What is thena? Discover the outstanding features of Thena and THE . token

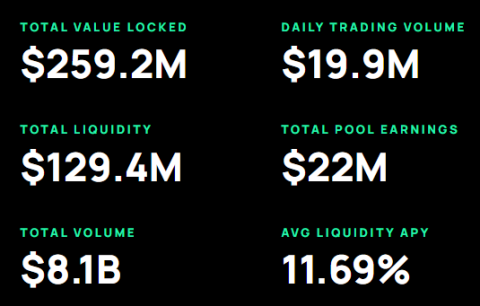

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

The dYdX protocol operates a derivatives exchange on Layer 2 StarkEx Network. The hybrid decentralized exchange offers perpetual futures contracts similar to those found on Binance, FTX, and other centralized exchanges. The ultimate goal of the protocol is to build a completely decentralized derivatives exchange where no one party, including the development team, can interfere with the basic operations of the protocol.

In the summer of 2017, Antonio Juliano, a former Coinbase engineer, founded dYdX. The first two products of the protocol, Expo and Solo, were built for margin trading on Ethereum. After seeing an explosion of perpetual contract trading on Bitmex in 2019, dYdX has decided to become the first DeFi protocol to offer this type of trading. The rollout of perpetual trading types for major tokens like BTC and ETH is quickly gaining popularity among many traders.

In Q2 2022, dYdX announced the switch from StarkEx to its own native blockchain, called dYdX Chain, as part of a fully decentralized effort.

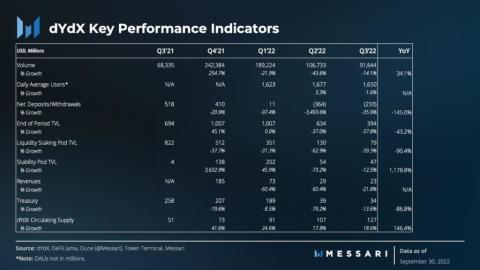

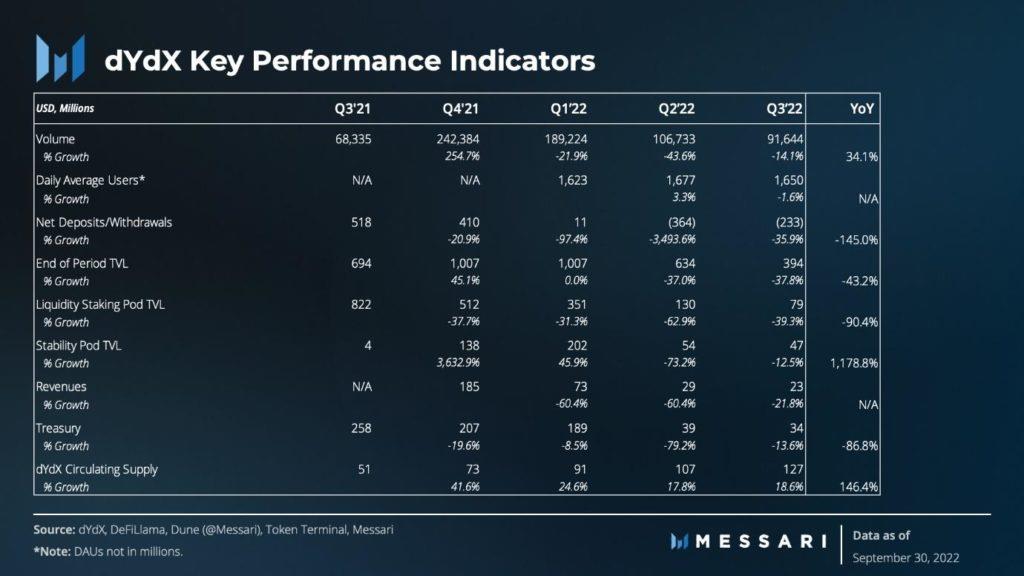

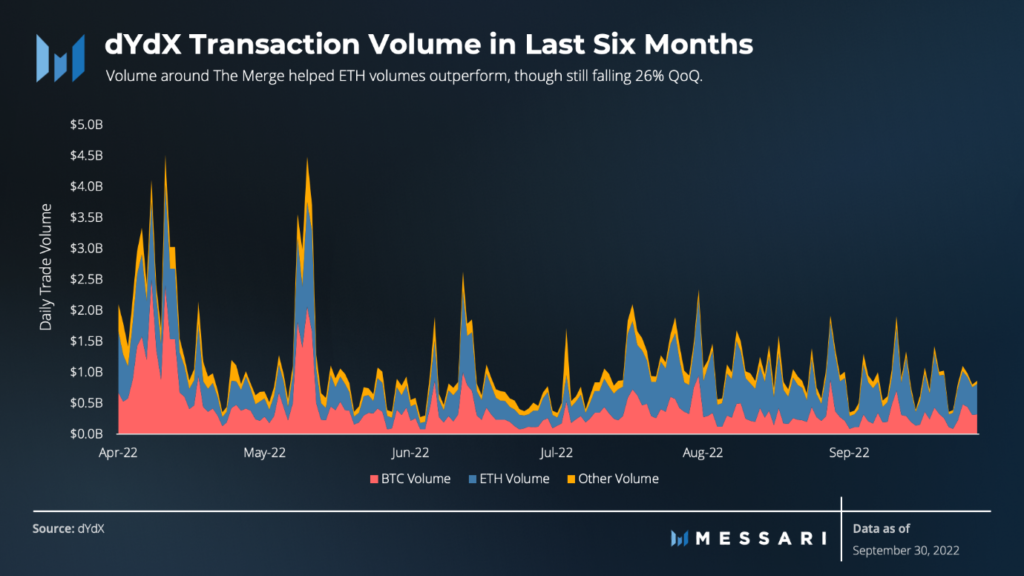

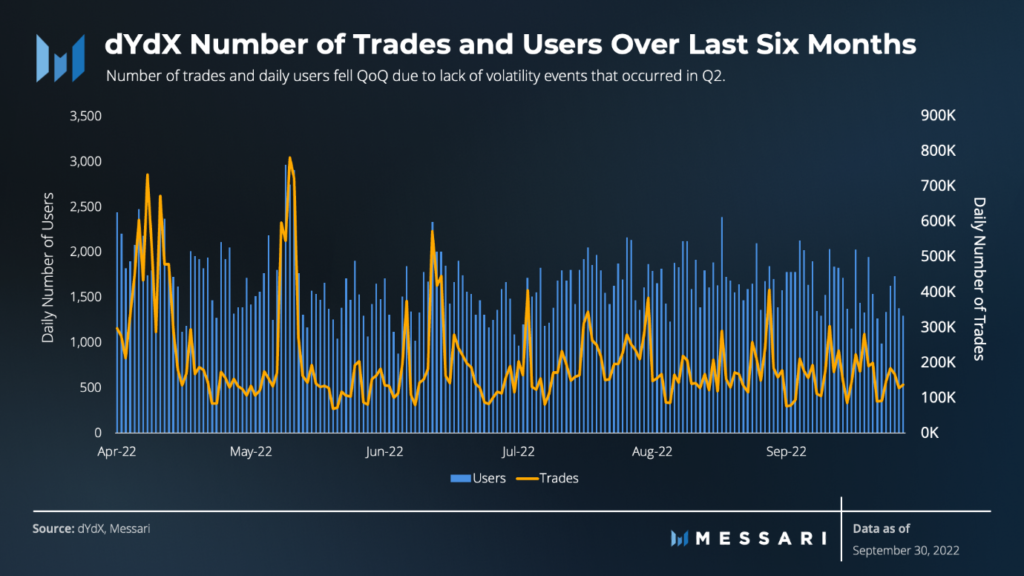

In Q3, dYdX didn't have as many highlights as it did in Q2, but The Merge was an important event and certainly had an impact on the quarterly results. Daily trading volume and users on dYdX in Q3 were as active as in Q2, when measured on an average basis. Trading in ETH has a higher percentage compared to previous quarters, as traders were prepared for several instances of trying to trade during the Ethereum hard fork. Despite healthy trader activity, dYdX continues to see large withdrawals from the network.

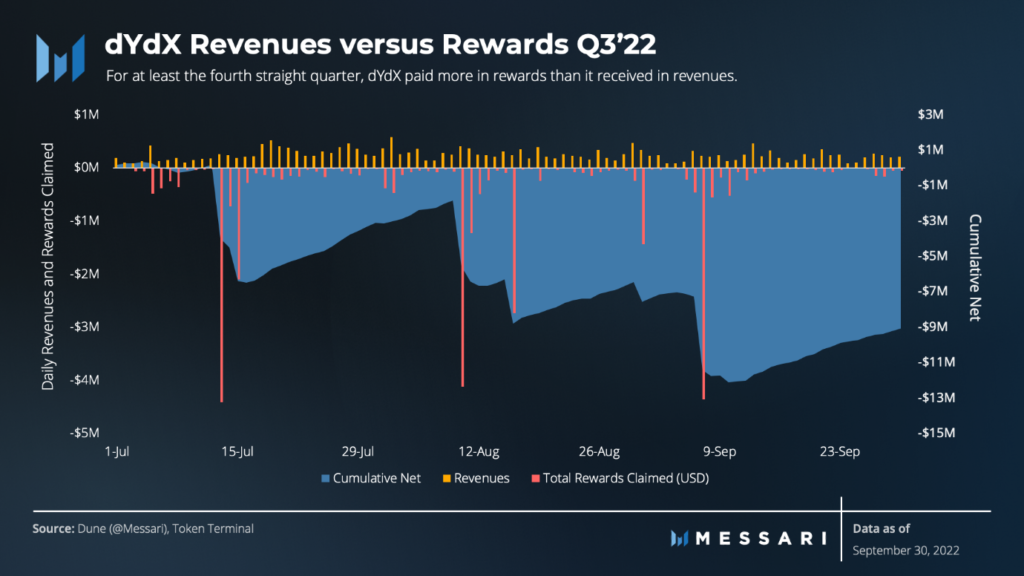

Governance efforts during the quarter focused on optimizing the DYDX (protocol native token) inflation reward. In another quarter, the revenue generated by the protocol was higher than the USD value of tokens paid out as incentives. Revenue is now accrued to dYdX Trading, not the community treasury. Treasury has only DYDX tokens to fund initiatives.

The move to V4, announced in June is a major milestone with the launch of the developer testnet. It is expected to launch dYdX Chain in Q2 of 2023, creating a decentralized order book and improving alignment between token holders and the protocol.

dYdX's trading revenue dropped 22%, from $29 million in Q2 to $22.6 million in Q3. Despite the drop in token prices, the rewards paid (in USD after claims) still exceeded through the revenue earned. Net expenses of $9 million were the smallest in the past four quarters. The rewards claimed spike is due to a schedule that allows rewards to be collected approximately every 28 days.

In Q3, trading volume fell 14% to $91.6 billion. Trading volume in Q2 was boosted by three high volume events in April, May and June. Q3 had The Merge event in September, which boosted ETH volume market share. increase higher. Despite less total volume, the average daily trading volume on dYdX in Q3 was actually $115 million higher than Q2's.

Similar to the figures for transaction volume, daily active users (DAUs) and total transactions declined in Q3. This could be the result of fewer events this quarter. dYdX had an average of 167,000 transactions in Q3 and 1,667 daily users.

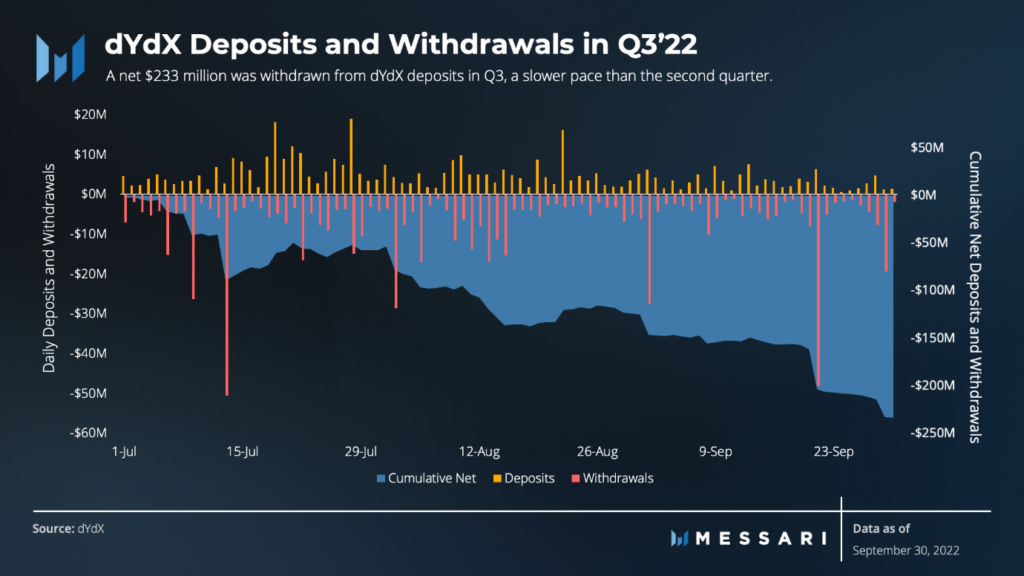

Despite healthy usage as measured by transactions and daily users, dYdX continued to see withdrawals in Q3. After $362 million left the platform in Q2 of the year. 2022, $233 million was withdrawn in Q3.

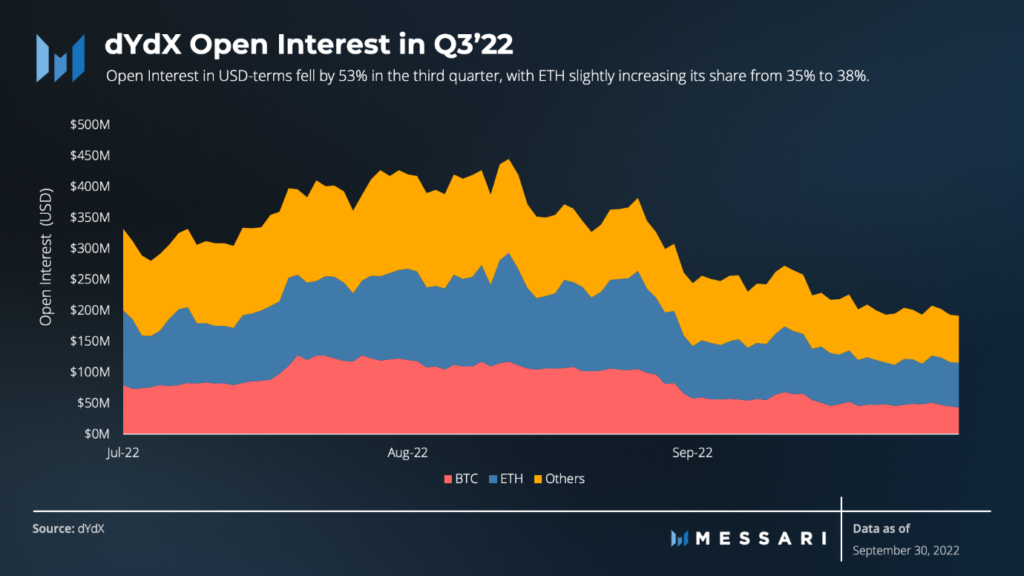

Due to the drop in deposits, open interest (OI) on dYdX halved in Q3. Under contract terms, BTC OI fell 50%, while ETH fell 38%, holding the better. Other tokens have much lower numbers: SUSHI, SOL, LTC, EOS, and AVAX all saw OI drops of 80% or more. While AAVE, DOGE, DOT, FIL, MATIC, MKR and UNI are down at least 70%. The only increase in OI statistics was in ETC, which grew by 59% in Q3 2022.

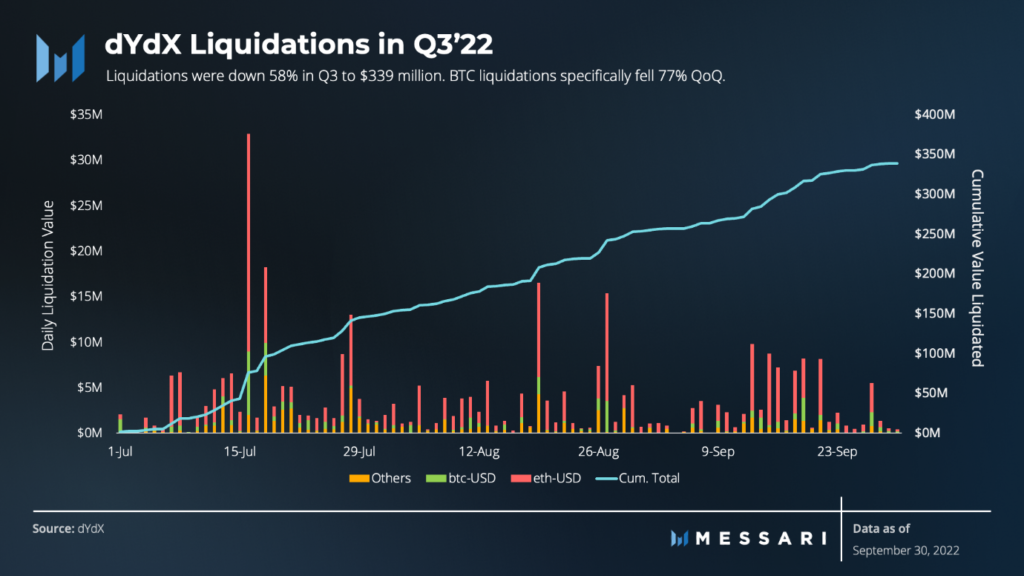

Less volatile markets mean fewer liquidations in Q3 and liquidation volumes fell 58% to $340 million. Ethereum liquidations increased from 52% in Q2 to 65% in Q3. Bitcoin's reduced volatility resulted in a 77% drop in liquidation volume, BTC liquidation only accounted for 14% of total liquidation volume in Q3 on the dYdX platform.

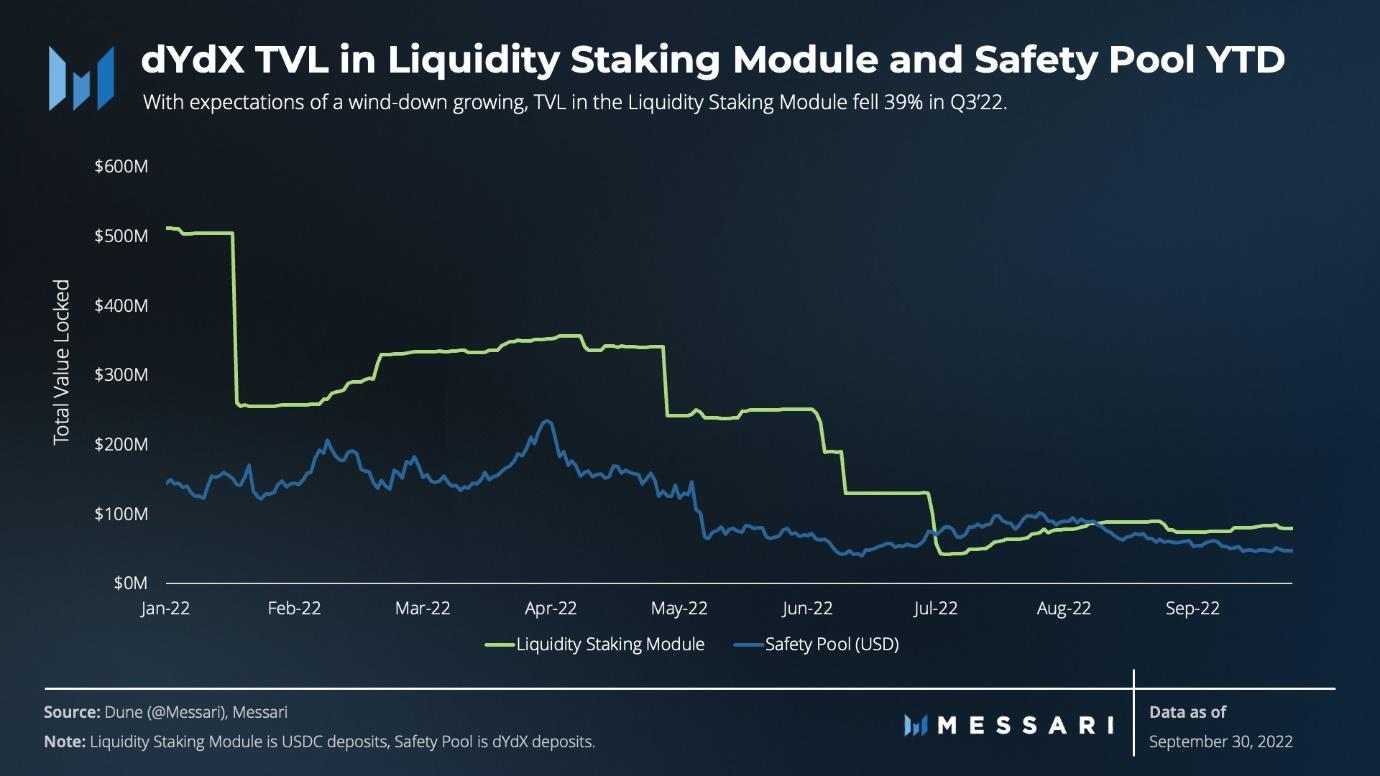

On July 2, a snapshot proposal was initiated to vote on cutting the liquidity staking module. Although forum discussions began in June, in the week following the snapshot vote, the TVL in the module dropped from $130 million to $42 million. This passed an on-chain vote ending September 27. On October 29, a snap vote was passed in favor of withdrawing the Safety Pool and sending the allocated DYDX tokens to the vault. silver. This still requires an on-chain vote for implementation.

On-chain events in Q1 and Q2 resulted in a higher volume share for dYdX in the first half of 2022. One positive for the protocol is to see a massive spike in volume towards the end of the epochs. standardized. This typically non-productive trade is incentivized through rewards. The modification of the reward schedule seems to have worked as intended.

ETH futures trading on five exchanges dYdX, FTX, Binance, Deribit, Bybit increased 17% from $350 billion in Q2 to $420 billion in Q3. dYdX maintains market share 10-15% throughout the Quarter, showing funding rates that rival the biggest CEXs.

dYdX offers a Liquidity Staking Module (LSM) – where anyone can deposit USDC that is approved by Market Makers and approved by the community as collateral to provide liquidity on dYdX. Stakingers were rewarded with DYDX tokens. Market makers have access to cheap (interest-free) capital that can only be used within the ecosystem. On September 27, the dYdX community voted in favor of scaling back the loan pool by setting the DYDX reward associated with USDC staking to 0.

Despite its attractive design, the Liquidity Staking Module does not appear to be an efficient way of allocating resources for the protocol. Sponsored by dYdX Grants, Xenophon Labs released a research report on LSM that found that “81% of bonus tokens were awarded to USDC without going to any market makers.” The main problem is that the amount of USDC staking depends on the price of dYdX and the change in capital availability leads to very low utilization by market makers.

On July 6, the community voted to cancel the LSM-linked borrowing pool and reuse the remaining DYDX token rewards.

On July 31, TrueFi's Ryan Rodenbaugh posted a proposal on the forum to improve LSM using TrueFi's "Automatic Line of Credit" (ALOC) product. Ideally, TrueFi's floating-rate ALOC will charge variable interest rates depending on the use of loan pools. These interest rates, which are largely based on USDC but are also incentivized with some dYdX, will reduce the volatility of available capital and thus increase usability. An important question, however, is to what extent will market makers be willing to borrow?

dYdX incentivizes usage on its exchange by rewarding trading with DYDX tokens to help offset fees paid. The previous version of the trading reward formula included fees paid, open interest (OI) and stkDYDX (staked DYDX).

In March, new research demonstrated that the opportunity to hit big OI rewards created a huge game space for farmers to earn DYDX with no additional liquidity or fees. Following the initial change to the rewards equation in April, reducing the weights given to OI, the community voted to remove any rewards attributed to greater open interest. The vote also reduces the total transaction reward per epoch by 25%.

Open interest has decreased markedly since these changes, but OI does not necessarily affect liquidity. In fact, open interest and volume on exchanges do not seem to be highly correlated.

The overall reduction in rewards strengthens the treasury and gives more strength to long-term investments.

Token reward management is the main topic of the Quarter and the reward for Liquidity Providers has also been addressed. The first change came in February, lowering the threshold for LPs and opening up rewards to more vendors. Then in May, at the behest of Wintermute (one of dYdX's largest Market Makers), the community voted to add a volume factor to the LP rewards equation. This August, the community took that plan a step further.

The August vote gave weight to the volume factor across all markets. Importantly, it increased the weight of the BTC and ETH markets due to concerns that reducing the depth factor too much would have a negative impact on illiquid markets. To further balance that incentive, the community has reduced the reward ratio for BTC and ETH markets from 20% to 10% each, which now allows more rewards to go to the markets. other. These are the two most in-depth markets on the exchange and it may not be necessary to spend a lot of money to attract liquidity.

So far, the changes have reduced spending to attract depth without hurting overall liquidity. Since the DAO is focused on optimizing the resources spent during the bear market, adjusting the rewards they offer to users is the main leverage they are using.

On August 23, dYdX Trading published a blog updating progress on V4. The main announcements are that Milestone 1, the launch of the developer test network, is complete. Additionally, this update has given a timeline for the Mainnet launch, currently scheduled for Q2 2023. Other plans include:

The launch of the developer testnet includes the completion of order book matching engine and margining system. As a first step, the project team achieved 50 transactions per second. There are a lot of optimizations and improvements still to be made, but this is positive progress on a major change to the protocol.

Traders continue to trade on the dYdX exchange, despite continuing to withdraw funds from the protocol. The average number of daily users tends to increase. The rewards paid to traders and investors are larger than the revenue paid to the protocol. The community used governance and voting to change all major rewards programs, close the liquidity staking pool, and reduce trading rewards. The launch of the dYdX chain is currently slated for Q2 2023. It provides an opportunity to further decentralize the protocol and better engage token holders with users.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

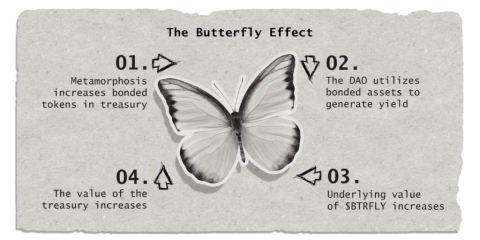

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

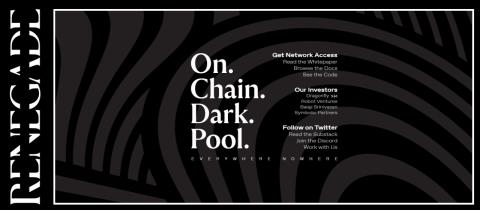

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

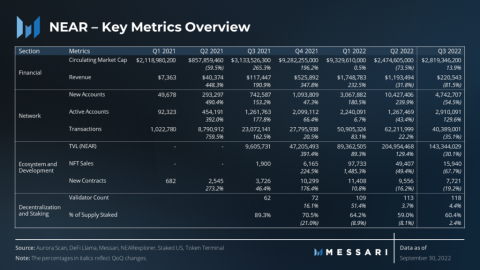

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

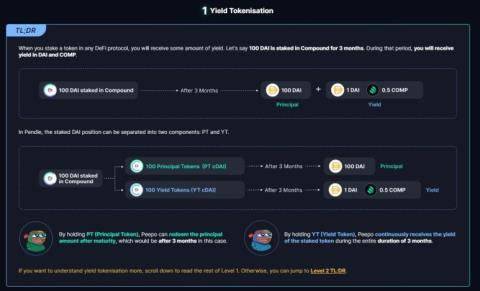

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

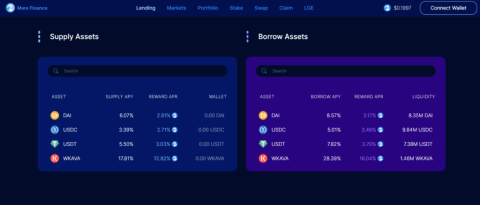

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.