Sei Network and Ecosystem Overview

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Justin Sun is a young billionaire, dubbed "little Jackma". He is the father of Tron, BitTorrent later Polynex and many other projects in the blockchain space. A typical example is the DeFi project called Just. So what is Just? What's so special about this project? Is the JST token a potential investment option? Let's explore the details of this project with TraderH4!

Just is the most active decentralized finance platform in the Tron network. This lending & borrowing platform allows users to borrow Stablecoins by staking TRX tokens to generate USDJ – a USD-pegged Stablecoin at a ratio of 1:1. Meanwhile, the JST token launched on Tron's blockchain, designed according to the TRC-20 standard is considered the main currency of the project and is Just's governance token.

Just's ecosystem provides 3 basic utilities for users including:

Another notable point of the project is that there are 2 separate active tokens, JST and USDJ.

The Just project will have two basic activities: stablecoin management USDJ and ecosystem management with JST tokens. This operating mechanism is the sustainable foundation for the development of lending activities on Just.

Use (Collateralized Debt Positions) to create Stablecoin USDJ

CDPs are the method used to transfer collateralized accounts into smart contracts to generate USDJ. Simply, USDJ Stablecoin is generated through deposit into CDP. Specifically, here are some stages to go through to create USDJ.

Although users will deposit TRX tokens as collateral to create USDJ Stablecoin, TRX tokens will actually be swapped to PTRX – the only collateral token accepted by the Just platform.

The Just platform will generate a CDP, then execute another transaction to deposit PTRX into the CDP to generate USDJ.

The owner of the CDP will make a transaction to determine the amount of USDJ generated in the CDP. The amount of TRX tokens collateralized by users will be treated as a debt. This amount of tokens will be locked until the user returns.

This is the final step for users to get back their mortgaged TRX assets. Just's payment mechanism is a bit complicated, the original principal will be returned in USDJ, but the interest amount users will have to pay in JST. Once the payment is completed, the CDP holder is allowed to send a transaction to Just to get all the collateral back.

Especially, in a strong bear market, collateral has been heavily devalued and is unable to repay, the CDP will be liquidated. This is like the margin mechanism in leveraged trading.

Just .'s governance mechanism

Anyone holding the JST token can vote on the modified smart contract on the system. Contracts with the highest number of votes will be valid proposals. Specifically, there will be two types of suitable proposals: Single action proposal contract and Delegating Proposal Contracts.

–

The core team of Just platform is 3 members with long experience and knowledge in the field of computer science, blockchain. As follows:

Join TraderH4 to follow the project's development roadmap from launch to now.

2nd quarter of 2020

3rd quarter of 2020

Q4 2020

1st quarter of 2021

Since then, the Just project has not updated any important milestones in the roadmap.

General overview of the JST . token

JST is a utility token, used in Just platform operations. Here are the important information about the JST token.

Specifically, JST tokens will mainly be used in the following activities:

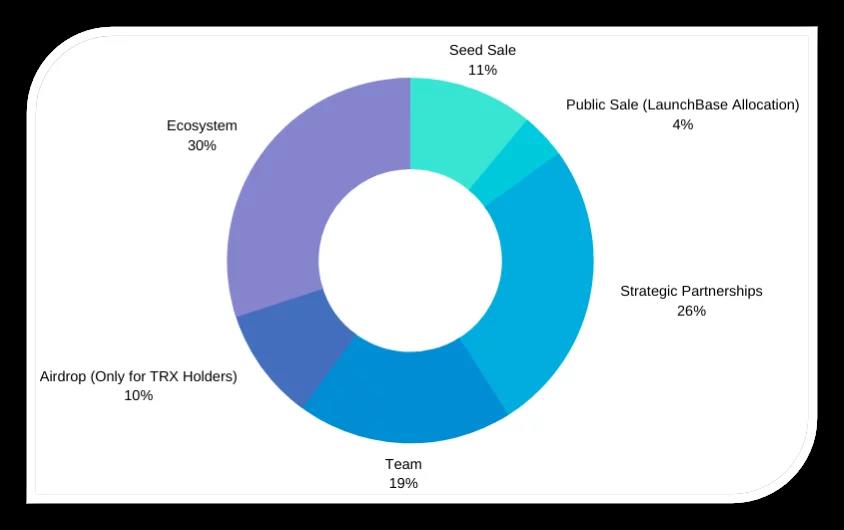

9.9 billion JST tokens will be allocated according to the plan as follows:

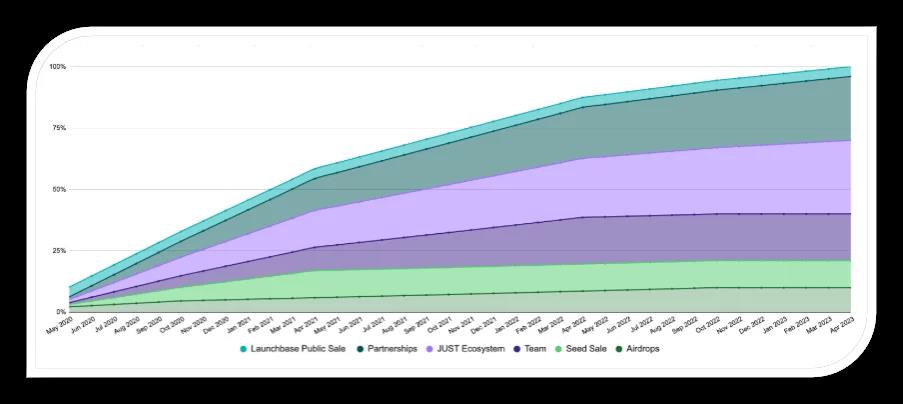

The JST token payment schedule is announced by the project as shown below.

JST is a token according to the TRC standard, so it will be stored on the following wallets:

According to the information TraderH4 updated on CoinMarketCap at the time of writing, the JST token has been listed and supported for trading on many leading exchanges today. Specifically, Binance, Huobi, Gate.io, FTX, OKX, Bithumb… The trading pairs with JST are also quite diverse such as: JST/USDT, JST/USDD, JST/BTC, JST/ETH, JST/KRW, JST/TRX…

TraderH4 cannot give you solid advice on whether or not to invest in the Just platform JST tokens. However, we will provide important reference information to help you evaluate the development potential of the project.

However, there is a fact that you also need to know Just the satellite DeFi project developed by Justin Sun with the aim of creating diversity for the Tron ecosystem. So the potential is undeniable, however the risk is not zero. Justin Sun is famous as a billionaire "with many talents", so investors are quite shy about his projects. Moreover, it seems that recently Just's popularity has become increasingly blurred. This is reflected in the price action of the JST token on the price chart, which sets ATH in April while BTC makes ATH in September. Therefore, you need to consider and research more information sources to make a choice. Best investment.

Below is a summary of frequently asked questions about the Just project as well as the JST token. If you have the same question can find the answer easily.

What pairs of JST tokens are there today?

JST is supported to trade with many other currencies, such as JST/BTC, JST/BUSD, JST/USDT, JST/ETH…

Through which channel can I get more information about Just?

Token JST is Poloniex's first IEO LaunchBase, officially taking place in early 2020.

Some projects compete with Just today such as MakerDAO, Compound, Constant...

The Just platform has 3 main functions: JustLend (decentralized lending), JustSwap (DeX exchange that allows token swaps on Tron's network) and JustStable (platform used to mint stablecoin USDJ).

Just (JST) a DeFi project supported by Justin Sun is behind the push with the mission of building a decentralized financial system on the Tron blockchain platform. Although Right after the launch, Just was highly anticipated due to the positive influence of CEO Justin Sun. However, over time the CEO's notoriety increased. Besides, the Tron ecosystem is just an idea copy of Ethereum with the purpose of creating FOMO psychology, making both Tron and Just no longer receive support and show signs of fading in the market. Therefore, you need to research the project and the token set carefully before making an investment decision. Good luck!

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

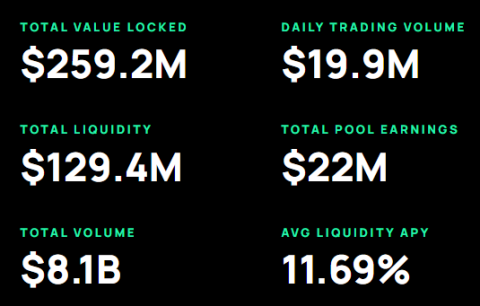

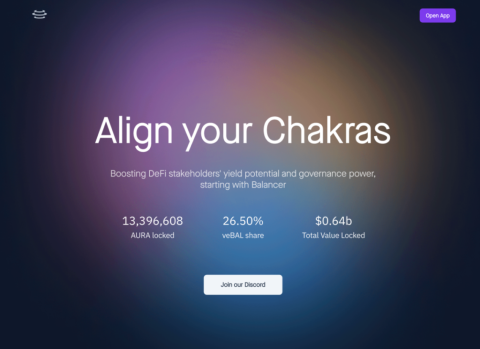

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

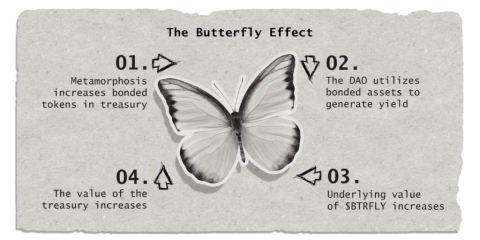

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

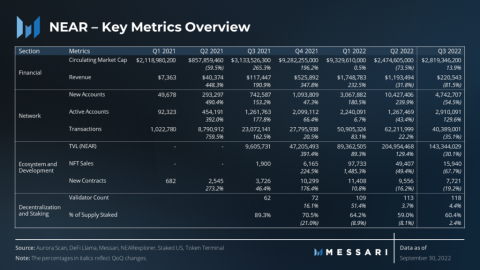

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

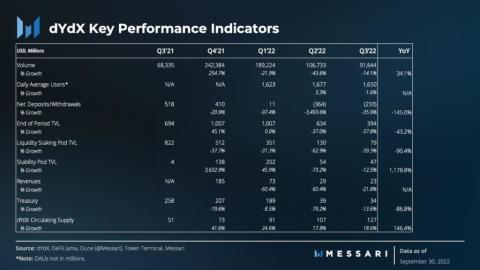

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Besides PancakeSwap, the BNB Chain ecosystem also has another AMM with TVL reaching 150 million USD after only two months of launch, this project is called Thena.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

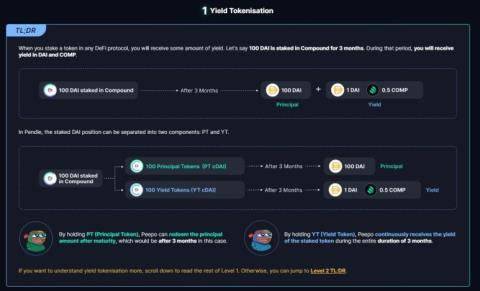

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

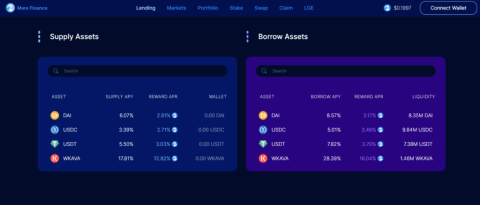

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.

Highstreet is a game that combines Metaverse, commerce and the Play to Earn trend. Thanks to the unique idea Highstreet has raised 5 million USD.