What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

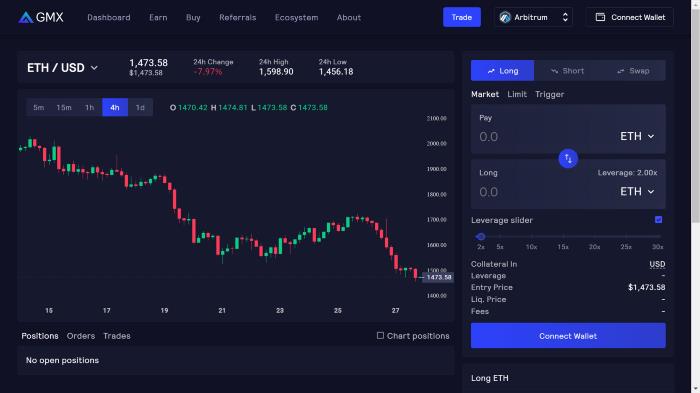

GMX is a decentralized spot and perpetual contract trading platform that allows users to swap tokens with low fees. This protocol first appeared on Arbitrum in September 2021 before launching on Avalanche in early 2022.

GMX provides a single multi-asset liquidity pool, making transactions smoother. Besides, GMX also allows users to provide liquidity in the pool, to earn an additional profit as part of the swap fee on the protocol. In addition, users can trade leverage (spread, funding fees, liquidation) and rebalance assets transferred back to liquidity providers.

The GMX platform is a combination of decentralized finance and a cryptocurrency exchange. The project is a decentralized derivatives exchange currently deployed on the Arbitrum scaling solution and the Avalanche blockchain. The protocol provides spot trading for several cryptocurrencies, namely ETH, WBTC, LINK, UNI, DAI, USDC, USDT and FRAX.

GMX's perpetual swap market allows traders to buy or sell tokens with up to 30x leverage. Instead of being done through the OrderBook, the transaction will be done through a shared liquidity mechanism called GLP. The price of the token on GMX will be secured by Chainlink – a leading Oracle project in the market.

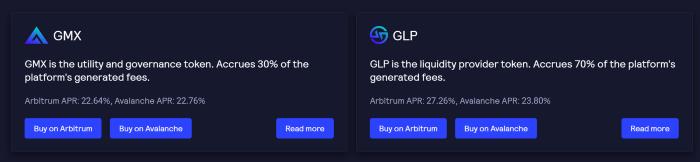

GMX's Tokenomics model consists of two tokens with distinct functions:

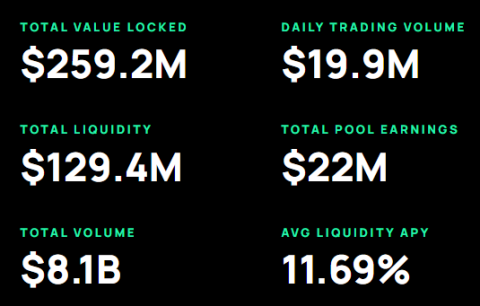

GMX has a total TVL value of more than $260 million, leading the entire Arbitrum ecosystem.

Swap (Swap)

Perpetual Trading

GLP

GLP is a liquidity provider (LP) token that can be minted or burned to redeem index component assets. The GLP swap fee value is not fixed and the index component assets are designed to bring the actual component weights back to the target weights.

Example : If the GLP contains ETH and ETH is higher/lower than the target weight of that pool, then transactions that can decrease/increase ETH in the pool will be incentivized with lower fees.

GLP holders act as the sole counterparty of all traders, thus incurring more P&L than traders' net positions. GLP producers will accumulate 70% of the platform fees as LP rewards.

Rewards are paid out in margin GMX (esGMX) and ETH – for staking on Arbitrum, or Avalanche (AVAX) – for staking on Avalanche.

Governance Staking

GMX is the exchange's governance token, which can be staking to receive 30% of the platform fee and paid with:

In there:

GMX is the platform's governance and utility token that allows investors to receive 30% of the trading fees collected from the entire platform. GMX is available on Arbitrum and Avalanche, which can be transferred via the Synapse Protocol bridge.

Users can staking their GMX on Arbitrum or Avalanche and earn 3 different types of rewards:

GLP is the native liquidity provider token of the GMX protocol. Basically, GLP is an index of large cap assets backed by the GMX protocol, including ETH, BTC, LINK, UNI, USDC, USDT, DAI, MIM and FRAX, it automatically rebalances every row. week.

This asset serves as an index of assets that exist in the multi-asset pool system on GMX. It can also be staking to earn esGMX and ETH rewards over time. Notably, GLP manufacturers receive 70% of GMX's cumulative fees.

A perpetual swap is like a futures contract with no expiration date. GMX offers unattended perpetual swaps with a user-friendly and easy-to-use UX design. On GMX, traders can Long/Short quickly with low swap and transaction fees. In addition, liquidity providers (LPs) can make money by providing assets to the GMX protocol's multi-asset system to facilitate smooth swaps and leveraged transactions.

GMX is positioning itself as a leading project in the field of providing derivative products with two main points:

Trading on GMX is backed by a multi-asset GLP team worth over $254 million. Unlike many other leveraged trading services, GMX users will borrow funds from a liquidity pool containing BTC, ETH, USDC, DAI, USDT, FRAX, UNI, and LINK, instead of a single entity.

Users can switch to Long/Short or simply swap tokens on the GMX exchange. Users can choose a minimum leverage of 1.1x and a maximum of 30x for perpetual trades.

Token price data on GMX is provided by Chainlink . As we can see, GMX uses aggregated price feeds from top volume exchanges to minimize the risk of liquidation due to real-time price misinformation. Liquidation occurs when the user's collateral is not enough to sustain the trade, then the platform forces the position to be closed and funds are deposited to cover the loss.

When a user opens a transaction or deposits collateral, GMX takes a snapshot of the asset's value. Therefore, the value of the collateral does not change during the transaction even if the price of the underlying asset changes.

The transaction fee to open or close a position is 0.1% and the swap fee is 0.33%. Variable borrowing fees are also deducted from the hourly deposit. GMX claims it can execute large trades exactly at tick prices depending on the depth of liquidity in its trading pool.

When users want long-term use, they can provide collateral with the token they are staking. Any profits they receive are paid in the same asset. For short trades, collateral is limited to GMX-backed stablecoins USDC, USDT, DAI or FRAX. Profits on short positions will be paid in stablecoins that users use as collateral.

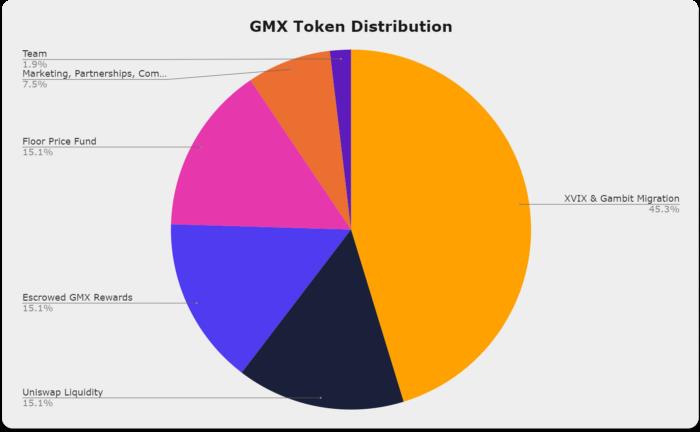

GMX is the utility and governance token of the protocol. GMX has a forecasted maximum supply of 13.25 million tokens, which could increase with more product launches in the future. However, if GMX wants to issue more tokens, it must be approved by the management board.

GMX will distribute 13.25 million tokens as follows:

The largest portion of the tokens (45.3%) was allocated for token conversion from XVIX and GMT (Gambit) token holders. This process involves swapping the original asset (XVIX, XLGE and GMT) for GMX at a price of 1 GMX = 2 USD.

In the design of GMX, there is the appearance of "floor price fund". This fund stores ETH and GLP, it is developed in two ways:

The floor fund helps ensure liquidity in GLP and provides reliable ETH rewards for those who staking GMX.

When the floor price fund increases, it can be used to buy back and burn GMX if “GMX floor price/Total supply” is less than the market price of GMX. At that time, the minimum floor price of GMX will be calculated according to ETH and GLP.

GMX is a derivatives exchange with a user-friendly interface designed using Chainlink's reputable price data feed. Besides, GMX also provides a trading platform with fast transaction processing speed because it has an abundant source of liquidity and extremely comfortable fees. However, the downside of GMX is the lack of diversity in supporting the trading pairs currently available on the platform. In the future, if GMX can support more trading pairs, it could become the leading derivatives exchange in the DeFi space .

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

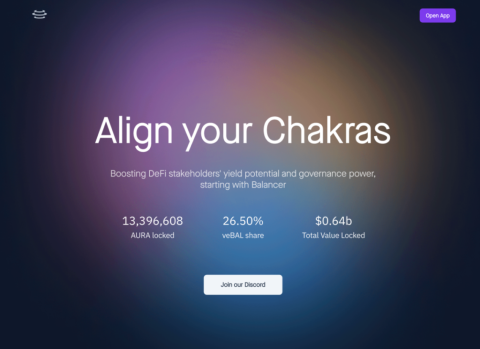

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

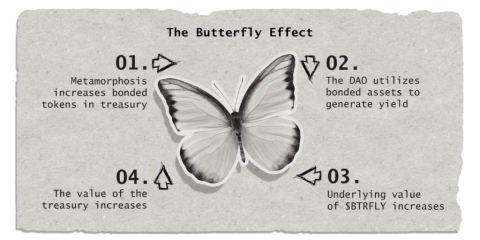

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

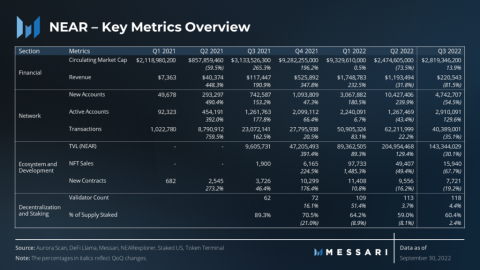

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

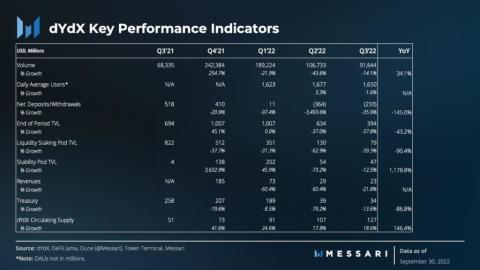

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

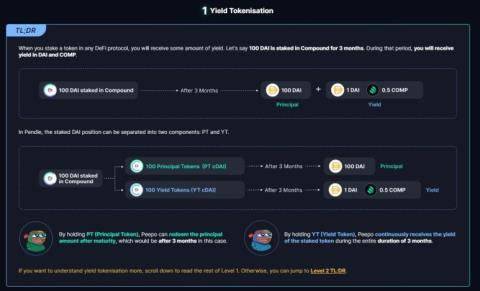

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

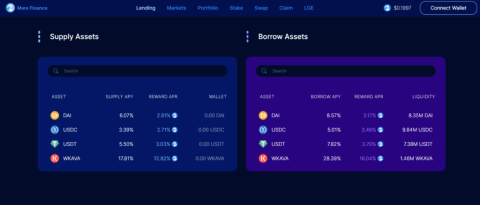

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.