What is AKITA? Detailed overview of Akita Inu and AKITA tokens

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

Network usage increased year over year, with a 12% increase in smart intercom calls and a 94% increase in transactions.

As mentioned above, in the first half of 2022, developer activity, as measured by new smart contract deployments , increased 288% year-on-year in 2021. Staking activity was in line with 75 – 77% of all staked XTZ tokens.

The ninth and tenth protocol upgrades, Ithaca and Jakarta, have been implemented.

The NFT Marketplace is the top five applications on Tezos by unique users as Tezos continues to command a global NFT presence.

Tezos core developers have announced plans to scale through built-in optimistic compilations.

Tezos is a Liquid Proof of Stake (LPoS) network based on low power and energy efficient consensus. This project combines on-chain governance with self-modifying functionality to perform fork-free network upgrades and manage future changes. Tezos supports multiple smart contract languages, has a robust NFT ecosystem, and is scaling through EVM and WASM compatible rollups solutions and inbuilt data layer enhancements.

Q2 2022 was the worst quarter for the crypto market in the past decade, with total market capitalization down 58%. Tezos' MarketCap ended the quarter at $1.3 billion, down 60% ($2 billion) for the quarter.

Tezos has also experienced similar price drops before. On July 21, 2021, Tezos dropped to $1.8 billion before rising 307% over the next 75 days to reach an all-time high of $7.4 billion on October 4, 2021. During Bear Market 2018, Tezos' capitalization fell to an all-time low of $272 million on December 7, 2018.

Network usage on Tezos includes smart contract calls and transactions. During Q2 2022, Tezos averaged 4.4 million contract calls (up 12% Q3 2021) and 3.7 million transactions per month (down 12% QoQ). Transaction fees have remained consistent, averaging $0.01 less than last year.

Overall, network usage has increased significantly year over year. In Q2 2021, Tezos averaged 1.9 million transactions per month, up 94% year-on-year. At the same time, smart contract calls are trending up.

Similarly, account indices have grown steadily. The total number of accounts has increased monthly over the last year, however, the number of new accounts has decreased for 9 out of 10 months, peaking in September 2021 with 147,000 and bottoming in June 2022 with 32,000. At the same time, deleted accounts, defined as empty accounts, doubled in Q2 2022 to 64,000.

NFTs account for the majority of network activity. In the first half of 2022, the NFT market represents the top five applications by users. Objkt is the most popular with 545,000 users (40% share), followed by Hic et Nunc (370,000 or 27%), fxhash (261,000 or 19%), and Teia and Versum (about 90,000 or 7 per cent). each person). In addition, Tezos has partnerships with prominent brands including Manchester United, Oracle, Red Bull Racing, Mclaren Racing, Team Vitality, Gap, Papa Johns, Evian Water, Ubisoft, CCP Games, LVMH Guerlain...

While Tezos' NFT marketplaces get most of the attention, Tezos also has a growing DeFi ecosystem. Youves, a synthetic asset protocol, has the most TVLs with $14 million, followed by decentralized exchange (DEX) Liquidity Baking ($13 million), stablecoin protocol Kolibri ($7 million), DEX QuipuSwap ($3 million), DEX Plenty DeFi ($2 million), and DEXs Vortex and SpicySwap (about $400,000 each). Tezos ended Q2 2022 with TVL reaching $41 million, ranking 50th in the TVL rankings according to Defi Llama.

Tezos uses a Liquid Proof of Stake (LPoS) consensus mechanism. Liquid PoS consensus is different from delegated proof-of-stake (DPoS) consensus because the authorizer (XTZ holders want to contribute their tokens) can participate in the consensus without giving up. their token management permissions set.

Validators on Tezos are called bakers and require a minimum of 6,000 XTZ ($8,800) to participate in the Tezos consensus. Validators are allocated block publishing rights based on their total stake and are required to post approximately 8.25% of their XTZ proxy. Tezos uses an inflationary block reward, about 4.8% annually, as well as transaction fees to incentivize validators and delegators to participate in consensus.

Until Q2 2022, Tezos has maintained a high and consistent staking rate of 75 – 77% of all XTZ tokens staked. Of the staking XTZ, 80% (557 million XTZ) comes from the authorizers, with the remaining 20% (141 million XTZ) coming from the validators. Tezos ended the quarter with a total supply of 922 million XTZ, a quarterly inflation rate of 1.1%.

Tezos ended the quarter with 406 active validators. During the 24-hour period of June 30, 2022, new blocks were signed and published in 36 different countries. The US registers the most validators with 37, followed by Switzerland (19), France (7), Canada (7), the Netherlands (7) and the UK (6).

The distribution of Tezos validators by stake shows that 448 million XTZ, or 64% of all staked XTZ, are delegated to the top 20 validators (5% of the validator set). These include exchanges that operate validators such as Coinbase, Binance, and Kraken, and the Tezos Foundation that operates seven validators. The remaining 247 million XTZ, or 36% of the total staked XTZ, is delegated to 386 validators.

Tezos is listed among the ecosystems with the largest number of developers according to the Electric Capital Developers Annual Report. In the first half of 2022, developer activity (measured by new smart contract deployments) grew 288% year-on-year in 2021. Activity has stabilized with an average of 7,335 contract deployments new smart every month.

Tezos smart contracts execute on a virtual machine named Michelson. A relatively high-level, functional, and statically-typed virtual machine that helps analyze and test contracts. Application developers typically use one of several smart contract languages such as SmartPy, JSLIGO, Archetype, and others.

Tezos is a self-modifying blockchain that eliminates the need for hard work by using on-chain governance to upgrade the protocol. Users delegate their XTZ to validators who participate in weighted voting. Therefore, validators are responsible for both consensus and governance. The self-revision administration process is divided into five phases with a total duration of approximately 2 months and 10 days.

As of May 2019, Tezos has undergone 10 protocol upgrades. In Q2 2022, the 9th upgrade named Ithaca and the tenth upgrade named Jakarta are released. Nomadic Labs, along with Marigold, TriliTech, Oxhead Alpha, Tarides, Dai Lambda, Functori and Tweagio, have announced the next protocol upgrade Kathmandu. Kathmandu will introduce improved randomness for distribution of baking permissions, event logging for off-chain systems in response to smart contract execution, persistent block validation tweaks to increase transaction max translation per second and support “Ghostnet” testnet upgrade with mainnet.

Q2 2022 was a busy quarter in every aspect of the Tezos ecosystem . Key developments include:

Tezos core developers rolled out the ninth upgrade to Ithaca and the tenth upgrade to Jakarta. Ithaca introduced a new consensus algorithm, expanded the number of operations transmitted through the network, and released numerous improvements throughout the protocol. Jakarta introduced optimistic rollups, smart contract improvements, and additional protocol upgrades. The next upgrade, Kathmandu, has been introduced and is on track to be rolled out in Q3.

Artists and brands from around the world have launched NFT projects. Notable projects include Evian Water, Gap, Montreux Jazz Festival, Maison Guerlain, Decathlon, Tezotopia Battles, Papa Johns, Oracle Red Bull Racing, McLaren Racing, Team Vitality… Tezos collaborates with artists, backgrounds new platforms and organizations such as VERSEverse, CADAF NFT Marketplace, Cortesi Gallery, Superchief Gallery, VerticalCrypto Art, Marina Abramović, Herbert W. Franke, Venice Biennale, Bloomberg Philanthropies, Serpentine Gallery, HEK Basel, NXT Museum, Light Art Space Foundation...

The Tezos community has hosted several workshops and hackathons with partners Gitcoin, Encode Club and Devfolio. The TezAsia hackathon has attracted more than 11,000 participants across Asia and India. Tezos Ukraine launched a hackathon with a prize pool of 250,000 USD and more than 1,100 participants. In addition, Tezos attended We Are Developers World Congress, a major event for Developers around the world.

Although Tezos has experienced a lot of growth in network usage year over year, the protocol still has some challenges to address:

Despite the rough start to 2022, Tezos network usage has increased significantly year over year. In Q2 2022, Tezos smart contract calls grew 12% compared to Q3 2021, transactions increased 94% y/y, transaction fees remained below $0.01, active Developers increased by 288% and staking was consistent with 75 – 77% of total staked XTZ Tokens. In addition, the NFT market continues to be the leading application and the DeFi ecosystem continues to grow.

Tezos also introduced the Ithaca ninth upgrade and the tenth Jakarta upgrade. Ithaca introduced the new consensus algorithm Tenderbake, expanded the number of operations and released many improvements. Jakarta has introduced optimistic compilations, smart contract improvements, and additional improvements across the protocol. The next protocol upgrade, Kathmandu, has also been announced. Kathmandu will introduce randomness for distribution of baking rights, event logging for off-chain systems to react to smart contract execution, continuous block validation tweaks to maximize transactions per second and support for testnet “Ghostnet” upgrade with mainnet. The end state for Tezos scaling is integrated with optimistic aggregations such as Smart Contract Optimistic Rollups (SCORUs)

Tezos has established itself as a leading NFT ecosystem and continues to see improvements in both network adoption and growth. Tezos must continue to gain market share and expand its network to compete with the top Layer 1s.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

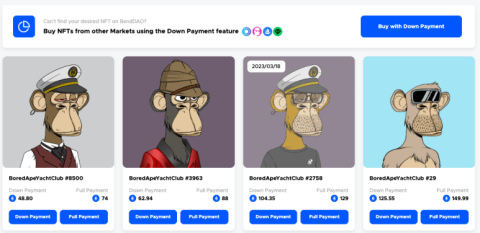

The NFT field is also gradually appearing similar pieces to DeFi and BendDAO is one of the indispensable projects for the NFT field.

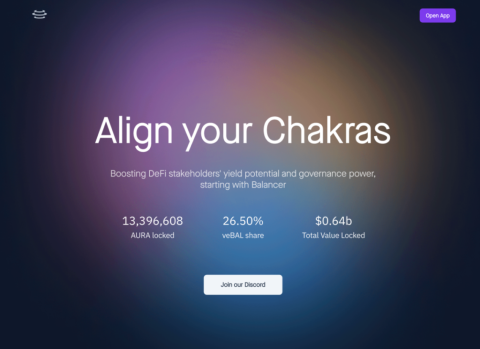

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

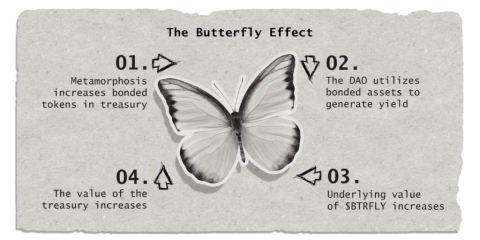

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

In this article, we'll cover how Router Protocol works, the project's features and roadmap, and what this project seeks to unlock in today's multi-chain world.

XYO Network is a network that collects and identifies data or information related to physical locations, by combining blockchain technology and IoT technology.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

60,000 Discord members, 6 distinct NFT collections, 3 years in production, 3 separate tokens, real innovations in DeFi. What is Berachain and is it real? Let's find out with TraderH4 in the article below.

In the framework of this article, let's learn about a role-playing game built on blockchain, Horizon Land Metaverse with the TraderH4 team.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

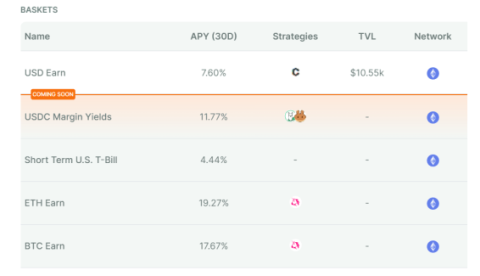

During the downtrend period, Yield farming projects seem to receive a lot of attention from investors. Affine is also one of the projects in this segment.

The Simba Empire project is an NFT game, built and developed on the Polygon blockchain (MATIC). Let's learn about the project with TraderH4!

Request Network is a secure and cost-effective decentralized payment network, built on top of the Ethereum platform.

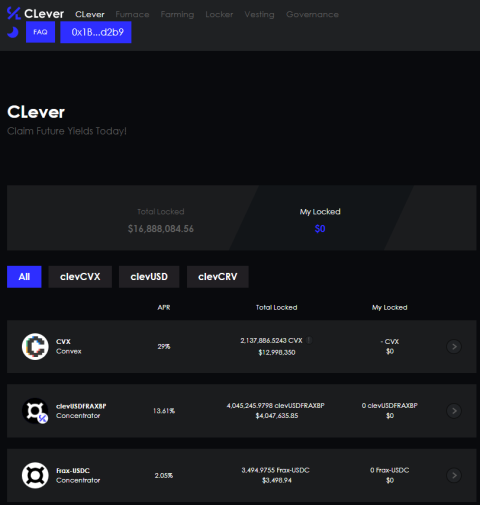

Clever offers users a passive income generating platform with a relatively high rate of return. In this article, we will learn about the Clever project together.

With the arrival of NFT on the Bitcoin network, NFT became the focus of the cryptocurrency market. JPEG'd is a protocol that allows investors to mortgage NFTs and receive stablecoins.

Themis is a multi-chain lending protocol that allows users to borrow and lend with both tokens and LP tokens. In this article, we will explore the Themis project together.

This article will send readers information about the PWN project, a decentralized peer-to-peer lending protocol on Ethereum and Polygon.

Liquity received attention when this project was listed in the Innovation Zone by Binance on February 27, 2023. Let's learn about this project with TraderH4 in the article below.

The explosion of the cryptocurrency and blockchain industry has led to the birth of a series of projects, but not all of them are of the same quality. Therefore, the stage of auditing, appraisal and checking for security holes during project implementation is extremely important.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.