What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Uniswap, as one of the leading AMM platforms, has updated its product with Uniswap V3 version, allowing users to provide liquidity within a certain price range, optimizing liquidity and increasing earnings from transaction fees. However, relying solely on transaction fee income is often not enough to cover losses due to market volatility. Poolshark introduces the AMM Directional concept, which helps users maximize profits from the liquidity provision through the application of buy and hold strategies across the pools on the platform.

Poolshark offers 2 types of Pool, that is Cover Pool and Price Pool.

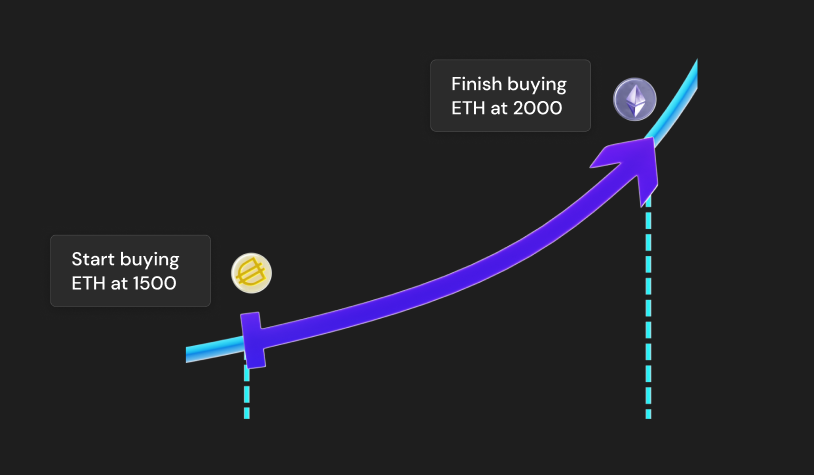

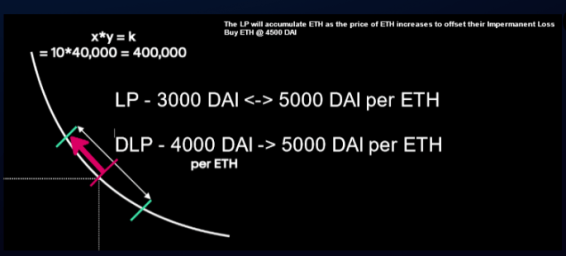

Cover Pool is used to protect or secure the position of a liquidity provider. In a Pool consisting of two tokens, ETH and USDC, traditionally AMMs will tend to decrease the amount of ETH and increase the amount of USDC when the price of ETH increases. However, with Cover Pool, on the contrary, the amount of ETH increases because USDC is used to buy ETH, leading to a decrease in the amount of USDC. This helps the LP earn a share of the profit from the ETH price increase to offset losses due to volatility. This loss is the result of a user's LP position selling at an average price lower than the current market price.

To explain better, there are two cases:

Case 1: Set limit for user's LP position

For example, if user Alice wants to buy ETH between 2,000 and 2,200 USDT while the current ETH price is 1,500 USDT, then Alice can set a lower limit of 2,000 and an upper limit of 2,200. When the ETH price reaches 2,000 USDT, Alice will start buying ETH and stop when the price crosses 2,200 USDT.

Case 2: Temporary loss prevention

For example, if user Alice is holding an LP position for the ETH/DAI trading pair on Uniswap v3 with a price range of 1,000 to 5,000 DAI, and the current ETH price is 3,000 DAI, Alice can set a lower limit of 3,000 and an upper limit of 5,000 for temporary loss prevention. If the ETH price falls below 3,000 DAI, Alice will sell ETH and buy it back when the price returns to the range between 3,000 and 5,000 DAI.

Price Pool: Because of the 2-way nature of LPs in AMM, users often face risks on both sides of the price line. However, with Price Pool, users can provide liquidity in a single direction, reducing the risk of trading activities.

Suppose we consider the ETH/DAI token pair. With the Price Pool, users can provide liquidity either way ETH converts to DAI or DAI converts to ETH.

AlphakEY is the founder and an experienced programmer in Smart Contract writing.

Zachary H is the Business Development Lead of Poolshark. He graduated with a bachelor's degree in business administration from Wilfrid Laurier University and worked at Milton Youth Theater Production, a company specializing in planning and organizing summer camps. He also has experience as a Sales Associate at Lowe's Canada company before deciding to join Poolshark in April 2022.

Currently, the project has not announced Tokenomics officially, we will update this information to readers later

There is currently no information about the project's investors and we will update this information for readers when there are latest updates.

Poolshark introduced a new concept called DAMM – to solve the problem of Impermanent loss and bring multiple methods of providing liquidity to users. However, since the project is still in beta and has not officially launched the mainnet, the effectiveness of this protocol has yet to be accurately assessed. Hope the information in the article has helped you to have more interesting knowledge about Poolshark. You can learn more about the project at the following social sites:

Website | Twitter | Medium

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

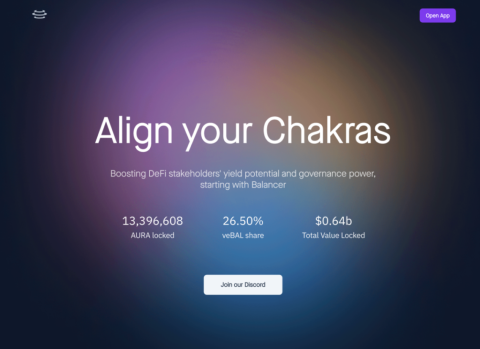

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

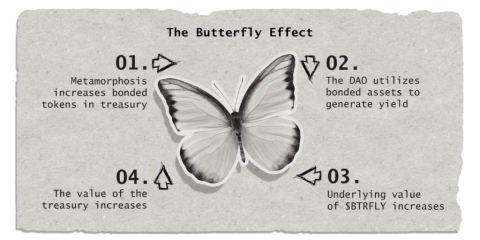

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

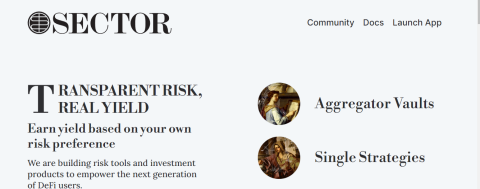

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

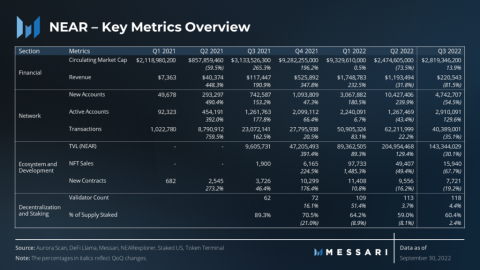

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

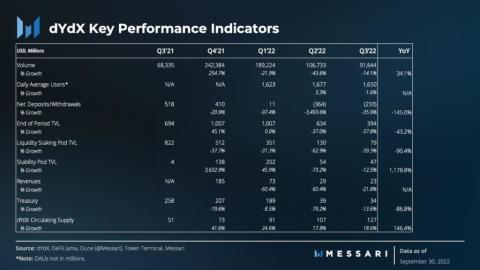

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

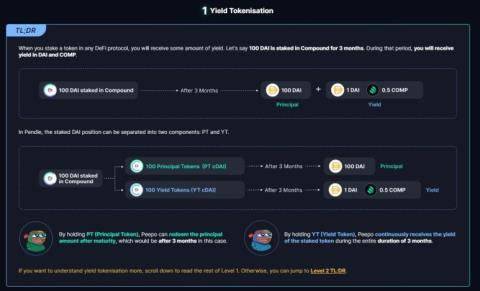

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

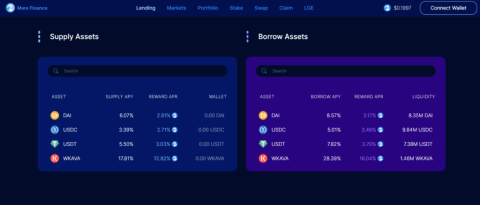

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.