What is thena? Discover the outstanding features of Thena and THE . token

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Launched by anonymous developers 0xmons, zefram.eth and 0xhamachi, Sudoswap is the first decentralized marketplace to offer swaps between NFT and ETH. Initially Sudoswap as an OTC NFT swap service. It is known for its peer-to-peer, no-fee swaps. This means you can directly trade or sell NFTs without the middleman taking care of the transaction like an exchange or a marketplace. Sudoswap has announced a new NFT marketplace that is changing the way crypto users think on NFT liquidity and trading. This new marketplace does this, by introducing the AMM model to the NFT.

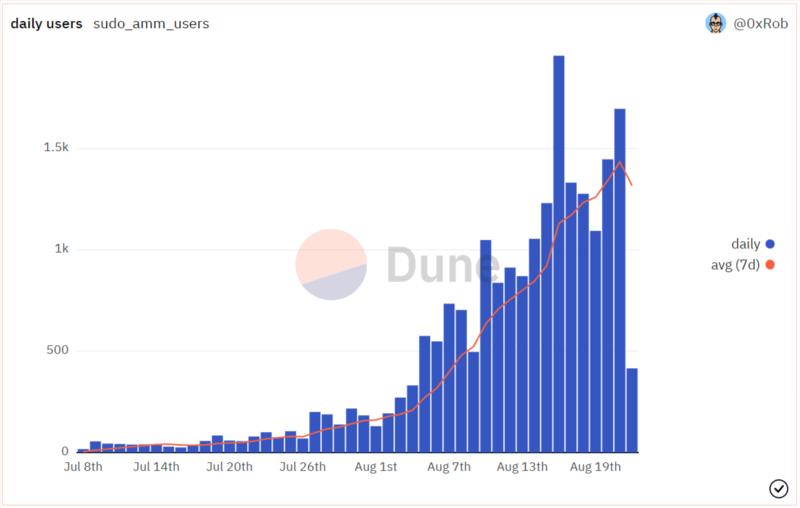

Sudoswap only launched in July 2022, so as the daily user numbers below show, the growth trajectory reflects the current state of their necessity.

What is the AMM model?

AMM is the underlying protocol that powers a decentralized exchange (DEX).

It allows assets to be traded using a crypto liquidity pool as a counterparty instead of a traditional marketplace of buyers and sellers. In this protocol, users are incentivized to become liquidity providers in exchange for a portion of the trading fees of auto market makers.

Sudoswap is a gas-efficient, decentralized on-chain NFT marketplace that uses the AMM model.

Using the AMM model, Sudoswap allows users to trade and exchange NFTs through the liquidity pool by buying and selling. So you can offer NFT to sell as well as ETH to buy.

In return, you will be paid a fee based on the trading difference.

Sudoswap is certainly paving the way for non-traditional financial products. The ability for buyers and sellers to exchange into customizable bonding curves created by liquidity providers distinguishes Sudoswap.

But why do we need Sudoswap in the first place? Currently, NFT markets operate on an orderbook model. That's also how traditional centralized exchanges work. While these traditional marketplaces are intended to provide decentralized services, they are not. And since none of the data is on-chain, they suffer from downtime, as well as a lack of transparency.

What's really great about this benefit is that literally anyone can create a website and display NFTs listed on a cryptocurrency exchange. And in doing so, they promote further decentralization.

When put on-chain also facilitates the participation of collectives in the chain including DAOs and multisig groups. Finally, an on-chain marketplace is less subject to censorship of any kind, a key principle of many blockchain participants.

Fees have made the NFT market structure inefficient.

The NFT market is currently dominated by centralized marketplaces like OpenSea LooksRare and a few smaller ones. These markets profit from trading by charging a platform fee every time an NFT is purchased.

Sudo AMM changes this completely. Anyone can use Ethereum to source Sudoswap-like liquidity in their applications.

Buyers frequently ask for a 10% price increase just to break even. Transactions on Sudoswap cost 0.5% instead of the standard 7.5% (2.5% + 5%) fee on other platforms, allowing for better price discovery.

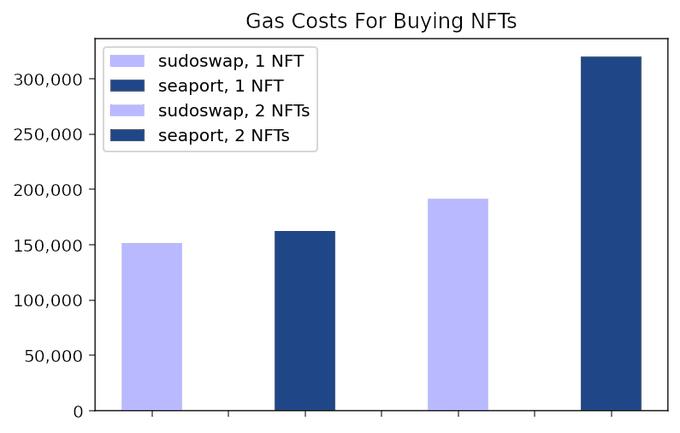

Sudo AMM is designed to save gas fees for traders. Trading single NFTs is as cheap as trading the most optimized NFT swaps, and trading NFTs in bulk can save you up to 40%.

Let's say you list NFT at a specific price, say 1 ETH. Then the floor price goes up, for example 2 ETH. Then your NFT has been purchased at a large discount. Sudoswap can help you avoid such shortcomings by automatically adjusting the selling price based on its floor price.

You can create buy and sell pools based on customizable alignment curves. Finally, Sudoswap users can earn platform fees by providing both ETH and NFT.

Let's take a closer look at how Sudoswap works below.

Sudoswap provides several services to NFT users. But the ingenuity behind the platform is that 0xmons took a look at what worked in the DEX and extended the model to include NFTs.

That's why Sudoswap allows users to use liquidity pools to buy and sell NFTs. Specifically, users can provide liquidity to pools to earn trading fees. Users can also create new groups for the purpose of buying or selling specific NFT collections. Note that a pool is created and operated by a single liquidity provider.

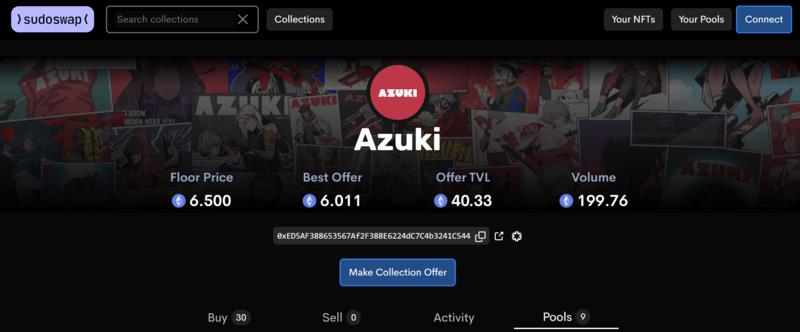

Let's use the popular Azuki collection as an example to consider. When browsing through Sudoswap's collections, under the blue "Make Collection Offer" button, you'll see a tab labeled "Pool" in the lower right-hand side.

When you click on it, you will see a list of different groups. Let's use the top group as an example. The team's highest balance is 16 Azuki NFT, with 27,644 ETH. The current price of one Azuki NFT in the pool is 6,639 ETH. The swap fee is 2.5% (i.e. a percentage of the total NFT value that a user earns each time NFT is bought or sold).

The delta level is 4%, which means that every time someone buys an Azuki NFT from the selected pool, the price will increase by 4%. Conversely, every time someone sells an Azuki NFT from the same pool, the price automatically adjusts, down 4%.

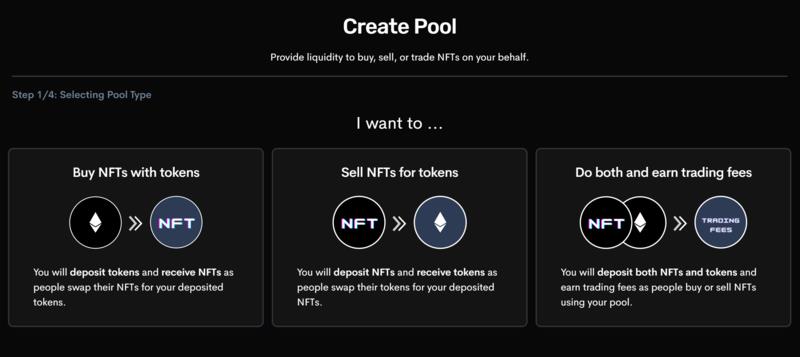

Users can create three types of pools: Sell-only, buy-only, and liquidity pools to earn platform fees.

Let's say you have 5 NFTs, but you don't want to list them all at floor price. In that case you can create a group where the price adjusts the way you have it configured. Doing so allows you to exit the NFT collection that has been set to semi-automatic mode without having to check the price all the time.

If you want to create buy pools instead, you can create them with ETH and set up your purchases on a bonding curve. This way, the price decreases with each purchase, and you can average the cost into an NFT position, scanning through the price ranges that you have reserved.

If you were wondering if Sudoswap has a governance token, it would be SUDO. XMON holders will be able to redeem SUDO in the future when it is released.

Let's discuss royalty payments to creators. How can Sudoswap provide these low fees to users? The platform eliminates creator fees. Despite what you've read, creator royalties aren't actually included in smart contracts.

Instead of eliminating royalties entirely, we will need to develop a new standard that will be adopted. Without royalties to creators, projects have no source of income after the initial mint. This can slow down or stop project development.

Some critics have convincingly argued that eliminating creator fees would have adverse effects. Removing creator fees while attempting to charge the platform empowers the platform, not the creator.

There are many ways to use Sudoswap, so let's start from scratch.

These extra options are used to buy NFT with tokens or sell NFT for tokens and earn protocol fees

Clicking on any of the options will take you to a new page. For tokens, there is currently only ETH. When it comes time to choose an NFT, you can just choose the NFT that you already hold in your wallet.

On the next page, you set up your team. Here, what you need to pay special attention to is the Bonding Curve and Delta. Bonding Curve is Linear or Exponential, Linear is expressed in ETH and Exponential is expressed as a percentage value. Delta means the amount of change in price per NFT sold or bought.

In the final step, all you need to do is review your information and then click “Create Pool”. then you're done.

Sudoswap is extremely user-friendly and intuitive. And its ingenuity lies partly in its simplicity. The platform took what worked with DEX and applied the same model to NFT.

Sudoswap has seen tremendous growth since its NFT market launch in July 2022. And it shows no signs of slowing down. With the rapid proliferation of NFT pools, combined with the removal of creator fees, Sudoswap is having a noticeable impact on the ecosystem.

Whether the cumulative impact will be positive or negative remains to be considered. One thing is for sure: Sudoswap has done wonders for NFT liquidity and empowering NFT collectors.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Let's learn about Sei Blockchain - a layer 1 chain focusing on trading. Dubbed “Decentralized NASDAQ” as it focuses on providing CeFi trading experience with DeFi tools.

Maya is a decentralized liquidity protocol for exchanging assets on blockchains.

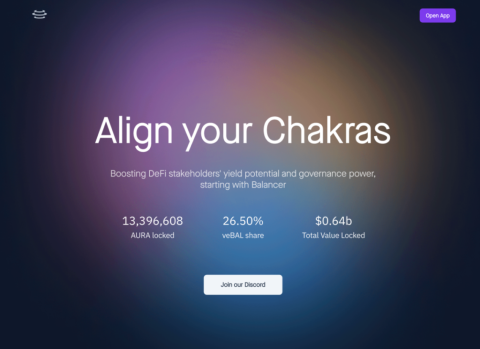

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

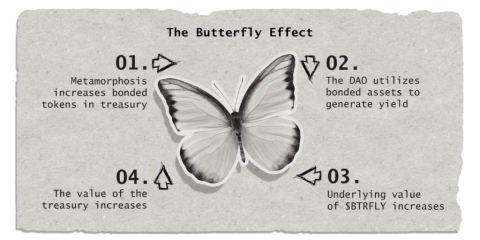

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

Just is the most impressive decentralized finance platform of the Tron ecosystem.

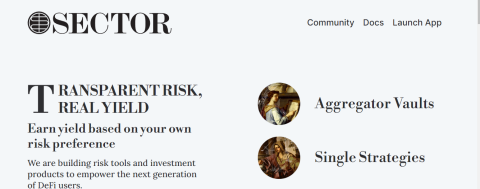

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

Privacy has always been a hot issue in the DeFi space. Renegade is developing a DEX that gives privacy to its users.

Rage Trade is one of the notable projects on the Arbitrum ecosystem this year. Let's learn about the Rage Trade project with TraderH4 in the article below.

ReStaking is a recently launched method and today, we will explore EigenLayer - the first project to provide a ReStaking solution on Ethereum.

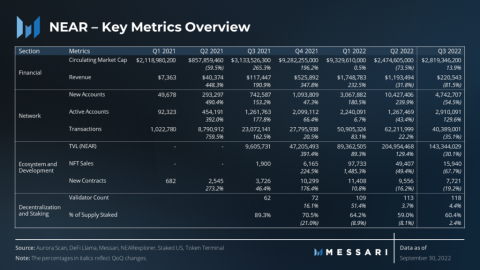

How did Near Protocol have a volatile Q3 for the crypto market? Let's find out with TraderH4 through the article below.

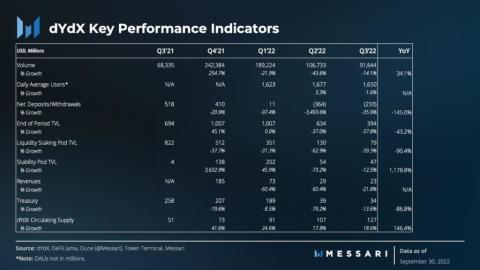

What's remarkable about the dYdX project in Q3, let's find out with the TraderH4 team through today's article.

Gains Network is a decentralized derivatives trading platform built first on the Polygon network and expanding to other decentralized networks.

Aptos is one of the projects whose token price has set ATH during the downtrend of the cryptocurrency market. Projects in this ecosystem are also noticed by many investors and Thala Labs is one of them.

In this article, let's learn about Pendle Finance with the TraderH4 team - a unique DeFi project that combines Yield Farming and Trading.

Mare Finance is a decentralized lending platform built on the Kava ecosystem. The project is being strongly supported by the Kava community, and we can find out the reasons behind that support in the article below.

In part one, we learned about the features of the Camelot project. In this section, we will continue to learn about Camelot V2.

API3 is one of the most prominent Oracle projects, what's so special about this project? Let's find out with TraderH4 through this article.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.