¿Es la tendencia algorítmica de Stablecoin 2021?

Este artículo presentará algunos proyectos Fork del gran proyecto Algorithmic Stablecoin. ¿Es esta una tendencia en 2021?

Bienvenido a la serie DeFi Legos: una serie de artículos interesantes que le brindan un análisis e investigación profundos en diferentes segmentos del mercado. El tema de hoy es Stablecoin.

Actualmente existen varias Stablecoins como USDT, USDC, DAI, ESD,... pero sus mecanismos son totalmente diferentes. Es por eso que en este artículo analizaré a fondo el sector Stablecoin y te daré información detallada sobre:

Como habrá muchos conocimientos especializados, es recomendable que tome nota de algunos puntos útiles para usted. Además, cada parte está vinculada a otra en orden, así que no te saltes ninguna parte. Ahora comencemos.

Descargo de responsabilidad: el propósito de este artículo es principalmente proporcionar información constructiva y puntos de vista personales, no asesoramiento financiero . Invertir en el mercado de criptomonedas es muy arriesgado, así que haga su propia investigación antes de invertir.

Definición de moneda estable

La palabra Stablecoin se combina con "Estable" y "Moneda":

En términos generales, el oro o la plata que se tokenizan en una criptomoneda se puede considerar como una Stablecoin; Las monedas fiduciarias también pueden considerarse Stablecoins de la misma manera.

Sin embargo, este artículo se centrará solo en las Stablecoins más utilizadas en criptografía: las Stablecoins que tienen un valor vinculado a $1.

El papel de Stablecoin en DeFi

En este momento, el mercado de criptomonedas vale más de $ 2200 mil millones, lo que indica que el flujo de efectivo circulante en el mercado es extremadamente grande y existe una gran demanda de comercio, almacenamiento o inversión en activos criptográficos.

Sin embargo, no todas las monedas Fiat son compatibles con los intercambios de cifrado. Si Stablecoin no existe, los usuarios primero deben cambiar la moneda fiduciaria de su país a USD (ya que el USD se acepta en todo el mundo como moneda de pago), luego continuar el intercambio a través de un intermediario (como un banco) con un alto costo y un alto margen. , trámites complicados,... antes de adquirir cualquier token de criptomoneda.

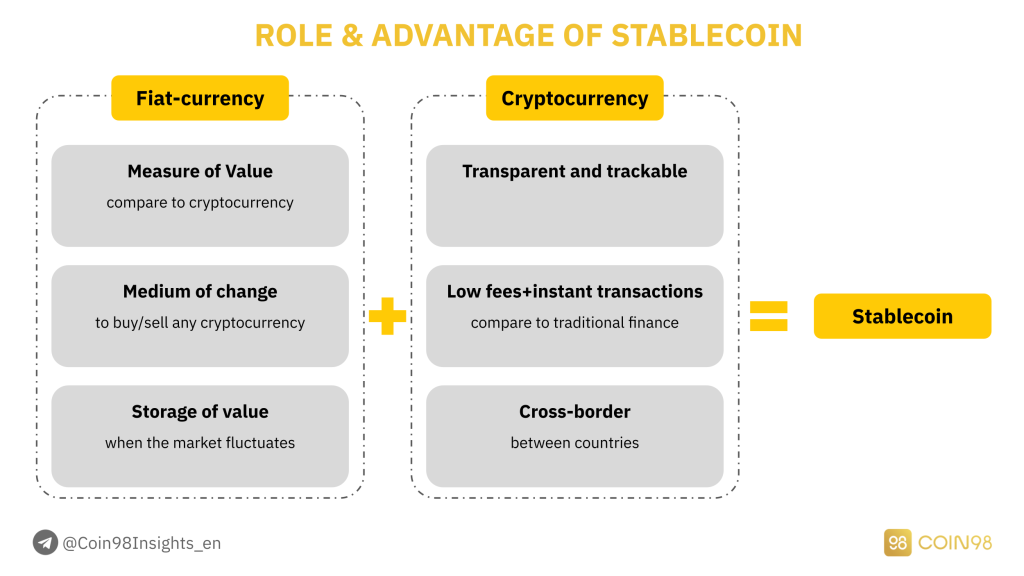

Stablecoin fue inventado para resolver este problema. Las fortalezas de Stablecoin se pueden ver como una combinación de 2 factores:

El papel y la ventaja de Stablecoin.

En el criptomercado, Stablecoin tiene el papel de:

Se cree que Stablecoin es la combinación perfecta del valor de la moneda Fiat y la conveniencia de la criptomoneda en la red blockchain. Stablecoin ayudará a los usuarios a invertir de la manera más rápida, acceder a la mayor cantidad de criptoactivos y, especialmente, eliminar el proceso intermediario innecesario.

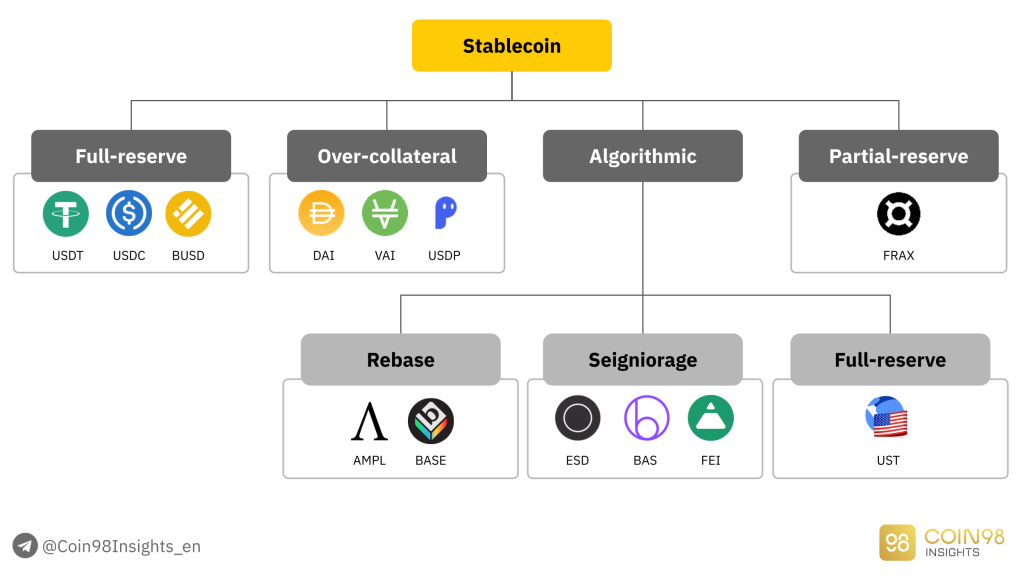

Diferentes tipos de monedas estables

USDT, USDC y DAI son las tres Stablecoins más populares. Sin embargo, el mundo de Stablecoin es mucho más enorme que eso, que se puede dividir en 4 tipos principales con diferentes capacidades de optimización de capitales.

4 tipos principales de Stablecoin.

En esta parte, analizaré el mecanismo, las fortalezas y las debilidades de cada uno de ellos.

Stablecoins de reserva completa (Stablecoins centralizados)

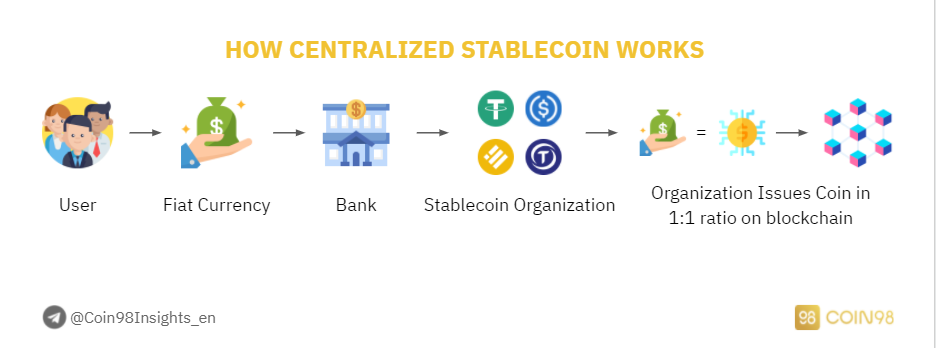

Cómo funciona Stablecoin centralizado.

Las Stablecoins de reserva completa son las Stablecoins que están respaldadas por una moneda Fiat en la vida real . Los casos más conocidos son USDT, USDC y BUSD respaldados por USD, lo que significa que por cada 1 USDT acuñado en la cadena de bloques, se reserva 1 USD en la vida real.

Los atributos de una Stablecoin de reserva completa:

Las Stablecoins de reserva completa, o Stablecoins centralizadas, se rigen por una organización en términos de su Suministro total y Suministro circulante. Más específicamente, USDT está controlado por Tether , USDC está controlado por Circle y BUSD está controlado por Binance y Paxos.

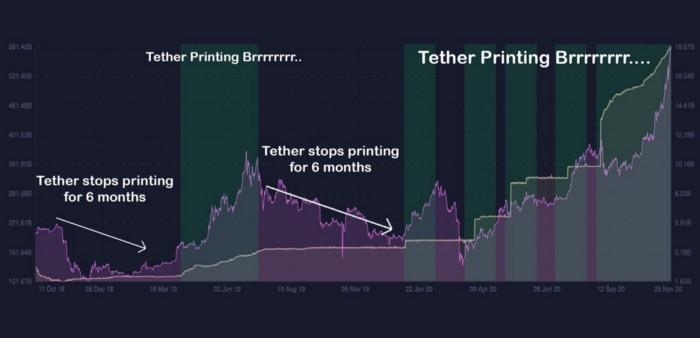

Si presta atención a las noticias con regularidad, notará que las Stablecoins centralizadas se han enfrentado a FUD sobre cuestiones legales de forma regular, especialmente Tether USDT. Desde 2016, se sospecha que Tether manipula el mercado con Bitfinex.

El FUD más grande es que Tether ha estado acuñando más monedas estables que el fondo reservado en el banco. Si este es el caso, la posibilidad de que Tether manipule el mercado es totalmente posible. No obstante, USDT ha sobrevivido desde 2016 hasta ahora y ha sostenido una productividad efectiva.

Tether FUD.

Stablecoins con garantía adicional (Stablecoins descentralizados)

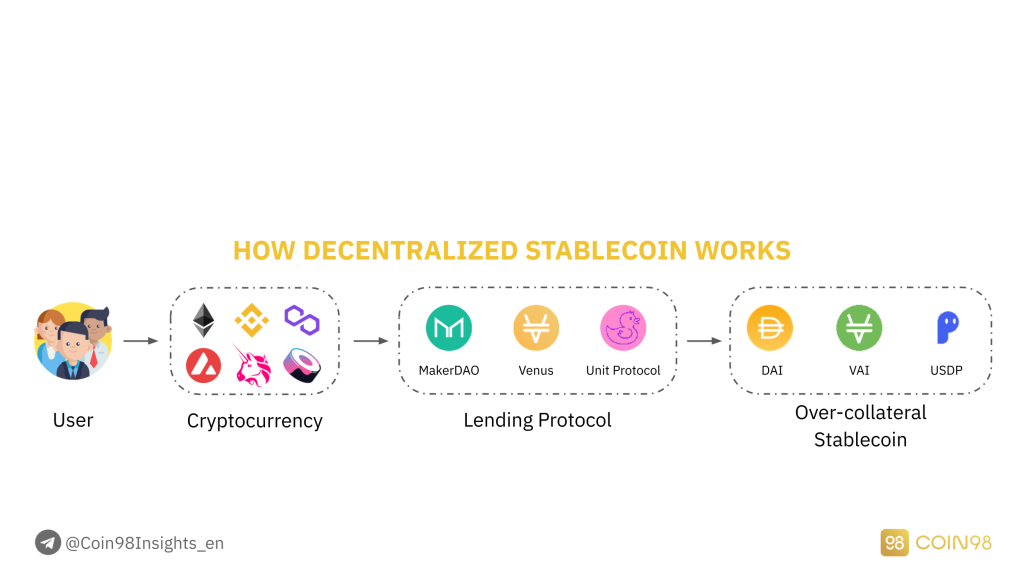

La Stablecoin con garantía adicional es el segundo tipo más popular de Stablecoin, que se crea cuando el valor de la garantía es mayor que el valor de las Stablecoins acuñadas. La Stablecoin sobre garantía más destacada es DAI, una moneda estable generada por MakerDAO, un protocolo de préstamo.

Los atributos de una Stablecoin Over-colateral:

Para acuñar DAI en el mercado, los usuarios deben garantizar otras criptomonedas para que su valor total sea al menos el 150% de la cantidad de DAI que se acuña. Si el precio de los activos cae por debajo del umbral permitido, esos activos se liquidarán para garantizar el valor del DAI acuñado.

Esto ha mantenido el precio de DAI estable y vinculado a 1 USD. No obstante, este enfoque limita la escalabilidad de los tokens DAI ya que su mecanismo no es eficiente en términos de capital (la acuñación de DAI siempre requiere una mayor cantidad de valor colateral).

Cómo funciona Stablecoin descentralizado.

Algunas Stablecoins con garantía adicional destacadas: MakerDAO (MKR y DAI), Venus (XVS y VAI), Party Parrot (PRT y PAI),...

Y eso es exactamente lo que sucedió el 12 de marzo de 2020. Cuando se produjo un Flash Dump, el precio de ETH se redujo a la mitad en 2 días, sin mencionar que la red Ethereum estaba congestionada. Desafortunadamente, esto resultó en enormes liquidaciones de activos.

En términos de eficiencia de capital, las Stablecoins Over-colateral no pueden utilizar fondos ya que la cantidad de Stablecoins que se permite acuñar representa solo el 75% del valor de la garantía, o incluso el 50% si los usuarios desean evitar un Flash Dump como se mencionó.

De hecho, la mayoría de los protocolos de préstamo permiten depositar garantías para tomar prestadas otras monedas estables como USDT o USDC, en lugar del mecanismo de garantía adicional como DAI. Esa es la razón principal por la que MakerDAO está dominando el segmento de Stablecoin Over-collateral.

Stablecoins sin reserva (Stablecoins algorítmicos)

Las Stablecoins sin reserva, o Stablecoins algorítmicas, son Stablecoins que se acuñan sin ninguna reserva respaldada . Los protocolos usan algoritmos para ajustar constantemente el suministro circulante de Stablecoin para mantener su precio en $1.

Los atributos de una Stablecoin algorítmica:

Las monedas estables algorítmicas incluyen 2 tipos principales: modelo de rebase y modelo de señoreaje.

1. Modelo de rebase

Las monedas estables que siguen el modelo de rebase usan solo 1 token, que aplica algoritmos para modificar el suministro circulante del token e influir en el precio. El proyecto más destacado que utiliza este modelo es AmpleForth (AMPL).

Cada 24 horas, el suministro de AMPL se cambiará dependiendo del precio de AMPL:

El proceso de Rebase afecta directamente la cantidad de tokens que tiene un usuario. Como resultado, se mantiene el equilibrio entre la oferta y la demanda para que el precio de AMPL vuelva a su nivel fijo.

Algunas Stablecoins algorítmicas prominentes que siguen el modelo Rebase: AmpleForth (AMPL), BASE Protocol (BASE), Yam Finance (YAM),...

2. Modelo de Señoreaje

Las monedas estables que siguen el modelo de señoreaje utilizan 2 o 3 tokens laterales en el proceso de operar y mantener el precio del token. Generalmente, un token es una Stablecoin y el otro es un token que aplica algunos mecanismos como Burn-Mint, Stake-Earn,... para aumentar/disminuir la oferta/demanda de la Stablecoin y mantenerla en un valor fijo.

Algunas Stablecoins algorítmicas prominentes que siguen el modelo de señoreaje:

Fortaleza: No se necesita capital ni garantías.

Debilidad: Teóricamente, Algorithmic Stablecoin puede resolver las limitaciones de Full-reserve Stablecoin y Over-colateral Stablecoin. En realidad, Algorithmic Stablecoin es el tipo más ineficiente e improductivo ya que su precio no puede mantenerse en $1 debido a la presión de venta extremadamente alta.

Este es el caso, ya que los proyectos de Algorithmic Stablecoin normalmente dan por sentado desde el principio que tienen una comunidad fuerte y sólida para apoyarlos en el mantenimiento del precio del token. Confían en la creencia de que el Programa de Incentivos puede atraer a un gran número de simpatizantes para el proyecto.

De hecho, el Programa de Incentivos (Agricultura) no es lo suficientemente persuasivo para animar a los usuarios a seguir el proyecto a largo plazo. Los usuarios se enfocan solo en la agricultura con una APR alta y luego venden las recompensas obtenidas ⇒ crean presión de venta> compran demanda ⇒ no fijan el precio.

Además, las monedas estables algorítmicas no se aplican ampliamente en el mercado. A excepción de Fei Protocol y Terra USD, los dos proyectos de Algorithmic Stablecoin más funcionales en este momento, no se destacan otros proyectos en este sector.

Stablecoins de reserva parcial (Stablecoins de reserva fraccionaria)

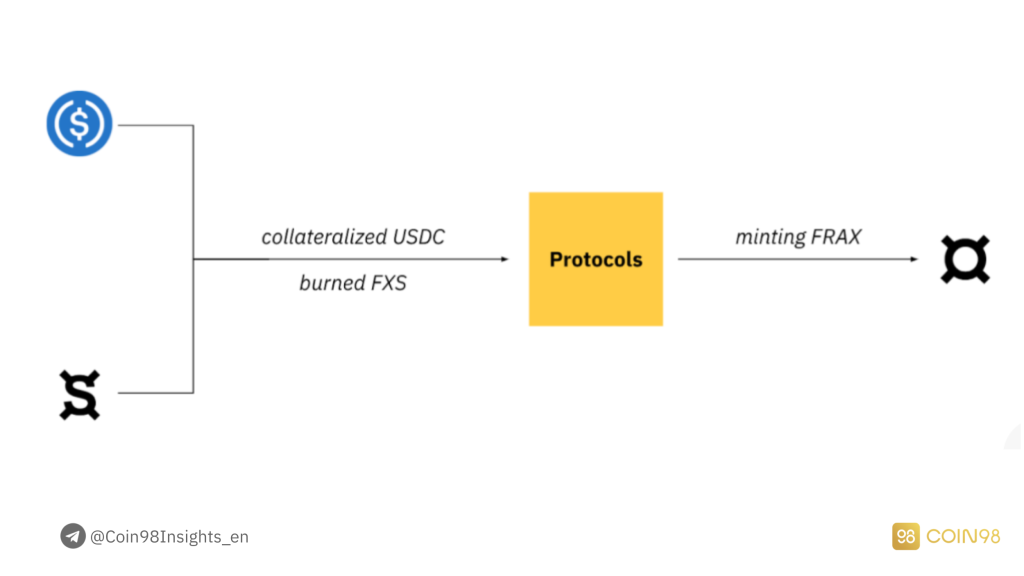

Las Stablecoins de reserva parcial, o Stablecoins de reserva fraccionaria, son la combinación de Stablecoins de reserva completa y Stablecoins algorítmicas . El primer y más excepcional ejemplo es Frax Finance.

Los atributos de una Stablecoin de reserva parcial:

Para acuñar 1 FRAX (una Stablecoin de reserva parcial), los usuarios deben poseer algunas Stablecoins (actualmente USDT y USDC) para subsidiar el precio de 1 FRAX. La proporción se puede ajustar de acuerdo con Frax Finance, con una tasa de garantía que oscila entre el 50 % y el 100 %.

modelo FRAX.

Algunas Stablecoins de reserva parcial prominentes: Frax Finance (FXS & FRAX),...

Fortaleza: Eficiencia de capital promedio, la combinación de Stablecoin de reserva completa (necesidad de garantía) y Stablecoin sin reserva (basada en algoritmos).

Debilidad: Frax Finance es actualmente el único proyecto que aplica este enfoque, lo que demuestra que no muchos desarrolladores están interesados en este segmento. Los datos en tiempo real también indican que la capitalización de mercado de FRAX es realmente pequeña y FXS no tiene muchas aplicaciones en DeFi o CeFi.

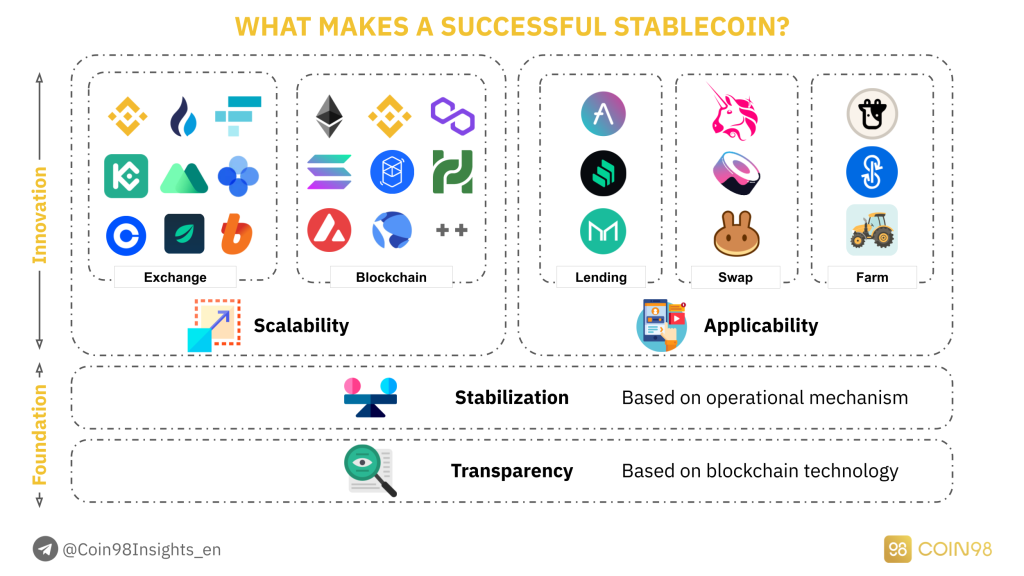

Los atributos de una Stablecoin exitosa

Después de analizar las fortalezas y debilidades de cada tipo de Stablecoin, ahora analizaremos los factores que crean una Stablecoin exitosa y efectiva. Posteriormente, podrás visualizar el proceso de trabajo y expansión en el criptomercado.

Para que una Stablecoin funcione de manera eficiente en el mercado, debe tener la pila completa de 4 factores, que incluyen:

4 elementos que hacen una Stablecoin exitosa.

Transparencia

La transparencia puede considerarse como la base básica de una Stablecoin valiosa. ¿Quiénes son los patrocinadores de esa Stablecoin? Si una Stablecoin está respaldada por patrocinadores enormes y de buena reputación, será confiable tanto para los usuarios minoristas como para las ballenas para el comercio y el almacenamiento. Por ejemplo:

La transparencia de una Stablecoin se puede evaluar a través del acceso de los usuarios a las herramientas de seguimiento o, en otras palabras, si los usuarios pueden rastrear el suministro total y las transacciones del token en la cadena de bloques. Sin embargo, en el caso de Stablecoins centralizados como USDT o USDC, sus transparencias aún son cuestionables, ya que no es seguro si la cantidad de USD encerrada dentro de la Bóveda de Tether o Circle es relativa a las Stablecoins acuñadas.

Estabilización

El siguiente elemento a considerar es la Estabilización, que también es una característica indispensable de una Stablecoin . Volviendo al propósito original, Stablecoin se creó como una herramienta para evitar toda la volatilidad en el mercado de las criptomonedas.

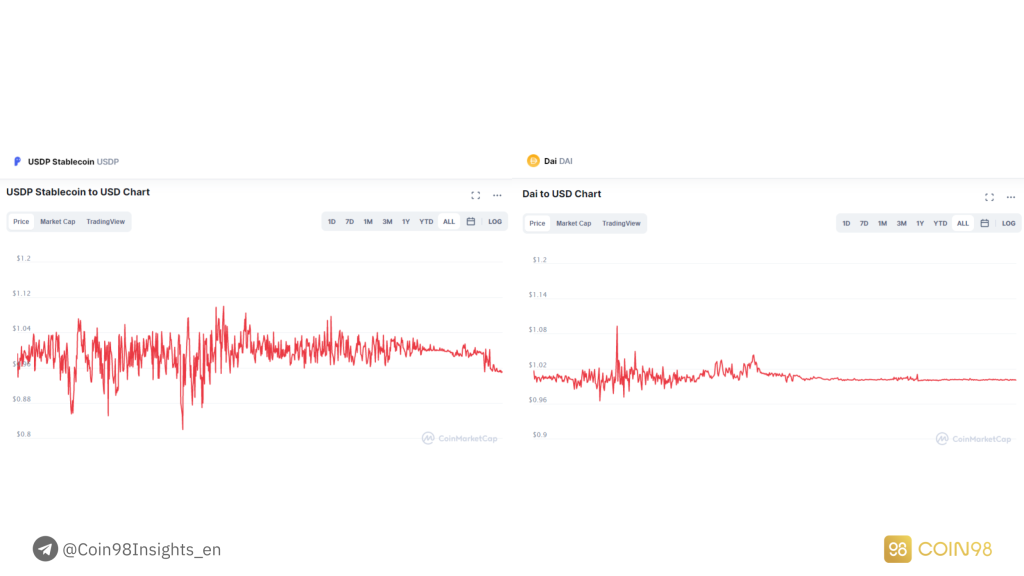

Por lo tanto, si una Stablecoin no puede mantener su paridad de manera constante, esa Stablecoin no puede usarse como un activo de almacenamiento. En la siguiente ilustración, se compararán las dos Stablecoins DAI (MakerDAO) y USDP (Unit Protocol).

Si bien el precio de DAI pudo mantenerse estable alrededor de $ 1, el valor de USDP generalmente cayó a $ 0.95, perdiendo un 5% en comparación con 1 DAI.

Compara USDP con DAI.

Si la Transparencia y la Estabilización son los requisitos para que una Stablecoin funcione productivamente, entonces la Aplicabilidad y la Escalabilidad son los dos factores que ayudan a una Stablecoin a expandirse ampliamente en el mercado.

Análisis extra: La paradoja de la Estabilización

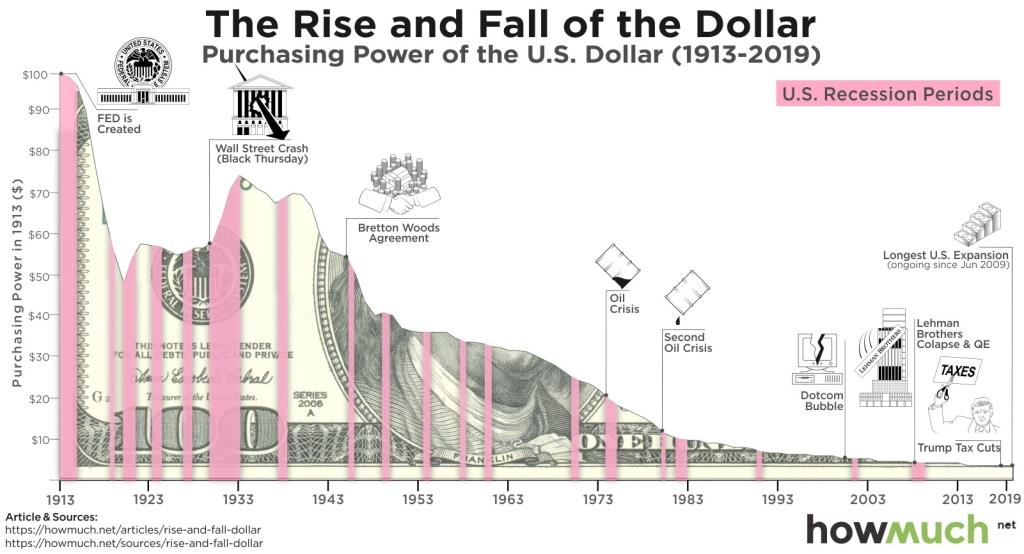

La mayoría de las Stablecoins fijan sus precios a USD, una moneda Fiat respaldada por toda la economía de los Estados Unidos. Como resultado, se consideran más estables que otras monedas altamente inflacionarias y activos altamente volátiles en el mercado bursátil o de criptomonedas.

Pero, ¿las Stablecoins son realmente "estables" si están vinculadas al USD?

Según las estadísticas proporcionadas por HowMuch, desde 1913 hasta 2019, el valor intrínseco de la moneda dólar se ha reducido en un 90%.

Lo que significa que, si en 1913 $100 podían comprar 10 kg de arroz, en 2019 $100 solo podían comprar menos de 1 kg de arroz. Esto sucedió debido a que EE. UU. abandonó los estándares del oro y el petróleo, lo que permitió a la FED imprimir dinero libremente sin ningún activo físico que respaldara su valor. Este evento creó una enorme inflación en USD.

Entonces, ¿el reciente aumento del precio de Bitcoin fue el resultado del esquema de bombeo o de la disminución del valor del USD?

El valor del USD se reduce con el tiempo

Escalabilidad

La escalabilidad puede considerarse el efecto de red de una Stablecoin. Cuando una Stablecoin expande su rango operativo, también aumenta la cantidad correspondiente de influencia.

En las plataformas CeFi, especialmente en los intercambios centralizados, USDT es una fuerza gigantesca, ya que se utiliza como principal activo comercial en algunos de los intercambios más grandes en este momento, como Binance, Huobi, FTX, OKEx, KuCoin,...

En las plataformas DeFi, USDC está teniendo el mayor impacto porque es el activo más común cuando se trata de crear Liquidity Pools. Aunque USDC se lanzó 3 tres años después de USDT, rápidamente emitió sus monedas estables en múltiples ecosistemas DeFi en desarrollo como Ethereum, BSC, Polygon, Fantom, Solana,...

Además de USDT y USDC, BUSD es otra Stablecoin de rápido crecimiento gracias a Binance, ya que no solo se utiliza como activo comercial en Binance Exchange, sino que también se implementa en los protocolos DeFi en Binance Smart Chain.

Aplicabilidad

Dado que una Stablecoin está ampliamente expandida, al mismo tiempo ejerce una influencia considerable en el mercado criptográfico. El siguiente paso es mejorar la Aplicabilidad .

Por ejemplo:

La aplicabilidad debe desarrollarse junto con la escalabilidad después de que la transparencia y la estabilización estén sólidamente construidas.

Las Stablecoins más destacadas del mercado

Hemos repasado algunos atributos básicos que hacen que una Stablecoin sea exitosa. Sin embargo, el segmento Stablecoin es extremadamente competitivo con un alto índice de dominación.

Las 10 Stablecoins principales en el mercado representan el 96% de la capitalización de mercado de Stablecoin. ¿Por qué las Stablecoins mejor clasificadas son tan dominantes? En esta parte, buscaremos las respuestas analizando los casos de estudio de 5 Stablecoins con la mayor capitalización de mercado, que incluyen:

Las 15 mejores monedas estables en este momento. Actualizado: 7 de octubre de 2021.

Atadura - USDT

Tether (USDT) es reconocida como la Stablecoin más antigua en el mercado de criptomonedas. Hasta el momento, Tether es la Stablecoin con mayor capitalización bursátil y con mayor influencia en el mercado.

Tether tiene la ventaja de implementar un advenimiento temprano, por lo tanto, puede construir un efecto de red increíblemente fuerte. Especialmente, todos los intercambios más grandes como Binance, FTX, Huobi están utilizando USDT como el principal par comercial para otras Altcoins.

Some exchanges have tried to be independent of USDT by issuing their own Stablecoins: BUSD from Binance, HUSD from Huobi. Nonetheless, USDT remains to be the most widespread among every CeFi exchange.

Not to mention on OTC markets, USDT is currently the main gateway for worldwide users to swap from Fiat-currencies to cryptocurrencies. In spite of the fact that OTC markets are still allowing the exchange of other cryptocurrencies like BTC, ETH,... USDT is still dominating the market with high liquidity, low slippage and the ability to be directly traded to other Altcoins across different exchanges.

USD Coin - USDC

Although USDC was founded after USDT, it possesses the advantage of being more friendly to the law system by receiving support from enormous backers, especially Coinbase. Moreover, big exchanges like Binance, KuCoin, and Huobi also use USDC.

Nevertheless, the reason behind USDC’s success is the approach to the DeFi Market. Instead of issuing a large number of Stablecoins on the Tron network like USDT, USDC quickly issued its Stablecoins on other developing DeFi ecosystems, namely Ethereum, BSC, Polygon, Solana, and Fantom.

By seizing the chance faster, Circle did not have to wait for long to take over the DeFi market and attract more users to utilize USDC in the DeFi space.

Binance USD - BUSD

Binance USD is the product made by the cooperation between Binance and Paxos (the managing company of PAX Stablecoin, recently changed its ticker to USDP). Despite the fact that BUSD was released after USDC, USDT and DAI, BUSD has the fastest growth.

Thanks to Binance, BUSD has been broadly applied in Binance Exchange since the beginning of 2020 by being paired with myriads of other tokens, at the same time providing free transaction cost to the paired assets.

When Binance Smart Chain exploded as a phenomenon in March 2021, Binance increased the issuing rate of BUSD on Binance Smart Chain and made it a pairing asset for liquidity pools just like USDT and USDC, which resulted in the tremendous growth of BUSD recently.

Though BUSD is applied in both DeFi and CeFi, its Scalability outside the Binance ecosystem is strictly limited. This situation is pretty understandable because no competitor wants Binance to dominate the market.

Dai - DAI

DAI is an Over-collateral Stablecoin created by the lending protocol MakerDAO. At the moment, MakerDAO is the top 4 lending project in crypto with over $12.7B TVL (Total Value Locked). The Market Cap of DAI is around $6.5B, showing that the Collateral ratio is currently around 49%.

Not only does MakerDAO allow common assets to be used as collateral, but it also supports the collateralizing of LP tokens from Uniswap, helping MakerDAO attract many more users through its diversity.

The advantage of MakerDAO was being founded really early, forming a substantial Network Effect. In terms of coverage across different DeFi ecosystems, DAI is even more popular than BUSD, and only behind USDT and USDC.

Terra USD - UST

Terra USD is a very special Stablecoin as it is the combination of a Full-reserve Stablecoin and an Algorithmic Stablecoin. To maintain the peg price at around 1 USD, Terra USD is backed by LUNA (Full-reserve) and has its price adjusted by an algorithmic mechanism (transfer the price volatility to LUNA).

The success of UST comes from 2 factors:

The first is an effective work model. This was proved through the market collapse on May 19, 2021, which made LUNA price fall from $16 to $4.

If the same thing happened to ETH, MakerDAO and DAI would definitely be considerably affected as ETH was the biggest collateral asset, therefore activating a Domino chain of constant liquidations. However, after that event, UST still stood steadily thanks to the anti-price manipulation mechanism, and then quickly returned to its peg.

The second is the support from the Terra ecosystem (#3 DeFi ecosystem in terms of TVL). UST seems to be the one and only Stablecoin of the ecosystem. As a result, all protocols inside Terra try to capture the value for UST. The most prominent protocol among them is Anchor, a lending platform that allows UST saving with up to 20% APR.

Data analysis of Stablecoin

I hope that with the analysis above, you have visualized the work model of Stablecoins in the market. How can they succeed, and how can they take over the market? In this part, I will dive deeper into the influence of Stablecoins on the crypto market through data analysis.

The Market Cap of Stablecoins

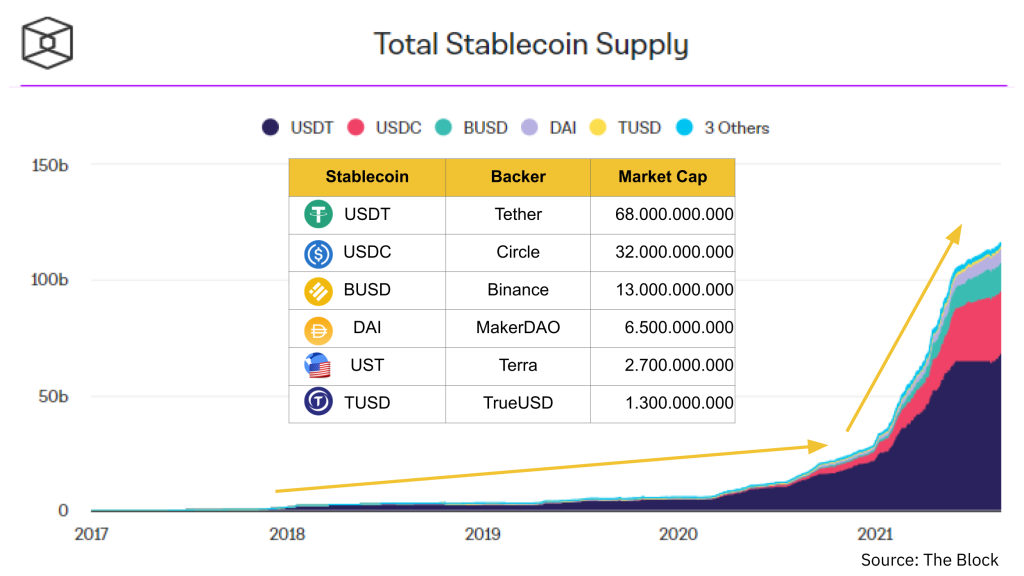

Stablecoins' Market Cap over time.

Market Cap ranking: USDT (#1), USDC (#2), BUSD (#3), DAI (#4), UST (#5), TUSD (#6).

According to the data above, the Market Cap of USDT is overwhelming at $68B, two times higher than that of USDC, even though no other Stablecoins in the market can surpass USDC.

The chart above also shows the two main periods of the crypto market:

Accumulating period (2018 - mid 2020)

In this period, Stablecoins grew slowly but steadily. This matched the market condition at that time when most crypto participants were retail investors, and the DeFi market didn’t receive much attention.

Furthermore, the Market Cap of the whole crypto market was really small, so every action from Tether brought about a huge influence. Every time Tether announced to “issue” more Stablecoins, the price of BTC pumped along.

Booming period (mid 2020 - now)

Forward to the second period, the market received more attention from whale investors and hedge funds, attracting a massive cash flow into the crypto market. The DeFi market gradually became more complete and appealing to the builders and investors.

Since September 2020 to now, the DeFi TVL has increased from $1B to more than $191B. The tremendous growth of DeFi has created a high demand for Stablecoin.

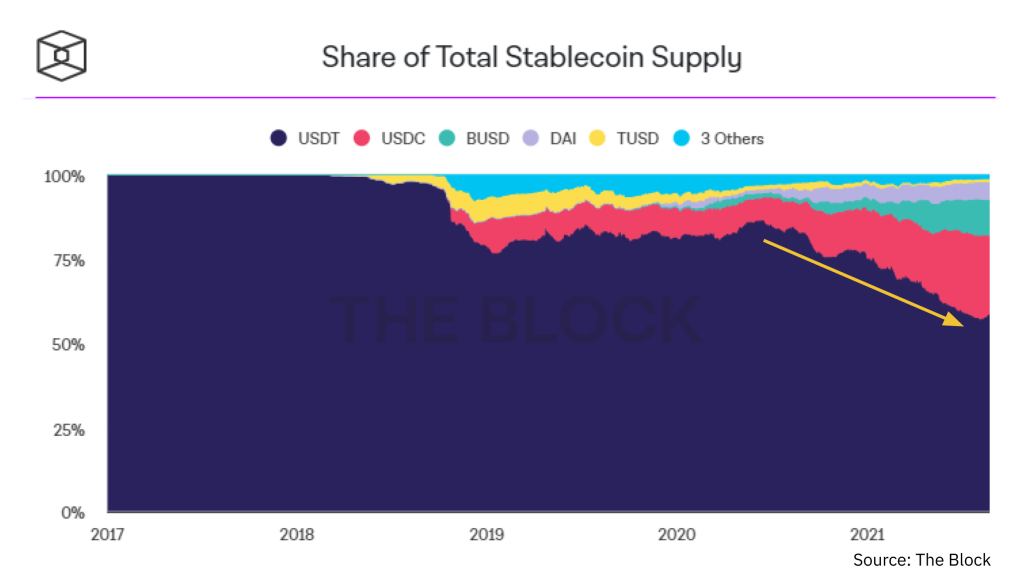

The Market Cap of USDT compared to other Stablecoins.

Although Tether's Market Cap is still overwhelming compared to other Stablecoins, USDC is also worth noting. If you take a close look at mid 2020, you will notice that the Market Cap of USDC rose incredibly fast, and it was at the same time when DeFi started its tremendous growth. That is the reason why when it comes to the DeFi market, I usually prioritize tracking USDC activities over others.

⇒ USDT and USDC are the two key Stablecoins in the market, so we should follow their activities closely because Stablecoins can be regarded as the cash flow supporting the market growth.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi

In the second period, the short-term price pumps of Bitcoin have been separated from Tether’s announcements on issuing Stablecoins. Nonetheless, Stablecoins will still be exerting an enormous influence on the market in the long term, as Stablecoins are the gateway for users to get access to the market and the inside assets.

More specific details can be illustrated in the pictures below. The growth of the market has brought along the demand for Stablecoins, and when Stablecoins were minted to satisfy the market’s demand, DeFi was the most rapidly growing sector.

The correlation between the Market Cap of Cryptocurrency, Stablecoin and DeFi.

But if you take a look at the time around May 2021, when the growth of Stablecoins slowed down, the crypto market in general and the DeFi market in particular collapsed shortly after (on May 19, 2021).

However, the Market Cap of the Stablecoin sector did not decline but actually slightly increased, showing that Tether and Circle (2 big companies in the field) did not burn Stablecoins out of the market. This indicates that the number of investors going into the market was still higher than the number of investors going out.

Consequently, in late July 2021, the crypto market witnessed a strong recovery thanks to the afore-minted Stablecoins in the market.

⇒ In the long term, the growth of Stablecoins is the key to speculate the growth of the whole crypto market. If you are following the DeFi market, don’t miss out on any moves from USDC as it is currently the fastest growing Stablecoin in DeFi.

Stablecoin Dominance

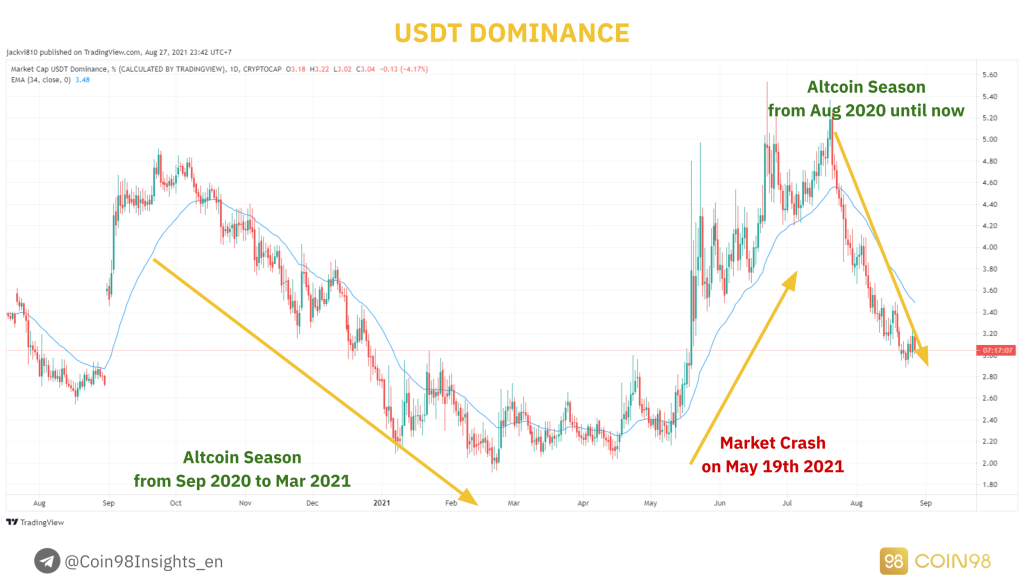

Stablecoin Dominance is the measure of Stablecoin’s Market Cap relative to the Market Cap of the rest of the coins. Here is an example of the USDT Dominance index (USDT.D) from Tradingview.

Although there are still a variety of Stablecoins in the market, the Market Cap of USDT takes up more than 50% of the market, and it has been acknowledged as the representative index of the whole Stablecoin segment, so we will analyze the movement of USDT.D.

How USDT Dominance is related to the market condition.

⇒ We can rely on the USDT.D index to define the market trend, therefore understanding the right time to invest, and the right time to take profit.

Stablecoins in DeFi ecosystems

As analyzed above, Stablecoins play an important role in being the gateway for the cash flow from the Fiat-currency market to the cryptocurrency market.

If you are aware of how the cash flow in the crypto market transfers between different layers, then Stablecoins play the same role of allowing investors to transfer their funds from the crypto market (macro) to blockchain ecosystems (micro).

In this part, I will analyze 3 Case Studies of 3 blockchain ecosystems. Namely Terra, Solana and Avalanche, so you can understand the role of Stablecoins in the growth of DeFi ecosystems.

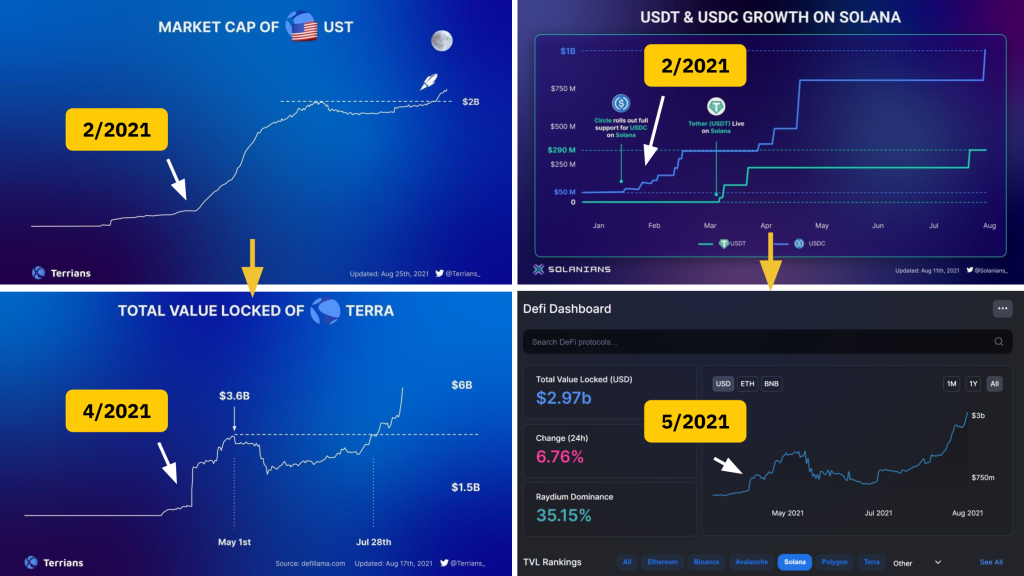

The Market Cap and TVL of Terra (left) and Solana (right).

Case Study 1: How did Terra USD foreshadow the growth of the Terra ecosystem?

Recently, we have witnessed the substantial growth of the Terra ecosystem with its TVL surpassing $6B, becoming the third largest ecosystem in the market behind Ethereum and Binance Smart Chain in terms of TVL.

The increase in TVL has produced a positive effect on the LUNA price, increasing the price of LUNA 700% since the market crash in May 2021. The question is, how could the TVL in Terra increase so rapidly?

The main catalyst is the Market Cap growth of Terra UST - the one and only Stablecoin in Terra. If you notice the chart above more carefully, you can see that when the DeFi TVL in the ecosystem rose, the UST Market Cap had seen an explosive growth 2 months before that, exceeding TrueUSD (TUSD) and Paxos (PAX) - two prominent Stablecoins in the market.

Case Study 2: USDC & Solana - the cooperation that grew Solana tremendously

Since February 2021, when the crypto market was not yet active, Circle and Solana Foundation had already started to issue more USDC into the Solana ecosystem to develop DeFi. Afterwards, in May 2021, the DeFi sector on Solana began to attract more users and reached $1.5B TVL.

During that period, the price of SOL (Solana native token) rose from $10 (February 2021) to $50 (May 2021). Even though a market crash happened shortly after, the number of Stablecoins on Solana continued to rise. In fact, the pace of issuing Stablecoins on Solana at that time was even faster than when the market was extremely active.

And the result is crystal clear: Since July 2021 to now, the cash flow into the Solana ecosystem has not stopped, helping the DeFi TVL to reach $3B. Every token in the Solana ecosystem has been growing tremendously (SOL, SRM, RAY, MNGO, SBR, ORCA,...) especially SOL has recovered from $25 to $170 at the time of this writing.

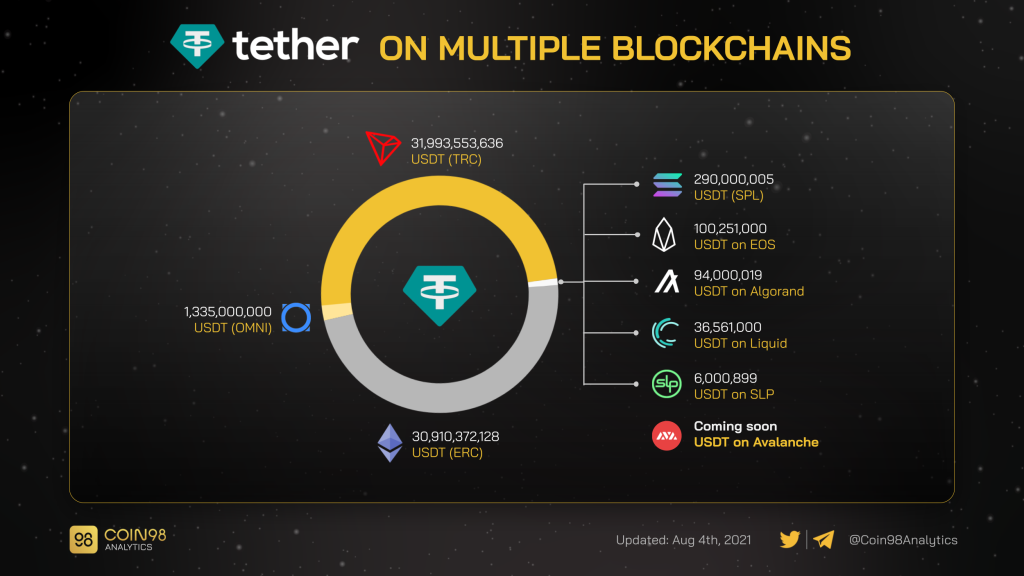

Case Study 3: Avalanche got in the sight of Tether

Tether has been deployed on multiple chains. Although the Market Cap of Tether on Tron and Ethereum accounts for the most, Tether has not issued any additional USDT on Tron, Omni, EOS, Algorand,... since earlier this year. Instead, Tether has now focused on Ethereum, Solana and Avalanche.

This resulted from the fact that they were the three immensely developed DeFi ecosystems. To compete with USDC, Tether quickly supported USDT on Avalanche to help the growth of the Avalanche ecosystem, therefore assisting tokens on Avalanche (AVAX, PNG, SNOB, XAVA) in recovering after the market collapse.

Aside from the Market Cap and Dominance index, the pace of growth is also an imperative index to track. For instance, even though the number of USDT on Solana is still incredibly small, at the same time, it is increasing at the most rapid pace compared to other ecosystems. Will that case happen again, but this time with Avalanche?

The number of USDT on different blockchains.

In conclusion, the investment opportunities do not come from Stablecoins, but from the movement of the market and of different blockchain ecosystems. Stablecoins help you to navigate that movement.

Note:

However, this case is only applicable to ecosystems with small TVL like Solana, Polygon, Terra, Avalanche, Fantom,... because when the ecosystem’s TVL is still insubstantial, the influence of issuing Stablecoins will be more immense, hence creating a motivation for the ecosystem to thrive.

To comprehensively developed ecosystems such as Ethereum and Binance Smart Chain, issuing Stablecoins does not matter that much as the number of Stablecoins being issued is too insignificant compared to the DeFi TVL of that ecosystem.

To speculate the cash flow efficiently, you have to:

Some useful tools to track Stablecoin indexes:

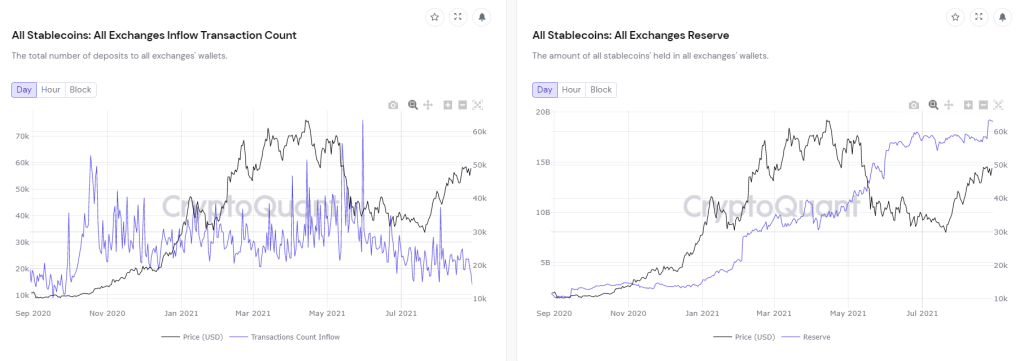

Stablecoin reserve on exchanges

Stablecoin reserve on exchanges.

Similar to the index of BTC Inflow & Outflow, the Stablecoin Exchanges Inflow & Outflow index allows investors to track the buy demand of the market. There are 2 circumstances:

In the long term, this index is correct to some extent. Before Bitcoin reached ATH (All-time high) in March 2021, the Stablecoin Reserve index had increased dramatically in November 2020 (5 months before). Before Bitcoin recovered in August 2021, the Stablecoin Inflow index had also risen significantly in June 2021.

However, the crypto market moves really quickly but this index does not show responsive signs in the short term (about 1 month). That is why this index should only be regarded as an additional tool to gather more information rather than a primary one, compared to the aforementioned methods.

How have Stablecoins evolved?

After going through some prominent Stablecoins, how they work and how they influence the crypto market, we will now look at the evolution of Stablecoins, hence defining the period we are at and predicting future Stablecoin movements.

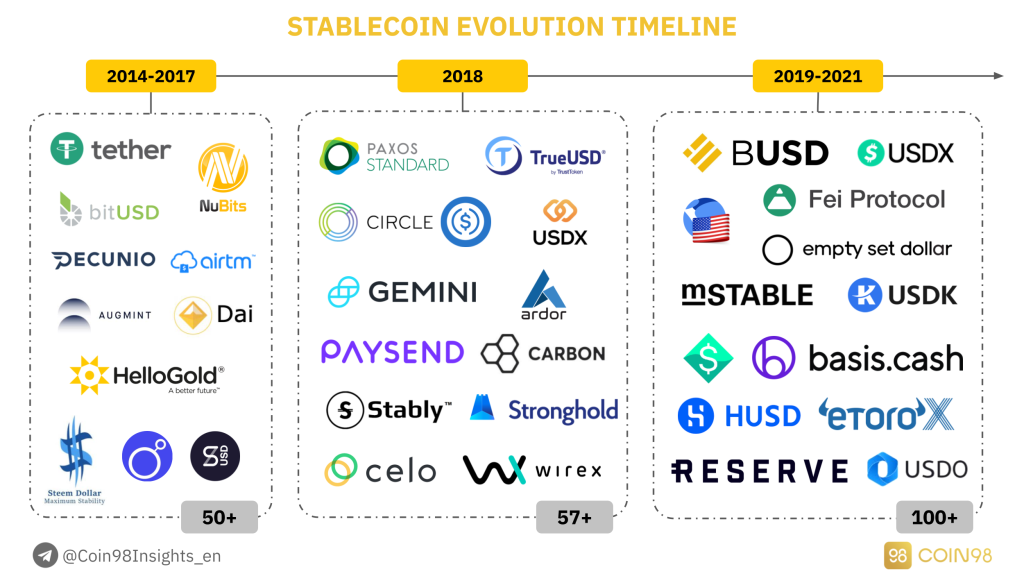

The evolution of Stablecoin.

First period (2014 - 2017): Pioneers in the Stablecoin sector

At an early stage of the first period, Stablecoins had the sole purpose of tokenizing all popular Fiat Currencies across the globe. Stablecoins were used mainly to resolve the problem of transactions’ cost and speed of the traditional financial system.

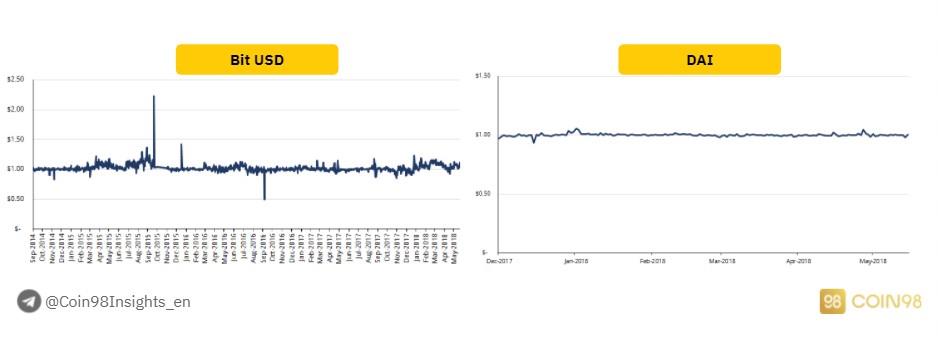

The most prominent of all was Bitshares, a platform founded by Charles Hoskinson (Ethereum's Co-founder and Cardano’s Founder). Bitshares tokenized a wide range of currencies, including CNY (BitCNY), Euro (BitEUR), USD (BitUSD), Gold (BitGOLD),...

Nevertheless, in order to create Fiat-backed cryptocurrencies, users had to collateralize BitShares with a larger amount. As BitShares were highly volatile, the value of Stablecoins such as BitUSD, BitEUR,... was not stable. Not to mention that with low liquidity, BitShares could be easily manipulated by speculators.

Compare Bit USD with DAI.

Fast forward to the end of the first period which is about 2017. The crypto market started to be recognized, and other Stablecoins like DAI and USDT started to appear. DAI was created and sustained up to this moment due to the incredibly high demand for lending & borrowing in the market. The stability of DAI was also better.

Meanwhile, USDT was backed by a gigantic force - Bitfinex. Bitfinex used to be the largest exchange in 2017, until Binance attracted more retail investors to its platform though most whales still stayed in Bitfinex. The substantial influence of Bitfinex at that time was the main catalyst that kept USDT stable around its peg and stood still till now.

Second period (2018): The boom of Stablecoins

The first period was the prerequisite for the second period, which was the most booming period of Stablecoins. The market witnessed the advent of various Stablecoin platforms as this was also the time when the crypto market became “Mainstream” in 2017, after Bitcoin reached an ATH of $20,000.

The demand to invest in Bitcoin as well as the demand for Stablecoins increased. To compete with USDT being backed by Bitfinex, a variety of exchanges issued their own Stablecoins (Gemini issued GUSD), whereas payment platforms also did the same thing (Paysend).

Stablecoins became a “trend” for whales to increase their influences on the crypto market that was already small. If you take a closer look at the illustration above, you can see that in 2018, more than 57 Stablecoin platforms appeared, ranging from Full-reserve Stablecoins to Over-collateral Stablecoins and Algorithmic Stablecoins.

This was also the time when Stablecoins that later became dominant made their debuts, namely Circle (USDC), Paxos (PAX), TrueUSD (TUSD),... they are the three major competitors of Tether (USDT).

Third period (2019-2021): Selection and elimination

From my perspective, the Stablecoin sector is currently in this period. After the booming phase in 2018-2019, myriads of Stablecoin projects appeared, at the same time a large number of projects showed their weaknesses.

Which is the main reason why in the third period, the market will begin the selection and elimination process, especially the recession of Algorithmic Stablecoin projects as they are not working efficiently (cannot maintain the peg price).

You can visualize the situation more clearly through the picture below along with the market’s real-time data. Over 200 Stablecoin projects have been developed, but the number of active and productive projects is only around 10 (USDT, USDC, BUSD,...). More and more Stablecoin projects are gradually fading into oblivion.

The number of active Stablecoins, in development, and closed.

Fourth period (2021+): Expand

The most important keyword to define the third and the fourth period is the Network Effect. As mentioned earlier, the Stablecoin segment is exceptionally competitive.

Among over 200 projects, only nearly 10 of them have an influence on the market. This forces Stablecoin platforms to constantly develop and expand so as to account for as much of the market as possible, including both DeFi and CeFi.

Except for USDT dominating the market for so long, USDC is a noteworthy Stablecoin in the fourth period. Officially launched in 2018 (3 years after Tether), USDC quickly deployed its Stablecoin on 10+ blockchains and focused mainly on the DeFi market, which was growing tremendously at that time. This approach made USDC more well-known than USDT in the DeFi market.

At the moment, BUSD is still following the Network Effect improvement scheme. Binance has been listing more BUSD trading pairs, issuing more BUSD to be used in the Binance Smart Chain ecosystem, with a vision of replacing USDT and USDC.

In the future, UST will definitely increase its Network Effect by accessing the Binance Smart Chain ecosystem and the Solana ecosystem - the two ecosystems possessing the largest cash flow behind Ethereum.

Anticipate the future of Stablecoin

Stablecoin weaknesses

We have gone through the approach and evolution of Stablecoins. So how can they be improved in the future to get rid of the current weaknesses? The answer to this question can be found in this part.

If you notice, Stablecoins are having 2 major issues without a solution which are Transparency and Applicability:

How Tether printing USDT affected the market.

Developing Stablecoins

Major companies are trying to create a Stablecoin that can solve both of the above problems, which can look like:

Some potential Stablecoins in development.

4 Stablecoins that are currently developing to satisfy the above requirements are:

1. Telegram TON

Pavel Durov - the founder of Telegram has been trying to issue a Stablecoin with high stability and high liquidity. However, he gave up the project after being pressured by SEC on the legal aspect.

2. Libra

During the past time, Facebook has been trying to create Libra and make it a global currency. Libra will be backed 50% by USD, 18% by EUR, 14% by JPY, 11% by GBP and 7% by SGD. However, it didn’t take long for Libra to fail as the Congress of the United States realized the threat of a private company competing with a public bank.

However, their ambition seems to remain enormous because after the failure of Libra, Facebook created Diem - Libra 2.0. At the moment, they have been able to cooperate with a variety of partners in the finance department in order to start expanding and integrating with social media applications like Facebook, Whatsapp,...

3. LPM Coin

JP Morgan - one of the biggest banks in the world, plans on creating JPM Coin, a Stablecoin that can replace the obsolete payment system Swift. Nonetheless, they have not made any further announcement. If JP Morgan successfully introduces their product, other major banks like HSBC, Citibank, Wells Fargo will also participate in the play.

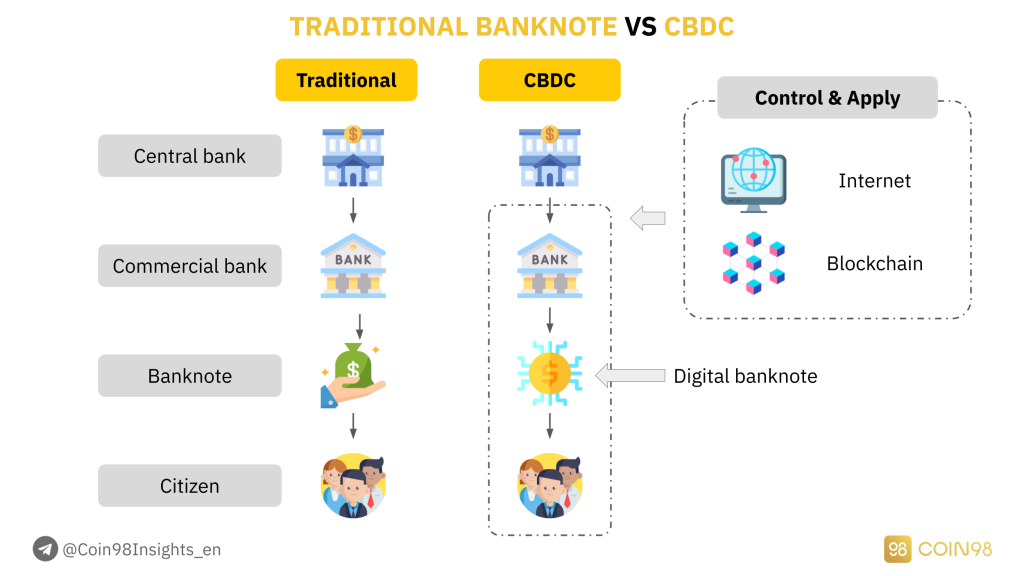

4. CBDC

The last Stablecoin, at the same time the most realistic one is CBDC. CBDC is short for Central Bank Digital Currency. Currently, many Western banks and China banks have been experimenting with the CBDC model and tried to apply it to their work models.

The difference between Traditional Banknote and CBDC.

Although there are still some limitations such that it is not yet possible to be applied worldwide, CBDC can be considered a Stablecoin comprehending all the benefits that the blockchain technology brings, namely transparency, tracing ability to prevent money laundering, low transaction cost, high speed.

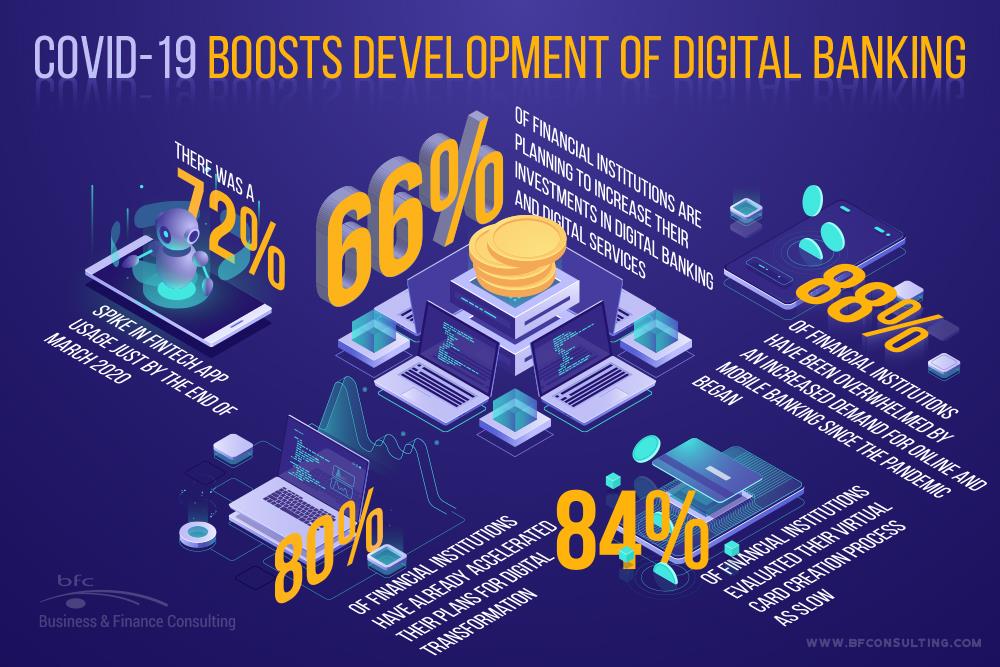

There is no doubt that CBDC will be applied in the future by not only commercial banks but also public banks. Moreover, the Covid 19 event taking place all around the world has shown how important CBDC can be to the global economy in the future.

When everyone has difficulties in commuting and using cash, CBDC becomes an optimal solution for the financial market to operate smoothly.

Covid-19 motivates the growth of Digital Banking.

Investment opportunities with Stablecoins

In terms of investment opportunities with Stablecoins, I can distribute into 2 types:

Now let’s go through each type of investment.

Discover investment opportunities through Stablecoin indexes

As mentioned above, Stablecoin is not the sector to invest in. The best way to make a profit from Stablecoin is to observe its movement and make decisions based on the cash flow.

Anytime Stablecoins are issued in an ecosystem, the cash flow immediately has the tendency to get into that ecosystem:

So in order to not miss any market trend, you have to observe and track them before they “take off”. Here are some useful questions that can help you find your own insights:

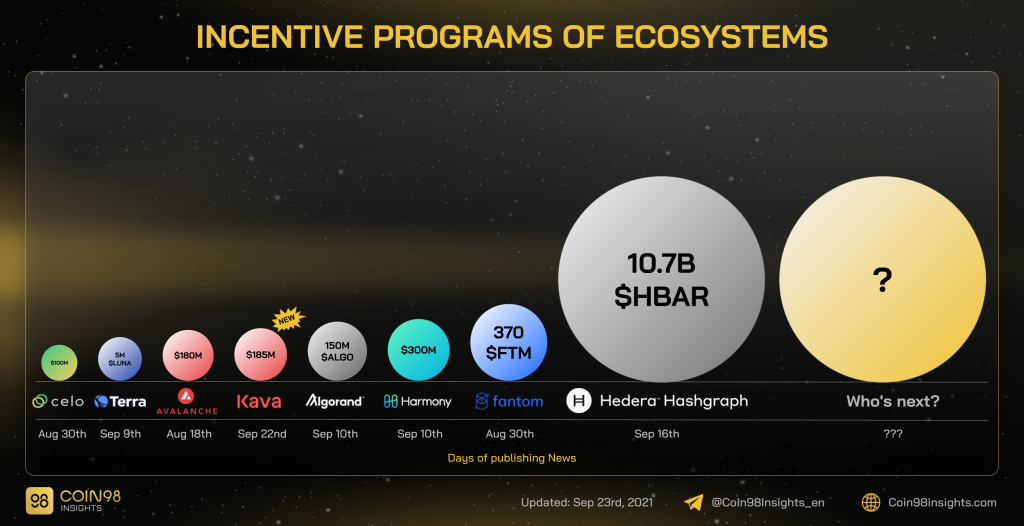

Most recently, multiple ecosystems have announced their DeFi incentive programs, including:

Incentive programs in different blockchains.

It is worth following the Stablecoin movement in these ecosystems and see if they are issuing any new Stablecoin or cooperating with any 3rd-party to do so.

Directly investing using Stablecoins

Nevertheless, if you own a large amount of capital and want to earn with zero risk in this market, using Stablecoins can still be the way to go.

Although the Yield is not as high as using Altcoins, using Stablecoins allows you to be flexible regardless of the market condition. Here are some advisable methods:

1. Lending (4 - 8% APR)

You can deposit Stablecoins on CEXs or lending platforms to receive savings. The advantage of using Lending is its simple interactions, transparent interest, and optional deposit period.

Here are some platforms that you can use Stablecoins to earn savings:

CEX: Binance, Huobi, Gate, MXC, OKEx,...

Centralized Lending: NEXO, BlockFi,...

Decentralized Lending:

However, the disadvantage of using Lending protocols is that the interest rate is pretty low, ranging from 4-8%/year. If you want to receive higher yields, take a look at Farming.

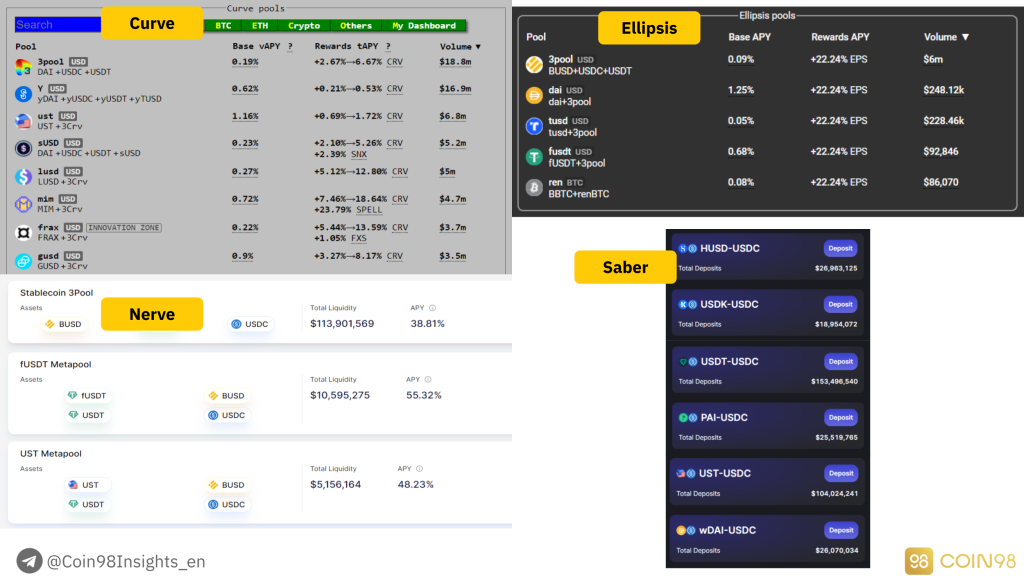

2. Farming (20 - 40% APR)

Farming is the approach to provide liquidity for decentralized exchanges to receive platform fees and the native token of the platform. To follow this way, you have to know some basic actions in DeFi, like providing liquidity.

The advantage of Farming is a higher yield with up to 20-40% per year, which is a really high interest rate. In Viet Nam, if you deposit USD, you won’t even receive interest. Whereas if you deposit VND, you will earn a 7% interest rate but the annual inflation rate is even higher than USD.

DeFi is really a gateway bringing a vast amount of opportunities to earn yields, and you can totally use Stablecoins to make a profit before actually investing in the market. Here are some Stablecoin AMM platforms that you can use for Farming:

Farming Stablecoins.

However, Farming on decentralized protocols has some particular risks, especially in the case of the protocol being hacked, which is why you should distribute your Stablecoin into smaller parts and use them on prestigious and high TVL platforms.

Conclusion

Here are some insights that you can use to find investment opportunities with Stablecoins:

Espero que te haya ayudado a obtener información más valiosa sobre este sector y cómo puedes obtener ganancias usando Stablecoins.

Si desea obtener más información sobre este tema, no dude en dejar un comentario a continuación y unirse a la Comunidad Coin98 para más discusiones.

Este artículo presentará algunos proyectos Fork del gran proyecto Algorithmic Stablecoin. ¿Es esta una tendencia en 2021?

Además de las monedas estables con respaldo fiduciario y criptográfico, hay otra moneda estable que es Algorithmic Stablecoin.

Analizar el mecanismo de acción de Terra lo ayudará a comprender la diferencia entre UST y LUNA y cómo Terra captura valor para LUNA.

Actualice la comprensión básica de Basis Protocol, brindándole así las vistas más intuitivas sobre el Token de ese proyecto.

Analice el modelo de operación de Balancer V2 y sus ventajas y desventajas, brindando así las vistas más intuitivas sobre Token BAL. Descubre su potencial en el creciente mundo de DeFi.

Analiza el modelo operativo de Anchor Protocol, explora cómo el proyecto genera valor para el token ANC y descubre nuevas oportunidades de inversión en el ecosistema DeFi.

Raydium es un intercambio descentralizado que utiliza el mecanismo AMM sobre la red Solana. ¡Sigue esta guía de Coin98 para aprender a usar Raydium y maximizar tus ganancias!

Un análisis profundo sobre la diferencia entre OKB y OKT, sus funciones en el ecosistema de OKEx y su rol en el futuro de la tecnología blockchain.

En este artículo, Coin98 lo guiará sobre cómo usar MDEX Exchange, que incluye: operar, intercambiar y agregar liquidez. Aprenda sobre las tarifas, la experiencia de usuario y más. ¡Empecemos!

Exploramos cómo 0x (ZRX) está transformando el panorama DeFi y analizando sus componentes clave que generan valor en el ecosistema blockchain.

Mina y Polygon trabajarán juntos para desarrollar productos que aumenten la escalabilidad, la verificación mejorada y la privacidad.

Analizar y evaluar el modelo operativo de Uniswap V2, el modelo más básico para cualquier AMM.

El intercambio Remitano es el primer intercambio que permite comprar y vender criptomonedas en VND. ¡Instrucciones detalladas para registrarse en Remitano y comprar y vender Bitcoin aquí mismo!

El artículo le proporcionará las instrucciones más completas y detalladas para usar la red de prueba Tenderize.