What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Before learning about the project, let's briefly understand the concept of Real Yeal. The term "Real Yield" can simply mean the actual profit after deducting inflation, it is similar to a stock dividend.

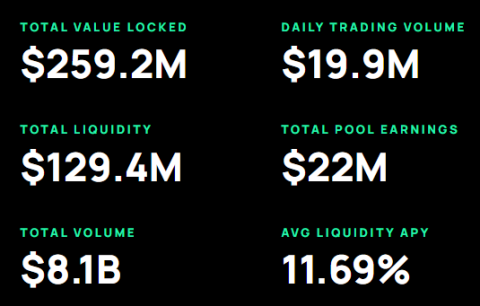

In DeFi, Real Yield refers to the actual yield generated by sustainable economic activities from services provided by DeFi protocols. Example: For Uniswap, the income collected from trading fees is paid by the trader to the liquidity provider for the protocol.

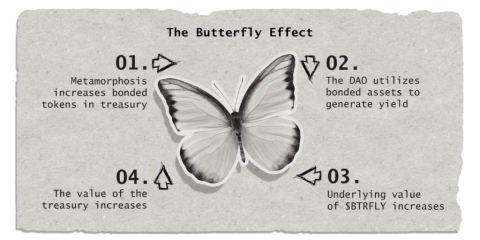

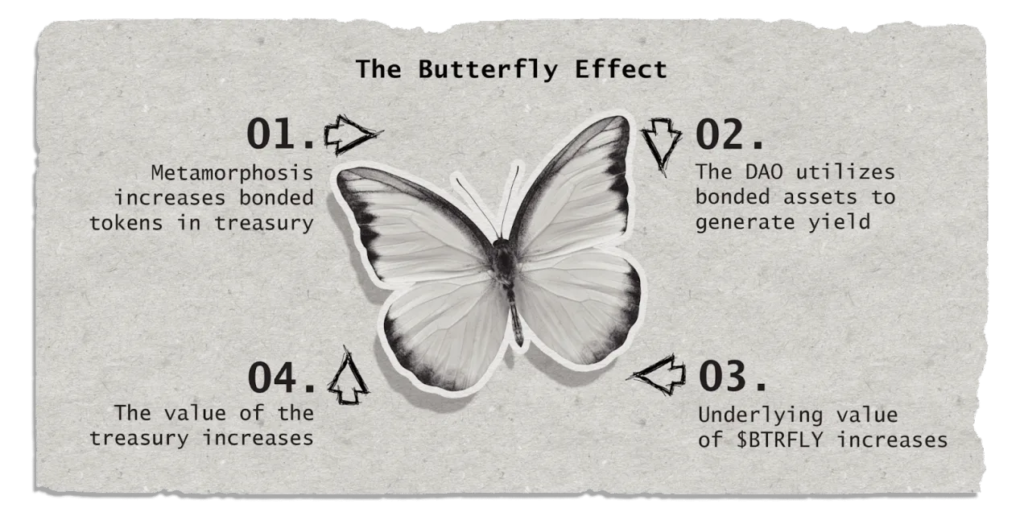

Initially the Redacted Cartel was forked from OlympusDAO using the POL (Protocol Owned Liquidity) mechanism, to accumulate as much liquidity as possible from the Curve ecosystem. At that time, the project allowed Bonding and Staking users to combine with Ve(3,3) of OlympusDAO to mint BTRFLY coins provided from the project's treasury with an APY of thousands of percent.

However, in the long run, this model is inefficient and has many problems, so the Redacted Cartel team has switched to a new model with 3 main features:

With innovations, Redacted Cartel becomes an effective assistant for DeFi projects in terms of governance, liquidity empowerment, and cash flow control.

Hidden Hand

The "Hidden Hand" was first coined by the economist Adam Smith in 1776, it means the following:

In a free market economy, each individual pursues his or her own personal interests and interests. And it is the actions of these individuals that tend to promote and strengthen the interests of the whole community through an "invisible hand - Hidden Hand".

The Hidden Hand in the Redacted Cartel is inspired by the above economic thought combined with the ve-Tokenomic model to create a marketplace for DAOs, providing an environment for "buying" and "selling" voting rights for parties. needs with a very simple operating mechanism.

Specifically, individuals and organizations wishing to "buy" voting rights will send a bribe into the Pool that they want to increase the reward, whereas the party "selling" voting rights can vote for That Pool or simply delegate your voting rights to Hidden Hand. The Redacted Cartel platform will then automatically vote for the Pool with the highest return.

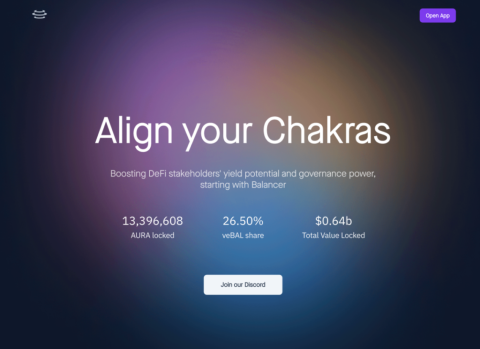

Up to the time of writing the article Hidden Hand, Redacted Cartel is supporting the DAO market for projects such as: Curve Finance, Convex Finance, Balancer, Aura Finance, Frax Finance...

Standard Mode (Standard Mode)

This mode allows users to load CVX into Pirex and receive pxCVX. In particular, the number of CVX that the user loads in will be guaranteed 1:1 with vlCVX and continuously re-locked (re-locked) to maximize the locking time, except for the case where there is a request to unlock the CVX from user.

The rewards will be distributed to users every 2 weeks after the voting rewards are allocated from the governance platforms supported by the Redacted Cartel.

Easy Mode (Easy Mode)

If a user wants to accumulate pxCVX rewards from locking up the CVX, they can continue to lock the pxCVX rewards into the ERC-4626 Pounder Vault. After that, the user will receive uCVX, which will continuously accumulate every time Pirex receives a reward from Bribes.

Advanced Mode (Expert Mode)

Advanced mode is developed specifically for users/or platforms who want to leverage on the number of votes they have. That is, users can receive Bribes rewards in the future and platforms can “pre-purchase” future votes.

After obtaining pxCVX, the user can lock pxCVX into the Vault of advanced mode and receive spxCVX (the longer the lock-up period, the more leveraged the voting power).

On December 22, 2022, Pirex announced that they would be launching a new GMX product, pxGMX and pxGLP. This product incentivizes stakers to deposit GMX into Pirex Vault, in order to accumulate more Multiplier Points, to be able to receive more rewards in the share of transaction fees shared by GMX holders.

Fee structure

Pirex will generate fee income every time it receives a reward from

Of Pirex's revenue, 75% of the revenue will be returned to the Redacted Cartel at a rate of 42.5% distributed to rlBTRFLY Holders, 42.5% to the Redacted Treasury and 15% to the DAO's storage.

DINERO

This is the product that is receiving the most attention from the Redacted Cartel community. Dinero was revealed to be a stablecoin product with over-staking, backed by Ethereum Liquid Staking Derivatives. This product is expected to be launched in Q1/2023. However, at the moment Redacted Cartal has not released a whitepaper for Dinero.

Dinero will include:

With the launch of Ethereum's Shanghai upgrade in March 2023, Liquid Staking Derivatives tokens such as LDO, RPL, SWISE, SD... at the beginning of the year recorded impressive growth. The Redacted Cartel's launch of the Dinero product promises to help this project capture more market share in the Liquid Staking Derivatives segment.

The Redacted Cartel creates value not only through its main products, currently Hidden Hand and Pirex, but also through its rich treasury.

All governance tokens in the treasury earn profits – either by being deposited in external Farming Pools or by voting in metrics to accumulate bribes. Even protocol-owned liquidity (POL) generates a return through swap fees.

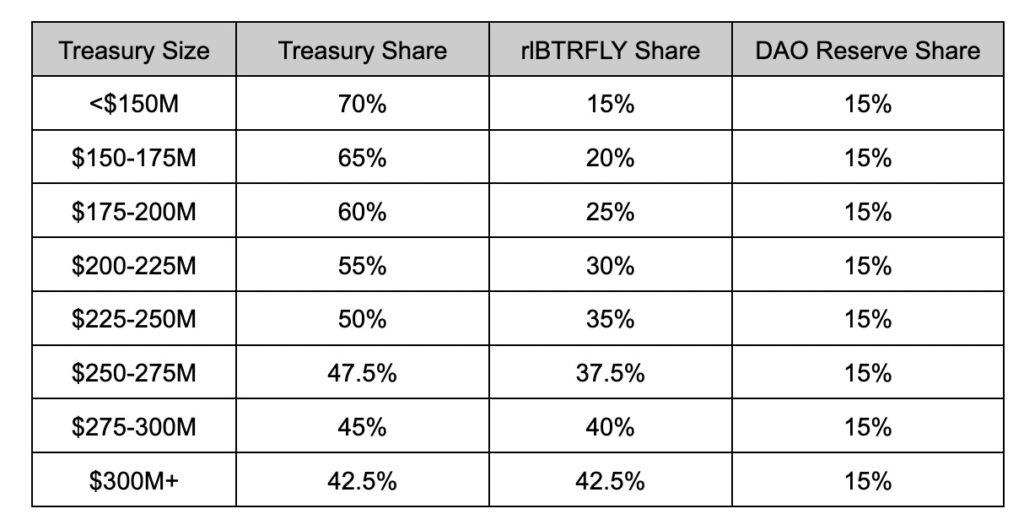

As seen above, the income generated by the treasury is apportioned according to the size of the treasury. Based on the current size of the treasury, 15% of the profits go to rlBTRFLY, 15% to the DAO reserve, and 70% back to the treasury.

In addition to creating value through the assets it holds, the treasury also creates intrinsic value for BTRFLY holders and essentially supports the supply of BTRFLY. This is especially useful in volatile and unfavorable market conditions as it creates a feeling of confidence and security.

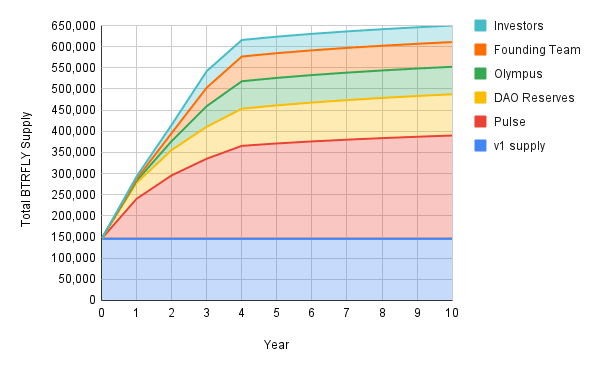

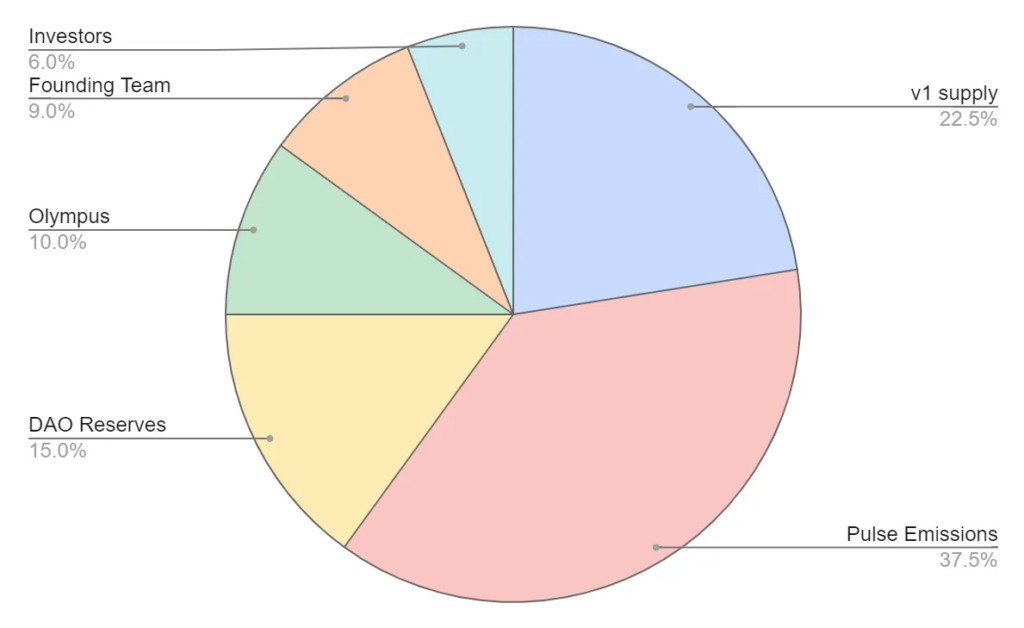

BTRFLY is the native token of the Redacted Cartel project. After the model change, the Redacted Cartel will have a fixed total supply of 650,000 BTRFLY and a circulating supply of 100,000 BTRFLY.

Functions of BTRFLY:

Note : Each Epoch will be ended every Thursday morning and rewards will be distributed to users every 2 Epoch.

According to the token allocation schedule, we can see the inflation of BTRFLY in the first 4 years is very large. However, the inflation rate from year 4 to year 10 will be extremely low. BTRFLY tokens are allocated to the parties as shown below:

The Redacted Cartel was really successful with the v2 version of the protocol. By structuring their core products around markets of great advantage and implementing a solid token model, they have positioned the protocol in a very financially profitable way.

When we see a model of transformation from valueless governance to cumulative value governance, the Redacted Cartel will be at the forefront of this segment. The Redacted Cartel team has regularly released new features and implementations to give the protocol an edge over others. And if the Redacted Cartel plays its cards right, it could be building an ecosystem that will be pivotal to DeFi as a whole.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

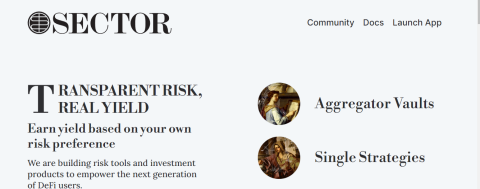

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

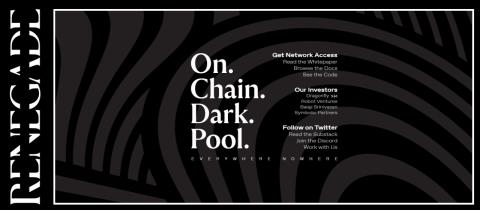

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

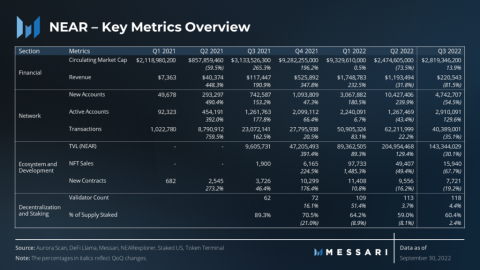

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

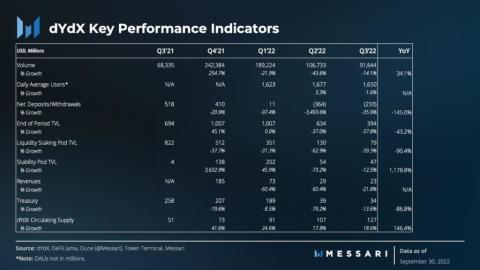

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

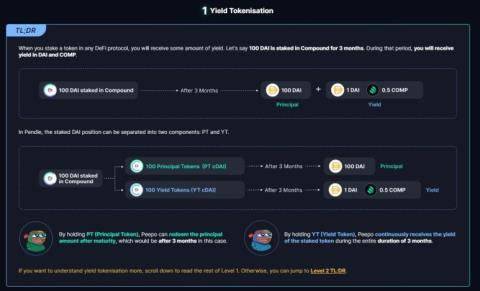

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

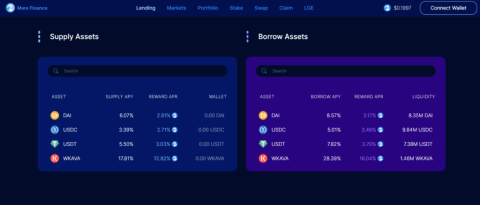

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.