What is AKITA? Detailed overview of Akita Inu and AKITA tokens

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

Synthetix is a decentralized finance (DeFi) protocol that facilitates the issuance and trading of synthetic assets on Ethereum. Similar to derivatives in traditional finance, synthetic assets are assets that derive value from cryptocurrencies and real-world assets. Synthetix's native token (SNX) provides collateral with synthetic assets. Besides, SNX is used to secure the Synthetix network through staking.

You can buy and sell assets in the real world by creating aggregate assets that track their real-time prices through an oracle feed. Unlike other systems, Synthetix does not ask you to provide your personal information or go through your know-your-customer (KYC) and anti-money laundering (AML) process. Moreover, you don't even need to create an account.

Through the Synthetix platform, you can access stocks, forex markets, raw materials, and other real-world assets. You can do this by simply locking the SNX token on the protocol. Alternatively, you can staking synthetic assets to generate passive income from the fees paid by buyers. Another cool feature of the Synthetix platform is that you can cash out trillions of US dollars in assets from legacy markets through real-world asset price exposure on the blockchain.

Kain Warwick is the founder and CEO of Synthetix. Before founding Synthetix, he created many crypto payment gateways in Australia, including Blueshyft. In addition, Warwick serves as an Advisory Board Member at Blockchain Australia and an Advisory Board Member at The Burger Collective. Initially, Warwick started Synthetix as Havven and raised US$30 million in 2018 through an Initial Coin Offering (ICO ).

In addition to Warwick, there are two core members of the Synthetix team – Justin Moses and Clinton Ennis. Moses is the Chief Technology Officer (CTO) at Synthetix and has been with the company since its inception. Previously, he was Technical Director at MongoDB, with extensive experience in large-scale systems, especially in design and implementation. On the other hand, Ennis boasts 18 years of experience in software engineering. Previously he was Architect Lead at JPMorgan Chase.

Synths are blockchain tokens issued to represent real-world assets in the marketplace, interact with them, and maximize the properties of the underlying assets without holding them. They strive to allow exposure to a wide range of assets (commodities, fiat currencies, bonds, etc.), remove barriers to entry, and improve real-world asset liquidity. Synths achieve all of this without sacrificing the potential of the underlying assets, such as their value, liquidity, and global adoption.

Each Synth is backed by a system of guarantees, participation, inflation control, fees, and governance. Therefore, if you want Synth to represent copper, the protocol will issue you a token, such as sCOPPER. Since the token is issued on the Synthetix chain, it is supported by the entire Synthetix infrastructure and governed by smart contracts.

This infrastructure acts as a system of guarantees, unintended damage mitigation, inflation control, exchange rates, miracles, and governance for that Synth. The Synthetix protocol's native token (SNX) controls these parameters because you must lock some SNXs in the protocol to create a Synth. Furthermore, Synthetix works similarly to MakerDAO . The difference is, in MakerDAO you can use different assets to mint DAI, but in Synthetix you can only mint different Synths using SNX.

Therefore, the use of oracles is essential for the normal operation of the Synthetix network, as they bridge real-world assets with Synths features on the blockchain. Example: If copper falls in value in the global market, the oracle passes this information to the Synthetix protocol and revalues sCOPPER to the global market.

Since Synths track the value of real-world assets, they must ensure their value is the same as the value of real-world assets. There are three ways through which Synths maintain their latch:

SNX stakers were in debt when they created Synths. If the rate falls, they can handle the situation by buying back sUSD at a lower price and burning it to minimize their debt as the protocol is always equivalent to 1 sUSD to 1 US dollar.

When users staking SNX, the system generates an exchange fee and allocates it to a liquidity pool accessible by SNX stakers. This process allows users to purchase Synths for various investment purposes.

Synthetix has partnered with dFusion to sell discounted SNX tokens in an auction for ETH. The ETHs that were then used to buy Synths fell below their peg.

SNX originated from the Havven project and ICO, which raised US$30 million with 100 million Havven tokens. However, when Havven changed its name to the Synthetix network, the Havven tokens were also renamed Synthetix (SNX).

According to Synthetix token allocation, 60% of SNX is assigned to investors and token sales, 20% to team and advisors, 12% to foundation, 5% to partnerships and 3% for bonuses and marketing incentives.

In March 2019, Synthetix developed an inflation token offering mechanism to incentivize investors. The table below shows an overview of this mechanism, based on a 1.25% weekly decline in inflation.

The inflation mechanism will end in September 2023 with a total token supply of around 250 million SNX. At this point, the protocol will move to a constant 2.5% annual release rate. However, there is a Synthetix Improvement Proposal (SIP) from Kain to end SNX inflation with a total supply of 300 million tokens in 10 weeks.

SNX is an ERC20 utility token that powers the Synthetix blockchain by supporting two main purposes:

As mentioned, Synth is generated by SNX tokens. You can mine Synth by staking SNX as collateral through its staking feature. Currently, Synths requires a 400% mortgage rate, but this could be modified in the future via community governance. Basically, SNX stakers ran into debt when they created Synths, and to unlock SNX, they had to write off debt by burning Synths.

In addition, Synthetix accepts ETH as an alternative collateral token. This means you can withdraw Synths using your ETH and start trading immediately instead of converting your ETH to SNX first. However, staking ETH requires a collateral of 150%, creating a debt in ETH. As a result, ETH stakers are issued in sETH instead of sUSD and are not eligible for gross debt. Pooled debt is where stakers share the risk to the debt pool and are incentivized for that role.

SNX holders are encouraged to stake their assets in a variety of ways.

First, an exchange reward is generated when a user exchanges Synths on the synthetic decentralized exchange (DEX) – Kwenta. Every transaction applies a transaction fee, which is allocated to a set of fees that the bidders claim their fair share of on a weekly basis. Fees range from 10 to 60 bps (0.1% to 0.6%) and are displayed in transactions.

The second incentive is the SNX staking reward, which is the result of the network's inflationary token mechanism. Currently, this mechanism is based on goal setting rate, which applies a target setting rate of 85%. The policy of increasing or decreasing inflation weekly based on whether the rate is lower or higher than the target, incentivizing policymakers to hit the target. If the reduction is in the range of 80-90%, the policy of reducing inflation is 5%.

The second major role of SNX is to give holders voting rights in the Synthetix DAO. The second major role of SNX is to give holders voting rights in the Synthetix DAO. All in all, Synthetix administration is facilitated by two components – SIP and SCCP. SIP is an acronym for Synthetix Proposal Improvement, and SNX holders use it to make proposals for protocol improvements. SCCP stands for Synthetix Configuration Change Proposal, and it allows protocol suggestions.

Initially, Synthetix's participation in governance was limited, meaning the project was not completely decentralized. Example: Core protocol design, reward mechanism setup, and system development are managed by the Synthetix Foundation, excluding them from governance voting. But as of 2020, the platform has split into three completely decentralized DAOs:

Several characteristics distinguish the Synthetix protocol from other DeFi projects. The most obvious is the ability for users to transact Synths without intermediaries. You can trade any Synth with another Synth on Kwenta and enjoy high liquidity. Another key function of Synthetix that makes it unique is peer-to-peer (P2C) trading, where transactions are processed quickly and easily without the use of an order book. A decentralized pool of SNX holders provides the necessary collateral and ensures the stability of the entire exchange.

Synths come in many forms and are labeled with the prefix, “s” – for example, sUSD and sGOLD. You do not need to trade with the same Synth that you originally minted. As long as the Synth you use for payment has a market value similar to the value you minted, it will be accepted by the protocol.

To facilitate the process of creating Synths, Synthetix has developed a platform that allows users to earn sUSD with SNX as collateral. Whenever you interact with the platform to create Synths, it contacts the Synthetix smart contract responsible for managing the mining processes. Here's the step-by-step process on how to do it:

First, go to the SNX minting site and connect your web3 wallet. Make sure you keep some SNX to use as transaction fees.

Second, you want to generate sUSD tokens using a certain amount of SNX. The protocol will lock SNX.

Finally, you can trade any Synths on the platform using the sUSD that you mined in step 2. Besides, you can staking SNX to generate passive income instead of leaving assets. Yours doesn't work.

Kwenta is a DEX where you can trade Synths. It was built on top of the Synthetix network to allow users to trade Synths directly instead of going the tedious and expensive route of withdrawing assets to a Web3 wallet before trading them on the DeFi protocol. Interestingly, Kwenta doesn't use orderbooks; instead, it is based on P2C transactions, where transactions are made using smart contracts. It also leverages the feats of Chainlink to generate a price feed to establish exchange rates for tokens.

To use Kwenta, you just need to connect your Web3 wallet, buy sUSD or any other Synth token and start trading. The platform includes three features:

Kwenta offers unlimited liquidity, no slippage, and permissionless and unattended trading. Currently, it supports the following Synths categories:

Besides the three categories, Kwenta supports inverse digital currencies and crypto indices. In contrast, cryptocurrencies like iBTC, iETH, and iBNB will track cryptocurrency prices. For example, when the price of ETH increases, the price of iETH decreases equally and vice versa. On the other hand, crypto indices and inverse crypto indices, such as sDEFI/iDEFI and sDEX/iDEX, track a basket of DeFi tokens and native DEX coins.

Lyra is a decentralized trading platform powered by an automated market mechanism (AMM). Notably, it uses Synthetix's stablecoin sUSD as its main quote token – traders use sUSD to pay fees for creating long or short positions. In addition, Lyra uses Synthetix as a one-stop protocol to get long and short details about the market's underlying tokens, such as delta hedging.

Synthetix has built one of the most essential and demanding protocols on the Ethereum network. It provides exposure to a wide range of crypto and non-crypto assets in a decentralized, permissionless and censorship-resistant manner, facilitating participation in the DeFi space. . Similar to derivatives in traditional finance, Synthetix assets are financial instruments in the form of ERC20 tokens known as Synths, that track and provide returns on other assets without requiring anyone to pay. use to hold assets.

However, the potential of synthetic assets remains largely untapped. It remains to be seen whether future developments will significantly boost Synthetix's utility and growth.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

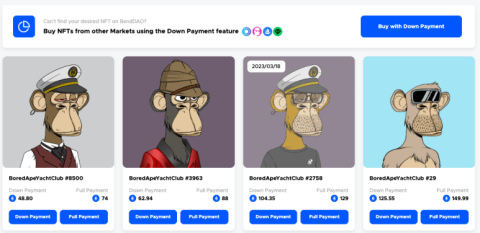

The NFT field is also gradually appearing similar pieces to DeFi and BendDAO is one of the indispensable projects for the NFT field.

In this article, let's find out with TraderH4 the operating mechanism and outstanding features of Aura Finance - a liquidity supply protocol built on Balancer.

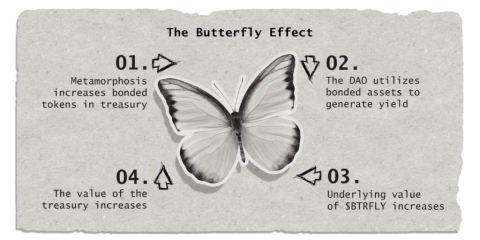

Real Yield is a new concept that will become more popular in late 2022 and early 2023 thanks to the Arbitrum ecosystem. Redacted Cartel is a three-in-one Real Yield project.

In this article, we'll cover how Router Protocol works, the project's features and roadmap, and what this project seeks to unlock in today's multi-chain world.

XYO Network is a network that collects and identifies data or information related to physical locations, by combining blockchain technology and IoT technology.

Sector Finance is a decentralized application (Dapp) designed to help users find profits with different strategies and levels of risk. Join the TraderH4 team to learn more about this project.

Poolshark is a directional AMM (DAMM) used to mitigate temporary losses and generate profits through providing liquidity to users.

60,000 Discord members, 6 distinct NFT collections, 3 years in production, 3 separate tokens, real innovations in DeFi. What is Berachain and is it real? Let's find out with TraderH4 in the article below.

In the framework of this article, let's learn about a role-playing game built on blockchain, Horizon Land Metaverse with the TraderH4 team.

In the framework of this article, let's learn about the Equilibre project with the TraderH4 team - a ve(3,3) AMM of Kava built on the idea of Velodrome.

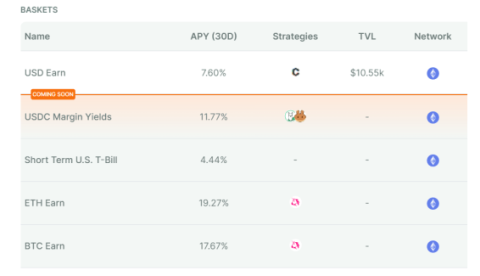

During the downtrend period, Yield farming projects seem to receive a lot of attention from investors. Affine is also one of the projects in this segment.

The Simba Empire project is an NFT game, built and developed on the Polygon blockchain (MATIC). Let's learn about the project with TraderH4!

Request Network is a secure and cost-effective decentralized payment network, built on top of the Ethereum platform.

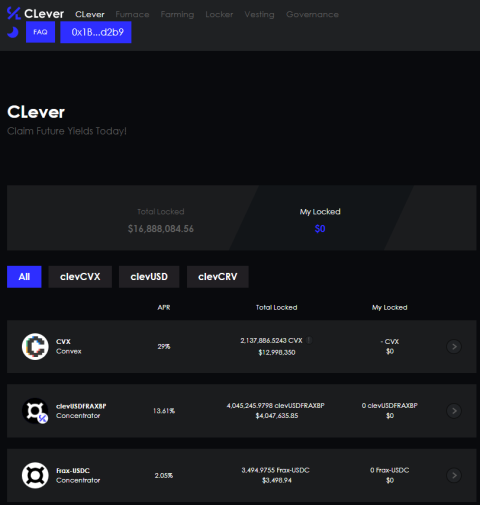

Clever offers users a passive income generating platform with a relatively high rate of return. In this article, we will learn about the Clever project together.

With the arrival of NFT on the Bitcoin network, NFT became the focus of the cryptocurrency market. JPEG'd is a protocol that allows investors to mortgage NFTs and receive stablecoins.

Themis is a multi-chain lending protocol that allows users to borrow and lend with both tokens and LP tokens. In this article, we will explore the Themis project together.

This article will send readers information about the PWN project, a decentralized peer-to-peer lending protocol on Ethereum and Polygon.

Liquity received attention when this project was listed in the Innovation Zone by Binance on February 27, 2023. Let's learn about this project with TraderH4 in the article below.

The explosion of the cryptocurrency and blockchain industry has led to the birth of a series of projects, but not all of them are of the same quality. Therefore, the stage of auditing, appraisal and checking for security holes during project implementation is extremely important.

Ngoài PancakeSwap, hệ sinh thái BNB Chain còn có một AMM khác có TVL đạt 150 triệu USD chỉ sau hai tháng ra mắt, dự án này được gọi là Thena.

Blockade Games provides a platform that allows developers to create blockchain games. In addition, Blockade Games also creates many interesting free games.

UNQ Club is a project that provides a blockchain platform that allows investors to collect and manage existing NFT assets.

BENQI is one of the important pieces of the Avalanche ecosystem. Join TraderH4 to find out what BENQI (QI) is as well as detailed information about the QI token.

In addition to a cryptocurrency storage wallet, SafePal is also known to many investors for its SFP tokens and airdrop events with attractive rewards.

The fever from Akita Inu in the Crypto market in the past time has created a great buzz along with the rapid development of the "dog house token".

What is IoTeX? This is a blockchain built and developed in conjunction with the Internet of Things (IoT). Join TraderH4 to learn this article.

What is OKB? OKB is an exchange coin of OKX and the OKX Chain blockchain. Let's learn about OKX and OKB exchanges with TraderH4 in this article.

DROPP GG brings an innovative and novel idea to provide an NFT mint platform based on geographies outside of the real world.

CronaSwap is a DEX built on Cronos Chain, which has a similar model to Uniswap.