What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Avalanche and Solana are blockchains with extremely developed ecosystems. In addition, both networks are continuously developing applications in areas such as DeFi, NFT, GameFi and DAO.

However, within the framework of this article we will not make comparisons on economic grounds. Because Avalanche and Solana have their own unique features in their economies and offer different features.

Instead, in season one, we'll look at both the strengths and weaknesses of Avalanche and Solana . These are two of the blockchains that receive a lot of attention from investors in the Crypto market.

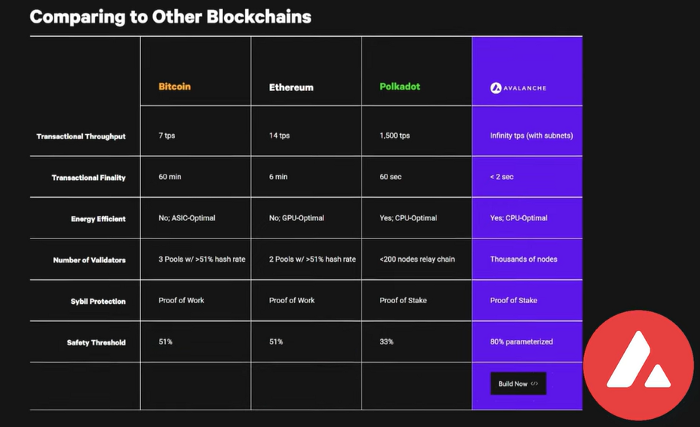

Avalanche is a blockchain using Proof of Stake (PoS) consensus mechanism , which is secure and scalable with high performance. This is where users can make bulk transactions without polluting the environment, with transaction processing times of less than two seconds and extremely low costs.

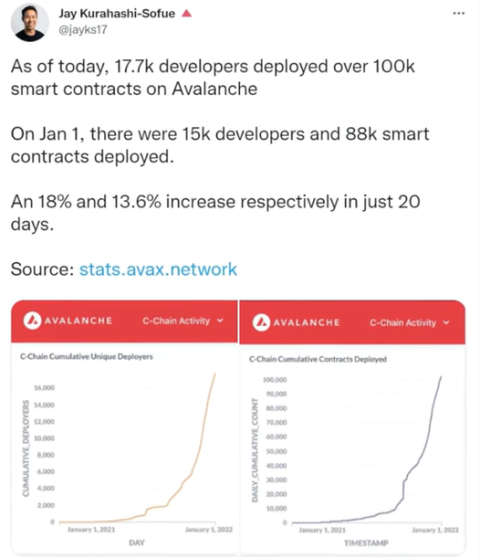

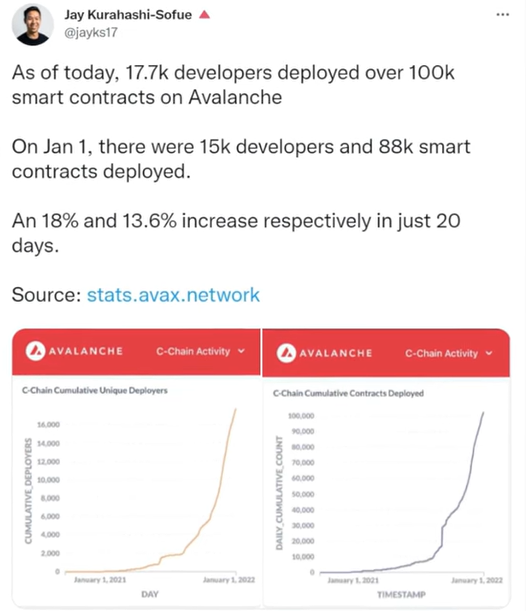

According to a January 2022 report, Avalanche has 17,700 developers and that number will continue to grow in the future.

Avalanche is not only backed by the community, but also backed by the experienced Ava Labs team. They are leaders at companies like Microsoft, Google, Morgan Stanley, AT&T, NASA and several other large companies.

The next candidate in this comparison is Solana (SOL). The platform was founded in 2017 by computer scientist Anatoly Yakovenko and is backed by Solana Labs – a software company based in the US and run by the Solana Foundation based in Switzerland.

Solana is also a decentralized blockchain where developers can build dapps. Similar to Avalanche, Solana is extensible and user- and developer-friendly.

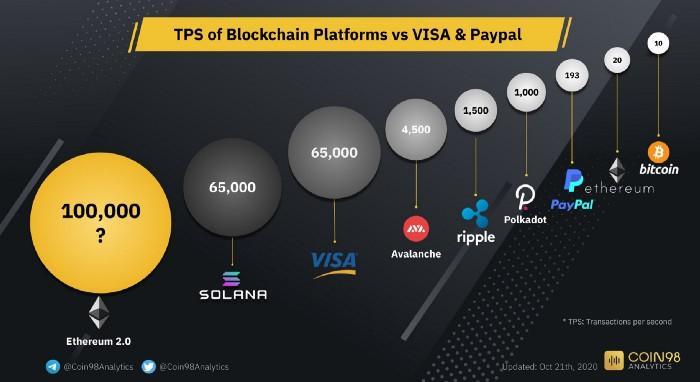

Solana uses PoH (Proof of History) consensus mechanism, based on PoS (Proof of Stake) to be able to process thousands of transactions per second. With Solana's block time of 400 milliseconds, Solana can process between 45,000 and 65,000 transactions per second.

This is the same speed as VISA's payment network and this makes Solana the fastest blockchain platform in the cryptocurrency market.

However, in fact, for Solana to achieve the transaction processing speed mentioned above, it requires many new improvements for the platform to develop further.

That's why Solana continues to grow its ecosystem with a variety of Dapps, DeFi protocols, NFTs, DAOs and more.

The team behind Solana is called Solana Labs, they will support the platform in technical aspects related to blockchain technology.

In this section, we will learn about the features of each project and the first will be Avalanche.

At Avalanche, developers have more flexibility to code in private and public smart contracts. At the same time, they can also develop Dapps combined with existing tokens and NFTs in the Avalanche ecosystem.

Thanks to its very high scalability, all users in Avalanche's ecosystem can simultaneously use any Dapp, but still ensure the performance of that Dapp.

For each subnet, Avalanche can handle about 4,500 transactions per second. Thus, people can perform a large number of transactions on this network, but still not experience congestion.

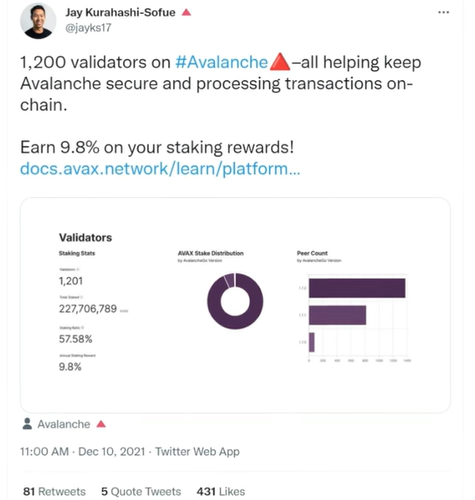

Additionally, Avalanche's team and community pride themselves on the security and decentralization of the network. Because Avalanche is a blockchain with 1,200 validators with an annual return of 9.8%. Therefore, it has a high level of security and is proven when it is resistant to 51% attack.

In addition, anyone holding AVAX has the right to participate in Avalanche's governance system, to pass governance proposals, as well as make proposals to help this network grow further. However, unlike other blockchains, Avalanche limits its right to change the system.

Another core feature is interoperability, Avalanche has the ability to connect with other blockchains, with the goal of supporting the execution of smart contracts.

For example , deBridge Finance is a cross-chain protocol that has developed Avalanche bridges with Ethereum, Binance Smart Chain , Arbitrum , and Polygon.

Another important bridging protocol compatible with Avalanche is WanChain. It supports Avalanche connecting with other blockchains such as Bitcoin, Polkadot, Moonriver , Ripple, Dogecoin, Fantom and EOS.

One of Solana's coolest features is that it allows any project to fully integrate within its solid Layer 1 platform. This means that Dapps will be more secure and stable over time.

Another important thing to consider of Solana is that it is censorship resistant. That is, Solana is made to resist external measures that can affect it.

In other words, Solana's architecture aims to satisfy the three very important properties of a perfect blockchain: scalability, high security, and decentralization.

Solana's nodes are called Clusters - a group of independent computers. It basically works to keep a record of events to create a decentralized ledger and no one has the right to delete the data in it.

Both projects have outstanding features and their own strengths. But overall, Avalanche has the upper hand in this comparison. Because in fact, Solana has some security related issues and there have been some very serious hacks, such as the hack of the Wormhole bridge. This has disappointed many Solana investors and reduced investor confidence in the network.

As we mentioned, Avalanche uses a Proof of Stake consensus mechanism. And the platform enjoys scalability, a high level of security, and decentralization. Besides, each Avalanche subnet can handle 4,500 transactions per second and saves energy as it does not need special hardware.

On the other hand, Solana has some pretty innovative key features using the new consensus mechanism, PoH. With this mechanism, nodes can verify the time and order of transactions to prioritize processing them in a certain order.

This consensus mechanism is a variation of Proof of Stake, but it uses a cryptographically secure function that records every feature of transactions over time.

With the advantage of using the new consensus mechanism Proof of History, Solana is definitely different from a lot of other blockchains including Avalanche. So Solana gets the edge over Avalanche in this part.

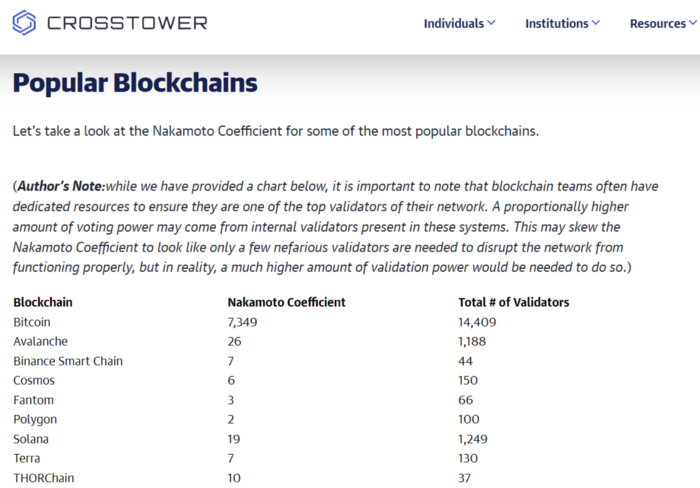

The only indicator that proves blockchain is truly decentralized is the Nakamoto coefficient. In the case of Avalanche, the Nakamoto coefficient is 26, and the network has about 1,200 validators.

In Solana's case, the network has 1,249 validators and Nakamoto's coefficient is 19. However, both of these platforms are far behind Ethereum 2.0 with 342,000 validators.

The reason for this disparity stems from transaction costs. If an investor wants to become one of the validators on Ethereum 2.0, it will cost a lot.

On the other hand, building a node in Avalanche currently costs 200 AVAX or about $15,000 and doesn't require much hardware. While Solana, it only costs you a maximum of about 10,000 USD, but must meet specialized hardware requirements.

Therefore, for the comparison of decentralization, Avalanche will prevail over Solana because the cost of creating a reasonable node does not require much hardware. Add to that the high Nakamoto coefficient and the number of validators of the platform is close to that of Solana.

The above is the first part of the Avalanche vs Solana blockchain comparison article. The TraderH4 team hopes that through the above article, readers can better understand the 3 core aspects that make up the brand of Avalanche and Solana, which are outstanding features, consensus mechanism and decentralization. At the same time, readers have a more intuitive view of the advantages of Avalanche and Solana when putting them on the same scale.

In the next section, we will continue to compare Avalanche and Solana through their ecosystems. Join the TraderH4 team for part two on the TraderH4.com website .

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

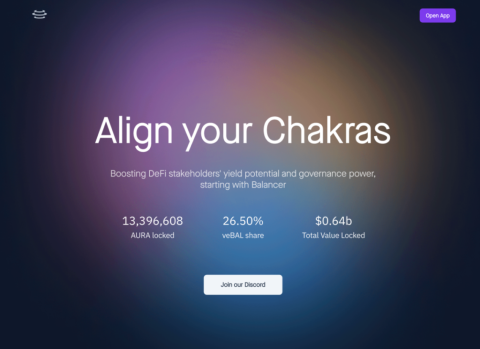

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

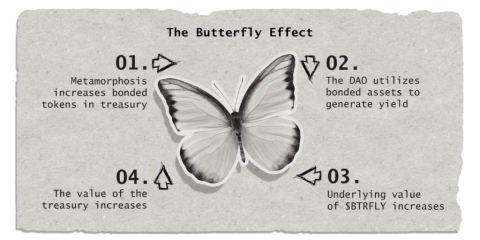

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

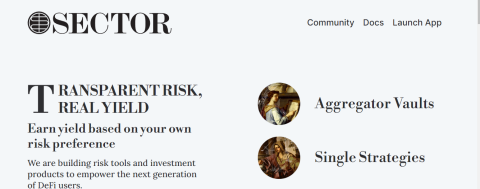

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

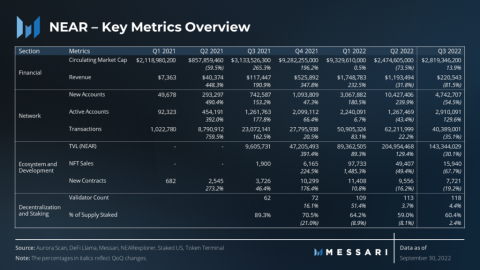

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

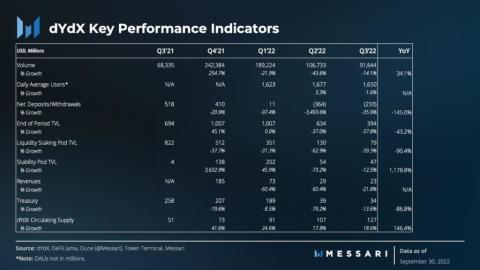

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

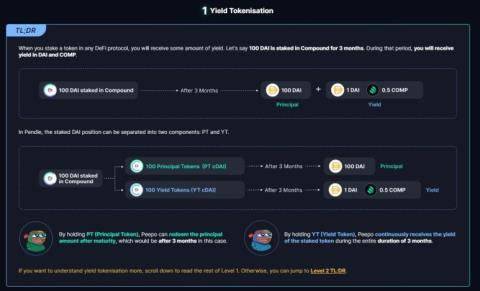

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

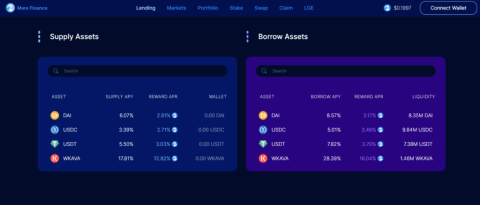

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.