Sei Network and Ecosystem Overview

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

After the FTX crisis , we have seen a series of exodus from centralized exchanges. ThorChain and Maya Protocol go hand in hand to provide traders with a self-managed, permissionless and decentralized exchange. But first, what is the relationship between ThorChain and Maya?

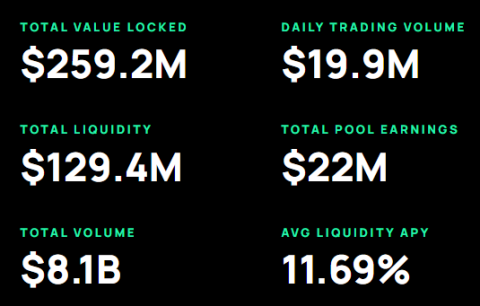

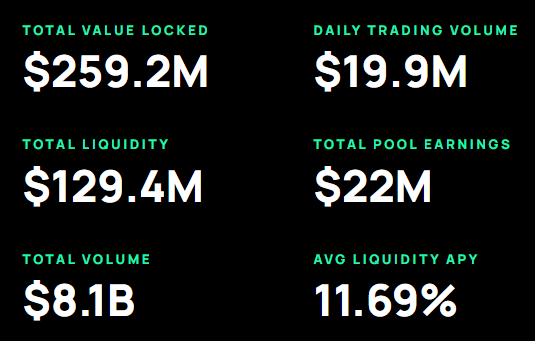

After four years of development, the ambitious project ThorChain finally launched its mainnet in June 2022. Powered by the RUNE token, ThorChain is a cross-chain liquidity network that runs Thor nodes on top 8 blockchain networks: Bitcoin, Ethereum, Binance Chain, Avalanche, Cosmos Hub, Dogecoin, Litecoin and Bitcoin Cash.

Working together between these chains, Thor nodes create a permissionless network to exchange cryptocurrencies. In a centralized exchange (CEX) like the now bankrupt FTX, customers rely on the honesty of their partners to swap assets. And if that honesty is just an illusion, the client's custodial wallet (exchange account) will cease to exist.

In stark contrast to such dangers, ThorChain uses a cross-chain technology called Continuous Liquidity Pools (CLP). Regardless of the counterparties, each asset in the CLP is represented by its own liquidity pool. In turn, these pools are constantly rebalanced by arbitrageurs and liquidity providers.

ThorChain's total volume across liquidity pools since the network's launch. Source: thorchain.org

As a result, the exchange rate between the two assets is maintained, allowing users to access them with their self-governing wallet.

The role of the RUNE token is to both facilitate cross-chain transactions and pay network fees. While ThorChain is not a Proof of Stake blockchain in the traditional sense, its Tendermint consensus engine uses validators' staked RUNE to confirm transactions and maintain the security of the network.

Interestingly, the popular Trust Wallet uses ThorChain's cutting-edge technology to enable revolutionary cross-chain swaps.

Just like ThorChain, Maya uses the Cosmos SDK infrastructure as a modular framework for building decentralized applications (Dapps) . Thus, Maya is a decentralized liquidity protocol for exchanging assets on the aforementioned blockchain networks.

Unlike the vampiric forks that sucked value from the original network, MayaChain is a friendly fork that complements ThorChain. After two years of hard work, the Maya developers finally launched the protocol on March 7, 2023.

To get a taste of Maya's capabilities, you can swap cryptocurrencies before that date. For instance, if you want to swap native Bitcoin for native Ether, visit the Maya stagenet, the beta precursor for the mainnet launch. However, in this sandbox environment, the possibility of slippage is very high.

Previously, one had to first convert Bitcoin into an ERC-20 token, such as Wrapped Bitcoin, and only then convert it to ETH.

Inheriting the security of ThorChain, Maya will have a public and transparent "Fair Launch" presentation. This means that, unlike typical token drops, Maya's CACAO drop will have neither early whales/investors nor core groups benefiting from early pricing.

Moreover, Maya's capital efficiency is doubled compared to ThorChain. Capital efficiency is the hallmark of the liquidity pool, because of the liquidity pool's ability to maximize available assets to generate revenue through swap fees.

For example, a highly capital efficient liquidity pool can generate more revenue with less capital, benefiting both the trader and the protocol. Typically, liquidity pools are more capital efficient than traditional order book exchanges because the latter's capital is tied up until the right trade is executed.

Thus, this leaves capital idle, i.e. no revenue is generated. As an evolution of the order book-based exchange, assets in the liquidity pool are always available for trading, generating ongoing revenue through fees.

Thus, the goal of capital efficiency in the liquidity pool is to strike a balance between sufficient liquidity for token swaps and minimizing idle capital. Maya Protocol has adjusted this balance in a way that allows node operators to provide liquidity with their staking capital.

Additionally, Maya's liquidity token, CACAO, can be transferred (exported) to secure other sidechains on the protocol. These could be future NFT marketplaces and other EVM-compatible smart contract platforms. Maya also brings reliability and redundancy to the space, just like MasterCard or Visa.

To fill its liquidity pool, Maya will perform a CACAO drop starting from the mainnet launch on March 7, 2023. Example: If you deposit $10,000 worth of BTC, you will receive tokens CACAO worth US$10,000, while keeping all BTC.

This “Liquidity Auction” (LA) will last 21 days, allowing you to participate with multiple assets: BTC, ETH, USDT, USDC and RUNE.

During that period, MAYA tokens will also be distributed. However, the MAYA token will only serve as the protocol's revenue token, similar to RUNE, rather than being paired with other tokens for swaps or used to pay network fees.

To be eligible for MAYA tokens, one must hold RUNE or NFT Mask Maya tokens, available on OpenSea, or participate in a Fair Launch with liquidity using a Tier 1 option.

As you may have noticed, CACAO/MAYA's dual tokenomics system is designed to facilitate fair launch. After all, the selling pressure on MAYA tokens has decreased due to their limited implementation.

Upon launch, Maya will offer token swaps for the following cryptocurrencies: Bitcoin, Ether, and ThorChain. BTC and ETH were intentionally included as pseudo-stablecoins under these uncertain macro conditions, due to their large market cap status being less volatile than other altcoins.

However, when the liquidity (LA) auction is completed after the 21-day period, Maya will support Dash and Kujira, followed by Osmosis and BSC.

After the four cryptocurrencies are integrated, Maya may also support Cardano, which is yet to be determined.

Should Maya's LA be discontinued, all assets will be refunded (returned) less network fees. On the other hand, if LA is completed successfully, but there are not enough funds in the liquidity pool, then there will be a Ragnarok event.

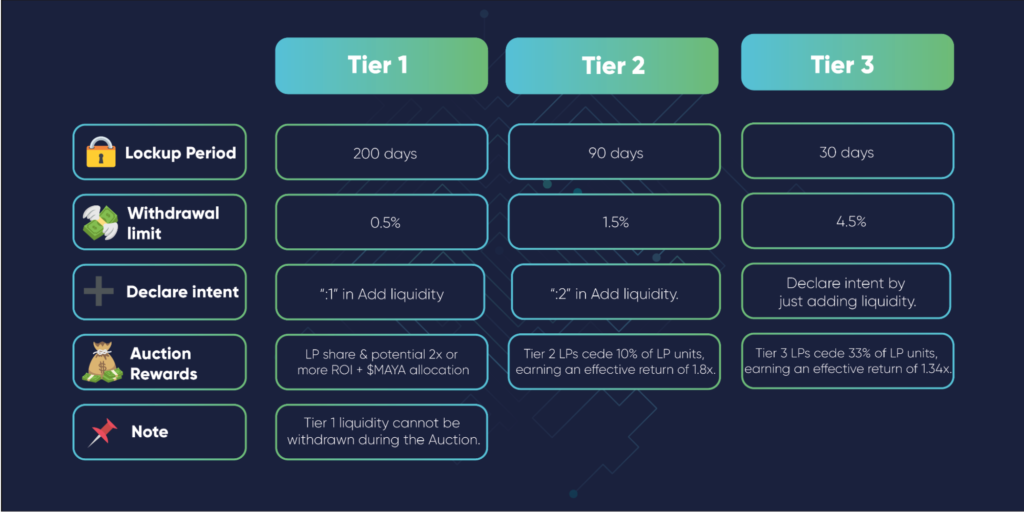

The Ragnarok event occurs when the protocol's minimum viability to continue, set at US$3–5 million, has not been reached, resulting in a refund. Below that minimum, and if LA is finalized, levels 2 and 3 of the protocol will be cut by 25% and 15% respectively, while tier 1 will stay the same. Here are 3 available floors.

So, based on user's liquidity contribution in Maya (LA) liquidity auction, they will get different withdrawal limits and rewards.

For yield farming, BTC, ETH and RUNE will have the same actual yield as with ThorChain's asymmetric staking. In a particular case, if the liquidity provider staking tokens to one party of the token pair's pool and let the pool balance itself on behalf of the LP, the LP will have fewer RUNE tokens left than it started with.

In the Maya roadmap shortly after launch, users can also see saver vaults. They will act as BTC, ETH, and RUNE storage but without the user becoming a liquidity provider (LP). This upcoming feature is a popular migration from ThorChain's own saver vaults.

The best way to participate in the liquidity auction is through ThorWallet – a self-regulatory wallet for the decentralized finance (DeFi) sector . ThorWallet is available on both the Apple and Google stores.

Maya Protocol itself has been audited by Halborn Security, which was founded in 2019 by hacker Steven Walbroehl. Since then, Halborn Security's team has grown to over 100 security experts who ensure that there are as few exploits as possible on the Web3/DeFi frontier.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

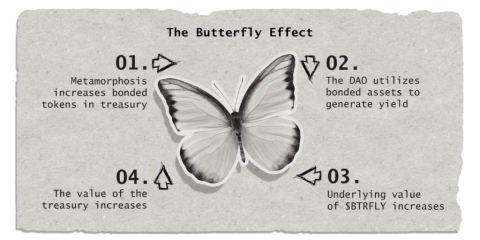

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

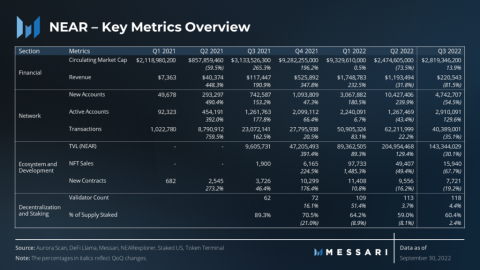

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

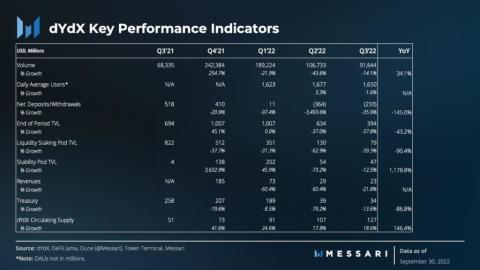

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Besides PancakeSwap, the BNB Chain ecosystem also has another AMM with TVL reaching 150 million USD after only two months of launch, this project is called Thena.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

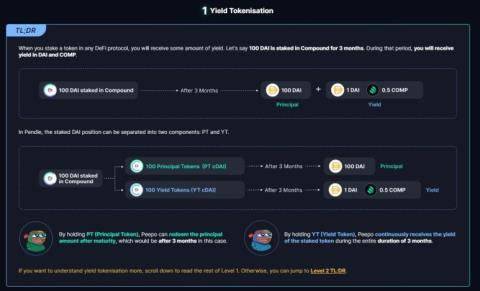

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

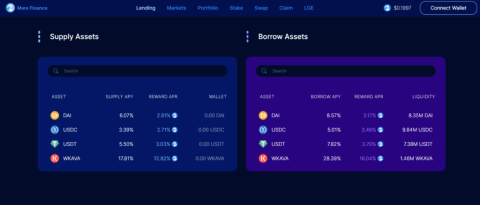

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.

Highstreet is a game that combines Metaverse, commerce and the Play to Earn trend. Thanks to the unique idea Highstreet has raised 5 million USD.