What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

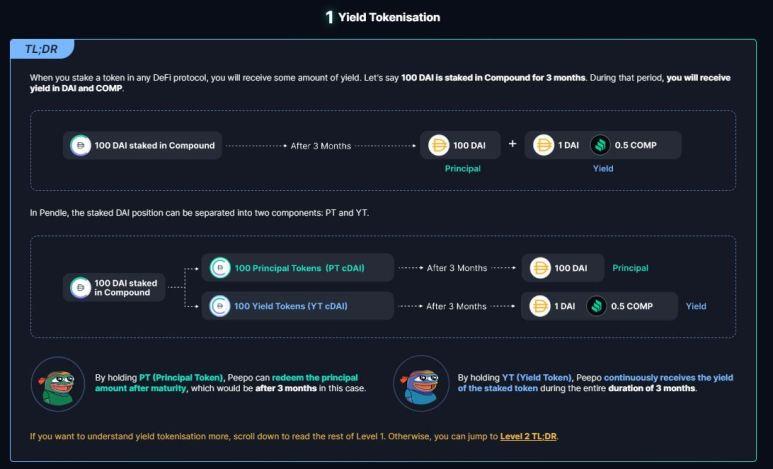

Pendle Finance is a DeFi project that brings a new design when combining DeFi Yield and Trading Protocol. The project provides users with a platform where they can freely create strategies to profit from their own profits in the future.

Pendle Finance has a relatively simple operating mechanism as follows:

Step 1 : Pendle Finance will wrap Yield – Bearing Tokens (also known as profitable tokens) in the form of SY.

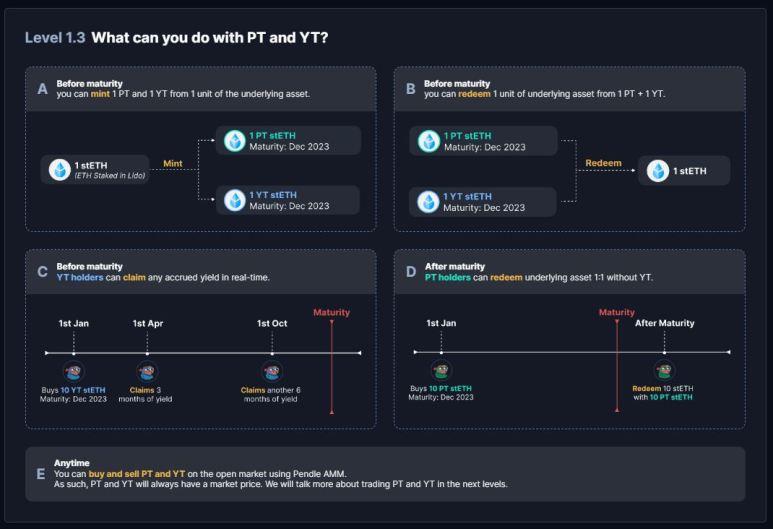

Step 2 : SY - the standard for issuing profit tokens in the future, will be divided into 2 types: PT (Principal Token - Original Token) and YT (Yield Token - Profit Token).

Step 3 : PT & YT are traded through custom Pendle AMM.

When you hold YT, PT or both, you can use them to:

In addition, Pendle Finance allows users to access a number of other profit-making strategies in the near future, including:

Fixing Your Yield: You will rely on supply and demand for PT to be able to buy assets at a discounted price and receive the full amount on the maturity date.

Leverage Yield Farming : Use leverage to generate more profit as 3AC did with Lido Finance & stETH.

Yield Trading : Your future profits can be traded, traded for more profit.

The project was built and developed by a Vietnamese team, including Nghia Pham, Thuc L., Daryl Tan, Kevin Tseng, Long Vuong Hoang...

On April 16, 2021, Pendle Finance raised $3.7 million in a Private round led by Mechanism Vapital with participation from Crypto.com , Spartan Group, Haskey Capital, LedgerPrime, Sora Ventures…

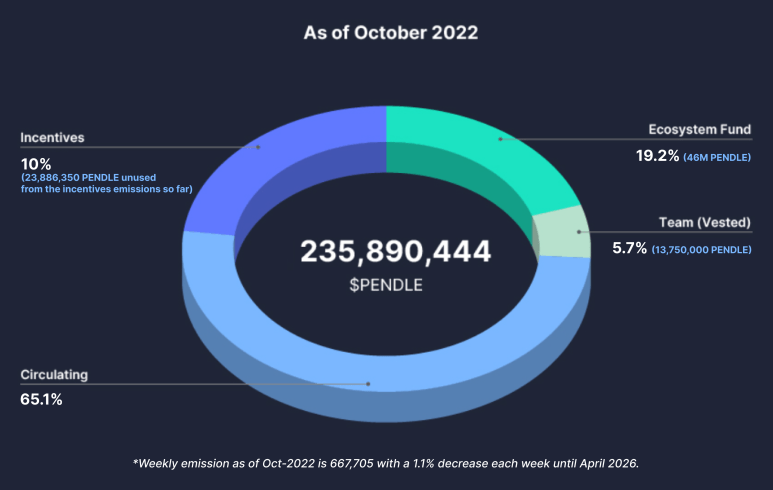

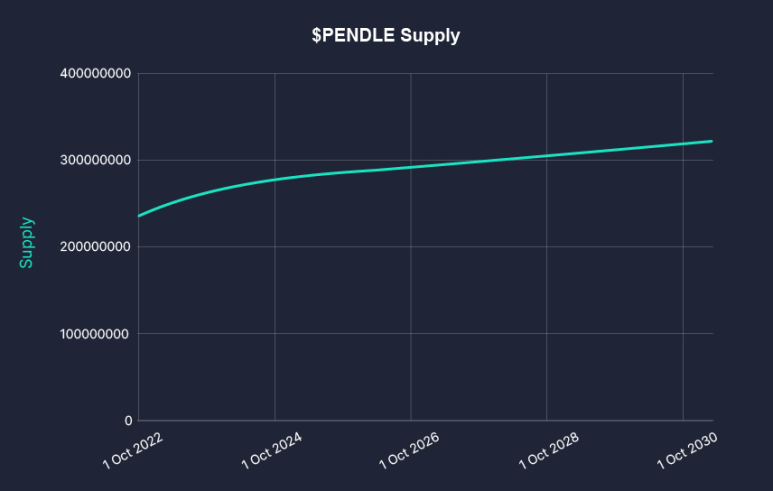

In October 2022, PENDLE's inflation will be close to 2%/year and from that time, the inflation rate will be reduced by 1.1% every week until April 2026.

Pendle Finance uses the same veToken model as many projects today. Pendle's veToken model has several highlights such as:

Above are detailed information about Pendle Finance and the PENDLE token. This is a DeFi project with a very unique idea when it became the first Yield Derivatives project. opens up a whole new market in DeFi helping users effectively use their capital. If you are interested in this project, you can follow some more social networking channels such as:

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

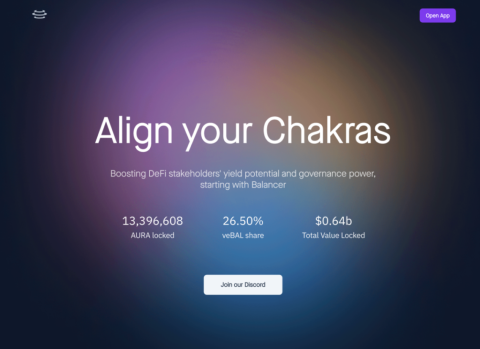

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

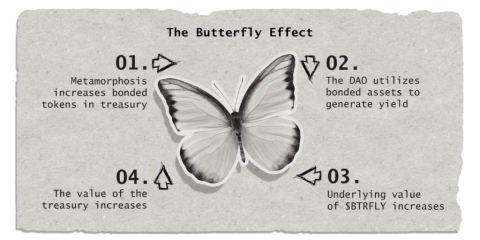

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

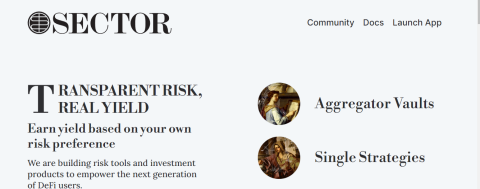

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

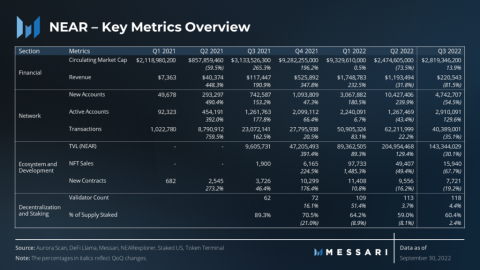

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

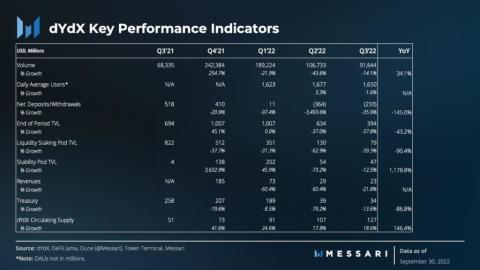

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

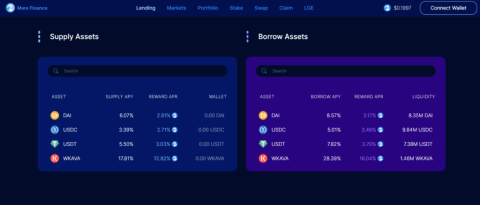

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.