Sei Network and Ecosystem Overview

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

EigenLayer provides a solution for ETH stakers to retake their ETH into a smart contract, helping to protect the security of other protocols. This retake benefits both the protocol and the stakers.

Collateral is staked to maintain the security of Ethereum and the protocol, which increases the security of the protocol. Stakers will receive staking rewards from two sources, from Ethereum and from the secured protocol. However, in exchange for securing other protocols, stakers face the risk of the protocols' punitive terms.

In blockchain design, decentralized security is a current challenge, especially for the Ethereum network. When middleware applications and non-EVM applications are developed on the Ethereum network, they will need to create a separate trust network to ensure security. However, building such a security system is expensive and requires a lot of resources to maintain and extend. With the development of many applications, security becomes more and more decentralized.

EigenLayer has introduced a new feature called “ReStaking” to solve the problem of decentralized security. The ReStaking feature is a set of smart contracts that allow ETH stakingers to retake their locked ETH to extend the security of other protocols. EigenLayer creates an intermediary layer that allows stakers to grant additional execution rights to staked ETH and effectively allows retakes for other protocols.

EigenLayer's ReStaking feature provides additional penalty conditions for ETH staked on the consensus layer. This extends security to other protocols such as bridges and data availability layers built on top of Ethereum. EigenLayer may implement ETH ReStaking for other protocols and use penalty conditions to incentivize validators to act honestly. EigenLayer's design also allows the project to provide authentication services outside of Ethereum.

ReStaking offers two basic ideas: pooled security (so-called secure cloud) and free-market governance.

Pooled security is the ultimate security system created by ReStaking. This system allows protocols to utilize the security of the Ethereum network and makes the cost to attack protocols significantly higher. Staked ETH is used as collateral to secure Ethereum and is also used to provide validation services for other protocols. With Pooled Security, participating validators will have to comply with new slashing conditions for their stake.

Free-market governance allows protocols to self-manage the amount of pooled security consumed. EigenLayer creates a competitive market for pooled security dictated by supply and demand. The important point here is that validators are not required to provide pooled security. Instead, they have the ability to define their own set of risk and reward parameters before providing services for a given protocol. This allows validators to choose the protocol they want to service, creating an open and competitive marketplace, and eliminating many of the inefficiencies that exist in current security models. ReStaking also minimizes the marginal cost of validator services because restakers can reuse their initial capital on various protocols other than Ethereum to earn additional profits.

EigenDA is the first application built on the EigenLayer platform. It is a data availability layer that brings a new paradigm to today's data availability landscape. EigenDA allows Ethereum to offload data availability within the security of the ecosystem, instead of having to perform off-chain operations.

The dual quorum model in EigenDA consists of Ethereum stakers (Ethereum's staking economic quorum) and the rest is run by RocketPool ETH stakers (or other liquid staking platforms). In order to achieve data availability, both quorum is required, which is a combination of economic trust and decentralized trust.

EigenDA is a pure data availability layer and can achieve up to 15 MB/s throughput even in its current state, 176 times higher than Ethereum's current throughput without danksharding. Built on top of EigenLayer with a high degree of freedom and using the core cryptographic architecture of danksharding, EigenDA can achieve projected throughput of up to 1 GB/s in the future.

In addition, EigenLayer can also be applied in some other areas such as Mev Boost, Oracle and Bridge.

EigenLayer offers the ability to participate in ReStaking with a variety of assets, including Native Staking, LSD restaking, ETH LP restaking and LSD LP restaking. Restaker can participate in two ways: Solo Staking or Trust Model.

With Solo Staking, Restaker can choose to provide validation services for protocols or delegate operations to other operators while remaining a validator for the Ethereum network. Meanwhile, with the Trust Model, Restaker chooses a trusted operator to authorize. If the selected operator does not comply with the agreement, they will be subject to certain penalties.

EigenLayer gives developers the ability to use the security of Ethereum without the cost of running their own security systems. When using the security of Ethereum, protocols are also allowed to control the underlying mechanisms, such as the consensus mechanism and the penalty mechanism. Thus, this will allow protocols to decide for themselves the important factors to prioritize, be it decentralization, scalability, or whatever else they desire.

Restaker allows EigenLayer to access their staked ETH. If there is ETH that has been staked through EigenLayer and this protocol is hacked or mined, this could have serious consequences for the safety of the Ethereum network.

Through this article, you have access to important information about EigenLayer. Protocol features and benefits were introduced, including the ability to participate in ReStaking with a variety of assets, the potential to ensure the security and stability of the Ethereum network, and Solo participation methods. Staking and Trust Model.

Stay tuned for the next articles to get the latest updates on EigenLayer and other blockchain projects.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

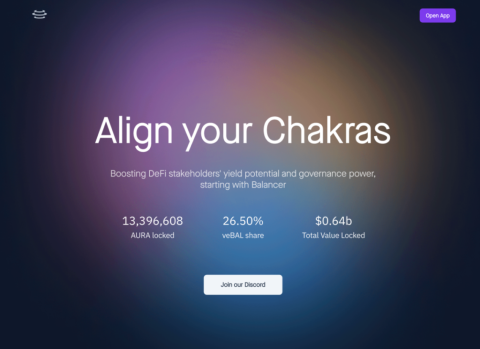

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

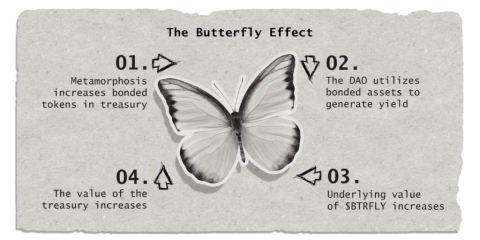

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

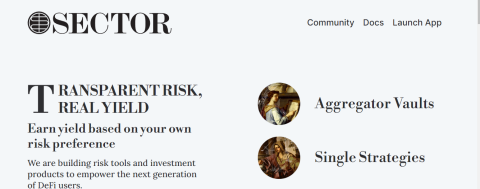

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

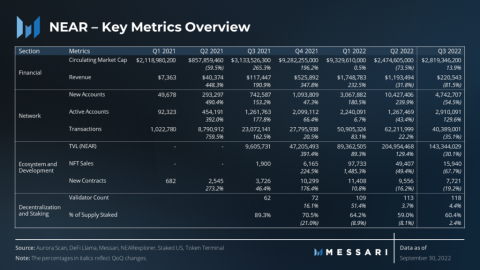

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

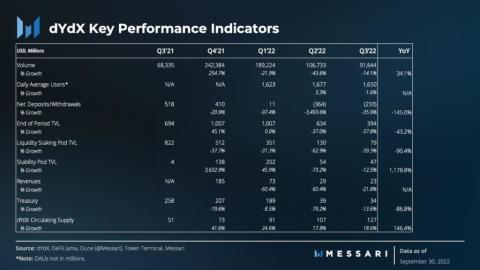

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Besides PancakeSwap, the BNB Chain ecosystem also has another AMM with TVL reaching 150 million USD after only two months of launch, this project is called Thena.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

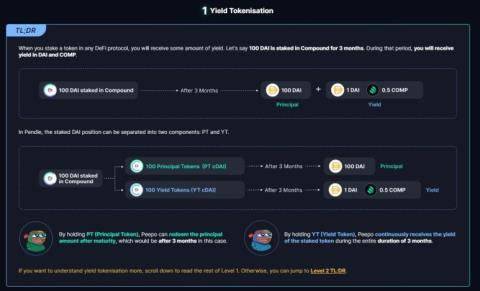

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

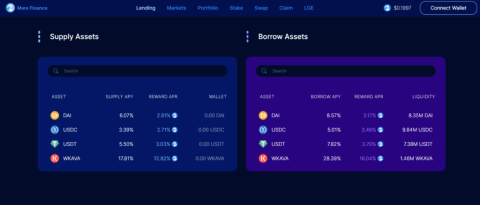

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.

Highstreet is a game that combines Metaverse, commerce and the Play to Earn trend. Thanks to the unique idea Highstreet has raised 5 million USD.