What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

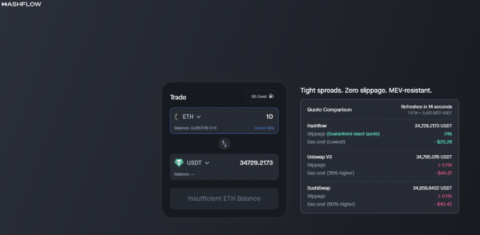

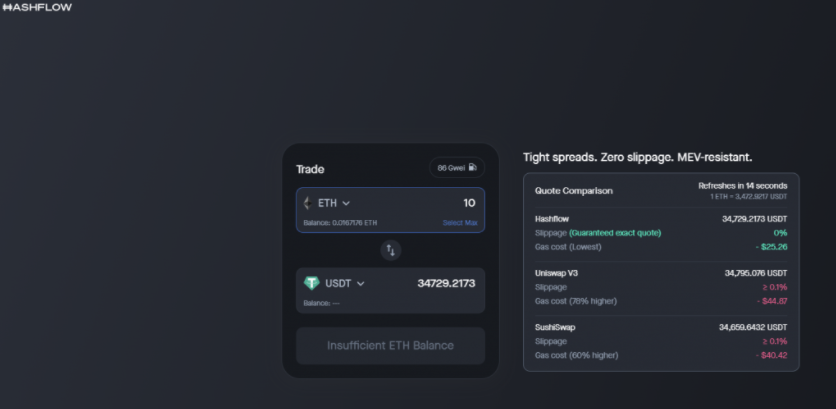

Hashflow is a protocol that allows investors to connect with the leading Market Makers in the cryptocurrency market. Hashflow is considered as the common standard connecting DeFi and CeFi. It creates a secure environment for all liquidity in CeFi. The project is also highly scalable with gas fees less than half that of Uniswap . This has helped investors to use capital with maximum efficiency. The Hashflow project will deploy Layer 2 development in the near future.

Some of the current problems of DeFi platforms that the Hashflow development team wants to solve are:

Slow transaction speed and expensive cost: It takes about 5 to 10 minutes for investors to make a transaction. At the same time, expensive transaction fees are also a major drawback for today's DeFi platforms.

Lack of scalability and flexibility: Investors can only buy crypto assets on a single platform.

No measures to limit MEV (Miner Extractable Value) : Current DeFi platforms often encounter front-running types such as Sandwich attack, Displacement attack, Suppression attack.

Trade any asset : Investors can trade many different cryptocurrencies on multiple platforms through Hashflow.

Create a liquidity gateway in CeFi : You can trade on-chain on any platform through Hashflow. This will save you gas costs.

Anti-MEV (Miner Extractable Value) : No more Sandwich attacks or the like.

Low Gas Fee : Investors only need to verify the signature and perform the transaction, so the gas fee is low compared to Uniswap.

Support Market Making Pool : Investors can allocate capital into these Market Making Pools to get the highest profit.

2019 : Hashflow was founded by Varun Vruddhula.

2020 : Testing an Alphanet of Hashflow working on Qume.

2021 : Allow users to register for Private Alpha testing on Hashflow. In addition, the Hashflow project has successfully raised more than 5.3 million USD from famous funds and investors.

From April 29, 2021 to August 2, 2021 : Users who trade on Private Alpha will be given 1 NFT of Hashflow.

2/10/2021 : Open Alpha phase and users will receive 1 NFT .

09/10/2021 : Open Beta phase, investors can add liquidity to earn income.

In May, Hashflow raised $3.2 million in a seed round from Dragonfly Capital, Electric Capital, IDEO CoLab Ventures, Alameda Research, Metastable, Galaxy Digital, Unanimous Capital, etc.

HFT is the governance token of Hashflow and plays an important role in the governance system. Specifically, HFT holders will be responsible for the community and treasury governance of Hashflow. According to the latest information from Hashflow, the project will issue HFT tokens in January 2022.

HFT is implemented on Ethereum so it will have an ERC-20 standard. Initially, the total supply of HFT will be 1,000,000,000 tokens.

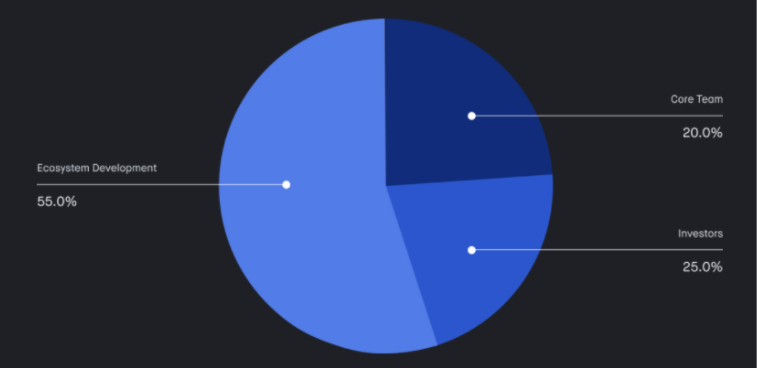

Hashflow recognizes that DeFi was created with the goal of empowering individuals. Therefore, the majority of HFT tokens will be owned by the community and ecosystem partners with 55% of the total supply. The remaining 45% will be held by Hashflow's developers and investors.

Specifically, HFT tokens will be distributed as follows:

Core Team : 20%, this team consists of founding members, engineers who designed, developed and implemented the Hashflow protocol. On December 23, 2021, Hashflow posted on Twitter that the project will transfer 1% of HFT tokens from this group to Hashbot Posters #1 and #2. This will reduce the Hashflow team's HFT token allocation to 19%.

Investors : 25%, this group will consist of early backers and early investors who supported Hashflow in the project launch journey.

Ecosystem Development : 55%, this is an aggregate pool consisting of a community treasury, community members rewards, early users and market makers who provided initial liquidity for Hashflow.

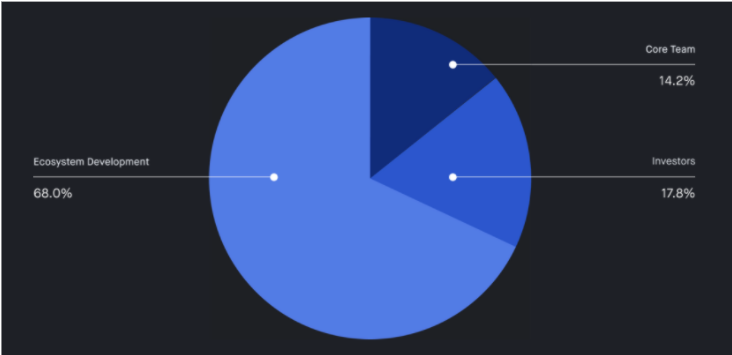

Over time, the community treasury will be allocated 5% more tokens per year from the Hashflow network's inflation rate. After 10 years, the allocation rate for developing the ecosystem will increase to 68%, the supply of HFT tokens will be as follows:

Ecosystem development

In the ecosystem development section, HFT will be distributed to the following sub-categories:

Community Treasury : 31.25%, these funds can be activated and deployed through governance at the discretion of HFT token holders.

Early Community Reward : 5.75%, this reward will be for the first users and those who have joined Hashflow.

Future recruitment of members : 4%, this token is for core members of the development team to join and contribute to the protocol after the launch of HFT.

Ecosystem Partners : 14%, these tokens will go to projects that have integrated into Hashflow soon as well as designated market makers (DMMs) who have provided liquidity on crypto-assets. The centralized exchange will receive the following allocation:

The goal of the above allocation scheme is to ensure that early contributors and market makers receive HFT tokens commensurate with the Hashflow founders allocation.

Calendar release

HFT tokens issued to the core team, investors, market makers and the community will be subject to the following test schedules:

The number of HFT tokens in the community treasury will not have a specific allocation time and can be used by the community to fund projects in the Hashflow ecosystem through the governance process.

Liquidity at TGE

At TGE, 11.75% of the initial HFT supply will be used as liquidity and may be available on the open market, specifically:

After 4 years, the HFT will be released annually at 5% at steady state. These tokens will be deposited directly into the community coffers and will then be allocated to programs that incentivize the ecosystem to grow. In the future, if HFT holders want to change the release schedule, they can do so through the administrative process.

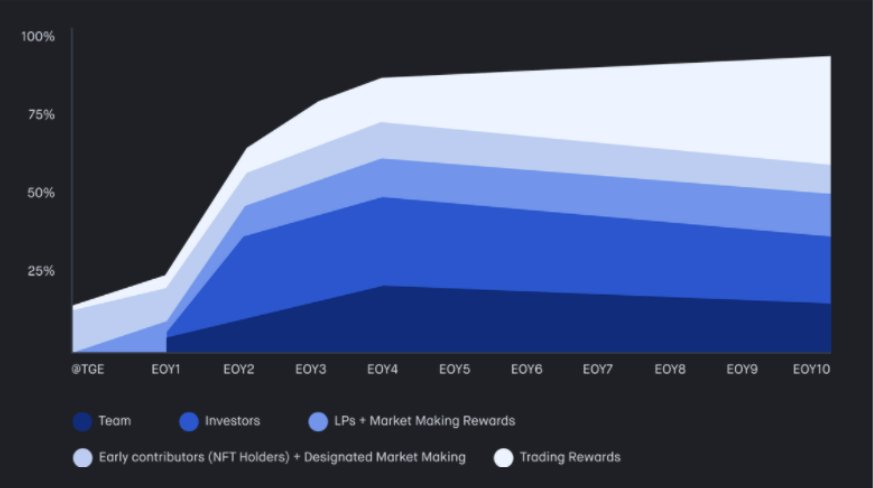

The chart below shows how issuing more tokens will impact token allocation over time. Note that after 3 years, the allocation of the core team and investors will continue to be permanently diluted. This helps to ensure that early contributors receive commensurate rewards and that the community can jointly decide how future funds will be allocated.

Expected allocation (% of total supply)

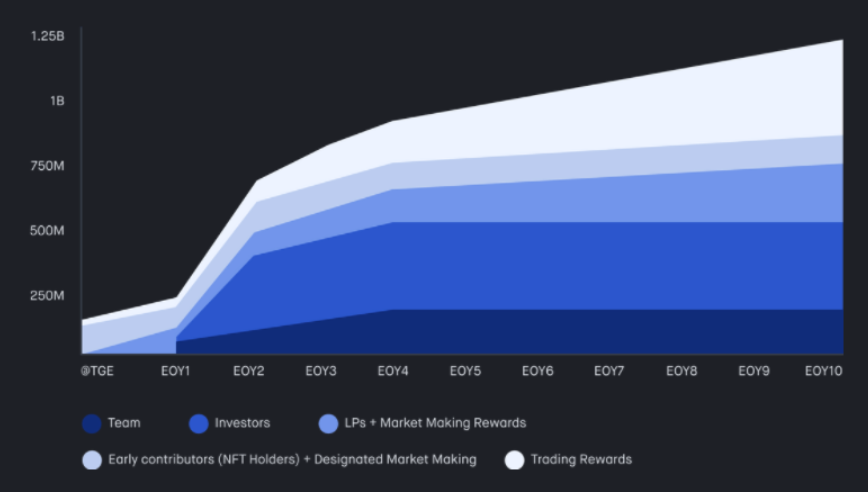

Expected allocation (# of HFT)

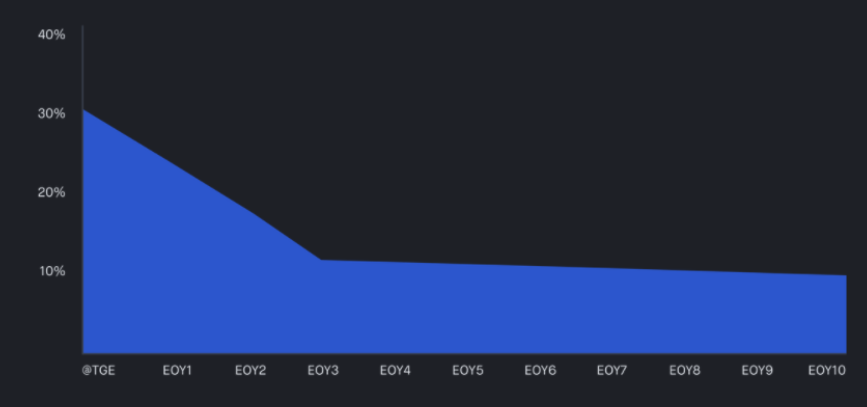

Community treasury reserve (% of total supply)

The chart below shows how HFT in the community coffers will be disbursed over time through the following community incentive programs:

Community encouragement

As mentioned, most of the initial HFT supply (55%) will be allocated to the development of the ecosystem. The purpose of this is to encourage usage as well as fund the development and growth of the Hashflow protocol.

During this round, the initial community incentives will be distributed as follows:

Retroactive NFT Rewards

The remaining 31.25% of HFT will be allocated to the community coffers and distributed through the following incentive programs:

Note : The core team initially assigned the HFT allocation mechanism to traders, liquidity providers, and market makers. But the Hashflow community can submit a governance proposal at any time to change the number of HFT tokens allocated to community incentive programs.

Reward progress

Currently, Hashflow is in Open Beta. This means that traders and community members can continue to receive rewards under the Open Beta rewards program.

The Open Beta phase will continue and end 1 week before Hashflow launches HFT tokens (scheduled for January 2022).

In addition to the Open Beta bonus, starting December 20, 2021, traders, market makers, and liquidity providers will also have the opportunity to receive rewards as part of the community treasury allocation program. copper. However, these rewards will be distributed once the HFT token is issued.

Traders, market makers and liquidity providers will receive the rewards starting this week, details as follows:

Trading Rewards

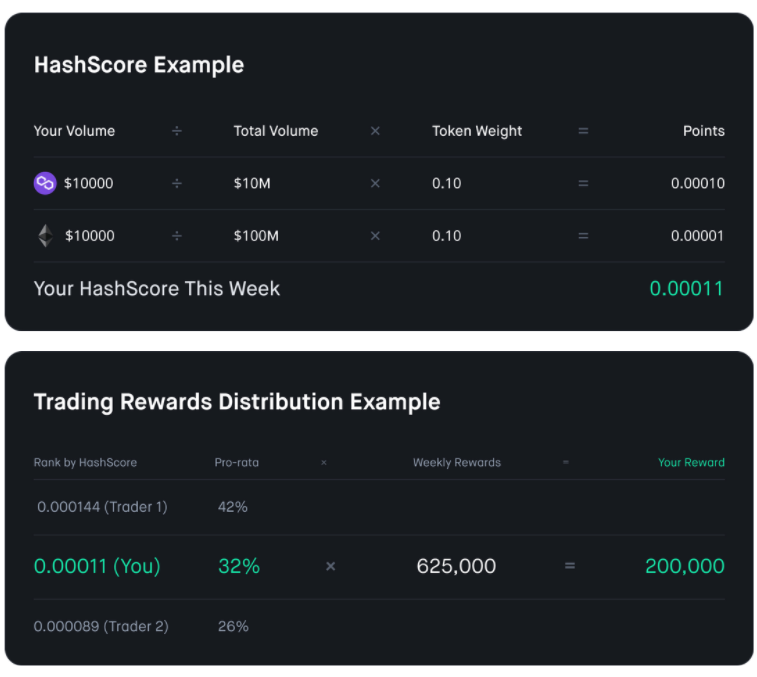

0.0625% of total HFT supply (625,000 HFT before inflation) will be distributed to traders on Hashflow every week with no restrictions or locks. The allocation for each trader will be calculated based on transaction volume across all assets that Hashflow supports and will be assigned by a HashScore.

NFT Staking Reward

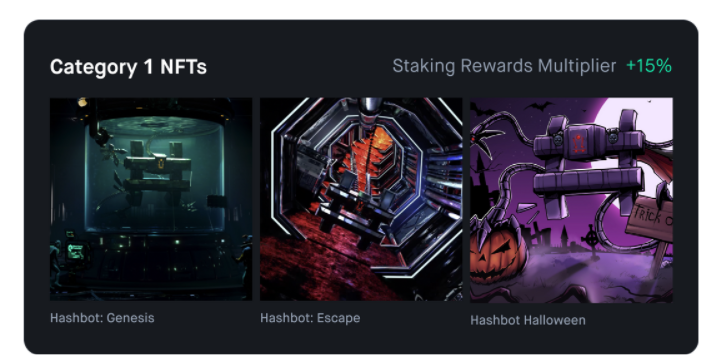

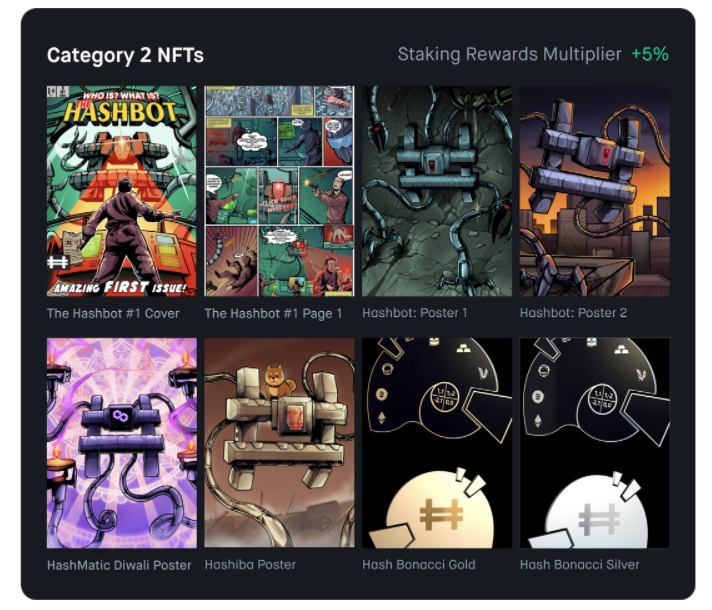

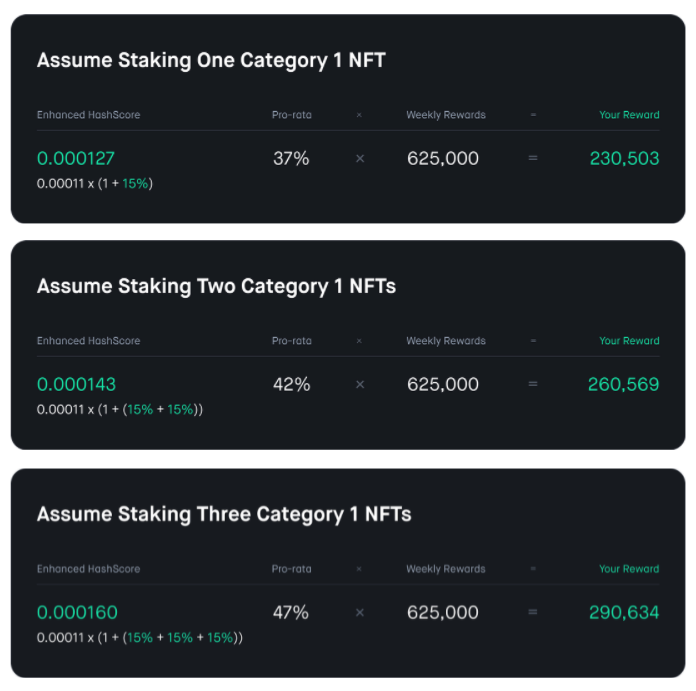

Hashflow NFT holders can stake their NFT on the platform. Each NFT belongs to an NFT portfolio (Category 1 or Portfolio 2) and once staked will be factored into the weekly HashScore of those NFTs. Once staked, each category 1 NFT will increase 15% of the weekly HashScore and each category 2 NFT will increase 5%. Some NFTs will be able to stake both to increase the multiplier effect up to a maximum of 1,000% .

Here are some examples of how staking NFT can further increase investor rewards.

Also, if the investor still hasn't received any Hashflow NFT, there is still a lot left undistributed. Since Hashflow is currently in Open Beta, all contributors still have the opportunity to earn NFT through trading, community participation on Discord and Twitter, and other community contributions.

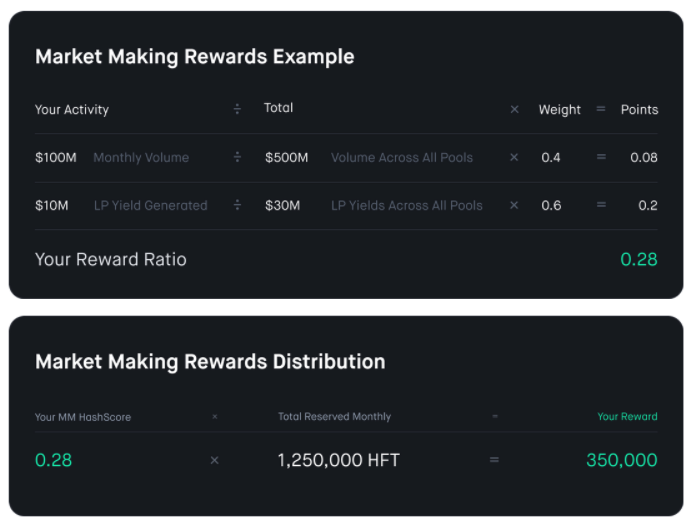

Market Maker Rewards

A total of 0.125% of the total HFT supply (1,250,000 HFT before inflation) will be set aside as a market maker reward each month.

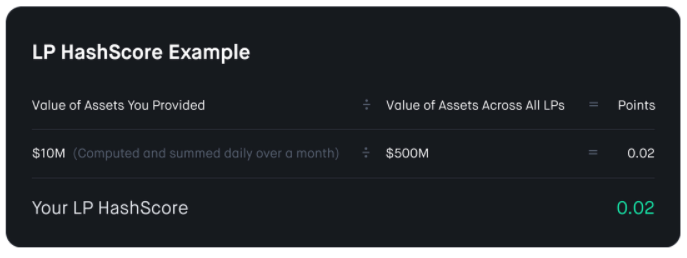

Liquidity Provider Rewards

A total of 0.125% of the total HFT supply (1,250,000 HFT) will be devoted to the liquidity providers on Hashflow. These HFT tokens are allocated on a monthly basis based on LP HashScore.

The HFT token launch event will be followed by the establishment of a regulatory body representing the investor community of HFT holders. These people will have the power to make decisions regarding the development of the Hashflow protocol. In the future, the project will transfer all the leadership of Hashflow to the community to realize the original goal of empowering individuals. This is exactly what DeFi is aiming for.

Thus, TraderH4 has just brought you basic information about the Hashflow project. This project is like a decentralized broker in the cryptocurrency market. Hashflow provides a bridge between the leading DeFi and Market Maker traders in the cryptocurrency market. With Hashflow, traders can directly receive quotes from Market Makers and easily conduct cryptocurrency transactions on-chain using Web3.0 wallets.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

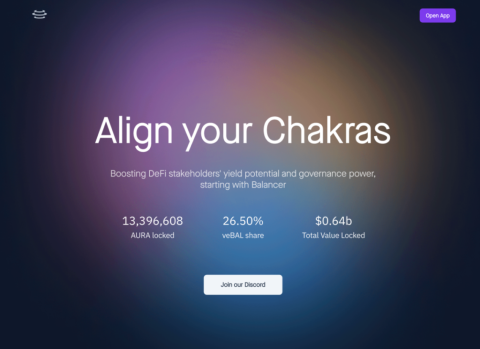

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

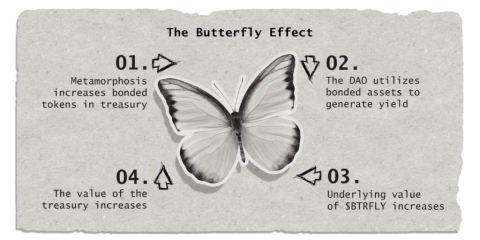

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

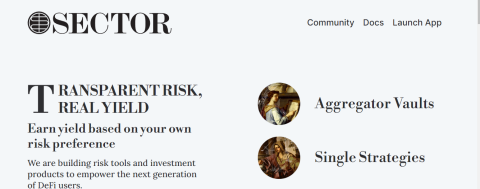

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

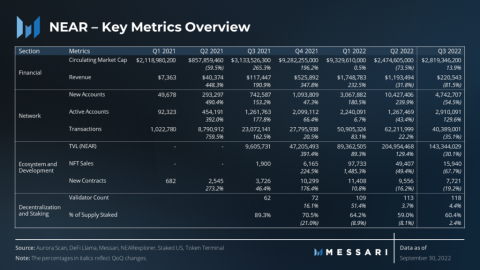

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

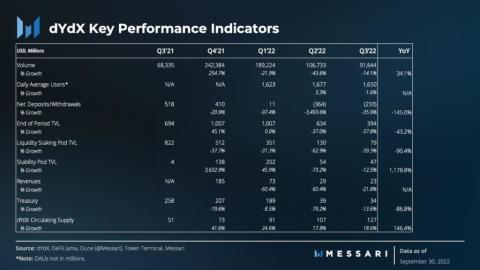

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

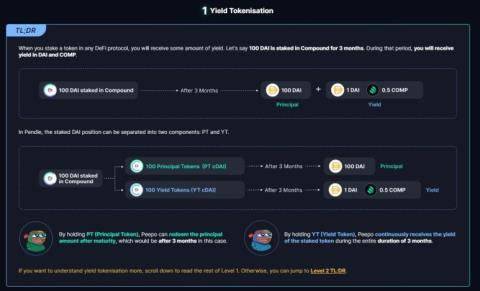

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

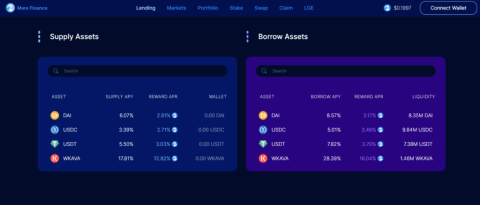

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.