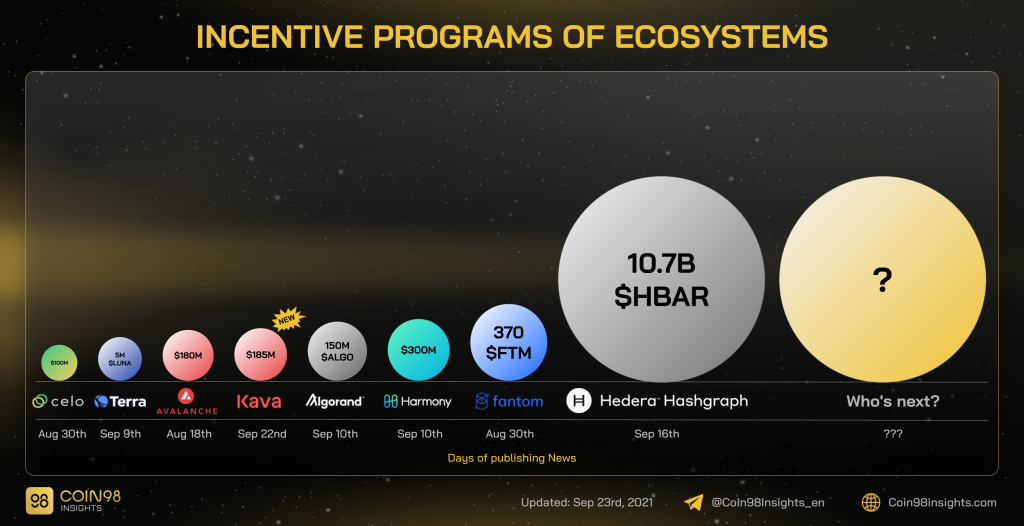

Most recently, multiple ecosystems have announced their DeFi incentive programs, including:

Incentive programs in different blockchains.

It is worth following the Stablecoin movement in these ecosystems and see if they are issuing any new Stablecoin or cooperating with any 3rd-party to do so.

Directly investing using Stablecoins

Nevertheless, if you own a large amount of capital and want to earn with zero risk in this market, using Stablecoins can still be the way to go.

Although the Yield is not as high as using Altcoins, using Stablecoins allows you to be flexible regardless of the market condition. Here are some advisable methods:

1. Lending (4 - 8% APR)

You can deposit Stablecoins on CEXs or lending platforms to receive savings. The advantage of using Lending is its simple interactions, transparent interest, and optional deposit period.

Here are some platforms that you can use Stablecoins to earn savings:

CEX: Binance, Huobi, Gate, MXC, OKEx,...

Centralized Lending: NEXO, BlockFi,...

Decentralized Lending:

However, the disadvantage of using Lending protocols is that the interest rate is pretty low, ranging from 4-8%/year. If you want to receive higher yields, take a look at Farming.

2. Farming (20 - 40% APR)

Farming is the approach to provide liquidity for decentralized exchanges to receive platform fees and the native token of the platform. To follow this way, you have to know some basic actions in DeFi, like providing liquidity.

The advantage of Farming is a higher yield with up to 20-40% per year, which is a really high interest rate. In Viet Nam, if you deposit USD, you won’t even receive interest. Whereas if you deposit VND, you will earn a 7% interest rate but the annual inflation rate is even higher than USD.

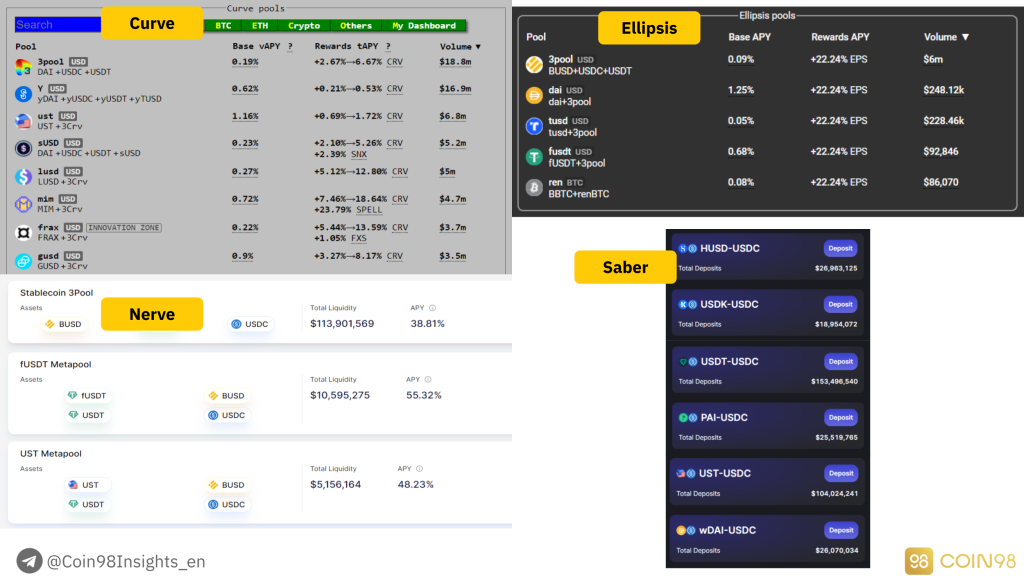

DeFi is really a gateway bringing a vast amount of opportunities to earn yields, and you can totally use Stablecoins to make a profit before actually investing in the market. Here are some Stablecoin AMM platforms that you can use for Farming:

Farming Stablecoins.

However, Farming on decentralized protocols has some particular risks, especially in the case of the protocol being hacked, which is why you should distribute your Stablecoin into smaller parts and use them on prestigious and high TVL platforms.

Conclusion

Here are some insights that you can use to find investment opportunities with Stablecoins:

J'espère que cela vous a aidé à acquérir des informations plus précieuses sur ce secteur et sur la manière dont vous pouvez réaliser des bénéfices en utilisant Stablecoins.

Si vous souhaitez en savoir plus sur ce sujet, n'hésitez pas à laisser un commentaire ci-dessous et à rejoindre la communauté Coin98 pour de plus amples discussions !

Cet article présentera quelques projets Fork du grand projet Algorithmic Stablecoin. Est-ce une tendance en 2021 ?

Qu'est-ce que Stablecoin ? Quel est le rôle de Stablecoin sur le marché ? Combien de types de Stablecoin existe-t-il ? En savoir plus sur les Stablecoins ici !

En plus des stablecoins adossés à des fiat et cryptés, il existe un autre stablecoin qui est Algorithmic Stablecoin.

L'analyse du mécanisme d'action de Terra vous aidera à comprendre la différence entre UST et LUNA et comment Terra capture la valeur pour LUNA.

L'article présente l'algorithme stablecoin BAC et le mécanisme permettant d'assurer la stabilité des prix avec la possibilité de réaliser des bénéfices pour les investisseurs.

Mettez à jour la compréhension de base du protocole de base, vous offrant ainsi les vues les plus intuitives sur le jeton de ce projet.

Découvrez comment utiliser SushiSwap avec le portefeuille Coin98, y compris l

Cet article vous guidera sur la façon d utiliser Uniswap, y compris l échange, l ajout de liquidités et la migration de liquidités d Uniswap V2 vers V3, ainsi que des mises à jour récentes et des conseils pratiques.

Dans cet article, Coin98 vous guidera sur la façon d

Mina et Polygon travailleront ensemble pour développer des produits qui augmentent l'évolutivité, la vérification améliorée et la confidentialité.

Analysez et évaluez le modèle de fonctionnement d'Uniswap V2, le modèle le plus basique pour tout AMM.

L'échange Remitano est le premier échange qui permet d'acheter et de vendre des crypto-monnaies en VND. Instructions pour s'inscrire à Remitano et acheter et vendre des Bitcoins en détail ici !

L'article vous fournira les instructions les plus complètes et les plus détaillées pour utiliser le testnet Tenderize.

L'article vous fournira le guide le plus complet et le plus détaillé sur l'utilisation de Mango Markets pour découvrir toutes les fonctionnalités de ce nouveau projet sur Solana.

Dans ce premier épisode de la série UNLOCKED, nous ajouterons une couche de sécurité supplémentaire à votre portefeuille en utilisant les paramètres de sécurité.

L'agriculture est une bonne chance pour les utilisateurs de gagner facilement de la crypto dans DeFi. Mais quelle est la bonne façon de cultiver la crypto et de rejoindre DeFi en toute sécurité ?