What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

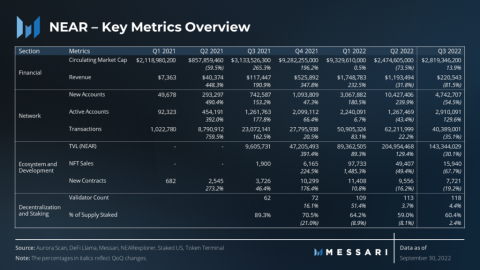

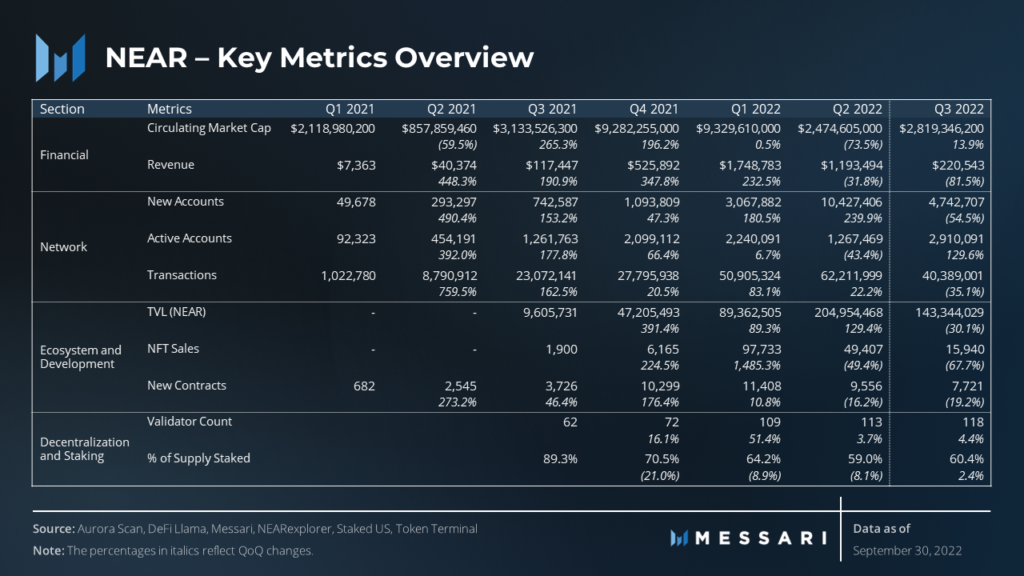

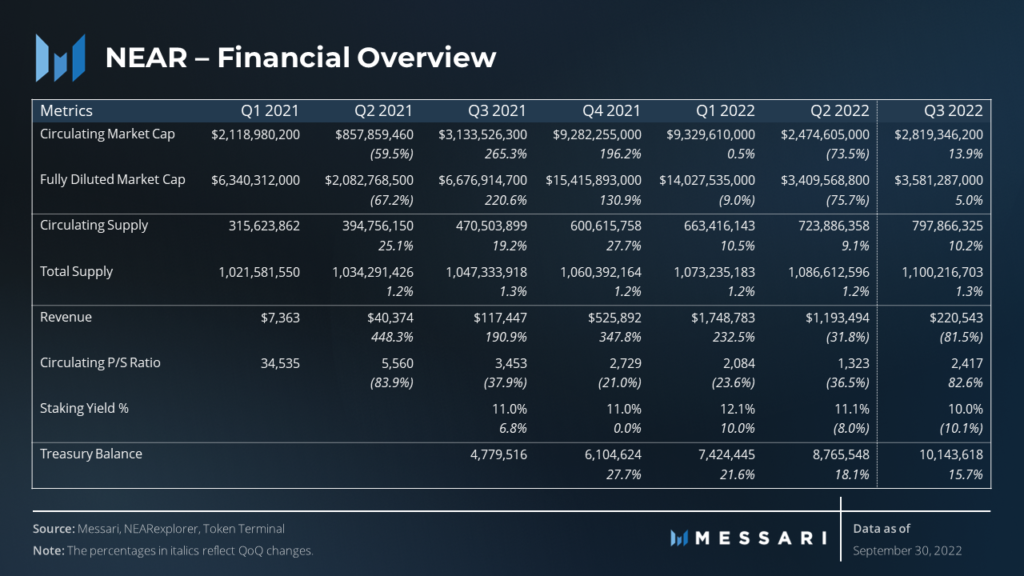

The second quarter saw NEAR lose 74% of its value by market capitalization. Near Protocol's market capitalization recovered in Q3 with a 14% quarter-on-quarter increase from $2.47 billion to $2.82 billion. Even so, the project's market capitalization is still down 70% from its all-time high of $9.6 billion on December 27, 2021.

Revenue fell 82% from Q2 to $220,000. The drop in revenue was due to a 35% drop in transactions and a conversion fee of just one cent lower. For comparison, Polygon had sales of $4.2 million (-26% QoQ) with a transaction fee of $0.09 and Avalanche had revenue of $2.3 million (-94% QoQ) with fees average transaction of 0.14 USD.

NEAR is the native token of Near Protocol. NEAR is used to secure the network through staking, use as transaction fees and storage fees. Unlike Ethereum's auction-style mechanism, NEAR transaction fees adjust according to network computation and bandwidth. Storage fees, considered long-term costs for resources, are payments made by accounts and smart contracts for the use of storage space on the Near Network.

NEAR has no fixed supply and uses both inflationary and deflationary mechanisms. There is a fixed annual inflation rate of 5%, of which 90% is given to the validator and the remaining 10% goes to the protocol treasury. The NEAR Treasury is controlled by the NEAR Foundation. At the end of Q3, the treasury had a balance of 10 million NEAR ($36 million). Of the total transaction fees, 70% is burned and the remaining 30% is transferred to the contract that the transaction started on. NEAR ended Q3 with approximately 800 million NEARs in circulation and the project continues on its 5-year distribution roadmap.

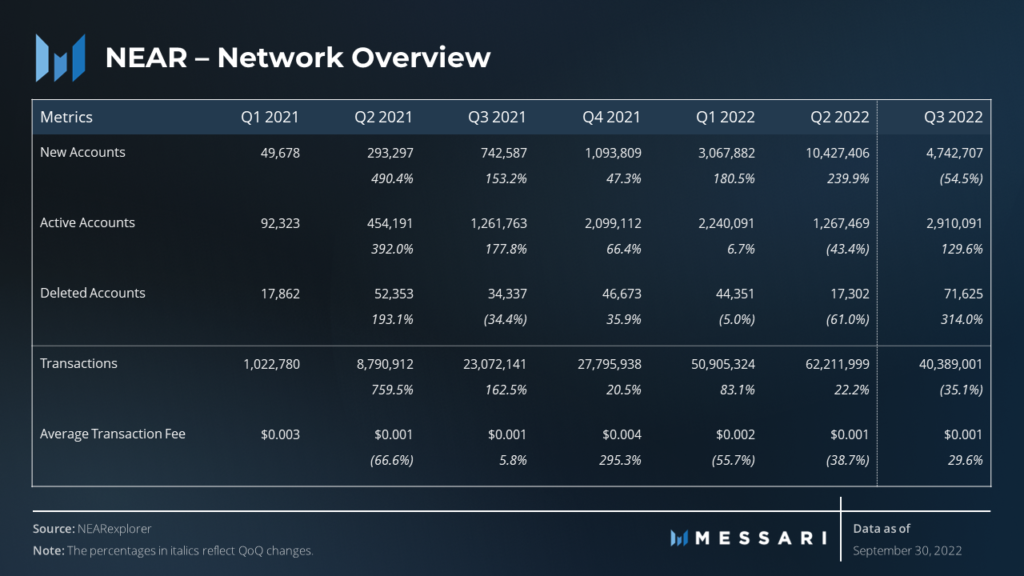

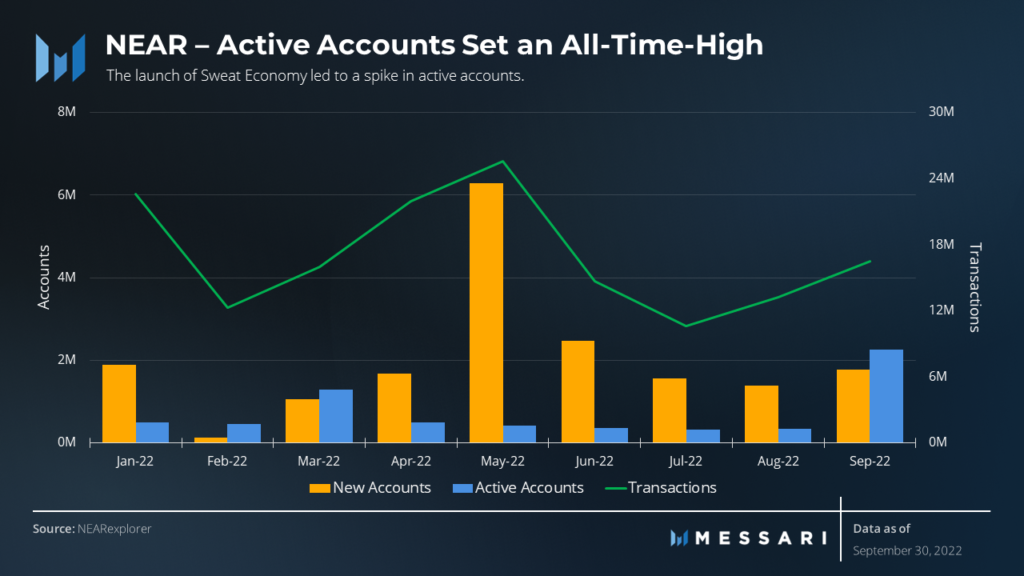

During Q3, the number of active addresses on the Near protocol skyrocketed 130% compared to Q2 to set an all-time high of 3 million accounts. The spike in active addresses was mainly due to the launch of Sweat Economy . Meanwhile, the statistics on the number of new addresses decreased by 55% QoQ to only 4.7 million and the number of transactions decreased by 35% compared to Q2 to 40 million.

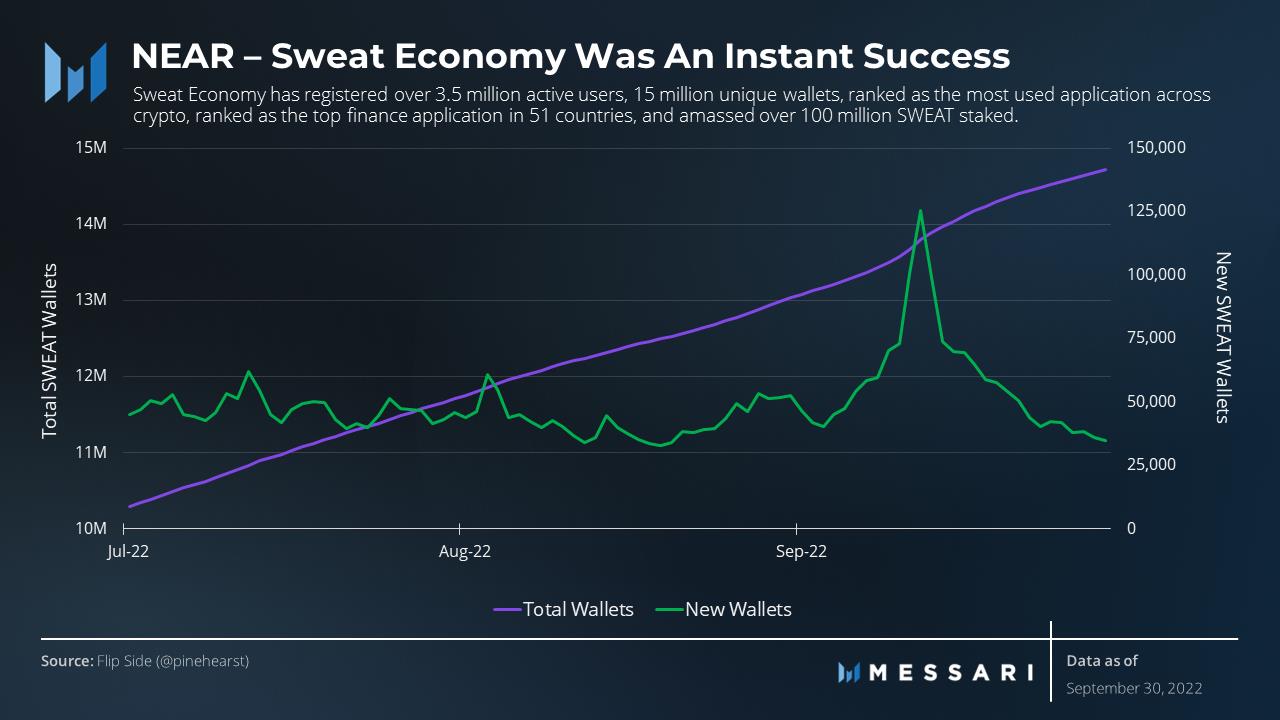

In April, a new partnership with Sweatcoin was announced by Near Protocol. Sweatcoin is a London-based technology company that encourages people to move a lot. The project was ahead of its time using a Web2 reward system, where users could accumulate tokens on the go and exchange them for rewards. Naturally, Sweatcoin made the move to Web3.

At the end of July, Sweatcoin launched on Near Protocol as Sweat Economy. This project has more than 3.5 million registered active users since its launch, 15 million unique wallets, ranked as the most used application in the crypto space. Not only that, this project is also ranked as the top financial application in 51 countries.

The statistics below give us an overview of the ecosystem and the development of Near Protocol in Q3. In the next section, we will analyze each piece of this ecosystem.

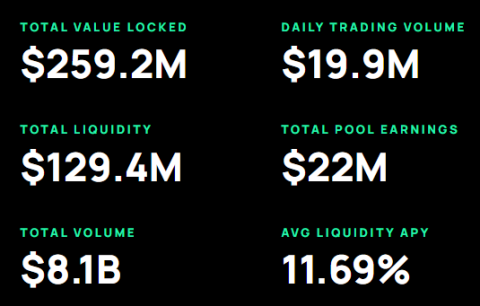

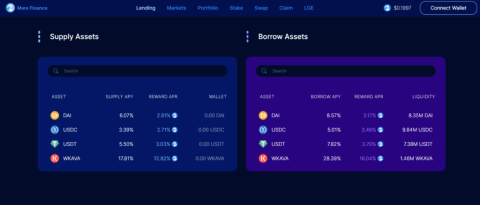

Near ended Q3 with a TVL of around $513 million, up 10x y/y but down 30% qoq. Ref Finance – a DEX on Near accounted for 45% of the TVL of the entire ecosystem. Ref Finance is already the flagship app on Near Protocol and boasts blue chip investors including Alameda, Dragonfly and Jump. Aurora, an EVM platform accounts for 33% of TVL or $170 million. Aurora is an important piece of the Near Ecosystem, which will be covered in more depth later in this article. To compare with some other Layer 1, Avalanche ended Q3 with TVL reaching $1.9 billion. Meanwhile, this figure of and Solana is $ 6.6 billion and $ 2.1 billion, respectively.

In Q3, Near Protocol saw sales of 16,000 NFT (68% Q2 down) and 20,000 active wallets (66% QoQ) with an even split between NFT buyers and NFT sellers. NFT's activity on Near Protocol is governed by Paras Marketplace , an NFT Marketplace for digital tokens. In addition, there are many NFT projects across various use cases recently launched or in development, including Mintbase, DAO Records, Raiz, Naksh, NEARxPublish and Endemic.

Near protocol has a primitive game ecosystem. However, many companies are developing games or services for the blockchain developer and gaming community including:

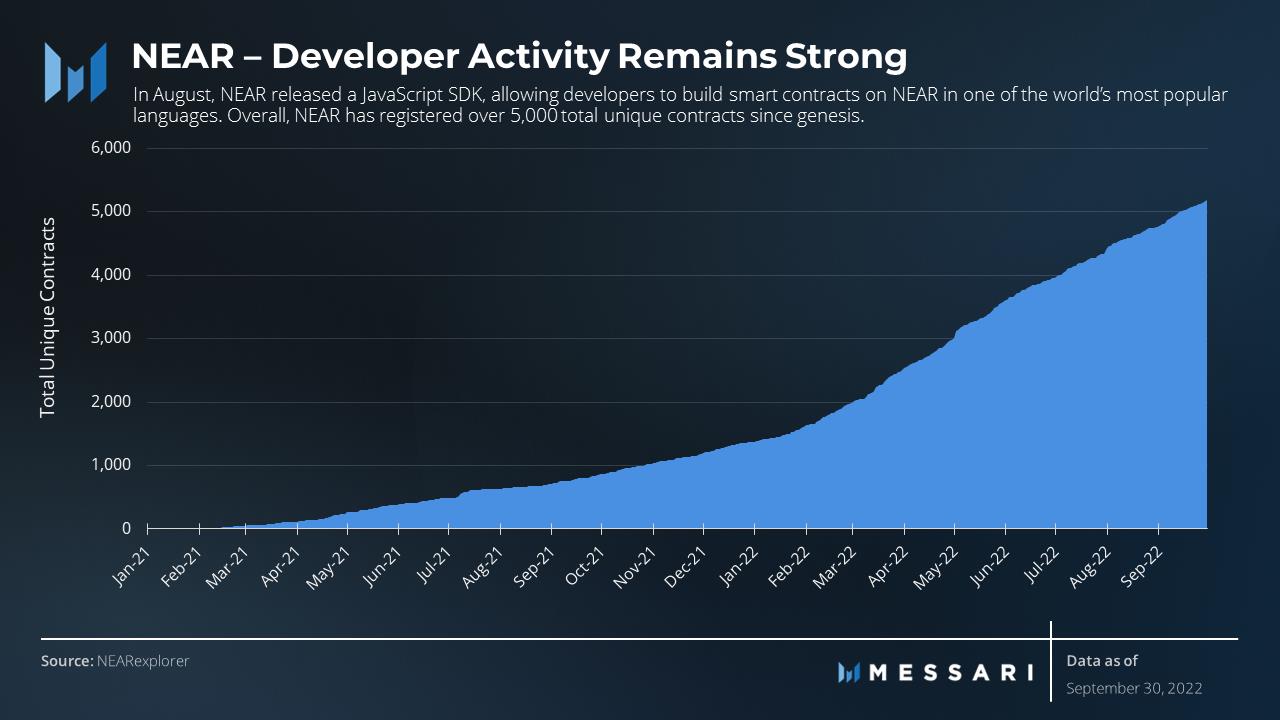

NEAR prioritizes being a developer-friendly blockchain, and the blockchain's smart contract programming language plays a big role in its ability to attract application developers. Previously, developers on NEAR were able to use Rust, AssemblyScript, and Solidity (via Aurora). In August, NEAR released the JavaScript SDK, allowing developers to build smart contracts on NEAR in one of the world's most popular languages. Overall, NEAR has signed up a total of more than 5,000 unique contracts since the project's inception.

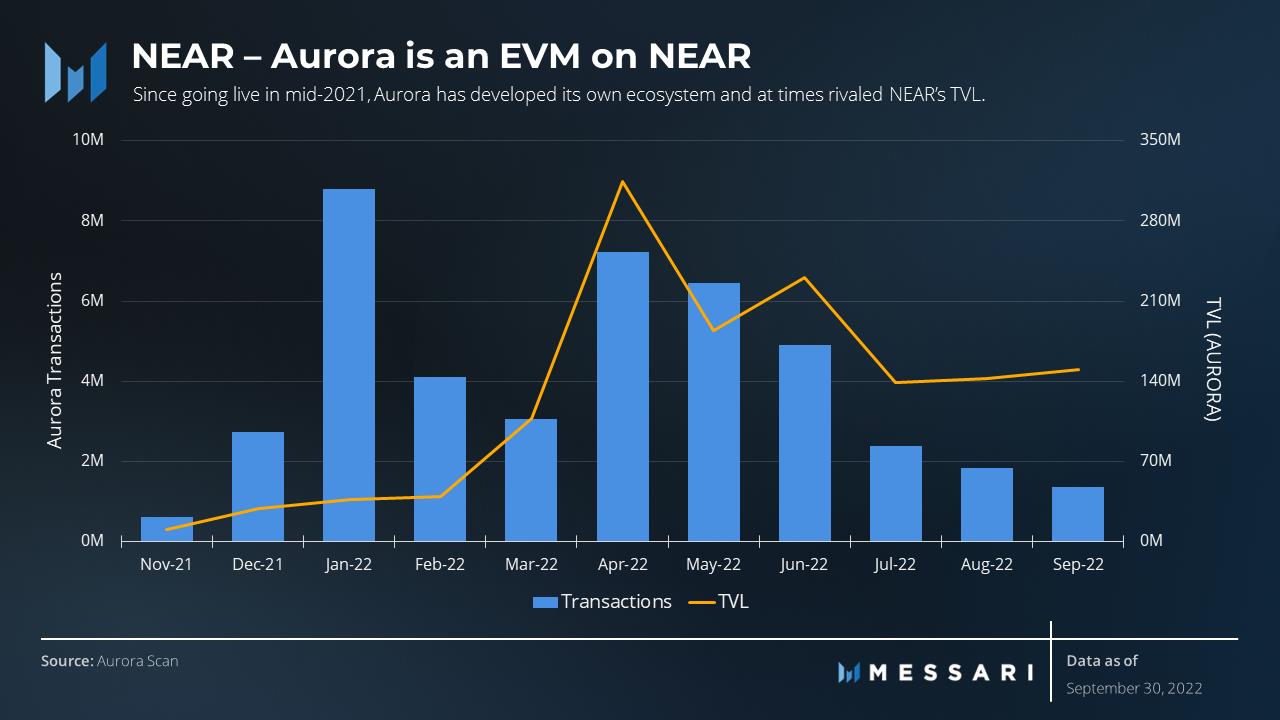

Aurora is an EVM deployed as a smart contract on Near Protocol. It combines the user and developer familiarity of EVM with the scalability and security of Near. Former Near Protocol members created Aurora, and EVM went live in mid-2021. Since then, Aurora has been one of the top applications on Near and its own ecosystem has even rivaled it. Near Protocol on TVL parameters.

In early September, Aurora released an upgrade that includes a new cross-contract calling feature. This feature connects Aurora's synchronous and asynchronous runtimes of NEAR, allowing the Aurora smart contract to communicate with any other smart contract on NEAR in a single transaction and without any which bridge. This further connects the two ecosystems, opening up new possibilities for Aurora applications such as a DEX aggregator that can mine liquidity on both Aurora and NEAR.

The Octopus Network is an EVM-compatible, substrate-based network of blockchains built as a collection of smart contracts on top of NEAR. Like Polkadot, app-chains must register and pass a vote by holders of Octopus' native token, OCT, before joining the network. There are now five app-chains on the mainnet.

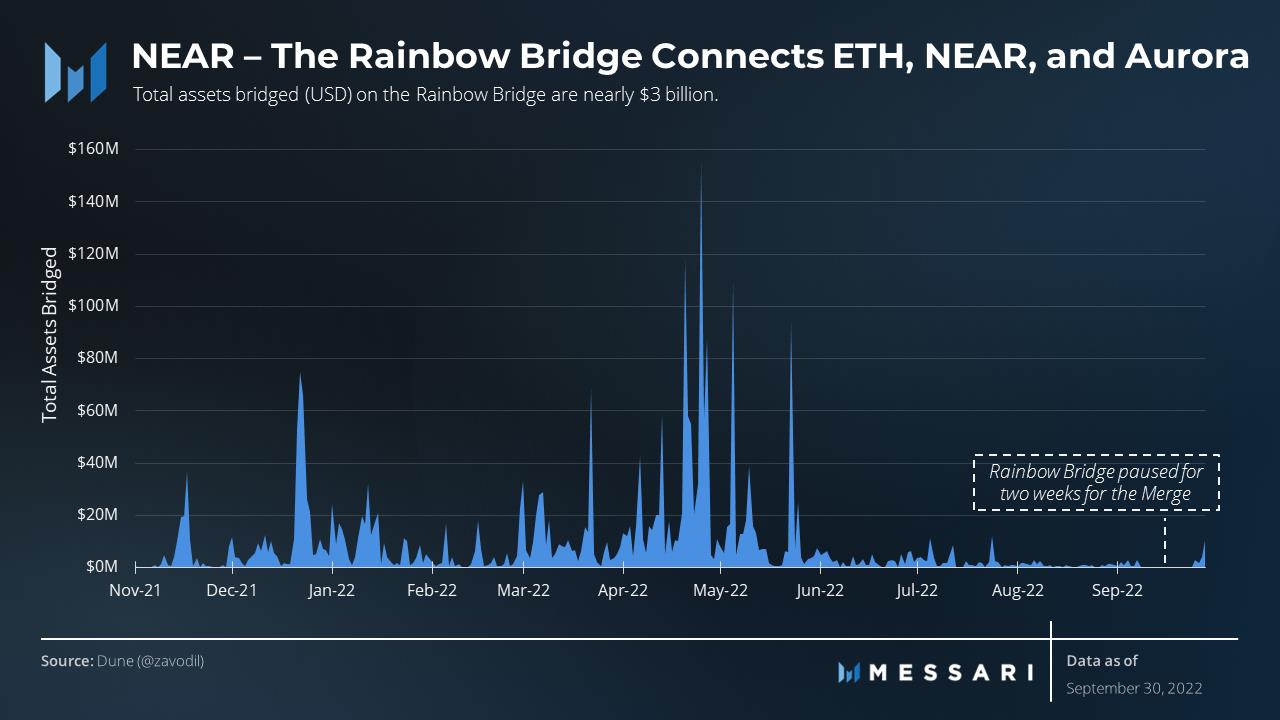

Rainbow Bridge is a permissionless and trustless bridge connecting Ethereum, Near and Aurora. The goal is when switching to Ethereum, use an optimistic design to save more gas.

Rainbow Bridge's architecture has been successfully tested twice this year, first in May and more recently in August.

Total assets bridged over Rainbow Bridge is nearly 3 billion USD. In Q3, bridging assets fell 90% from $1.5 billion to $145,000. The decline was further exacerbated by the suspension of the bridge for about two weeks to wait for The Merge event.

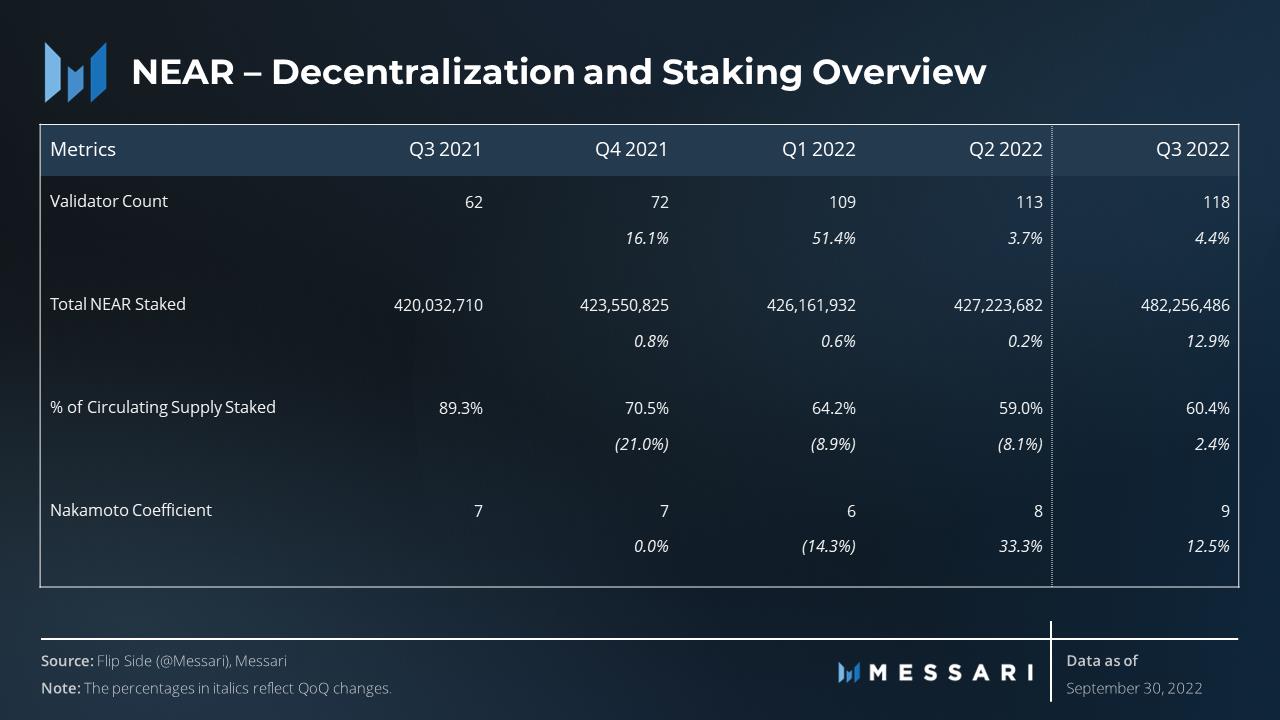

Near uses the Thresholded Proof of Stake (PoS) consensus algorithm to execute transactions. The network algorithmically sets a minimum validator participation threshold within which validators bid to participate.

Overall, Near ended Q3 with 483 million NEAR staking, up 13% from Q2, equal to 60% of circulating supply. Near protocol has 118 validators with a Nakamoto coefficient of 9. NEAR has increased the number of active validators quarterly, indicating that the network is slowly decentralizing. The Nakamoto coefficient of 9 puts Near in the middle of the crypto space.

NEAR is built upon horizontal scaling with a unique sharding design called Nightshade, which is being worked on in four phases. Starting with Phase 0, launching in Q4 2021, it splits the network into four data shards. Validators are required to store only the state of their specified shard but still have to validate (process and execute) transactions from all shards.

At the end of September, Phase 1 was released on mainnet. Phase 1 triples the network's validating capacity, adding up to 200 chunk-only producers to 100 block producers. Through chunk-only producers, phase 1 brings some of the full features (data and processing) to Near Protocol. However, block producers still have to confirm all shards.

Nightshade has two more phases planned before it's fully deployed. Phase 2 will remove the requirement for block producers to confirm all shards. Therefore, Near will have full data and sharding processing. Phase 3 will bring dynamic resharding, allowing the network to automatically add and exclude shards based on network usage.

In Q3, the NEAR protocol yielded mixed results. NEAR's finances recover from a historically bad second quarter.

During the negative phases of the market, the ecosystem of Near Protocol continues to grow. Not only that, the indicators related to decentralization and staking are generally positive. Additionally, in Q3 Near raised over US$1 billion to accelerate ecosystem development. Although Near faces stiff competition in other Layer 1 layers, its massive fundraising, developer focus, and unique scaling plan can help this project set itself apart. .

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

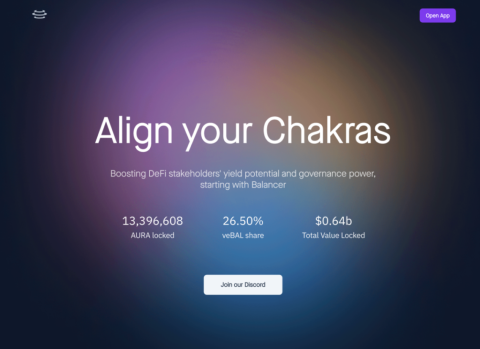

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

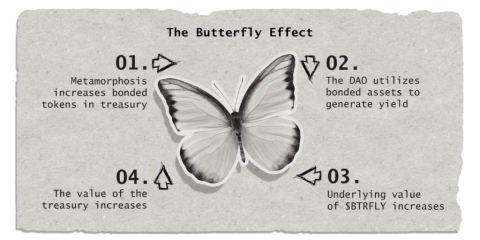

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

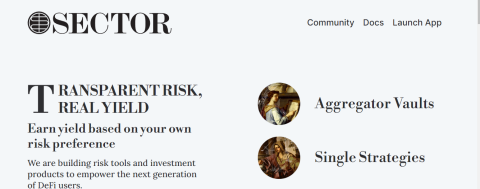

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

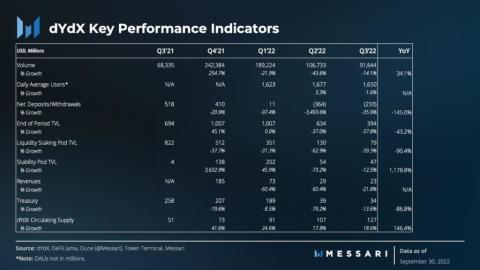

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

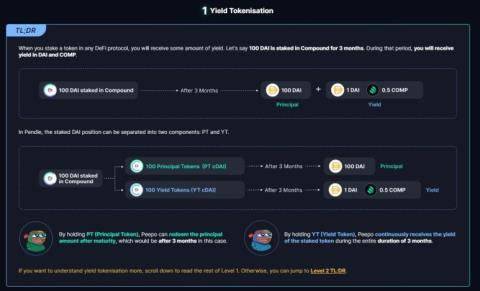

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.